3.1 Case study: Housing values in Boston

This case study is motivated by Harrison and Rubinfeld (1978), who proposed an hedonic model51 for determining the willingness of house buyers to pay for clean air. The study of Harrison and Rubinfeld (1978) employed data from the Boston metropolitan area, containing 560 suburbs and 14 variables. The Boston dataset is available through the file Boston.xlsx file and through the dataset MASS::Boston.

The description of the related variables can be found in ?Boston and Harrison and Rubinfeld (1978),52 but we summarize here the most important ones as they appear in Boston. They are aggregated into five categories:

- Dependent variable:

medv, the median value of owner-occupied homes (in thousands of dollars). - Structural variables indicating the house characteristics:

rm(average number of rooms “in owner units”) andage(proportion of owner-occupied units built prior to 1940). - Neighborhood variables:

crim(crime rate),zn(proportion of residential areas),indus(proportion of non-retail business area),chas(whether there is river limitation),tax(cost of public services in each community),ptratio(pupil-teacher ratio),black(variable \(1000(B - 0.63)^2,\) where \(B\) is the proportion of black population – low and high values of \(B\) increase housing prices) andlstat(percent of lower status of the population). - Accessibility variables:

dis(distances to five employment centers) andrad(accessibility to radial highways – larger index denotes better accessibility). - Air pollution variable:

nox, the annual concentration of nitrogen oxide (in parts per ten million).

We begin by importing the data:

# Read data

Boston <- readxl::read_excel(path = "Boston.xlsx", sheet = 1, col_names = TRUE)

# # Alternatively

# data(Boston, package = "MASS")A quick summary of the data is shown below:

summary(Boston)

## crim zn indus chas nox rm

## Min. : 0.00632 Min. : 0.00 Min. : 0.46 Min. :0.00000 Min. :0.3850 Min. :3.561

## 1st Qu.: 0.08205 1st Qu.: 0.00 1st Qu.: 5.19 1st Qu.:0.00000 1st Qu.:0.4490 1st Qu.:5.886

## Median : 0.25651 Median : 0.00 Median : 9.69 Median :0.00000 Median :0.5380 Median :6.208

## Mean : 3.61352 Mean : 11.36 Mean :11.14 Mean :0.06917 Mean :0.5547 Mean :6.285

## 3rd Qu.: 3.67708 3rd Qu.: 12.50 3rd Qu.:18.10 3rd Qu.:0.00000 3rd Qu.:0.6240 3rd Qu.:6.623

## Max. :88.97620 Max. :100.00 Max. :27.74 Max. :1.00000 Max. :0.8710 Max. :8.780

## age dis rad tax ptratio black lstat

## Min. : 2.90 Min. : 1.130 Min. : 1.000 Min. :187.0 Min. :12.60 Min. : 0.32 Min. : 1.73

## 1st Qu.: 45.02 1st Qu.: 2.100 1st Qu.: 4.000 1st Qu.:279.0 1st Qu.:17.40 1st Qu.:375.38 1st Qu.: 6.95

## Median : 77.50 Median : 3.207 Median : 5.000 Median :330.0 Median :19.05 Median :391.44 Median :11.36

## Mean : 68.57 Mean : 3.795 Mean : 9.549 Mean :408.2 Mean :18.46 Mean :356.67 Mean :12.65

## 3rd Qu.: 94.08 3rd Qu.: 5.188 3rd Qu.:24.000 3rd Qu.:666.0 3rd Qu.:20.20 3rd Qu.:396.23 3rd Qu.:16.95

## Max. :100.00 Max. :12.127 Max. :24.000 Max. :711.0 Max. :22.00 Max. :396.90 Max. :37.97

## medv

## Min. : 5.00

## 1st Qu.:17.02

## Median :21.20

## Mean :22.53

## 3rd Qu.:25.00

## Max. :50.00The two goals of this case study are:

- Q1. Quantify the influence of the predictor variables in the housing prices.

- Q2. Obtain the “best possible” model for decomposing the housing prices and interpret it.

