6.9 Two in a row

Two in a row patterns are 2-day patterns. It is completely opposite of engulfing or harami patterns. The real bodies of two day candles are completely disjoint.

6.9.1 Kicking up

Bullish signal:

- bearish candle on day 1

- bullish candle on day 2

- gap up between day 1 and day 2

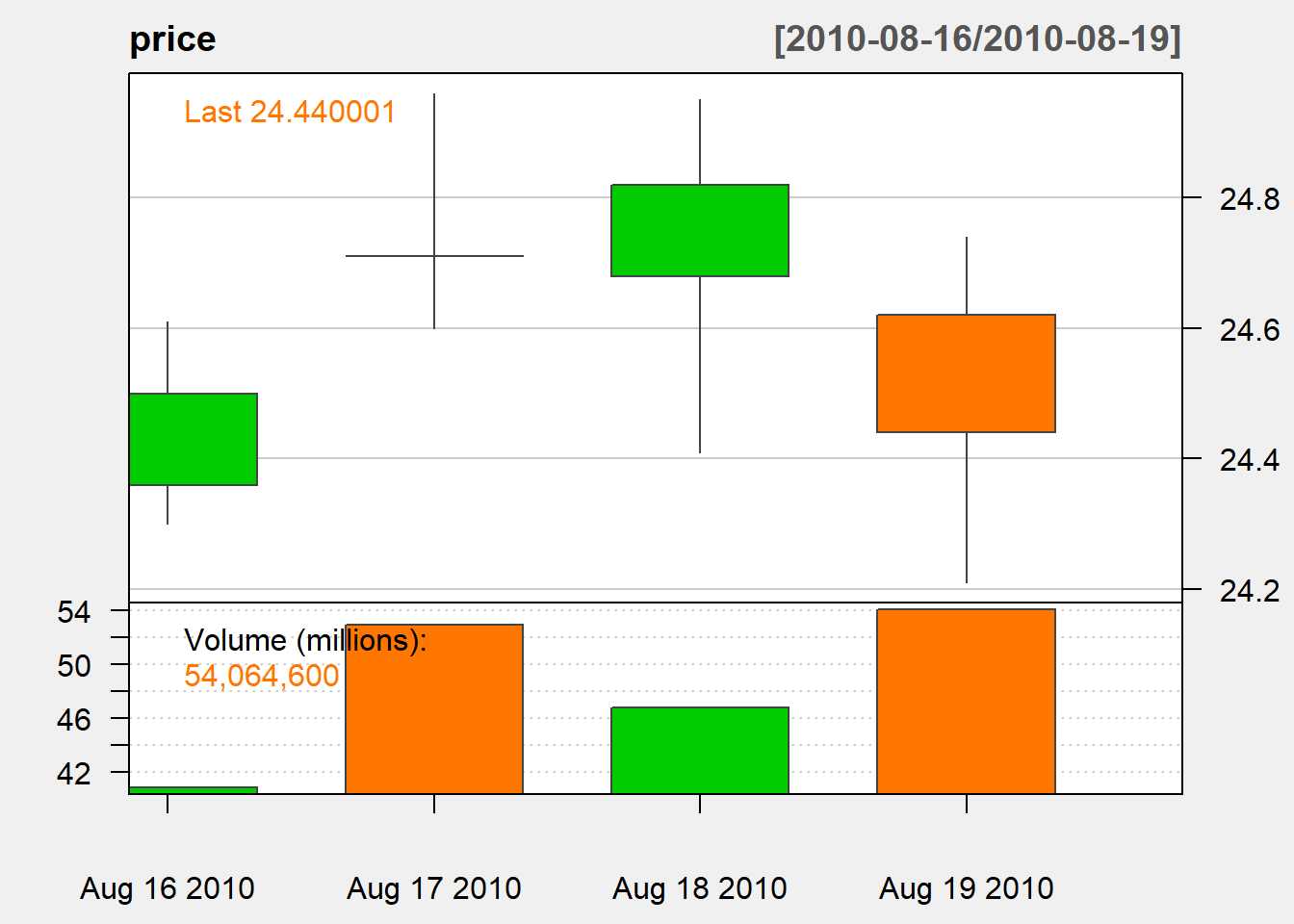

Here is an exmample:

