16 Marketing-Finance Interface

Review papers

(Edeling and Fischer 2016): meta-analysis

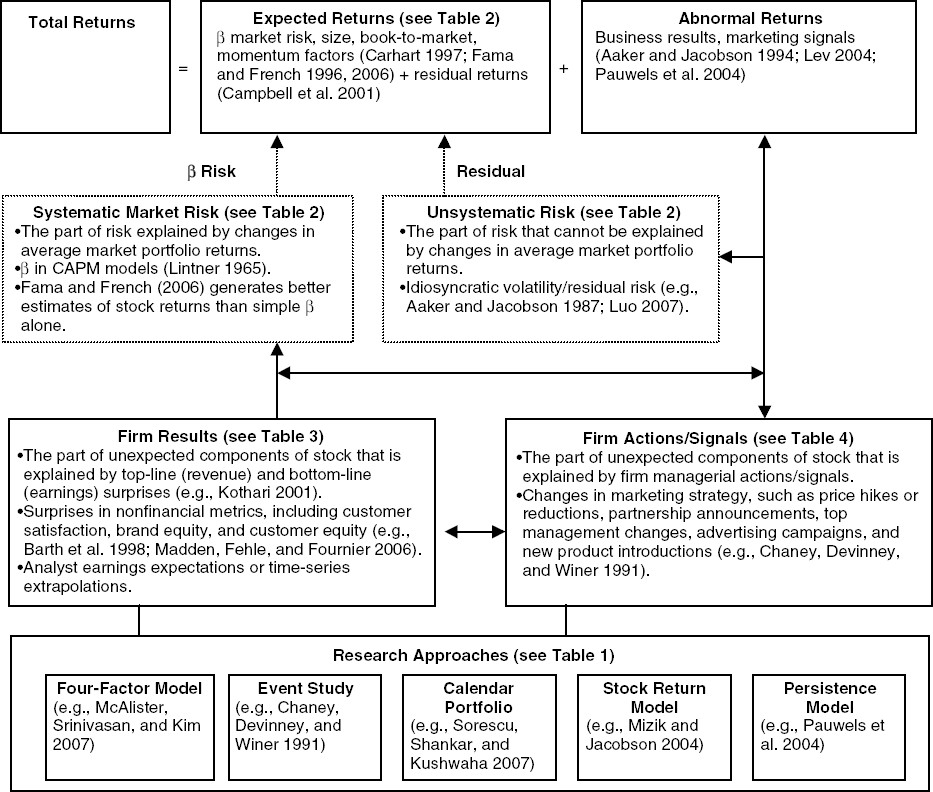

Market efficiency

Weak efficiency: historical information only

Semi-strong efficiency: historical info + public info in real time

Strong Efficiency: historical info + public and private info

In marketing, the general consensus is that market efficiency holds in between its weak and semi-strong form

stock market reward firms with higher stock prices as good news about marketing becomes available and vice versa.

Stock market valuation is in sync with product-market valuation (i.e., actions that drive value in product markets should drive firm value)

Methods

Single equation approach based on ECM: (e.g., (S. Srinivasan et al. 2009)) recognizing random walk

Stock return response modeling

Persistence Modeling (VAR modeling)

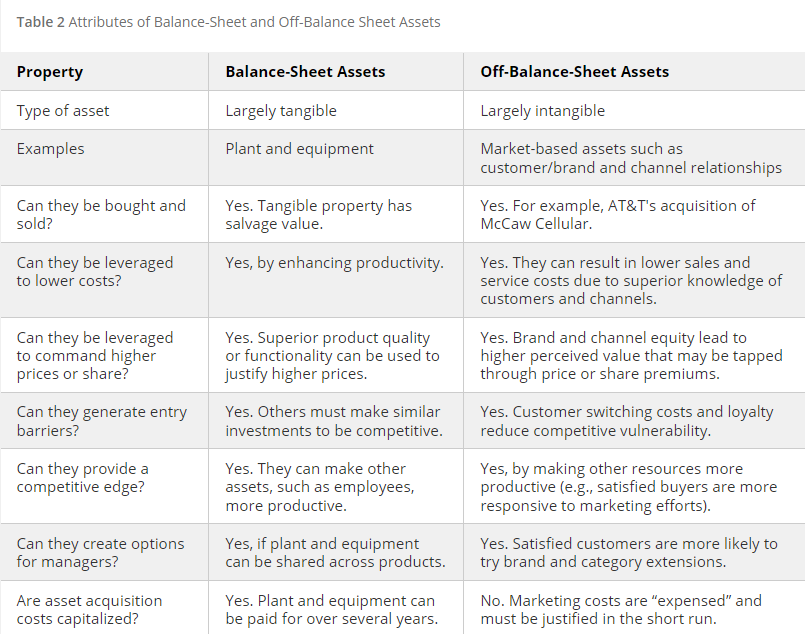

Market-based assets are defined as those “arise from the commingling of the firm with entities in its external environment” (Srivastava, Shervani, and Fahey 1998b, 2)

