33.14 Application of Event Study

Several R packages facilitate event studies. Below are some commonly used ones:

| Package | Description |

|---|---|

eventstudies |

Computes abnormal returns and visualizes event impact |

erer |

Implements event study methodology in economics and finance |

EventStudy |

Provides API-based event study tools (requires subscription) |

AbnormalReturns |

Implements market model and FF3 abnormal return calculations |

PerformanceAnalytics |

Provides tools for risk and performance measurement |

estudy2 |

A flexible event study implementation |

To install these packages, run:

install.packages(

c(

"eventstudies",

"erer",

"EventStudy",

"AbnormalReturns",

"PerformanceAnalytics",

"tidyquant",

"tidyverse"

)

)33.14.1 Sorting Portfolios for Expected Returns

A common approach in finance is to sort stocks into portfolios based on firm characteristics such as size and book-to-market (B/M) ratio. This method helps control for the possibility that standard models (e.g., Fama-French) may not be correctly specified.

Sorting Process

Sort all stock returns into 10 deciles based on size (market capitalization).

Within each size decile, sort returns into 10 deciles based on B/M ratio.

Calculate the average return of each portfolio for each period (i.e., the expected return for stocks given their characteristics).

Compare each stock’s return to its corresponding portfolio.

Important Notes:

Sorting often leads to more conservative estimates compared to Fama-French models.

If the event study results change depending on the sorting order (e.g., sorting by B/M first vs. size first), this suggests that the findings are not robust.

33.14.2 erer Package

The erer package provides a straightforward implementation of event studies.

Step 1: Load Required Libraries

Step 2: Load Sample Data

The package includes an example dataset, daEsa, which contains stock returns and event dates.

data(daEsa)

head(daEsa)

#> date tb3m sp500 bbc bow csk gp ip kmb

#> 1 19900102 0.3973510 1.76420 2.5352 1.3575 0.6289 4.1237 1.3274 1.8707

#> 2 19900103 0.6596306 -0.25889 0.2747 0.8929 6.2500 0.9901 -0.2183 -0.3339

#> 3 19900104 -0.5242464 -0.86503 -1.3699 -0.4425 -2.3529 0.7353 -0.4376 -0.1675

#> 4 19900105 -0.6587615 -0.98041 -0.5556 -0.4444 1.2048 0.0000 0.2198 -0.6711

#> 5 19900108 0.0000000 0.45043 -1.3966 -0.8929 -1.1905 0.4866 -0.2193 1.0135

#> 6 19900109 0.1326260 -1.18567 0.2833 -0.4505 -2.4096 -0.2421 -2.1978 -2.1739

#> lpx mwv pch pcl pop tin wpp wy

#> 1 1.7341 1.6529 4.0816 1.5464 2.43525 -1.0791 2.9197 2.7149

#> 2 0.8523 2.0325 0.0000 0.5076 1.41509 -1.4545 0.7092 -2.2026

#> 3 -0.2817 0.3984 0.3268 -0.5051 -0.93023 -0.1845 2.1127 -0.9009

#> 4 -0.8475 -0.3968 -0.6515 -0.5076 0.00000 0.5545 -0.6897 -0.4545

#> 5 -0.5698 -0.3984 0.3279 1.0204 -0.93897 -0.5515 -0.6944 0.0000

#> 6 -0.2865 -1.6000 0.3268 -2.5253 -3.79147 -2.4030 0.6993 -1.8265Step 3: Compute Abnormal Returns

We define the estimation window (250 days before the event) and the event window (\(\pm5\) days around the event):

