2 Day 2 (June 6)

2.1 Announcements

- Assignment 1 is due on Monday.

- Upload to Canvas

- Assignment should only take 15-30 min if everything works

- Do not spend more than 1 hour

- After 1 hour of trying please visit me during office hours

- Do not wait until this weekend to do the assignment

- Recommended reading

- Chapters 1 and 2 (pgs 1 - 28) in Linear Models with R

- Chapter 2 in Applied Regression and ANOVA Using SAS

- Today’s lecture in the news

- Please realize this is a satirical article (link)

2.2 Intro to statistical modelling

- A difficult question

- How much money will I have for retirement?

- What is data?

- Something in the real world that you can, in some way, observe and measure with or without error

- What is a statistic?

- A function of the data

- What is a model?

- Mathematical models

- Statistical models

- Two difficult questions

- How much money will I have for retirement?

- Point prediction vs. distributional prediction

- What data/information do I have?

- What data do I need?

- How can I answer this question using a statistical model?

- At what location and date was a novel disease first introduced?

- What data do I have?

- What data do I need?

- How can I answer this question using a statistical model?

- Uncertainty quantification

- How much money will I have for retirement?

- Example: my retirement

- Personal information

- Obviously this isn’t my actual information, but it isn’t too far off!

- Since I am a millennial I don’t think social security will be around when I retire (i.e., assume social security contributes $0 to my retirement)

- As of 1/1/23 I have $100,000 in 401k style retirement in accounts

- All of money is invested into an S&P 500 index fund (VOO to be exact)

- I am 35 as of 1/1/23

- I want to know how much pre-tax money I will have at a given retirement age (e.g., 65, 70, etc)

