36 Endogeneity

In applied research, it’s often tempting to treat regression coefficients as if they represent causal relationships. A positive coefficient on advertising spend, for example, might be interpreted as evidence that increasing ad budgets will increase sales. But such interpretations rely on a critical assumption: that the independent variables we include in a model are exogenous.

This chapter explores the central threat to this assumption: endogeneity.

Endogeneity refers to any situation where an explanatory variable is correlated with the error term in a regression model. When this happens, our coefficient estimates are biased and inconsistent, and any causal claims are invalid.

To understand where endogeneity comes from, let’s begin with the familiar linear regression model:

\[ \mathbf{Y = X \beta + \epsilon} \]

Where:

- \(\mathbf{Y}\) is an \(n \times 1\) vector of observed outcomes,

- \(\mathbf{X}\) is an \(n \times k\) matrix of explanatory variables (including a column of ones for the intercept, if present),

- \(\beta\) is a \(k \times 1\) vector of unknown parameters,

- \(\epsilon\) is an \(n \times 1\) vector of unobserved error terms.

The Ordinary Least Squares estimator is:

\[ \begin{aligned} \hat{\beta}_{OLS} &= (\mathbf{X}'\mathbf{X})^{-1}(\mathbf{X}'\mathbf{Y}) \\ &= (\mathbf{X}'\mathbf{X})^{-1}(\mathbf{X}'(\mathbf{X\beta + \epsilon})) \\ &= (\mathbf{X}'\mathbf{X})^{-1}(\mathbf{X}'\mathbf{X})\beta + (\mathbf{X}'\mathbf{X})^{-1}(\mathbf{X}'\epsilon) \\ &= \beta + (\mathbf{X}'\mathbf{X})^{-1}(\mathbf{X}'\epsilon) \end{aligned} \]

This derivation makes it clear: OLS is unbiased only if the second term vanishes in expectation. That is:

\[ E[(\mathbf{X}'\mathbf{\epsilon})] = 0 \quad \text{or equivalently,} \quad Cov(\mathbf{X}, \epsilon) = 0 \]

To produce valid estimates, OLS requires two conditions:

Zero Conditional Mean:

\[ E[\epsilon \mid \mathbf{X}] = 0 \] This implies that once we condition on the regressors, there is no systematic error left.No Correlation Between Regressors and Errors:

\[ Cov(\mathbf{X}, \epsilon) = 0 \] This is a stronger requirement. If it fails, we have an endogeneity problem.

The first condition is often satisfied by including an intercept or accounting for the distributional properties of errors. The second condition—lack of correlation between \(\mathbf{X}\) and \(\epsilon\)—is much harder to satisfy, especially in observational data.

Endogeneity violates one of the core assumptions of regression, and it has serious consequences:

- Coefficient bias: Estimates systematically differ from the true parameter values.

- Inconsistency: The bias does not vanish as the sample size increases.

- Incorrect inference: Hypothesis tests and confidence intervals become unreliable.

- Misleading decisions: In business and policy settings, this can lead to costly errors.

There are several common sources of endogeneity (Hill et al. 2021). However, most problems fall into two broad categories:

This occurs when a relevant variable is:

- Left out of the model (i.e., omitted),

- Correlated with both the explanatory variable(s) and the outcome.

When is OVB a problem?

- The omitted variable is correlated with an included regressor.

- It also affects the dependent variable.

If either condition fails, there’s no bias.

Example (Economics): We want to estimate the effect of school on earnings, but typical unobservables (e.g., motivation, ability/talent, or self-selection) pose a threat to our identification strategy.

Example (Marketing): Suppose we regress sales on advertising spend, but omit product quality. If higher-quality products get more advertising and also generate more sales, the ad spend coefficient picks up some of the effect of quality—resulting in an upward bias.

Example (Finance): Regressing firm performance on executive compensation might omit executive ability. If more able executives both command higher compensation and deliver better results, OVB leads to biased inferences.

Simultaneity arises when the dependent variable and an explanatory variable are determined jointly, in equilibrium.

Example (Economics): Price and quantity demanded are determined together in supply-and-demand models. A regression of quantity on price without modeling supply will yield a biased estimate of demand sensitivity.

A special case of simultaneity where the causation runs opposite to what the model assumes.

Example (Health Policy): A naive model might regress health outcomes on insurance coverage. But it’s plausible that people in poor health are more likely to purchase insurance, causing reverse causality.

Over longer time intervals (e.g., yearly business data), reverse causality can look just like simultaneity in terms of its effect on regression estimates.

Even if a relevant variable is included, imprecise measurement introduces bias.

Classical Measurement Error (in \(X\)):

- Leads to attenuation bias—estimated coefficients are biased toward zero.

- Occurs frequently in survey data, behavioral measures, and administrative records.

Example (Digital Marketing): Click-through rates or exposure to ads may be tracked with browser cookies or device IDs, but such identifiers are imperfect. The resulting measurement error biases the estimated effect of advertising downward.

Sample selection becomes a source of endogeneity when inclusion in the sample is related to the outcome variable.

Example (Labor Economics): Estimating the effect of education on wages using only employed individuals excludes those not currently working. If employment is correlated with unobserved traits (e.g., motivation), the wage equation is biased.

Summary Table: Types of Endogeneity

| Type | Mechanism | Example Context |

|---|---|---|

| Omitted Variable Bias | Omitted variable affects both \(X\) and \(Y\) | Managerial talent in finance, brand quality |

| Simultaneity | \(X\) and \(Y\) determined jointly | Price \(\leftrightarrow\) Demand |

| Reverse Causality | \(Y\) causes \(X\) (opposite direction from model assumption) |

Health \(\to\) Insurance Revenue \(\to\) Ad Spend |

| Measurement Error | \(X\) is observed with error | Digital metrics, survey measures |

| Endogenous Sample Selection | Sample selection is correlated with outcome | Labor force participation, customer panels |

Endogeneity is not always fatal—if we can identify it and adjust for it, we can still make credible inferences.

If you suspect an omitted variable but have data on it, you can include it as a control. This is called a “selection on observables” approach.

However, this strategy is often insufficient because:

- Many important factors are unobserved (e.g., motivation, ability, expectations).

- Measured variables may contain measurement error, creating new biases.

- Toolbox for Endogeneity

To address more complex cases, including those involving unobservables, we introduce more advanced methods (see Causal Inference Toolbox)

36.1 Endogenous Treatment

Endogenous treatment occurs when the variable of interest (the “treatment”) is not randomly assigned and is correlated with unobserved determinants of the outcome. As discussed earlier, this can arise from omitted variables, simultaneity, or reverse causality. But even if the true variable is theoretically exogenous, measurement error can make it endogenous in practice.

This section focuses on how measurement errors, especially in explanatory variables, introduce bias—typically attenuation bias—and why they are a central concern in applied research.

36.1.1 Measurement Errors

Measurement error refers to the difference between the true value of a variable and its observed (measured) value.

- Sources of measurement error:

- Coding errors: Manual or software-induced data entry mistakes.

- Reporting errors: Self-report bias, recall issues, or strategic misreporting.

Two Broad Types of Measurement Error

-

Random (Stochastic) Error — Classical Measurement Error

- Noise is unpredictable and averages out in expectation.

- Error is uncorrelated with the true variable and the regression error.

- Common in survey data, tracking errors.

-

Systematic (Non-classical) Error — Non-Random Bias

- Measurement error exhibits consistent patterns across observations.

- Often arises from:

- Instrument error: e.g., faulty sensors, uncalibrated scales.

- Method error: poor sampling, survey design flaws.

- Human error: judgment errors, social desirability bias.

Key insight:

- Random error adds noise, pushing estimates toward zero.

- Systematic error introduces bias, pushing estimates either upward or downward.

36.1.1.1 Classical Measurement Error

36.1.1.1.1 Right-Hand Side Variable

Let’s examine the most common and analytically tractable case: classical measurement error in an explanatory variable.

Suppose the true model is:

\[ Y_i = \beta_0 + \beta_1 X_i + u_i \]

But we do not observe \(X_i\) directly. Instead, we observe:

\[ \tilde{X}_i = X_i + e_i \]

where \(e_i\) is the measurement error, assumed classical:

- \(E[e_i] = 0\)

- \(Cov(X_i, e_i) = 0\)

- \(Cov(e_i, u_i) = 0\)

Now, substitute \(\tilde{X}_i\) into the regression:

\[ \begin{aligned} Y_i &= \beta_0 + \beta_1 ( \tilde{X}_i - e_i ) + u_i \\ &= \beta_0 + \beta_1 \tilde{X}_i + (u_i - \beta_1 e_i) \\ &= \beta_0 + \beta_1 \tilde{X}_i + v_i \end{aligned} \]

where \(v_i = u_i - \beta_1 e_i\) is a composite error term.

Since \(\tilde{X}_i\) contains \(e_i\), and \(v_i\) contains \(e_i\), we now have:

\[ Cov(\tilde{X}_i, v_i) \neq 0 \]

This correlation violates the exogeneity assumption and introduces endogeneity.

We can derive the asymptotic bias:

\[ \begin{aligned} E[\tilde{X}_i v_i] &= E[(X_i + e_i)(u_i - \beta_1 e_i)] \\ &= -\beta_1 Var(e_i) \\ &\neq 0 \end{aligned} \]

This implies:

- If \(\beta_1 > 0\), then \(\hat{\beta}_1\) is biased downward.

- If \(\beta_1 < 0\), then \(\hat{\beta}_1\) is biased upward.

This is called attenuation bias: the estimated effect is biased toward zero.

As the variance of the error \(Var(e_i)\) increases or \(\frac{Var(e_i)}{Var(\tilde{X}_i)} \to 1\), this bias becomes more severe.

Attenuation Factor

The OLS estimator based on the noisy regressor is

\[ \hat{\beta}_{OLS} = \frac{ \text{cov}(\tilde{X}, Y)}{\text{var}(\tilde{X})} = \frac{\text{cov}(X + e, \beta X + u)}{\text{var}(X + e)}. \]

Using the assumptions of classical measurement error, it follows that:

\[ plim\ \hat{\beta}_{OLS} = \beta \cdot \frac{\sigma_X^2}{\sigma_X^2 + \sigma_e^2} = \beta \cdot \lambda, \]

where:

- \(\sigma_X^2\) is the variance of the true regressor \(X\),

- \(\sigma_e^2\) is the variance of the measurement error \(e\), and

- \(\lambda = \frac{\sigma_X^2}{\sigma_X^2 + \sigma_e^2}\) is called the reliability ratio, signal-to-total variance ratio, or attenuation factor.