We can identify the pattern through the following code:

kick.up <-c(NA)

for (i in 2:length(Cl(MSFT))){

if (D[i-1]>0 &&

U[i]>0 &&

OP[i]>=CL[i-1]){

kick.up [i] <- 1

} else{

kick.up[i] <- 0

}

}

kick.up <- reclass(kick.up,Cl(MSFT))Let us check if our code does the job:

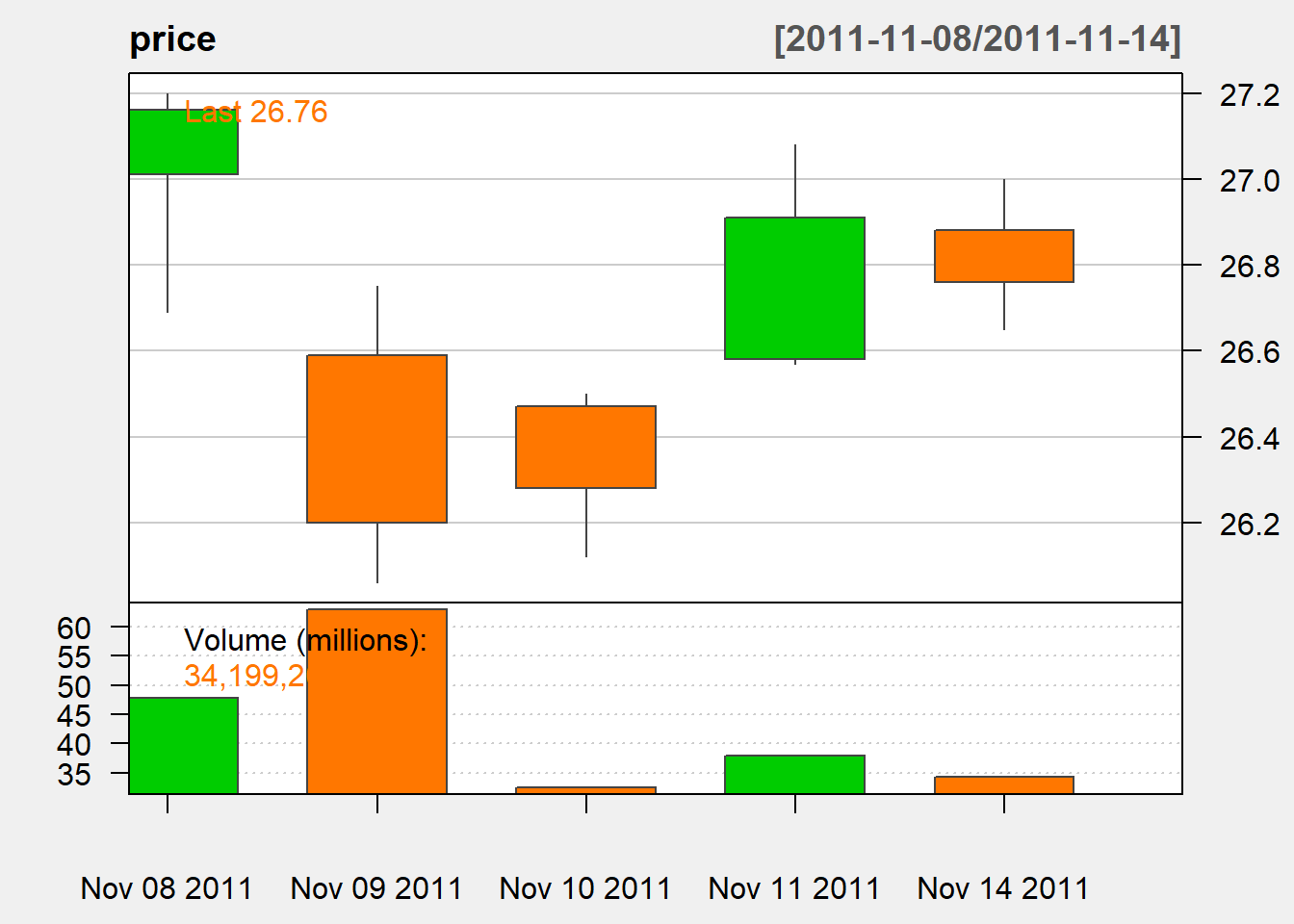

## [,1]

## 2011-11-08 0

## 2011-11-09 0

## 2011-11-10 0

## 2011-11-11 1

## 2011-11-14 0