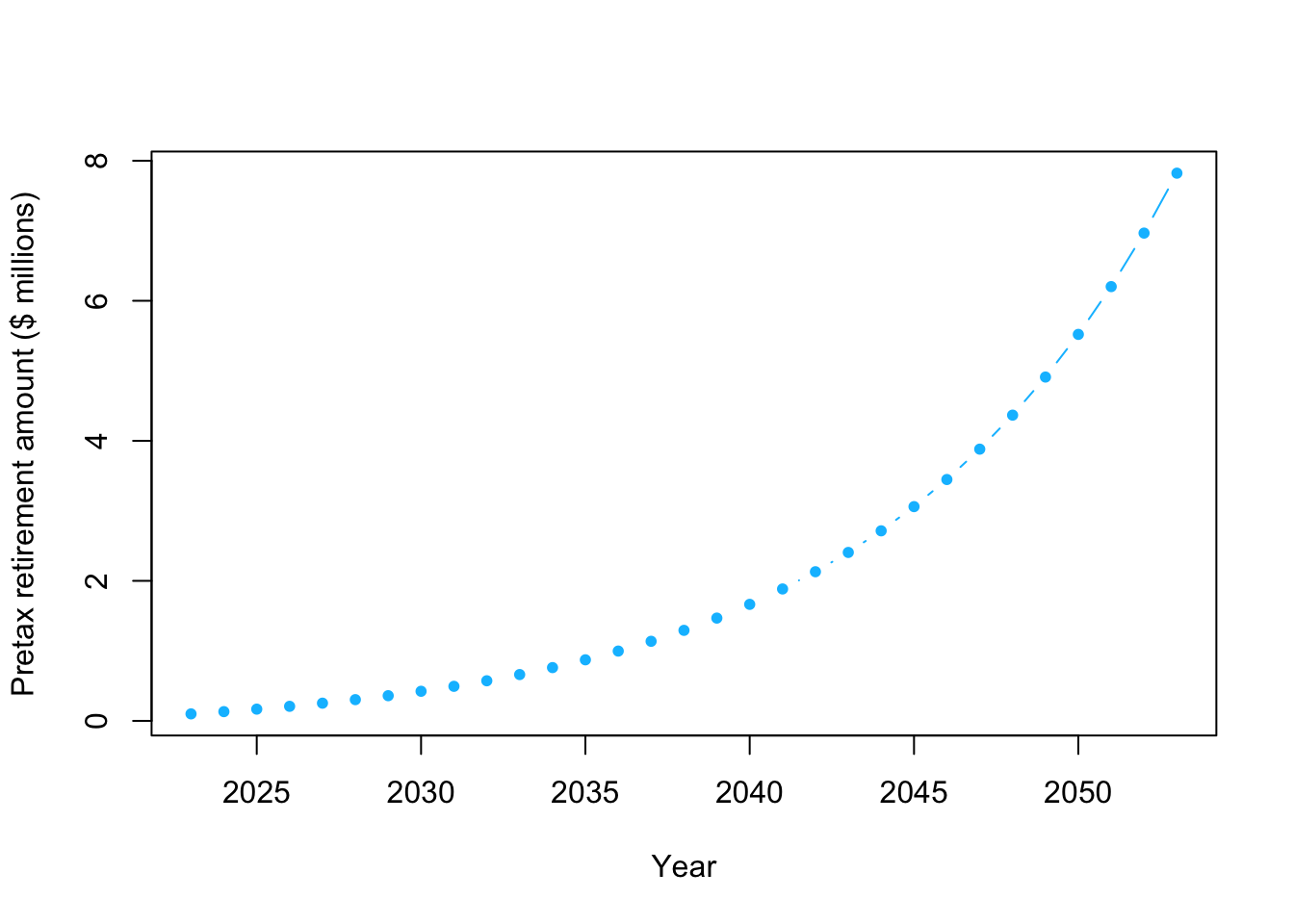

- Example using a mathematical model

- Whiteboard demonstration

- What are the model assumptions?

- In program R

- Personal information

# The value of my 401k retirement account as of 1/1/23

y_2023 <- 100000

# How much money will I add to my 401k each year

q <- 20000

# Rate of return for S&P 500 index fund

r <- 0.12

# How much $ will I have in 2024

y_2024 <- y_2023*(1+r)+q

y_2024## [1] 132000# How much $ will I have in 2025

y_2025 <- y_2024*(1+r)+q

y_2025## [1] 167840# How much $ will I have in 2026

y_2026 <- y_2025*(1+r)+q

y_2026## [1] 207980.8# Using a for loop to calculate how much $ will I have

year <- seq(2023,2023+30,by=1)

y <- matrix(,length(year),1)

rownames(y) <- year

y[1,1] <- 100000

for(t in 1:30){

y[t+1,1] <- y[t,1]*(1+r)+q

}

plot(year,y/10^6,typ="b",pch=20,col="deepskyblue",xlab="Year",ylab="Pretax retirement amount ($ millions)")

# How much $ will I have when I am 65?

# Note that units are millions of $

retirement.year <- 2023+30

y[which(year==retirement.year)]/10^6## [1] 7.822646- Example using a Bayesian statistical model