Since \(\lambda \in (0, 1]\), the bias always attenuates the estimate toward zero. The degree of attenuation bias is:

\[ \hat{\beta}_{OLS} - \beta = - (1 - \lambda)\beta, \]

which implies:

- If \(\lambda = 1\), then \(\hat{\beta}_{OLS} = \beta\) — no bias (no measurement error).

- If \(\lambda < 1\), then \(\hat{\beta}_{OLS} < \beta\) — attenuation toward zero.

Important Notes on Measurement Error

-

Data transformations can magnify measurement error.

Suppose the true model is nonlinear:

\[ y = \beta x + \gamma x^2 + \epsilon, \]

and \(x\) is measured with classical error. Then, the attenuation factor for \(\hat{\gamma}\) is approximately the square of the attenuation factor for \(\hat{\beta}\):

\[ \lambda_{\hat{\gamma}} \approx \lambda_{\hat{\beta}}^2. \]

This shows how nonlinear transformations (e.g., squares, logs) can exacerbate measurement error problems.

-

Including covariates can increase attenuation bias.

Adding covariates that are correlated with the mismeasured variable can worsen bias in the coefficient of interest, especially if the measurement error is not accounted for in those covariates.

Remedies for Measurement Error

To address attenuation bias caused by classical measurement error, consider the following strategies:

- Use validation data or survey information to estimate \(\sigma_X^2\), \(\sigma_e^2\), or \(\lambda\) and apply correction methods (e.g., SIMEX, regression calibration).

-

Instrumental Variables Approach

Use an instrument \(Z\) that:- Is correlated with the true variable \(X\),

- Is uncorrelated with the regression error \(\epsilon\), and

- Is uncorrelated with the measurement error \(e\).

-

Abandon your project

If no good instruments or validation data exist, and the attenuation bias is too severe, it may be prudent to reconsider the analysis or research question. (Said with love and academic humility.)

36.1.1.1.2 Left-Hand Side Variable

Measurement error in the dependent variable (i.e., the response or outcome) is fundamentally different from measurement error in explanatory variables. Its consequences are often less problematic for consistent estimation of regression coefficients (e.g., the zero conditional mean assumption is not violated), but not necessarily for statistical inference (e.g., higher standard errors) or model fit.

Suppose we are interested in the standard linear regression model:

\[ Y_i = \beta X_i + u_i, \]

but we do not observe \(Y_i\) directly. Instead, we observe:

\[ \tilde{Y}_i = Y_i + v_i, \]

where:

- \(v_i\) is measurement error in the dependent variable,

- \(E[v_i] = 0\) (mean-zero),

- \(v_i\) is uncorrelated with \(X_i\) and \(u_i\),

- \(v_i\) is homoskedastic and independent across observations.

Be extra careful here!

These are classical‐error assumptions:

- Mean zero: \(\mathbb{E}[v\mid X]=0\).

- Exogeneity: \(v\) is uncorrelated with each regressor and with the structural disturbance \(\epsilon\) (i.e., \(\operatorname{Cov}(X,v)=\operatorname{Cov}(\epsilon,v)=0\)).

- Homoskedasticity / finite moments for the law‑of‑large‑numbers to apply.

The regression we actually estimate is:

\[ \tilde{Y}_i = \beta X_i + u_i + v_i. \]

We can define a composite error term:

\[ \tilde{u}_i = u_i + v_i, \]

so that the model becomes:

\[ \tilde{Y}_i = \beta X_i + \tilde{u}_i. \]

Under the classical-error assumptions, the extra noise simply enlarges the composite error term \(\tilde{u}_i\), leaving

\[ \hat\beta^{\text{OLS}} =\beta + ( X' X)^{-1} X'(u+v) \xrightarrow{p} \beta , \]

so the estimator remains consistent and only its variance rises.

Key Insights

-

Unbiasedness and Consistency of \(\hat{\beta}\):

As long as \(E[\tilde{u}_i \mid X_i] = 0\), which holds under the classical assumptions (i.e., \(E[u_i \mid X_i] = 0\) and \(E[v_i \mid X_i] = 0\)), the OLS estimator of \(\beta\) remains unbiased and consistent.

This is because measurement error in the left-hand side does not induce endogeneity. The zero conditional mean assumption is preserved.

-

Interpretation (Why Econometricians Don’t Panic):

Econometricians and causal researchers often focus on consistent estimation of causal effects under strict exogeneity. Since \(v_i\) just adds noise to the outcome and doesn’t systematically relate to \(X_i\), the slope estimate \(\hat{\beta}\) remains a valid estimate of the causal effect \(\beta\).

-

Statistical Implications (Why Statisticians Might Worry):

Although \(\hat{\beta}\) is consistent, the variance of the error term increases due to the added noise \(v_i\). Specifically:

\[ \text{Var}(\tilde{u}_i) = \text{Var}(u_i) + \text{Var}(v_i) = \sigma_u^2 + \sigma_v^2. \]

This leads to:

- Higher residual variance \(\Rightarrow\) lower \(R^2\)

- Higher standard errors for coefficient estimates

- Wider confidence intervals, reducing the precision of inference

Thus, even though the point estimate is valid, inference becomes weaker: hypothesis tests are less powerful, and conclusions less precise.

Practical Illustration

- Suppose \(X\) is a marketing investment and \(Y\) is sales revenue.

- If sales are measured with noise (e.g., misrecorded sales data, rounding, reporting delays), the coefficient on marketing is still consistently estimated.

- However, uncertainty around the estimate grows: wider confidence intervals might make it harder to detect statistically significant effects, especially in small samples.

Summary Table: Measurement Error Consequences

| Location of Measurement Error | Bias in \(\hat{\beta}\) | Consistency | Affects Inference? | Typical Concern |

|---|---|---|---|---|

| Regressor (\(X\)) | Yes (attenuation) | No | Yes | Econometric & statistical |

| Outcome (\(Y\)) | No | Yes | Yes | Mainly statistical |

36.1.1.2 Non-Classical Measurement Error

In the classical measurement error model, we assume that the measurement error \(\epsilon\) is independent of the true variable \(X\) and of the regression disturbance \(u\). However, in many realistic data scenarios, this assumption does not hold. Non-classical measurement error refers to cases where:

- \(\epsilon\) is correlated with \(X\),

- or possibly even correlated with \(u\).

Violating the classical assumptions introduces additional and potentially complex biases in OLS estimation.

Recall that in the classical measurement error model, we observe:

\[ \tilde{X} = X + \epsilon, \]

where:

- \(\epsilon\) is independent of \(X\) and \(u\),

- \(E[\epsilon] = 0\).

The true model is:

\[ Y = \beta X + u. \]

Then, OLS based on the mismeasured regressor gives:

\[ \hat{\beta}_{OLS} = \frac{\text{cov}(\tilde{X}, Y)}{\text{var}(\tilde{X})} = \frac{\text{cov}(X + \epsilon, \beta X + u)}{\text{var}(X + \epsilon)}. \]

With classical assumptions, this simplifies to:

\[ plim\ \hat{\beta}_{OLS} = \beta \cdot \frac{\sigma_X^2}{\sigma_X^2 + \sigma_\epsilon^2} = \beta \cdot \lambda, \]

where \(\lambda\) is the reliability ratio, which attenuates \(\hat{\beta}\) toward zero.

Let us now relax the independence assumption and allow for correlation between \(X\) and \(\epsilon\). In particular, suppose:

- \(\text{cov}(X, \epsilon) = \sigma_{X\epsilon} \ne 0\).

Then the probability limit of the OLS estimator becomes:

\[ \begin{aligned} plim\ \hat{\beta} &= \frac{\text{cov}(X + \epsilon, \beta X + u)}{\text{var}(X + \epsilon)} \\ &= \frac{\beta (\sigma_X^2 + \sigma_{X\epsilon})}{\sigma_X^2 + \sigma_\epsilon^2 + 2 \sigma_{X\epsilon}}. \end{aligned} \]

We can rewrite this as:

\[ \begin{aligned} plim\ \hat{\beta} &= \beta \left(1 - \frac{\sigma_\epsilon^2 + \sigma_{X\epsilon}}{\sigma_X^2 + \sigma_\epsilon^2 + 2 \sigma_{X\epsilon}} \right) \\ &= \beta (1 - b_{\epsilon \tilde{X}}), \end{aligned} \]

where \(b_{\epsilon \tilde{X}}\) is the regression coefficient of \(\epsilon\) on \(\tilde{X}\), or more precisely:

\[ b_{\epsilon \tilde{X}} = \frac{\text{cov}(\epsilon, \tilde{X})}{\text{var}(\tilde{X})}. \]

This makes clear that the bias in \(\hat{\beta}\) depends on how strongly the measurement error is correlated with the observed regressor \(\tilde{X}\). This general formulation nests the classical case as a special case:

- In classical error: \(\sigma_{X\epsilon} = 0 \Rightarrow b_{\epsilon \tilde{X}} = \frac{\sigma^2_\epsilon}{\sigma^2_X + \sigma^2_\epsilon} = 1 - \lambda\).

Implications of Non-Classical Measurement Error

- When \(\sigma_{X\epsilon} > 0\), the attenuation bias can increase or decrease depending on the balance of variances.

- In particular:

- If more than half of the variance in \(\tilde{X}\) is due to measurement error, increasing \(\sigma_{X\epsilon}\) increases attenuation.

- If less than half is due to measurement error, it can actually reduce attenuation.

- This phenomenon is sometimes called mean-reverting measurement error: the measurement error pulls observed values toward the mean, distorting estimates Bound, Brown, and Mathiowetz (2001).

36.1.1.2.1 A General Framework for Non-Classical Measurement Error

Bound, Brown, and Mathiowetz (2001) offer a unified matrix framework that accommodates measurement error in both the independent and dependent variables.

Let the true model be:

\[ \mathbf{Y = X \beta + \epsilon}, \]

but we observe \(\tilde{X} = X + U\) and \(\tilde{Y} = Y + v\), where:

- \(U\) is a matrix of measurement error in \(X\),

- \(v\) is a vector of measurement error in \(Y\).

