Chapter 2 Introduction to Regression and Linear Models

Regression Analysis is a statistical tool that utilizes the relation between a dependent variable and one or more independent variables so that the dependent variable can be predicted using the independent variable/s.

In this course, we will focus on datasets and models where the dependent and independent variables are numeric or quantitative in nature.

2.1 Historical Origin of the term “Regression”

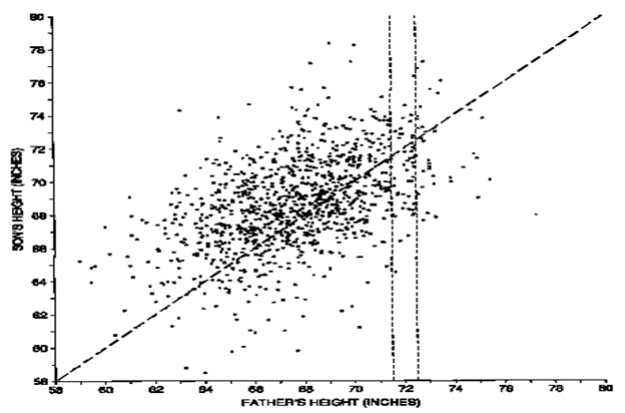

Regression analysis was first developed by Sir Francis Galton in the latter part of the 19th century.

Galton had studied the heights of fathers and sons and noted that the heights of sons of both tall and short fathers appeared to revert or regress to the mean of height of the fathers. He considered this tendency to be a regression to mediocrity.

Galton developed a mathematical description of this regression tendency, the precursor of today’s regression models.

The term regression persists to this day to describe statistical relations between variables, but may be differently described from how Galton first used it.

Most of the statistical methodologies pioneered by Galton (regression, psychometrics, usage of questionnaires) are unfortunately utilized by Galton for eugenics and scientific racism.

2.2 Uses of Regression Analysis

- Data Description – summarize and describe the data; describes the relationship of the dependent variable against the independent variable

- Prediction – forecast the expected value of the variable of interest given the values of the other (independent) variables; very important and useful in planning

- Structural Analysis – the use of an estimated model for the quantitative measurement of the relationships of the variables (example: economic variables); it facilitates the comparison of rival theories of the same phenomena; quantifies the relationship between the variables

2.3 Classification of Regression Models

In terms of distributional assumptions

- Parametric – assumes a fixed structural form where the dependent variable (linearly) depends on the independent variables; the distribution is known and is indexed by unknown parameters

- Nonparametric – the dependent variable depends on the explanatory variables but the distribution is not specified (distribution-free) and not indexed by a parameter

- Semi-parametric – considers an unknown distribution but indexed by some parameter

In terms of types of dependent and independent variables

| Dependent | Independent | Model |

|---|---|---|

| Continuous | Continuous | Classical Regression |

| Continuous | Continuous added Categorical |

Classical Regression with use of Dummy Variables |

| Continuous | Categorical added Continuous |

Analysis of Covariance (ANCOVA) |

| Continuous | All Categorical | Analysis of Variance (ANOVA) |

| Categorical | Any Combination | Logistic Regression |

| Categorical | All Categorical | Log-Linear Models |

2.4 The Linear Model

Two points can be represented by a straight line. Recall the slope-intercept equation of a line

\[ Y = a + mX \]

where \(a\) is the y-intercept, and \(m\) is the slope of the line.

Example 1: Some deterministic models can be represented by a straight line.

You are selling hotdogs with a unit price of 25 pesos per piece. Assuming there are no tips and you have no other items to sell, then the daily sales has a deterministic relationship with the number of hotdogs sold.

\[ sales =25 \times hotdogs \]

## [1] 250However, most phenomena are governed by some probability or randomness. What if we are modelling the expected net income where we consider the tips, possible spoilage of food, and other random scenario?

That is why we add a random error term \(\varepsilon\) to characterize a stochastic linear model.

\[ sales = 25 \times hotdogs + \varepsilon \] where \(\varepsilon\) is a random value that may be positive or negative.

## [1] 249.0634## [1] 249.8843Example 2: a variable can be a function of another variable, but the relationship may be stochastic, not deterministic.

Suppose we have the following variables collected from 10 students.