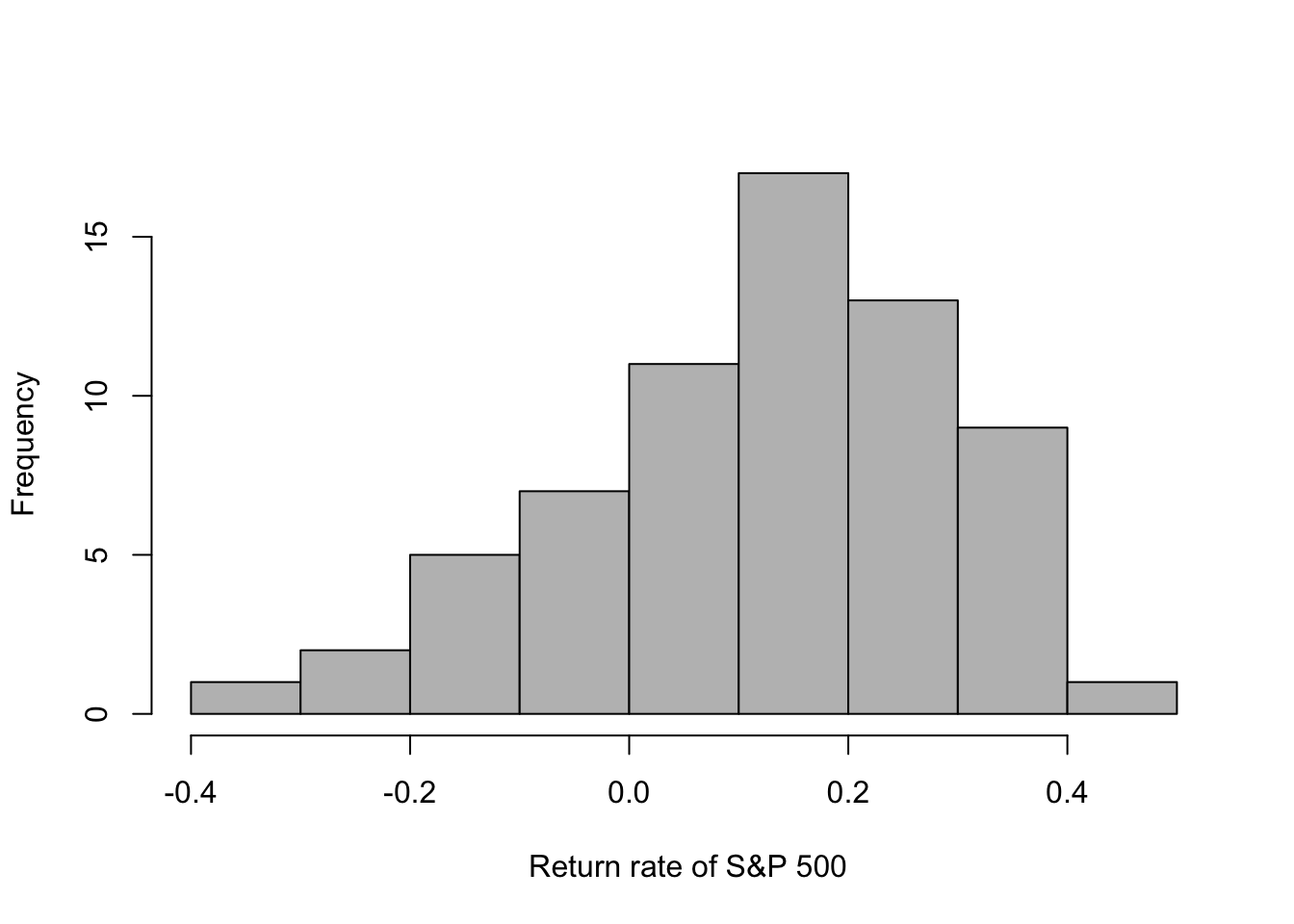

- S&P 500 return since inception in 1957

# Download S&P 500 returns

url <- "https://www.dropbox.com/s/81ccahyuaas1zpd/s%26p500.csv?dl=1"

df.sp500 <- read.csv(url)

head(df.sp500)## year return

## 1 2022 -0.1811

## 2 2021 0.2871

## 3 2020 0.1840

## 4 2019 0.3149

## 5 2018 -0.0438

## 6 2017 0.2183mean(df.sp500$return)## [1] 0.1152742hist(df.sp500$return,main="",col="grey",xlab=" Return rate of S&P 500")  - Example using the prior predictive distribution

