22.3 RFM

RFM is calculated as:

- A recency score is assigned to each customer based on date of most recent purchase.

- A frequency ranking is assigned based on frequency of purchases

- Monetary score is assigned based on the total revenue generated by the customer in the period under consideration for the analysis

## # A tibble: 39,999 × 5

## customer_id revenue most_recent_visit number_of_orders recency_days

## <dbl> <dbl> <date> <dbl> <dbl>

## 1 22086 777 2006-05-14 9 232

## 2 2290 1555 2006-09-08 16 115

## 3 26377 336 2006-11-19 5 43

## 4 24650 1189 2006-10-29 12 64

## 5 12883 1229 2006-12-09 12 23

## 6 2119 929 2006-10-21 11 72

## 7 31283 1569 2006-09-11 17 112

## 8 33815 778 2006-08-12 11 142

## 9 15972 641 2006-11-19 9 43

## 10 27650 970 2006-08-23 10 131

## # ℹ 39,989 more rows# a unique customer id

# number of transaction/order

# total revenue from the customer

# number of days since the last visit

rfm_data_orders # to generate data_orders, use rfm_table_order()## # A tibble: 4,906 × 3

## customer_id order_date revenue

## <chr> <date> <dbl>

## 1 Mr. Brion Stark Sr. 2004-12-20 32

## 2 Ethyl Botsford 2005-05-02 36

## 3 Hosteen Jacobi 2004-03-06 116

## 4 Mr. Edw Frami 2006-03-15 99

## 5 Josef Lemke 2006-08-14 76

## 6 Julisa Halvorson 2005-05-28 56

## 7 Judyth Lueilwitz 2005-03-09 108

## 8 Mr. Mekhi Goyette 2005-09-23 183

## 9 Hansford Moen PhD 2005-09-07 30

## 10 Fount Flatley 2006-04-12 13

## # ℹ 4,896 more rows# unique customer id

# date of transaction

# and amount

# customer_id: name of the customer id column

# order_date: name of the transaction date column

# revenue: name of the transaction amount column

# analysis_date: date of analysis

# recency_bins: number of rankings for recency score (default is 5)

# frequency_bins: number of rankings for frequency score (default is 5)

# monetary_bins: number of rankings for monetary score (default is 5)analysis_date <- lubridate::as_date('2007-01-01')

rfm_result <-

rfm_table_customer(

rfm_data_customer,

customer_id,

number_of_orders,

recency_days,

revenue,

analysis_date

)

