33.4 Event Studies in Marketing

A key challenge in marketing-related event studies is determining the appropriate dependent variable (Skiera, Bayer, and Schöler 2017). Traditional event studies in finance use cumulative abnormal returns (CAR) on shareholder value (\(CAR^{SHV}\)). However, marketing events primarily affect a firm’s operating business, rather than its total shareholder value, leading to potential distortions if financial leverage is ignored.

According to valuation theory, a firm’s shareholder value (\(SHV\)) consists of three components (Schulze, Skiera, and Wiesel 2012):

\[ SHV = \text{Operating Business Value} + \text{Non-Operating Assets} - \text{Debt} \]

Many marketing-related events primarily impact operating business value (e.g., brand perception, customer satisfaction, advertising efficiency), while non-operating assets and debt remain largely unaffected.

Ignoring firm-specific leverage effects in event studies can cause:

- Inflated impact for firms with high debt.

- Deflated impact for firms with large non-operating assets.

Thus, it is recommended that both \(CAR^{OB}\) and \(CAR^{SHV}\) be reported, with justification for which is most appropriate.

Few event studies have explicitly controlled for financial structure. Exceptions include:

- (Gielens et al. 2008): Studied marketing spending shocks while accounting for leverage.

- (Chaney, Devinney, and Winer 1991): Examined advertising expenses and firm value, controlling for financial structure.

33.4.1 Definition

- Cumulative Abnormal Return on Shareholder Value (\(CAR^{SHV}\))

\[ CAR^{SHV} = \frac{\sum \text{Abnormal Returns}}{SHV} \]

Shareholder Value (\(SHV\)): Market capitalization, defined as:

\[ SHV = \text{Share Price} \times \text{Shares Outstanding} \]

- Cumulative Abnormal Return on Operating Business (\(CAR^{OB}\))

To correct for leverage effects, \(CAR^{OB}\) is calculated as:

\[ CAR^{OB} = \frac{CAR^{SHV}}{\text{Leverage Effect}} \]

where:

\[ \text{Leverage Effect} = \frac{\text{Operating Business Value}}{\text{Shareholder Value}} \]

Key Relationships:

- Operating Business Value = \(SHV -\) Non-Operating Assets \(+\) Debt.

- Leverage Effect (\(LE\)) measures how a 1% change in operating business value translates into shareholder value movement.

- Leverage Effect vs. Leverage Ratio

Leverage Effect (\(LE\)) is not the same as the leverage ratio, which is typically:

\[ \text{Leverage Ratio} = \frac{\text{Debt}}{\text{Firm Size}} \]

where firm size can be:

Book value of equity

Market capitalization

Total assets

Debt + Equity

33.4.2 When Can Marketing Events Affect Non-Operating Assets or Debt?

While most marketing events impact operating business value, in rare cases they also influence non-operating assets and debt:

| Marketing Event | Impact on Financial Structure |

|---|---|

| Excess Pre-ordering (G. C. Hall, Hutchinson, and Michaelas 2004) | Affects short-term debt |

| CMO Turnover (Berger, Ofek, and Yermack 1997) | Higher debt due to manager turnover |

| Unique Product Development (Bhaduri 2002) | Alters debt levels |

These exceptions highlight why controlling for financial structure is crucial in event studies.

33.4.3 Calculating the Leverage Effect

We can express leverage effect (\(LE\)) as:

\[ \begin{aligned} LE &= \frac{\text{Operating Business Value}}{\text{Shareholder Value}} \\ &= \frac{(\text{SHV} - \text{Non-Operating Assets} + \text{Debt})}{\text{SHV}} \\ &= \frac{prcc_f \times csho - ivst + dd1 + dltt + pstk}{prcc_f \times csho} \end{aligned} \]

where:

\(prcc_f\) = Share price

\(csho\) = Common shares outstanding

\(ivst\) = Short-term investments (Non-Operating Assets)

\(dd1\) = Long-term debt due in one year

\(dltt\) = Long-term debt

\(pstk\) = Preferred stock

33.4.4 Computing Leverage Effect from Compustat Data

# Load required libraries

library(tidyverse)

# Load dataset

df_leverage_effect <- read.csv("data/leverage_effect.csv.gz") %>%

# Filter active firms

filter(costat == "A") %>%

# Drop missing values

drop_na() %>%

# Compute Shareholder Value (SHV)

mutate(shv = prcc_f * csho) %>%

# Compute Operating Business Value (OBV)

mutate(obv = shv - ivst + dd1 + dltt + pstk) %>%

# Compute Leverage Effect

mutate(leverage_effect = obv / shv) %>%

# Remove infinite values and non-positive leverage effects

filter(is.finite(leverage_effect), leverage_effect > 0) %>%

# Compute within-firm statistics

group_by(gvkey) %>%

mutate(

within_mean_le = mean(leverage_effect, na.rm = TRUE),

within_sd_le = sd(leverage_effect, na.rm = TRUE)