Then, the observed model becomes:

\[ \hat{\beta} = (\tilde{X}' \tilde{X})^{-1} \tilde{X}' \tilde{Y}. \]

Substituting the observed quantities:

\[ \begin{aligned} \tilde{Y} &= Y + v = X \beta + \epsilon + v, \\ &= \tilde{X} \beta - U \beta + v + \epsilon. \end{aligned} \]

Hence,

\[ \hat{\beta} = (\tilde{X}' \tilde{X})^{-1} \tilde{X}' (\tilde{X} \beta - U \beta + v + \epsilon), \]

which simplifies to:

\[ \hat{\beta} = \beta + (\tilde{X}' \tilde{X})^{-1} \tilde{X}' (-U \beta + v + \epsilon). \]

Taking the probability limit:

\[ plim\ \hat{\beta} = \beta + plim\ [(\tilde{X}' \tilde{X})^{-1} \tilde{X}' (-U \beta + v)], \]

Now define:

\[ W = [U \quad v], \]

and we can express the bias compactly as:

\[ plim\ \hat{\beta} = \beta + plim\ [(\tilde{X}' \tilde{X})^{-1} \tilde{X}' W \begin{bmatrix} - \beta \\ 1 \end{bmatrix} ]. \]

This formulation highlights a powerful insight:

Bias in \(\hat{\beta}\) arises from the linear projection of the measurement errors onto the observed \(\tilde{X}\).

This expression does not assert that \(v\) necessarily biases \(\hat\beta\); it simply makes explicit that bias arises whenever the linear projection of \((U\beta-v)\) onto \(\tilde X\) is non‑zero. Three cases illustrate the point:

| Case | Key correlation | Consequence for \(\hat\beta\) |

| Classical Y‑error only | projection term vanishes | Consistent; larger standard errors | | \(U\equiv0, \operatorname{Cov}(\tilde X,v)=0\) | | | | ||

| Correlated Y‑error | projection picks up \(v\) | Biased (attenuation or sign reversal possible) | | \(U\equiv0, \operatorname{Cov}(\tilde X,v)\neq0\) | | | | ||

| Both X‑ and Y‑error, independent | \(U\beta\) projects onto \(\tilde X\) | Biased because of \(U\), not \(v\) | | \(\operatorname{Cov}(X,U)\neq0, \operatorname{Cov}(\tilde X,v)=0\) | | | | ||

Hence, your usual “harmless \(Y\)-noise” result is the special case in the first row.

Practical implications

Check assumptions explicitly. If the dataset was generated by self‑reports, simultaneous proxies, or modelled outcomes, it is rarely safe to assume \(\operatorname{Cov}(X,v)=0\).

-

Correlated errors in \(Y\) can creep in through:

- Common data‑generating mechanisms (e.g., same survey module records both earnings (\(Y\)) and hours worked (\(X\))).

- Prediction‑generated variables where \(v\) inherits correlation with the features used to build \(\tilde Y\).

Joint mis‑measurement (\(U\) and \(v\) correlated) is common in administrative or sensor data; here, even “classical” \(v\) with respect to \(X\) can correlate with \(\tilde X=X+U\).

Measurement error in \(Y\) is benign only under strong exogeneity and independence conditions. The Bound–Brown–Mathiowetz matrix form (Bound, Brown, and Mathiowetz 2001) simply shows that once those conditions fail—or once \(X\) itself is mis‑measured—the same projection logic that produces attenuation bias for \(X\) can also transmit bias from \(v\) to \(\hat\beta\).

So the rule of thumb you learned is true in its narrow, classical setting, but Bound, Brown, and Mathiowetz (2001) remind us that empirical work often strays outside that safe harbor.

Consequences and Correction

- Non-classical error can lead to over- or underestimation, unlike the always-attenuating classical case.

- The direction and magnitude of bias depend on the correlation structure of \(X\), \(\epsilon\), and \(v\).

- This poses serious problems in many survey and administrative data settings where systematic misreporting occurs.

Practical Solutions

Instrumental Variables

Use an instrument \(Z\) that is correlated with the true variable \(X\), but uncorrelated with both measurement error and the regression disturbance. IV can help eliminate both classical and non-classical error-induced biases.Validation Studies

Use a subset of the data with accurate measures to estimate the structure of measurement error and correct estimates via techniques such as regression calibration, multiple imputation, or SIMEX.Modeling the Error Process

Explicitly model the measurement error process, especially in longitudinal or panel data (e.g., via state-space models or Bayesian approaches).Binary/Dummy Variable Case

Non-classical error in binary regressors (e.g., misclassification) also leads to bias, but IV methods still apply. For example, if education level is misreported in survey data, a valid instrument (e.g., policy-based variation) can correct for misclassification bias.

Summary

| Feature | Classical Error | Non-Classical Error |

|---|---|---|

| \(\text{Cov}(X, \epsilon)\) | 0 | \(\ne 0\) |

| Bias in \(\hat{\beta}\) | Always attenuation | Can attenuate or inflate |

| Consistency of OLS | No | No |

| Effect of Variance Structure | Predictable | Depends on \(\sigma_{X\epsilon}\) |

| Fixable with IV | Yes | Yes |

In short, non-classical measurement error breaks the comforting regularity of attenuation bias. It can produce arbitrary biases depending on the nature and structure of the error. Instrumental variables and validation studies are often the only reliable tools for addressing this complex problem.

36.1.1.3 Solution to Measurement Errors in Correlation Estimation

36.1.1.3.1 Bayesian Correction for Correlation Coefficient

We begin by expressing the Bayesian posterior for a correlation coefficient \(\rho\):

\[ \begin{aligned} P(\rho \mid \text{data}) &= \frac{P(\text{data} \mid \rho) P(\rho)}{P(\text{data})} \\ \text{Posterior Probability} &\propto \text{Likelihood} \times \text{Prior Probability} \end{aligned} \]

Where:

- \(\rho\) is the true population correlation coefficient

- \(P(\text{data} \mid \rho)\) is the likelihood function

- \(P(\rho)\) is the prior density of \(\rho\)

- \(P(\text{data})\) is the marginal likelihood (a normalizing constant)

With sample correlation coefficient \(r\):

\[ r = \frac{S_{xy}}{\sqrt{S_{xx} S_{yy}}} \]

According to Schisterman et al. (2003), pp. 3, the posterior density of \(\rho\) can be approximated as:

\[ P(\rho \mid x, y) \propto P(\rho) \cdot \frac{(1 - \rho^2)^{(n - 1)/2}}{(1 - \rho r)^{n - 3/2}} \]

This approximation leads to a posterior that can be modeled via the Fisher transformation:

- Let \(\rho = \tanh(\xi)\), where \(\xi \sim N(z, 1/n)\)

- \(r = \tanh(z)\) is the Fisher-transformed correlation

Using conjugate normal approximations, we derive the posterior for the transformed correlation \(\xi\) as:

- Posterior Variance:

\[ \sigma^2_{\text{posterior}} = \frac{1}{n_{\text{prior}} + n_{\text{likelihood}}} \]

- Posterior Mean:

\[ \mu_{\text{posterior}} = \sigma^2_{\text{posterior}} \left(n_{\text{prior}} \cdot \tanh^{-1}(r_{\text{prior}}) + n_{\text{likelihood}} \cdot \tanh^{-1}(r_{\text{likelihood}})\right) \]

To simplify the mathematics, we may assume a prior of the form:

\[ P(\rho) \propto (1 - \rho^2)^c \]

where \(c\) controls the strength of the prior. If no prior information is available, we can set \(c = 0\) so that \(P(\rho) \propto 1\).

Example: Combining Estimates from Two Studies

Let:

- Current study: \(r_{\text{likelihood}} = 0.5\), \(n_{\text{likelihood}} = 200\)

- Prior study: \(r_{\text{prior}} = 0.2765\), \(n_{\text{prior}} = 50205\)

Step 1: Posterior Variance

\[ \sigma^2_{\text{posterior}} = \frac{1}{50205 + 200} = 0.0000198393 \]

Step 2: Posterior Mean

Apply Fisher transformation:

- \(\tanh^{-1}(0.2765) \approx 0.2841\)

- \(\tanh^{-1}(0.5) = 0.5493\)

Then:

\[ \begin{aligned} \mu_{\text{posterior}} &= 0.0000198393 \times (50205 \times 0.2841 + 200 \times 0.5493) \\ &= 0.0000198393 \times (14260.7 + 109.86) \\ &= 0.0000198393 \times 14370.56 = 0.2850 \end{aligned} \]

Thus, the posterior distribution of \(\xi = \tanh^{-1}(\rho)\) is:

\[ \xi \sim N(0.2850, 0.0000198393) \]

Transforming back:

- Posterior mean correlation: \(\rho = \tanh(0.2850) = 0.2776\)

- 95% CI for \(\xi\): \(0.2850 \pm 1.96 \cdot \sqrt{0.0000198393} = (0.2762, 0.2937)\)

- Transforming endpoints: \(\tanh(0.2762) = 0.2694\), \(\tanh(0.2937) = 0.2855\)

The Bayesian posterior distribution for the correlation coefficient is:

- Mean: \(\hat{\rho}_{\text{posterior}} = 0.2776\)

- 95% CI: \((0.2694,\ 0.2855)\)

This Bayesian adjustment is especially useful when:

- There is high sampling variation due to small sample sizes

- Measurement error attenuates the observed correlation

- Combining evidence from multiple studies (meta-analytic context)

By leveraging prior information and applying the Fisher transformation, researchers can obtain a more stable and accurate estimate of the true underlying correlation.