Assets are “any physical, organizational, or human attribute that enables the firm to generate and implement strategies that improve its efficiency and effectiveness in the marketplace” (Srivastava, Shervani, and Fahey 1998b, 3)

Sustained value creation test

- Convertible (firms can exploit assets)

- Rare

- Imperfectly imitable

- No perfect substitutes

Market-based assets are: relational and intellectual.

-

Relational market-based assets are “outcomes of the relationship between a firm and key external stakeholders, including distributors, retailers, end customers, other strategic partners”. (Srivastava, Shervani, and Fahey 1998b)

- For example, brand equity = relational assets between firms and their customers, while channel equity - relational assets between firms and their channel partners. Brand equity can be created from advertising and superior product functionality.

Intellectual market-based assets are “the types of knowledge a firm possesses about the environment, such as the emerging and the potential state of market conditions and the entities in it, including competitors, customers, channels, suppliers, and social and political interest group.” (Srivastava, Shervani, and Fahey 1998b)

Intangible assets can be thought of as (Srivastava, Shervani, and Fahey 1998b, 5)

Stock: “a specific amount or extent of brand equity or knowledge of customers’ purchasing criteria possessed by a firm

Flow: “the extent to which a stock of a particular asset is augmenting or decaying.”

Examples of market-based assets

Customer relationships

Channel relationships

Partner relationships

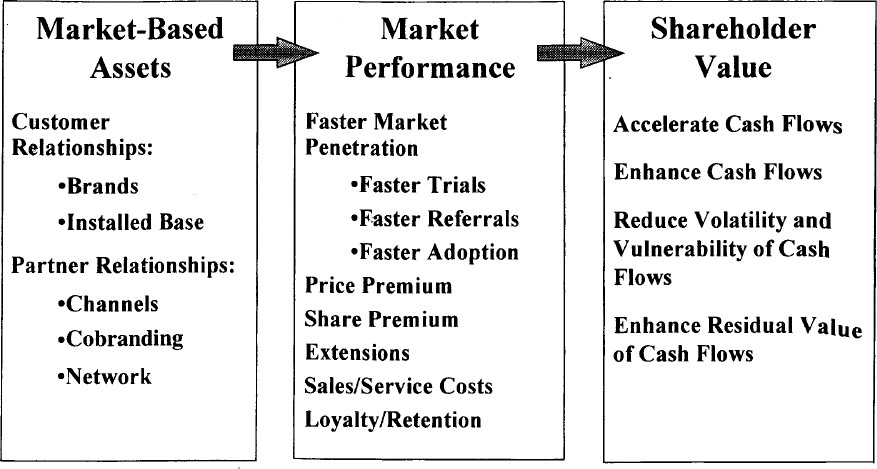

Market-based assets “increase shareholder value by accelerating and enhancing cash flows, lowering the volaitliity and vulnerability of cash flows, and increasing the residual value of cash flows” (Srivastava, Shervani, and Fahey 1998b, 2)

