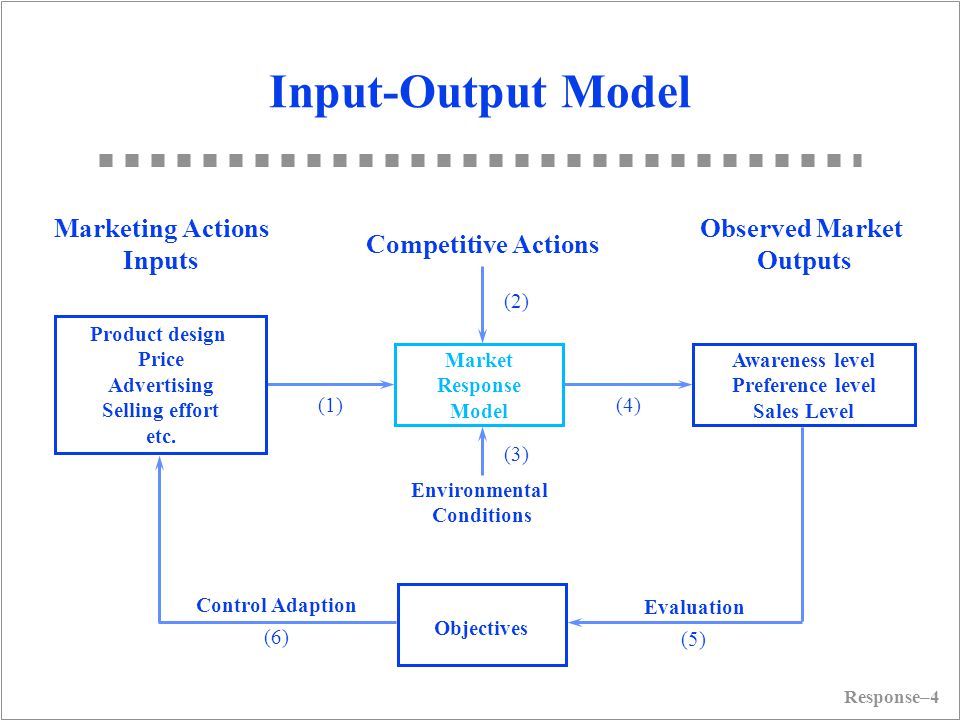

21.6 Market Response Model

Marketing Inputs:

- Selling effort

- advertising spending

- promotional spending

Marketing Outputs:

- sales

- share

- profit

- awareness

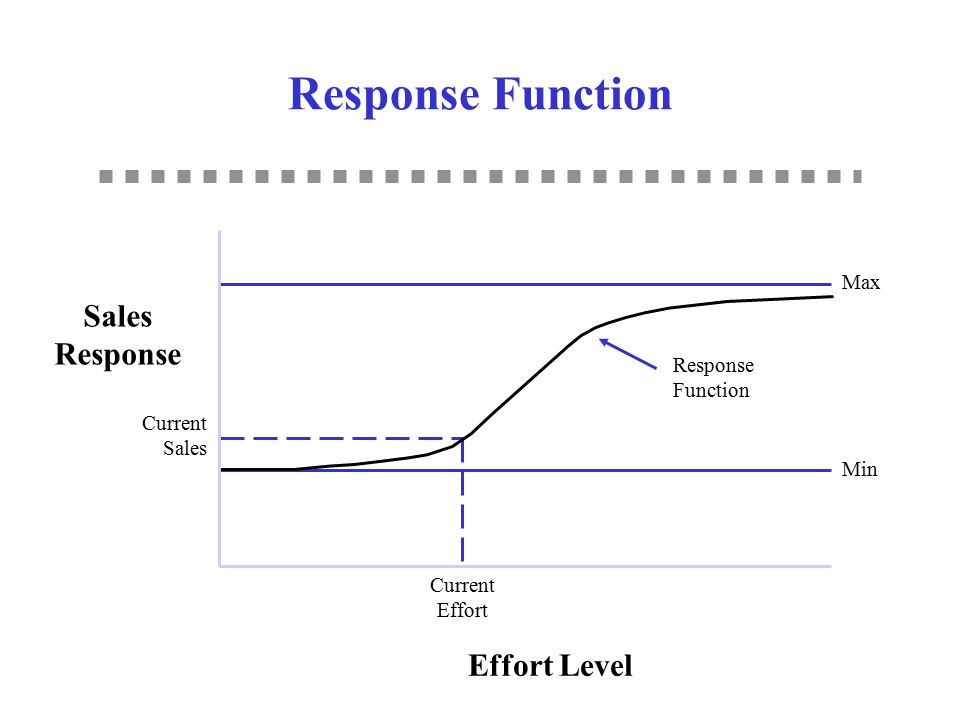

Give phenomena for a good model:

- P1: Dynamic sales response involves a sales growth rate and a sales decay rate that are different

- P2: Steady-state response can be concave or S-shaped. Positive sales at 0 adverting.