# Define inputs

n_new <- 200

r_new <- 0.5

alpha <- 0.05

# Bayesian update function for correlation coefficient

update_correlation <- function(n_new, r_new, alpha) {

# Prior (meta-analysis study)

n_meta <- 50205

r_meta <- 0.2765

# Step 1: Posterior variance (in Fisher-z space)

var_xi <- 1 / (n_new + n_meta)

# Step 2: Posterior mean (in Fisher-z space)

mu_xi <- var_xi * (n_meta * atanh(r_meta) + n_new * atanh(r_new))

# Step 3: Confidence interval in Fisher-z space

z_crit <- qnorm(1 - alpha / 2)

upper_xi <- mu_xi + z_crit * sqrt(var_xi)

lower_xi <- mu_xi - z_crit * sqrt(var_xi)

# Step 4: Transform back to correlation scale

mean_rho <- tanh(mu_xi)

upper_rho <- tanh(upper_xi)

lower_rho <- tanh(lower_xi)

# Return all values as a list

list(

mu_xi = mu_xi,

var_xi = var_xi,

upper_xi = upper_xi,

lower_xi = lower_xi,

mean_rho = mean_rho,

upper_rho = upper_rho,

lower_rho = lower_rho

)

}

# Run update

updated <-

update_correlation(n_new = n_new,

r_new = r_new,

alpha = alpha)

# Display updated posterior mean and confidence interval

cat("Posterior mean of rho:", round(updated$mean_rho, 4), "\n")

#> Posterior mean of rho: 0.2775

cat(

"95% CI for rho: (",

round(updated$lower_rho, 4),

",",

round(updated$upper_rho, 4),

")\n"

)

#> 95% CI for rho: ( 0.2694 , 0.2855 )

# For comparison: Classical (frequentist) confidence interval around r_new

se_r <- sqrt(1 / n_new)

z_r <- qnorm(1 - alpha / 2) * se_r

ci_lo <- r_new - z_r

ci_hi <- r_new + z_r

cat("Frequentist 95% CI for r:",

round(ci_lo, 4),

"to",

round(ci_hi, 4),

"\n")

#> Frequentist 95% CI for r: 0.3614 to 0.638636.1.2 Simultaneity

Simultaneity arises when at least one of the explanatory variables in a regression model is jointly determined with the dependent variable, violating a critical assumption for causal inference: temporal precedence.

Why Simultaneity Matters

- In classical regression, we assume that regressors are determined exogenously—they are not influenced by the dependent variable.

- Simultaneity introduces endogeneity, where regressors are correlated with the error term, rendering OLS estimators biased and inconsistent.

- This has major implications in fields like economics, marketing, finance, and social sciences, where feedback mechanisms or equilibrium processes are common.

Real-World Examples

- Demand and supply: Price and quantity are determined together in market equilibrium.

- Sales and advertising: Advertising influences sales, but firms also adjust advertising based on current or anticipated sales.

- Productivity and investment: Higher productivity may attract investment, but investment can improve productivity.

36.1.2.1 Simultaneous Equation System

We begin with a basic two-equation structural model:

\[ \begin{aligned} Y_i &= \beta_0 + \beta_1 X_i + u_i \quad \text{(Structural equation for } Y) \\ X_i &= \alpha_0 + \alpha_1 Y_i + v_i \quad \text{(Structural equation for } X) \end{aligned} \]

Here:

- \(Y_i\) and \(X_i\) are endogenous variables — both determined within the system.

- \(u_i\) and \(v_i\) are structural error terms, assumed to be uncorrelated with the exogenous variables (if any).

The equations form a simultaneous system because each endogenous variable appears on the right-hand side of the other’s equation.

To uncover the statistical properties of these equations, we solve for \(Y_i\) and \(X_i\) as functions of the error terms only:

\[ \begin{aligned} Y_i &= \frac{\beta_0 + \beta_1 \alpha_0}{1 - \alpha_1 \beta_1} + \frac{\beta_1 v_i + u_i}{1 - \alpha_1 \beta_1} \\ X_i &= \frac{\alpha_0 + \alpha_1 \beta_0}{1 - \alpha_1 \beta_1} + \frac{v_i + \alpha_1 u_i}{1 - \alpha_1 \beta_1} \end{aligned} \]

These are the reduced-form equations, expressing the endogenous variables as functions of exogenous factors and disturbances.

36.1.2.2 Simultaneity Bias in OLS

If we naïvely estimate the first equation using OLS, assuming \(X_i\) is exogenous, we get:

\[ \text{Bias: } \quad Cov(X_i, u_i) = Cov\left(\frac{v_i + \alpha_1 u_i}{1 - \alpha_1 \beta_1}, u_i\right) = \frac{\alpha_1}{1 - \alpha_1 \beta_1} \cdot Var(u_i) \]

This violates the Gauss-Markov Theorem that regressors be uncorrelated with the error term. The OLS estimator for \(\beta_1\) is biased and inconsistent.

To allow for identification and estimation, we introduce exogenous variables:

\[ \begin{cases} Y_i = \beta_0 + \beta_1 X_i + \beta_2 T_i + u_i \\ X_i = \alpha_0 + \alpha_1 Y_i + \alpha_2 Z_i + v_i \end{cases} \]

Where:

- \(X_i\), \(Y_i\) — endogenous variables

- \(T_i\), \(Z_i\) — exogenous variables, not influenced by any variable in the system

Solving this system algebraically yields the reduced form model:

\[ \begin{cases}\begin{aligned}Y_i &= \frac{\beta_0 + \beta_1 \alpha_0}{1 - \alpha_1 \beta_1} + \frac{\beta_1 \alpha_2}{1 - \alpha_1 \beta_1} Z_i + \frac{\beta_2}{1 - \alpha_1 \beta_1} T_i + \tilde{u}_i \\&= B_0 + B_1 Z_i + B_2 T_i + \tilde{u}_i\end{aligned}\\\begin{aligned}X_i &= \frac{\alpha_0 + \alpha_1 \beta_0}{1 - \alpha_1 \beta_1} + \frac{\alpha_2}{1 - \alpha_1 \beta_1} Z_i + \frac{\alpha_1\beta_2}{1 - \alpha_1 \beta_1} T_i + \tilde{v}_i \\&= A_0 + A_1 Z_i + A_2 T_i + \tilde{v}_i\end{aligned}\end{cases} \]

The reduced form expresses endogenous variables as functions of exogenous instruments, which we can estimate using OLS.

Using reduced-form estimates \((A_1, A_2, B_1, B_2)\), we can identify (recover) the structural coefficients:

\[ \begin{aligned} \beta_1 &= \frac{B_1}{A_1} \\ \beta_2 &= B_2 \left(1 - \frac{B_1 A_2}{A_1 B_2}\right) \\ \alpha_1 &= \frac{A_2}{B_2} \\ \alpha_2 &= A_1 \left(1 - \frac{B_1 A_2}{A_1 B_2} \right) \end{aligned} \]

36.1.2.3 Identification Conditions

Estimation of structural parameters is only possible if the model is identified.

Order Condition (Necessary but Not Sufficient)

A structural equation is identified if:

\[ K - k \ge m - 1 \]

Where:

\(M\) = total number of endogenous variables in the system

\(m\) = number of endogenous variables in the given equation

\(K\) = number of total exogenous variables in the system

\(k\) = number of exogenous variables appearing in the given equation

Just-identified: \(K - k = m - 1\) (exact identification)

Over-identified: \(K - k > m - 1\) (more instruments than necessary)

Under-identified: \(K - k < m - 1\) (cannot be estimated)

Note: The order condition is necessary but not sufficient. The rank condition must also be satisfied for full identification, which we cover in Instrumental Variables.

This simultaneous equations framework provides the foundation for instrumental variable estimation, where:

- Exogenous variables not appearing in a structural equation serve as instruments.

- These instruments allow consistent estimation of endogenous regressors’ effects.

The reduced-form equations are often used to generate fitted values of endogenous regressors, which are then used in a Two-Stage Least Squares estimation process

36.1.3 Reverse Causality

Reverse causality refers to a situation in which the direction of causation is opposite to what is presumed. Specifically, we may model a relationship where variable \(X\) is assumed to cause \(Y\), but in reality, \(Y\) causes \(X\), or both influence each other in a feedback loop.

This violates a fundamental assumption for causal inference: temporal precedence — the cause must come before the effect. In the presence of reverse causality, the relationship between \(X\) and \(Y\) becomes ambiguous, and statistical estimators such as OLS become biased and inconsistent.

In a standard linear regression model:

\[ Y_i = \beta_0 + \beta_1 X_i + u_i \]

We interpret \(\beta_1\) as the causal effect of \(X\) on \(Y\). However, this interpretation implicitly assumes that:

- \(X_i\) is exogenous (uncorrelated with \(u_i\))

- Changes in \(X_i\) occur prior to or independently of changes in \(Y_i\)

If \(Y_i\) also affects \(X_i\), then \(X_i\) is not exogenous — it is endogenous, because it is correlated with \(u_i\) via the reverse causal path.

Reverse causality is especially problematic in observational data where interventions are not randomly assigned. Some key examples include:

- Health and income: Higher income may improve health outcomes, but healthier individuals may also earn more (e.g., due to better productivity or fewer sick days).

- Education and wages: Education raises wages, but higher-income individuals might afford better education — or individuals with higher innate ability (reflected in \(u\)) pursue more education and also earn more.

- Crime and policing: Increased police presence is often assumed to reduce crime, but high-crime areas are also likely to receive more police resources.

- Advertising and sales: Firms advertise more to boost sales, but high sales may also lead to higher advertising budgets — especially when revenue is reinvested in marketing.

To model reverse causality explicitly, consider:

36.1.3.1 System of Equations

\[ \begin{aligned} Y_i &= \beta_0 + \beta_1 X_i + u_i \quad &\text{(Y depends on X)} \\ X_i &= \gamma_0 + \gamma_1 Y_i + v_i \quad &\text{(X depends on Y)} \end{aligned} \]

This feedback loop represents a simultaneous system, but where the causality direction is unclear. The two equations indicate that both variables are endogenous.

Even if we estimate only the first equation using OLS, the bias becomes apparent:

\[ Cov(X_i, u_i) \ne 0 \quad \Rightarrow \quad \hat{\beta}_1 \text{ is biased} \]

Why? Because \(X_i\) is determined by \(Y_i\), which itself depends on \(u_i\). Thus, \(X_i\) indirectly depends on \(u_i\).

In causal diagram notation (Directed Acyclic Graphs, or DAGs), reverse causality violates the acyclicity assumption. Here’s an example:

- Intended model: \(X \rightarrow Y\)

- Reality: \(X \leftrightarrow Y\) (feedback loop)

This non-directional causality prevents us from interpreting coefficients causally unless additional identification strategies are applied.

