8.4 Buy and Hold

We want to compare buy and hold strategy.

We first get the data

getSymbols("SPY", from=from, to=to, adjust=TRUE)8.4.1 Step 1: Initialization

rm.strat("buyHold")

#Initial Setup

initPortf("buyHold", "SPY", initDate = initDate)

initAcct("buyHold", portfolios = "buyHold",

initDate = initDate, initEq = initEq)8.4.2 Steps 2-4: Applying trading rule

Since buy and sell are not given by trading rule, we directly add transaction to it.

We first add the transaction to buy at the beginning:

FirstDate <- first(time(SPY))

# Enter order on the first date

BuyDate <- FirstDate

equity = getEndEq("buyHold", FirstDate)

FirstPrice <- as.numeric(Cl(SPY[BuyDate,]))

UnitSize = as.numeric(trunc(equity/FirstPrice))

addTxn("buyHold", Symbol = "SPY",

TxnDate = BuyDate, TxnPrice = FirstPrice,

TxnQty = UnitSize, TxnFees = 0)We first add the transaction to sell at the end:

LastDate <- last(time(SPY))

# Exit order on the Last Date

LastPrice <- as.numeric(Cl(SPY[LastDate,]))

addTxn("buyHold", Symbol = "SPY",

TxnDate = LastDate, TxnPrice = LastPrice,

TxnQty = -UnitSize , TxnFees = 0)8.4.3 Step 5: Evaluation

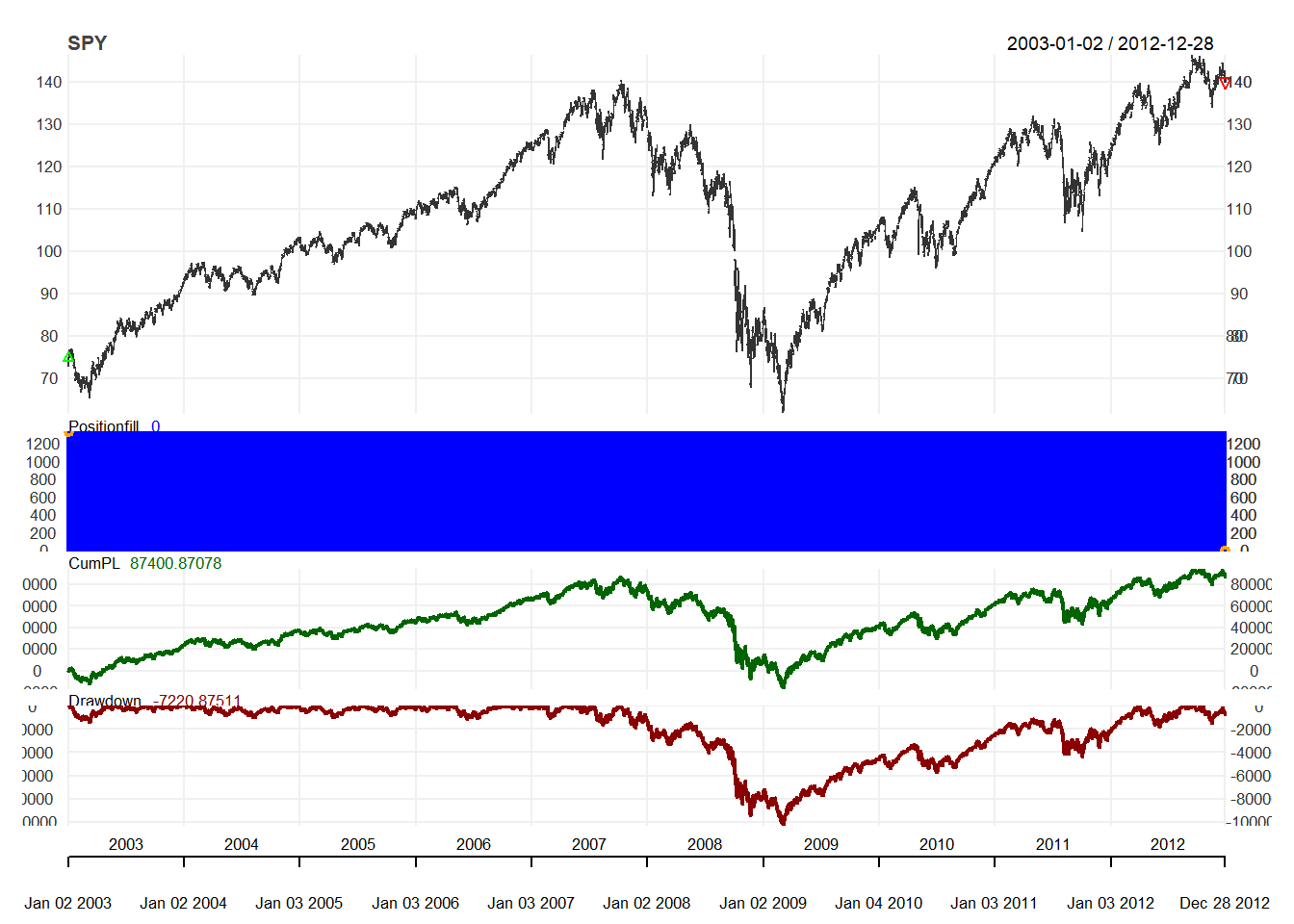

After updates, we can plot the trading position.

