2 Preprocessing

This chapter will cover the concepts seen in Session 1 Preprocessing. Make sure that you go over the video and slides before going over this chapter.

Throughout the book and the exercises, we will be using data from a newpaper publishing company. A newspaper publishing company (NPC) has contacted you to address their increasing churn rates. This evolution has been jumpstarted by the rise of news-websites, and has continued at an accelerating rate due to the popularity of tablet computers and (social) news-aggregator applications. Hence the NPC requires a predictive retention (or churn) model in order to predict which customers will not renew their newspaper subscriptions. Before building a predictive model, a data scientist must always get some understanding of the data (e.g., plots and summary statistics) and solve several data quality issues. Also, before the data can be used in a predictive model several preprocessing steps have to be performed and features should be created.

The company has provided you two tables to start with:

Customers: contains socio-demographic data about the customers.

Subscription: contains information about the subscriptions of NPC’s customers.

Customers

| Variable | Description |

|---|---|

| CustomerID | Unique customer identifier |

| Gender | M = Male, F = Female, NA = Not Available |

| DoB | Date of Birth |

| District | Macro-geographical grouping: district 1-8 |

| ZIP | Meso-geographical grouping |

| StreeID | Micro-geographical grouping: street identifiers |

Subscriptions

| Variable | Description |

|---|---|

| SubscriptionID | Unique subscription identifier |

| CustomerID | Customer identifier |

| ProductID | Product identifier |

| Pattern | Denotes delivery days. The position in the string equals the days in the week. {1=delivery, 0=non-delivery} e.g., 1000000 = delivery only on Monday 1111110 = delivery on all days (except Sundays) |

| StartDate | Subscription start date |

| EndDate | Subscription end date |

| NbrNewspapers | Total number of copies including NbrStart as determined at the start of the subscription. |

| NbrStart | Maximum number of copies before payment is received. |

| RenewalDate | Date that renewal is processed. |

| PaymentType | BT = Bank transfer, DD = Direct debit |

| PaymentStatus | Paid and Not Paid |

| PaymentDate | Date of payment |

| FormulaID | Formula identifier |

| GrossFormulaPrice | GrossFormulaPrice = NetFormulaPrice + TotalDiscount |

| NetFormulaPrice | NetFormulaPrice = GrossFormulaPrice –TotalDiscount |

| NetNewspaperPrice | Price of a single newspaper |

| ProductDiscount | Discount based on the product |

| FormulaDiscount | Discount based on the formula |

| TotalDiscount | TotalDiscount = ProductDiscount + FormulaDiscount |

| TotalPrice | TotalPrice = NbrNewspapers * NetNewspaperPrice OR TotalPrice = NetFormulaPrice + TotalCredit |

| TotalCredit | The customer’s credit of previous transactions. Credit is negative, debit is positive. |

The goal will be to explore the data, solve possible quality issues and effectively prepare the data. The prepared basetable should contain the traditional RFM variables from the subscriptions table and some socio-demographics from the customers tables.

Before performing advanced preprocessing and feature engineering. Let’s first read in and explore the data.

2.1 Data understanding

Before we can read in the data, we should load the necessary packages. For data understanding and preparation, we will heavily use the tidyverse approach (check https://www.tidyverse.org/ for more information). The student should be able understand and code all of the given examples. If a student wants more explanation and practice in the tidyverse, they can follow the suggested Datacamp courses on Ufora.

if (!require("pacman")) install.packages("pacman")

require("pacman", character.only = TRUE, quietly = TRUE)

p_load(tidyverse)2.1.1 Reading in the data

First and foremost, we must set the working directory and read the data from disk before. If your are working in a normal R script, you can do this with the setwd("Your working directory") command.

Since this books works in a notebook, we have to change the directory of our notebook. The notebook directory is by default the directory where your Rmd file is located. Since our data is located at another directory, we have to change the root.dir of knitr. Be aware that if you would use the setwd("Your working directory") command, you only change the working directory for that specific code chunk.

p_load(knitr)

knitr::opts_knit$set(root.dir = "C:\\Users\\matbogae\\OneDrive - UGent\\PPA22\\PredictiveAnalytics\\Book_2022\\data codeBook_2022")

getwd()## [1] "C:/Users/matbogae/OneDrive - UGent/PPA22/PredictiveAnalytics/Book_2022"Subscriptions table

Let’s now read in the data.

# Since it is a text file with a ';' you can use the

# universal read.table command

subscriptions <- read.table(file = "subscriptions.txt", header = TRUE,

sep = ";")

# However, we prefer the read_delim function of the

# tidyverse, and use ';' as delim

subscriptions <- read_delim(file = "subscriptions.txt", delim = ";",

col_names = TRUE)## Rows: 8252 Columns: 21## -- Column specification --------------------------

## Delimiter: ";"

## chr (7): Pattern, StartDate, EndDate, Renewal...

## dbl (14): SubscriptionID, CustomerID, ProductI...##

## i Use `spec()` to retrieve the full column specification for this data.

## i Specify the column types or set `show_col_types = FALSE` to quiet this message.# Let's take a glimpse at the structure of the data. We see

# that there are 8252 observations, and 21 variables along

# with the first couple of values of each variable

subscriptions %>%

glimpse()## Rows: 8,252

## Columns: 21

## $ SubscriptionID <dbl> 1000687, 1000823, 1001~

## $ CustomerID <dbl> 286997, 659050, 608896~

## $ ProductID <dbl> 8, 5, 3, 8, 8, 8, 8, 8~

## $ Pattern <chr> "1111110", "1111110", ~

## $ StartDate <chr> "13/02/2010", "30/01/2~

## $ EndDate <chr> "14/08/2010", "27/02/2~

## $ NbrNewspapers <dbl> 152, 25, 25, 25, 25, 3~

## $ NbrStart <dbl> 10, 10, 25, 25, 25, 10~

## $ RenewalDate <chr> "15/07/2010", "11/02/2~

## $ PaymentType <chr> "BT", "DD", "DD", "BT"~

## $ PaymentStatus <chr> "Paid", "Paid", "Paid"~

## $ PaymentDate <chr> "09/02/2010", "20/01/2~

## $ FormulaID <dbl> 8636, 9417, 5389, 4688~

## $ GrossFormulaPrice <dbl> 148.0, 27.0, 22.9, 22.~

## $ NetFormulaPrice <dbl> 148.0, 27.0, 22.9, 22.~

## $ NetNewspaperPrice <dbl> 0.973684, 1.080000, 0.~

## $ ProductDiscount <dbl> 0, 0, 0, 0, 0, 0, 0, 0~

## $ FormulaDiscount <dbl> 0, 0, 0, 0, 0, 0, 0, 0~

## $ TotalDiscount <dbl> 0, 0, 0, 0, 0, 0, 0, 0~

## $ TotalPrice <dbl> 148.0, 27.0, 22.9, 22.~

## $ TotalCredit <dbl> 0, 0, 0, 0, 0, 0, 0, 0~# One way to speed up the reading, is to specify the

# classes of the columns (col_types) upfront. For example,

# the Paymentstatus and PaymentType are characters, but it

# better to put them as factor. Sometimes read_delim might

# mix up the decimal separator, so it is good practice to

# specify it with the locale option

# see ?read_delim for more options

subscriptions <- read_delim(file = "subscriptions.txt", delim = ";",

col_names = TRUE, col_types = cols("c", "c", "c", "c", "c",

"c", "i", "i", "c", "f", "f", "c", "c", "n", "n", "n",

"n", "n", "n", "n", "n"), locale = locale(decimal_mark = "."))

# If we are reading in a table for the first time, and we

# don't know the classes, we can use the n_max parameter in

# read_delim

subscriptions <- read_delim(file = "subscriptions.txt", col_names = TRUE,

delim = ";", n_max = 5)## Rows: 5 Columns: 21## -- Column specification --------------------------

## Delimiter: ";"

## chr (6): StartDate, EndDate, RenewalDate, Pay...

## dbl (15): SubscriptionID, CustomerID, ProductI...##

## i Use `spec()` to retrieve the full column specification for this data.

## i Specify the column types or set `show_col_types = FALSE` to quiet this message.subscriptions <- read_delim(file = "subscriptions.txt", col_names = TRUE,

delim = ";", col_types = cols("c", "c", "c", "c", "c", "c",

"i", "i", "c", "f", "f", "c", "c", "n", "n", "n", "n",

"n", "n", "n", "n"))

# Another very fast option is to use the fread function of

# data.table, which is blazingly fast And does not really

# require you to set any other parameters, because

# everything is optimized! p_load(data.table) subscription

# <- fread('subscriptions.txt')Customers table

customers <- read_delim(file = "customers.txt", delim = ";",

col_names = TRUE, col_types = cols("i", "f", "c", "f", "c",

"c"))

# Let's have a glimpse as well

customers %>%

glimpse()## Rows: 1,389

## Columns: 6

## $ CustomerID <int> 106785, 910656, 913085, 65831~

## $ Gender <fct> M, F, M, M, M, , M, M, M, , F~

## $ DOB <chr> "09/11/1934", "16/06/1974", "~

## $ District <fct> 5, 5, 5, 1, 1, 5, 1, 5, 1, 5,~

## $ ZIP <chr> "3910", "3510", "3500", "2800~

## $ StreeID <chr> "46362", "37856", "37513", "2~2.1.2 Working with dates

As you might have noticed, when reading in the data, dates are read in as a character vector. The function as.Date() from the base package creates a Date object. Most systems store dates internally as the number of days (numeric vector) since some origin. When using as.Date or as_date on a numeric vector we need to set the origin. The origin on this system (and most systems) is “1970/01/01”.

# For more information look at the help function ?as.DateThe tidyverse alternative for dates is the lubridate package. For a nice overview of all the functionalities of lubridate, have a look at the cheatsheet: https://rawgit.com/rstudio/cheatsheets/master/lubridate.pdf.

p_load(lubridate)

# ?as_dateLet’s have a closer look how both packages handle dates.

# This is how you find out what the origin is:

Sys.Date() - as.integer(Sys.Date())## [1] "1970-01-01"# This is Today's date:

Sys.Date()## [1] "2022-02-07"# Converting an integer requires an origin:

as.Date(10, origin = "1970/01/01")## [1] "1970-01-11"as_date(10, origin = "1970/01/01")## [1] "1970-01-11"# formats for base Date functions %d day as a number %a

# abbreviated weekday %A unabbreviated weekday %m month %b

# abbreviated month %B unabbreviated month %y 2-digit year

# %Y 4-digit year

# More information: help(strftime) help(ISOdatetime)

# Specifying a date format:

f <- "%d/%m/%Y"

# Subtraction of two dates as Date object using the format:

as.Date("02/01/1970", format = f) - as.Date("01/01/1970", format = f)## Time difference of 1 days# Lubridate does not work with this syntax but rather with

# dmy() = day month year

dmy("02/01/1970") - dmy("01/01/1970")## Time difference of 1 days# Subtraction of two dates as numeric objects:

as.numeric(as.Date("02/01/1970", format = f)) - as.numeric(as.Date("01/01/1970",

format = f))## [1] 1# OR

as.numeric(dmy("02/01/1970")) - as.numeric(dmy("01/01/1970"))## [1] 1# Adding zero days to the origin should be 0:

as.numeric(as.Date(0, origin = "1970/01/01"))## [1] 0# OR

as.numeric(as_date(0, origin = "1970/01/01"))## [1] 0Now let’s apply this knowledge, to our data sets.

# For the subscriptions table Let's just have a look at a

# data variable to know the format

subscriptions %>%

pull(StartDate) %>%

head()## [1] "13/02/2010" "30/01/2010" "30/01/2010"

## [4] "13/02/2010" "16/01/2010" "14/02/2010"# Get the positions of the date variables

(vars <- which(names(subscriptions) %in% c("StartDate", "EndDate",

"PaymentDate", "RenewalDate")))## [1] 5 6 9 12# Transform to dates

subscriptions[, vars] <- subscriptions[, vars] %>%

map_df(., function(x) dmy(x))

# Check whether everything is okay You will notice that the

# desired variables have changed to 'date'

subscriptions %>%

glimpse()## Rows: 8,252

## Columns: 21

## $ SubscriptionID <chr> "1000687", "1000823", ~

## $ CustomerID <chr> "286997", "659050", "6~

## $ ProductID <chr> "8", "5", "3", "8", "8~

## $ Pattern <chr> "1111110", "1111110", ~

## $ StartDate <date> 2010-02-13, 2010-01-3~

## $ EndDate <date> 2010-08-14, 2010-02-2~

## $ NbrNewspapers <int> 152, 25, 25, 25, 25, 3~

## $ NbrStart <int> 10, 10, 25, 25, 25, 10~

## $ RenewalDate <date> 2010-07-15, 2010-02-1~

## $ PaymentType <fct> BT, DD, DD, BT, BT, BT~

## $ PaymentStatus <fct> Paid, Paid, Paid, Paid~

## $ PaymentDate <date> 2010-02-09, 2010-01-2~

## $ FormulaID <chr> "8636", "9417", "5389"~

## $ GrossFormulaPrice <dbl> 148.0, 27.0, 22.9, 22.~

## $ NetFormulaPrice <dbl> 148.0, 27.0, 22.9, 22.~

## $ NetNewspaperPrice <dbl> 0.973684, 1.080000, 0.~

## $ ProductDiscount <dbl> 0, 0, 0, 0, 0, 0, 0, 0~

## $ FormulaDiscount <dbl> 0, 0, 0, 0, 0, 0, 0, 0~

## $ TotalDiscount <dbl> 0, 0, 0, 0, 0, 0, 0, 0~

## $ TotalPrice <dbl> 148.0, 27.0, 22.9, 22.~

## $ TotalCredit <dbl> 0, 0, 0, 0, 0, 0, 0, 0~subscriptions %>%

pull(StartDate) %>%

head()## [1] "2010-02-13" "2010-01-30" "2010-01-30"

## [4] "2010-02-13" "2010-01-16" "2010-02-14"# For the customers table

customers$DOB <- dmy(customers$DOB)2.1.3 Data exploration

To get an understanding of the data, we will perform some statistical and visual data exploration.

Basic commands

# What are the dimensions of the data? The first number is

# the number of rows, the second number is the number of

# columns?

dim(subscriptions)## [1] 8252 21nrow(subscriptions) #same as dim(subscriptions)[1]## [1] 8252ncol(subscriptions) #same as dim(subscriptions)[2]## [1] 21# Look at the structure of the object

# str(subscriptions,vec.len=0.5)

subscriptions %>%

glimpse()## Rows: 8,252

## Columns: 21

## $ SubscriptionID <chr> "1000687", "1000823", ~

## $ CustomerID <chr> "286997", "659050", "6~

## $ ProductID <chr> "8", "5", "3", "8", "8~

## $ Pattern <chr> "1111110", "1111110", ~

## $ StartDate <date> 2010-02-13, 2010-01-3~

## $ EndDate <date> 2010-08-14, 2010-02-2~

## $ NbrNewspapers <int> 152, 25, 25, 25, 25, 3~

## $ NbrStart <int> 10, 10, 25, 25, 25, 10~

## $ RenewalDate <date> 2010-07-15, 2010-02-1~

## $ PaymentType <fct> BT, DD, DD, BT, BT, BT~

## $ PaymentStatus <fct> Paid, Paid, Paid, Paid~

## $ PaymentDate <date> 2010-02-09, 2010-01-2~

## $ FormulaID <chr> "8636", "9417", "5389"~

## $ GrossFormulaPrice <dbl> 148.0, 27.0, 22.9, 22.~

## $ NetFormulaPrice <dbl> 148.0, 27.0, 22.9, 22.~

## $ NetNewspaperPrice <dbl> 0.973684, 1.080000, 0.~

## $ ProductDiscount <dbl> 0, 0, 0, 0, 0, 0, 0, 0~

## $ FormulaDiscount <dbl> 0, 0, 0, 0, 0, 0, 0, 0~

## $ TotalDiscount <dbl> 0, 0, 0, 0, 0, 0, 0, 0~

## $ TotalPrice <dbl> 148.0, 27.0, 22.9, 22.~

## $ TotalCredit <dbl> 0, 0, 0, 0, 0, 0, 0, 0~# Display the first couple of rows

head(subscriptions)## # A tibble: 6 x 21

## SubscriptionID CustomerID ProductID Pattern

## <chr> <chr> <chr> <chr>

## 1 1000687 286997 8 1111110

## 2 1000823 659050 5 1111110

## 3 1001004 608896 3 1111110

## 4 1001130 799769 8 1111110

## 5 1001564 451025 8 1111110

## 6 1002005 273071 8 1111110

## # ... with 17 more variables: StartDate <date>,

## # EndDate <date>, NbrNewspapers <int>,

## # NbrStart <int>, RenewalDate <date>,

## # PaymentType <fct>, PaymentStatus <fct>,

## # PaymentDate <date>, FormulaID <chr>,

## # GrossFormulaPrice <dbl>,

## # NetFormulaPrice <dbl>, ...# Display the last couple of rows

tail(subscriptions)## # A tibble: 6 x 21

## SubscriptionID CustomerID ProductID Pattern

## <chr> <chr> <chr> <chr>

## 1 999409 654047 7 1111110

## 2 999518 677422 6 1111110

## 3 999536 735141 3 0001000

## 4 999592 724712 2 1111110

## 5 999701 497901 8 1111110

## 6 999848 1115876 1 1111110

## # ... with 17 more variables: StartDate <date>,

## # EndDate <date>, NbrNewspapers <int>,

## # NbrStart <int>, RenewalDate <date>,

## # PaymentType <fct>, PaymentStatus <fct>,

## # PaymentDate <date>, FormulaID <chr>,

## # GrossFormulaPrice <dbl>,

## # NetFormulaPrice <dbl>, ...# How long is a vector? This is the same as

# nrow(subscriptions)

length(subscriptions$PaymentStatus)## [1] 8252# What are the column names?

colnames(subscriptions) #or names(subscriptions)## [1] "SubscriptionID" "CustomerID"

## [3] "ProductID" "Pattern"

## [5] "StartDate" "EndDate"

## [7] "NbrNewspapers" "NbrStart"

## [9] "RenewalDate" "PaymentType"

## [11] "PaymentStatus" "PaymentDate"

## [13] "FormulaID" "GrossFormulaPrice"

## [15] "NetFormulaPrice" "NetNewspaperPrice"

## [17] "ProductDiscount" "FormulaDiscount"

## [19] "TotalDiscount" "TotalPrice"

## [21] "TotalCredit"# Look at a random subset of the data.

subscriptions[sample(1:nrow(subscriptions), 5), ]## # A tibble: 5 x 21

## SubscriptionID CustomerID ProductID Pattern

## <chr> <chr> <chr> <chr>

## 1 532760 671127 4 1111110

## 2 940370 104207 8 1111110

## 3 984652 1006986 7 1111110

## 4 189782 216602 8 1111110

## 5 721117 599124 3 1111110

## # ... with 17 more variables: StartDate <date>,

## # EndDate <date>, NbrNewspapers <int>,

## # NbrStart <int>, RenewalDate <date>,

## # PaymentType <fct>, PaymentStatus <fct>,

## # PaymentDate <date>, FormulaID <chr>,

## # GrossFormulaPrice <dbl>,

## # NetFormulaPrice <dbl>, ...# Frequencies

table(subscriptions$PaymentStatus)##

## Paid Not Paid

## 7831 421Visual data exploration

One of the major strengths of R is the plots and the superb plotting package ggplot2. Whilst the goal of this book is not to provide a comprehensive overview of all the plotting abilites of base R and ggplot2, we will briefly discuss some of the more important commands.