) %>%

ungroup()

# Summary statistics

mean_le <- mean(df_leverage_effect$leverage_effect, na.rm = TRUE)

max_le <- max(df_leverage_effect$leverage_effect, na.rm = TRUE)

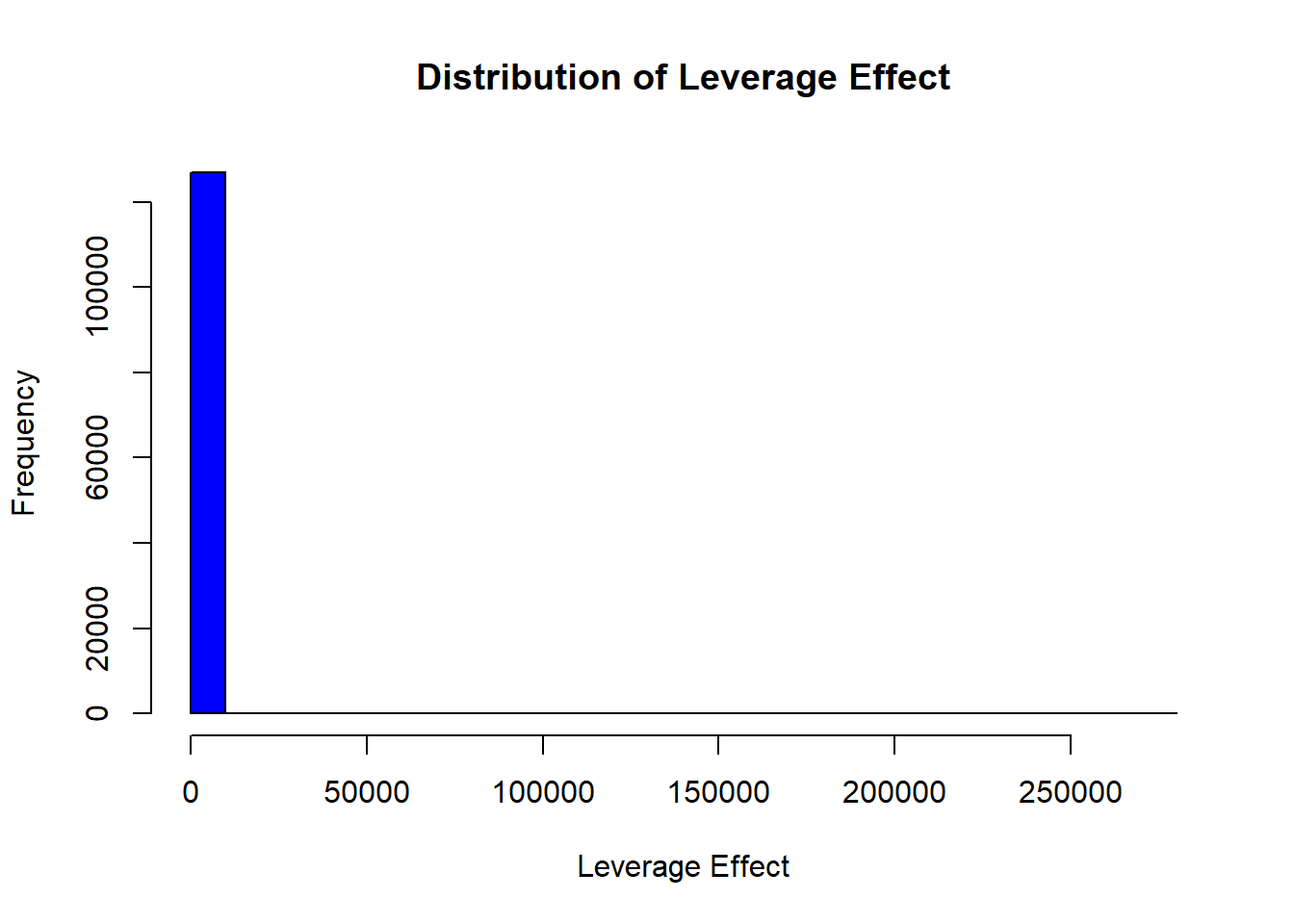

# Plot histogram of leverage effect

hist(

df_leverage_effect$leverage_effect,

main = "Distribution of Leverage Effect",

xlab = "Leverage Effect",

col = "blue",

breaks = 30

)