- \(X\) - highschool exam score in algebra

- \(Y\) - Stat 101 Final Exam scores

| Student | X | Y |

|---|---|---|

| 1 | 90 | 85 |

| 2 | 87 | 87 |

| 3 | 85 | 89 |

| 4 | 85 | 90 |

| 5 | 95 | 92 |

| 6 | 96 | 94 |

| 7 | 82 | 80 |

| 8 | 78 | 75 |

| 9 | 75 | 60 |

| 10 | 84 | 78 |

There seems to be a linear relationship between \(X\) and \(Y\) (although not perfectly linear).

Our main goal is to represent this relationship using an equation.

In this graph:

- \(Y = \beta_0 + \beta_1X\) represents the straight line.

- \(Y_i = \beta_0 + \beta_1X_i+\varepsilon_i\) represents the points in the scatter plot

- The \(\beta\)s are the model parameters

- The \(\varepsilon\)s are the error terms

- If we are asking “which equation best represents the data”, it is the same as asking “what are the values of \(\beta\) that best represent the data”.

- If there are \(k\) independent variables, the points are represented by: \(Y_i = \beta_0 + \beta_1X_{i1} + \beta_2X_{i2} + \cdots + \beta_kX_{ik} + \varepsilon_i\)

Justification of the Error Term

- The error term represents the effect of many factors (apart form the X’s) not included in the model which do affect the response variable to some extent and which vary at random without reference to the independent variables.

- Even if we know that the relevant factors have significant effect on the response, there is still a basic and unpredictable element of randomness in responses which can be characterized by the inclusion of a random error term.

- \(\varepsilon\) accounts for errors of observations or measurements in recording \(Y\).

- Errors can be positive or negative, but are expected to be very small (close to 0)

Linear Model in Matrix Form

Take note that we assume a model for every observation \(i=1,\cdots, n\), which implies that we are essentially handling \(n\) equations. To facilitate handling n equations, we can use the concepts in matrix theory.

Instead of \(Y_i = \beta_0 + \beta_1X_{i1} + \beta_2X_{i2} + \cdots + \beta_kX_{ik} + \varepsilon_i\) for each observation \(i\) from \(1\) to \(n\), we can make it compact using matrix notations.

Given the following vectors and matrices:

\[ \textbf{Y}=\begin{bmatrix} Y_1 \\ Y_2 \\ \vdots\\ Y_n \end{bmatrix} \quad \textbf{X} =\begin{bmatrix} 1 & X_{11} & X_{12} & \cdots & X_{1k} \\ 1 & X_{21} & X_{12} & \cdots & X_{2k} \\ \vdots & \vdots & \vdots & \ddots & \vdots \\ 1 & X_{n1} & X_{n2} & \cdots & X_{nk} \end{bmatrix} \quad \boldsymbol{\beta}= \begin{bmatrix} \beta_0 \\ \beta_1 \\ \beta_2 \\ \vdots\\ \beta_k \end{bmatrix} \quad \boldsymbol{\varepsilon} = \begin{bmatrix} \varepsilon_1 \\ \varepsilon_2 \\ \vdots\\ \varepsilon_n \end{bmatrix} \]

Definition 2.1 (Matrix Form of the Linear Equation)

The \(k\)-variable, \(n\)-observations linear model can be written as

\[\begin{align} \underset{n\times1}{\textbf{Y}} &= \underset{n\times (k+1)}{\textbf{X}}\underset{(k+1)\times1}{\boldsymbol{\beta}} + \underset{n\times 1}{\boldsymbol{\varepsilon}}\\ \\ \begin{bmatrix} Y_1 \\ Y_2 \\ \vdots\\ Y_n \end{bmatrix} &= \begin{bmatrix} 1 & X_{11} & X_{12} & \cdots & X_{1k} \\ 1 & X_{21} & X_{12} & \cdots & X_{2k} \\ \vdots & \vdots & \vdots & \ddots & \vdots \\ 1 & X_{n1} & X_{n2} & \cdots & X_{nk} \end{bmatrix} \begin{bmatrix} \beta_0 \\ \beta_1 \\ \beta_2 \\ \vdots\\ \beta_k \end{bmatrix} + \begin{bmatrix} \varepsilon_1 \\ \varepsilon_2 \\ \vdots\\ \varepsilon_n \end{bmatrix} \\ \\ \begin{bmatrix} Y_1 \\ Y_2 \\ \vdots\\ Y_n \end{bmatrix} &= \begin{bmatrix} \beta_0 + \beta_1X_{11} + \beta_2X_{12} + \cdots & \beta_kX_{1k} +\varepsilon_1 \\ \beta_0 + \beta_1X_{21} + \beta_2X_{12} + \cdots & \beta_kX_{2k} +\varepsilon_2\\ \vdots \\ \beta_0 + \beta_1X_{n1} + \beta_2X_{n2} + \cdots & \beta_kX_{nk} +\varepsilon_n \end{bmatrix} \end{align}\]

where

- \(Y_i\) is the value of the response variable on the \(i^{th}\) trial. Collectively, \(\textbf{Y}\) is the response vector.

- \(X_{ij}\) is a known constant, namely, the value of the \(j^{th}\) independent variable on the \(i^{th}\) trial. Collectively, \(\textbf{X}\) is the design matrix.

- \(\beta_0, \beta_1, \cdots , \beta_k\) are parameters. Collectively, \(\boldsymbol{\beta}\) is the regression coefficients vector.

- \(\varepsilon_i\) is a random error term on trial \(i=1,...,n\). Collectively, \(\boldsymbol{\varepsilon}\) is the error term vector.

The statistical uses of the linear model:

- The model summarizes the linear relationship between \(Y\) and the \(X\) s.

- It can help explain how variability in \(Y\) is affected by the \(X\) s.

- It can help determine \(Y\) given prior knowledge on \(X\) .

Illustrations for the Case of Two Independent Variables

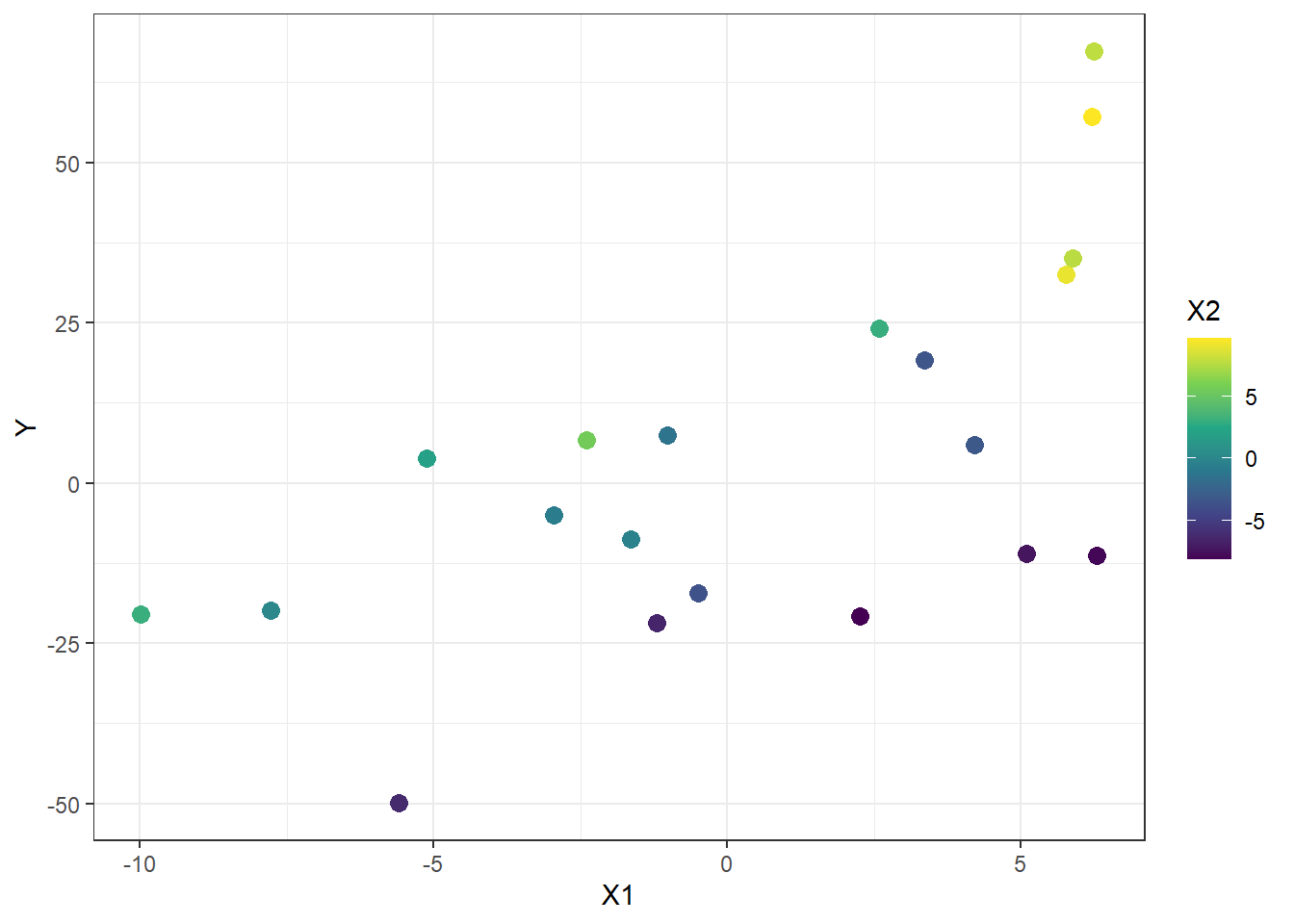

Suppose you have the following dataset:

| Y | X1 | X2 |

|---|---|---|

| 42.270713 | 4.1394004 | 6.2667461 |

| 31.002599 | 1.5033792 | 8.4675790 |

| 19.881936 | -7.3233710 | 6.9665372 |

| 19.741975 | 9.9466627 | -0.1550762 |

| -33.256623 | 3.9943669 | -8.7217065 |

| -17.367894 | 1.5780056 | -6.0598082 |

| -42.308513 | -3.5205959 | -5.7694959 |

| -14.293954 | 1.1431900 | -7.2613144 |

| 6.168092 | -5.4545351 | 8.6246384 |

| 15.885794 | -2.0308315 | 5.8123232 |

| 1.642875 | 5.9738936 | -5.1390990 |

| -16.549392 | -7.2115162 | 2.4971037 |

| 30.428063 | 8.0765724 | 2.1499017 |

| 53.876856 | 4.7790415 | 7.3612454 |

| 29.751159 | 9.5693603 | 1.6273101 |

| 36.548555 | 2.2756130 | 6.7145628 |

