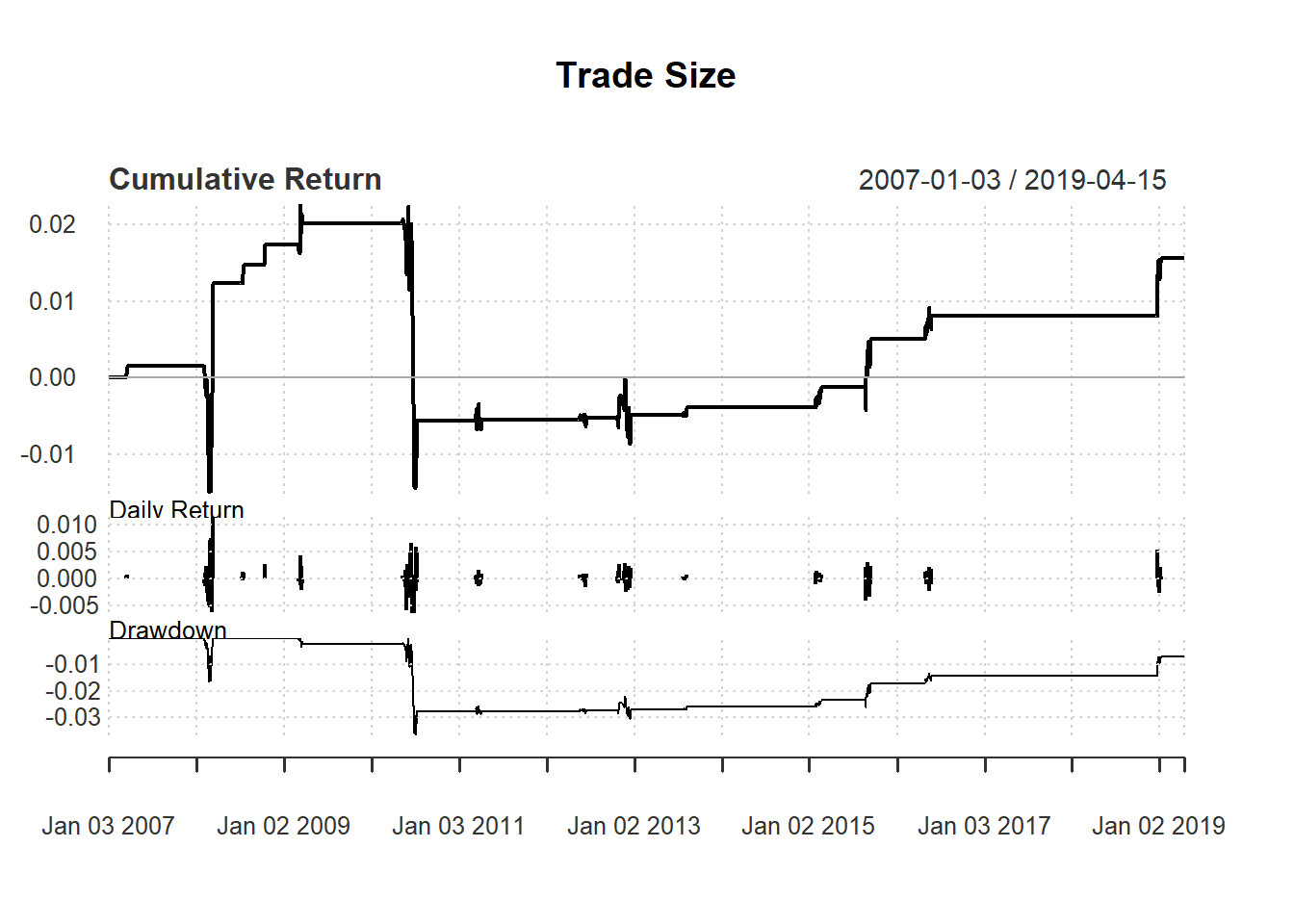

7.9 Trading Size

Wealth: 1 million

Trade unit: 1000 stocks per trade

Test the following strategy based on 14-day RSI :

Buy one more unit if RSI <30.

Keep buying the same if 30 < RSI < 50

Stop trading if RSI >= 50

Evaluate based on day trading

To take trade size into account, we need to keep track of wealth:

qty <-1000

day <-14

signal <- c() #trade signal with size

signal[1:(day+1)] <- 0

price <- Cl(MSFT)

wealth <-c()

wealth[1:(day+1)] <- 1000000

return<-c()

return[1:(day+1)] <- 0

profit <-c()

profit[1:(day+1)] <- 0We now generate trading signal with size:

rsi <- RSI(price, day) #rsi is the lag of RSI

for (i in (day+1): length(price)){

if (rsi[i] < 30){ #buy one more unit if rsi < 30

signal[i] <- signal[i-1]+1

} else if (rsi[i] < 50){ #no change if rsi < 50

signal[i] <- signal[i-1]

} else { #sell if rsi > 50

signal[i] <- 0

}

}

signal<-reclass(signal,price)Now we are ready to apply Trade Rule

Close <- Cl(MSFT)

Open <- Op(MSFT)

trade <- Lag(signal)

for (i in (day+1):length(price)){

profit[i] <- qty * trade[i] * (Close[i] - Open[i])

wealth[i] <- wealth[i-1] + profit[i]

return[i] <- (wealth[i] / wealth[i-1]) -1

}

ret3<-reclass(return,price)

charts.PerformanceSummary(ret3, main="Trade Size")