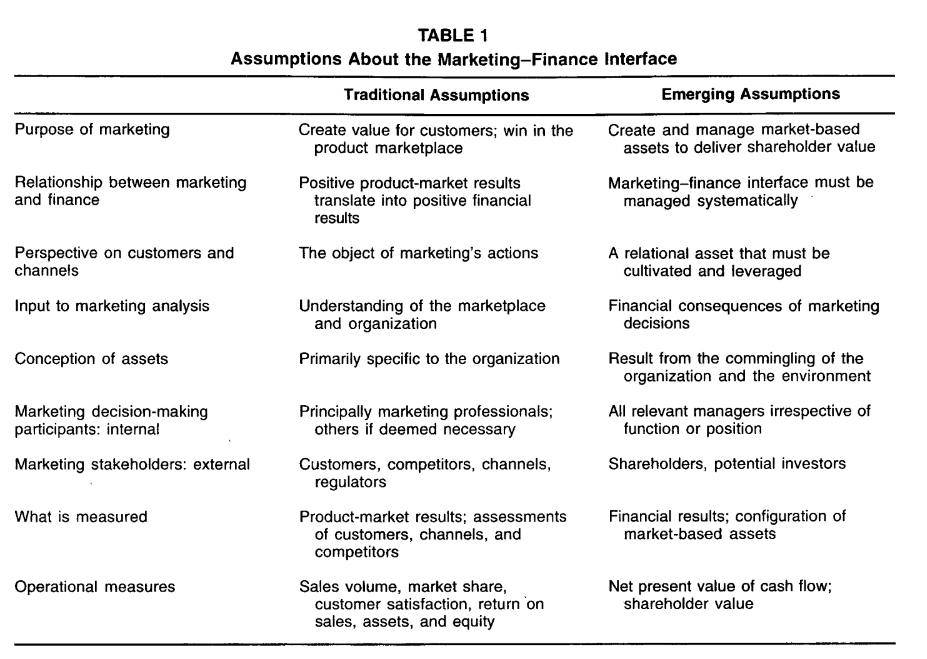

(Srivastava, Shervani, and Fahey 1998b, 2, table 1)

Market-based assets: 3 propositions

- The more market-based assets external entities can develop, the more satisfied and eager they are to work with the firm, and the more valuable they are to the firm.

- The more market-based assets pass asset testing, the more external entities benefit.

- When a company taps or leverages market-based assets to boost cash flows, shareholder value is created.

Generating Customer Value

Different from tangible balance-sheet assets, intangible assets can create long-term sustained customer value by

satisfying the four resource-based tests (knowledge and relationships pass all the tests)

adding the value-generating capability of physical assets (Marketing capabilities inherent in organizational processes, such as new product development, order fulfillment, and speed to market, cannot be generated or utilized without knowledge of and relationships with external entities, such as customers, distributors, suppliers, and other strategic partners. The successful execution of these competencies extends and enhances knowledge and relationships.)

exploiting the benefits of organizational networks (network is “a coordinated set of knowledge sources and cooperative relationships” where the value can be greater than the sum of its individual components (Srivastava, Shervani, and Fahey 1998b, 7))

Asset Valuation Methods and Drivers of Shareholder Value

Book value (bad because of historical value)

Replacement value (bad because of measurement issue)

PE (bad because of accrual accounting measure of firm performance)

-

shareholder value approach (current best): discounted future cash flow.

Present value of cash flows during the value growth period and long-term residual value of the business at the end of the value growth period.

-

Value of any strategy is determined by

An acceleration of cash flows (today’s money is preferred than tomorrow’s - less risk)

An increase in the level of cash flows (e.g., higher sales, or lower costs, working capital, fixed investments)

A reduction in risk associated with cash flows (either via volatility or vulnerability of future cash flows), and firm’s cost of capital

The residual value of the business (long-term value is improved by larger customer base).

Market-Based Assets and Shareholder value

-

Accelerating cash flow: increasing the responsiveness of the marketplace to marketing activity

Quicker response to ads from greater brand equity (brand awareness), faster product trial (Keller 1993)

Speed up product life cycle (time-to-market acceptance) from installed base and more partnership to speed to up the product adoption process(Robertson 1993)

-

Enhancing cash flows:

generating higher revenues: e.g., product extension

Lowering costs: extensions can increase market share and advertising efficiency and lower costs.

Lowering working capital requirements: relationship marketing can increase efficiency

Lowering fixed capital requirement: relationship marketing can increase efficiency. Networked market-based assets (from cooperative ventures - co-branding, co-marketing alliances) allow partners to leverage each other’s networks including customer base.

-

Vulnerability and Volatility of Cash Flows

The vulnerability of cash flows decreases with increased customer satisfaction loyalty and retention

Customers and channel partners relationships enhance stability in operations (from greater sharing of information, automatic ordering and replenishment, lower inventories).

Net present value of a cash flow is enhanced with increased switching costs, and lowering of capital requirements from operation integration.

-

Residual Value of Cash Flows (those beyond forecast periods)

increase with size, loyalty and quality (purchase more) of customer base

customer base creates barriers fro competition.