Remember that the ggplot2 syntax always looks like this:

-Data : ggplot(data = , ...)

-Mapping (aesthetics): mapping = aes(x = , y = ), if you want to add grouping variables use the col and fill option.

-Geometric object (geom): geom_point() if no data our mapping argument are specified this object inherits the data and the aesthetics from the ggplot() function.

-Summary stats: stat_smooth(method = 'loess')

#Many functions are object-oriented: the same function

#reacts differently to different data types, this is called method dispatching

#The plot function in base R works like this, as well as the qplot function

#of ggplot2

plot(subscriptions$PaymentStatus)

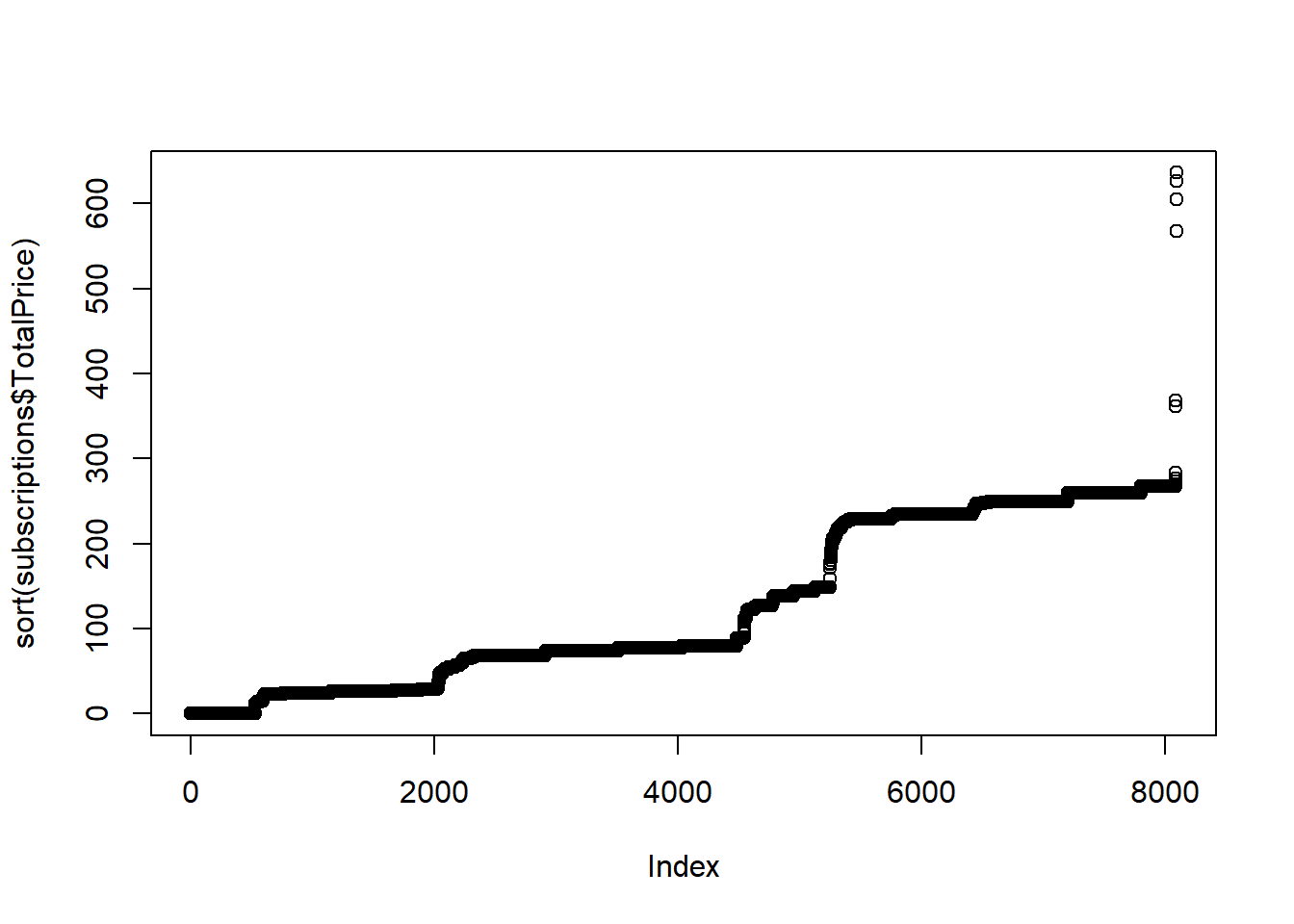

plot(sort(subscriptions$TotalPrice))

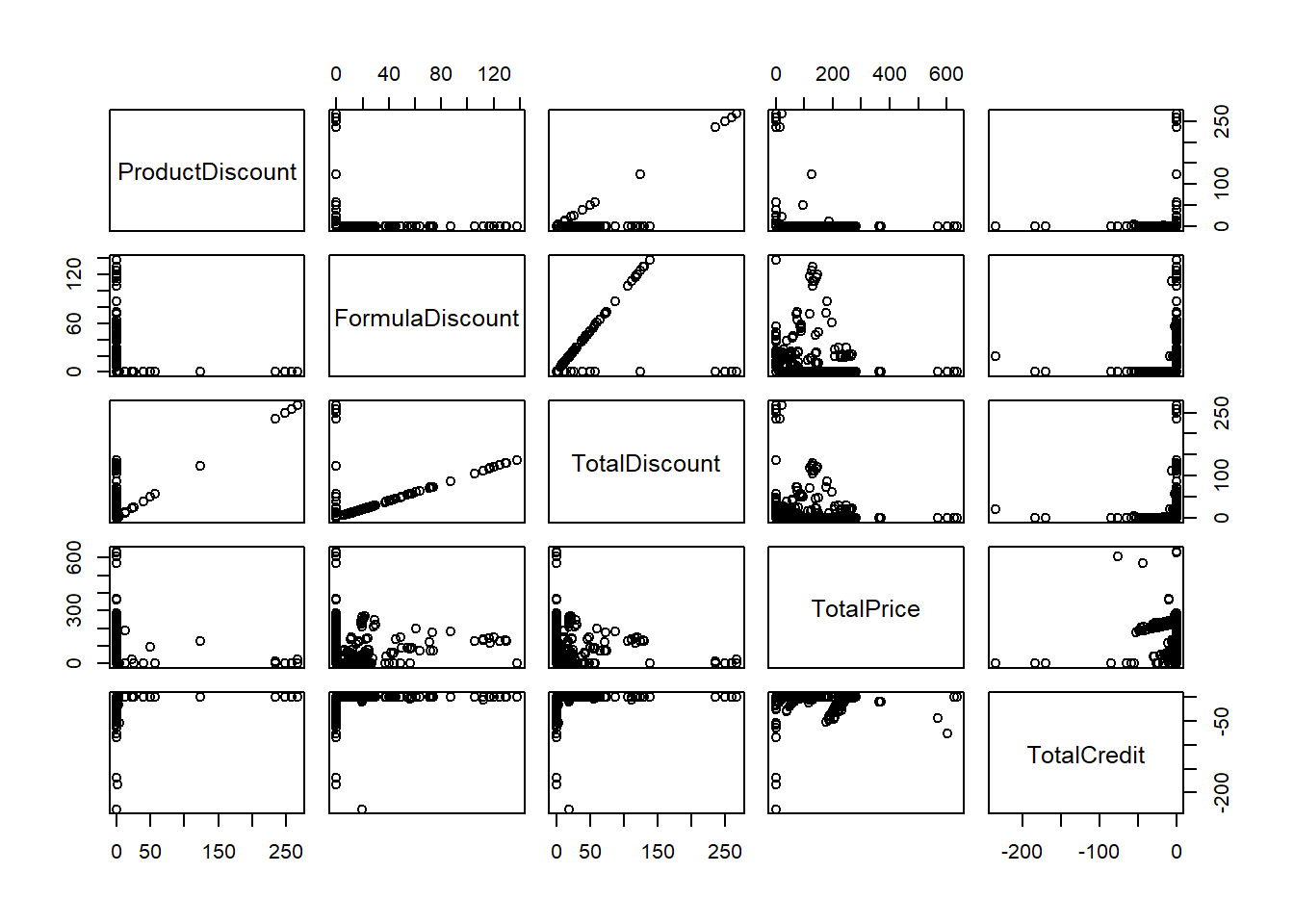

pairs(subscriptions[,17:21]) # a scatterplot matrix of variables in the data

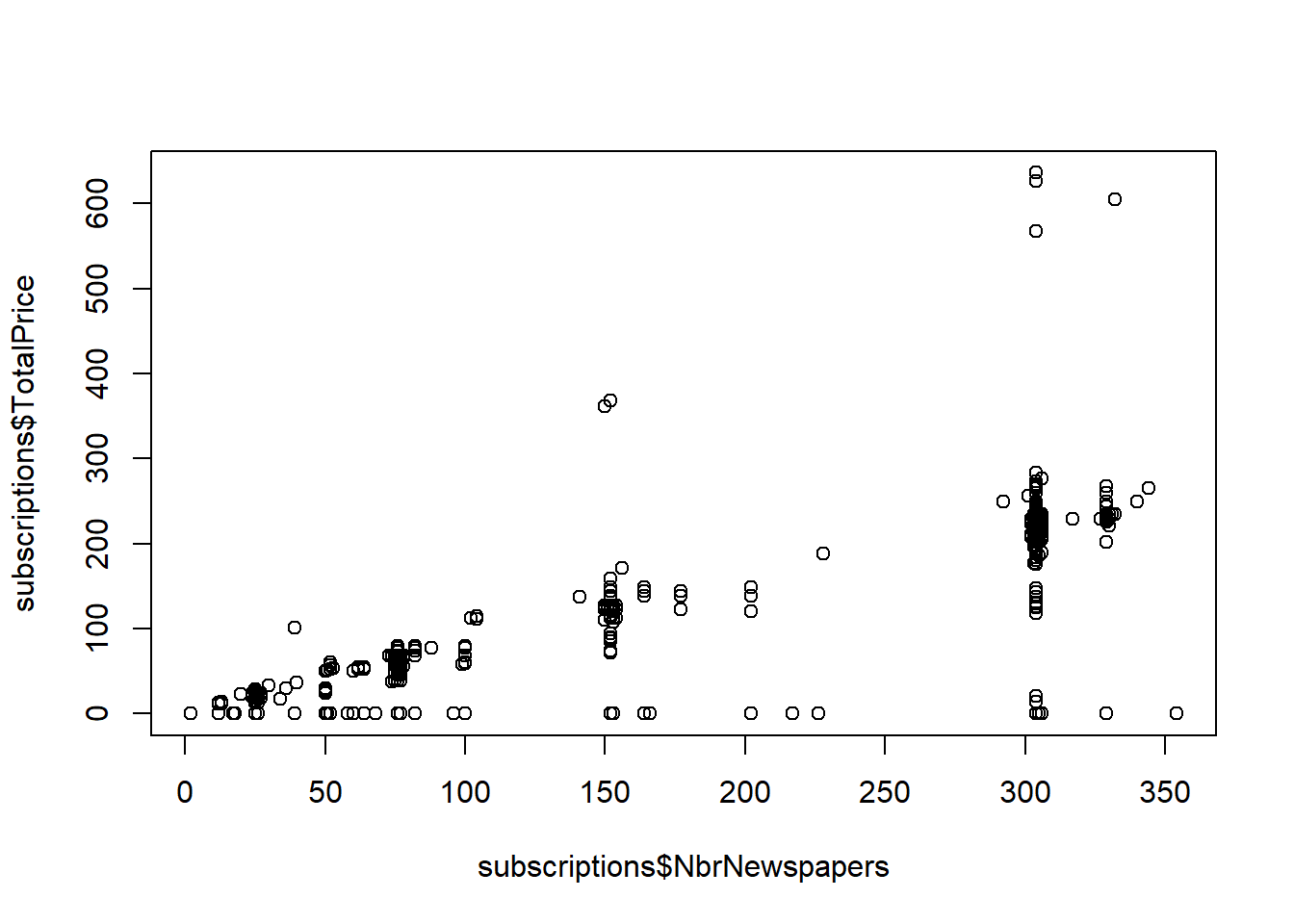

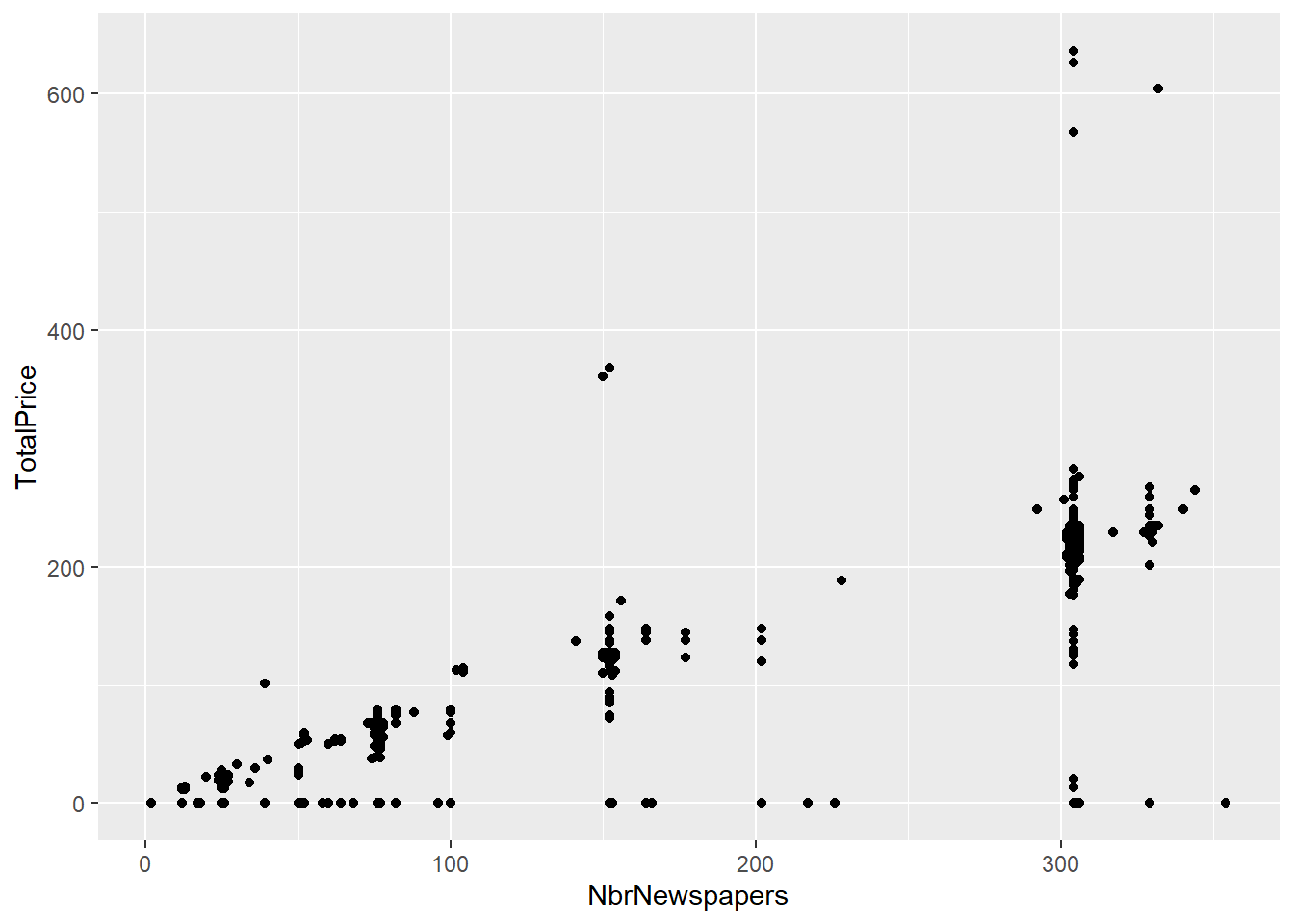

#Scatterplot

plot(subscriptions$NbrNewspapers,subscriptions$TotalPrice)

#Or with ggplot

subscriptions %>% ggplot(., aes(NbrNewspapers, TotalPrice)) + geom_point()

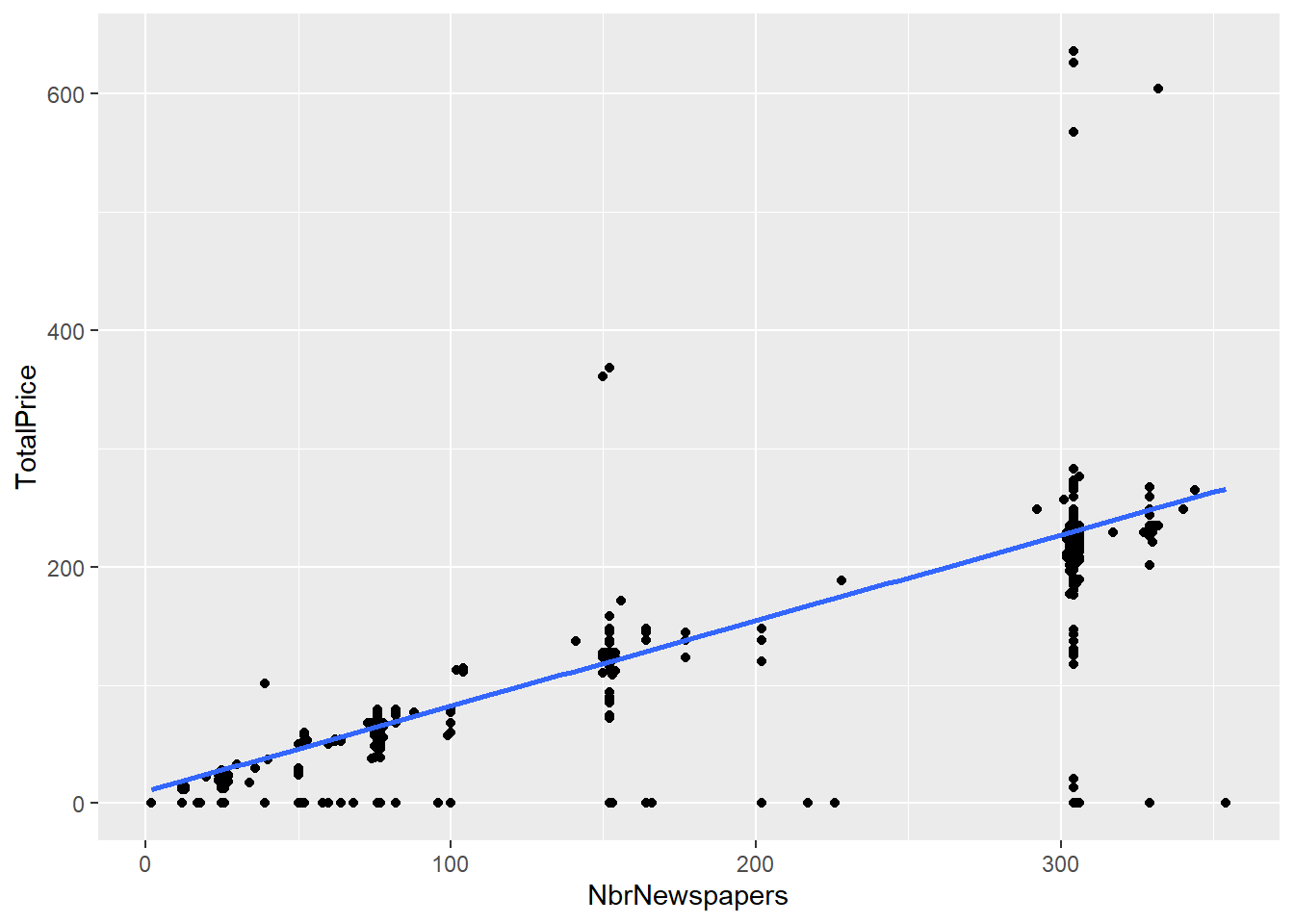

#Add a regression line

subscriptions %>% ggplot(., aes(NbrNewspapers, TotalPrice)) + geom_point() +

stat_smooth(method = "lm")## `geom_smooth()` using formula 'y ~ x'