rfm_result## # A tibble: 39,999 × 8

## customer_id recency_days transaction_count amount recency_score

## <dbl> <dbl> <dbl> <dbl> <int>

## 1 22086 232 9 777 2

## 2 2290 115 16 1555 4

## 3 26377 43 5 336 5

## 4 24650 64 12 1189 5

## 5 12883 23 12 1229 5

## 6 2119 72 11 929 5

## 7 31283 112 17 1569 4

## 8 33815 142 11 778 3

## 9 15972 43 9 641 5

## 10 27650 131 10 970 3

## # ℹ 39,989 more rows

## # ℹ 3 more variables: frequency_score <int>, monetary_score <int>,

## # rfm_score <dbl># customer_id: unique customer id

# date_most_recent: date of most recent visit

# recency_days: days since the most recent visit

# transaction_count: number of transactions of the customer

# amount: total revenue generated by the customer

# recency_score: recency score of the customer

# frequency_score: frequency score of the customer

# monetary_score: monetary score of the customer

# rfm_score: RFM score of the customer22.3.1 Visualization

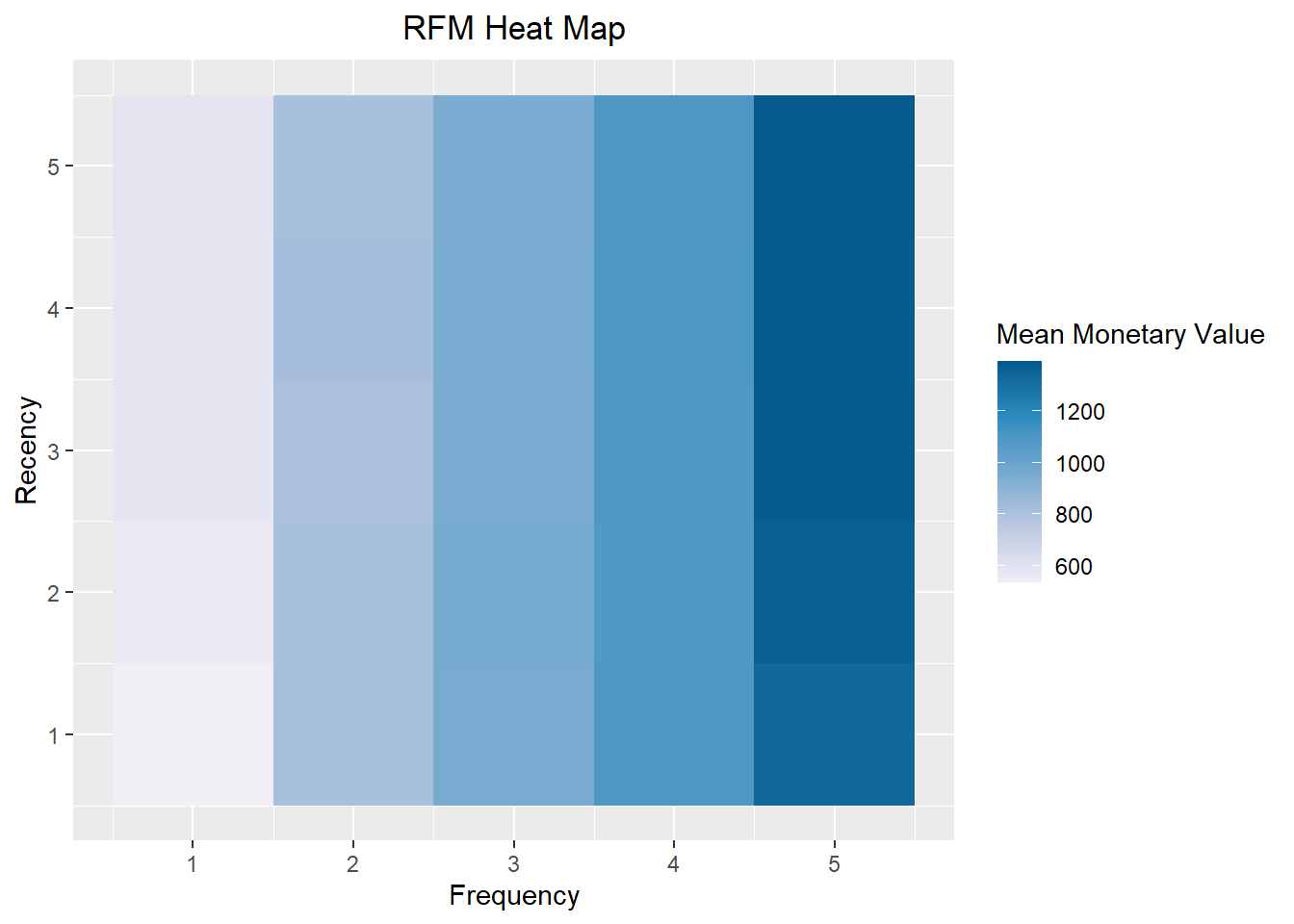

heat map shows the average monetary value for different categories of recency and frequency scores