Cash flow is encouraged to be firm performance measure because of less accrual accounting problems (i.e., historical performance, not adjusted for risk, and easily manipulated)

Marketing actions (e.g, adverting, product innovation) can build long-term assets (e.g., brand equity, customer equity), in turn increase short-term profitability (e.g., increase marketing effectiveness for dollars spent on advertising) (Roland T. Rust et al. 2004)

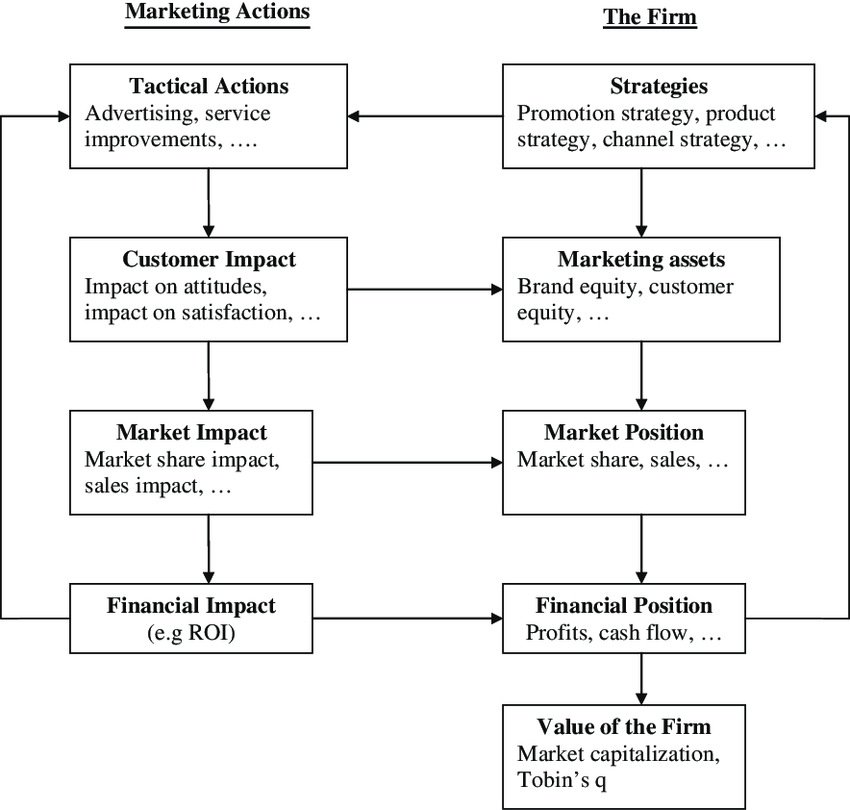

The Chain of Marketing Productivity (source (Roland T. Rust et al. 2004))

Relationship between marketing and finance (Srivastava, Shervani, and Fahey 1998b)

Stage 1: Market-based Assets

- Customer relationships: Brands, installed base.

- Partner Relationship: channels, co-branding network.

Stage 2:

- Faster Market penetration

- Price premium

- share premium

- extensions

- reduce sales/service costs

- Loyalty/ Retention

Stage 3: Shareholder value:

- Accelerate Cash Flows

- Enhance Cash Flows

- Reduce Volatility and Vulnerability of Cash flows

- Enhance Residual Value of Cash Flows.

(Grewal, Chandrashekaran, and Citrin 2010; McAlister et al. 2016; Neil A. Morgan and Rego 2009a) used Tobin’s Q in marketing research. since it is “forward-looking, risk-adjusted, and less easily manipulated by managers” (Wies et al. 2019). When probing factors affecting Tobin’s Q, it was suggested to control for financial leverage, and cash flows

S. J. Anderson, Chandy, and Zia (2018) found that there is a significant improvements from increasing both business skills (marketing and finance). However, the pathway to improve profits from marketing skills is via growth focus (e.g., higher sales, more investments in products, and employees). The pathway to improve profits from the finance skills is via efficiency or cost focus. Hence, the recommendation is that marketing/sales skills have better fit for startups, while finance/accounting skills are more needed in mature companies.

Cheong, Hoffmann, and Zurbruegg (2021) found that advertising investments is not only beneficial in terms of customers, but also in terms of investors since it reduces stock price synchronicity (i.e., a firm stock price follows closely to its industry moving)

Lacka et al. (2021) define price impact as” the impact on the variance of stock price.” They estimate the permanent and temporary price impacts of the firm-generated Twitter content of S&P 500 IT firms: firm-generated tweets induce both permanent and temporary price impacts, depending on valence and subject matter. Tweets reflecting only valence or subject matter concerning consumer or competitor orientation only have temporary price impacts, while those with both attributes generate permanent price impact. Moreover, negative valence tweets about competitors generate the largest permanent price impacts.

