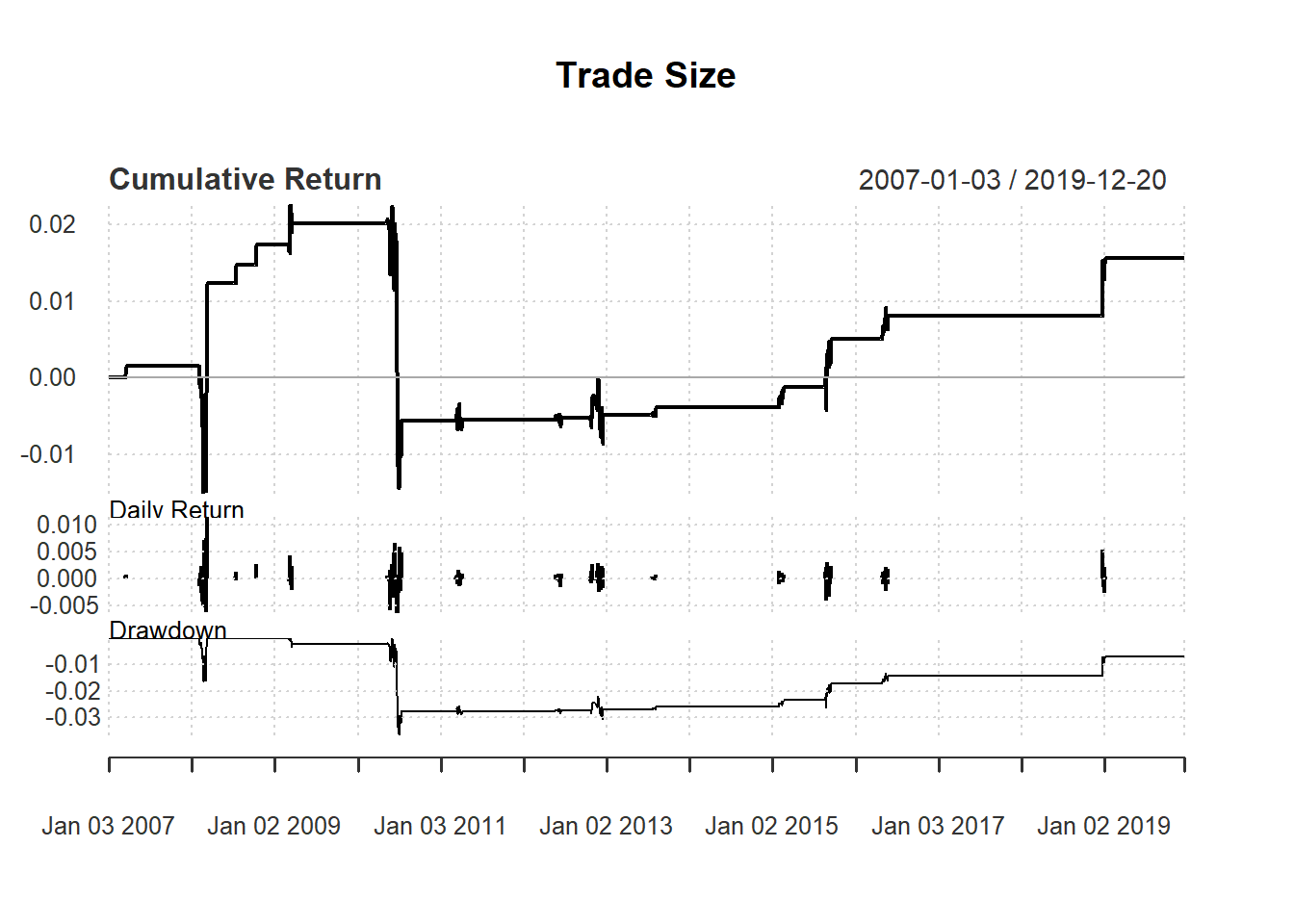

7.8 Trading Size

Wealth: 1 million

Trade unit: 1000 stocks per trade

Test the following strategy based on 14-day RSI :

Buy one more unit if RSI <30.

Keep buying the same if 30 < RSI < 50

Stop trading if RSI >= 50

Evaluate based on day trading

We will use closing price of MSFT to construct our technical indicator:

price <- Cl(MSFT)First, we generate the techncial indicator:

day <-14

rsi <- RSI(price, day)Second, we generate trading signal together with size:

signal <- c()

signal[1:(day+1)] <- 0

for (i in (day+1): length(price)){

if (rsi[i] < 30){ #buy one more unit

signal[i] <- signal[i-1]+1

} else if (rsi[i] < 50){ #no change

signal[i] <- signal[i-1]

} else { #sell all

signal[i] <- 0

}

}

signal<-reclass(signal,price)To take trade size into account, we need to keep track of wealth:

qty <-1000 #trading size

wealth <-c()

wealth[1:(day+1)] <- 1000000

profit <-c()

profit[1:(day+1)] <- 0

return<-c()

return[1:(day+1)] <- 0Here, wealth is the market value of the portfolio, profit is the absolute amount of profit each day, and return is the daily percentage profit.

Now we are ready to apply Trade Rule

Close <- Cl(MSFT)

Open <- Op(MSFT)

trade <- Lag(signal)

for (i in (day+1):length(price)){

profit[i] <- qty * trade[i] * (Close[i] - Open[i])

wealth[i] <- wealth[i-1] + profit[i]

return[i] <- (wealth[i] / wealth[i-1]) -1

}

ret<-reclass(return,price)Now we are ready to visualize the trading outcome.

charts.PerformanceSummary(ret, main="Trade Size")