33.5 Economic Significance

The total wealth gain (or loss) resulting from a marketing event is given by:

\[ \Delta W_t = CAR_t \times MKTVAL_0 \]

where:

- \(\Delta W_t\) = Change in firm value (gain or loss).

- \(CAR_t\) = Cumulative abnormal return up to date \(t\).

- \(MKTVAL_0\) = Market value of the firm before the event window.

Interpretation:

- If \(\Delta W_t > 0\): The event increased firm value.

- If \(\Delta W_t < 0\): The event decreased firm value.

- The magnitude of \(\Delta W_t\) reflects the economic impact of the marketing event in dollar terms.

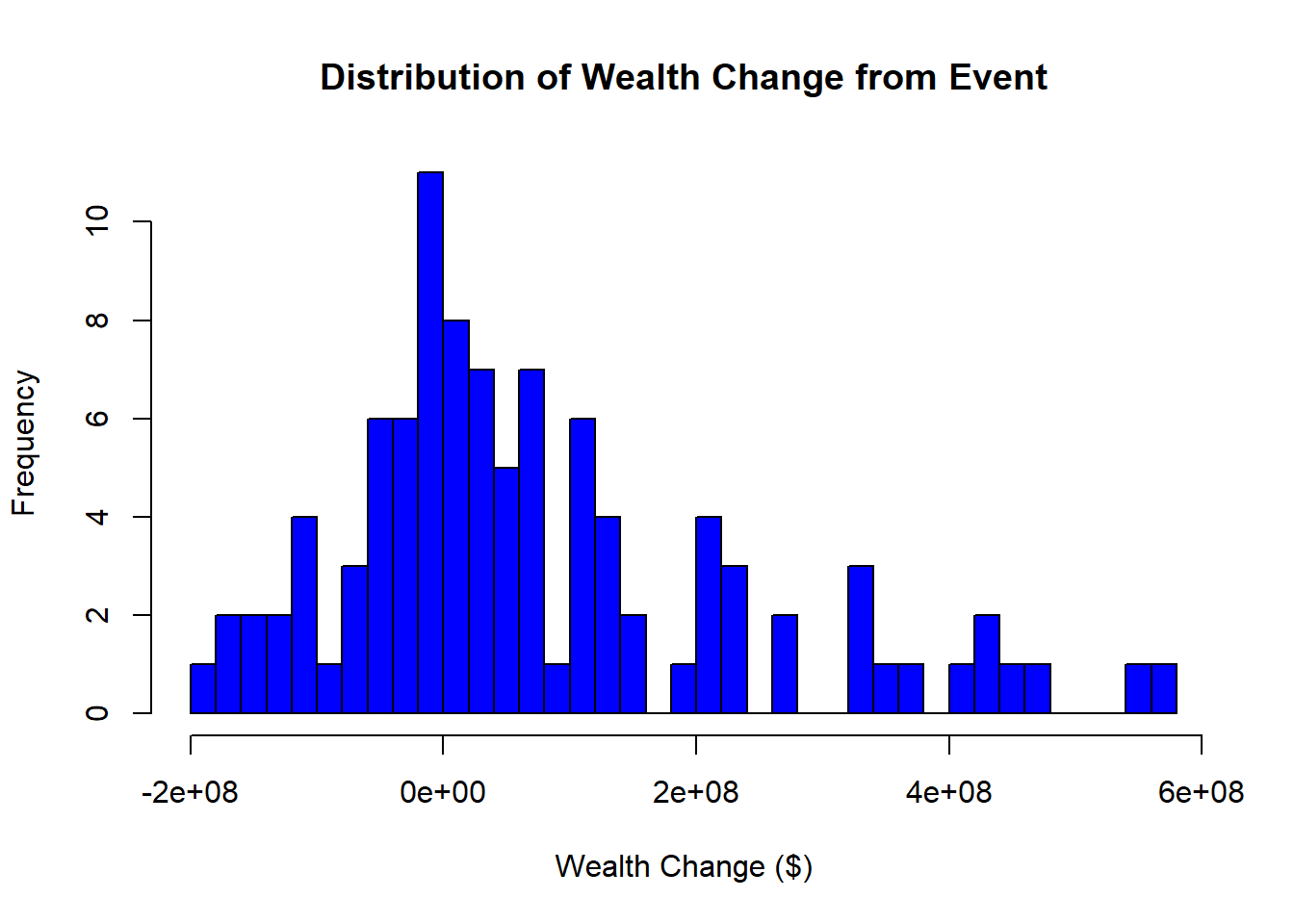

By computing \(\Delta W_t\), researchers can translate stock market reactions into tangible financial implications, helping assess the real-world significance of marketing decisions.

# Load necessary libraries

library(tidyverse)

# Simulated dataset of event study results

df_event_study <- tibble(

firm_id = 1:100,

# 100 firms

CAR_t = rnorm(100, mean = 0.02, sd = 0.05),

# Simulated CAR values

MKTVAL_0 = runif(100, min = 1e8, max = 5e9) # Market value in dollars

)

# Compute total wealth gain/loss

df_event_study <- df_event_study %>%

mutate(wealth_change = CAR_t * MKTVAL_0)

# Summary statistics of economic impact

summary(df_event_study$wealth_change)

#> Min. 1st Qu. Median Mean 3rd Qu. Max.

#> -480381755 -34137766 16928671 35496387 102861746 368836886

# Histogram of total wealth gain/loss

hist(

df_event_study$wealth_change,

main = "Distribution of Wealth Change from Event",

xlab = "Wealth Change ($)",

col = "blue",

breaks = 30

)