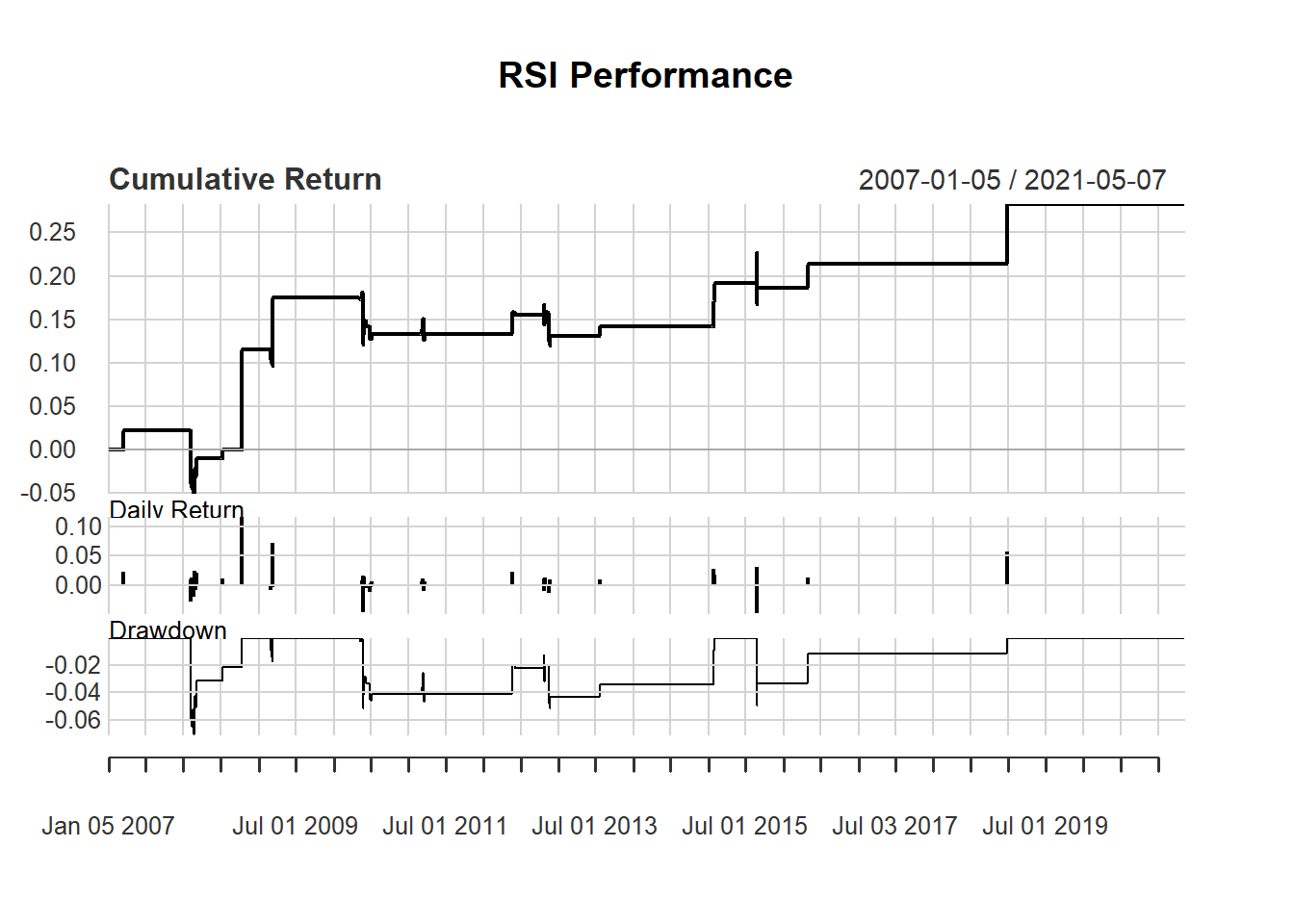

7.4 Buy rule based on RSI

Consider following day-trading strategy based on 14-day RSI:

- buy one unit if RSI <30 and

- otherwise no trade.

Evaluate this based on day trading:

day <-14

price <- Cl(MSFT)

returnMSFT <- (Cl(MSFT) - Op(MSFT))/Op(MSFT)

signal <- c() #initialize vector

rsi <- RSI(price, day) #rsi is the lag of RSI

signal [1:day+1] <- 0 #0 because no signal until day+1

for (i in (day+1): length(price)){

if (rsi[i] < 30){ #buy if rsi < 30

signal[i] <- 1

}else { #no trade all if rsi > 30

signal[i] <- 0

}

}

signal<-reclass(signal,Cl(MSFT))To keep thing simple, we allow costless short selling. Otherwise, we only allow a sell after a buy.