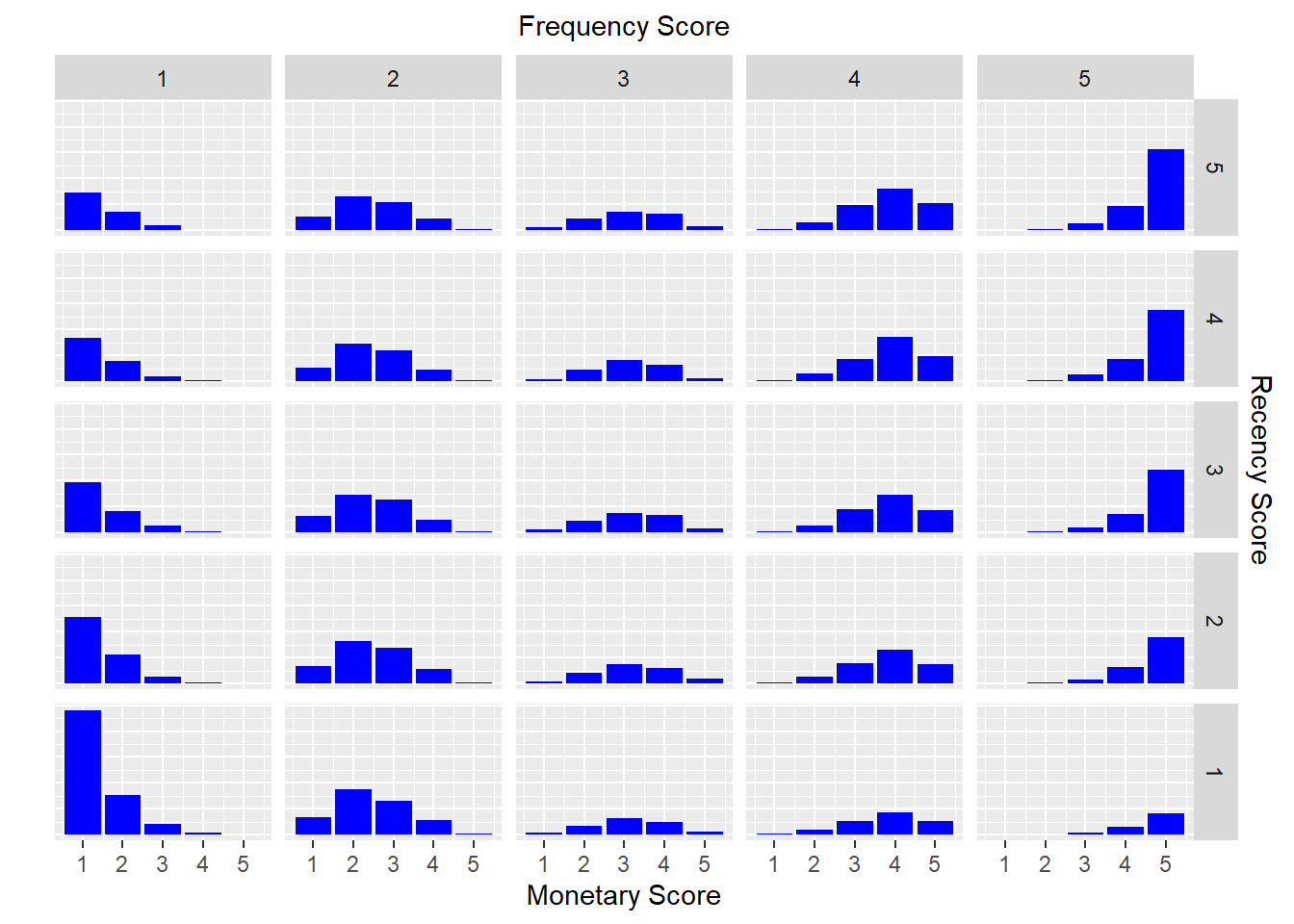

bar chart

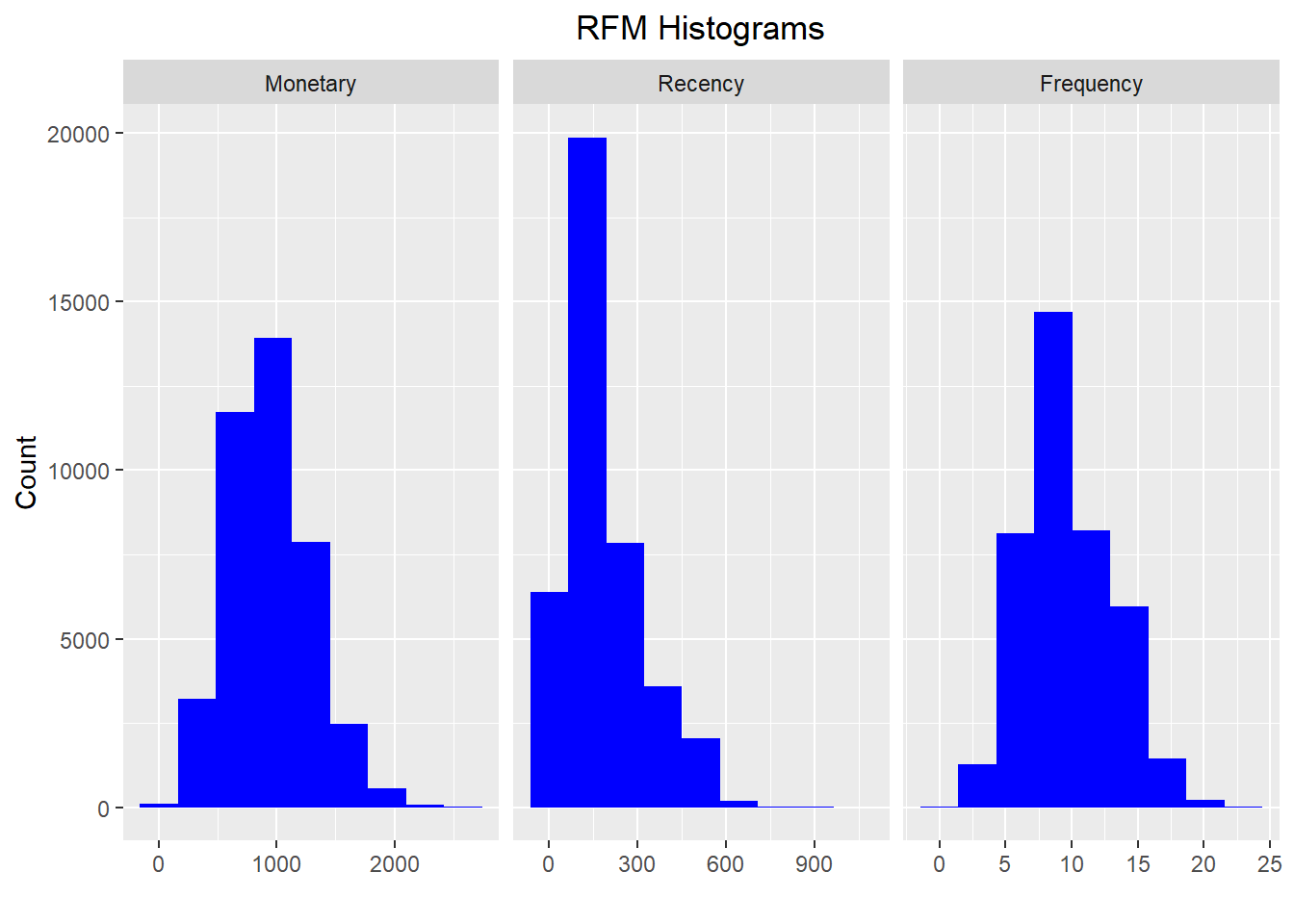

histogram

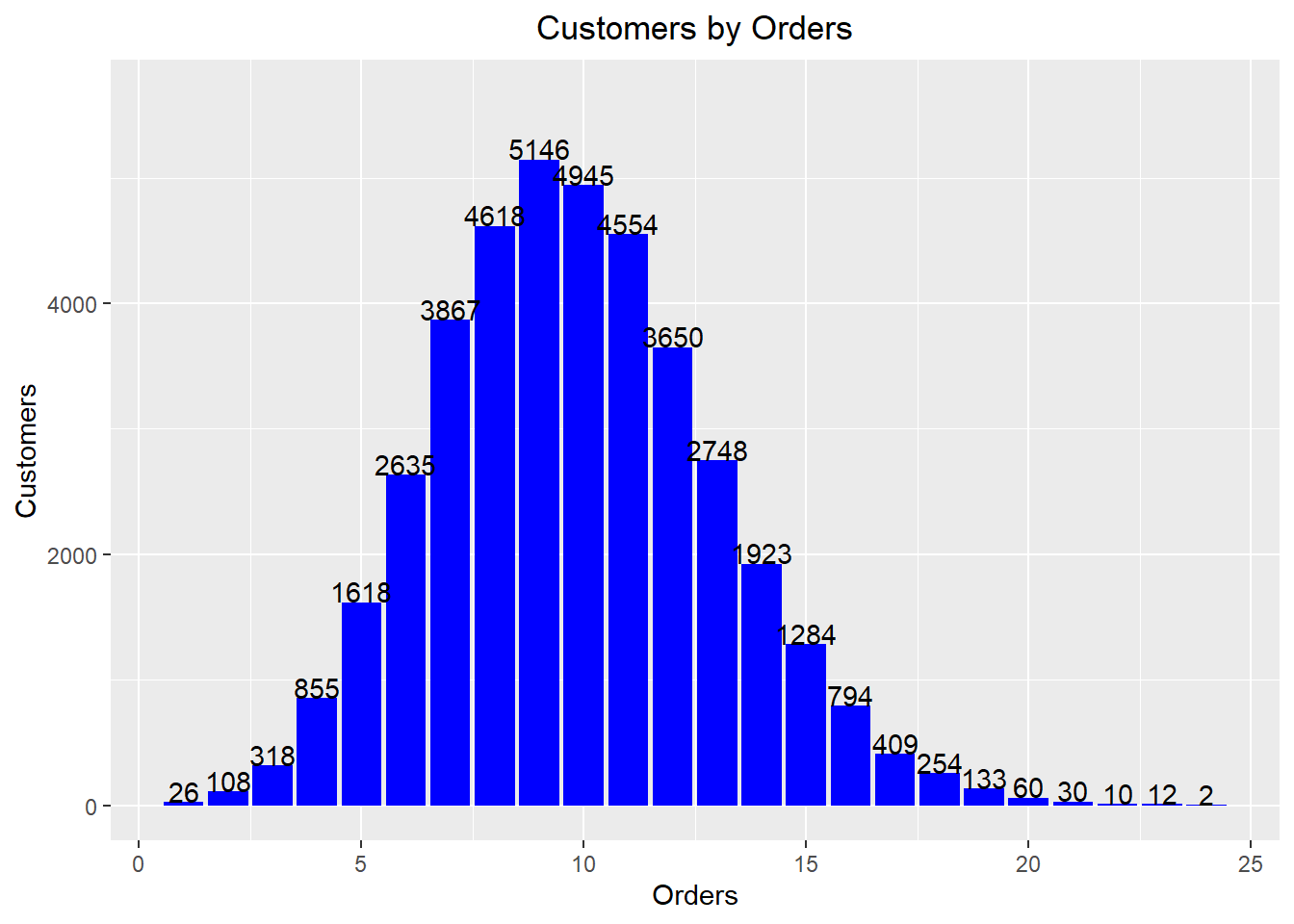

Customers by Orders

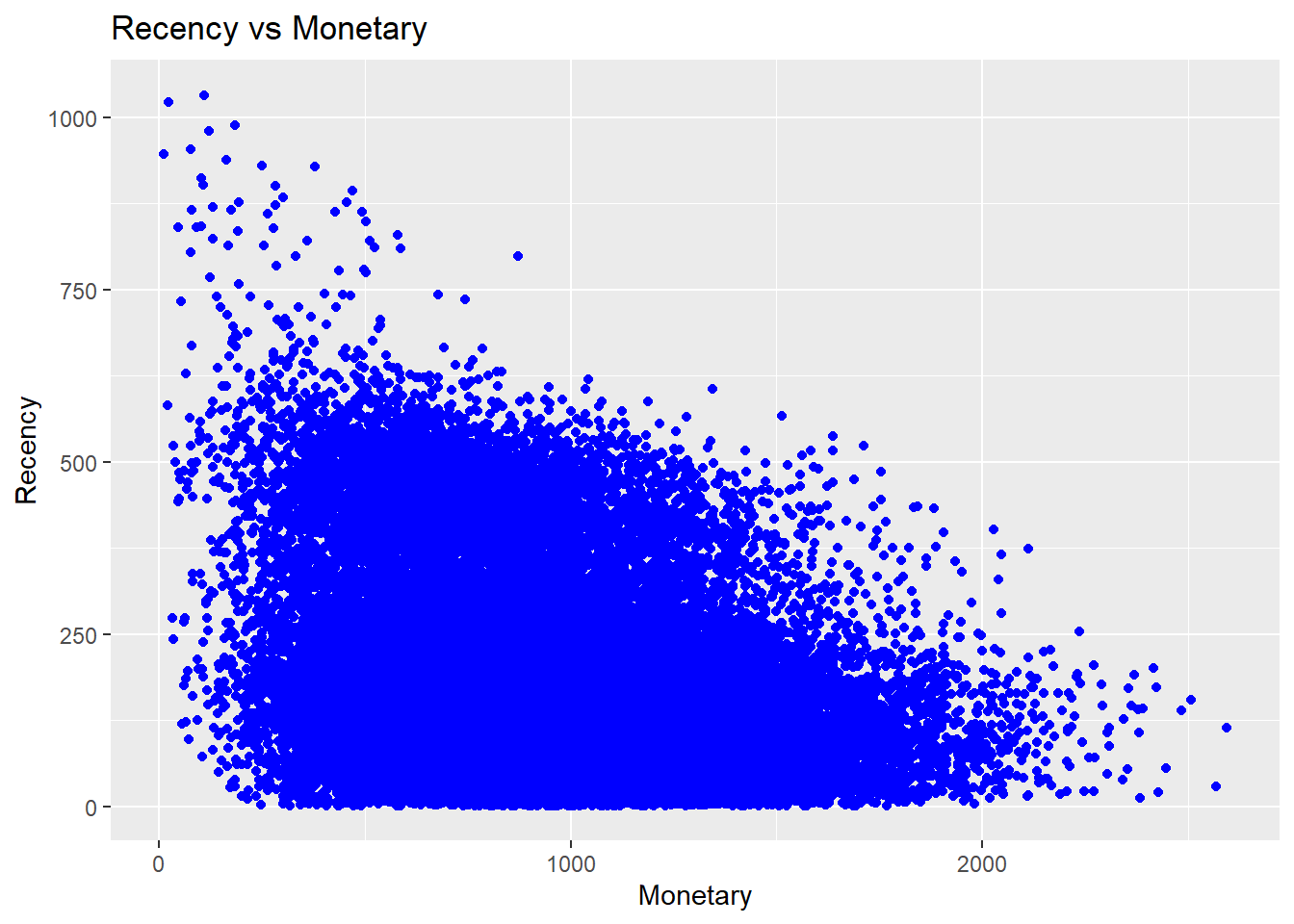

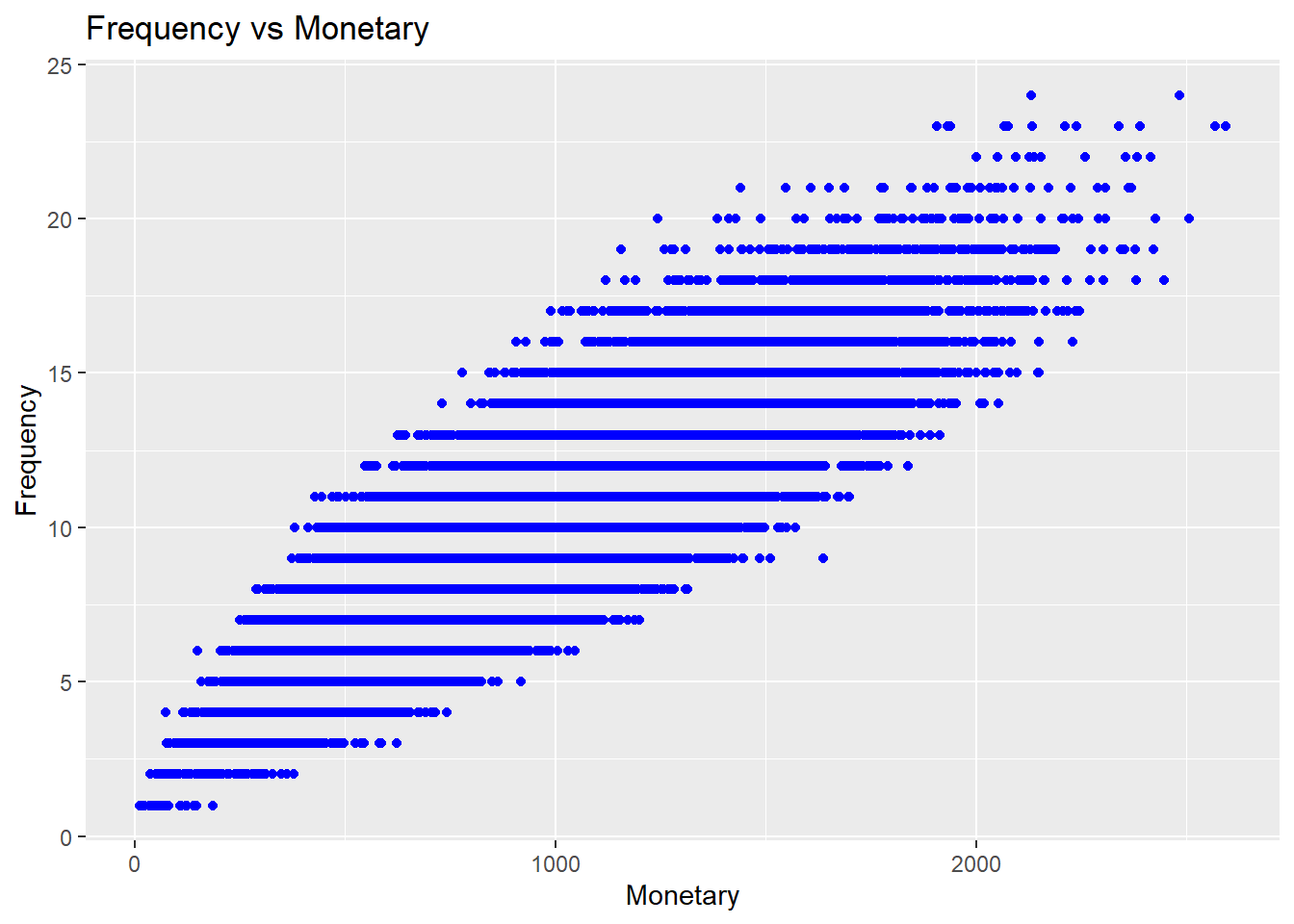

