38.2 Branding

Branding-finance literature review:

From a comprehensive search process with 4 criteria, 114 journal articles that look at the brand-related actions and stock market-based outcomes and 38 more with accounting-based metrics

Measuring the financial impact of brands

Stock returns (event studies)

Stock returns (response models) to examine continuous events.

Idiosyncratic and systematic risk

Firm value (Tobin’s q) = the ratio of the market value of a firm to the replacement cost of its assets. Even though criticism regarding this metric has been raised (Bendle and Butt 2018), there are answers (R. H. Peters and Taylor 2017). Factors impact brand Tobin’s q:

corporate branding strategy (V. R. Rao, Agarwal, and Dahlhoff 2004)

characteristics of a brand portfolio (Neil A. Morgan and Rego 2009b)

advertising (Fang Wang, Zhang, and Ouyang 2008)

Accounting-based performance and related outcomes are important for understanding the indirect effect f brand actions on financial value.

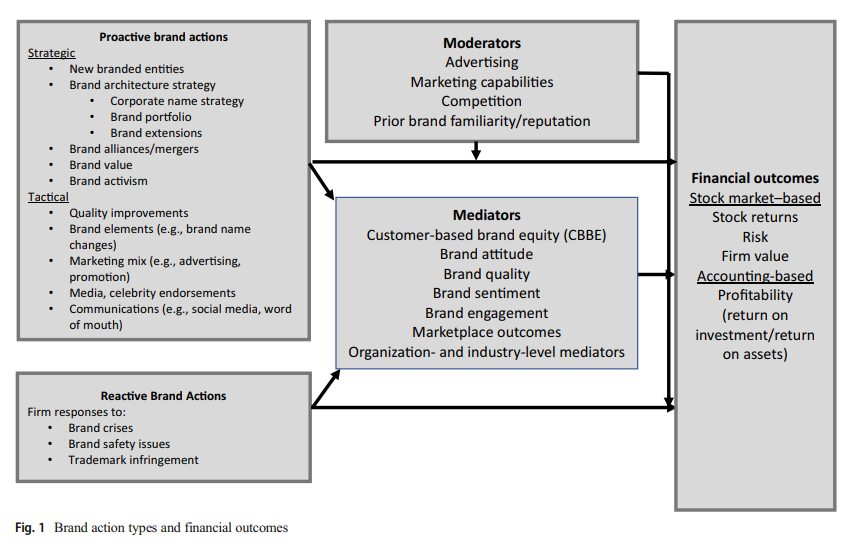

Categorizing brand actions by scope and cause

Cause (proactive vs. reactive)

Proactive actions can be more positive than reactive actions.

Even though managers are paid to be proactive, but is it always good to be proactive? Researchers have over-researched actions that can be taken by managers, but what if we play by the status quo (idea by Taleb)?

- bias toward intervention (naive interventionism: intervention that produces small visible gains, while creating the possibility off large - later harm): restraint from inaction is not likely to be rewarded.

Scope (strategic vs. tactical)

Strategic actions focus on broader and longer-term goals (targeting, segmentation, diversification, new product introduction, rebranding, brand architecture, and brand acquisitions)

Tactical actions focus on short-term expected implications (e.g., marketing mix)

Brand-finance interface:

Theoretical perspectives:

Signaling theory/ info economics theory: brands are signals of quality to both investors and consumers (Connelly et al. 2010). (call for research on signal environment and signal feedback dimension)

Signaler: Types of actions and firms

Signal: signal quality (credibility)

receiver of signal: type of signal

signaling environment (e.g., social media platforms)

feedback from receiver to signaler

Resource-based theory: A business’s ability to generate value depends on its resources, whether they are valuable, rare, and costly to replicate, and if the organization is organized to get value from them. And if a resource has these components, it can create sustained competitive advantage.

Mediators

Brand quality perceptions

attitudes

engagement: receives less attention

marketplace outcomes (e.g., customer lifetime value, market share)

organization-focused processes:

industry-based processes (e.g., barriers to entry, threat of competition, analyst converge, relative market share): receives less attention

Moderators (then what is the difference between the organization factors as mediators and moderators):

advertising (and other marketing mix variables)

Prior brand strength

organization factors (e..g., marketing capabilities)

industry factors (e.g., competition)

Financial consequences of brand actions based on the scope and cause of actions

Proactive-strategic brand actions

brand introduction and brand innovation: are value-creating activities (on revenue, profitability, firm value)

brand architecture (e.g., new products in new and existing markets, brand naming strategy, target market)

2 corporate naming strategies

House of brands

Branded house: greater efficiency and lower customization and cannibalization, more potential risk(V. R. Rao, Agarwal, and Dahlhoff 2004)

leverage brand (e..g, leverage brand reputation to appeal to newer segments of consumers)

Brand image and reputational capital:

reputational capital: “an organization’s stock of perceptual and social assets.” (p. 649)

Corporate social performance: “doing well while doing good.” But the impact of its on firm performance is still under debate, which means we might be able to find moderators for this relationship.

Sociopolitical activism (CSA): can be negative.

Further research: new brand type (e.g., digital brand, sharing platform), or global branding, cocreation.

Proactive-tactical brand actions

Brand tactical actions (Keller and Swaminathan, 2019):

choice of brand elements (e.g., brand names, URLs, logos, symbols, characters, spokespeople, slogans, jingles, packages,signage).

marketing-mix activities (4Ps)

secondary associations (linking to other people, places, or things).

Brand tactical actions by this paper:

Name changes: good signal for changes in strategic direction.

Brand quality improvement: positive effect on firm perofrmnace

Advertising: direct (signalling and spillover on investors) and indirect effect (brand meaning and brand strength) on firm performance

Social Media Communications: earned and owned social media influence brand awareness, purchase intent, and customer satisfaction then stock performance.

WOM communication: using social tagging to assess brand image.

pricing and channels: pricing and brand image have inverse relationship, while distribution intensity has a positive impacts on brand equity.

celebrity endorsement: can have positive and negative impact on firm performance

Further research: mostly stem from info rich environment.

Reactive brand actions

Product recalls: negatively affect stock return, but prior reputation and advertising strength can mitigate this negative impact. And it can spillover to competitors as well. Prior reputation can serve as both a benefit (dampen unintentional impact), but a liability (exacerbate intentional impact - e.g., corporate social irresponsibility).

Trademark disputes and protection: always good for plaintiff (regardless of thee verdict), bad for defendant in casae of unfavorable verdict.

Brand crises: e.g., #DeleteUber

Further Research: resolve double-edge sword of prior reputation; when and how advertising can mitigate crises; whether and when firms should be proactive vs. reactive) in regard to brand crises.

Additional research on contingent factors

Number and strength of competitors can be a moderator of the impact of brand actions on CBBE (in my research, I look at both the impact of competition on brand actions e.g., social media adoption, and as a moderator between brand action and brand reputation).

The quality of brand actions

The speed of brand actions: (e.g., first -mover advantage)