7.6 Comparing rules

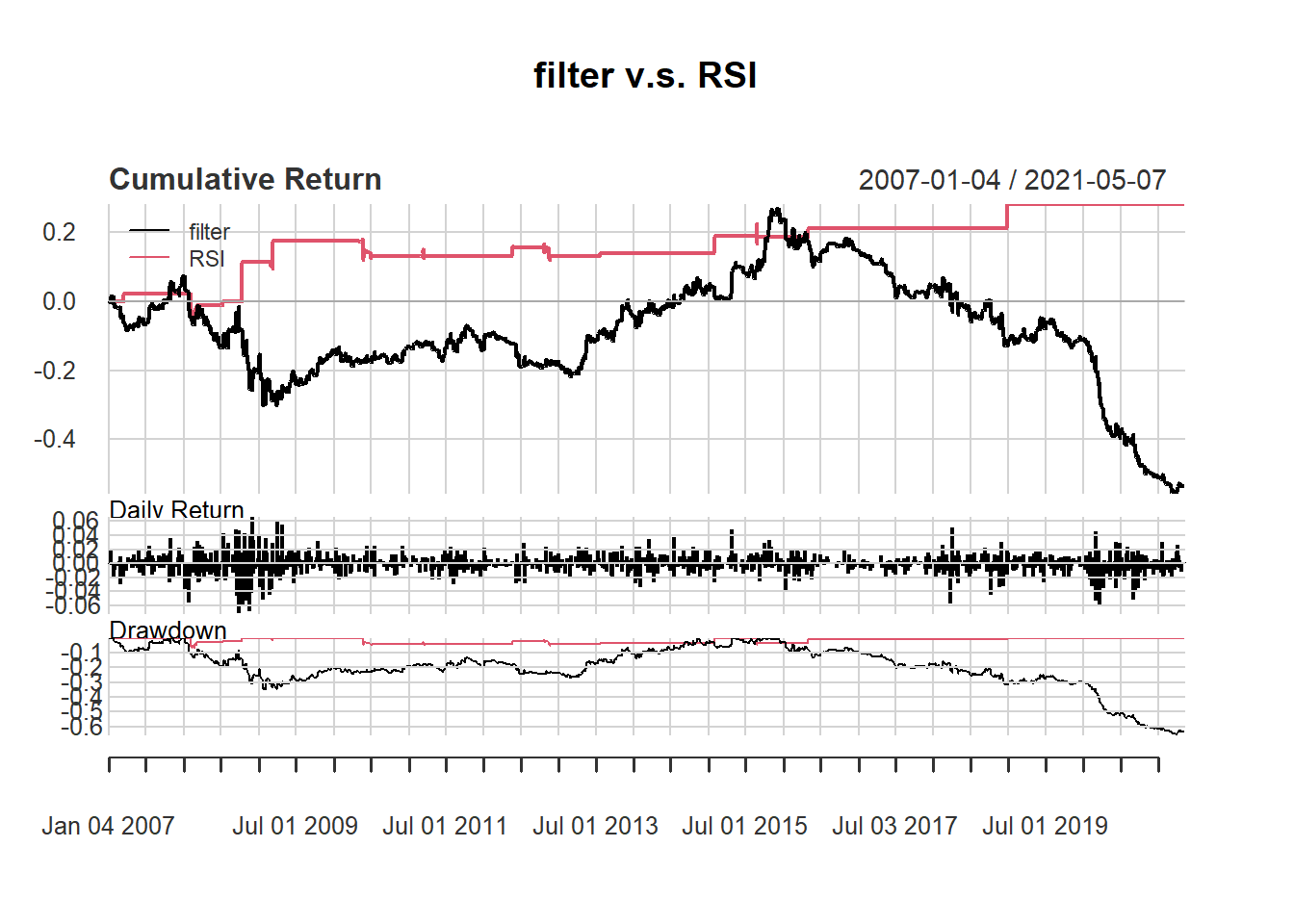

We can compare filter and RSI rules directly.

We start with some initalization:

day <-14

price <- Cl(MSFT)

returnMSFT <- (Cl(MSFT) - Op(MSFT))/Op(MSFT)

r <- price/Lag(price) - 1 # % price change

delta <-0.005 #threshold

filter.signal <-c(0) # first date has no signal

rsi <- RSI(price, day) #rsi is the lag of RSI

RSI.signal <- c() #initialize vector

RSI.signal [1:day+1] <- 0 #0 because no signal until day+1We calculate the trading signal for filter rule:

for (i in 2: length(price)){

if (r[i] > delta){

filter.signal[i]<- 1

} else

filter.signal[i]<- 0

}

filter.signal<-reclass(filter.signal,Cl(MSFT))We calculate the trading signal for RSI rule:

for (i in (day+1): length(price)){

if (rsi[i] < 30){ #buy if rsi < 30

RSI.signal[i] <- 1

}else { #no trade all if rsi > 30

RSI.signal[i] <- 0

}

}

RSI.signal<-reclass(RSI.signal,Cl(MSFT))We now all apply our trading rules are based on yesterday signal:

filter.trade <- Lag(filter.signal,1)

filter.ret <- returnMSFT*filter.trade

names(filter.ret) <- 'filter'

RSI.trade <- Lag(RSI.signal,1)

RSI.ret <- returnMSFT*RSI.trade

names(RSI.ret) <- 'RSI'Now compare the two trading rules: