6.12 Three Methods

Three methods are 5-day patterns. There are relatively rare but it can be informative if found.

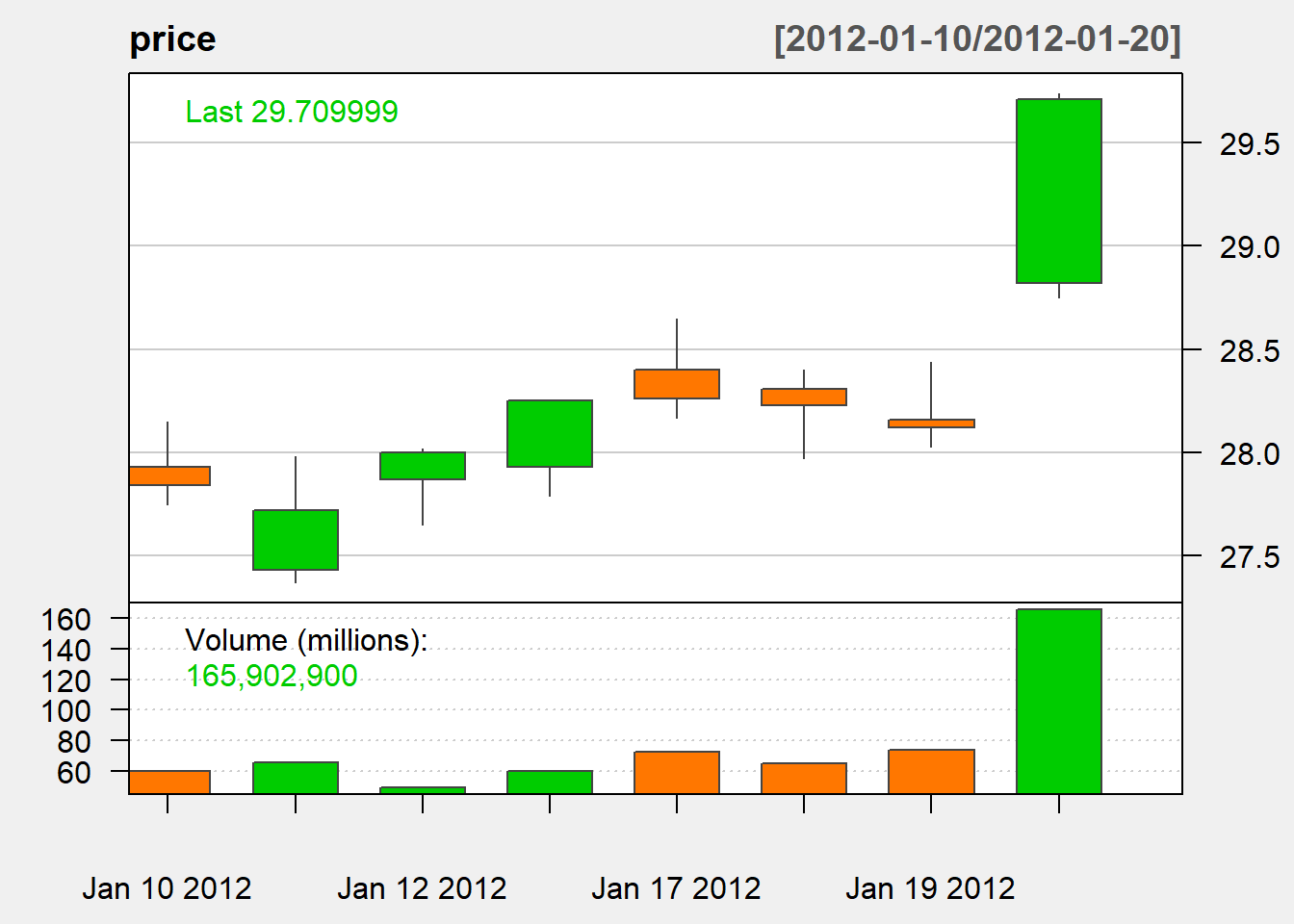

6.12.1 Rising Three

Bullish signal:

- Large bullish candle on day 1

- (small) bearish candles for next 3 days

- Large bullish candle on day 5

- Day 1 low is lowest

- Day 5 high is highest

Here is an exmample:

price <- MSFT['2012-01-10/2012-01-22']

candleChart(price, theme='white')

6.12.2 Falling three

Bearish signal:

- Large bearish candle on day 1

- (small) bullish candles for next 3 days

- Large bearish candle on day 5

- Day 1 high is the highest

- Day 5 low is the lowest