8.1 Interday Trading

Trading signal:

Buy signal arises if 14-day RSI < 30

Sell signal arises if 14-day RSI > 50

Trading Rule:

Buy 300 units under buy signal

Sell all when sell signal appears

Initial wealth: 10,000

Note that we need to keep track of both cash and stock holdings.

qty <-300

day <-14

signal <- c() #trade signal

signal[1:(day+1)] <- 0

price <- Cl(MSFT)

stock <- c() #stock holding

stock[1:(day+1)] <-0

cash <-c()

cash[1:(day+1)] <- 10000 Trading signal is based on simple RSI:

rsi <- RSI(price, day) #rsi is the lag of RSI

for (i in (day+1): length(price)){

if (rsi[i] < 30){ #buy one more unit if rsi < 30

signal[i] <- 1

} else if (rsi[i] < 50){ #no change if rsi < 50

signal[i] <- 0

} else { #sell if rsi > 50

signal[i] <- -1

}

}

signal<-reclass(signal,price)Assume buying at closing price. We keep track of how cash and stock changes:

trade <- Lag(signal) #rsi is the lag of RSI

for (i in (day+1): length(price)){

if (trade[i]>=0){

stock[i] <- stock[i-1] + qty*trade[i]

cash[i] <- cash[i-1] -

qty*trade[i]*price[i]

} else{

stock[i] <- 0

cash[i] <- cash[i-1] +

stock[i-1]*price[i]

}

}

stock<-reclass(stock,price)

cash<-reclass(cash,price)To evaluate performance, we calculate equity using cash and stock holdings.

equity <-c()

equity[1:(day+1)] <- 10000

return<-c()

return[1:(day+1)] <- 0

for (i in (day+1): length(price)){

equity[i] <- stock[i] * price[i] + cash[i]

return[i] <- equity[i]/equity[i-1]-1

}

equity<-reclass(equity,price)