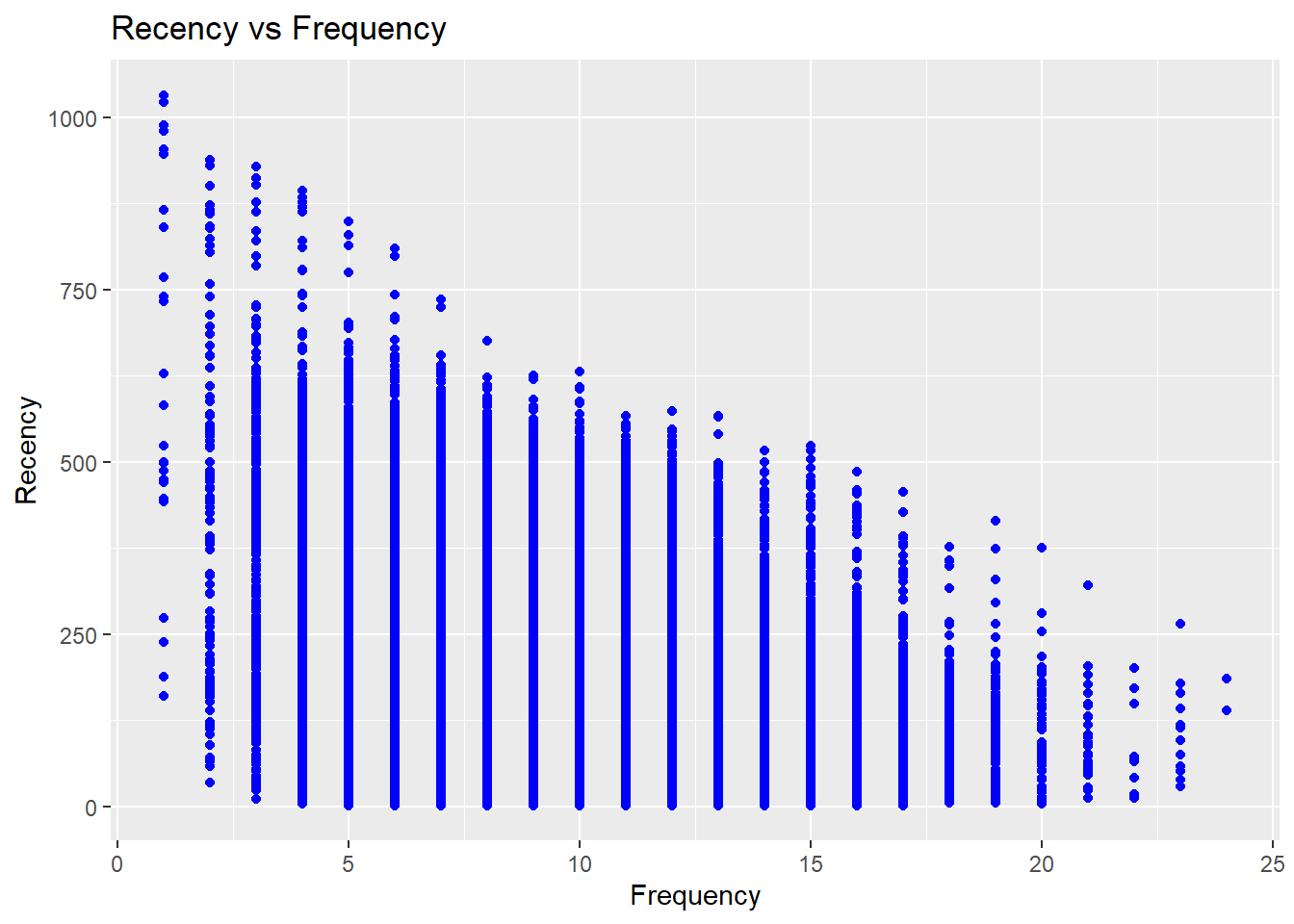

Scatter Plots

22.3.2 RFMC

- clumpiness is defined as the degree of nonconformity to equal spacing (Yao Zhang, Bradlow, and Small 2015)

In finance, clumpiness can indicate high growth potential but large risk, Hence, it can be incorporated into firm acquisition decision. Originated from sports phenomenon - hot hand effect - where success leads to more success.

In statistics, clumpiness is the serial dependence or “non-constant propensity, specifically temporary elevations of propensity— i.e. periods during which one event is more likely to occur than the average level.” (Yao Zhang, Bradlow, and Small 2013)

Properties of clumpiness:

- Min (max) if events are equally spaced (close to one another)

- Continuity

- Convergence

References

Zhang, Yao, Eric T. Bradlow, and Dylan S. Small. 2013. “New Measures of Clumpiness for Incidence Data.” Journal of Applied Statistics 40 (11): 2533–48. https://doi.org/10.1080/02664763.2013.818627.

———. 2015. “Predicting Customer Value Using Clumpiness: From RFM to RFMC.” Marketing Science 34 (2): 195–208. https://doi.org/10.1287/mksc.2014.0873.