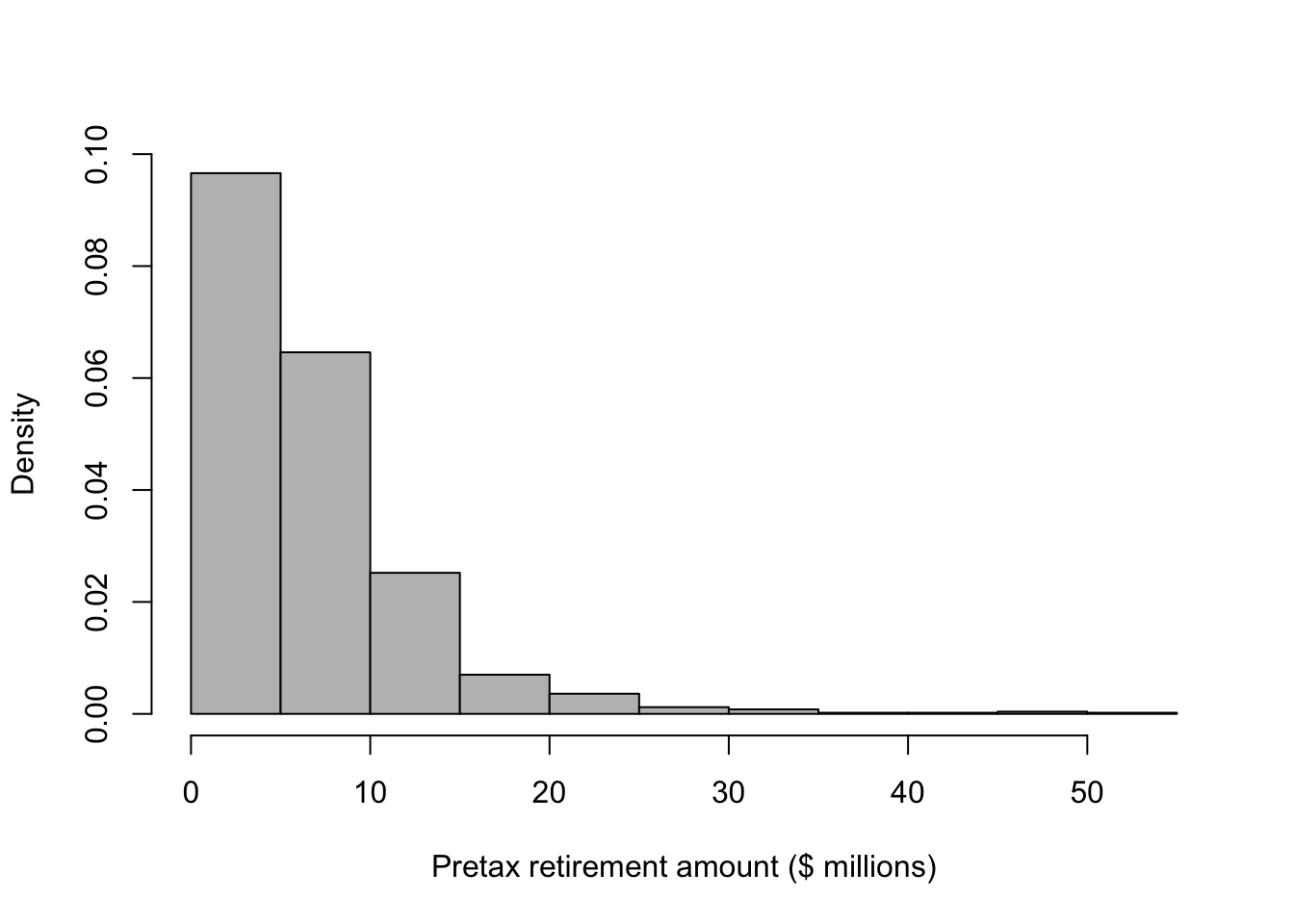

- Example using the prior predictive distribution

# Download S&P 500 returns

url <- "https://www.dropbox.com/s/81ccahyuaas1zpd/s%26p500.csv?dl=1"

df.sp500 <- read.csv(url)

# The value of my 401k retirement account as of 1/1/23

y_2023 <- 100000

# How much money will I add to my 401k each year

q <- 20000

# Using a for loop to calculate how much $ will I have

year <- seq(2023,2023+30,by=1)

Y <- matrix(,length(year),1000)

rownames(Y) <- year

Y[1,] <- y_2023

set.seed(3410)

for(m in 1:1000){

for(t in 1:30){

r <- sample(df.sp500$return,1)

Y[t+1,m] <- Y[t,m]*(1+r)+q

}

}

# Prior predictive distribution for a given year

retirement.year <- 2023+30

hist(Y[which(year==retirement.year),]/10^6,col="grey",freq=FALSE,xlab="Pretax retirement amount ($ millions)",main="")

