1 Day 1 (January 17)

1.1 Welcome and preliminaries

Teaching Assistant

-

- How I will use Canvas

- Grades and assignment submissions only

- How I will use Canvas

-

- Required and Recomended material

- Statistical programming languages

- Reproducibility requirement (data analysis and computing can be successfully repeated)

- Academic Honesty: working in groups, sharing code, etc.

- Grades

- Topics

Who is in this class?

- Group work and collaboration

url <- "https://www.dropbox.com/s/w09lq70ex377ell/students_STAT_768_A.csv?dl=1"

df <- read.csv(url)

par(mar=c(13,2,2,2))

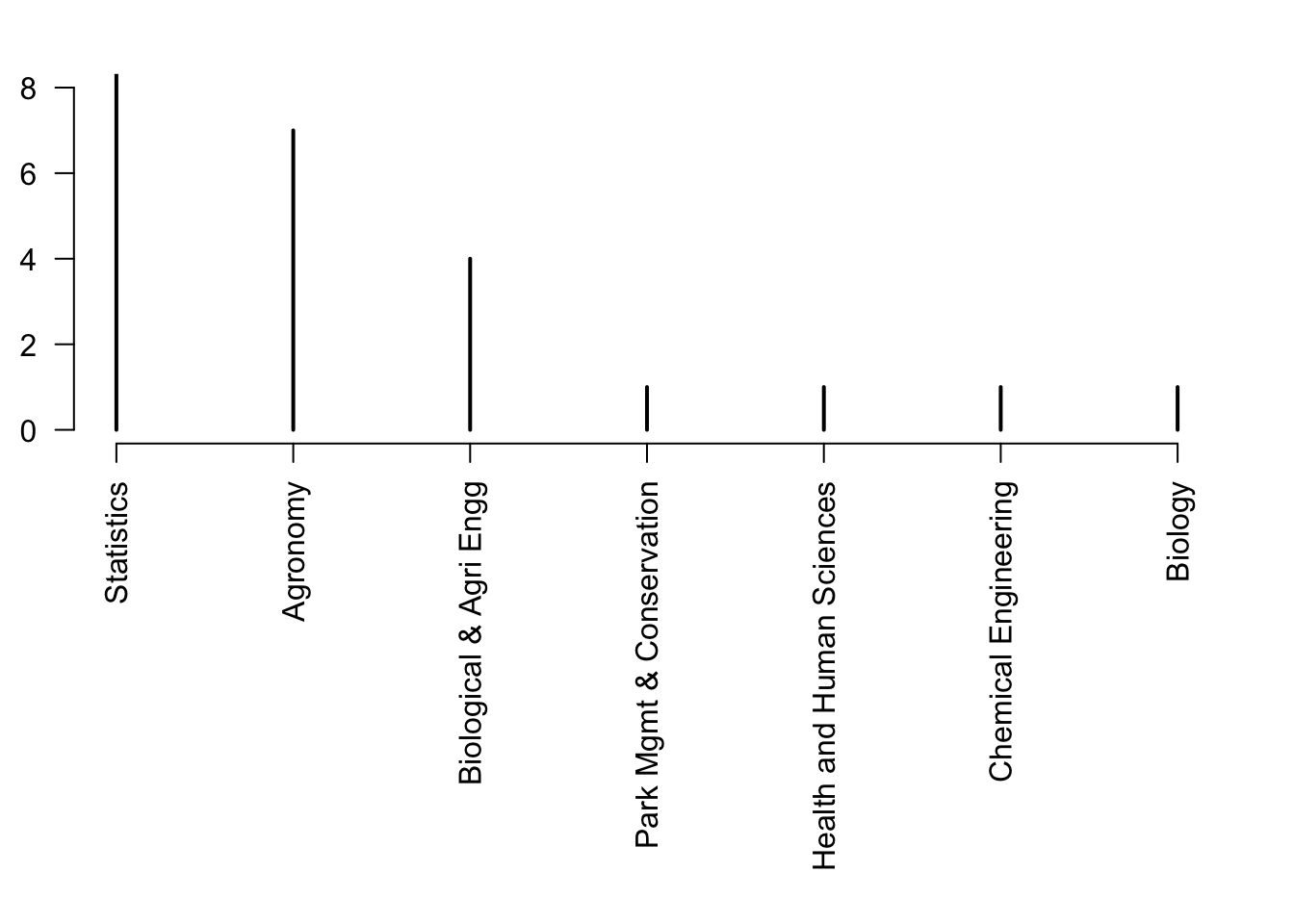

plot(rev(sort(table(df$degreeProgram))),las=2,xlab="",ylab="Number of students",ylim=c(0,8))

par(mar=c(13,2,2,2))

