6.7 Harami

Harami is a Japanese word Pregnant. It is 2-day pattern that is mirror of engulfing pattern. The real body of day 2 candle is completely contained in that of day 1. Simiarly, there are two types of harami depends on price movement:

- Bullish harami

- Bearish harami

6.7.1 Bullish Harami

Bullish signal as bullish force fights back:

- Large Bearish Candle on Day 1

- Small Bullish Candle on Day 2

- Real body of Day 2 Candle within that of Day 1.

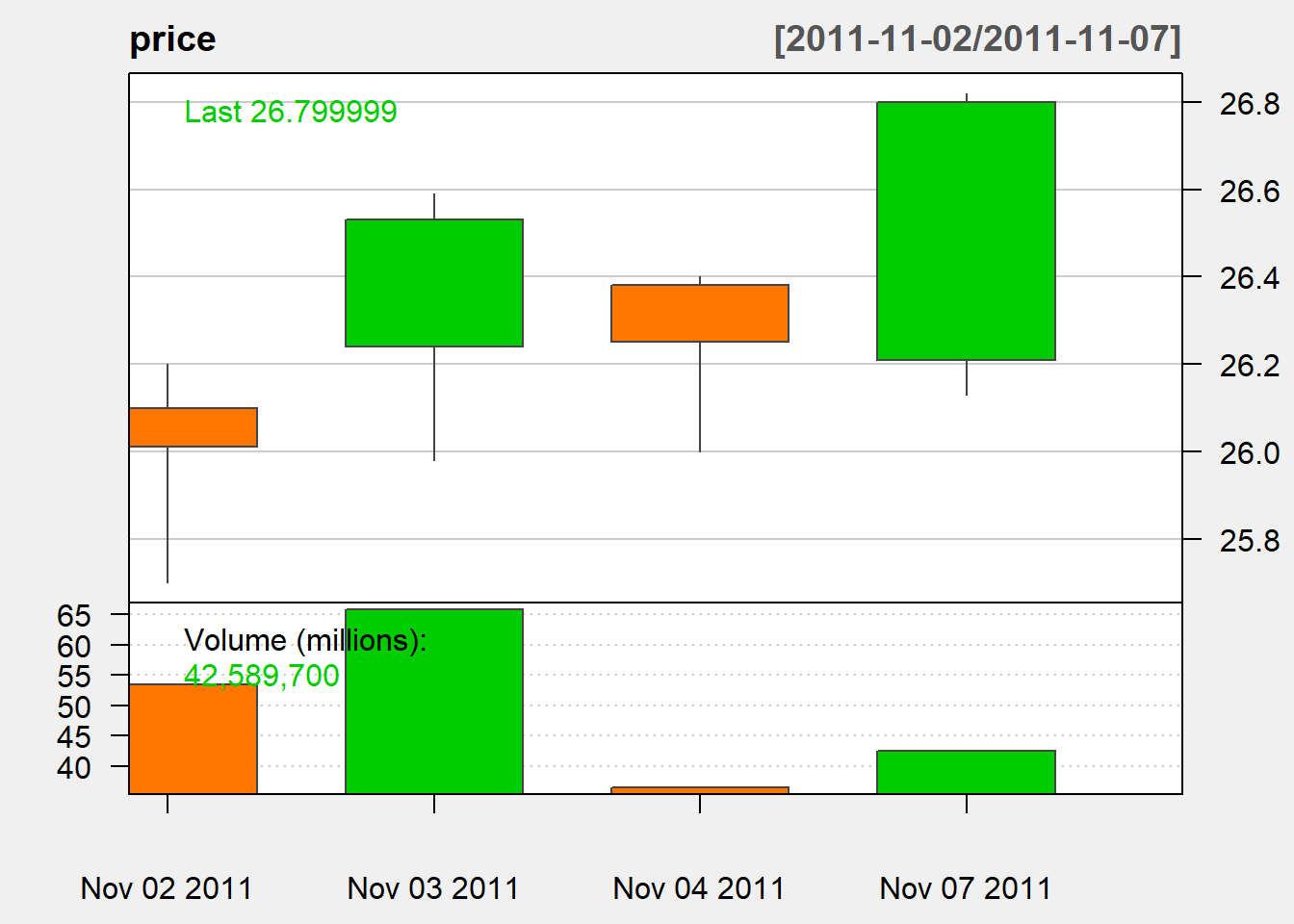

Here is an exmample:

We can identify the pattern through the following code:

harami <-c(0)

for (i in 2:N){

if (D[i-1]>0 &&

U[i]>0 &&

OP[i]>=CL[i-1] &&

CL[i]<=OP[i-1]){

harami[i] <- 1

} else{

harami[i] <- 0

}

}

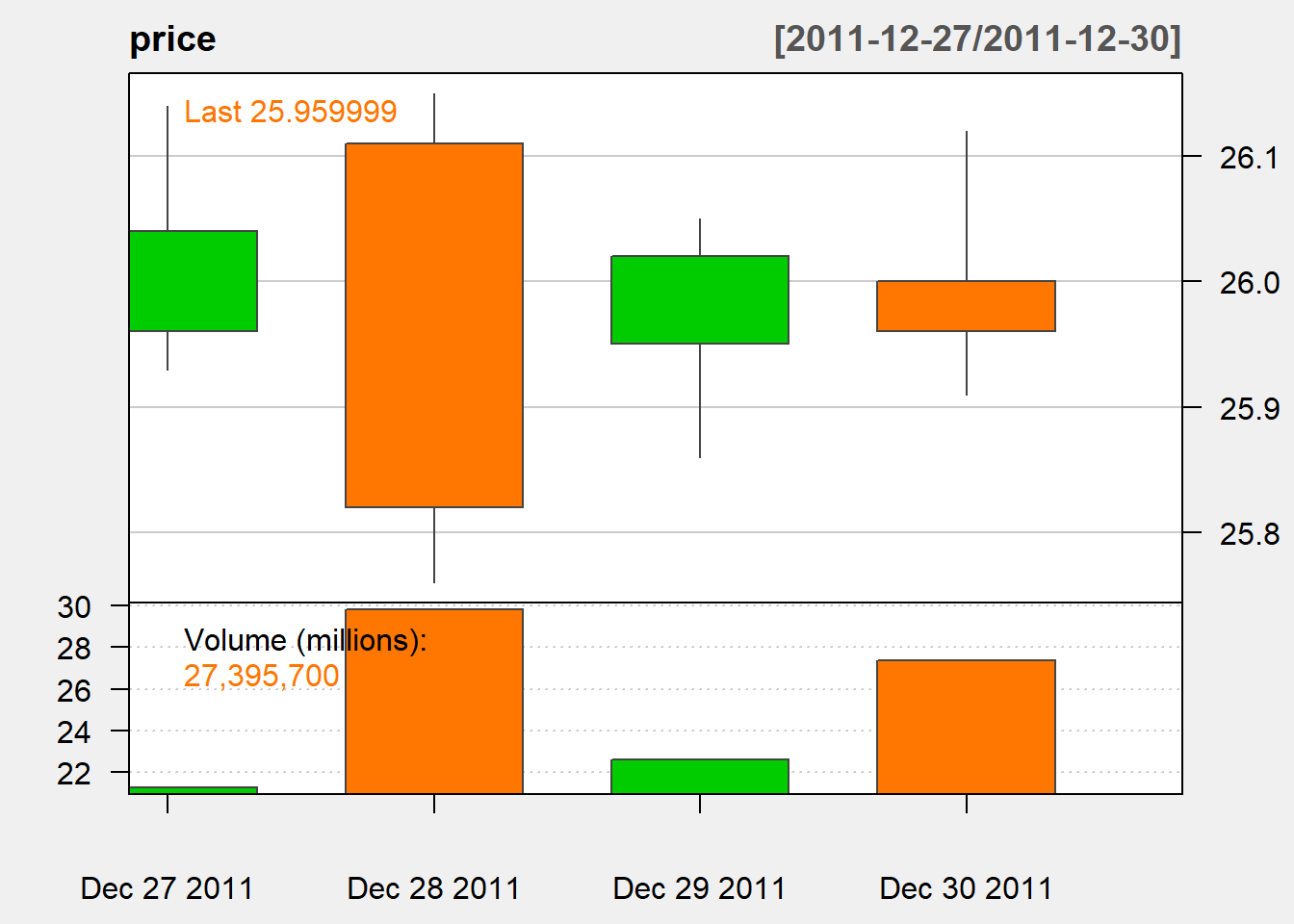

harami <- reclass(harami,Cl(MSFT))Let us check if our code does the job:

## [,1]

## 2011-12-27 0

## 2011-12-28 0

## 2011-12-29 1

## 2011-12-30 0