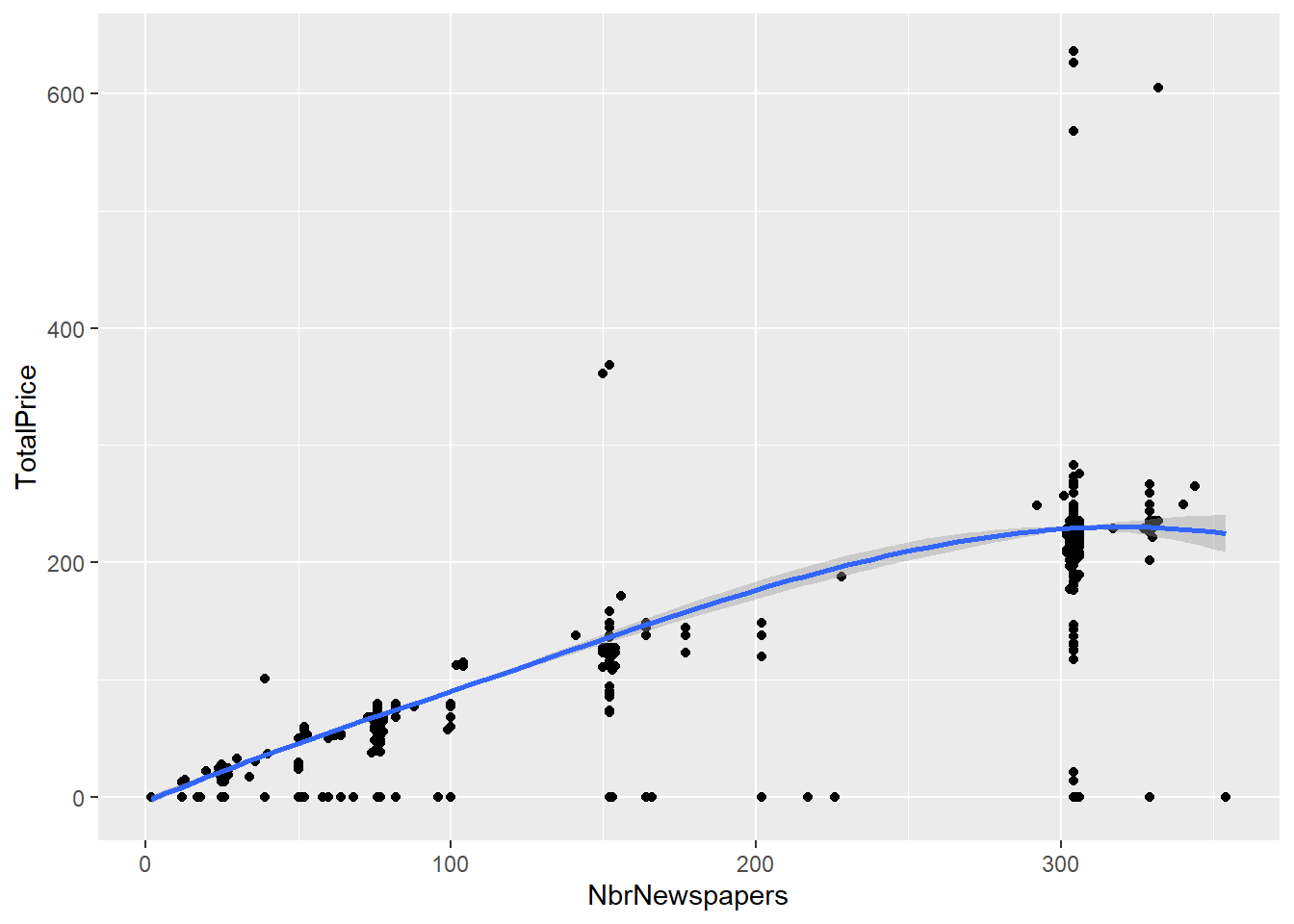

#Or a loess smoother

subscriptions %>% ggplot(., aes(NbrNewspapers, TotalPrice)) + geom_point() +

stat_smooth(method = "loess")## `geom_smooth()` using formula 'y ~ x'

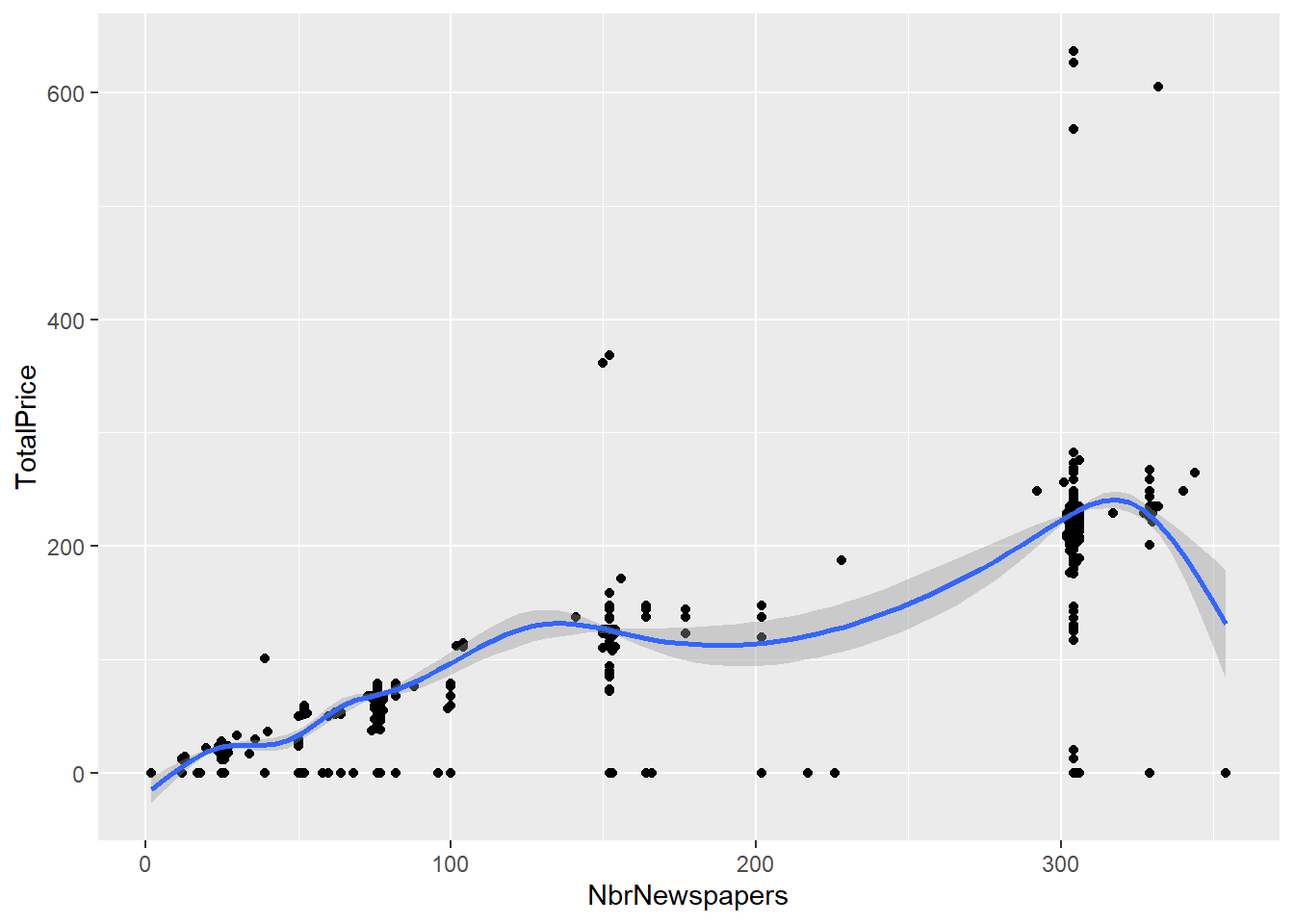

#You can even build a GAM with a cubic regression spline

subscriptions %>% ggplot(., aes(NbrNewspapers, TotalPrice)) + geom_point() +

stat_smooth(method = "gam")## `geom_smooth()` using formula 'y ~ s(x, bs = "cs")'

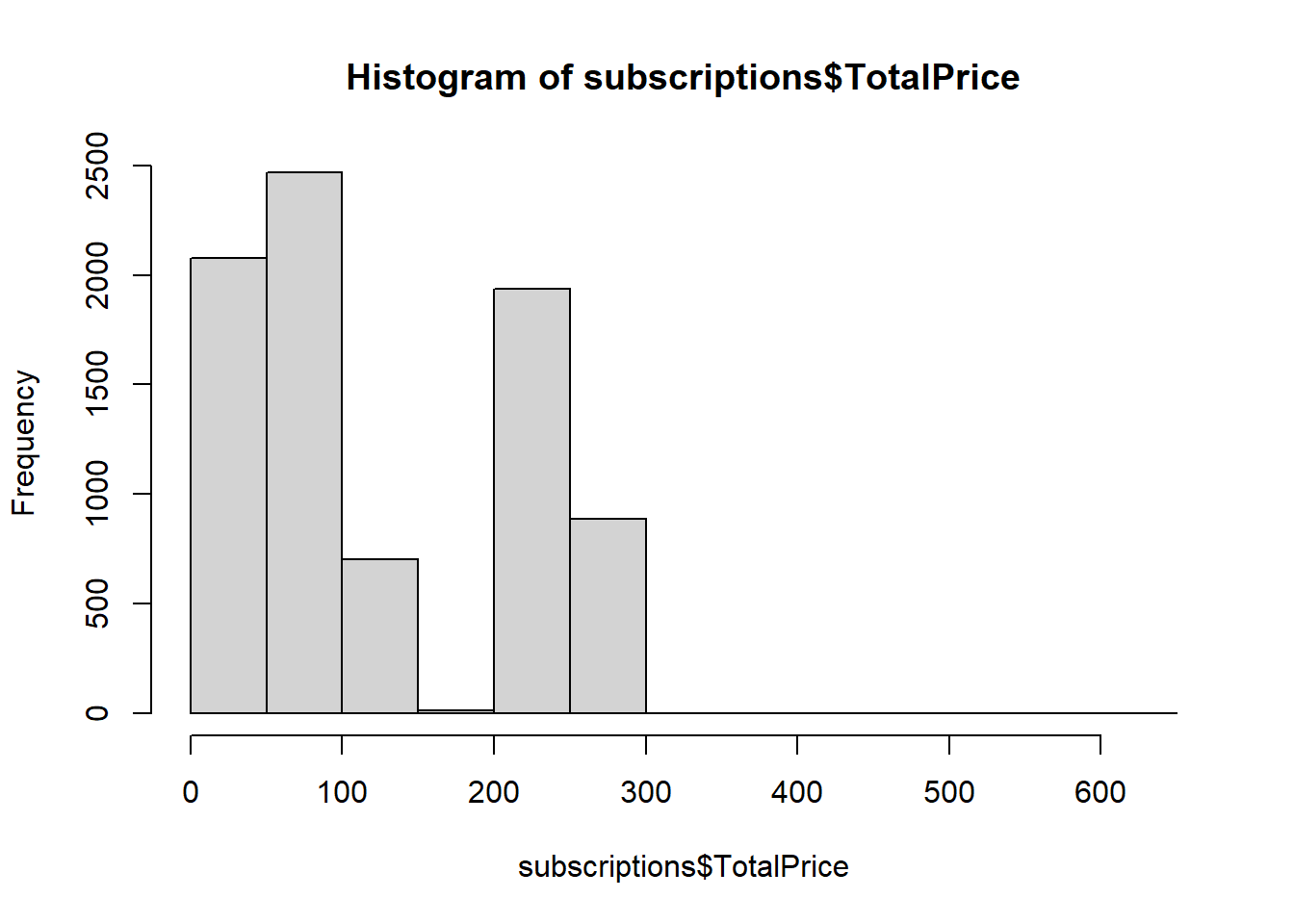

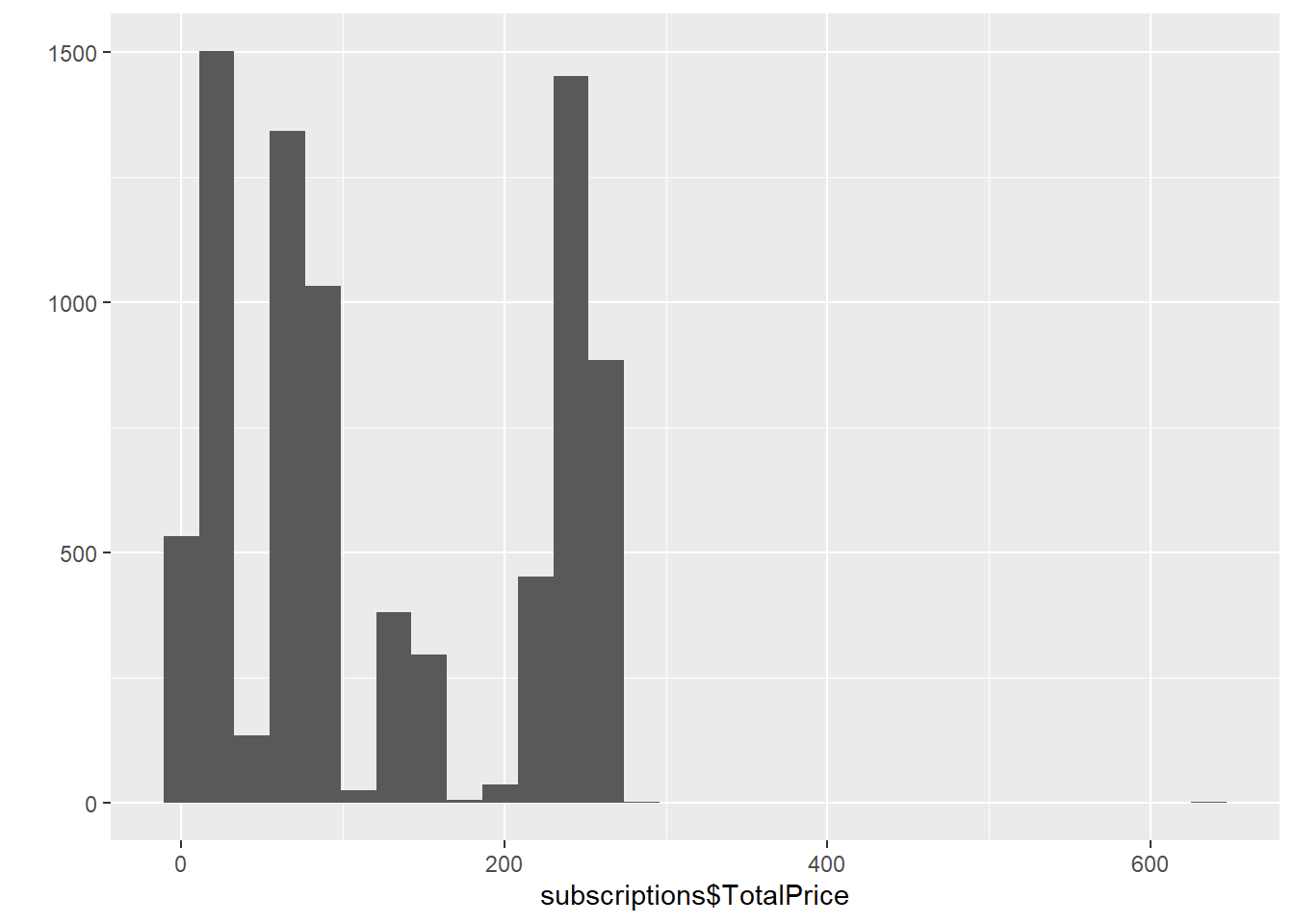

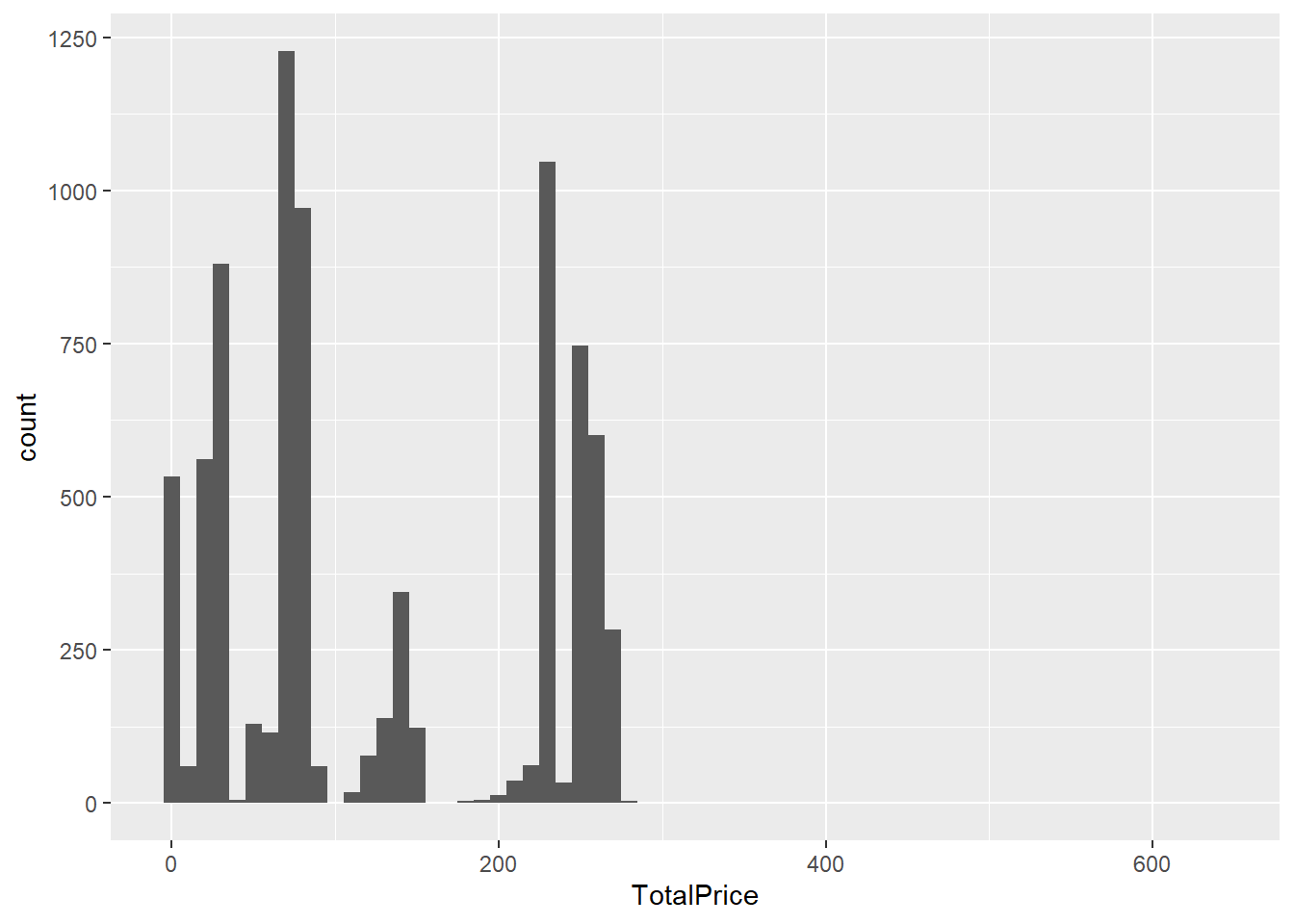

#A histogram of TotalPrice

hist(subscriptions$TotalPrice)

qplot(subscriptions$TotalPrice)## `stat_bin()` using `bins = 30`. Pick better

## value with `binwidth`.

subscriptions %>% ggplot(., aes(TotalPrice)) + geom_histogram(binwidth = 10)

