B Quick Start

B.1 Linear Regression

See also Section 6.1.

Suppose we have a data frame called housing with real estate transaction data from Saratoga Springs, New York (ADD source: https://dasl.datadescription.com/datafile/saratoga-house-prices/). The first few observations of this data set are shown below.

| Price | Baths | Bedrooms | Fireplace | Acres | Age |

|---|---|---|---|---|---|

| 142.212 | 1.0 | 3 | 0 | 2.00 | 133 |

| 134.865 | 1.5 | 3 | 1 | 0.38 | 14 |

| 118.007 | 2.0 | 3 | 1 | 0.96 | 15 |

| 138.297 | 1.0 | 2 | 1 | 0.48 | 49 |

| 129.470 | 1.0 | 3 | 1 | 1.84 | 29 |

| 206.512 | 2.0 | 3 | 0 | 0.98 | 10 |

These variables are defined as follows:

Price: The sales price of a home in thousands of dollars.Baths: The number of bathrooms in the home.Bedrooms: The number of bedrooms in the home.Fireplace: Whether the home has a fireplace.Acres: The lot size in acres.Age: The age of the home in years.

We can fit a regression with Price as the dependent (\(Y\)) variable using the lm() function as follows:

Then we can apply the summary() function to fit to get a summary of our model:

##

## Call:

## lm(formula = Price ~ Baths + Bedrooms + Fireplace + Acres + Age,

## data = housing)

##

## Residuals:

## Min 1Q Median 3Q Max

## -141.47 -33.43 -6.11 19.78 470.00

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) -27.17190 8.61390 -3.154 0.001654 **

## Baths 65.38343 3.78293 17.284 < 0.0000000000000002 ***

## Bedrooms 16.92751 2.91667 5.804 0.00000000857 ***

## Fireplace 21.12512 4.27226 4.945 0.00000088638 ***

## Acres 8.78877 2.37834 3.695 0.000231 ***

## Age -0.04538 0.05945 -0.763 0.445458

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 60.55 on 1057 degrees of freedom

## Multiple R-squared: 0.4887, Adjusted R-squared: 0.4863

## F-statistic: 202.1 on 5 and 1057 DF, p-value: < 0.00000000000000022We can apply confint() to fit() to get a 95% confidence interval for each of the coefficients of our model:

## 2.5 % 97.5 %

## (Intercept) -44.0741786 -10.26961652

## Baths 57.9605197 72.80634988

## Bedrooms 11.2043862 22.65062633

## Fireplace 12.7420535 29.50819039

## Acres 4.1219695 13.45558042

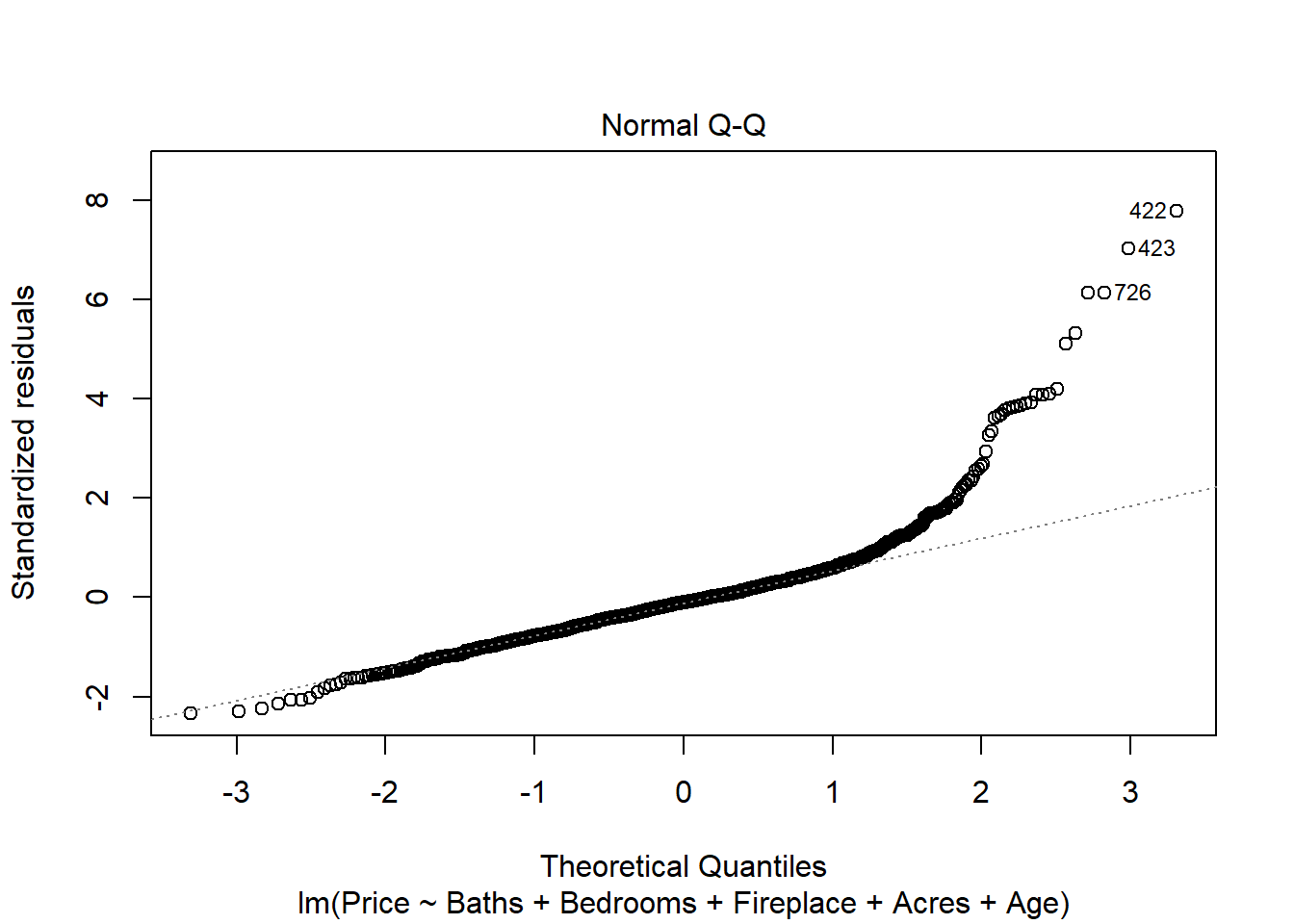

## Age -0.1620358 0.07127757Finally, to check that our error terms are normally-distributed, we can create a qq-plot by applying the plot() function with which=2 as a parameter:

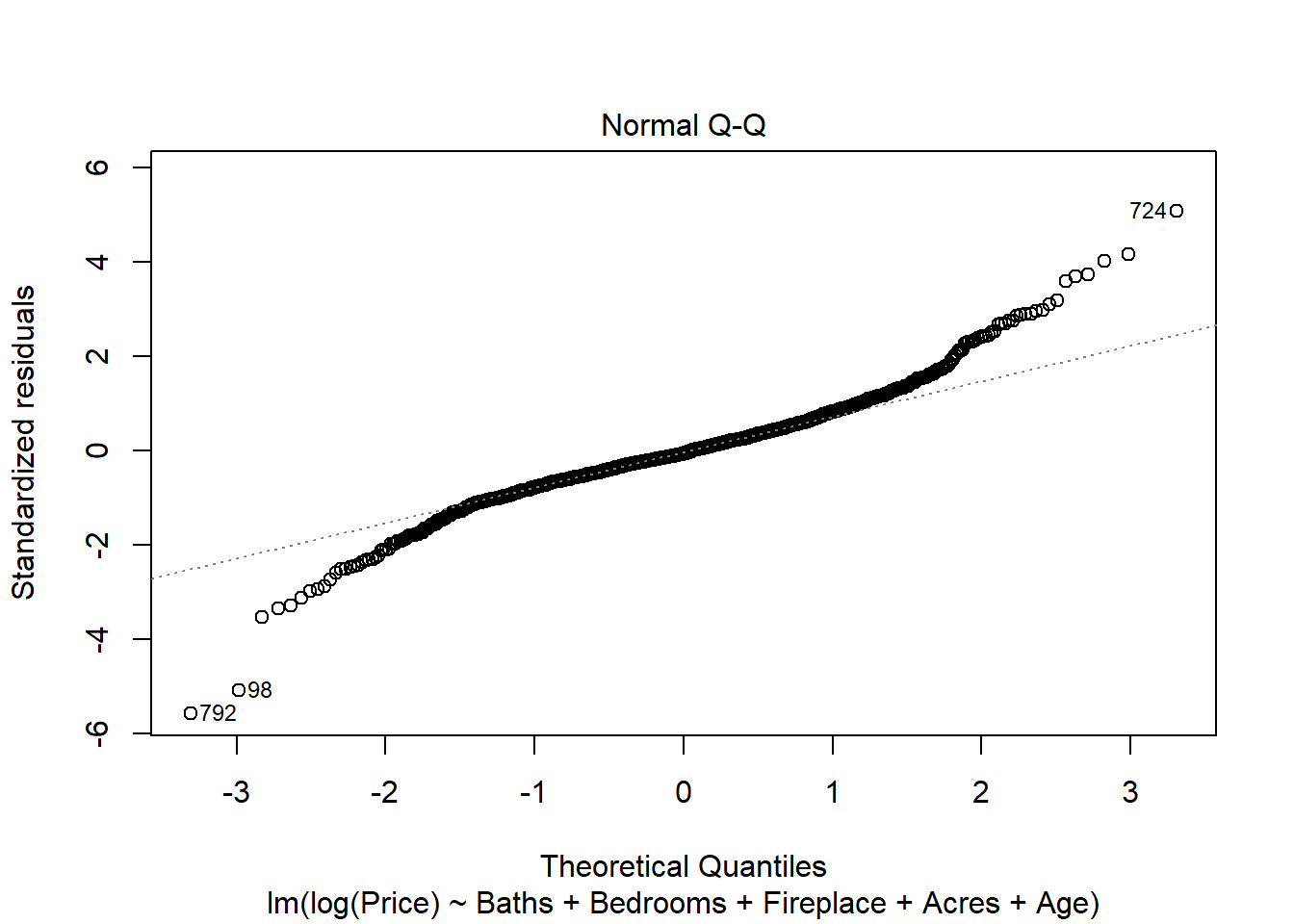

This qq-plot is problematic, as the right-hand side shows unusual tail behavior. This is likely because Price is positively-skewed; there are a handful of “outlier” houses that are very expensive. To address this, we could try fitting a new regression where we model the log of Price as our independent variable:

fitLog <- lm(log(Price) ~ Baths + Bedrooms + Fireplace + Acres + Age, data=housing)

plot(fitLog, which=2)

B.2 Estimating \(\beta\) of a Stock

To estimate the “beta” (\(\beta\)) of a stock:

- Load the

quantmodpackage. - Use the

getSymbols()function to pull the historical returns data for a particular stock over a given period. - Use

getSymbols()to pull the S&P 500 market returns data for the same time period. - Extract the returns from the objects created in steps 2 & 3.

- Use

lm()to regress the market returns onto the stock returns.

Following these steps, let’s calculate an estimate for the five-year monthly \(\beta\) on Disney at the time of writing (May 4, 2021). Note that “DIS” is the ticker for Disney and “SPY” is the ticker for the S&P 500.

# Step 1

library(quantmod)

# Step 2

DIS <- getSymbols("DIS", from="2016-05-04", to="2021-05-04", auto.assign=FALSE)

# Step 3

SPY <- getSymbols("SPY", from="2016-05-04", to="2021-05-04", auto.assign=FALSE)

# Step 4

disReturns <- monthlyReturn(Ad(DIS))

spyReturns <- monthlyReturn(Ad(SPY))

# Step 5

fit <- lm(disReturns ~ spyReturns)

summary(fit)##

## Call:

## lm(formula = disReturns ~ spyReturns)

##

## Residuals:

## Min 1Q Median 3Q Max

## -0.07951 -0.04642 -0.01340 0.03205 0.18854

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) -0.003560 0.007992 -0.445 0.658

## spyReturns 1.190923 0.178991 6.654 0.0000000104 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 0.05917 on 59 degrees of freedom

## Multiple R-squared: 0.4287, Adjusted R-squared: 0.419

## F-statistic: 44.27 on 1 and 59 DF, p-value: 0.00000001041Of course, it is important to note the 95% confidence interval on our estimate of \(\beta\), which we can get using confint():

## 2.5 % 97.5 %

## (Intercept) -0.01955258 0.01243257

## spyReturns 0.83276270 1.54908236