OLS assumes:

\[ E[u_i \mid X_i] = 0 \]

Under reverse causality, this condition fails. The resulting estimator \(\hat{\beta}_1\) captures both the effect of \(X\) on \(Y\) and the feedback from \(Y\) to \(X\), leading to:

- Omitted variable bias: \(X_i\) captures unobserved information from \(Y_i\)

- Simultaneity bias: caused by the endogenous nature of \(X_i\)

36.1.3.2 Distinction from Simultaneity

Reverse causality is a special case of endogeneity, often manifesting as simultaneity. However, the key distinction is:

- Simultaneity: Variables are determined together (e.g., in equilibrium models), and both are modeled explicitly in a system.

- Reverse causality: Only one equation is estimated, and the true causal direction is unknown or opposite to what is modeled.

Reverse causality may or may not involve a full simultaneous system — it’s often unrecognized or assumed away, making it especially dangerous in empirical research.

There are no mechanical tests that definitively detect reverse causality, but researchers can:

- Use temporal data (lags): Estimate \(Y_{it} = \beta_0 + \beta_1 X_{i,t-1} + u_{it}\) and examine the temporal precedence of variables.

- Apply Granger causality tests in time series (not strictly causal, but helpful diagnostically).

- Use theoretical reasoning to justify directionality.

- Check robustness across different time frames or instrumental variables.

36.1.3.3 Solutions to Reverse Causality

The following methods can mitigate reverse causality:

- Find a variable \(Z\) that affects \(X\) but is not affected by \(Y\), nor correlated with \(u_i\).

- First stage: \(X_i = \pi_0 + \pi_1 Z_i + e_i\)

- Second stage: \(\hat{X}_i\) from the first stage is used in the regression for \(Y\).

- Randomized Controlled Trials (RCTs)

- In experiments, the treatment (e.g., \(X\)) is assigned randomly and therefore exogenous by design.

- Natural Experiments / Quasi-Experimental Designs

- Use external shocks or policy changes that affect \(X\) but not \(Y\) directly (e.g., difference-in-differences, regression discontinuity).

- Panel Data Methods

- Use fixed-effects or difference estimators to eliminate time-invariant confounders.

- Lag independent variables to examine delayed effects and improve causal direction inference.

- Structural Equation Modeling

- Estimate a full system of equations to explicitly model feedback.

36.1.4 Omitted Variable Bias

Omitted Variable Bias (OVB) arises when a relevant explanatory variable that influences the dependent variable is left out of the regression model, and the omitted variable is correlated with one or more included regressors. This violates the exogeneity assumption of OLS and leads to biased and inconsistent estimators.

Suppose we are interested in estimating the effect of an independent variable \(X\) on an outcome \(Y\), and the true data-generating process is:

\[ Y_i = \beta_0 + \beta_1 X_i + \beta_2 Z_i + u_i \]

However, if we omit \(Z_i\) and estimate the model:

\[ Y_i = \gamma_0 + \gamma_1 X_i + \varepsilon_i \]

Then the estimate \(\hat{\gamma}_1\) may be biased because \(X_i\) may be correlated with \(Z_i\), and \(Z_i\) influences \(Y_i\).

Let us derive the bias formally.

True model:

\[ Y_i = \beta_0 + \beta_1 X_i + \beta_2 Z_i + u_i \quad \text{(1)} \]

Estimated model (with \(Z_i\) omitted):

\[ Y_i = \gamma_0 + \gamma_1 X_i + \varepsilon_i \quad \text{(2)} \]

Now, substitute the true model into the omitted model:

\[ Y_i = \beta_0 + \beta_1 X_i + \beta_2 Z_i + u_i = \gamma_0 + \gamma_1 X_i + \varepsilon_i \]

Comparing both models, the omitted variable becomes part of the new error term:

\[ \varepsilon_i = \beta_2 Z_i + u_i \]

Now, consider the OLS assumption:

\[ E[\varepsilon_i \mid X_i] = 0 \quad \text{(OLS requirement)} \]

But since \(\varepsilon_i = \beta_2 Z_i + u_i\) and \(Z_i\) is correlated with \(X_i\), we have:

\[ Cov(X_i, \varepsilon_i) = \beta_2 Cov(X_i, Z_i) \ne 0 \]

Therefore, OLS assumption fails, and \(\hat{\gamma}_1\) is biased.

Let us calculate the expected value of the OLS estimator \(\hat{\gamma}_1\).

From regression theory, when omitting \(Z_i\), the expected value of \(\hat{\gamma}_1\) is:

\[ E[\hat{\gamma}_1] = \beta_1 + \beta_2 \cdot \frac{Cov(X_i, Z_i)}{Var(X_i)} \]

This is the Omitted Variable Bias formula.

Interpretation:

The bias in \(\hat{\gamma}_1\) depends on: - \(\beta_2\): the true effect of the omitted variable on \(Y\) - \(Cov(X_i, Z_i)\): the correlation between \(X\) and the omitted variable \(Z\)

36.1.4.1 Direction of the Bias

- If \(\beta_2 > 0\) and \(Cov(X_i, Z_i) > 0\): \(\hat{\gamma}_1\) is upward biased

- If \(\beta_2 < 0\) and \(Cov(X_i, Z_i) > 0\): \(\hat{\gamma}_1\) is downward biased

- If \(Cov(X_i, Z_i) = 0\): No bias, even if \(Z_i\) is omitted

Note: Uncorrelated omitted variables do not bias the OLS estimator, although they may reduce precision.

36.1.4.2 Practical Example: Education and Earnings

Suppose we model:

\[ \text{Earnings}_i = \gamma_0 + \gamma_1 \cdot \text{Education}_i + \varepsilon_i \]

But the true model includes ability (\(Z_i\)):

\[ \text{Earnings}_i = \beta_0 + \beta_1 \cdot \text{Education}_i + \beta_2 \cdot \text{Ability}_i + u_i \]

Omitting “ability” — a determinant of both education and earnings — leads to bias in the estimated effect of education:

- If more able individuals pursue more education and ability raises earnings (\(\beta_2 > 0\)), then \(\hat{\gamma}_1\) overstates the true return to education.

36.1.4.3 Generalization to Multiple Regression

In models with multiple regressors, omitting a relevant variable that is correlated with at least one included regressor will bias all coefficients affected by the correlation structure.

For example:

\[ Y_i = \beta_0 + \beta_1 X_{1i} + \beta_2 X_{2i} + u_i \]

If \(X_2\) is omitted, and \(Cov(X_1, X_2) \ne 0\), then:

\[ E[\hat{\gamma}_1] = \beta_1 + \beta_2 \cdot \frac{Cov(X_1, X_2)}{Var(X_1)} \]

36.1.4.4 Remedies for OVB

- Include the omitted variable

- If \(Z\) is observed, include it in the regression model.

-

If \(Z\) is unobserved but \(X\) is endogenous, find an instrument \(W\):

- Relevance: \(Cov(W, X) \ne 0\)

- Exogeneity: \(Cov(W, u) = 0\)

- Use Panel Data Methods

- Fixed Effects: eliminate time-invariant omitted variables.

- Difference-in-Differences: exploit temporal variation to isolate effects.

- Randomization ensures omitted variables are orthogonal to treatment, avoiding bias.

36.2 Endogenous Sample Selection

Endogenous sample selection arises in observational or non-experimental research whenever the inclusion of observations (or assignment to treatment) is not random, and the same unobservable factors influencing selection also affect the outcome of interest. This scenario leads to biased and inconsistent estimates of causal parameters (e.g., Average Treatment Effect) if not properly addressed.

This problem was first formalized in the econometric literature by J. Heckman (1974), J. J. Heckman (1976b), and J. J. Heckman (1979), whose work addressed the issue in the context of labor force participation among women. Later, Amemiya (1984) generalize the method. Now, it has since been applied widely across social sciences, epidemiology, marketing, and finance.

Endogenous sample selection is often conflated with general selection bias, but it is important to understand that sample selection refers specifically to the inclusion of observations into the estimation sample, not just to assignment into treatment (i.e., selection bias).

This problem comes in many names such as self-selection problem, incidental truncation, or omitted variable (i.e., the omitted variable is how people were selected into the sample). Some disciplines consider nonresponse/selection bias as sample selection:

- When unobservable factors that affect who is in the sample are independent of unobservable factors that affect the outcome, the sample selection is not endogenous. Hence, the sample selection is ignorable and estimator that ignores sample selection is still consistent.

- When the unobservable factors that affect who is included in the sample are correlated with the unobservable factors that affect the outcome, the sample selection is endogenous and not ignorable, because estimators that ignore endogenous sample selection are not consistent (we don’t know which part of the observable outcome is related to the causal relationship and which part is due to different people were selected for the treatment and control groups).

Many evaluation studies use observational data, and in such data:

- Participants are not randomly assigned.

- Treatment or exposure is determined by individual or institutional choices.

- Counterfactual outcomes are not observed.

- The treatment indicator is often endogenous.

Some notable terminologies include:

-

Truncation: Occurs when data are collected only from a restricted subpopulation based on the value of a variable.

- Left truncation: Values below a threshold are excluded (e.g., only high-income individuals are surveyed).

- Right truncation: Values above a threshold are excluded.

-

Censoring: Occurs when the variable is observed but coarsened beyond a threshold.

- E.g., incomes below a certain level are coded as zero; arrest counts above a threshold are top-coded.

-

Incidental Truncation: Refers to selection based on a latent variable (e.g., employment decisions), not directly observed. This is what makes Heckman’s model distinct.

- Also called non-random sample selection.

- The error in the outcome equation is correlated with the selection indicator.

Researchers often categorize self-selection into:

-

Negative (Mitigation-Based) Selection: Individuals select into a treatment or sample to address an existing problem, so they start off with worse potential outcomes.

- Bias direction: Underestimates true treatment effects (makes the treatment look less effective than it is).

- Individuals select into treatment to combat a problem they already face.

-

Examples:

- People at high risk of severe illness (e.g., elderly or immunocompromised individuals) are more likely to get vaccinated. If we compare vaccinated vs. unvaccinated individuals without adjusting for risk factors, we might mistakenly conclude that vaccines are ineffective simply because vaccinated individuals had worse initial health conditions.

- Evaluating the effect of job training programs—unemployed individuals with the greatest difficulty finding jobs are most likely to enroll, leading to underestimated program benefits.

-

Positive (Preference-Based) Selection: Individuals select into a treatment or sample because they have advantageous traits, preferences, or resources. Hence, those who take treatment are systematically better off compared to those who do not.

- Bias direction: Overestimates true treatment effects (makes the treatment look more effective than it is).

- Individuals select into treatment because they inherently prefer it, rather than because of an underlying problem.