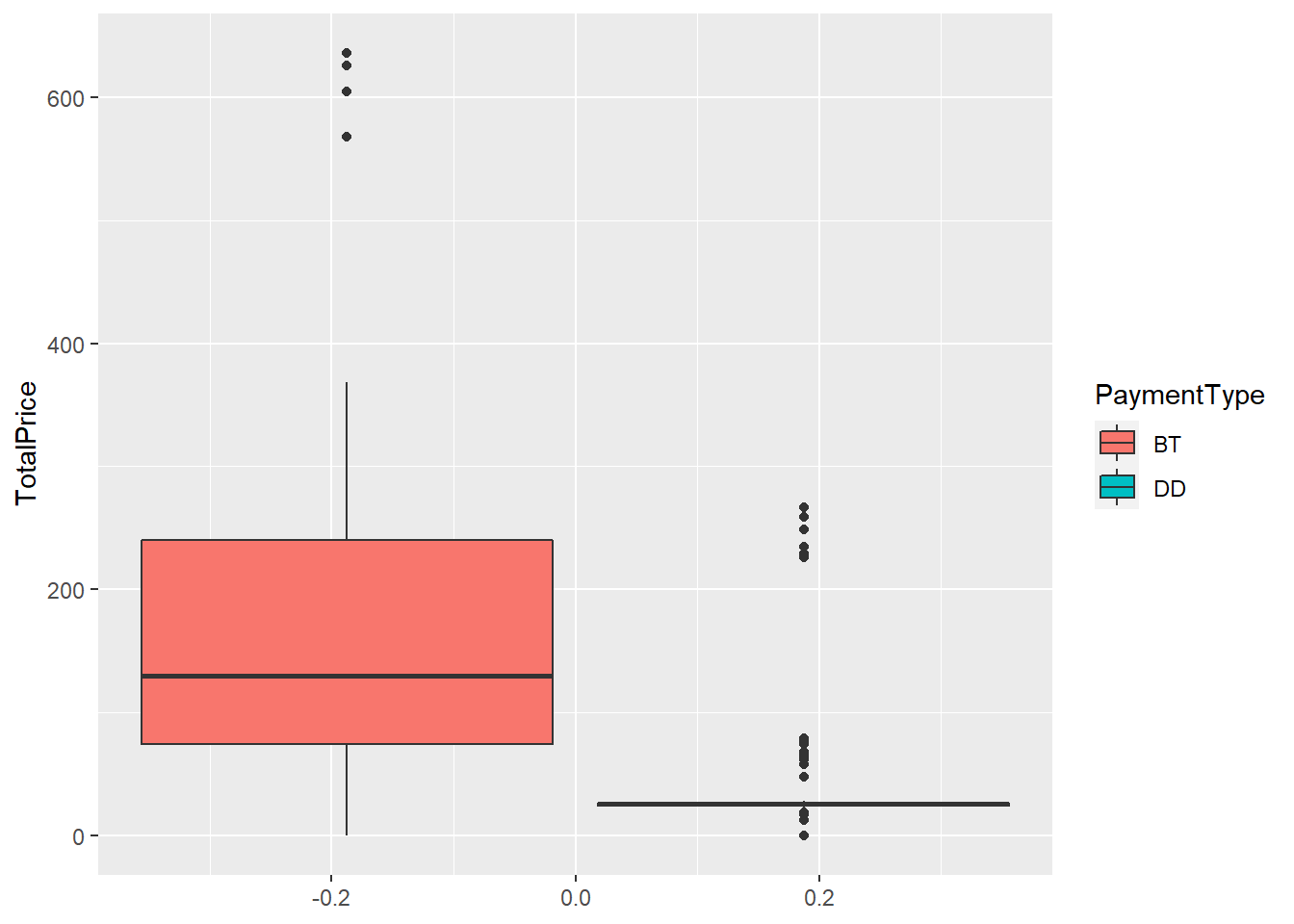

#A box plot of total price and payment type

subscriptions %>% ggplot(., aes(y = TotalPrice, fill = PaymentType)) +

geom_boxplot()

Statistical data exploration

#summarize a factor

summary(subscriptions$PaymentStatus)## Paid Not Paid

## 7831 421#summarize a numeric variable

summary(subscriptions$TotalPrice)## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 0.0 29.6 79.0 125.4 235.0 636.0

## NA's

## 161#Mean

mean(subscriptions$TotalPrice, na.rm=TRUE)## [1] 125.372#Variance

var(subscriptions$TotalPrice, na.rm=TRUE)## [1] 9047.803#Standard deviation

sd(subscriptions$TotalPrice, na.rm=TRUE)## [1] 95.11994#Which values are not missing in TotalPrice?

head(!is.na(subscriptions$TotalPrice))## [1] TRUE TRUE TRUE TRUE TRUE TRUE#Correlation between two variables

cor(subscriptions$TotalPrice[!is.na(subscriptions$TotalPrice)],

subscriptions$NbrNewspapers[!is.na(subscriptions$TotalPrice)])## [1] 0.8988953#Range of a variable

range(subscriptions$TotalPrice[!is.na(subscriptions$TotalPrice)])## [1] 0.00 635.96#Minimum

min(subscriptions$TotalPrice, na.rm=TRUE)## [1] 0#Maximum

max(subscriptions$TotalPrice, na.rm=TRUE)## [1] 635.96#Is this a numeric vector?

is.numeric(subscriptions$TotalPrice)## [1] TRUEis.numeric(subscriptions$CustomerID)## [1] FALSE#It is much easier to plot all the statistic in one table for all variables

#The summary function can be messy though ...

summary(subscriptions)## SubscriptionID CustomerID

## Length:8252 Length:8252

## Class :character Class :character

## Mode :character Mode :character

##

##

##

##

## ProductID Pattern

## Length:8252 Length:8252

## Class :character Class :character

## Mode :character Mode :character

##

##

##

##

## StartDate EndDate

## Min. :2006-01-02 Min. :2007-01-02

## 1st Qu.:2007-09-30 1st Qu.:2008-03-08

## Median :2008-10-01 Median :2009-03-17

## Mean :2008-09-09 Mean :2009-03-11

## 3rd Qu.:2009-09-11 3rd Qu.:2010-02-18

## Max. :2011-02-24 Max. :2011-03-02

##

## NbrNewspapers NbrStart

## Min. : 2.0 Min. : 0

## 1st Qu.: 76.0 1st Qu.:10

## Median : 77.0 Median :10

## Mean :159.8 Mean :15

## 3rd Qu.:304.0 3rd Qu.:25

## Max. :354.0 Max. :30

## NA's :21

## RenewalDate PaymentType PaymentStatus

## Min. :2007-09-26 BT:6743 Paid :7831

## 1st Qu.:2008-09-01 DD:1509 Not Paid: 421

## Median :2009-06-01

## Mean :2009-06-08

## 3rd Qu.:2010-03-22

## Max. :2011-02-02

## NA's :2020

## PaymentDate FormulaID

## Min. :2005-12-14 Length:8252

## 1st Qu.:2007-08-30 Class :character

## Median :2008-09-15 Mode :character

## Mean :2008-08-17

## 3rd Qu.:2009-08-14

## Max. :2011-01-27

## NA's :421

## GrossFormulaPrice NetFormulaPrice

## Min. : 0.1697 Min. : 0.0

## 1st Qu.: 68.0000 1st Qu.: 68.0

## Median : 79.0000 Median : 79.0

## Mean :135.8778 Mean :133.3

## 3rd Qu.:235.0000 3rd Qu.:235.0

## Max. :310.9143 Max. :276.0

## NA's :161 NA's :161

## NetNewspaperPrice ProductDiscount

## Min. :0.0000 Min. : 0.000

## 1st Qu.:0.8092 1st Qu.: 0.000

## Median :0.8783 Median : 0.000

## Mean :0.8562 Mean : 2.459

## 3rd Qu.:0.9737 3rd Qu.: 0.000

## Max. :1.1200 Max. :267.000

## NA's :161 NA's :161

## FormulaDiscount TotalDiscount TotalPrice

## Min. : 0.000 Min. : 0 Min. : 0.0

## 1st Qu.: 0.000 1st Qu.: 0 1st Qu.: 29.6

## Median : 0.000 Median : 0 Median : 79.0

## Mean : 2.541 Mean : 5 Mean :125.4

## 3rd Qu.: 0.000 3rd Qu.: 0 3rd Qu.:235.0

## Max. :138.000 Max. :267 Max. :636.0

## NA's :161 NA's :161 NA's :161

## TotalCredit

## Min. :-235.0001

## 1st Qu.: 0.0000

## Median : 0.0000

## Mean : -0.5294

## 3rd Qu.: 0.0000

## Max. : 0.0000

## NA's :161#the psych package contains a nice describe function

p_load(psych)

psych::describe(subscriptions)## vars n mean sd

## SubscriptionID* 1 8252 4126.50 2382.29

## CustomerID* 2 8252 753.91 367.79

## ProductID* 3 8252 6.25 2.32

## Pattern* 4 8252 10.89 0.99

## StartDate 5 8252 NaN NA

## EndDate 6 8252 NaN NA

## NbrNewspapers 7 8252 159.82 117.97

## NbrStart 8 8231 15.00 7.29

## RenewalDate 9 6232 NaN NA

## PaymentType* 10 8252 1.18 0.39

## PaymentStatus* 11 8252 1.05 0.22

## PaymentDate 12 7831 NaN NA

## FormulaID* 13 8252 475.12 135.58

## GrossFormulaPrice 14 8091 135.88 92.60

## NetFormulaPrice 15 8091 133.34 93.25

## NetNewspaperPrice 16 8091 0.86 0.20

## ProductDiscount 17 8091 2.46 24.60

## FormulaDiscount 18 8091 2.54 10.73

## TotalDiscount 19 8091 5.00 26.60

## TotalPrice 20 8091 125.37 95.12

## TotalCredit 21 8091 -0.53 5.01

## median trimmed mad min

## SubscriptionID* 4126.50 4126.50 3058.60 1.00

## CustomerID* 773.00 760.04 440.33 1.00

## ProductID* 8.00 6.63 0.00 1.00

## Pattern* 11.00 11.00 0.00 1.00

## StartDate NA NaN NA Inf

## EndDate NA NaN NA Inf

## NbrNewspapers 77.00 158.51 78.58 2.00

## NbrStart 10.00 14.69 0.00 0.00

## RenewalDate NA NaN NA Inf

## PaymentType* 1.00 1.10 0.00 1.00

## PaymentStatus* 1.00 1.00 0.00 1.00

## PaymentDate NA NaN NA Inf

## FormulaID* 517.00 501.86 47.44 1.00

## GrossFormulaPrice 79.00 134.26 82.14 0.17

## NetFormulaPrice 79.00 131.66 82.14 0.00

## NetNewspaperPrice 0.88 0.89 0.14 0.00

## ProductDiscount 0.00 0.00 0.00 0.00

## FormulaDiscount 0.00 0.00 0.00 0.00

## TotalDiscount 0.00 0.08 0.00 0.00

## TotalPrice 79.00 122.84 83.17 0.00

## TotalCredit 0.00 0.00 0.00 -235.00

## max range skew kurtosis

## SubscriptionID* 8252.00 8251.00 0.00 -1.20

## CustomerID* 1389.00 1388.00 -0.12 -1.00

## ProductID* 8.00 7.00 -1.06 -0.28

## Pattern* 11.00 10.00 -9.43 87.99

## StartDate -Inf -Inf NA NA

## EndDate -Inf -Inf NA NA

## NbrNewspapers 354.00 352.00 0.29 -1.70

## NbrStart 30.00 30.00 0.46 -1.28

## RenewalDate -Inf -Inf NA NA

## PaymentType* 2.00 1.00 1.64 0.69

## PaymentStatus* 2.00 1.00 4.08 14.65

## PaymentDate -Inf -Inf NA NA

## FormulaID* 621.00 620.00 -1.72 2.15

## GrossFormulaPrice 310.91 310.74 0.24 -1.64

## NetFormulaPrice 276.00 276.00 0.25 -1.62

## NetNewspaperPrice 1.12 1.12 -2.57 8.46

## ProductDiscount 267.00 267.00 10.07 99.78

## FormulaDiscount 138.00 138.00 7.08 64.03

## TotalDiscount 267.00 267.00 8.14 70.76

## TotalPrice 635.96 635.96 0.37 -1.23

## TotalCredit 0.00 235.00 -26.81 1008.08

## se

## SubscriptionID* 26.22

## CustomerID* 4.05

## ProductID* 0.03

## Pattern* 0.01

## StartDate NA

## EndDate NA

## NbrNewspapers 1.30

## NbrStart 0.08

## RenewalDate NA

## PaymentType* 0.00

## PaymentStatus* 0.00

## PaymentDate NA

## FormulaID* 1.49

## GrossFormulaPrice 1.03

## NetFormulaPrice 1.04

## NetNewspaperPrice 0.00

## ProductDiscount 0.27

## FormulaDiscount 0.12

## TotalDiscount 0.30

## TotalPrice 1.06

## TotalCredit 0.062.1.4 Data quality

As mentioned in the slides, the most common data quality issues are:

- multicollinearity,

- missings values

- and outliers.

We will show in this section how to detect and hndle these issues.

2.1.4.1 Multicollinearity

Some basic correlation checking functions from base R:

# To check correlation, you must only focus on numeric

# variables

num <- subscriptions %>%

select_if(is.numeric)