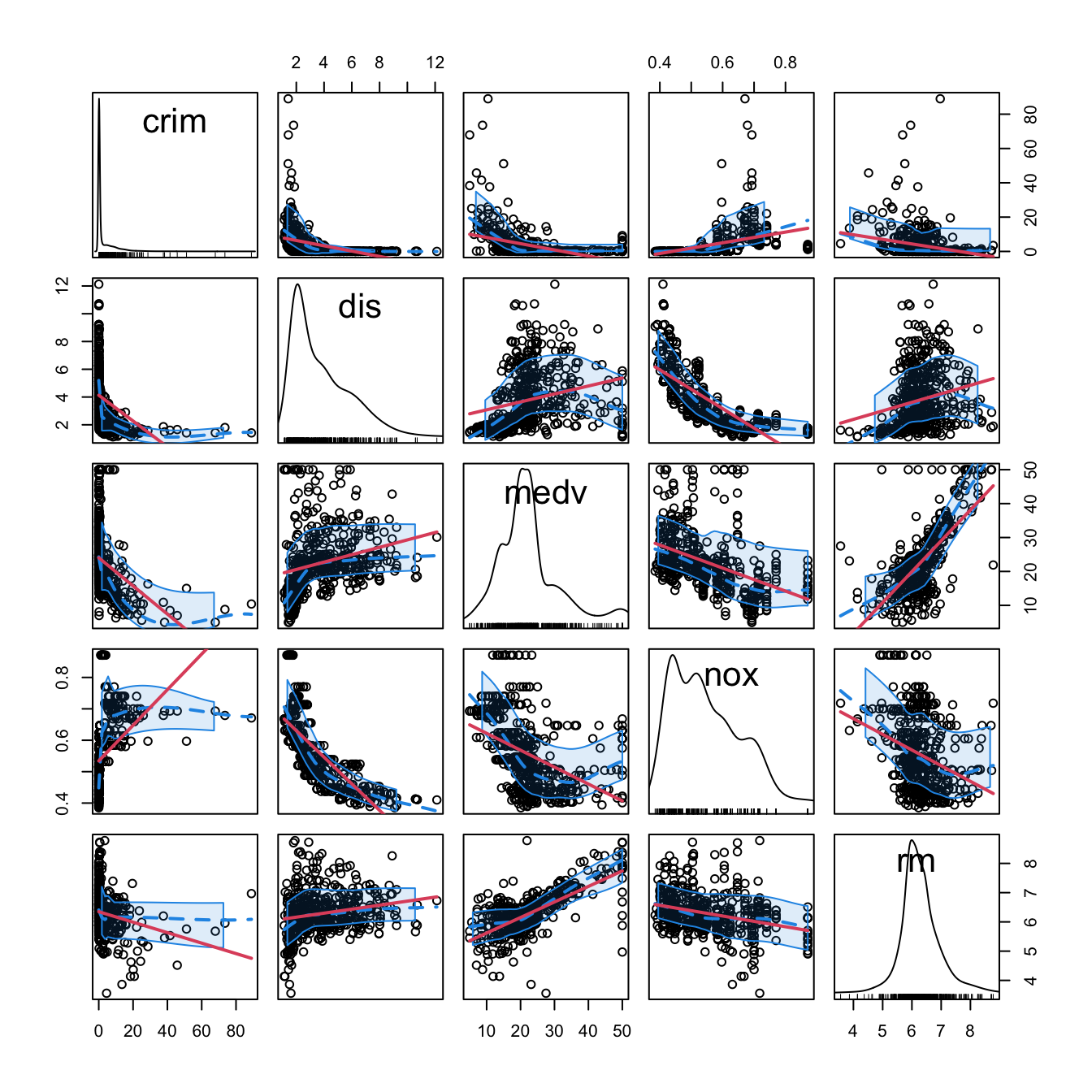

We begin by making an exploratory analysis of the data with a matrix scatterplot. Since the number of variables is high, we opt to plot only five variables: crim, dis, medv, nox, and rm. Each of them represents the five categories in which variables were classified.

car::scatterplotMatrix(~ crim + dis + medv + nox + rm, regLine = list(col = 2),

col = 1, smooth = list(col.smooth = 4, col.spread = 4),

data = Boston)

Figure 3.1: Scatterplot matrix for crim, dis, medv, nox, and rm from the Boston dataset. The diagonal panels show an estimate of the unknown pdf of each variable (see Section 6.1.2). The red and blue lines are linear and nonparametric (see Section 6.2) estimates of the regression functions for pairwise relations.

Note the peculiar distribution of crim, very concentrated at zero, and the asymmetry in medv, with a second mode associated to the most expensive properties. Inspecting the individual panels, it is clear that some nonlinearity exists in the data and that some predictors are going to be more important than others (and recall that we have plotted just a subset of all the predictors).

References

An hedonic model is a model that decomposes the price of an item into separate components that determine its price. For example, an hedonic model for the price of a house may decompose its price into the house characteristics, the kind of neighborhood, and the location.↩︎

But be aware of the changes in units for

medv,black,lstat, andnox.↩︎