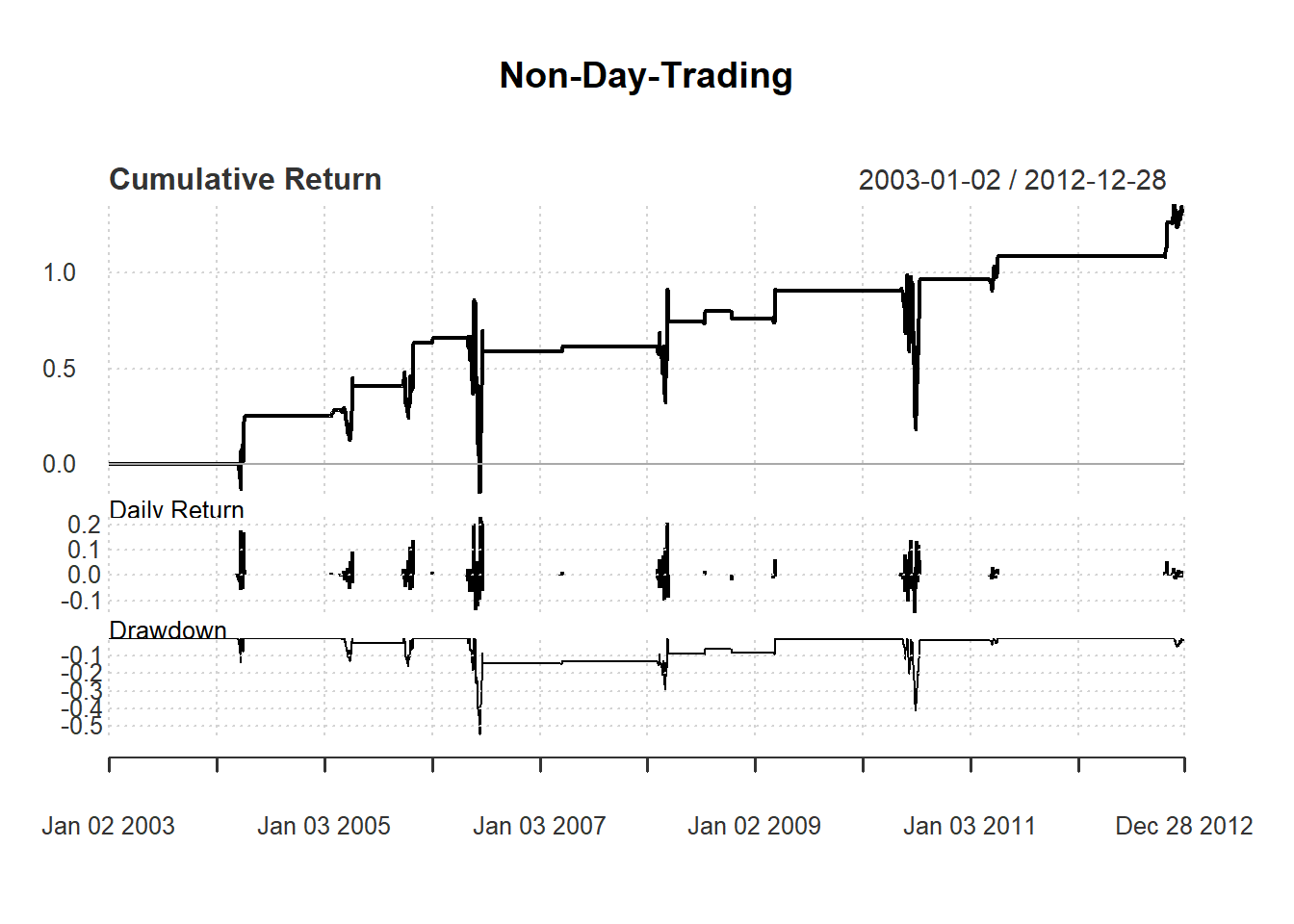

return<-reclass(return,price)Performance Charts

charts.PerformanceSummary(return,

main="Non-Day-Trading")