-

Examples:

- People who are health-conscious and physically active are more likely to join a fitness program. If we compare fitness program participants to non-participants, we might falsely attribute their better health outcomes to the program, when in reality, their pre-existing lifestyle contributed to their improved health.

- Evaluating the effect of private school education—students who attend private schools often come from wealthier families with greater academic support, making it difficult to isolate the true impact of the school itself.

Both forms of selection reflect correlation between unobservables (driving selection) and potential outcomes—the hallmark of endogenous selection bias.

Some seminal applied works in this area include:

- Labor Force Participation (J. Heckman 1974)

- Wages are observed only for women who choose to work.

- Unobservable preferences (reservation wages) drive participation.

- Ignoring this leads to biased estimates of the returns to education.

- Union Membership (Lewis 1986)

- Wages differ between union and non-union workers.

- But union membership is not exogenous—workers choose to join based on anticipated benefits.

- Naïve OLS yields biased estimates of union premium.

- Comparing income of college graduates vs. non-graduates.

- Attending college is a choice based on expected gains, ability, or family background.

- A treatment effect model (described next) is more appropriate here.

36.2.1 Unifying Model Frameworks

Though often conflated, there are several overlapping models to address endogenous selection:

- Sample Selection Model (J. J. Heckman 1979): Outcome is unobserved if an agent is not selected into the sample.

- Treatment Effect Model: Outcome is observed for both groups (treated vs. untreated), but treatment assignment is endogenous.

- Heckman-Type / Control Function Approaches: Decompose the endogenous regressor or incorporate a correction term (Inverse Mills Ratio or residual) to control for endogeneity.

All revolve around the challenge: unobserved factors affect both who is included (or treated) and outcomes.

To formalize the problem, we consider the outcome and selection equations. Let:

- \(y_i\): observed outcome (e.g., wage)

- \(x_i\): covariates affecting outcome

- \(z_i\): covariates affecting selection

- \(w_i\): binary indicator for selection into the sample (e.g., employment)

36.2.1.1 Sample Selection Model

We begin with an outcome equation, which describes the variable of interest \(y_i\). However, we only observe \(y_i\) if a certain selection mechanism indicates it is part of the sample. That mechanism is captured by a binary indicator \(w_i = 1\). Formally, the observed outcome equation is:

\[ \begin{aligned} y_i &= x_i' \beta + \varepsilon_i, \quad &\text{(Observed only if } w_i = 1\text{)}, \\ \varepsilon_i &\sim N(0, \sigma_\varepsilon^2). \end{aligned} \]

Here, \(x_i\) is a vector of explanatory variables (or covariates) that explain \(y_i\). The noise term \(\varepsilon_i\) is assumed to be normally distributed with mean zero and variance \(\sigma_\varepsilon^2\). However, because we only see \(y_i\) for those cases in which \(w_i = 1\), we must account for how the selection occurs.

Next, we specify the selection equation via a latent index model. Let \(w_i^*\) be an unobserved latent variable:

\[ \begin{aligned} w_i^* &= z_i' \gamma + u_i, \\ w_i &= \begin{cases} 1 & \text{if } w_i^* > 0, \\ 0 & \text{otherwise}. \end{cases} \end{aligned} \]

Here, \(z_i\) is a vector of variables that influence whether or not \(y_i\) is observed. In practice, \(z_i\) may overlap with \(x_i\), but can also include variables not in the outcome equation. For identification, we normalize \(\mathrm{Var}(u_i) = 1\). This is analogous to the probit model’s standard normalization.

Because \(w_i = 1\) exactly when \(w_i^* > 0\), this event occurs if \(u_i \ge -z_i' \gamma\). Therefore,

\[ \begin{aligned} P(w_i = 1) &= P\bigl(u_i \ge -z_i' \gamma\bigr),\\ &= 1 - \Phi\bigl(-z_i'\gamma\bigr), \\ &= \Phi\bigl(z_i'\gamma\bigr), \end{aligned} \]

where we use the symmetry of the standard normal distribution.

We assume \((\varepsilon_i, u_i)\) are jointly normally distributed with correlation \(\rho\). In other words,

\[ \begin{pmatrix} \varepsilon_i \\ u_i \end{pmatrix} \sim \mathcal{N} \!\Biggl( \begin{pmatrix} 0 \\ 0 \end{pmatrix}, \begin{pmatrix} \sigma^2_\varepsilon & \rho \sigma_\varepsilon \\ \rho \sigma_\varepsilon & 1 \end{pmatrix} \Biggr). \]

- If \(\rho = 0\), the selection is exogenous: whether \(y_i\) is observed is unrelated to unobserved determinants of \(y_i\).

- If \(\rho \neq 0\), sample selection is endogenous. Failing to model this selection mechanism leads to biased estimates of \(\beta\).

Interpreting \(\rho\)

- \(\rho > 0\): Individuals with higher unobserved components in \(\varepsilon_i\) (and thus typically larger \(y_i\)) are more likely to appear in the sample. (Positive selection)

- \(\rho < 0\): Individuals with higher unobserved components in \(\varepsilon_i\) are less likely to appear. (Negative selection)

- \(\rho = 0\): No endogenous selection. Observed outcomes are effectively random with respect to the unobserved part of \(y_i\).

In empirical practice, \(\rho\) signals the direction of bias one might expect if the selection process is ignored.

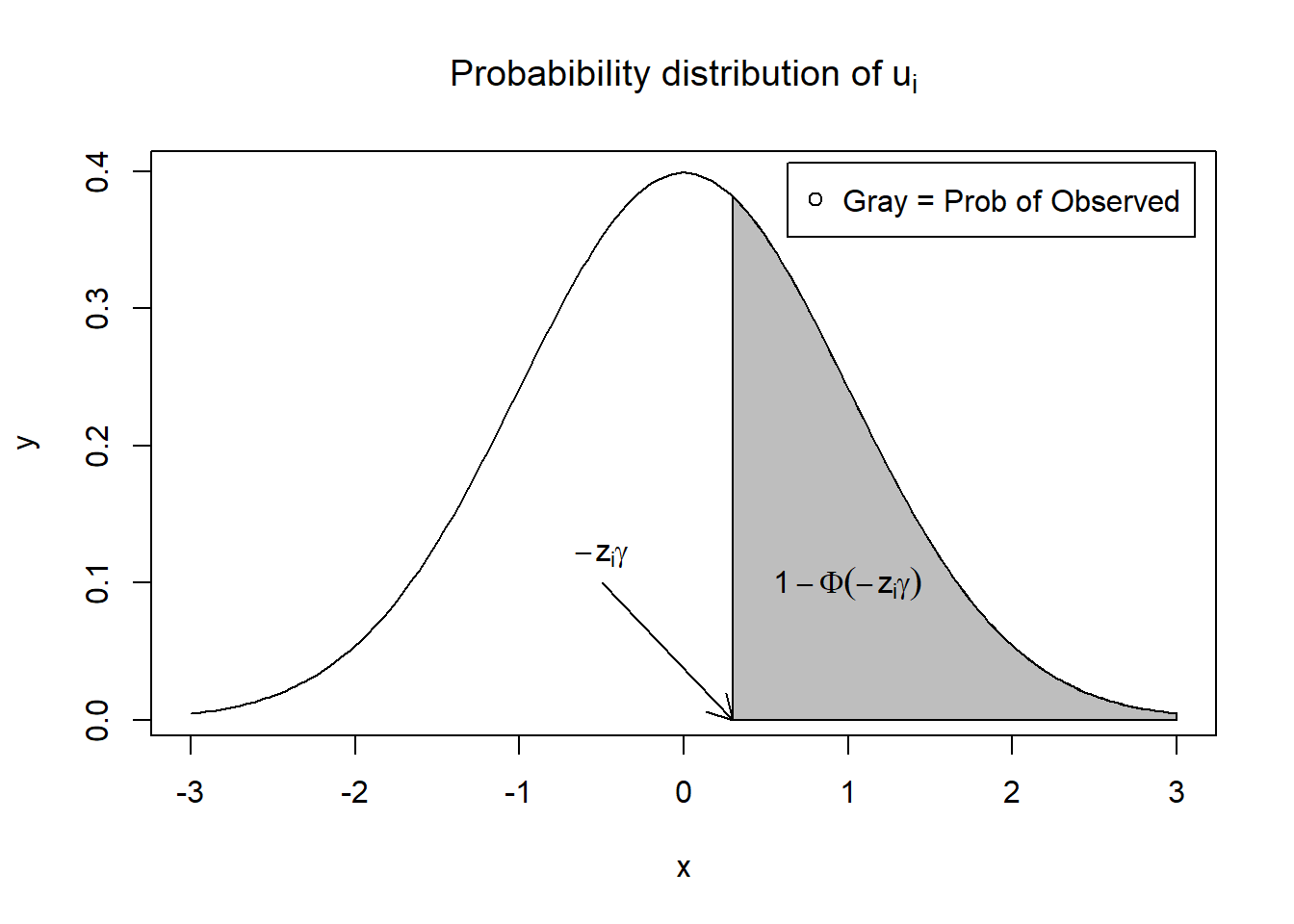

Often, it is helpful to visualize how part of the distribution of \(u_i\) (the error in the selection equation) is truncated based on the threshold \(w_i^*>0\). Below is a notional R code snippet that draws a normal density and shades the region where \(u_i > -z_i'\gamma\).

x = seq(-3, 3, length = 200)

y = dnorm(x, mean = 0, sd = 1)

plot(x,

y,

type = "l",

main = bquote("Probabibility distribution of" ~ u[i]))

x_shaded = seq(0.3, 3, length = 100)

y_shaded = dnorm(x_shaded, 0, 1)

polygon(c(0.3, x_shaded, 3), c(0, y_shaded, 0), col = "gray")

text(1, 0.1, expression(1 - Phi(-z[i] * gamma)))

arrows(-0.5, 0.1, 0.3, 0, length = 0.15)

text(-0.5, 0.12, expression(-z[i] * gamma))

legend("topright",

"Gray = Prob of Observed",

pch = 1,

inset = 0.02)

In this figure, the gray‐shaded area represents \(u_i > -z_i'\gamma\). Observations in that range are included in the sample. If \(\rho\neq 0\), then the unobserved factors that drive \(u_i\) also affect \(\varepsilon_i\), causing a non‐representative sample of \(\varepsilon_i\).