# The cor function is the basic function, use =

# 'complete.obs' This makes sure that NAs are removes The

# pearson correlation is used by default

cor(num, use = "complete.obs")## NbrNewspapers NbrStart

## NbrNewspapers 1.000000000 -0.005760365

## NbrStart -0.005760365 1.000000000

## GrossFormulaPrice 0.993094452 -0.047692429

## NetFormulaPrice 0.987601066 -0.066964648

## NetNewspaperPrice -0.263394477 -0.089530891

## ProductDiscount 0.118920801 0.002573026

## FormulaDiscount -0.013726229 0.170440557

## TotalDiscount 0.104439967 0.071086115

## TotalPrice 0.898755683 -0.047748444

## TotalCredit -0.076992126 -0.062646229

## GrossFormulaPrice

## NbrNewspapers 0.993094452

## NbrStart -0.047692429

## GrossFormulaPrice 1.000000000

## NetFormulaPrice 0.993357985

## NetNewspaperPrice -0.239253882

## ProductDiscount 0.123407907

## FormulaDiscount -0.004171282

## TotalDiscount 0.112441179

## TotalPrice 0.894965233

## TotalCredit -0.070708252

## NetFormulaPrice

## NbrNewspapers 0.98760107

## NbrStart -0.06696465

## GrossFormulaPrice 0.99335798

## NetFormulaPrice 1.00000000

## NetNewspaperPrice -0.19170938

## ProductDiscount 0.12525766

## FormulaDiscount -0.11920740

## TotalDiscount 0.06777928

## TotalPrice 0.90130644

## TotalCredit -0.07160146

## NetNewspaperPrice

## NbrNewspapers -0.26339448

## NbrStart -0.08953089

## GrossFormulaPrice -0.23925388

## NetFormulaPrice -0.19170938

## NetNewspaperPrice 1.00000000

## ProductDiscount -0.42322276

## FormulaDiscount -0.39838536

## TotalDiscount -0.55197344

## TotalPrice -0.07438657

## TotalCredit 0.10630468

## ProductDiscount FormulaDiscount

## NbrNewspapers 0.118920801 -0.013726229

## NbrStart 0.002573026 0.170440557

## GrossFormulaPrice 0.123407907 -0.004171282

## NetFormulaPrice 0.125257660 -0.119207403

## NetNewspaperPrice -0.423222763 -0.398385356

## ProductDiscount 1.000000000 -0.023713925

## FormulaDiscount -0.023713925 1.000000000

## TotalDiscount 0.915200448 0.381182609

## TotalPrice -0.130254808 -0.110503163

## TotalCredit 0.010150644 0.012139029

## TotalDiscount TotalPrice

## NbrNewspapers 0.10443997 0.89875568

## NbrStart 0.07108612 -0.04774844

## GrossFormulaPrice 0.11244118 0.89496523

## NetFormulaPrice 0.06777928 0.90130644

## NetNewspaperPrice -0.55197344 -0.07438657

## ProductDiscount 0.91520045 -0.13025481

## FormulaDiscount 0.38118261 -0.11050316

## TotalDiscount 1.00000000 -0.16499960

## TotalPrice -0.16499960 1.00000000

## TotalCredit 0.01428030 -0.03404007

## TotalCredit

## NbrNewspapers -0.07699213

## NbrStart -0.06264623

## GrossFormulaPrice -0.07070825

## NetFormulaPrice -0.07160146

## NetNewspaperPrice 0.10630468

## ProductDiscount 0.01015064

## FormulaDiscount 0.01213903

## TotalDiscount 0.01428030

## TotalPrice -0.03404007

## TotalCredit 1.00000000# To make this less messy, you can round the number

round(cor(num, use = "complete.obs"), 2)## NbrNewspapers NbrStart

## NbrNewspapers 1.00 -0.01

## NbrStart -0.01 1.00

## GrossFormulaPrice 0.99 -0.05

## NetFormulaPrice 0.99 -0.07

## NetNewspaperPrice -0.26 -0.09

## ProductDiscount 0.12 0.00

## FormulaDiscount -0.01 0.17

## TotalDiscount 0.10 0.07

## TotalPrice 0.90 -0.05

## TotalCredit -0.08 -0.06

## GrossFormulaPrice

## NbrNewspapers 0.99

## NbrStart -0.05

## GrossFormulaPrice 1.00

## NetFormulaPrice 0.99

## NetNewspaperPrice -0.24

## ProductDiscount 0.12

## FormulaDiscount 0.00

## TotalDiscount 0.11

## TotalPrice 0.89

## TotalCredit -0.07

## NetFormulaPrice

## NbrNewspapers 0.99

## NbrStart -0.07

## GrossFormulaPrice 0.99

## NetFormulaPrice 1.00

## NetNewspaperPrice -0.19

## ProductDiscount 0.13

## FormulaDiscount -0.12

## TotalDiscount 0.07

## TotalPrice 0.90

## TotalCredit -0.07

## NetNewspaperPrice

## NbrNewspapers -0.26

## NbrStart -0.09

## GrossFormulaPrice -0.24

## NetFormulaPrice -0.19

## NetNewspaperPrice 1.00

## ProductDiscount -0.42

## FormulaDiscount -0.40

## TotalDiscount -0.55

## TotalPrice -0.07

## TotalCredit 0.11

## ProductDiscount FormulaDiscount

## NbrNewspapers 0.12 -0.01

## NbrStart 0.00 0.17

## GrossFormulaPrice 0.12 0.00

## NetFormulaPrice 0.13 -0.12

## NetNewspaperPrice -0.42 -0.40

## ProductDiscount 1.00 -0.02

## FormulaDiscount -0.02 1.00

## TotalDiscount 0.92 0.38

## TotalPrice -0.13 -0.11

## TotalCredit 0.01 0.01

## TotalDiscount TotalPrice

## NbrNewspapers 0.10 0.90

## NbrStart 0.07 -0.05

## GrossFormulaPrice 0.11 0.89

## NetFormulaPrice 0.07 0.90

## NetNewspaperPrice -0.55 -0.07

## ProductDiscount 0.92 -0.13

## FormulaDiscount 0.38 -0.11

## TotalDiscount 1.00 -0.16

## TotalPrice -0.16 1.00

## TotalCredit 0.01 -0.03

## TotalCredit

## NbrNewspapers -0.08

## NbrStart -0.06

## GrossFormulaPrice -0.07

## NetFormulaPrice -0.07

## NetNewspaperPrice 0.11

## ProductDiscount 0.01

## FormulaDiscount 0.01

## TotalDiscount 0.01

## TotalPrice -0.03

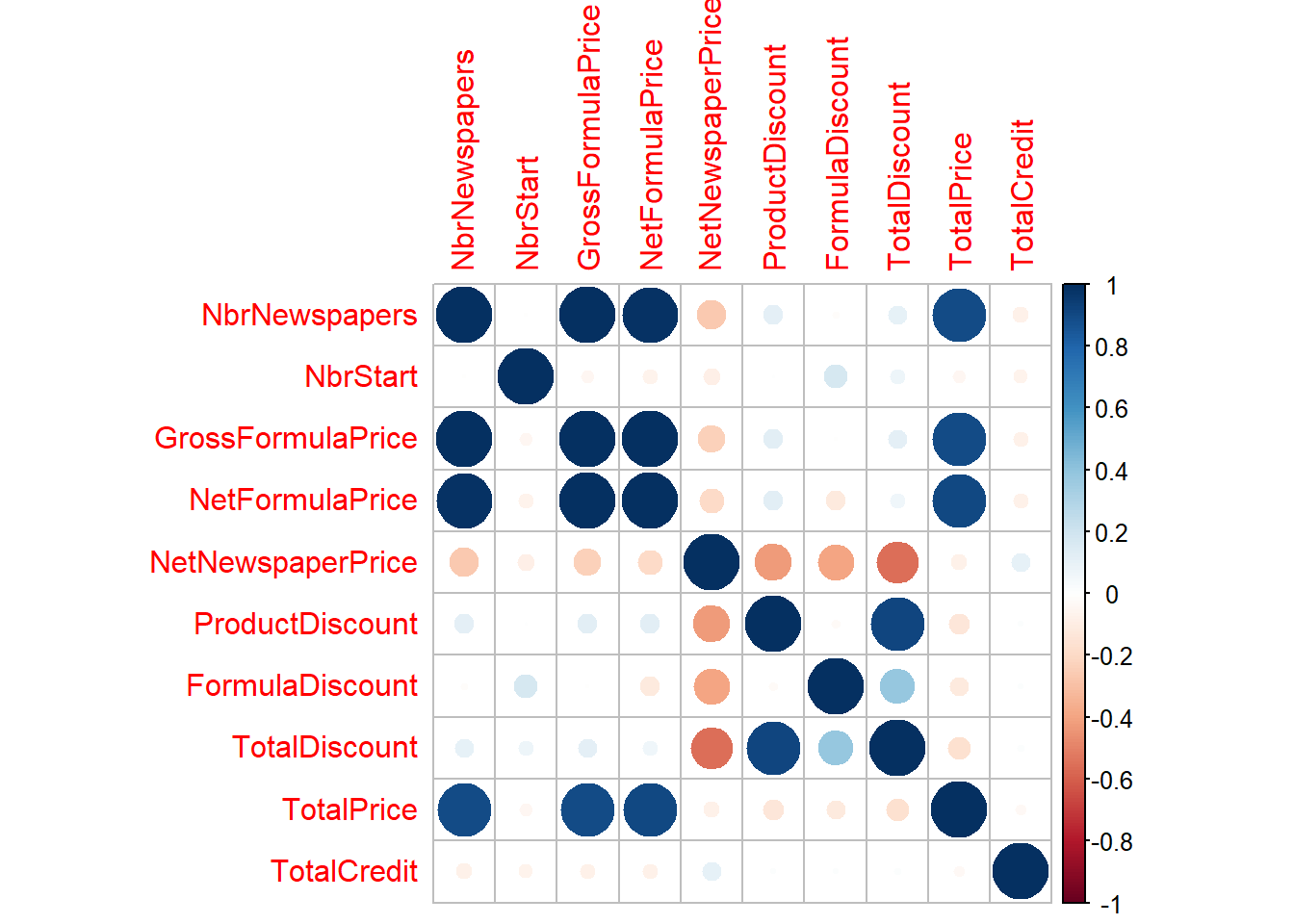

## TotalCredit 1.00Often researchers make correlation plots to get a nice and quik overview of the correlations between variables. The corrplot package makes nice correlation plot (see: https://cran.r-project.org/web/packages/corrplot/vignettes/corrplot-intro.html).

Another good package in R to perform correlation analysis is the correlation package. This package has tons of options to perform correlation analysis (also with binary vars) and by default a correlation test is performed.

There are also other packages available to create correlation plots, for example

-http://www.sthda.com/english/wiki/ggcorrplot-visualization-of-a-correlation-matrix-using-ggplot2

-https://github.com/tidymodels/corrr

We will only focus on the former two packages.

#A correlation plot of corrplot

p_load(corrplot)

p_load(see)

corr <- cor(num, use = 'complete.obs')

corrplot(corr, method = "circle")

#The correlation package

p_load(correlation)

#The output is by default in the long format

correlation::correlation(subscriptions)## # Correlation Matrix (pearson-method)

##

## Parameter1 | Parameter2 | r | 95% CI | t | df | p

## ----------------------------------------------------------------------------------------------

## NbrNewspapers | NbrStart | -9.32e-03 | [-0.03, 0.01] | -0.85 | 8229 | > .999

## NbrNewspapers | GrossFormulaPrice | 0.99 | [ 0.99, 0.99] | 761.50 | 8089 | < .001***

## NbrNewspapers | NetFormulaPrice | 0.99 | [ 0.99, 0.99] | 565.89 | 8089 | < .001***

## NbrNewspapers | NetNewspaperPrice | -0.26 | [-0.28, -0.24] | -24.60 | 8089 | < .001***

## NbrNewspapers | ProductDiscount | 0.12 | [ 0.10, 0.14] | 10.76 | 8089 | < .001***

## NbrNewspapers | FormulaDiscount | -0.01 | [-0.03, 0.01] | -1.18 | 8089 | > .999

## NbrNewspapers | TotalDiscount | 0.10 | [ 0.08, 0.13] | 9.46 | 8089 | < .001***

## NbrNewspapers | TotalPrice | 0.90 | [ 0.89, 0.90] | 184.51 | 8089 | < .001***

## NbrNewspapers | TotalCredit | -0.08 | [-0.10, -0.06] | -6.95 | 8089 | < .001***

## NbrStart | GrossFormulaPrice | -0.05 | [-0.07, -0.03] | -4.29 | 8070 | < .001***

## NbrStart | NetFormulaPrice | -0.07 | [-0.09, -0.05] | -6.03 | 8070 | < .001***

## NbrStart | NetNewspaperPrice | -0.09 | [-0.11, -0.07] | -8.08 | 8070 | < .001***

## NbrStart | ProductDiscount | 2.57e-03 | [-0.02, 0.02] | 0.23 | 8070 | > .999

## NbrStart | FormulaDiscount | 0.17 | [ 0.15, 0.19] | 15.54 | 8070 | < .001***

## NbrStart | TotalDiscount | 0.07 | [ 0.05, 0.09] | 6.40 | 8070 | < .001***

## NbrStart | TotalPrice | -0.05 | [-0.07, -0.03] | -4.29 | 8070 | < .001***

## NbrStart | TotalCredit | -0.06 | [-0.08, -0.04] | -5.64 | 8070 | < .001***

## GrossFormulaPrice | NetFormulaPrice | 0.99 | [ 0.99, 0.99] | 776.83 | 8089 | < .001***

## GrossFormulaPrice | NetNewspaperPrice | -0.24 | [-0.26, -0.22] | -22.20 | 8089 | < .001***

## GrossFormulaPrice | ProductDiscount | 0.12 | [ 0.10, 0.14] | 11.17 | 8089 | < .001***

## GrossFormulaPrice | FormulaDiscount | -3.59e-03 | [-0.03, 0.02] | -0.32 | 8089 | > .999

## GrossFormulaPrice | TotalDiscount | 0.11 | [ 0.09, 0.13] | 10.19 | 8089 | < .001***

## GrossFormulaPrice | TotalPrice | 0.90 | [ 0.89, 0.90] | 180.57 | 8089 | < .001***

## GrossFormulaPrice | TotalCredit | -0.07 | [-0.09, -0.05] | -6.38 | 8089 | < .001***

## NetFormulaPrice | NetNewspaperPrice | -0.19 | [-0.21, -0.17] | -17.61 | 8089 | < .001***

## NetFormulaPrice | ProductDiscount | 0.13 | [ 0.10, 0.15] | 11.35 | 8089 | < .001***

## NetFormulaPrice | FormulaDiscount | -0.12 | [-0.14, -0.10] | -10.74 | 8089 | < .001***

## NetFormulaPrice | TotalDiscount | 0.07 | [ 0.05, 0.09] | 6.12 | 8089 | < .001***

## NetFormulaPrice | TotalPrice | 0.90 | [ 0.90, 0.91] | 187.27 | 8089 | < .001***

## NetFormulaPrice | TotalCredit | -0.07 | [-0.09, -0.05] | -6.46 | 8089 | < .001***

## NetNewspaperPrice | ProductDiscount | -0.42 | [-0.44, -0.41] | -42.00 | 8089 | < .001***

## NetNewspaperPrice | FormulaDiscount | -0.40 | [-0.42, -0.38] | -39.07 | 8089 | < .001***

## NetNewspaperPrice | TotalDiscount | -0.55 | [-0.57, -0.54] | -59.53 | 8089 | < .001***

## NetNewspaperPrice | TotalPrice | -0.07 | [-0.10, -0.05] | -6.76 | 8089 | < .001***

## NetNewspaperPrice | TotalCredit | 0.11 | [ 0.08, 0.13] | 9.63 | 8089 | < .001***

## ProductDiscount | FormulaDiscount | -0.02 | [-0.05, 0.00] | -2.13 | 8089 | 0.265

## ProductDiscount | TotalDiscount | 0.92 | [ 0.91, 0.92] | 204.18 | 8089 | < .001***

## ProductDiscount | TotalPrice | -0.13 | [-0.15, -0.11] | -11.80 | 8089 | < .001***

## ProductDiscount | TotalCredit | 0.01 | [-0.01, 0.03] | 0.91 | 8089 | > .999

## FormulaDiscount | TotalDiscount | 0.38 | [ 0.36, 0.40] | 37.10 | 8089 | < .001***

## FormulaDiscount | TotalPrice | -0.11 | [-0.13, -0.09] | -9.94 | 8089 | < .001***

## FormulaDiscount | TotalCredit | 0.01 | [-0.01, 0.03] | 1.06 | 8089 | > .999

## TotalDiscount | TotalPrice | -0.16 | [-0.19, -0.14] | -15.01 | 8089 | < .001***

## TotalDiscount | TotalCredit | 0.01 | [-0.01, 0.04] | 1.27 | 8089 | > .999

## TotalPrice | TotalCredit | -0.03 | [-0.06, -0.01] | -3.07 | 8089 | 0.019*

##

## p-value adjustment method: Holm (1979)

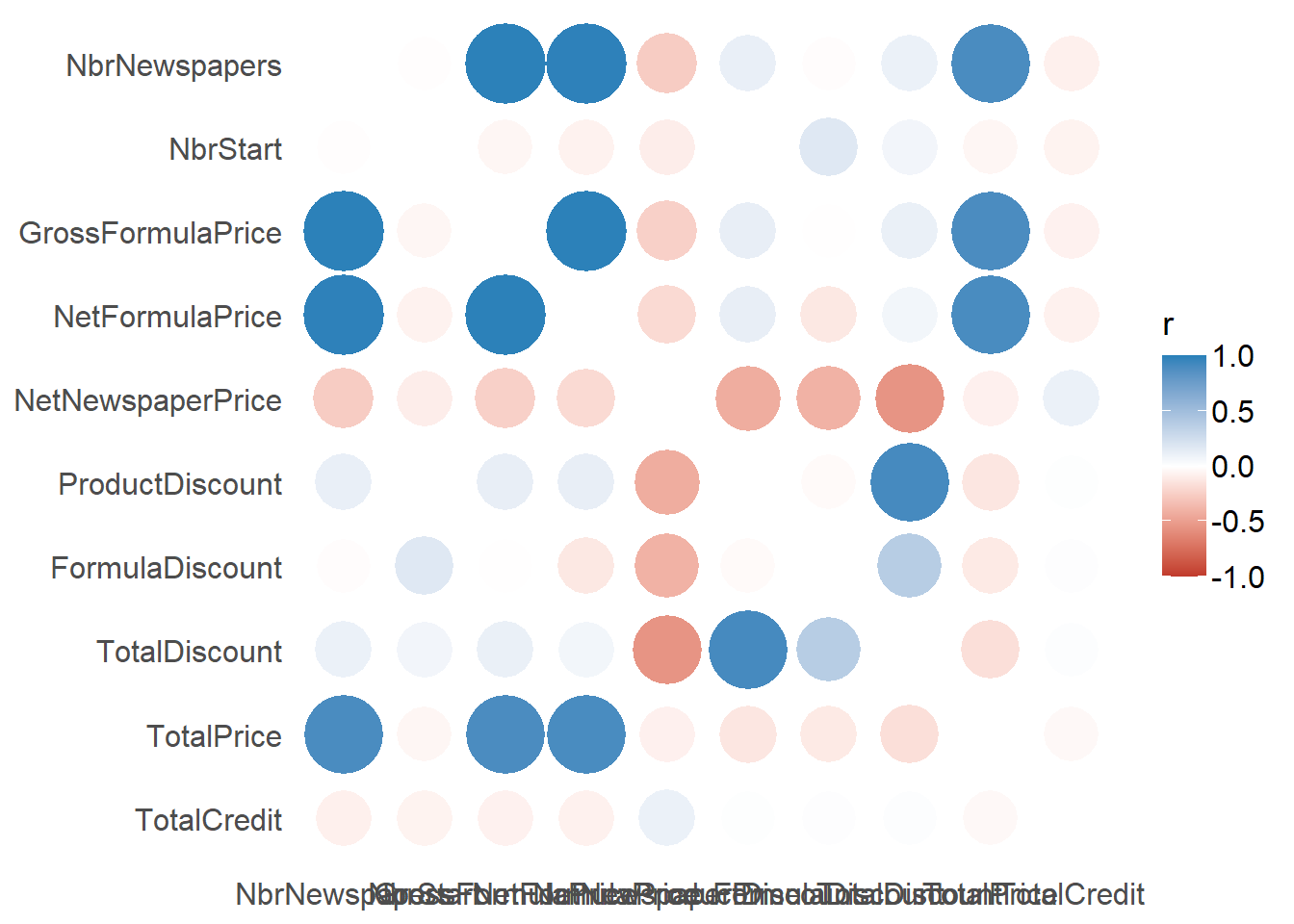

## Observations: 8072-8231#This package also has a correlation plot

#although the options and layout in corrplot are nicer...

correlation::correlation(subscriptions) %>% summary(redundant = TRUE) %>%

plot()

In slide 76, we saw a heuristic to delete highly correlated variables and hence solve multicollinearity. The idea is quite simple, you determine the two highest correlated variables, delete the one with highest average correlation with all other variables and repeat until your correlation is below the desired threshold. The findCorrelation function of the caret package implements this heuristic.

p_load(caret)

# The findCorrelation function will look at the mean

# absolute correlation and remove the one the largest one

# It takes the correlation matrix as an input The cutoff is

# the desired max amount of correlation Exact = FALSE,

# which will not re-evaluated the correlation at each step

(highCorr <- findCorrelation(corr, cutoff = 0.75, verbose = TRUE,

names = TRUE, exact = FALSE))##

## Combination row 1 and column 3 is above the cut-off, value = 0.993

## Flagging column 3

## Combination row 1 and column 4 is above the cut-off, value = 0.988

## Flagging column 4

## Combination row 3 and column 4 is above the cut-off, value = 0.993

## Flagging column 4

## Combination row 6 and column 8 is above the cut-off, value = 0.915

## Flagging column 8

## Combination row 1 and column 9 is above the cut-off, value = 0.899

## Flagging column 1

## Combination row 3 and column 9 is above the cut-off, value = 0.895

## Flagging column 3

## Combination row 4 and column 9 is above the cut-off, value = 0.901

## Flagging column 4## [1] "GrossFormulaPrice" "NetFormulaPrice"

## [3] "TotalDiscount" "NbrNewspapers"# By setting exact = TRUE, the function will recalculate

# the average correlations at each step This will increase

# the computation time, and remove less predictors By

# default exact = TRUE if the number of predictors < 100

(highCorr <- findCorrelation(corr, cutoff = 0.75, verbose = TRUE,

names = TRUE, exact = TRUE))## Compare row 4 and column 3 with corr 0.993

## Means: 0.392 vs 0.236 so flagging column 4

## Compare row 3 and column 1 with corr 0.993

## Means: 0.311 vs 0.204 so flagging column 3

## Compare row 1 and column 9 with corr 0.899

## Means: 0.212 vs 0.186 so flagging column 1

## Compare row 8 and column 6 with corr 0.915

## Means: 0.35 vs 0.169 so flagging column 8

## All correlations <= 0.75## [1] "NetFormulaPrice" "GrossFormulaPrice"

## [3] "NbrNewspapers" "TotalDiscount"Since there are better ways of selecting features, we will not remove these highly correlated variables at this stage

2.1.4.2 Missing values

# There is no built-in function in R to see all the missing

# values at once However, with 1 line of code you can

# easily spot the number of missing values

colSums(is.na(subscriptions))## SubscriptionID CustomerID

## 0 0

## ProductID Pattern

## 0 0

## StartDate EndDate

## 0 0

## NbrNewspapers NbrStart

## 0 21

## RenewalDate PaymentType

## 2020 0

## PaymentStatus PaymentDate

## 0 421

## FormulaID GrossFormulaPrice

## 0 161

## NetFormulaPrice NetNewspaperPrice

## 161 161

## ProductDiscount FormulaDiscount

## 161 161

## TotalDiscount TotalPrice

## 161 161

## TotalCredit

## 161colSums(is.na(customers))## CustomerID Gender DOB District

## 0 0 0 0

## ZIP StreeID

## 0 0Remember that in order to handle missing values, you should always consider the cause of the missing values.

Also the number of missing values is important, if a variable has too many missing value it is better to remove them.