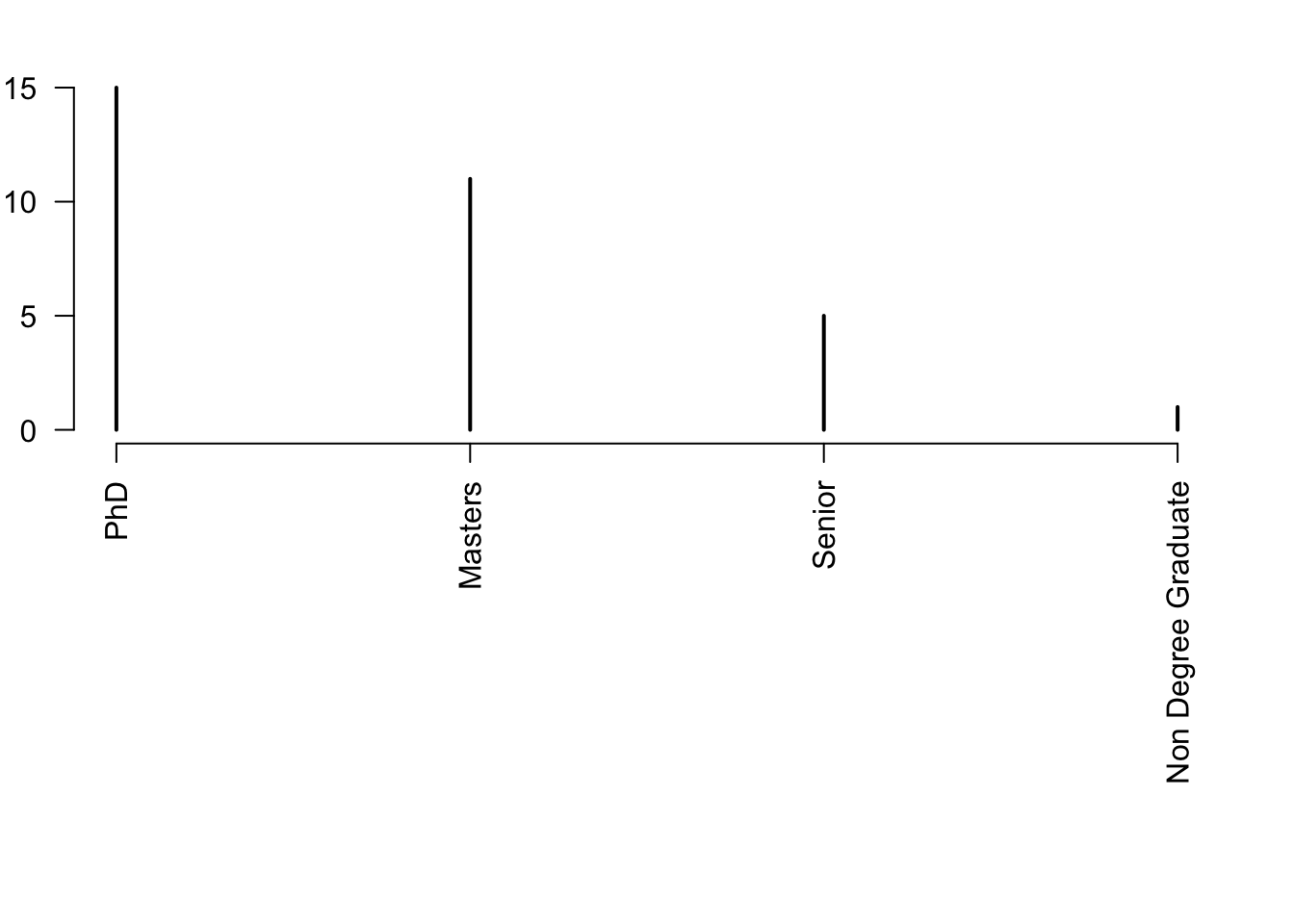

plot(rev(sort(table(df$classLevel))),las=2,xlab="",ylab="Number of students",ylim=c(0,15))

