10.6 Simulation

We will consider two different simulations:

- random walk model, and

- Roll model of security price.

10.6.1 Random Walk

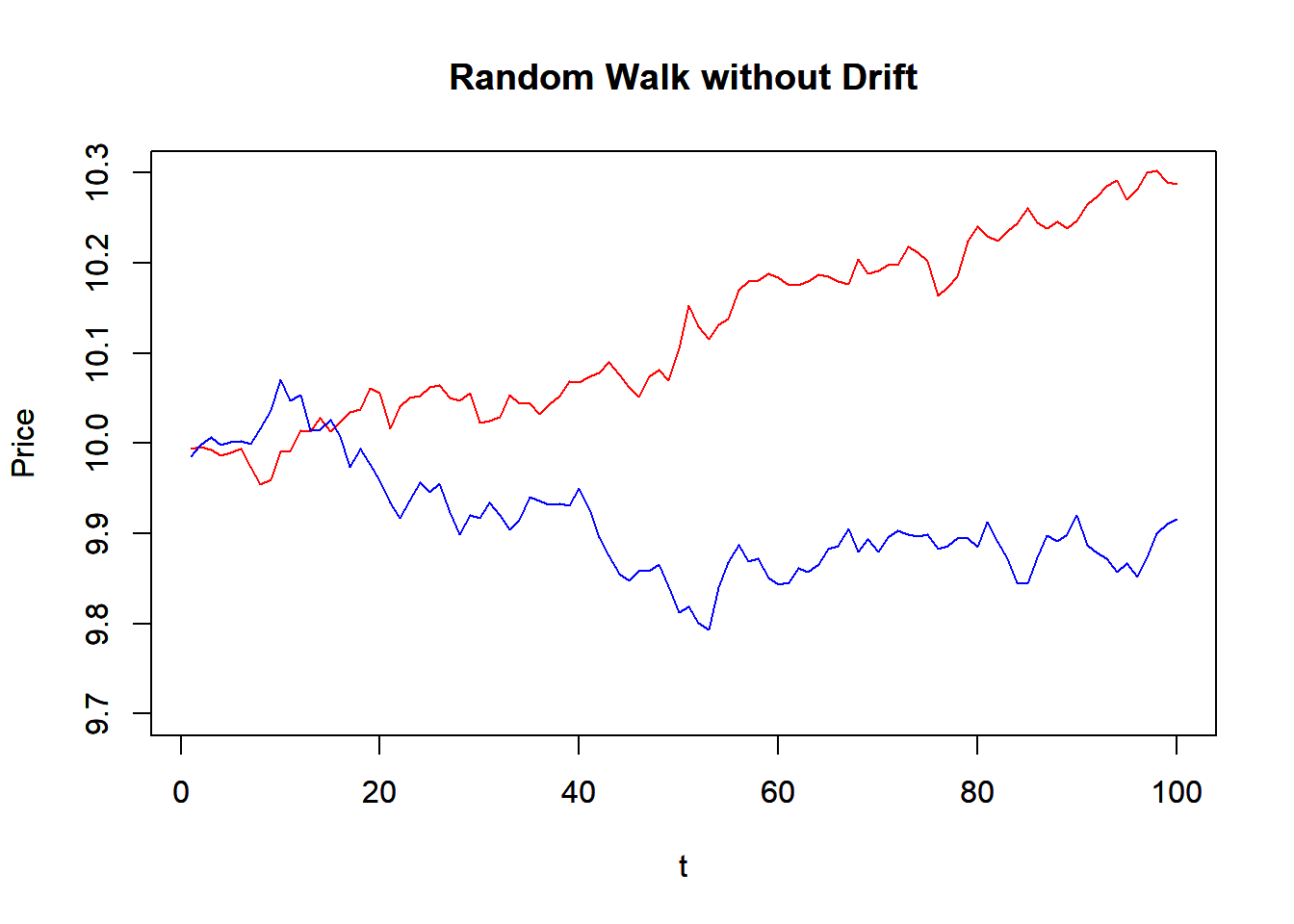

We first construct a random walk function that simulates random walk model. It takes the number of period (N), initial value (x0), drift (mu), and variance. The function use rnorm() to generate random normal variable, and then use cumsum() to get the random walk. Note that the whole function is based on vector operation, instead of looping over time.

\[ X_t = x_0 + t \mu + z_t \] where \(\mu\) is the drift and \(z_t\) are i.i.d standardized normal random variables.

Here is a function that generate a time series of random walk.

RW <- function(N, x0, mu, variance) {

z<-cumsum(rnorm(n=N, mean=0,

sd=sqrt(variance)))

t<-1:N

x<-x0+t*mu+z

return(x)

}Now we can plot two random walk time series.