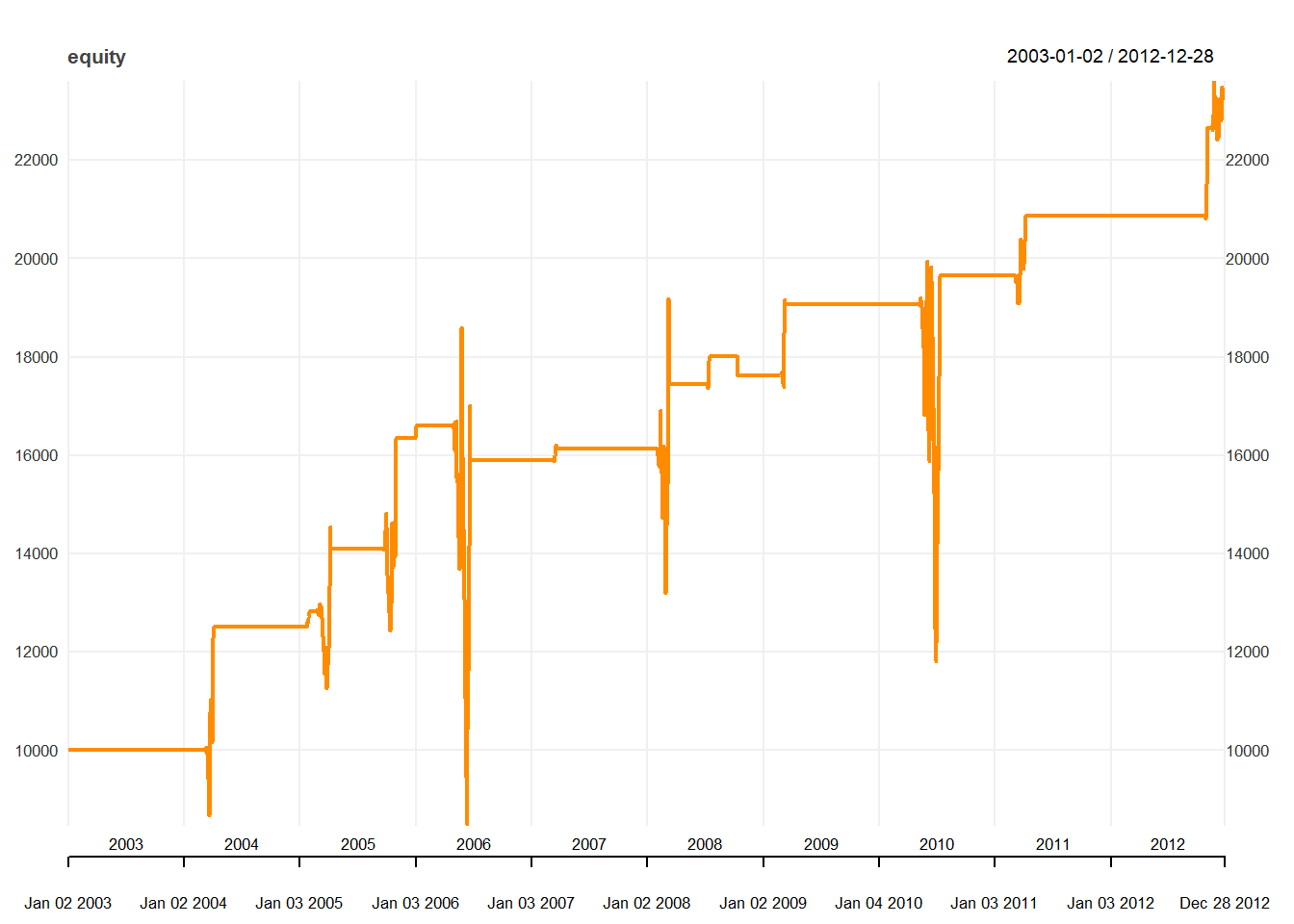

We can plot the equity line showing how the performance of the strategy:

chart_Series(equity, main="equity line")

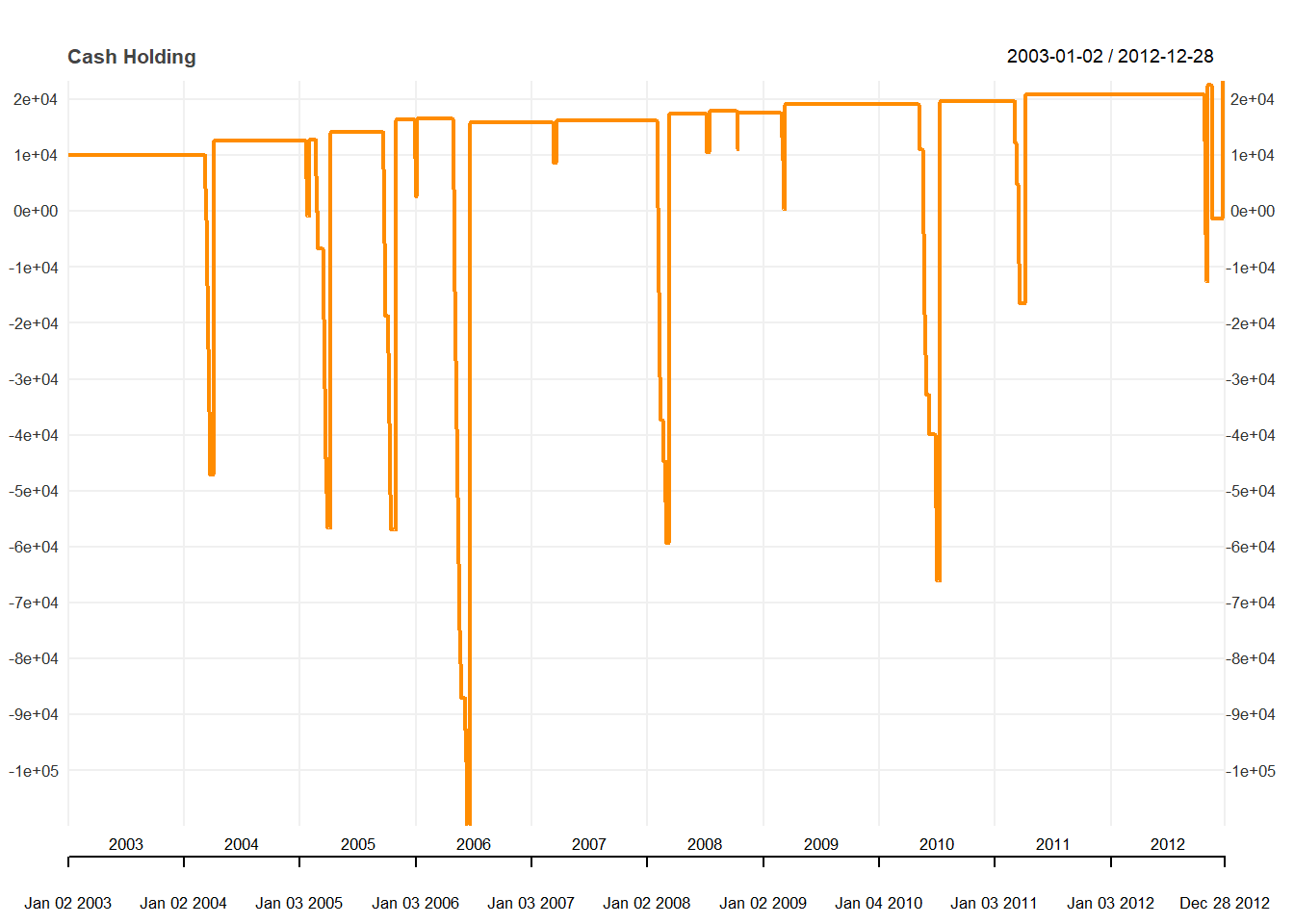

We can check the cash account over time:

chart_Series(cash, name="Cash Holding")