For example, in the case of RenewalDate deleting the variable might be better. Another solution can be to just add an indicator whether or not there was a renewal (which is the same as adding an indicator for NA).

However, handling your missing values at this point in time is not a good idea. It is better to perform your missing value imputation on the final basetable. So you should first calculate your dependent varables, compute your predictors and merge the tables. At the time of merging, be cautious that you treat missing values due to the merges differently!

Before imputing our missing values, we will perform several preprocessing steps. Note that I will not show you these preprocessing steps at this stage. In one of the exercises, you will have to perform these steps yourself. It is a good exercise for yourself to try these steps yourself and see whether your get the same result.

In this case we want to build a churn model, so the first thing that we have to do is determine our ‘churn’ variable. To determine churn, we first select the active subscriptions that can be targeted in the dependent period. This means those whose subscriptions end in the dependent period. Hence, active customers are those that have a start date before t2 and an end date in the dep (after t3 and before t4). We won’t consider them if they end after t4. We determine t1, t2, t3, t4 as follows:

f <- "%d/%m/%Y"

start_ind <- as.Date("02/01/2006", f)

end_ind <- as.Date("01/06/2009", f)

start_dep <- as.Date("02/06/2009", f)

end_dep <- as.Date("02/06/2010", f) #dump date

length_ind <- end_ind - start_indAfter setting the time window, we should define churners as active customers who did not buy something in the dependent period. After having established the churn variable, we can compute several variables per customer However, you should only calculate your variables wit respect to the time window! So the idea will be to set your time window and only select active customers and compute variables on the subscriptions and customer table and finally join them together.

Since we are interested in preprocessing some variables at a later stage, we will only compute variables for the subscriptions table and not treat the dummies in the customer table (this will be done later in the preprocessing step). The resulting table of the data preprocessing can be found below:

# Load the data

load("SubCust.Rdata")

# Let's have a look at the data

SubCust %>%

glimpse()## Rows: 1,178

## Columns: 40

## $ CustomerID <chr> "100139", "10~

## $ ProductID_1_sum <int> 0, 0, 0, 0, 0~

## $ ProductID_2_sum <int> 0, 0, 0, 1, 0~

## $ ProductID_3_sum <int> 0, 0, 0, 0, 1~

## $ ProductID_4_sum <int> 0, 0, 0, 0, 0~

## $ ProductID_5_sum <int> 0, 0, 0, 0, 0~

## $ ProductID_6_sum <int> 0, 0, 0, 0, 0~

## $ ProductID_7_sum <int> 0, 0, 2, 0, 0~

## $ ProductID_8_sum <int> 5, 3, 0, 0, 0~

## $ Pattern_0000010_sum <int> 0, 0, 1, 0, 0~

## $ Pattern_0000100_sum <int> 0, 0, 0, 0, 0~

## $ Pattern_0001000_sum <int> 0, 0, 0, 0, 0~

## $ Pattern_0010000_sum <int> 0, 0, 0, 0, 0~

## $ Pattern_0100010_sum <int> 0, 0, 0, 0, 0~

## $ Pattern_1000010_sum <int> 0, 0, 0, 0, 0~

## $ Pattern_1001010_sum <int> 0, 0, 0, 0, 0~

## $ Pattern_1111110_sum <int> 5, 3, 1, 1, 1~

## $ PaymentType_BT_sum <int> 5, 3, 2, 1, 1~

## $ PaymentType_DD_sum <int> 0, 0, 0, 0, 0~

## $ PaymentStatus_Paid_sum <int> 5, 3, 2, 1, 1~

## $ PaymentStatus_Not.Paid_sum <int> 0, 0, 0, 0, 0~

## $ StartDate_rec <dbl> 152, 152, 107~

## $ RenewalDate_rec <dbl> 192, 192, NA,~

## $ PaymentDate_rec <dbl> 173, 167, 89,~

## $ NbrNewspapers_mean <dbl> 152.0, 304.0,~

## $ NbrStart_mean <dbl> 16, 15, 12, 2~

## $ GrossFormulaPrice_mean <dbl> 134.8000, 247~

## $ NetFormulaPrice_mean <dbl> 134.8000, 247~

## $ NetNewspaperPrice_mean <dbl> 0.8868566, 0.~

## $ ProductDiscount_mean <dbl> 0, 0, 0, 0, 0~

## $ FormulaDiscount_mean <dbl> 0.00, 0.00, 6~

## $ TotalDiscount_mean <dbl> 0.00, 0.00, 6~

## $ TotalPrice_mean <dbl> 134.8000, 247~

## $ TotalCredit_mean <dbl> 0.0, 0.0, 0.0~

## $ Gender <fct> M, M, M, M, M~

## $ District <fct> 5, 5, 1, 1, 1~

## $ ZIP <chr> "3740", "3740~

## $ StreeID <chr> "44349", "444~

## $ Age <dbl> 46, 76, 51, 7~

## $ churn <fct> 0, 0, 1, 1, 1~In sum, for the subscriptions table, I have taken the mean of all continuous variables per customer.

If a certain value had an NA, I just removed the NAs from the computation. A customer can have more than one subscription, so you should summarize this per customer. For the discrete variables, I have taken the sum per customer

and for the date variables I calculated the recency.Finally, I merged all tables together with the dependent variable.

Let’s now have a look at the NAs.

colSums(is.na(SubCust))## CustomerID

## 0

## ProductID_1_sum

## 0

## ProductID_2_sum

## 0

## ProductID_3_sum

## 0

## ProductID_4_sum

## 0

## ProductID_5_sum

## 0

## ProductID_6_sum

## 0

## ProductID_7_sum

## 0

## ProductID_8_sum

## 0

## Pattern_0000010_sum

## 0

## Pattern_0000100_sum

## 0

## Pattern_0001000_sum

## 0

## Pattern_0010000_sum

## 0

## Pattern_0100010_sum

## 0

## Pattern_1000010_sum

## 0

## Pattern_1001010_sum

## 0

## Pattern_1111110_sum

## 0

## PaymentType_BT_sum

## 0

## PaymentType_DD_sum

## 0

## PaymentStatus_Paid_sum

## 0

## PaymentStatus_Not.Paid_sum

## 0

## StartDate_rec

## 0

## RenewalDate_rec

## 154

## PaymentDate_rec

## 4

## NbrNewspapers_mean

## 0

## NbrStart_mean

## 0

## GrossFormulaPrice_mean

## 0

## NetFormulaPrice_mean

## 0

## NetNewspaperPrice_mean

## 0

## ProductDiscount_mean

## 0

## FormulaDiscount_mean

## 0

## TotalDiscount_mean

## 0

## TotalPrice_mean

## 0

## TotalCredit_mean

## 0

## Gender

## 211

## District

## 0

## ZIP

## 0

## StreeID

## 0

## Age

## 0

## churn

## 0colSums(is.na(SubCust))/nrow(SubCust)## CustomerID

## 0.000000000

## ProductID_1_sum

## 0.000000000

## ProductID_2_sum

## 0.000000000

## ProductID_3_sum

## 0.000000000

## ProductID_4_sum

## 0.000000000

## ProductID_5_sum

## 0.000000000

## ProductID_6_sum

## 0.000000000

## ProductID_7_sum

## 0.000000000

## ProductID_8_sum

## 0.000000000

## Pattern_0000010_sum

## 0.000000000

## Pattern_0000100_sum

## 0.000000000

## Pattern_0001000_sum

## 0.000000000

## Pattern_0010000_sum

## 0.000000000

## Pattern_0100010_sum

## 0.000000000

## Pattern_1000010_sum

## 0.000000000

## Pattern_1001010_sum

## 0.000000000

## Pattern_1111110_sum

## 0.000000000

## PaymentType_BT_sum

## 0.000000000

## PaymentType_DD_sum

## 0.000000000

## PaymentStatus_Paid_sum

## 0.000000000

## PaymentStatus_Not.Paid_sum

## 0.000000000

## StartDate_rec

## 0.000000000

## RenewalDate_rec

## 0.130730051

## PaymentDate_rec

## 0.003395586

## NbrNewspapers_mean

## 0.000000000

## NbrStart_mean

## 0.000000000

## GrossFormulaPrice_mean

## 0.000000000

## NetFormulaPrice_mean

## 0.000000000

## NetNewspaperPrice_mean

## 0.000000000

## ProductDiscount_mean

## 0.000000000

## FormulaDiscount_mean

## 0.000000000

## TotalDiscount_mean

## 0.000000000

## TotalPrice_mean

## 0.000000000

## TotalCredit_mean

## 0.000000000

## Gender

## 0.179117148

## District

## 0.000000000

## ZIP

## 0.000000000

## StreeID

## 0.000000000

## Age

## 0.000000000

## churn

## 0.000000000# Only 3 variables have NAs: payment date, renewal date and

# genderAs mentioned in the slides, there are two options:

-delete the columns: this can maybe be done for renewal date, however gender is a very important variable in every churn model, so should not be negelected. Also the number of NAs is acceptable, so we choose imputation.

-impute the values with the median(continuous)/mode(discrete) or impute with a model (e.g., random forest).

We will chose for imputation and therefore we will use the imputeMissing package.

# To impute variables, install the package imputeMissings

p_load(imputeMissings)

# This package is especially designed for a predictive

# context It allows you to compute the values on a training

# dataset and impute them on new data. This is very

# convenient in predictive contexts.

# For example: define training data

(train <- data.frame(v_int = as.integer(c(3, 3, 2, 5, 1, 2, 4,

6)), v_num = as.numeric(c(4.1, NA, 12.2, 11, 3.4, 1.6, 3.3,

5.5)), v_fact = as.factor(c("one", "two", NA, "two", "two",

"one", "two", "two")), stringsAsFactors = FALSE))## v_int v_num v_fact

## 1 3 4.1 one

## 2 3 NA two

## 3 2 12.2 <NA>

## 4 5 11.0 two

## 5 1 3.4 two

## 6 2 1.6 one

## 7 4 3.3 two

## 8 6 5.5 two# Compute values on train data randomForest method

values <- compute(train, method = "randomForest")

# median/mode method

(values2 <- compute(train))## $v_int

## [1] 3

##

## $v_num

## [1] 4.1

##

## $v_fact

## [1] "two"# define new data

(newdata <- data.frame(v_int = as.integer(c(1, 1, 2, NA)), v_num = as.numeric(c(1.1,

NA, 2.2, NA)), v_fact = as.factor(c("one", "one", "one",

NA)), stringsAsFactors = FALSE))## v_int v_num v_fact

## 1 1 1.1 one

## 2 1 NA one

## 3 2 2.2 one

## 4 NA NA <NA># locate the NA's

is.na(newdata)## v_int v_num v_fact

## [1,] FALSE FALSE FALSE

## [2,] FALSE TRUE FALSE

## [3,] FALSE FALSE FALSE

## [4,] TRUE TRUE TRUE# how many missings per variable?

colSums(is.na(newdata))## v_int v_num v_fact

## 1 2 1# Impute on newdata using the previously created object

imputeMissings::impute(newdata, object = values) #using randomForest values## v_int v_num v_fact

## 1 1.000000 1.1000 one

## 2 1.000000 3.9814 one

## 3 2.000000 2.2000 one

## 4 2.456469 3.9814 oneimputeMissings::impute(newdata, object = values2) #using median/mode values## v_int v_num v_fact

## 1 1 1.1 one

## 2 1 4.1 one

## 3 2 2.2 one

## 4 3 4.1 two# One can also impute directly in newdata without the

# compute step

imputeMissings::impute(newdata)## v_int v_num v_fact

## 1 1 1.10 one

## 2 1 1.65 one

## 3 2 2.20 one

## 4 1 1.65 one# It may be useful to have indicators for the variables

# imputations. These indicators may be predictive. To

# create these indicators, use flag=TRUE

# Flag parameter

imputeMissings::impute(newdata, flag = TRUE)## v_int v_num v_fact v_int_flag v_num_flag

## 1 1 1.10 one 0 0

## 2 1 1.65 one 0 1

## 3 2 2.20 one 0 0

## 4 1 1.65 one 1 1

## v_fact_flag

## 1 0

## 2 0

## 3 0

## 4 1Now let’s apply this missing value imputation to our data. There is , however, one problem. Ideally imputation should be done on the training set and the same values should be used on the test set. This means that we should first split our data into training and test and we can then perform missing value imputation.

# Split in train and test using a 50/50 split Set the same

# seed to have the same splits

set.seed(100)

ind <- sample(x = nrow(SubCust), size = round(0.5 * nrow(SubCust)),

replace = FALSE)

train <- SubCust[ind, ]

test <- SubCust[-ind, ]

# You can also save the data to make sture you get the same

# splits save(train,test, file = 'SubCust_traintest.Rdata')

# I have already created the data for you, so you can just

# load the data to make sure you are using the same splits

# load('SubCust_traintest.Rdata')

# Let's compute the values with on the training set

# randomForest method: make sure you delete the churn

# variable, the customerID and characters variables (ZIP,

# StreeID) values <- compute(data = train[,!names(train)

# %in% c('churn', 'CustomerID', 'ZIP', 'StreeID')],

# method='randomForest') As can be noticed, the random

# forest procedure takes quite some time (we did not run it

# for the compilation of this book) this is because the

# function calculates a random forest for all variables

# calculating the median/mode is a lot faster In most churn

# literature, the median/mode is preferred, so this will

# also be our preferred option

values2 <- compute(train)

# impute the train and test data with the imputation values

# also add a flag for missing values

train_imp <- imputeMissings::impute(train, object = values2,

flag = TRUE)

test_imp <- imputeMissings::impute(test, object = values2, flag = TRUE)

colSums(is.na(train_imp))## CustomerID

## 0

## ProductID_1_sum

## 0

## ProductID_2_sum

## 0

## ProductID_3_sum

## 0

## ProductID_4_sum

## 0

## ProductID_5_sum

## 0

## ProductID_6_sum

## 0

## ProductID_7_sum

## 0

## ProductID_8_sum

## 0

## Pattern_0000010_sum

## 0

## Pattern_0000100_sum

## 0

## Pattern_0001000_sum

## 0

## Pattern_0010000_sum

## 0

## Pattern_0100010_sum

## 0

## Pattern_1000010_sum

## 0

## Pattern_1001010_sum

## 0

## Pattern_1111110_sum

## 0

## PaymentType_BT_sum

## 0

## PaymentType_DD_sum

## 0

## PaymentStatus_Paid_sum

## 0

## PaymentStatus_Not.Paid_sum

## 0

## StartDate_rec

## 0

## RenewalDate_rec

## 0

## PaymentDate_rec

## 0

## NbrNewspapers_mean

## 0

## NbrStart_mean

## 0

## GrossFormulaPrice_mean

## 0

## NetFormulaPrice_mean

## 0

## NetNewspaperPrice_mean

## 0

## ProductDiscount_mean

## 0

## FormulaDiscount_mean

## 0

## TotalDiscount_mean

## 0

## TotalPrice_mean

## 0

## TotalCredit_mean

## 0

## Gender

## 0

## District

## 0

## ZIP

## 0

## StreeID

## 0

## Age

## 0

## churn

## 0

## RenewalDate_rec_flag

## 0

## PaymentDate_rec_flag

## 0

## Gender_flag

## 0colSums(is.na(test_imp))## CustomerID

## 0

## ProductID_1_sum

## 0

## ProductID_2_sum

## 0

## ProductID_3_sum

## 0

## ProductID_4_sum

## 0

## ProductID_5_sum

## 0

## ProductID_6_sum

## 0

## ProductID_7_sum

## 0

## ProductID_8_sum

## 0

## Pattern_0000010_sum

## 0

## Pattern_0000100_sum

## 0

## Pattern_0001000_sum

## 0

## Pattern_0010000_sum

## 0

## Pattern_0100010_sum

## 0

## Pattern_1000010_sum

## 0

## Pattern_1001010_sum

## 0

## Pattern_1111110_sum

## 0

## PaymentType_BT_sum

## 0

## PaymentType_DD_sum

## 0

## PaymentStatus_Paid_sum

## 0

## PaymentStatus_Not.Paid_sum

## 0

## StartDate_rec

## 0

## RenewalDate_rec

## 0

## PaymentDate_rec

## 0

## NbrNewspapers_mean

## 0

## NbrStart_mean

## 0

## GrossFormulaPrice_mean

## 0

## NetFormulaPrice_mean

## 0

## NetNewspaperPrice_mean

## 0

## ProductDiscount_mean

## 0

## FormulaDiscount_mean

## 0

## TotalDiscount_mean

## 0

## TotalPrice_mean

## 0

## TotalCredit_mean

## 0

## Gender

## 0

## District

## 0

## ZIP

## 0

## StreeID

## 0

## Age

## 0

## churn

## 0

## RenewalDate_rec_flag

## 0

## PaymentDate_rec_flag

## 0

## Gender_flag

## 02.1.4.3 Outliers

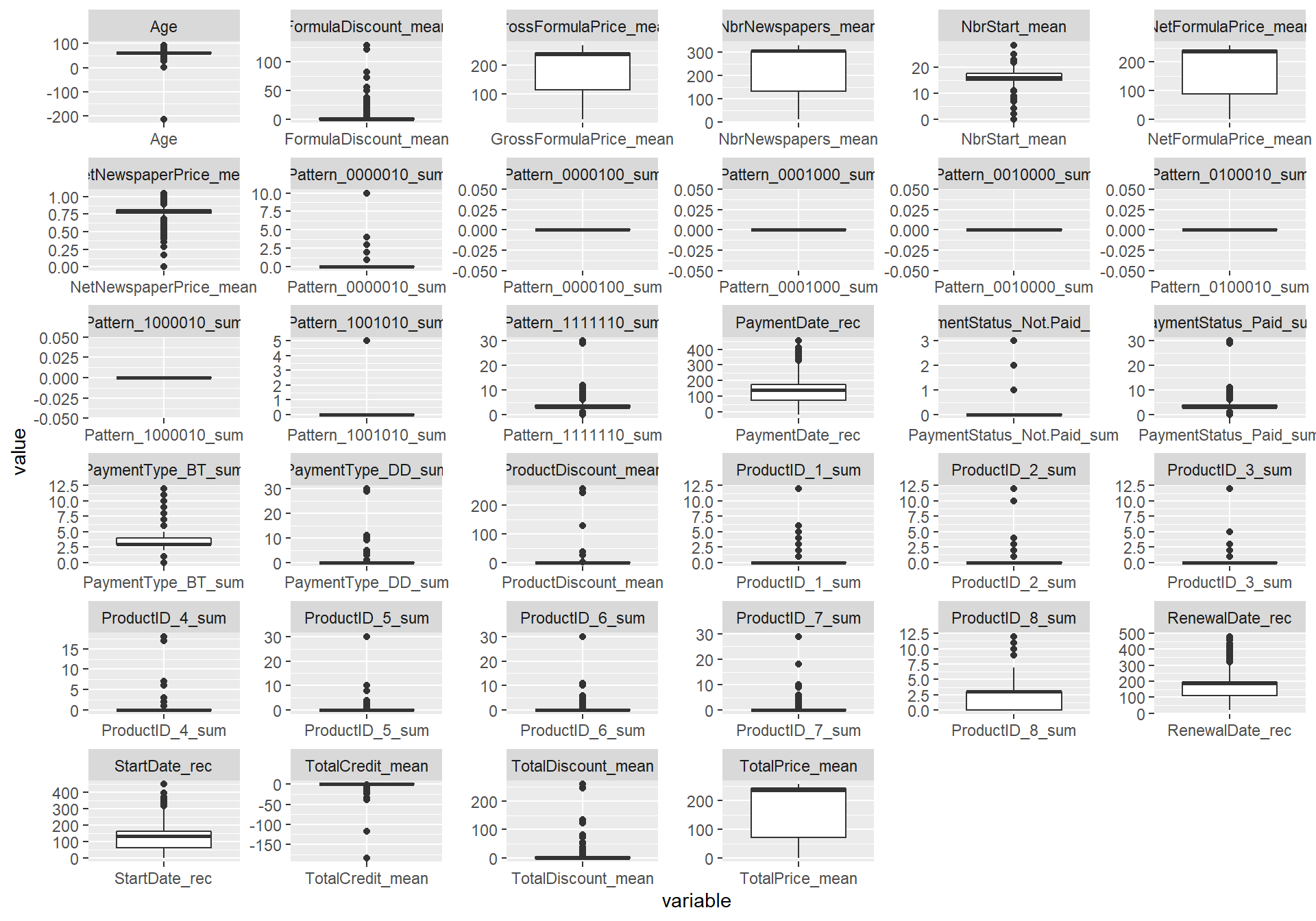

Outliers can be detected and treated in different ways: graphically or statistically (e.g., Z-scores). We will focus on one of the most common ways to spot outliers: box plots and histograms.