| 66.018884 | 0.8475198 | 8.5238986 |

| -33.800136 | -3.6971958 | -6.9440852 |

| -5.937577 | -4.7612040 | 3.3669084 |

| 31.786225 | 1.2350132 | 1.2156630 |

In a 2-dimensional plane, it can be visualized as follows

It can be also visualized using a 3-dimensional plane. You can drag around to change the view angle.

Now, we want a line (or a plane) that passes through the center of the points. Let’s try this equation: \[ Y = 2 + 3X_1 + 4X_2 \] The line that passes through the center of the points can be visualized in this 3D graph:

How did we come up with the intercept and slope values 2,3, and 4?

Wild guess? Trial and error?

This can be answered in the next chapter, Estimation Procedures

2.5 Assumptions

The multiple linear regression model is represented by the matrix equation \(\textbf{Y} = \textbf{X} \boldsymbol{\beta} + \boldsymbol{\varepsilon}\)

Given \(n\) observations, we want to fit this equation.

How do we regulate the balance between summarizing data and model fit?

IMPOSE ASSUMPTIONS

Types of Error Assumptions

Classical Assumptions: \(E(\varepsilon_i)=0 ,\quad Var(\varepsilon_i)=\sigma^2 \quad\forall i, \quad Cov(\varepsilon_i,\varepsilon_j)=0 \quad \forall i\neq j\)

Normal Error Model Assumptions: \(\varepsilon_i\overset{iid}{\sim}N(0,\sigma^2)\)

Linear Regression Variable Assumptions

Independent Variables: Assumed to be constant, predetermined, or something that is already gathered; uncorrelated or linearly independent from each other.

Dependent Variable: Assumed to still be unknown and inherently random; each observation is independent with one another.

Important Features of the Model

(\(Y_i\) as a random variable). The observed value of \(Y_i\) in the \(i^{th}\) trial is the sum of two components: \[ Y_i\quad=\quad\underset{\text{constant terms}}{\underbrace{\beta_0 + \beta_1X_{i1} + \beta_2X_{i2} + \cdots + \beta_kX_{ik}}} \quad+ \underset{\text{random term}}{\underbrace{\varepsilon_i}} \]

Hence, \(Y_i\) is a random variable.

(Expectation of \(Y_i\)). Since \(E(\varepsilon_i) = 0\), it follows that \(E(Y_i)=\beta_0 + \beta_1X_{i1} + \beta_2X_{i2}+ \cdots + \beta_kX_{ik}\). Thus, the response \(Y_i\), when the level of the \(k\) independent variables (X’s) in the \(i^{th}\) trial are known, comes from a probability distribution whose mean is \(\beta_0 + \beta_1X_{i1} + \beta_2X_{i2}+ \cdots + \beta_kX_{ik}\). This constant value is referred to as the regression function for the model.

(Error Term). The observed value of the \(Y_i\) in the \(i^{th}\) trial exceeds or falls short of the value of the regression function by the error term amount \(\varepsilon_i\).

(Homoscedasticity). The error terms are assumed to have a constant variance. Thus, the responses \(Y_i\) have the same constant variance.

(Independence of Observations). The error terms are assumed to be uncorrelated. Hence, the outcome in any one trial has no effect on the error term for any other trial – as to whether it is positive or negative, small or large. Since the error terms \(\varepsilon_i\) and \(\varepsilon_j\) are uncorrelated, so are the responses \(Y_i\) and \(Y_j\).

(Normality of \(\varepsilon_i\)) Under the normal error model assumption, \(\varepsilon_1, \varepsilon_2, \cdots, \varepsilon_n \overset{iid}{\sim}N(0,\sigma^2)\)

We can express it as a random vector of errors \(\boldsymbol{\varepsilon}=\begin{bmatrix} \varepsilon_1 & \varepsilon_2 & \cdots & \varepsilon_n \end{bmatrix}'\), and its distribution is assumed to be \(n\)-variate normal. That is,

\[ \boldsymbol{\varepsilon} \sim N_n(\textbf{0},\sigma^2\textbf{I}) \]Is it justifiable to impose normality assumption on the error terms?

- A major reason why the normality assumption for the error terms is justifiable in many situations is that the error terms frequently represent the effects of many factors omitted explicitly in the model, that do affect the response to some extent and that vary at random without reference to the independent variables. Also, there might be random measurement errors in recording \(Y\).

- Insofar as these random effects have a degree of mutual independence, the composite error term representing all these factors will tend to comply with the CLT and the error term distribution would approach normality as the number of factor effects becomes large.

- Insofar as these random effects have a degree of mutual independence, the composite error term representing all these factors will tend to comply with the CLT and the error term distribution would approach normality as the number of factor effects becomes large.

- A second reason why the normality assumption for the error terms is frequently justifiable is that some of the estimation and testing procedures to be discussed in the next chapters are based on the t-distribution, which is not sensitive to moderate departures from normality.

- Thus, unless the departures from normality are serious, particularly with respect to skewness, the actual confidence coefficients and risks of errors will be close to the levels for exact normality.

- A major reason why the normality assumption for the error terms is justifiable in many situations is that the error terms frequently represent the effects of many factors omitted explicitly in the model, that do affect the response to some extent and that vary at random without reference to the independent variables. Also, there might be random measurement errors in recording \(Y\).

(Distribution of \(Y_i\)). The assumption of normality of error terms implies that the \(Y_i\) are also independent (but not necessarily identical) normal random variables. That is: \[ Y_i\overset{ind}{\sim}Normal(\mu=\beta_0 + \beta_1X_{i1} + \beta_2X_{i2}+ \cdots + \beta_kX_{ik},\sigma^2) \]

In summary, the regression assumptions are the following:

- the expected value of the unknown quantity \(\varepsilon_i\) is 0 for every observation \(i\)

- the variance of the errors term is the same for all observations

- the error terms and observations are uncorrelated

- the error terms follow a normal distribution (under the Normal error model assumption)

- the independent variables are linearly independent from each other

- the independent variables are assumed to be constants and not random