P1<-RW(100,10,0,0.0004)

P2<-RW(100,10,0,0.0004)

plot(P1, main="Random Walk without Drift",

xlab="t",ylab="Price", ylim=c(9.7,10.3),

typ='l', col="red")

par(new=T) #to draw in the same plot

plot(P2, main="Random Walk without Drift",

xlab="t",ylab="Price", ylim=c(9.7,10.3),

typ='l', col="blue")

par(new=F)10.6.2 Roll Model

To simulate the Roll model, we first simulate the price series and simulated trade prices. We calculate the first difference of the price and then we can estimate the first and the second orders of autocovariances. Then we can compare the true trading cost with the estimate one.

require(zoo)

trial <-1000 #Number of trial

cost <-c() #cost each trial

sd <-c() #sd each trial

true.cost = 2

true.sd = 1

time = 1:trial

for (i in 1:trial) {

#Simulated Price Series

epsilon = rnorm(time,sd=true.sd)

prices = cumsum(epsilon)

m_t = zoo(prices)

a_t = m_t + true.cost

b_t = m_t - true.cost

#simulated trade prices

q_t = sign(rnorm(time))

p_t = m_t + (true.cost * q_t)

#1st difference of prices

delta_p <- p_t-lag(p_t)

#omit n.a. entry

delta_p <- na.omit(delta_p)

gamma_0 <- var(delta_p)

gamma_1 <- cov(delta_p[1:length(delta_p)-1],

delta_p[2:length(delta_p)])

sigma_2 <- gamma_0 + 2 * gamma_1

if(gamma_1 > 0){

print("Error: Positive Autocovariance!")

} else {

cost <- append(cost,sqrt(-1*gamma_1))

sd <-append(sd,sigma_2)

}

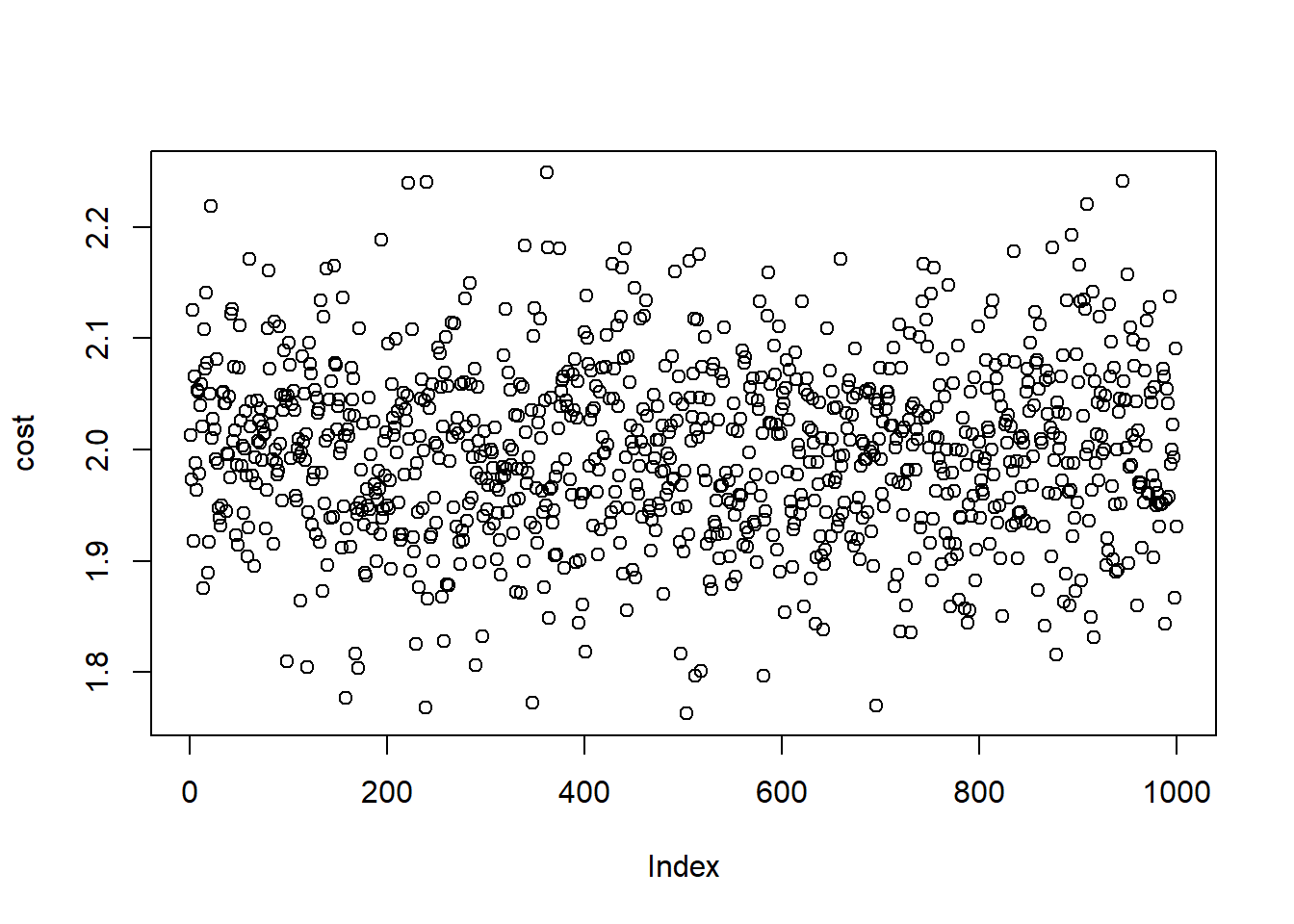

}Here is the plot for the stimulated trading cost:

plot(cost)

