To illustrate the impact of correlated and uncorrelated events, let’s conduct a simulation study.

# Load required libraries

library(dplyr)

library(ggplot2)

library(tidyr)

library(tidyverse)

# Parameters

n <- 100000 # Number of observations

n_focal <- round(n * 0.2) # Number of focal events

overlap_correlated <- 0.5 # Overlapping percentage between focal and correlated events

# Function to compute mean and confidence interval

mean_ci <- function(x) {

m <- mean(x)

ci <- qt(0.975, length(x)-1) * sd(x) / sqrt(length(x)) # 95% confidence interval

list(mean = m, lower = m - ci, upper = m + ci)

}

# Simulate data

set.seed(42)

data <- tibble(

date = seq.Date(

from = as.Date("2010-01-01"),

by = "day",

length.out = n

),

# Date sequence

focal = rep(0, n),

correlated = rep(0, n),

ab_ret = rnorm(n)

)

# Define focal events

focal_idx <- sample(1:n, n_focal)

data$focal[focal_idx] <- 1

true_effect <- 0.25

# Adjust the ab_ret for the focal events to have a mean of true_effect

data$ab_ret[focal_idx] <-

data$ab_ret[focal_idx] - mean(data$ab_ret[focal_idx]) + true_effect

# Determine the number of correlated events that overlap with focal and those that don't

n_correlated_overlap <-

round(length(focal_idx) * overlap_correlated)

n_correlated_non_overlap <- n_correlated_overlap

# Sample the overlapping correlated events from the focal indices

correlated_idx <- sample(focal_idx, size = n_correlated_overlap)

# Get the remaining indices that are not part of focal

remaining_idx <- setdiff(1:n, focal_idx)

# Check to ensure that we're not attempting to sample more than the available remaining indices

if (length(remaining_idx) < n_correlated_non_overlap) {

stop("Not enough remaining indices for non-overlapping correlated events")

}

# Sample the non-overlapping correlated events from the remaining indices

correlated_non_focal_idx <-

sample(remaining_idx, size = n_correlated_non_overlap)

# Combine the two to get all correlated indices

all_correlated_idx <- c(correlated_idx, correlated_non_focal_idx)

# Set the correlated events in the data

data$correlated[all_correlated_idx] <- 1

# Inflate the effect for correlated events to have a mean of

correlated_non_focal_idx <-

setdiff(all_correlated_idx, focal_idx) # Fixing the selection of non-focal correlated events

data$ab_ret[correlated_non_focal_idx] <-

data$ab_ret[correlated_non_focal_idx] - mean(data$ab_ret[correlated_non_focal_idx]) + 1

# Define the numbers of uncorrelated events for each scenario

num_uncorrelated <- c(5, 10, 20, 30, 40)

# Define uncorrelated events

for (num in num_uncorrelated) {

for (i in 1:num) {

data[paste0("uncorrelated_", i)] <- 0

uncorrelated_idx <- sample(1:n, round(n * 0.1))

data[uncorrelated_idx, paste0("uncorrelated_", i)] <- 1

}

}

# Define uncorrelated columns and scenarios

unc_cols <- paste0("uncorrelated_", 1:num_uncorrelated)

results <- tibble(

Scenario = c(

"Include Correlated",

"Correlated Effects",

"Exclude Correlated",

"Exclude Correlated and All Uncorrelated"

),

MeanEffect = c(

mean_ci(data$ab_ret[data$focal == 1])$mean,

mean_ci(data$ab_ret[data$focal == 0 |

data$correlated == 1])$mean,

mean_ci(data$ab_ret[data$focal == 1 &

data$correlated == 0])$mean,

mean_ci(data$ab_ret[data$focal == 1 &

data$correlated == 0 &

rowSums(data[, paste0("uncorrelated_", 1:num_uncorrelated)]) == 0])$mean

),

LowerCI = c(

mean_ci(data$ab_ret[data$focal == 1])$lower,

mean_ci(data$ab_ret[data$focal == 0 |

data$correlated == 1])$lower,

mean_ci(data$ab_ret[data$focal == 1 &

data$correlated == 0])$lower,

mean_ci(data$ab_ret[data$focal == 1 &

data$correlated == 0 &

rowSums(data[, paste0("uncorrelated_", 1:num_uncorrelated)]) == 0])$lower

),

UpperCI = c(

mean_ci(data$ab_ret[data$focal == 1])$upper,

mean_ci(data$ab_ret[data$focal == 0 |

data$correlated == 1])$upper,

mean_ci(data$ab_ret[data$focal == 1 &

data$correlated == 0])$upper,

mean_ci(data$ab_ret[data$focal == 1 &

data$correlated == 0 &

rowSums(data[, paste0("uncorrelated_", 1:num_uncorrelated)]) == 0])$upper

)

)

# Add the scenarios for excluding 5, 10, 20, and 50 uncorrelated

for (num in num_uncorrelated) {

unc_cols <- paste0("uncorrelated_", 1:num)

results <- results %>%

add_row(

Scenario = paste("Exclude", num, "Uncorrelated"),

MeanEffect = mean_ci(data$ab_ret[data$focal == 1 &

data$correlated == 0 &

rowSums(data[, unc_cols]) == 0])$mean,

LowerCI = mean_ci(data$ab_ret[data$focal == 1 &

data$correlated == 0 &

rowSums(data[, unc_cols]) == 0])$lower,

UpperCI = mean_ci(data$ab_ret[data$focal == 1 &

data$correlated == 0 &

rowSums(data[, unc_cols]) == 0])$upper

)

}

ggplot(results,

aes(

x = factor(Scenario, levels = Scenario),

y = MeanEffect,

ymin = LowerCI,

ymax = UpperCI

)) +

geom_pointrange() +

coord_flip() +

ylab("Mean Effect") +

xlab("Scenario") +

ggtitle("Mean Effect of Focal Events under Different Scenarios") +

geom_hline(yintercept = true_effect,

linetype = "dashed",

color = "red")

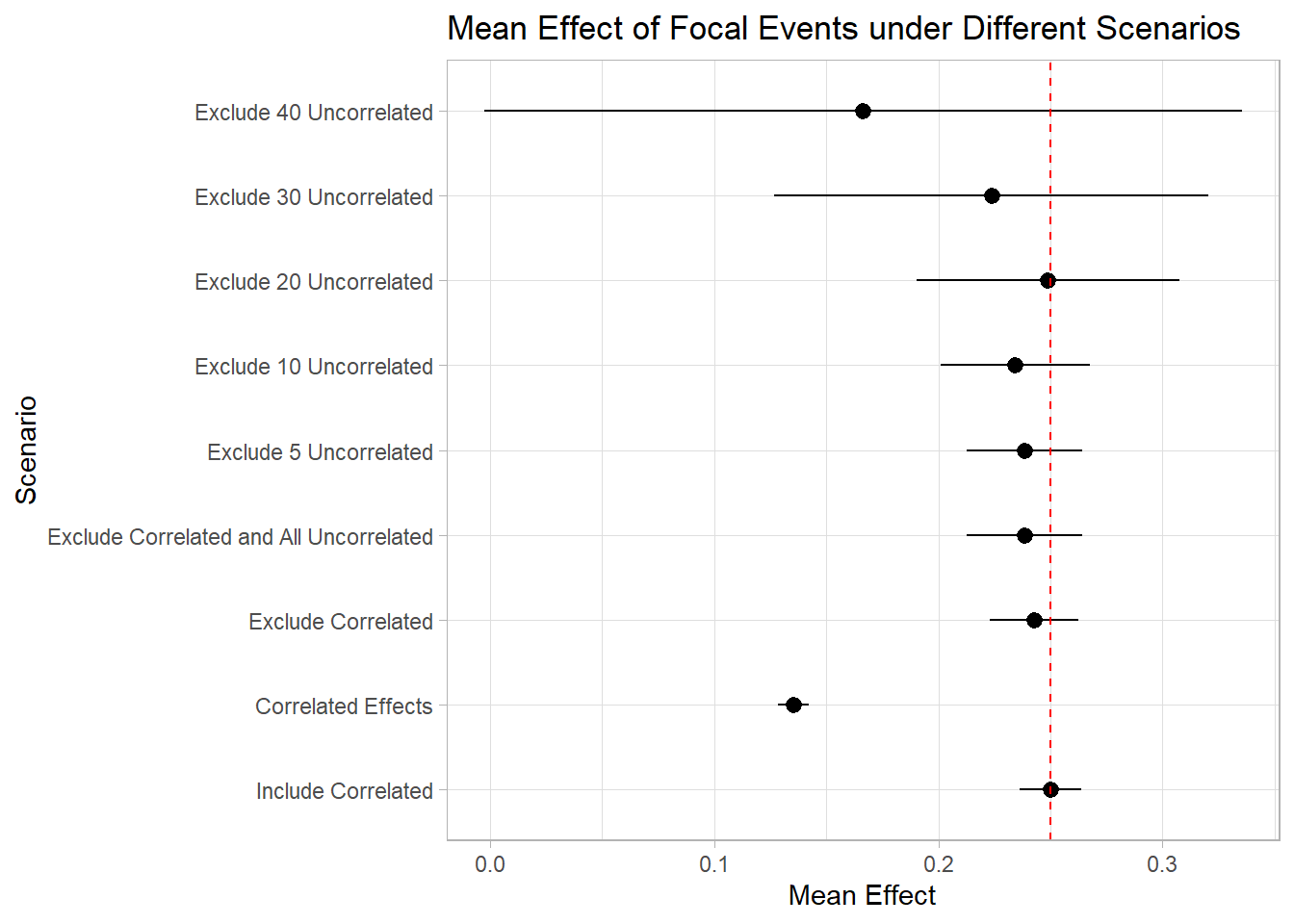

As depicted in the plot, the inclusion of correlated events demonstrates minimal impact on the estimation of our focal events. Conversely, excluding these correlated events can diminish our statistical power. This is true in cases of pronounced correlation.

However, the consequences of excluding unrelated events are notably more significant. It becomes evident that by omitting around 40 unrelated events from our study, we lose the ability to accurately identify the true effects of the focal events. In reality and within research, we often rely on the Key Developments database, excluding over 150 events, a practice that can substantially impair our capacity to ascertain the authentic impact of the focal events.

This little experiment really drives home the point – you better have a darn good reason to exclude an event from your study!