# Summary of prior predictive distribution

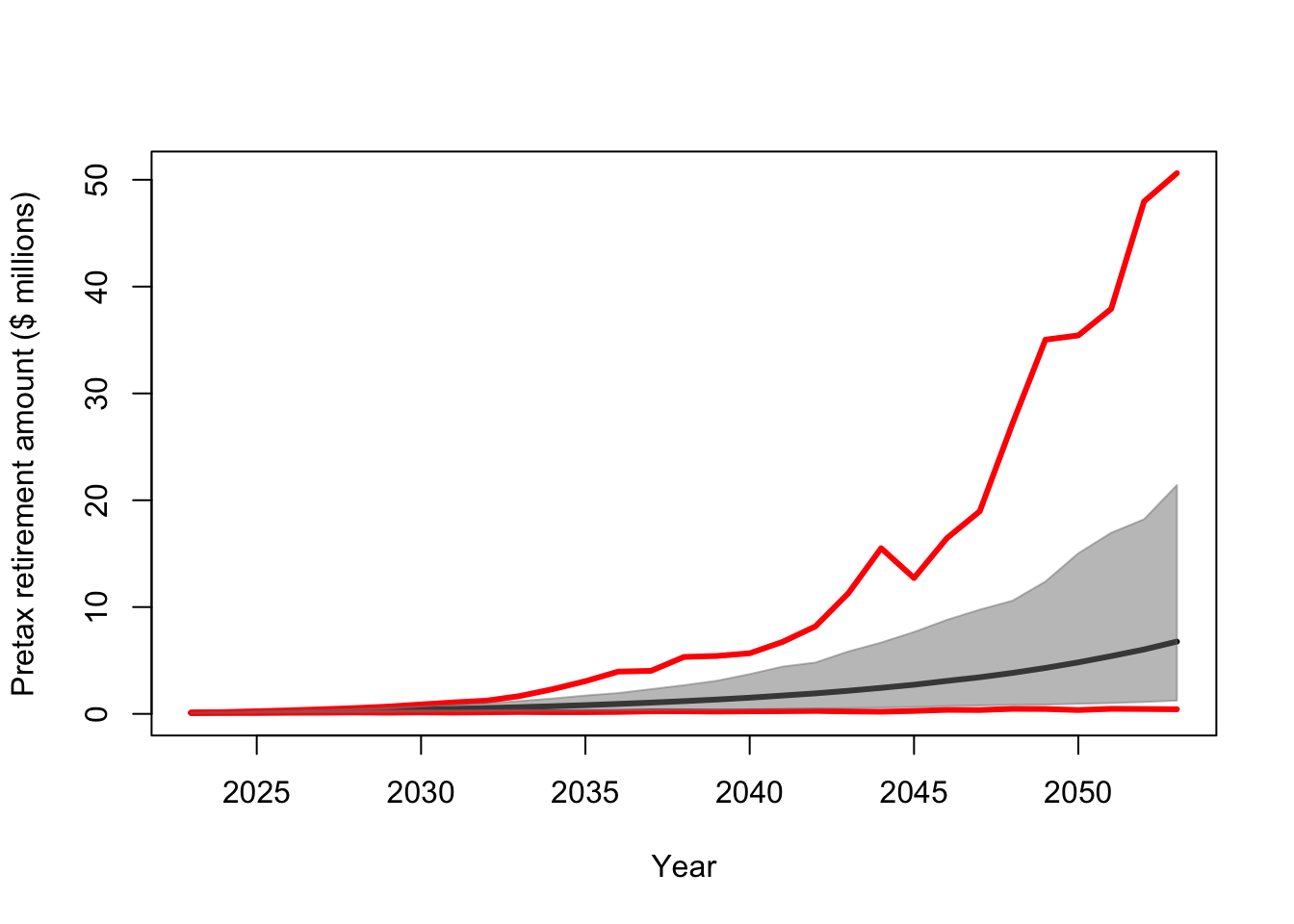

mean(Y[which(year==retirement.year),]/10^6)## [1] 6.767347max(Y[which(year==retirement.year),]/10^6)## [1] 50.62067min(Y[which(year==retirement.year),]/10^6)## [1] 0.4278632quantile(Y[which(year==retirement.year),]/10^6,probs=c(0.025,0.975))## 2.5% 97.5%