A core insight of the Heckman model is the conditional expectation of \(y_i\) given \(w_i=1\):

\[ E\bigl(y_i \mid w_i = 1\bigr) = E\bigl(y_i \mid w_i^*>0\bigr) = E\bigl(x_i'\beta + \varepsilon_i \mid u_i > -z_i'\gamma\bigr). \]

Since \(x_i'\beta\) is nonrandom (conditional on \(x_i\)), we get

\[ E\bigl(y_i \mid w_i=1\bigr) = x_i'\beta + E\bigl(\varepsilon_i \mid u_i > -z_i'\gamma\bigr). \]

From bivariate normal properties:

\[ \varepsilon_i | u_i=a \sim N\left(\rho\sigma_{\varepsilon}\cdot a, (1-\rho^2)\sigma_{\varepsilon}^2\right) \]

Thus,

\[ E\bigl(\varepsilon_i \mid u_i > -z_i'\gamma\bigr) = \rho\sigma_{\varepsilon} E\bigl(u_i \mid u_i > -z_i'\gamma\bigr). \]

If \(U\sim N(0,1)\), then

\[ E(U \mid U>a) = \frac{\phi(a)}{1-\Phi(a)} = \frac{\phi(a)}{\Phi(-a)}, \] where \(\phi\) is the standard normal pdf, \(\Phi\) is the cdf. By symmetry, \(\phi(-a)=\phi(a)\) and \(\Phi(-a)=1-\Phi(a)\). Letting \(a = -z_i'\gamma\) yields

\[ E\bigl(U \mid U > -z_i'\gamma\bigr) = \frac{\phi(-z_i'\gamma)}{1-\Phi(-z_i'\gamma)} = \frac{\phi(z_i'\gamma)}{\Phi(z_i'\gamma)}. \]

Define the Inverse Mills Ratio (IMR) as

\[ \lambda(x) = \frac{\phi(x)}{\Phi(x)}. \]

Hence,

\[ E\bigl(\varepsilon_i \mid u_i > -z_i'\gamma\bigr) = \rho\sigma_{\varepsilon}\lambda\bigl(z_i'\gamma\bigr), \] and therefore

\[ \boxed{ E\bigl(y_i \mid w_i=1\bigr) = x_i'\beta + \rho\sigma_{\varepsilon} \frac{\phi\bigl(z_i'\gamma\bigr)}{\Phi\bigl(z_i'\gamma\bigr)}. } \]

This extra term is the so‐called Heckman correction.

The IMR appears in the two‐step procedure as a regressor for bias correction. It has useful derivatives:

\[ \frac{d}{dx}[\text{IMR}(x)] = \frac{d}{dx}\left[\frac{\phi(x)}{\Phi(x)}\right] = -x\text{IMR}(x)-[\text{IMR}(x)]^2 \]

This arises from the quotient rule and the fact that \(\phi'(x)=-x\phi(x)\), \(\Phi'(x)=\phi(x)\). The derivative property also helps in interpreting marginal effects in selection models.

36.2.1.2 Treatment Effect (Switching) Model

While the sample selection model is used when outcome is only observed for one group (e.g., \(D = 1\)), the treatment effect model is used when outcomes are observed for both groups, but treatment assignment is endogenous.

Treatment Effect Model Equations:

- Outcome: \[ y_i = x_i' \beta + D_i \delta + \varepsilon_i \]

- Selection: \[\begin{aligned} D_i^* &= z_i' \gamma + u_i \\ D_i &= 1 \text{ if } D_i^* > 0 \end{aligned}\]

Where:

\(D_i\) is the treatment indicator.

\((\varepsilon_i, u_i)\) are again bivariate normal with correlation \(\rho\).

The treatment effect model is sometimes called a switching regression.

36.2.1.3 Heckman-Type vs. Control Function

- Heckman Sample Selection: Insert an Inverse Mills Ratio (IMR) to adjust the outcome equation for non-random truncation.

- Control Function: Residual-based or predicted-endogenous-variable approach that mirrors IV logic, but typically still requires an instrument or parametric assumption.

| Heckman Sample Selection Model | Heckman-Type Corrections | |

| When | Only observes one sample (treated), addressing selection bias directly. | Two samples are observed (treated and untreated), known as the control function approach. |

| Model | Probit | OLS (even for dummy endogenous variable) |

| Integration of 1st stage | Also include a term (called Inverse Mills ratio) besides the endogenous variable. | Decompose the endogenous variable to get the part that is uncorrelated with the error terms of the outcome equation. Either use the predicted endogenous variable directly or include the residual from the first-stage equation. |

| Advantages and Assumptions | Provides a direct test for endogeneity via the coefficient of the inverse Mills ratio but requires the assumption of joint normality of errors. | Does not require the assumption of joint normality, but can’t test for endogeneity directly. |

36.2.2 Estimation Methods

36.2.2.1 Heckman’s Two-Step Estimator (Heckit)

Step 1: Estimate Selection Equation with Probit

We estimate the probability of being included in the sample: \[ P(w_i = 1 \mid z_i) = \Phi(z_i' \gamma) \]

From the estimated model, we compute the Inverse Mills Ratio (IMR): \[ \lambda_i = \frac{\phi(z_i' \hat{\gamma})}{\Phi(z_i' \hat{\gamma})} \]

This term captures the expected value of the error in the outcome equation, conditional on selection.

Step 2: Include IMR in Outcome Equation

We then estimate the regression: \[ y_i = x_i' \beta + \delta \lambda_i + \nu_i \]

- If \(\delta\) is significantly different from 0, selection bias is present.

- \(\lambda_i\) corrects for the non-random selection.

- OLS on this augmented model yields consistent estimates of \(\beta\) under the joint normality assumption.

- Pros: Conceptually simple; widely used.

- Cons: Relies heavily on the bivariate normal assumption for \((\varepsilon_i, u_i)\). If no good exclusion variable is available, identification rests on the functional form.

Specifically, the model can be identified without an exclusion restriction, but in such cases, identification is driven purely by the non-linearity of the probit function and the normality assumption (through the IMR). This is fragile.

- With strong exclusion restriction for the covariate in the correction equation, the variation in this variable can help identify the control for selection.

- With weak exclusion restriction, and the variable exists in both steps, it’s the assumed error structure that identifies the control for selection (J. Heckman and Navarro-Lozano 2004).

- In management, Wolfolds and Siegel (2019) found that papers should have valid exclusion conditions, because without these, simulations show that results using the Heckman method are less reliable than those obtained with OLS.

For robust identification, we prefer an exclusion restriction:

- A variable that affects selection (through \(z_i\)) but not the outcome.

- Example: Distance to a training center might affect the probability of enrollment, but not post-training income.

Without such a variable, the model relies solely on functional form.

The Heckman two-step estimation procedure is less efficient than FIML. One key limitation is that the two-step estimator does not fully exploit the joint distribution of the error terms across equations, leading to a loss of efficiency. Moreover, the two-step approach may introduce measurement error in the second stage. This arises because the inverse Mills ratio used in the second stage is itself an estimated regressor, which can lead to biased standard errors and inference.

###########################

# SIM 1: Heckman 2-step #

###########################

suppressPackageStartupMessages(library(MASS))

set.seed(123)

n <- 1000

rho <- 0.5

beta_true <- 2

gamma_true <- 1.0

Sigma <- matrix(c(1, rho, rho, 1), 2)

errors <- mvrnorm(n, c(0,0), Sigma)

epsilon <- errors[,1]

u <- errors[,2]

x <- rnorm(n)

w <- rnorm(n)

# Selection

z_star <- w*gamma_true + u

z <- ifelse(z_star>0,1,0)

# Outcome

y_star <- x * beta_true + epsilon

# Observed only if z=1

y_obs <- ifelse(z == 1, y_star, NA)

# Step 1: Probit

sel_mod <- glm(z ~ w, family = binomial(link = "probit"))

z_hat <- predict(sel_mod, type = "link")

lambda_vals <- dnorm(z_hat) / pnorm(z_hat)

# Step 2: OLS on observed + IMR

data_heck <- data.frame(y = y_obs,

x = x,

imr = lambda_vals,

z = z)

observed_data <- subset(data_heck, z == 1)

heck_lm <- lm(y ~ x + imr, data = observed_data)

summary(heck_lm)

#>

#> Call:

#> lm(formula = y ~ x + imr, data = observed_data)

#>

#> Residuals:

#> Min 1Q Median 3Q Max

#> -2.76657 -0.60099 -0.02776 0.56317 2.74797

#>

#> Coefficients:

#> Estimate Std. Error t value Pr(>|t|)

#> (Intercept) 0.01715 0.07068 0.243 0.808

#> x 1.95925 0.03934 49.800 < 2e-16 ***

#> imr 0.41900 0.10063 4.164 3.69e-05 ***

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

#>

#> Residual standard error: 0.8942 on 501 degrees of freedom

#> Multiple R-squared: 0.8332, Adjusted R-squared: 0.8325

#> F-statistic: 1251 on 2 and 501 DF, p-value: < 2.2e-16

cat("True beta=", beta_true, "\n")

#> True beta= 2

cat("Heckman 2-step estimated beta=", coef(heck_lm)["x"], "\n")

#> Heckman 2-step estimated beta= 1.95924936.2.2.2 Full Information Maximum Likelihood

Jointly estimates the selection and outcome equations via ML, assuming:

\[ \biggl(\varepsilon_i, u_i\biggr) \sim \mathcal{N}\biggl(\begin{pmatrix}0\\0\end{pmatrix},\begin{pmatrix}\sigma_{\varepsilon}^2 & \rho\sigma_{\varepsilon}\\\rho\sigma_{\varepsilon} & 1\end{pmatrix}\biggr). \]

- Pros: More efficient if the distributional assumption is correct. Allows a direct test of \(\rho=0\) (LR test).

- Cons: More sensitive to specification errors (i.e., requires stronger distributional assumptions); potentially complex to implement.