Note that for the plotting, we will using the pivot_longer function, which transforms the data from a wide to a long format. This can come in very handy when plotting, you might have a look at this blogpost https://thatdatatho.com/2020/03/28/tidyrs-pivot_longer-and-pivot_wider-examples-tidytuesday-challenge/ tp see how pivoting works in R. The tidyr website also contains some good examples, to get you more familar with the coding style: https://tidyr.tidyverse.org/articles/pivot.html.

#Outliers are mainly related to continuous variables, so let's plot all

#outliers for al numerics

#Again, this will only be done on the training data and the same rule

#will be applied to the test data

num <- train_imp %>% select_if(is.numeric)

#Boxplots

#For easy plotting, we will transform the table from a wide to a long format

#using pivot_longer

#This means that instead of using one column for every variable,

#This is how the wide table looks like: one column for every variable

num %>% head()## ProductID_1_sum ProductID_2_sum

## 503 0 0

## 985 0 0

## 1004 0 1

## 919 0 0

## 470 0 0

## 823 0 0

## ProductID_3_sum ProductID_4_sum

## 503 0 0

## 985 0 0

## 1004 0 2

## 919 0 0

## 470 0 0

## 823 0 0

## ProductID_5_sum ProductID_6_sum

## 503 0 0

## 985 0 0

## 1004 0 0

## 919 0 3

## 470 0 0

## 823 0 0

## ProductID_7_sum ProductID_8_sum

## 503 0 4

## 985 0 2

## 1004 0 0

## 919 0 0

## 470 0 4

## 823 0 3

## Pattern_0000010_sum Pattern_0000100_sum

## 503 0 0

## 985 0 0

## 1004 0 0

## 919 0 0

## 470 0 0

## 823 0 0

## Pattern_0001000_sum Pattern_0010000_sum

## 503 0 0

## 985 0 0

## 1004 0 0

## 919 0 0

## 470 0 0

## 823 0 0

## Pattern_0100010_sum Pattern_1000010_sum

## 503 0 0

## 985 0 0

## 1004 0 0

## 919 0 0

## 470 0 0

## 823 0 0

## Pattern_1001010_sum Pattern_1111110_sum

## 503 0 4

## 985 0 2

## 1004 0 3

## 919 0 3

## 470 0 4

## 823 0 3

## PaymentType_BT_sum PaymentType_DD_sum

## 503 4 0

## 985 2 0

## 1004 3 0

## 919 3 0

## 470 4 0

## 823 3 0

## PaymentStatus_Paid_sum

## 503 4

## 985 2

## 1004 3

## 919 3

## 470 4

## 823 3

## PaymentStatus_Not.Paid_sum StartDate_rec

## 503 0 62

## 985 0 78

## 1004 0 359

## 919 0 318

## 470 0 86

## 823 0 96

## RenewalDate_rec PaymentDate_rec

## 503 91 68

## 985 101 53

## 1004 390 370

## 919 349 339

## 470 117 105

## 823 126 115

## NbrNewspapers_mean NbrStart_mean

## 503 310.2500 15.00000

## 985 46.5000 7.50000

## 1004 304.6667 16.66667

## 919 313.0000 16.66667

## 470 304.0000 15.00000

## 823 219.3333 15.00000

## GrossFormulaPrice_mean NetFormulaPrice_mean

## 503 247.7075 243.0000

## 985 45.1000 45.1000

## 1004 237.6667 237.6667

## 919 237.6667 237.6667

## 470 243.0000 243.0000

## 823 185.5600 168.7067

## NetNewspaperPrice_mean ProductDiscount_mean

## 503 0.7850320 0.00000

## 985 0.9647820 1.56055

## 1004 0.7801140 0.00000

## 919 0.7599373 0.00000

## 470 0.7993303 0.00000

## 823 0.7109210 0.00000

## FormulaDiscount_mean TotalDiscount_mean

## 503 4.70750 4.70750

## 985 0.00000 1.56055

## 1004 0.00000 0.00000

## 919 0.00000 0.00000

## 470 0.00000 0.00000

## 823 16.85333 16.85333

## TotalPrice_mean TotalCredit_mean Age

## 503 243.0000 0.0000000 61

## 985 38.5000 -7.7894500 61

## 1004 237.6667 0.0000000 55

## 919 237.3333 -0.3333333 57

## 470 243.0000 0.0000000 61

## 823 168.7067 0.0000000 60#This is how the long table looks like:

#the column names will be casted into one variable called 'variable'

#and the corresponding values will be casted into a 'value' variable

#So now you will have only two columns variable and value but with

#20,026 observations (584 obs * 34 variables)

#See: https://tidyr.tidyverse.org/index.html for more information

num %>%

pivot_longer(everything(),names_to = "variable", values_to = "value") %>%

head(n = 20)## # A tibble: 20 x 2

## variable value

## <chr> <dbl>

## 1 ProductID_1_sum 0

## 2 ProductID_2_sum 0

## 3 ProductID_3_sum 0

## 4 ProductID_4_sum 0

## 5 ProductID_5_sum 0

## 6 ProductID_6_sum 0

## 7 ProductID_7_sum 0

## 8 ProductID_8_sum 4

## 9 Pattern_0000010_sum 0

## 10 Pattern_0000100_sum 0

## 11 Pattern_0001000_sum 0

## 12 Pattern_0010000_sum 0

## 13 Pattern_0100010_sum 0

## 14 Pattern_1000010_sum 0

## 15 Pattern_1001010_sum 0

## 16 Pattern_1111110_sum 4

## 17 PaymentType_BT_sum 4

## 18 PaymentType_DD_sum 0

## 19 PaymentStatus_Paid_sum 4

## 20 PaymentStatus_Not.Paid_sum 0#Plot the boxplot in one tidy command

num %>%

pivot_longer(everything(),names_to = "variable", values_to = "value") %>%

ggplot(aes(x = variable, y = value)) + geom_boxplot() +

facet_wrap(~variable, scales = "free")

#While boxplots are clear visualizations, some of you may prefer violin plots

#If you would want a violin plot, just state: geom_violin

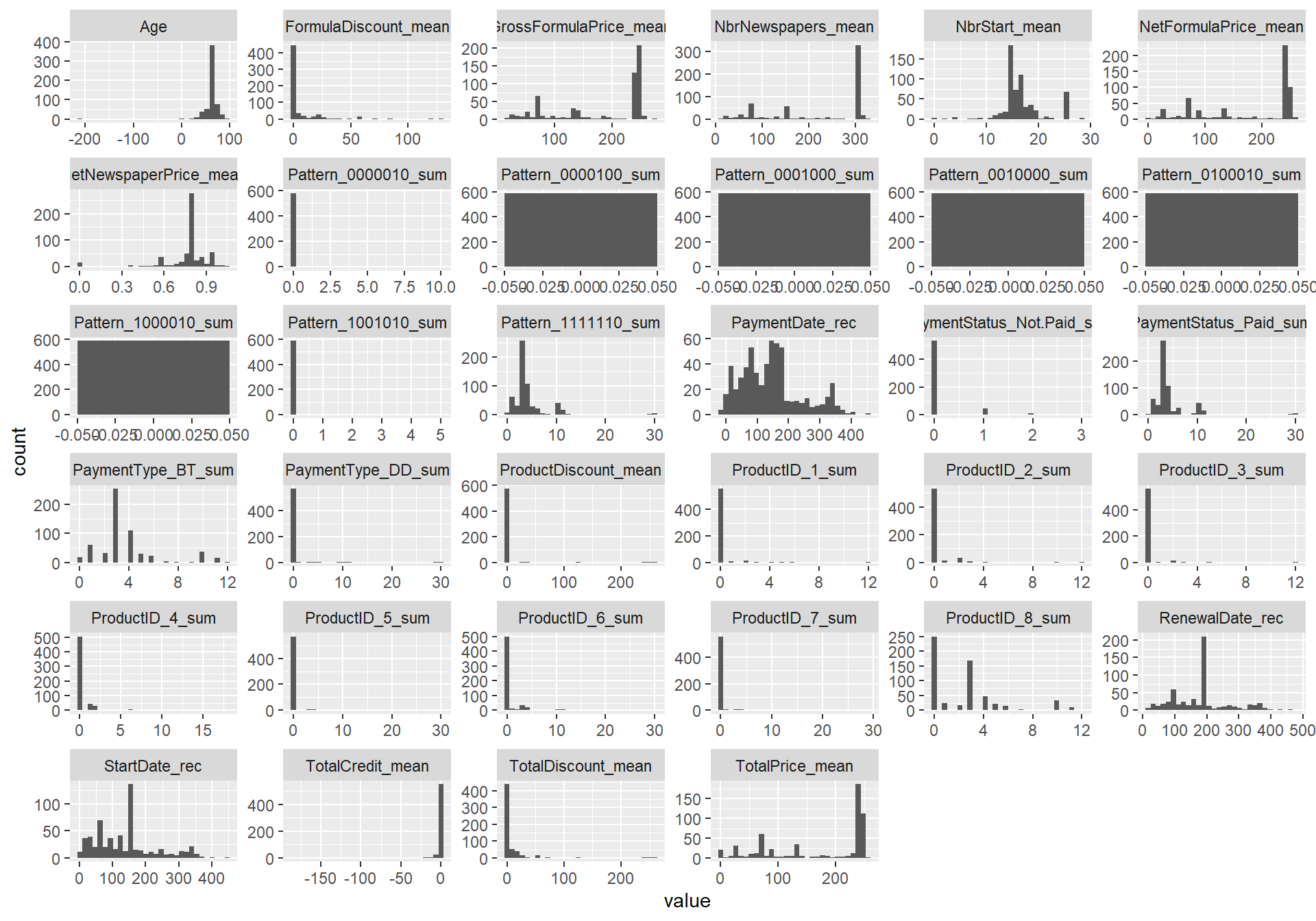

#Histograms

num %>%

pivot_longer(everything(),names_to = "variable", values_to = "value") %>%

ggplot(aes(x = value)) + geom_histogram() +

facet_wrap(~variable, scales = "free")## `stat_bin()` using `bins = 30`. Pick better

## value with `binwidth`.

#When looking at the boxplots, you might believe that there are many outliers

#However, when looking at the histograms, things don't seem that odd

#So we might assume that these observations are just valid and maybe coming from

#another skewed distribution

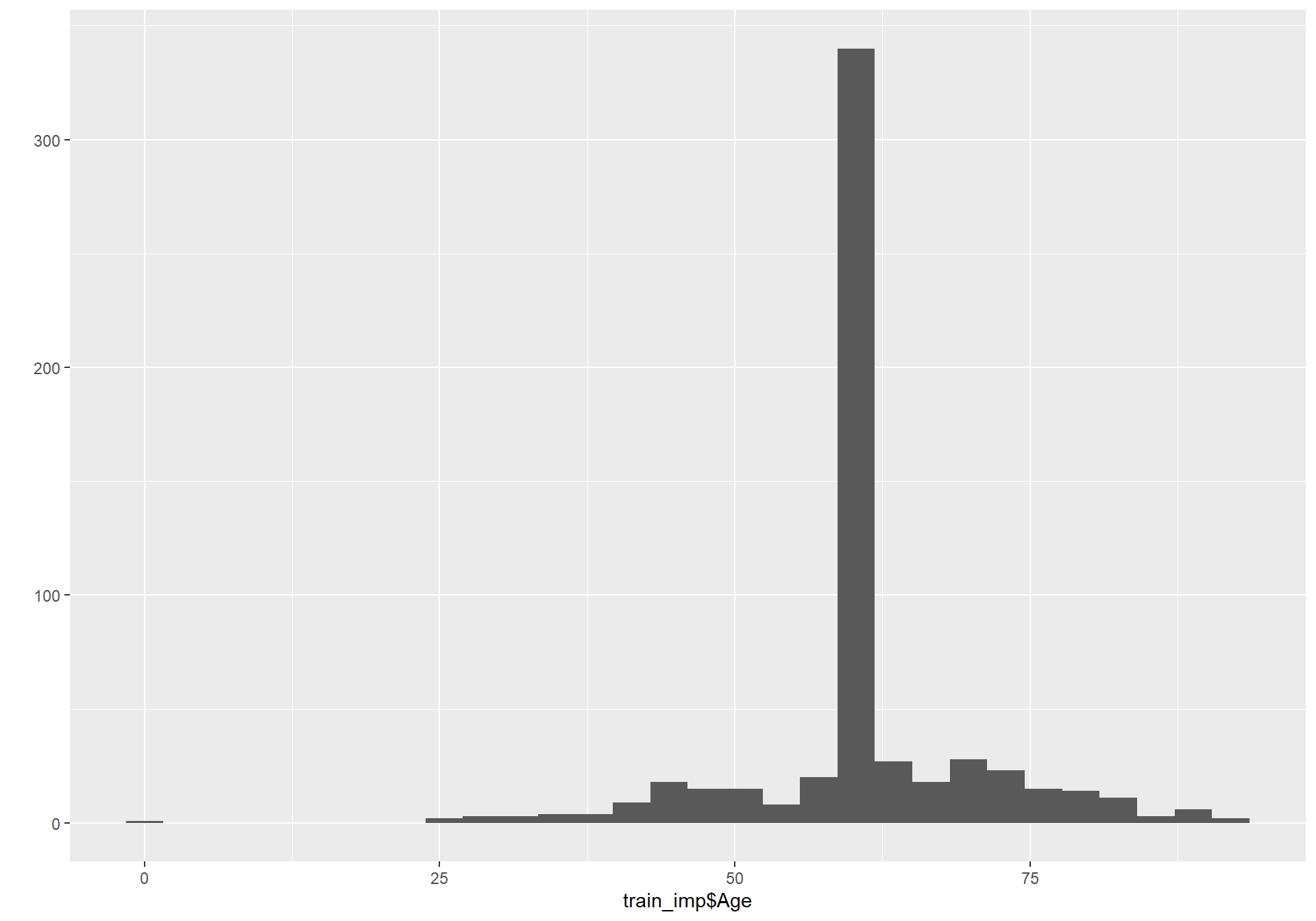

#The only odd thing is the negative age

#So the idea is to set this to NA and impute with the median (of the training set!)

train_imp$Age <- ifelse(train_imp$Age < 0, NA,train_imp$Age)

train_imp$Age <- ifelse(is.na(train_imp$Age),

median(train_imp$Age, na.rm = TRUE), train_imp$Age)

test_imp$Age <- ifelse(test_imp$Age < 0,

median(train_imp$Age, na.rm = TRUE), test_imp$Age)

#Let's replot the age variable to see whether everything is correct

qplot(train_imp$Age)## `stat_bin()` using `bins = 30`. Pick better

## value with `binwidth`.

#Apparantly there is is also someone with a very young age, let's just leave it

#like this at this point.

#Let's save our train and test data after solving the data quality issues

save(train_imp,test_imp, file = 'SubCust_traintest_preparation.Rdata')2.2 Data preparation

To make sure that we are using the same data, let’s load our saved data set.

