5.11 TTR

In the TTR package, we can use RSI() function:

## rsi

## 2012-12-26 38.85768

## 2012-12-27 35.28442

## 2012-12-28 38.26621Note that the third input is a function. You may use SMA or EMA.

Further notice that this is different from what we have above. It is because their upward and downward indicators use numerical values instead:

\[U_{t}=\left\{ \begin{array}{cl} P_t-P_{t-1}, & P_t>P_{t-1} \\ 0, & P_t \leq P_{t-1} \end{array} \right. \] and \[ D_{t}=\left\{ \begin{array}{cl} 0, & P_t\geq P_{t-1} \\ P_{t-1}-P_{t}, & P_t < P_{t-1} \end{array} \right. \]

Hence, we need to modify our code:

myRSI <- function (price,n){

N <- length(price)

U <- rep(0,N)

D <- rep(0,N)

rsi <- rep(NA,N)

Lprice <- Lag(price,1)

for (i in 2:N){

if (price[i]>=Lprice[i]){

U[i] <- price[i]- Lprice[i]

} else{

D[i] <- Lprice[i]- price[i]

}

if (i>n){

AvgUp <- mean(U[(i-n+1):i])

AvgDn <- mean(D[(i-n+1):i])

rsi[i] <- AvgUp/(AvgUp+AvgDn)*100

}

}

rsi <- reclass(rsi, price)

return(rsi)

}Now we can see that we have the same result:

## [,1]

## 2012-12-26 38.85768

## 2012-12-27 35.28442

## 2012-12-28 38.266215.11.1 Trading signal

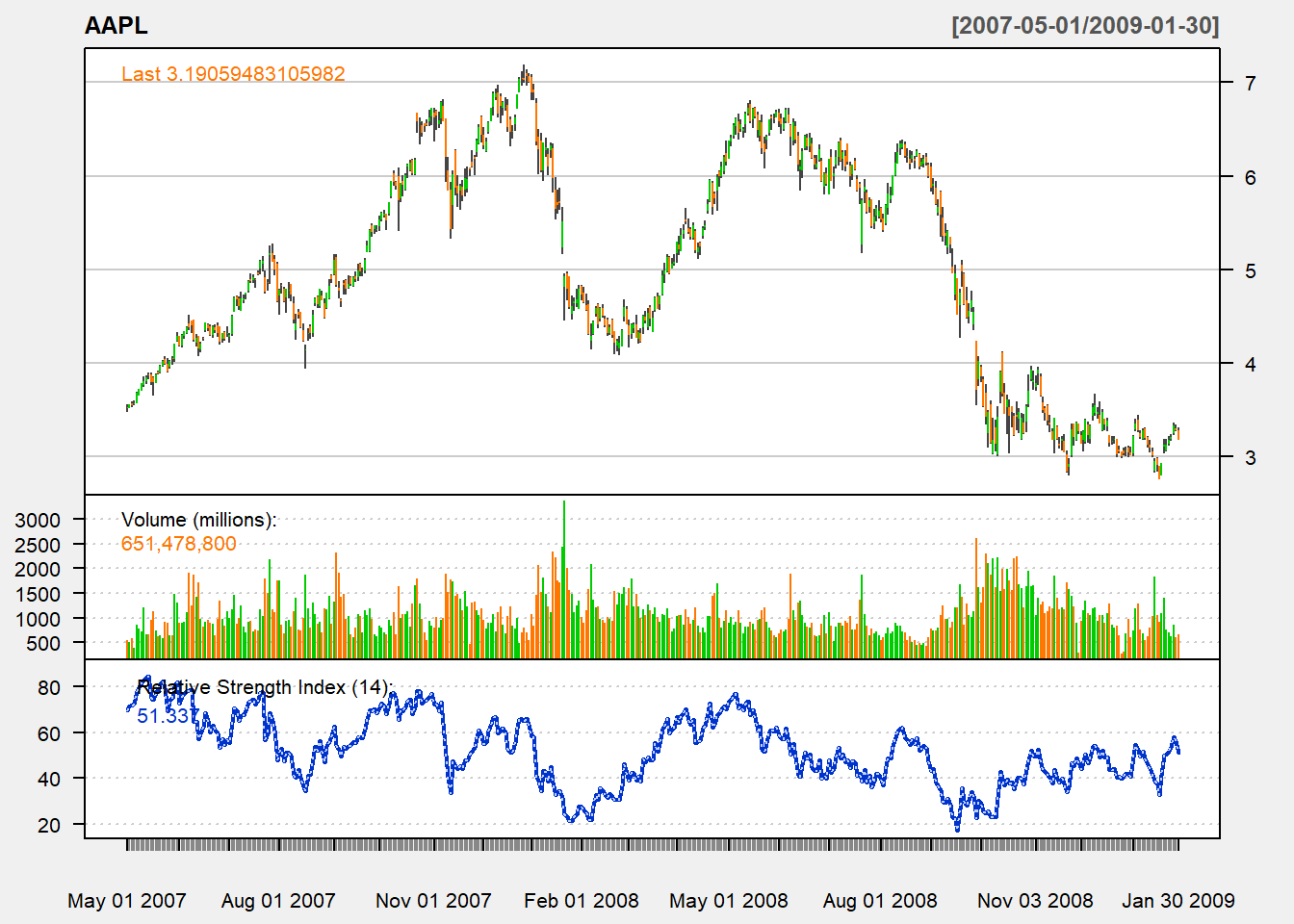

Buy signal arises when RSI is less than 30.

Sell signal arrises when RSI is higher than 30.