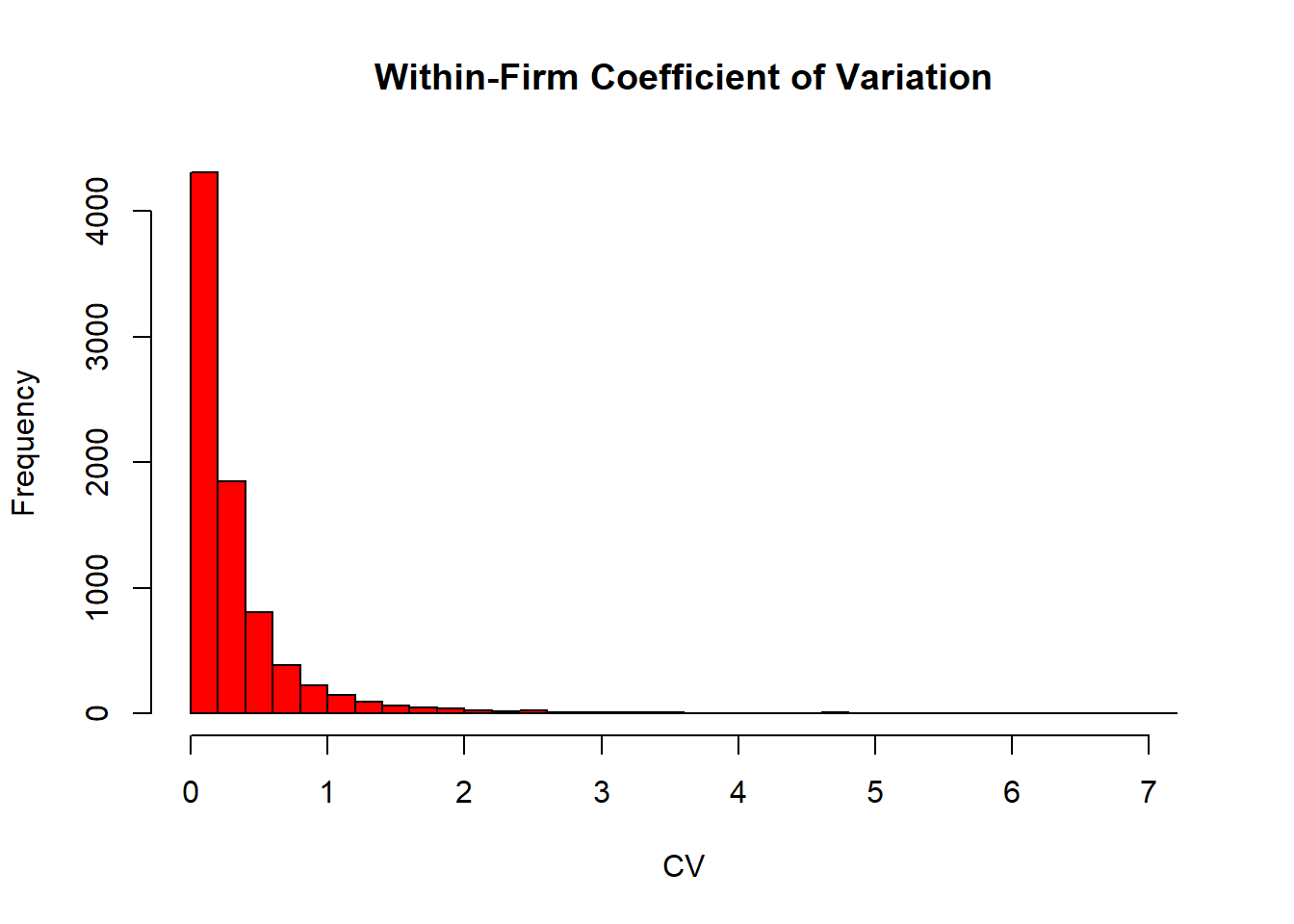

# Compute coefficient of variation (CV)

cv_le <-

sd(df_leverage_effect$leverage_effect, na.rm = TRUE) / mean_le * 100

# Plot within-firm coefficient of variation histogram

df_leverage_effect %>%

group_by(gvkey) %>%

slice(1) %>%

ungroup() %>%

mutate(cv = within_sd_le / within_mean_le) %>%

pull(cv) %>%

hist(

main = "Within-Firm Coefficient of Variation",

xlab = "CV",

col = "red",

breaks = 30

)