We can use the sampleSelection package in R to perform full maximum likelihood estimation for the same data:

#############################

# SIM 2: 2-step vs. FIML #

#############################

suppressPackageStartupMessages(library(sampleSelection))

# Using same data (z, x, y_obs) from above

# 1) Heckman 2-step (built-in)

heck2 <-

selection(z ~ w, y_obs ~ x, method = "2step", data = data_heck)

summary(heck2)

#> --------------------------------------------

#> Tobit 2 model (sample selection model)

#> 2-step Heckman / heckit estimation

#> 1000 observations (496 censored and 504 observed)

#> 7 free parameters (df = 994)

#> Probit selection equation:

#> Estimate Std. Error t value Pr(>|t|)

#> (Intercept) 0.02053 0.04494 0.457 0.648

#> w 0.94063 0.05911 15.913 <2e-16 ***

#> Outcome equation:

#> Estimate Std. Error t value Pr(>|t|)

#> (Intercept) 0.01715 0.07289 0.235 0.814

#> x 1.95925 0.03924 49.932 <2e-16 ***

#> Multiple R-Squared:0.8332, Adjusted R-Squared:0.8325

#> Error terms:

#> Estimate Std. Error t value Pr(>|t|)

#> invMillsRatio 0.4190 0.1018 4.116 4.18e-05 ***

#> sigma 0.9388 NA NA NA

#> rho 0.4463 NA NA NA

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

#> --------------------------------------------

# 2) FIML

heckFIML <-

selection(z ~ w, y_obs ~ x, method = "ml", data = data_heck)

summary(heckFIML)

#> --------------------------------------------

#> Tobit 2 model (sample selection model)

#> Maximum Likelihood estimation

#> Newton-Raphson maximisation, 2 iterations

#> Return code 8: successive function values within relative tolerance limit (reltol)

#> Log-Likelihood: -1174.233

#> 1000 observations (496 censored and 504 observed)

#> 6 free parameters (df = 994)

#> Probit selection equation:

#> Estimate Std. Error t value Pr(>|t|)

#> (Intercept) 0.02169 0.04488 0.483 0.629

#> w 0.94203 0.05908 15.945 <2e-16 ***

#> Outcome equation:

#> Estimate Std. Error t value Pr(>|t|)

#> (Intercept) 0.008601 0.071315 0.121 0.904

#> x 1.959195 0.039124 50.077 <2e-16 ***

#> Error terms:

#> Estimate Std. Error t value Pr(>|t|)

#> sigma 0.94118 0.03503 26.867 < 2e-16 ***

#> rho 0.46051 0.09411 4.893 1.16e-06 ***

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

#> --------------------------------------------You can compare the coefficient estimates on x from heck2 vs. heckFIML. In large samples, both should converge to the true \(\beta\). FIML is typically more efficient, but if the normality assumption is violated, both can be biased.

36.2.2.3 CF and IV Approaches

- Control Function

- Residual-based approach: Regress the selection (or treatment) variable on excluded instruments and included controls. Obtain the predicted residual. Include that residual in the main outcome regression.

- If correlated residual is significant, that indicates endogeneity; adjusting for it can correct bias.

- Often used in the context of treatment effect models or simultaneously with IV logic.

- In the pure treatment effect context, an IV must affect treatment assignment but not the outcome directly.

- For sample selection, an exclusion restriction (“instrument”) must shift selection but not outcomes.

- Example: Distance to a training center influences participation in a job program but not post-training earnings.

36.2.3 Theoretical Connections

36.2.3.1 Conditional Expectation from Truncated Distributions

In the sample selection scenario:

\[ \begin{aligned} \mathbb{E}[y_i\mid w_i=1] &= x_i\beta + \mathbb{E}[\varepsilon_i\mid w_i^*>0],\\ &= x_i\beta + \rho\sigma_{\varepsilon}\frac{\phi(z_i'\gamma)}{\Phi(z_i'\gamma)}, \end{aligned} \]

where \(\rho\sigma_{\varepsilon}\) is the covariance term and \(\phi\) and \(\Phi\) are the standard normal PDF and CDF, respectively. This formula underpins the inverse Mills ratio correction.

- If \(\rho>0\), then the same unobservables that increase the likelihood of selection also increase outcomes, implying positive selection.

- If \(\rho<0\), selection is negatively correlated with outcomes.

- \(\hat{\rho}\): Estimated correlation of error terms. If significantly different from 0, endogenous selection is present.

- Wald or Likelihood Ratio Test: Used to test \(H_0: \rho = 0\).

- Lambda (\(\hat{\lambda}\)): Product of \(\hat{\rho} \hat{\sigma}_\varepsilon\)—measures strength of selection bias.

- Inverse Mills Ratio: Can be saved and inspected to understand sample inclusion probabilities.

36.2.3.2 Relationship Among Models

All the models in Unifying Model Frameworks can be seen as special or generalized cases:

If one only has data for the selected group, it’s a sample selection setup.

If data for both groups exist, but assignment is endogenous, it’s a treatment effect problem.

If there’s a valid instrument, one can do a control function or IV approach.

If the normality assumption holds and selection is truly parametric, Heckman or FIML correct for the bias.

Summary Table of Methods

| Method | Data Observed | Key Assumption | Exclusion? | Pros | Cons |

|---|---|---|---|---|---|

| OLS (Naive) | Full or partial, ignoring selection | No endogeneity in errors | Not required | Simple to implement | Biased if endogeneity is present |

| Heckman 2-Step (Heckit) | Outcome only for selected group | Joint normal errors; linear functional | Strongly recommended | Intuitive, widely used | Sensitive to normality/functional form. |

| FIML (Full ML) | Same as Heckman (subset observed) | Joint normal errors | Strongly recommended | More efficient, direct test of \(\rho=0\) | Complex, more sensitive to misspecification |

| Control Function | Observed data for both or one group (depending on setup) | Some form of valid instrument or exog. | Yes (instrument) | Extends easily to many models | Must find valid instrument, no direct test for endogeneity |

| Instrumental Variables | Observed data for both groups, or entire sample (for selection) | IV must affect selection but not outcome | Yes (instrument) | Common approach in program evaluation | Exclusion restriction validity is critical |

36.2.3.3 Concerns

- Small Samples: Two-step procedures can be unstable in smaller datasets.

- Exclusion Restrictions: Without a credible variable that predicts selection but not outcomes, identification depends purely on functional form (bivariate normal + nonlinearity of probit).

- Distributional Assumption: If normality is seriously violated, neither 2-step nor FIML may reliably remove bias.

- Measurement Error in IMR: The second-stage includes an estimated regressor \(\hat{\lambda}_i\), which can add noise.

- Connection to IV: If a strong instrument exists, one could proceed with a control function or standard IV in a treatment effect setup. But for sample selection (lack of data on unselected), the Heckman approach is more common.

- Presence of Correlation between the Error Terms: The Heckman treatment effect model outperforms OLS when \(\rho \neq 0\) because it corrects for selection bias due to unobserved factors. However, when \(\rho = 0\), the correction is unnecessary and can introduce inefficiency, making simpler methods more accurate.

36.2.4 Tobit-2: Heckman’s Sample Selection Model

The Tobit-2 model, also known as Heckman’s standard sample selection model, is designed to correct for sample selection bias. This arises when the outcome variable is only observed for a non-random subset of the population, and the selection process is correlated with the outcome of interest.

A key assumption of the model is the joint normality of the error terms in the selection and outcome equations.

36.2.4.1 Panel Study of Income Dynamics

We demonstrate the model using the classic dataset from Mroz (1984), which provides data from the 1975 Panel Study of Income Dynamics on married women’s labor-force participation and wages.

We aim to estimate the log of hourly wages for married women, using:

-

educ: Years of education -

exper: Years of work experience -

exper^2: Experience squared (to capture non-linear effects) -

city: A dummy for residence in a big city

However, wages are only observed for those who participated in the labor force, meaning an OLS regression using only this subsample would suffer from selection bias.

Because we also have data on non-participants, we can use Heckman’s two-step method to correct for this bias.

- Load and Prepare Data

library(sampleSelection)

library(dplyr)

library(nnet)

library(ggplot2)

library(reshape2)

data("Mroz87") # PSID data on married women in 1975

Mroz87 = Mroz87 %>%

mutate(kids = kids5 + kids618) # total number of children

head(Mroz87)

#> lfp hours kids5 kids618 age educ wage repwage hushrs husage huseduc huswage

#> 1 1 1610 1 0 32 12 3.3540 2.65 2708 34 12 4.0288

#> 2 1 1656 0 2 30 12 1.3889 2.65 2310 30 9 8.4416

#> 3 1 1980 1 3 35 12 4.5455 4.04 3072 40 12 3.5807

#> 4 1 456 0 3 34 12 1.0965 3.25 1920 53 10 3.5417

#> 5 1 1568 1 2 31 14 4.5918 3.60 2000 32 12 10.0000

#> 6 1 2032 0 0 54 12 4.7421 4.70 1040 57 11 6.7106

#> faminc mtr motheduc fatheduc unem city exper nwifeinc wifecoll huscoll

#> 1 16310 0.7215 12 7 5.0 0 14 10.910060 FALSE FALSE

#> 2 21800 0.6615 7 7 11.0 1 5 19.499981 FALSE FALSE

#> 3 21040 0.6915 12 7 5.0 0 15 12.039910 FALSE FALSE

#> 4 7300 0.7815 7 7 5.0 0 6 6.799996 FALSE FALSE

#> 5 27300 0.6215 12 14 9.5 1 7 20.100058 TRUE FALSE

#> 6 19495 0.6915 14 7 7.5 1 33 9.859054 FALSE FALSE

#> kids

#> 1 1

#> 2 2

#> 3 4

#> 4 3

#> 5 3

#> 6 0- Model Overview

The two-step Heckman selection model proceeds as follows:

Selection Equation (Probit):

Models the probability of labor force participation (lfp = 1) as a function of variables that affect the decision to work.Outcome Equation (Wage):

Models log wages conditional on working. A correction term, the IMR, is included to account for the non-random selection into work.

Step 1: Naive OLS on Observed Wages

ols1 = lm(log(wage) ~ educ + exper + I(exper ^ 2) + city,

data = subset(Mroz87, lfp == 1))

summary(ols1)

#>

#> Call:

#> lm(formula = log(wage) ~ educ + exper + I(exper^2) + city, data = subset(Mroz87,

#> lfp == 1))

#>

#> Residuals:

#> Min 1Q Median 3Q Max

#> -3.10084 -0.32453 0.05292 0.36261 2.34806

#>

#> Coefficients:

#> Estimate Std. Error t value Pr(>|t|)

#> (Intercept) -0.5308476 0.1990253 -2.667 0.00794 **