5.3 Exponential moving average (EMA)

EMA with \(n\) lagged period at time \(t\): \[\begin{align*} &ema_t(P,n)\\ &= \beta P_t + \beta (1-\beta)P_{t-1}+\beta(1-\beta )^{2}P_{t-2}+ \cdots\\ &=\beta P_t + (1-\beta) ema_{t-1}(P,n) \end{align*}\]

where the smoothing coefficient \(\beta\) is usually\[\beta=\frac{2}{n+1}\]

myEMA <- function (price,n){

ema <- c()

ema[1:(n-1)] <- NA

ema[n]<- mean(price[1:n])

beta <- 2/(n+1)

for (i in (n+1):length(price)){

ema[i]<-beta * price[i] +

(1-beta) * ema[i-1]

}

ema <- reclass(ema,price)

return(ema)

}Let us apply our function:

## [,1]

## 2012-12-26 19.16076

## 2012-12-27 19.08783

## 2012-12-28 19.00324In the application, the first EMA will be given by SMA, and subsequent EMAs is calcualted by the update formula.

5.3.1 TTR

In the TTR package, we can use EMA():

## EMA

## 2012-12-26 19.16076

## 2012-12-27 19.08783

## 2012-12-28 19.00324We can see that our code gives the same result.

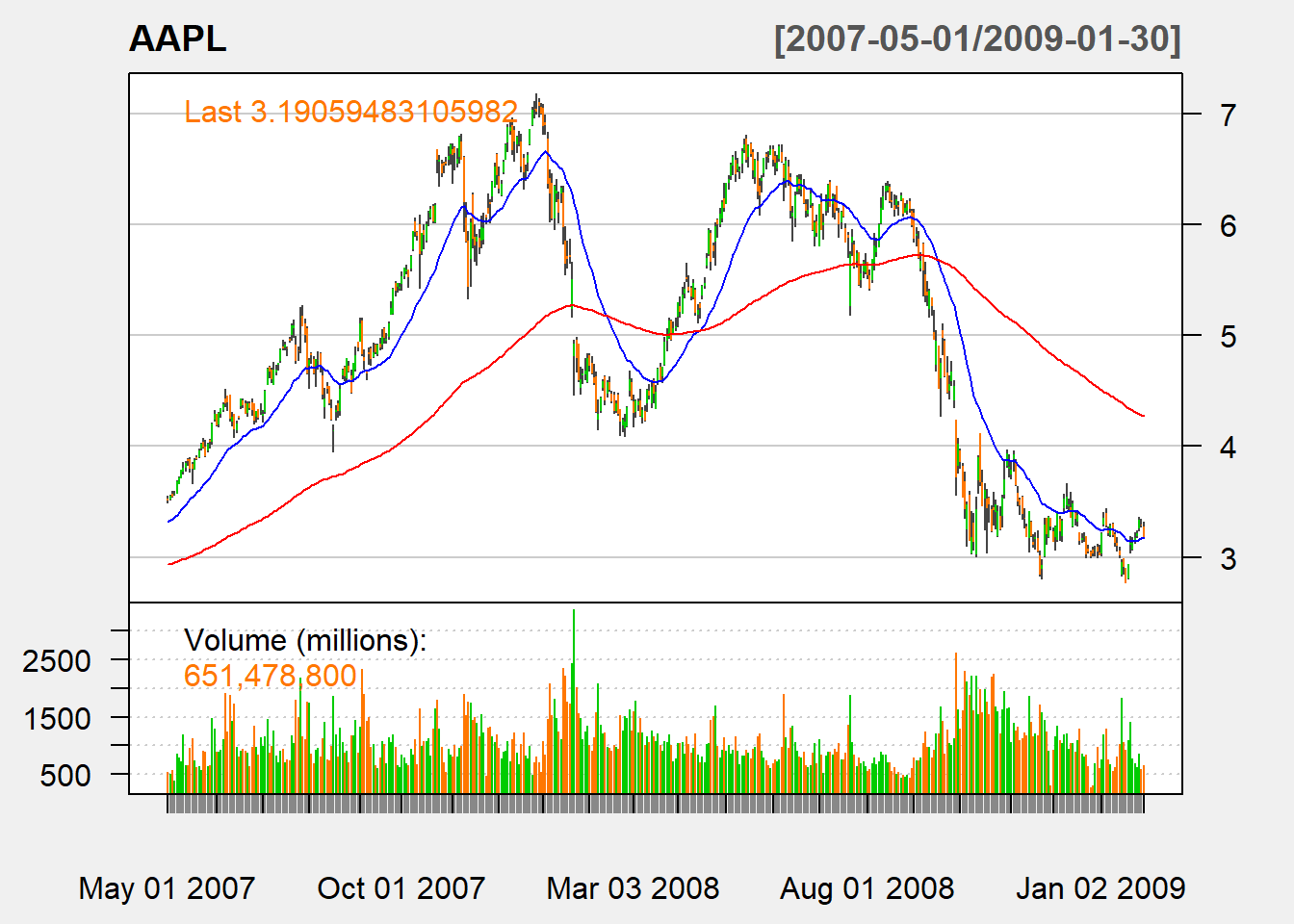

5.3.2 Trading signal

Buy signal arises when a short-run EMA crosses from below to above a long-run EMA.

Sell signal arrises when a short-run EMA crosses from above to above a long-run EMA.