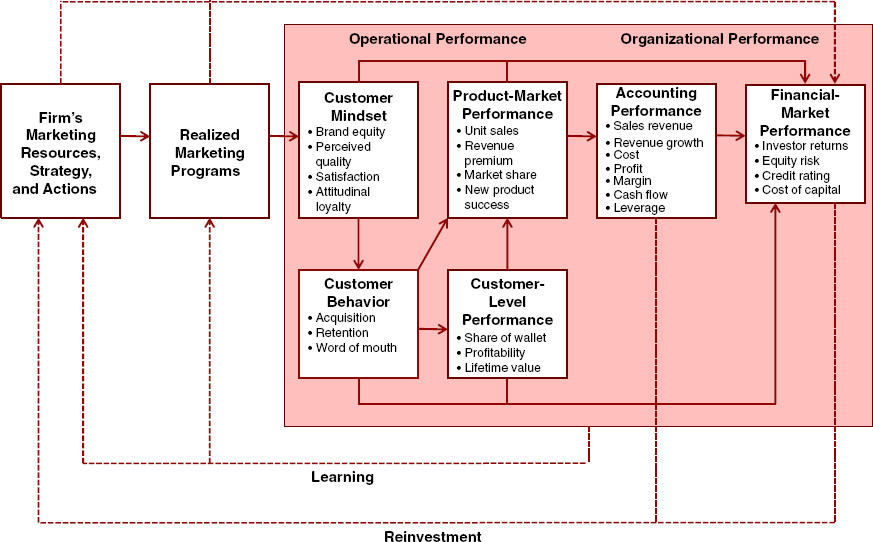

(Katsikeas et al. 2016) Performance outcomes in marketing

(D. R. King and Slotegraaf 2011) Impact of Firm Investment Decisions on Industry Growth and Volatility

-

Research Context:

Managers’ challenge in deciding firm investments aimed at both creating and capturing value.

Proposition: Such investment decisions can shape the growth and volatility of an entire industry.

-

Objective:

- To determine the impact of aggregate firm investments on the growth and volatility of industry profit and sales.

-

Methodology:

- Analysis of data from 377 industries spanning a 16-year period.

-

Key Findings:

Firm investments have a noticeable effect on both the growth rate and volatility of their respective industries.

Investment in value creation and value appropriation has intricate relationships with different facets of the industry environment.

16.1 Marketing Value

(Hanssens and Pauwels 2016) argue for marketing value in a firm and how to appropriate assess its effectiveness and efficiency.

16.2 Business Valuation

(McCarthy, Fader, and Hardie 2017) Valuing subscription-based business

- Use DISH network and Sirius XM Holdings data, the authors estimate the overall value of the firm (customer-based corporate valuation)

16.3 M&A

(H. Singh and Montgomery 1987)

-

Variable of interest:

DV: cumulative portfolio abnormal returns

IV: relatedness between acquirer and target

Similarity is the presence of technological or product-market relationships between acquirer and target

Data: 106 mergers (1975 - 1980)

Related firms create more value when merging

-

Variable of interest:

DV: merger dollar gains

IV: product-market fit (between acquirer and target)

Similarity is the presence of similar target markets, similar products, or both.

Data: 218 mergers (1962 - 1983)

Related firms create more value when merging

-

Variable of interest:

DV: ROA

IV: Similarity in R&D, capital, and administrative intensities

Complementary is differences between acquirers and targets in R&D, capital, debt, and administrative intensity

R&D complementarity boosted unrelated acquisitions.

(Datta, Pinches, and Narayanan 1992)

-

Variable of interest:

DV: wealth effects

IV: # of bids, type of financing, and acquisition

Similarity is overlap in served markets

Data: 41 primary studies

Similar firms create more value when merging

-

Variable of interest:

DV: ROA

IV: similarity in market coverage, operational efficiency, marketing activity, client mix, and risk propensity

Difference between acquirers and targets was based on a distance metric

Sample: 46 horizontal mergers (banking)

Differences impede horizontal banking merger success.

(Healy, Palepu, and Ruback 1997)

Returns to buyer’s shareholders are connected with managers’ equity stakes.

Leveraged buyouts (LBOs) that align management and shareholder interests provide value for purchasers.

(Agrawal, Jaffe, and Mandelker 1992; Loughran and Vijh 1997)

Cash deals are more popular with investors than stock-financed deals. The bad signaling effect of equity financing suggests managers may offer overvalued stock. This unfavorable stock market reaction to stock financing is permanent.

Negative returns for acquirers who paid with equity five years post-takeover.

-

Variable of interest:

DV: ROA

IV: product-market relatedness and resource complementarities

Complementarity is the presence of related assets

Data: 24 mergers (case study)

Resource complementarities contribute to merging success

Excess cash acquisitions fail. Announcement period returns are negatively associated with an acquirer’s cash.