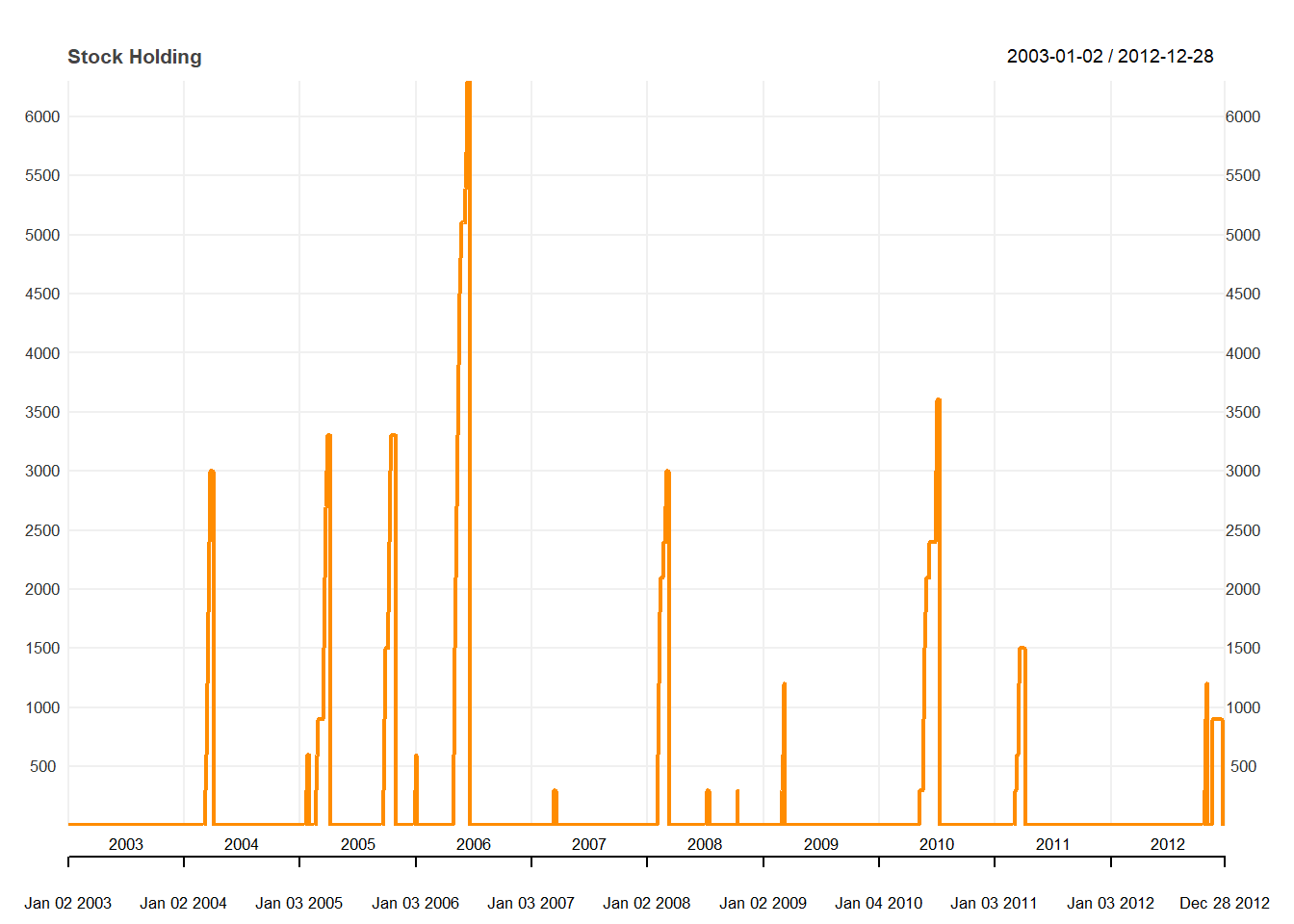

Finall, We can stock holdings:

chart_Series(stock, name="Stock Holding")