7.8 Combining two indicators: EMA and RSI

Test the following strategy using EMA and RSI based on day trading:

Buy signal based on EMA rule.

Sell signal based on RSI rule.

Tie-breaking: buy-signal has priority

We use 14-day RSI and use 70 as threshold for selling.

n <- 14

delta<-0.005

price <- Cl(MSFT)

r <- price/Lag(price) - 1

rsi <- RSI(price, n)

signal <-c() # first signal is NA

signal[1:n] <-0

# Generate Trading Signal

for (i in (n+1):length(price)){

if (r[i] > delta){

signal[i]<- 1

} else if (rsi[i] > 70){

signal[i]<- -1

} else

signal[i]<- 0

}

signal<-reclass(signal,price)

## Apply Trading Rule

trade3 <- Lag(signal)

ret3<-dailyReturn(MSFT)*trade3

names(ret3) <- 'Combine'

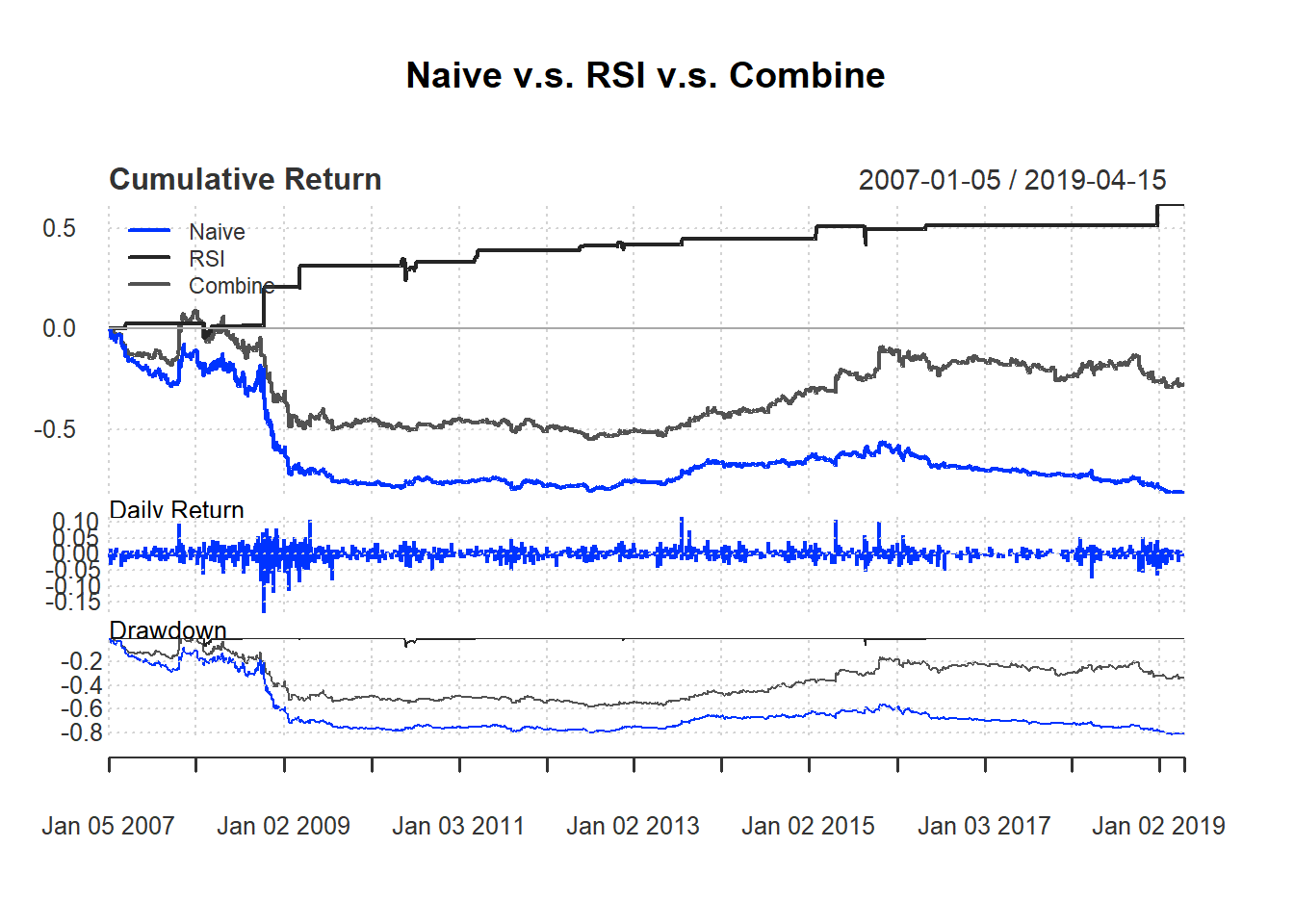

retall <- cbind(ret1, ret2, ret3)To draw trade performance summary with different colors, we use the option colorset. Common options includes redfocus, bluefocus, greenfocus, rainbow4equal andrich12equal.

charts.PerformanceSummary(

retall, main="Naive v.s. RSI v.s. Combine",

colorset=bluefocus)

Exercise

Test the following strategy based on EMA and RSI

Buy signal based on EMA rule.

Sell signal based on RSI rule

Day trading based on yesterday signal: buy at open and sell at close