A cash reserve eliminates external borrowing. When managers are shielded from the external market, they make irrational investment decisions.

(Larsson and Finkelstein 1999)

-

Variable of interest

DV: Synergy realization

IV: combination potential, degree of integration achieved, lack of employee resistance

Data: 112 mergers (case study)

Complementary operations increase synergy, especially with organizational integration.

- there is evidence for underperformance after M&A performance

(M. L. Mitchell and Stafford 2000)

- Small acquirers see favorable returns three years post-acquisition.

Undervalued acquirers with high book-to-market ratios (value’ acquirers) have favorable long-run returns, while overvalued acquirers with low book-to-market ratios have negative returns.

The stock market extrapolates management’s ability to make solid purchases from the company’s finances. “Glamour” acquirers’ managers are generally overconfident in their ability to handle an acquisition, and their actions aren’t rigorously checked. Value’ acquirers, rigorously scrutinized by other stakeholders, are more cautious in appraising possible targets, leading to wiser decisions.

(Megginson, Morgan, and Nail 2004)

Business similarity between merging firms is linked with positive stock performance.

Divestitures or spin-offs that dispose of non-core assets or operating divisions boost stockholder value.

(Moeller, Schlingemann, and Stulz 2004)

- Small acquirers have larger announcement period returns, regardless of target ownership (public/private).

(Fuller, Netter, and Stegemoller 2002; Conn et al. 2005)

Buyer shareholders enjoyed big gains when the target was a privately owned corporation or a parent-controlled subsidiary.

The bidder benefits from the illiquidity discount and enhanced information sharing from concentrated ownership.

Bidders using stock transfers and other non-cash means did not underperform and saw positive stock market reactions. Private target managers, who are expected to become major stakeholders in the new business, have a greater motive to supervise the bidder’s management, which provides value for the bidder. Deferred tax obligations in a stock offer may lead target ownership to accept a lower price. This leads to increased shareholder returns.

A lack of awareness around private bids makes it easier for bidders to abandon discussions, reducing hubris-driven judgments. The stock market favors glamour’ businesses bidding for private targets.

(Moeller, Schlingemann, and Stulz 2005)

- When inorganic growth is no longer sustainable, serial acquirers with high valuations lose money on their purchases.

(Cosh, Guest, and Hughes 2006)

- CEO ownership increased long-term returns.

(Swaminathan, Murshed, and Hulland 2008) found that when merging organizations have poor strategic emphasis alignment, diversity improves value. In contrast, when merging organizations have strong strategic emphasis alignment, value is enhanced when the merger goal is consolidation.

For a summary of M&A research in marketing up until 2008 (see table 1, p. 34)

-

Contributions:

Strategic emphasis alignment is an important variable in merger value creation

Both resource similarity and resource complementarity create value (but under different merger motives)

marketing resources (e..g, advertising relative to R&D) affect M&A value creation.

-

Merger motives (p. 40):

Consolidation: to gain power by combining two firms with similar products and serving similar markets

related diversification: two firms that operate in completely non-overlapping businesses.

-

unrelated diversification: two firms in closely related industries

“related diversification in which firms gain access to and acquire a related technology”

“related diversification in which firms acquire a related product for product line filling”

Data: 206 M&A (electronics, chemicals, foods).

Method: event studies

Strategic emphasis was operationalized by substracting the firm’s R&D expenditures from its advertising expenditures and dividing it by the total assets of the firm in the year preceding the merger (following (Mizik and Jacobson 2003))

Strategic emphasis alignment: absolute value fo the difference between the acquirer strategic emphasis and that of the target.

(D. R. King, Slotegraaf, and Kesner 2008) see Research and Development

(Chari, Ouimet, and Tesar 2009)

Acquirers of domestic targets experience bigger short- and long-term wealth benefits than offshore acquirers. Deals that diversify across borders perform poorly. Returns are higher when the target’s domestic product and financial markets move independently of the acquirer’s own nation. Stock markets favor developed market acquirers in emerging markets.

As developing market spreads grow, acquirer returns rise. When majority ownership is transferred, the acquirer, target, and acquirer’s shareholders all enjoy stronger profits, especially in R&D- and brand-intensive businesses where intellectual assets are significant.

(Bouwman, Fuller, and Nain 2009)

In terms of two- and three-year buy-and-hold returns, bull market acquisitions underperform bear market acquisitions.

Managers suffer from hubris during market upswings and overestimate synergies and profits. When the market is pessimistic, managers make more cautious decisions, thus purchases are motivated by realistic prospects of beneficial synergies.

(Swaminathan and Moorman 2009)

-

Contribution:

alliance announcements create value for firm

When network efficiency and density are moderate, they have the most favorable influence.

Network reputation and network centrality have no effect

marketing alliance capability (firm’s ability to management a network of previous marketing alliances), positively influence value creation.

-

Network features:

Network centrality: whether the company has partnerships (# of firms with which a firm is directly connected)

Network efficiency: The company’s network offers new capabilities (the degree to which the firm’s network of alliances involves firms that possess non-redundant knowledge, skills, and capabilities)

Network density: the firm’s network involves interconnections among firms (the degree of interconnectedness among various actors in a network)

Network reputation: the firm has a strong reputation (aggregate-level quality ascribed to firms in a firm’s network).

Marketing alliance capability: The company may handle marketing relationships

To construct the network variables, they were used from the period of 5 years before, but other research use 7 years (Gulati and Gargiulo 1999; Schilling and Phelps 2007)

-

How firm networks influence firm abnormal returns?

Networks multiply alliance benefits

Networks facilitate alliance compliance

Networks signal firms and alliance quality

-

Control variables:

Following (Shantanu Dutta, Narasimhan, and Rajiv 1999), installed base of customers (firm sales), firm resources devoted to building customer relationships (firm receivables), marketing expenditures (firm selling, general, and administrative expenses), firm advertising expenditures. Then, add technical know-how (R&D expenditure). All of these variables use Koyck lag function, then combine under principal components analysis to avoid multicollinearity.

firm alliance experience

size of alliance partners (ratio of market cap of the firm to the partner)

Intra industry alliances vs. inter industry alliances (following (Rindfleisch and Moorman 2001))

Repeat partnering

partner network characteristics (same network variables)

Selection model and value creation model because partnership may be based on referrals (following (Verbeek and Nijman 1992)

Umashankar, Bahadir, and Bharadwaj (2021) found that M&A decreases customer satisfaction that cannibalize firm value despite potential efficiencies (due to a shift by executives from customers attention to financial issues). The presence of marketing experts in upper echelons can mitigate this negative effect. Customer dissatisfaction with M&As might offset any synergy and efficiency advantages.

16.4 Stock Return Response Modeling

Valuation model

\[ MarketCap_{it} = \sum_{T = t}^\infty (\frac{1}{1 + r_{it}})^{T-t} E(CF_T) \]

Equivalently,

\[ MarketCap_{it} = (1 + Eret_{it}) MarketCap_{it-1}+ \sum_{T=t}^\infty (\frac{1}{1+r_{it}})^{T-t} \Delta E(CF_{iT}) \]

where0

\(Eret\) = expected rate of return for an asset

\(\Delta E(CF_{iT})\) = change in the expected cash flows

Hence, the stock return can be written as

\[ StockReturn_{it} = \]

16.5 Tobin’s Q

Traditional Tobin’s q (V. R. Rao, Agarwal, and Dahlhoff 2004)

\[ q = \frac{MVE + PS + DEBT}{TA} \]

where

MVE = share price x number of common stock outstanding

PS = liquidating value of the firm’s preferred stock

DEBT = (short-term liabilities - short-term assets) + book value of long-term debt

TA = book value of total assets

Tobin’s q is scale independent. Hence, it’s a good measure of relative market performance

(R. H. Peters and Taylor 2017) Peters and Taylor Total Q

The neoclassical theory of investment can still be applied to intangible assets.

-

Propose a new Tobin’s q proxy that accounts for intangible capital, which is called total q

= the firm’s market value divided by the sum of its physical and intangible capital stocks

-

Firm’s intangible capital = sum of its knowledge capital and organizational capital

R&D spending = an investment in knowledge capital (using the perpetual -inventory method to a firm’s past R&D to measure the replacement cost of its knowledge capital)

Fraction of past selling, general, and administrative (SG&A) spending is organization capital, which includes human capital, brand, customer relationship,s and distribution systems.

A firm’s total capital as the sum of its physical and intangible capital (measured at replacement cost

Intangible capital is costlier than physical capital to adjust

Sample excludes utilities (SIC 4900-4999), financial firms (6000-6999), others (9000+), missing or non-positive book value of assets or sales, and firms with less than $5mil in physical capital. Winsorize all regression variables at the 1% level to remove outliers.