hh <- evReturn(

y = daEsa,

firm = "wpp",

y.date = "date",

index = "sp500",

est.win = 250,

event.date = 19990505,

event.win = 5

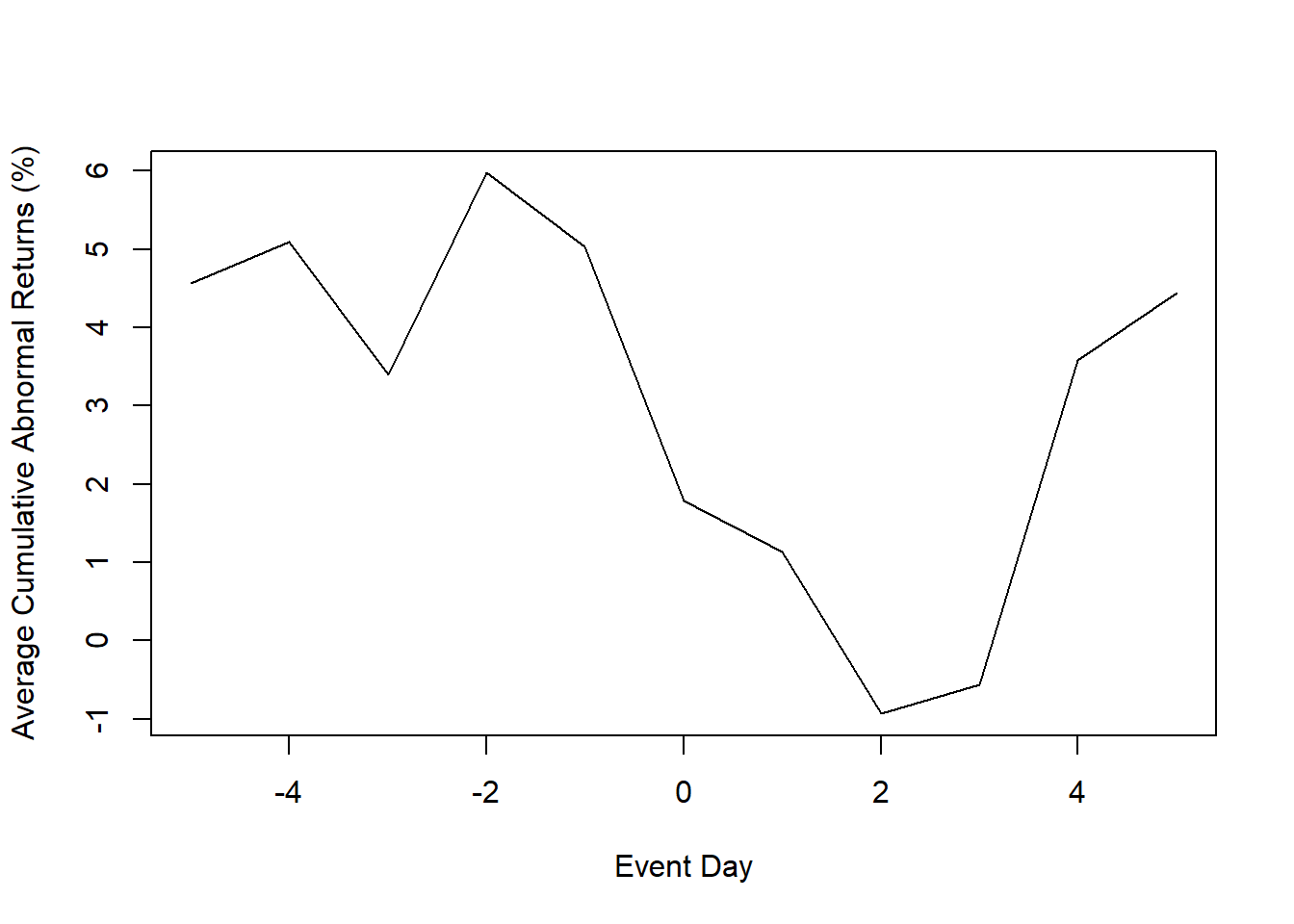

)Step 4: Visualizing the Results

33.14.3 Eventus

2 types of output:

-

Using different estimation methods (e.g., market model to calendar-time approach)

Does not include event-specific returns. Hence, no regression later to determine variables that can affect abnormal stock returns.

Cross-sectional Analysis of Eventus: Event-specific abnormal returns (using monthly or data data) for cross-sectional analysis (under Cross-Sectional Analysis section)

- Since it has the stock-specific abnormal returns, we can do regression on CARs later. But it only gives market-adjusted model. However, according to (A. Sorescu, Warren, and Ertekin 2017), they advocate for the use of market-adjusted model for the short-term only, and reserve the FF4 for the longer-term event studies using monthly daily.

33.14.3.1 Basic Event Study

- Input a text file contains a firm identifier (e.g., PERMNO, CUSIP) and the event date

- Choose market indices: equally weighted and the value weighted index (i.e., weighted by their market capitalization). And check Fama-French and Carhart factors.

- Estimation options

Estimation period:

ESTLEN = 100is the convention so that the estimation is not impacted by outliers.Use “autodate” options: the first trading after the event date is used if the event falls on a weekend or holiday

- Abnormal returns window: depends on the specific event

- Choose test: either parametric (including Patell Standardized Residual (PSR)) or non-parametric

33.14.3.2 Cross-sectional Analysis of Eventus

Similar to the Basic Event Study, but now you can have event-specific abnormal returns.