1.3 Intro to Bayesian statistical modelling

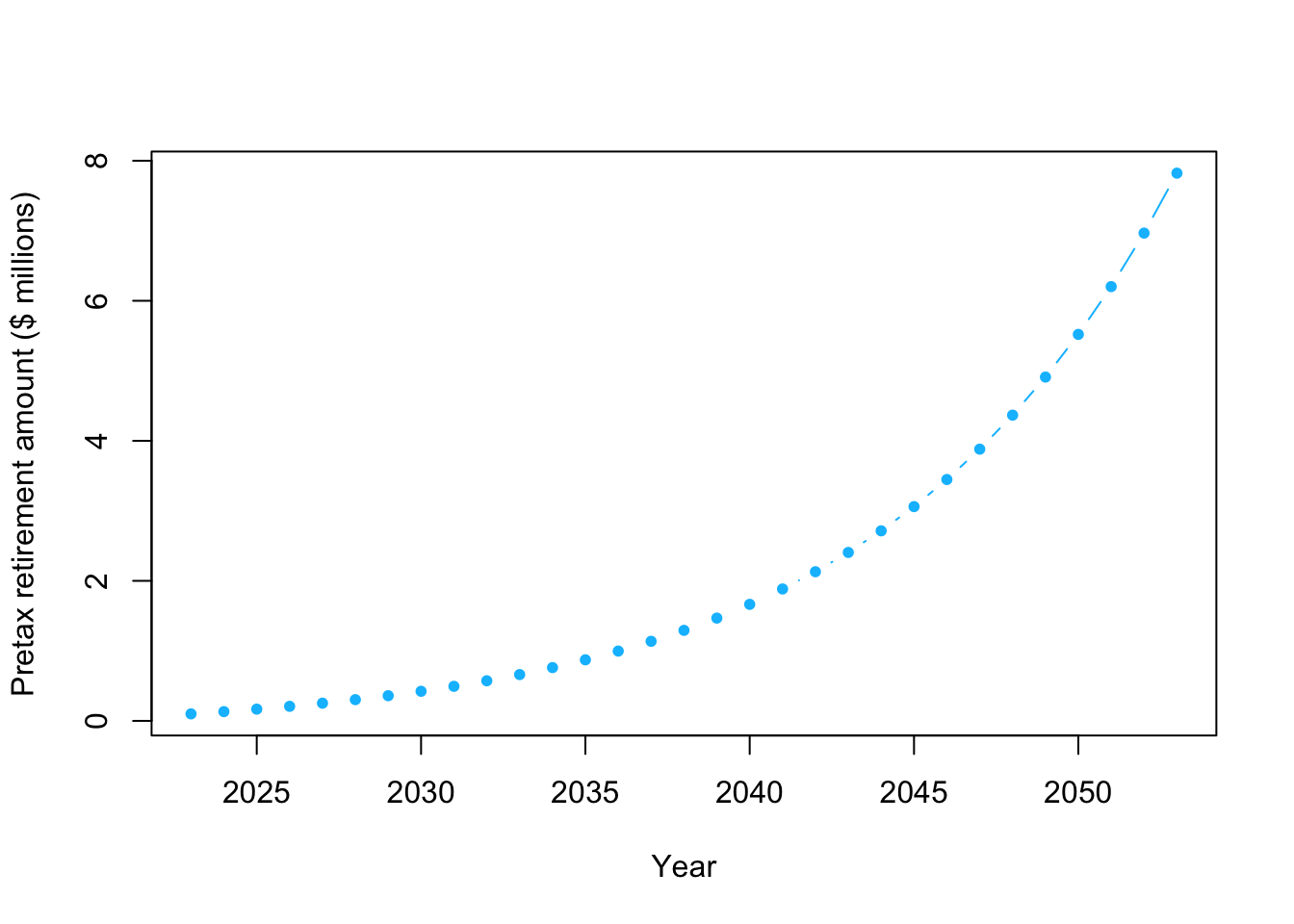

Example: my retirement

- Personal information

- Obviously this isn’t my actual information, but it isn’t too far off!

- Since I am a millennial I don’t think social security will be around when I retire (i.e., assume social security contributes $0 to my retirement)

- As of 1/1/23 I have $100,000 in 401k retirement in accounts

- All of money is invested into an S&P 500 index fund (VOO to be exact)

- I am 35 as of 1/1/23

- I want to know how much pre-tax money I will have at a given retirement age (e.g., 65, 70, etc)

- Example using a mathematical model

- Whiteboard demonstration

- What are the model assumptions?

- In program R

# The value of my 401k retirement account as of 1/1/23 y_2023 <- 100000 # How much money will I add to my 401k each year q <- 20000 # Rate of return for S&P 500 index fund r <- 0.12 # How much $ will I have in 2024 y_2024 <- y_2023*(1+r)+q y_2024## [1] 132000# How much $ will I have in 2025 y_2025 <- y_2024*(1+r)+q y_2025## [1] 167840# How much $ will I have in 2026 y_2026 <- y_2025*(1+r)+q y_2026## [1] 207980.8# Using a for loop to calculate how much $ will I have year <- seq(2023,2023+30,by=1) y <- matrix(,length(year),1) rownames(y) <- year y[1,1] <- 100000 for(t in 1:30){ y[t+1,1] <- y[t,1]*(1+r)+q } plot(year,y/10^6,typ="b",pch=20,col="deepskyblue",xlab="Year",ylab="Pretax retirement amount ($ millions)")

# How much $ will I have when I am 65? # Note that units are millions of $ retirement.year <- 2023+30 y[which(year==retirement.year)]/10^6## [1] 7.822646- Personal information