updatePortf(Portfolio = "buyHold")## [1] "buyHold"updateAcct(name = "buyHold")## [1] "buyHold"updateEndEq(Account = "buyHold")## [1] "buyHold"chart.Posn("buyHold", Symbol = "SPY")

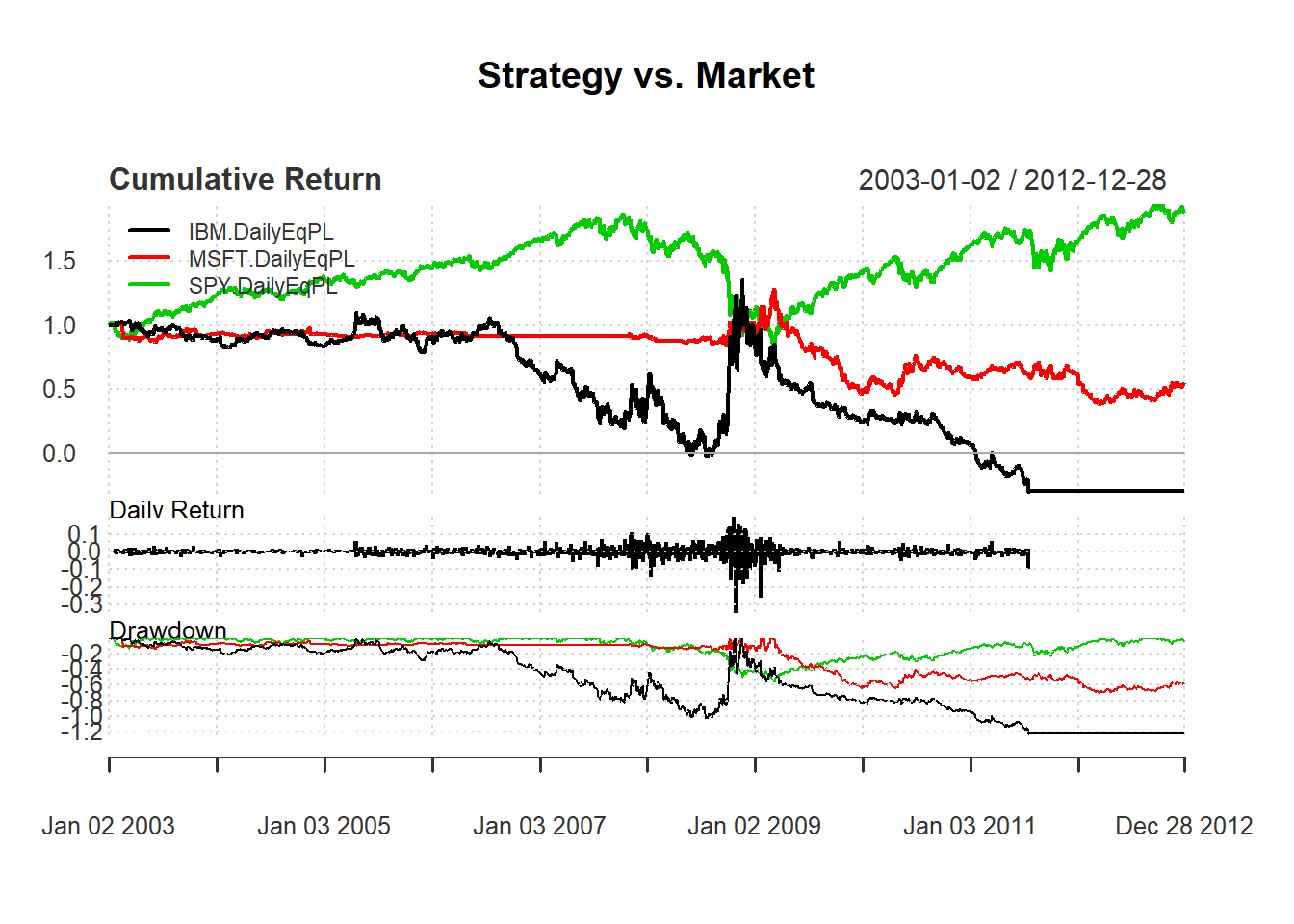

Now we are ready to compare buy-hold and the simple trading rule.

# Compare strategy and market

rets <- PortfReturns(Account = account.st)

rets.bh <- PortfReturns(Account = "buyHold")

returns <- cbind(rets, rets.bh)

charts.PerformanceSummary(

returns, geometric = FALSE,

wealth.index = TRUE,

main = "Strategy vs. Market")