Proposed total q

\[ \begin{aligned} q^{tot}_{it} &= \frac{V_{it}}{K_{it}^{phy} + K_{it}^{int}} \\ &= \frac{prcc_f \times csho + dltt + dlc- act}{ppegt + K_{it}^{int}} \end{aligned} \]

where

\(V_{it}\) = firm’s market value = outshining equity (prcc_f times csho)+ book value of debt (dltt + dlc) - firm’s current assets (act)

\(K_{it}^{phy}\) = replacement cost of physical capital = ppegt

\(K_{it}^{int}\) = replacement cost of intangible capital

Previous Tobin’s q measure did not include the intangible part (Fazzari, Hubbard, and Petersen 1987) (Erickson and Whited 2011)

Intangible capital can be

-

Created internally

-

knowledge knowledge (e.g., patents, software): using perpetual inventory method \(G_{it} = (1- \delta_{RD}) G_{i, t-1} + RD_{it}\)

\(G_{it}\) = the end-of-period stock of knowledge capital (for \(G_{i0}\) can assume to be 0)

\(\delta_{RD}\) =depreciation rate (use BEA’s industry-specific R&D depreciation rates (W. C. Y. Li and Hall 2018) and 15% for missing data)

\(RD_{it}\) = real expenditures on R&D during the year (if missing treat as 0, (Lev and Radhakrishnan 2005)

brand capital (advertising under selling expense within SG&A)

human capital (employee training under general or admin expense within SG&A)

Others: Other Intangible Assets (intano) in Compustat

-

-

Purchased externally

Goodwill (not separately identifiable e.g., human capital is booked under goodwill).

Other Intangible Asset: (e..g, patent, software if separately identifiable)

16.6 Corporate Agility

Corporate agility defined as “a firm’s ability to adapt to environmental changes”

(Lehn 2021) hypothesizes that firm agility increases firms’ survival rates.

Since firms have to report accurately to the SEC, this measure is reliable.

-

Agility measured as the sensitivity of its responsive strategies to rivals’ threats.

- “A firm’s corporate agility is estimated as the sensitivity of its product similarity or dissimilarity (to its rival’s products) to the rivals’ product similarity (to the firm’s products.” (p. 9)

Agility is different from firm flexibility

16.7 Firm Complexity

(Hoitash and Hoitash 2017) Accounting Reporting Complexity

Accounting complexity is defined as “the difficulty to understand, prepare, audit, and analyze the financial reports.” (p. 262)

Accounting reporting complexity (ARC) is based on the count of accounting items disclosed in eXtensible Business Reporting Language (XBRL) 10-K filings.

Operating complexity: measured by the number of business and geographic segments and the existence of foreign operations as measure of complexity

-

Linguistic complexity of financial reports (i.e., readability)

Fog Index (Gunning et al. 1952)

Length of 10-K filings

-

Data

-

XBRL from Calbench, criteria:

2011-2014 that filed within 150 days of the fiscal year-end

merge with compustat

positive sales, and non-missing common shares outstanding

assets > 10 mil

Exclude missing data on material weaknesses, audit fess, restatements from Audit Analytics

-

ARC is inversely associated with financial reporting quality

ARC is positively associated with audit delay and audit fees

(Hoitash and Hoitash 2022) Firm complexity

-

ARC was used to measure firm complexity

- It can be dis aggregated to measure the complexity of specific economic activities, (e.g., derivatives or leases)

Even though (Loughran and McDonald 2020a, 2020b) measure firm complexity using dictionary-based approach, the texts can sometimes refer to other companies’ activities, whereas accounting line items belong to the focal firm

Accounting disclosures comprise the majority of economic and corporate activity. Consequently, these disclosures can reflect company complexity holistically.

Other measures of complexity: such as number of operating segments (e.g., https://gist.github.com/joosti/213050de42d6e78f1634) using BUSSEG (business segments) and OPSEG (operating segment) in compustat.

-

(Hoitash, Hoitash, and Yezegel 2021) find that when complexity increases, analysts struggle to create accurate forecasts.

- (Garcia, Villiers, and Li 2020) find that CSR are positively correlated with greater ARC.

16.9 Initial Public Offerings

Businesses focus on more growth (e.g., number of users) than traditional financial measures and take longer to go public (double the age before going public as compared to 1980s).

More retail investors due to lo-cost trading platforms.

Longer but still uninformative data. Proposed triggered disclosure

Firms can use their innovation potential as a credible signal of their quality at the time of an initial public offering (IPO).

Innovation potential is positively associated with the initial value of the IPO and with first-day IPO returns, and negatively associated with the extent to which insiders sell their shares at the time of the IPO.

Patents have a stronger impact on insider sales than preannouncements and generic references to future innovation, while preannouncements have the strongest impact on first-day IPO returns.