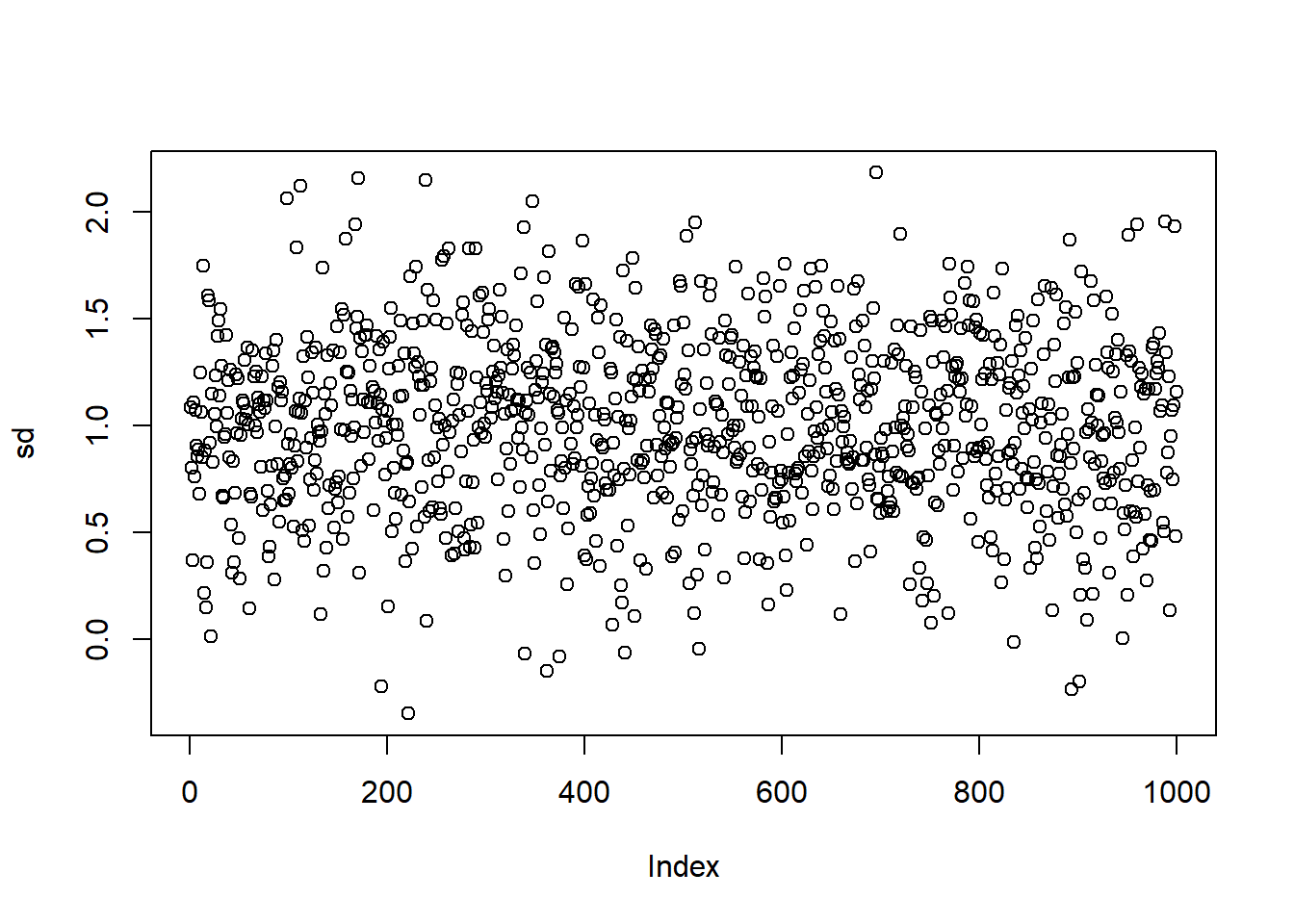

Here is the plot for the stimulated standard deviation:

plot(sd)

Comparison of the true and the stimulated costs and standard deviation:

est.cost <- mean(cost)

est.sd <- mean(sd)

cat("True cost and sd are", true.cost," and ", true.sd)## True cost and sd are 2 and 1cat("Estimated cost and sd are", est.cost," and ", est.sd)## Estimated cost and sd are 1.998507 and 1.00303