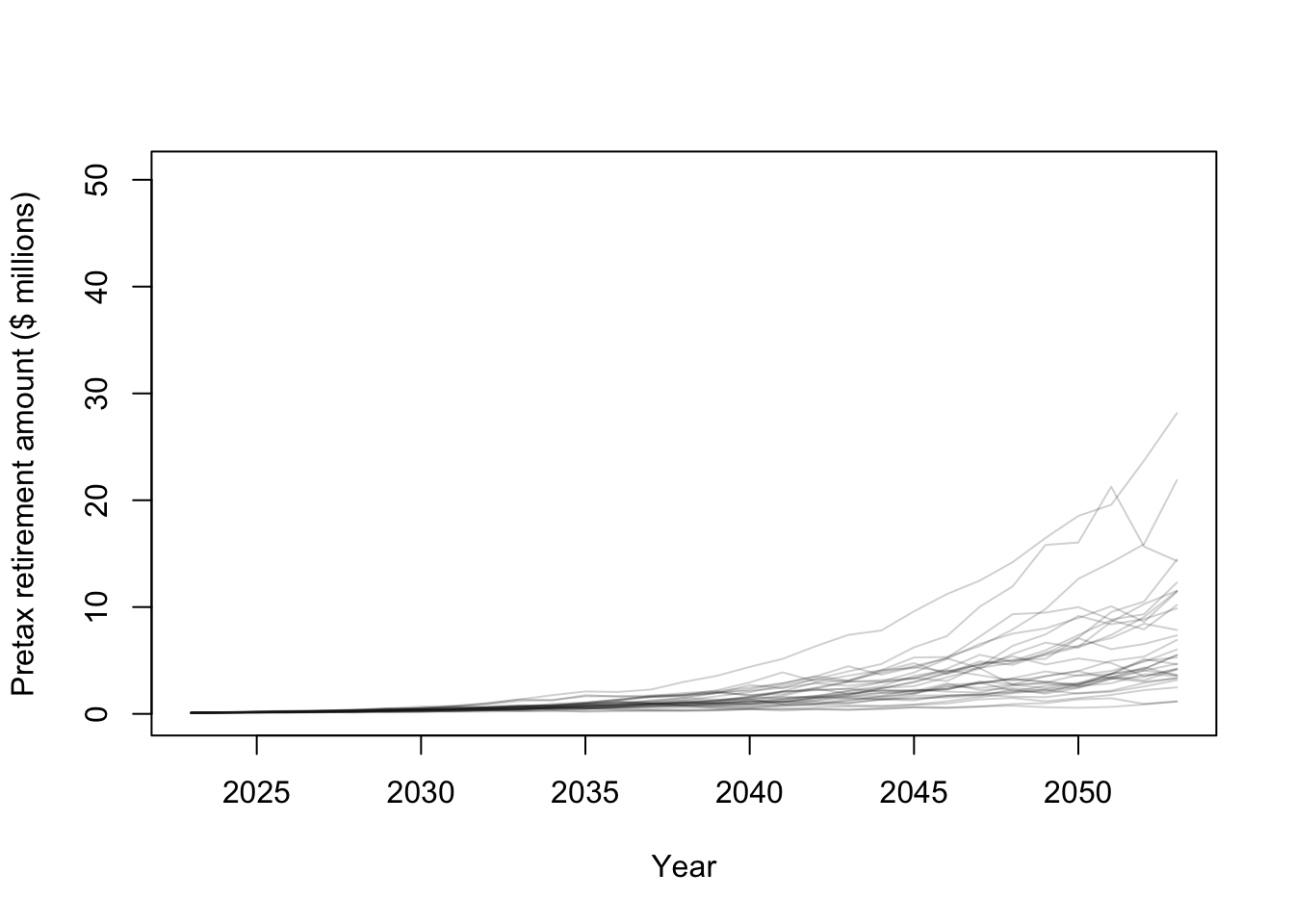

## 1.24744 21.41771# Plot some financial trajectories (i.e., random draws from the prior predictive distribution)

plot(year,Y[,1]/10^6,typ="l",lwd=1,ylim=c(0,max(Y/10^6)),col=rgb(0.1,0.1,0.1,.2),xlab="Year",ylab="Pretax retirement amount ($ millions)")

for(i in 1:30){

points(year,Y[,i]/10^6,typ="l",lwd=1,col=rgb(0.1,0.1,0.1,.2))

}

# Plot of prior predictive distribution for all years

E.Y <- apply(Y/10^6,1,mean)

u.CI <- apply(Y/10^6,1,quantile,prob=0.975)

l.CI <- apply(Y/10^6,1,quantile,prob=0.025)

max.Y <- apply(Y/10^6,1,max)

min.Y <- apply(Y/10^6,1,min)

plot(year,E.Y,typ="l",lwd=3,ylim=c(0,max(max.Y)),xlab="Year",ylab="Pretax retirement amount ($ millions)")

points(year,max.Y,typ="l",lwd=3,col="red")

points(year,min.Y,typ="l",lwd=3,col="red")

polygon(c(year,rev(year)),c(u.CI,rev(l.CI)),

col=rgb(0.5,0.5,0.5,0.5),border=rgb(0.5,0.5,0.5,0.5))

- Further reading/learning