- P3: Competitive effects

- P4: Advertising effectiveness dynamics due to changes in media, copy, and other factors.

- P5: Sales still increase or fall off even as advertising is held constant.

Saunder (1987) phenomena

- P1: Output = 0 when Input = 0

- P2: The relationship between input and output is linear

- P3: Returns decrease as the scale of input increases (i.e., additional unit of input gives less output)

- P4: Output cannot exceed some level (i.e., saturation)

- P5: Returns increase as scale of input increases (i.e., additional unit of input gives more output)

- P6: Returns first increase and then decrease as input increases (i.e., S-shaped return)

- P7: Input must exceed some level before it produces any output (i.e., threshold)

- P8: Beyond some level of input, output declines (i.e., supersaturation point)

Aggregate Response Models

Linear model: \(Y = a + bX\)

Through origin

can only handle constant returns to scale (i.e., can’t handle concave, convex, and S-shape)

The Power Series/Polynomial model: \(Y = a + bX + c X^2 + dX^3 + ...\)

- can’t handle saturation and threshold

Fraction root model/ Power model: \(Y = a+bX^c\) where c is prespecified

c = 1/2, called square root model

c = -1, called reciprocal model

c can be interpreted as elasticity if a = 0.

c = 1, linear

c <1, decreasing return

c>1, increasing returns

Semilog model: \(Y = a + b \ln X\)

- Good when constant percentage increase in marketing effort (X) result in constant absolute increase in sales (Y)

Exponential model: \(Y = ae^{bX}\) where X >0

b > 0, increasing returns and convex

b < 0, decreasing returns and saturation

Modified exponential model: \(Y = a(1-e^{-bX}) +c\)

Decreasing returns and saturation

upper bound = a + c

lower bound = c

typically used in selling effort

Logistic model: \(Y = \frac{a}{a+ e^{-(b+cX)}}+d\)

increasing return followed by decreasing return to scale, S-shape

saturation = a + d

good with saturation and s-shape

Gompertz model

ADBUDG model (Little 1970) : \(Y = b + (a-b)\frac{X^c}{d + X^c}\)

c > 1, S-shaped

0 < c < 1

Concave

saturation effect

upper bound at a

lower bound at b

typically used in advertising and selling effort.

can handle, through origin, concave, saturation, S-shape

Additive model for handling multiple Instruments: \(Y = af(X_1) + bg(X_2)\)

Multiplicative model for handling multiple instruments: \(Y = aX_1^b X_2^c\) where c and c are elasticities. More generally, \(Y = af(X_1)\times bg(X_2)\)

Multiplicative and additive model: \(Y = af(X_1) + bg(X_2) + cf(X_1) g(X_2)\)

Dynamic response model: \(Y_t = a_0 + a_1 X_t + \lambda Y_{t-1}\) where \(a_1\) = current effect, \(\lambda\) = carry-over effect

Dynamic Effects

Carry-over effect: current marketing expenditure influences future sales

- Advertising adstock/ advertising carry-over is the same thing: lagged effect of advertising on sales

Delayed-response effect: delays between when marketing investments and their impact

Customer holdout effects

Hysteresis effect

New trier and wear-out effect

Stocking effect

Simple Decay-effect model:

\[ A_t = T_t + \lambda T_{t-1}, t = 1,..., \]

where

- \(A_t\) = Adstock at time t

- \(T_t\) = value of advertising spending at time t

- \(\lambda\) = decay/ lag weight parameter

Response Models can be characterized by:

The number of marketing variables

whether they include competition or not

the nature of the relationship between the input variables

- Linear vs. S-shape

whether the situation is static vs. dynamic

whether the models reflect individual or aggregate response

the level of demand analyzed

- sales vs. market share

Market Share Model and Competitive Effects: \(Y = M \times V\) where

Y = Brand sales models

V = product class sales models

M = market-share models

Market share (attraction) models

\[ M_i = \frac{A_i}{A_1 + ..+ A_n} \]

where \(A_i\) attractiveness of brand i

Individual Response Model:

Multinomial logit model representing the probability of individual i choosing brand l is

\[ P_{il} = \frac{e^{A_{il}}}{\sum_j e^{A_{ij}}} \]

where

- \(A_{ij}\) = attractiveness of product j for individual i \(A_{ij} = \sum_k w_k b_{ijk}\)

- \(b_{ijk}\) = individual i’s evaluation of product j on product attribute k, where the summation is over all the products that individual

iis considering to purchase - \(w_k\) = importance weight associated with attribute k in forming product preferences.