# Load the data

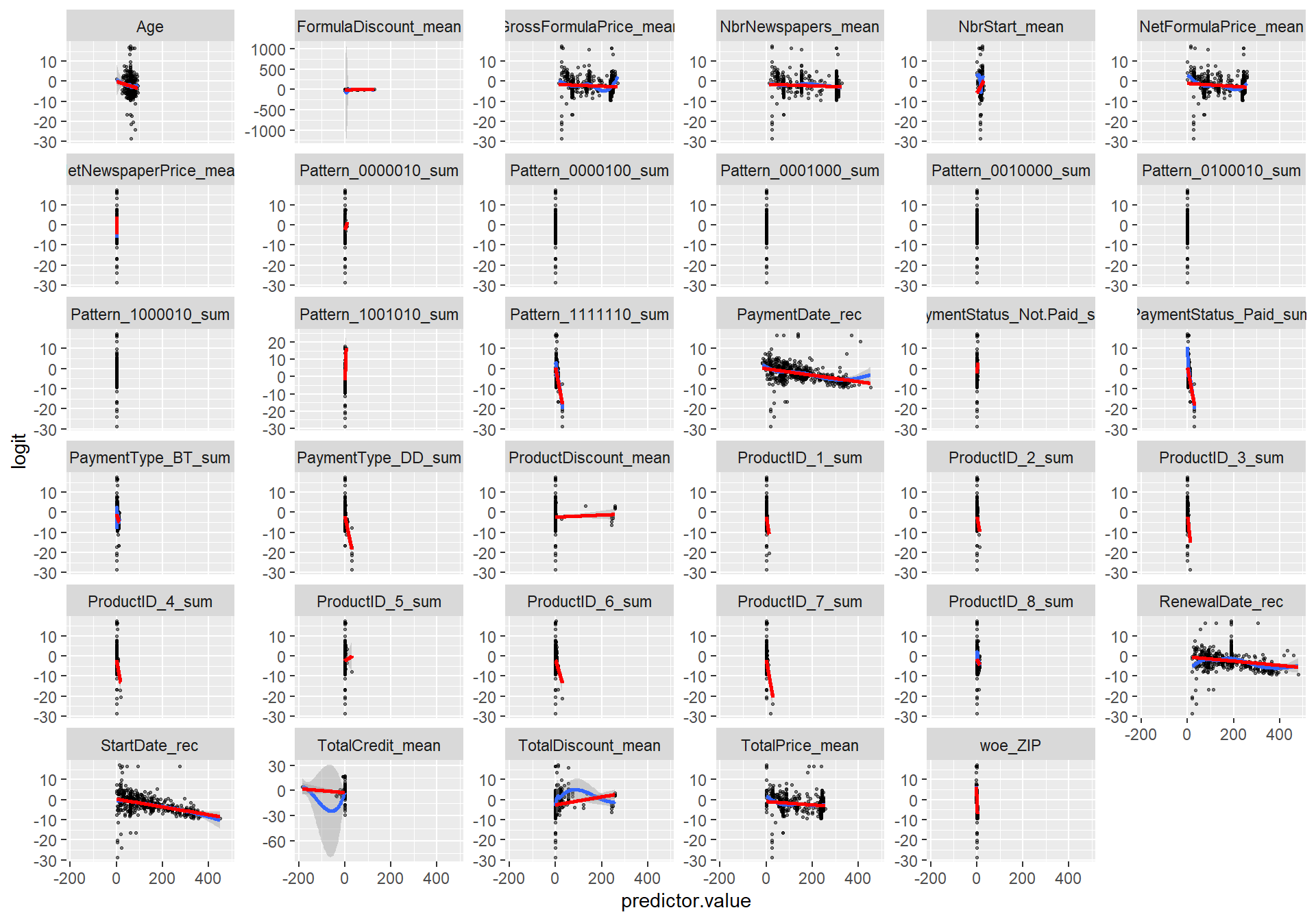

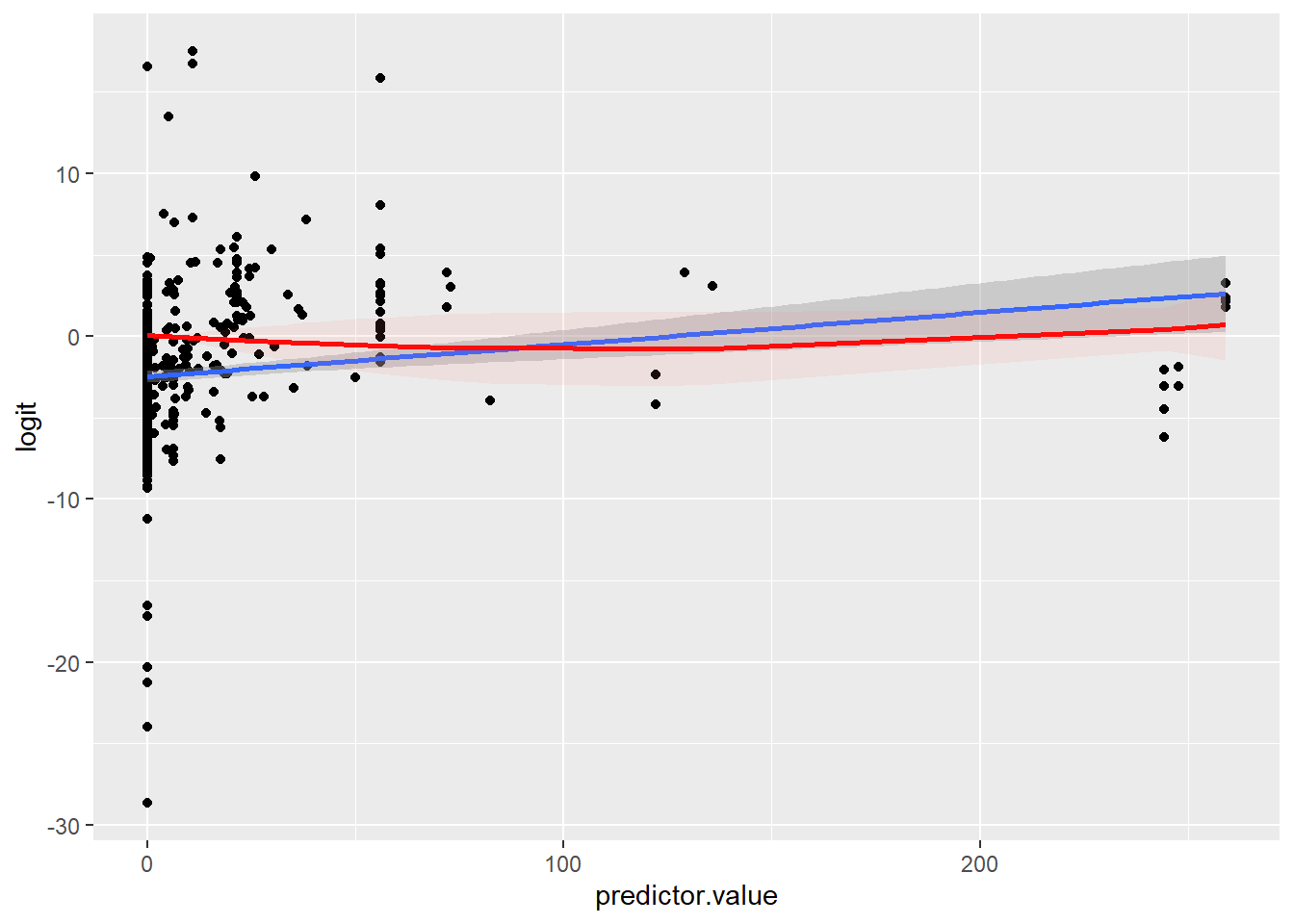

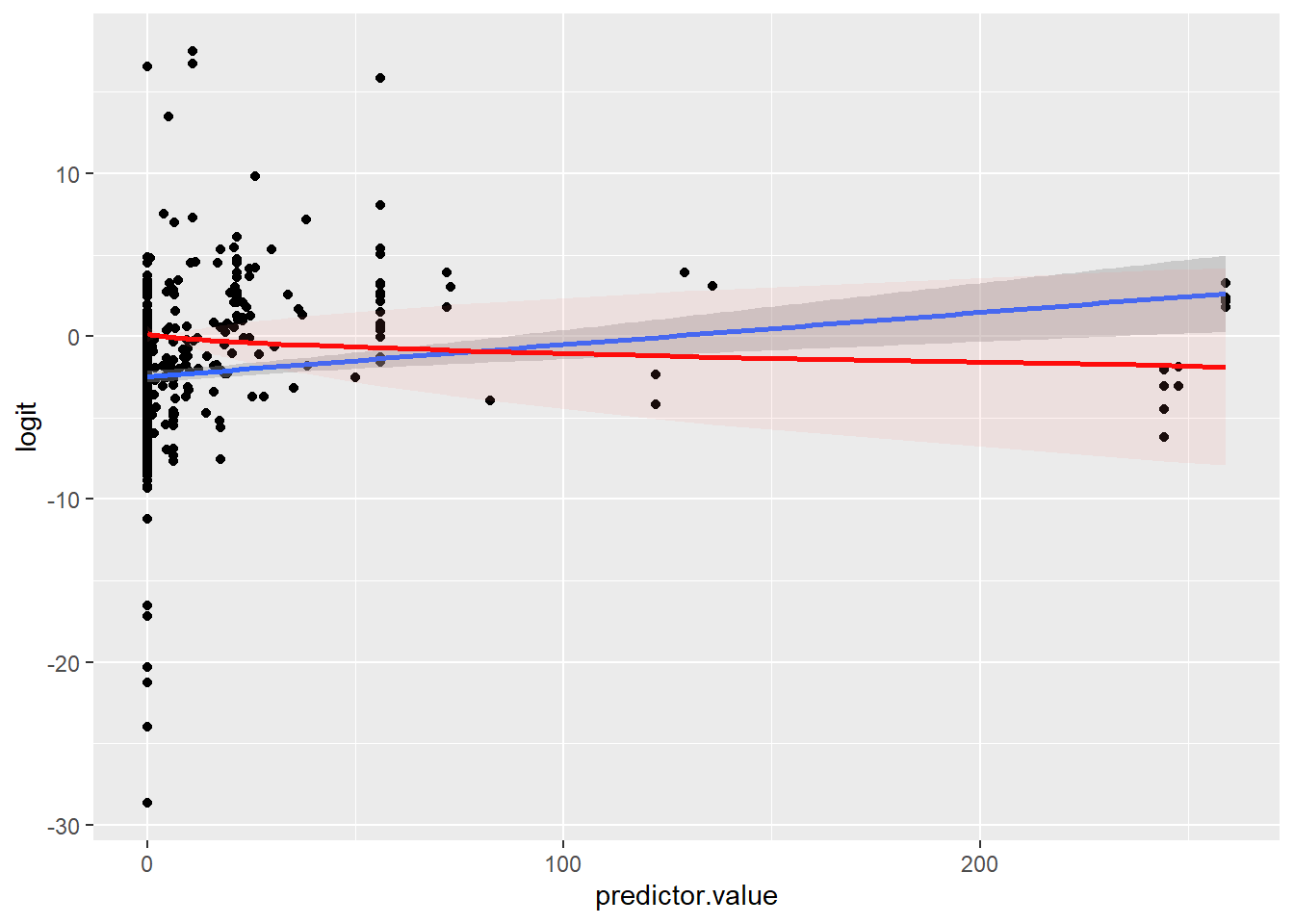

load("SubCust_traintest_preparation.Rdata")In this section, we will look into some specific value transformations, representations, feature engineering and variable selection methods.

2.2.1 Value transformations

Let’s look into some specific value transformation. Note that we will not use standardizing or normalization here because this can impact feature engineering at a later stage.

Continuous categorization

Continuous categorization will categoize numeric variables into bins. A very good package to perform binning in R is the rbin package (see: https://github.com/rsquaredacademy/rbin).

p_load(rbin)

# For example, let's bin the age variable, as this is often

# done in churn modeling Equal frequency binning

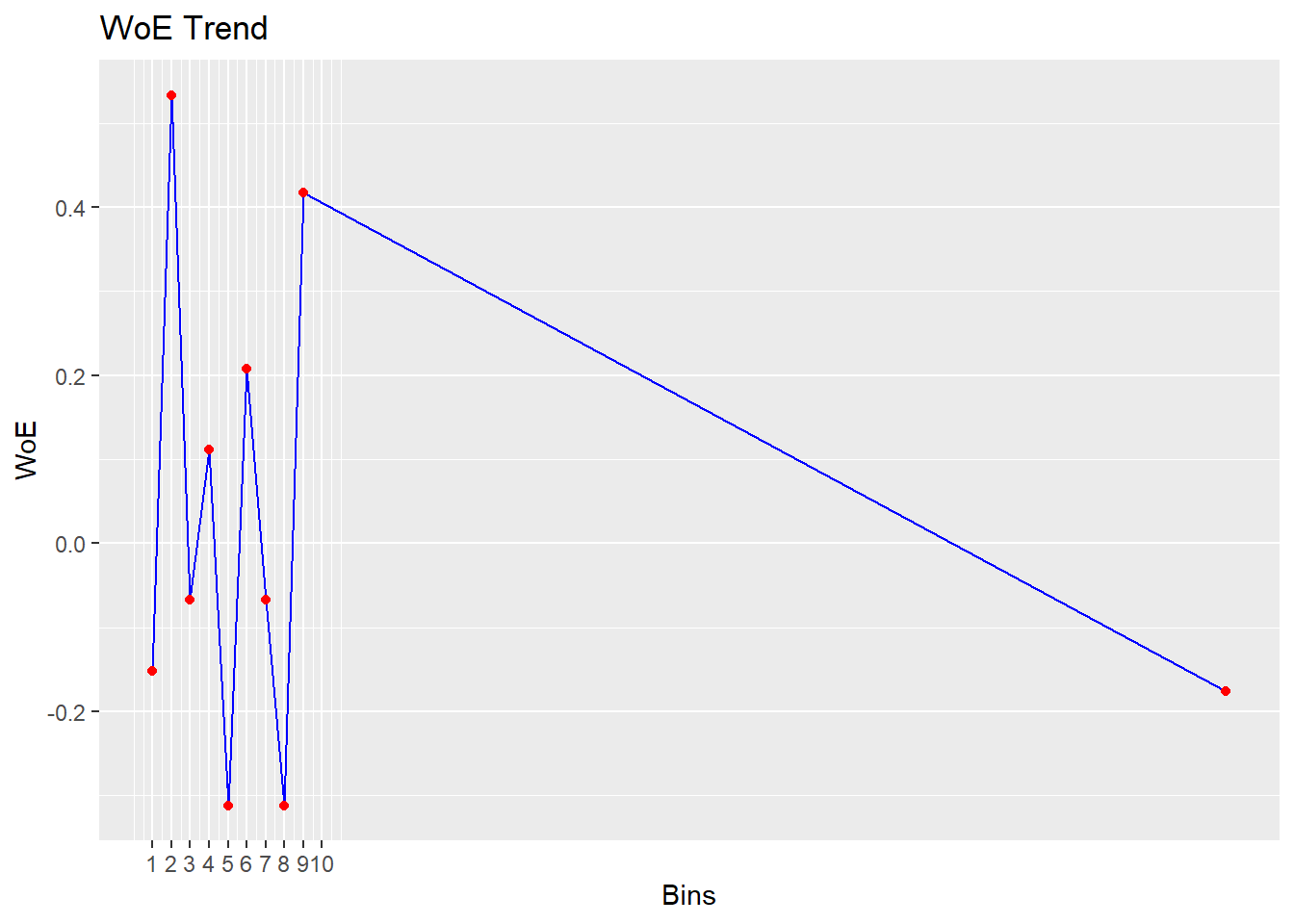

bin <- rbin_equal_freq(data = train_imp, response = churn, predictor = Age,

bins = 10)

bin## Binning Summary

## ------------------------------------

## Method Equal Frequency

## Response churn

## Predictor Age

## Bins 10

## Count 589

## Goods 152

## Bads 437

## Entropy 0.81

## Information Value 0.07

##

##

## lower_cut upper_cut bin_count good bad

## 1 1 49 59 16 43

## 2 50 61 59 10 49

## 3 61 61 59 19 40

## 4 61 61 59 13 46

## 5 61 61 59 17 42

## 6 61 61 59 14 45

## 7 61 61 59 16 43

## 8 61 66 59 11 48

## 9 66 74 58 17 41

## 10 74 93 59 19 40

## good_rate woe iv entropy

## 1 0.2711864 -0.06744128 0.0004629836 0.8431620

## 2 0.1694915 0.53318253 0.0247069708 0.6565403

## 3 0.3220339 -0.31161220 0.0104286691 0.9065795

## 4 0.2203390 0.20763936 0.0040981454 0.7607860

## 5 0.2881356 -0.15159640 0.0023849548 0.8663007

## 6 0.2372881 0.11155249 0.0012125270 0.7905014

## 7 0.2711864 -0.06744128 0.0004629836 0.8431620

## 8 0.1864407 0.41725306 0.0156350547 0.6939660

## 9 0.2931034 -0.17569395 0.0031661095 0.8726965

## 10 0.3220339 -0.31161220 0.0104286691 0.9065795# A cool thing about the function is that it also shows you

# the WOE and IV for your binning exercise Hence, you can

# already see whether the binning has a good effect on

# predictive value Remember that a good rule-of-thumb is an

# IV>0.10

# You can also make a WOE plot to see the the effect of

# each age category Remember that a positive WOE means that

# there are more events (1) than non-events (0)

# The current package version is still a little buggy,

# which is why you get the same plot twice if you call the

# plot function on your binning object and why the 10th is

# perhaps placed rather unclear on the plot

# Nevertheless, the plot allows for a quick interpretation

# of the effect of your binning on the dependent variable.

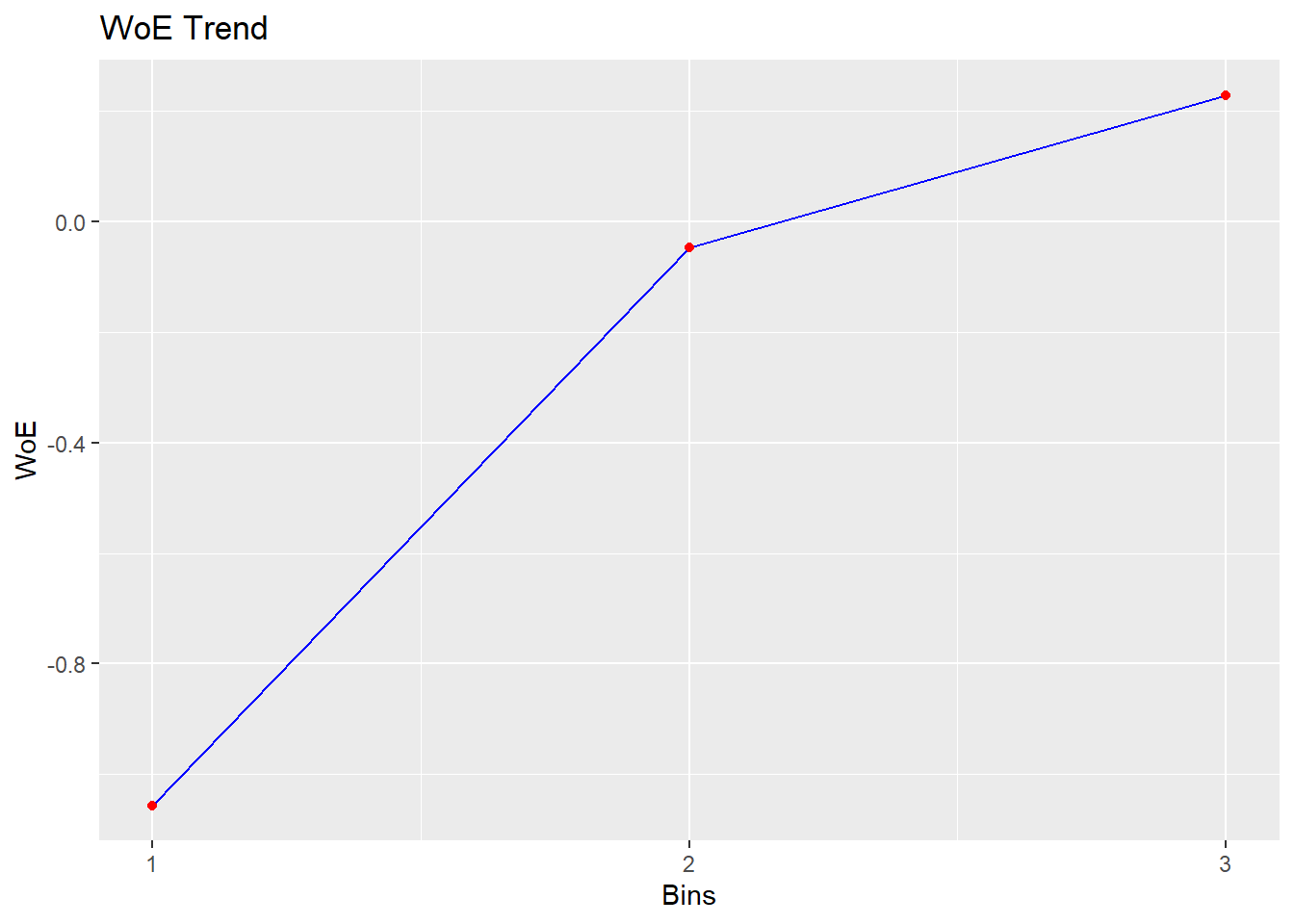

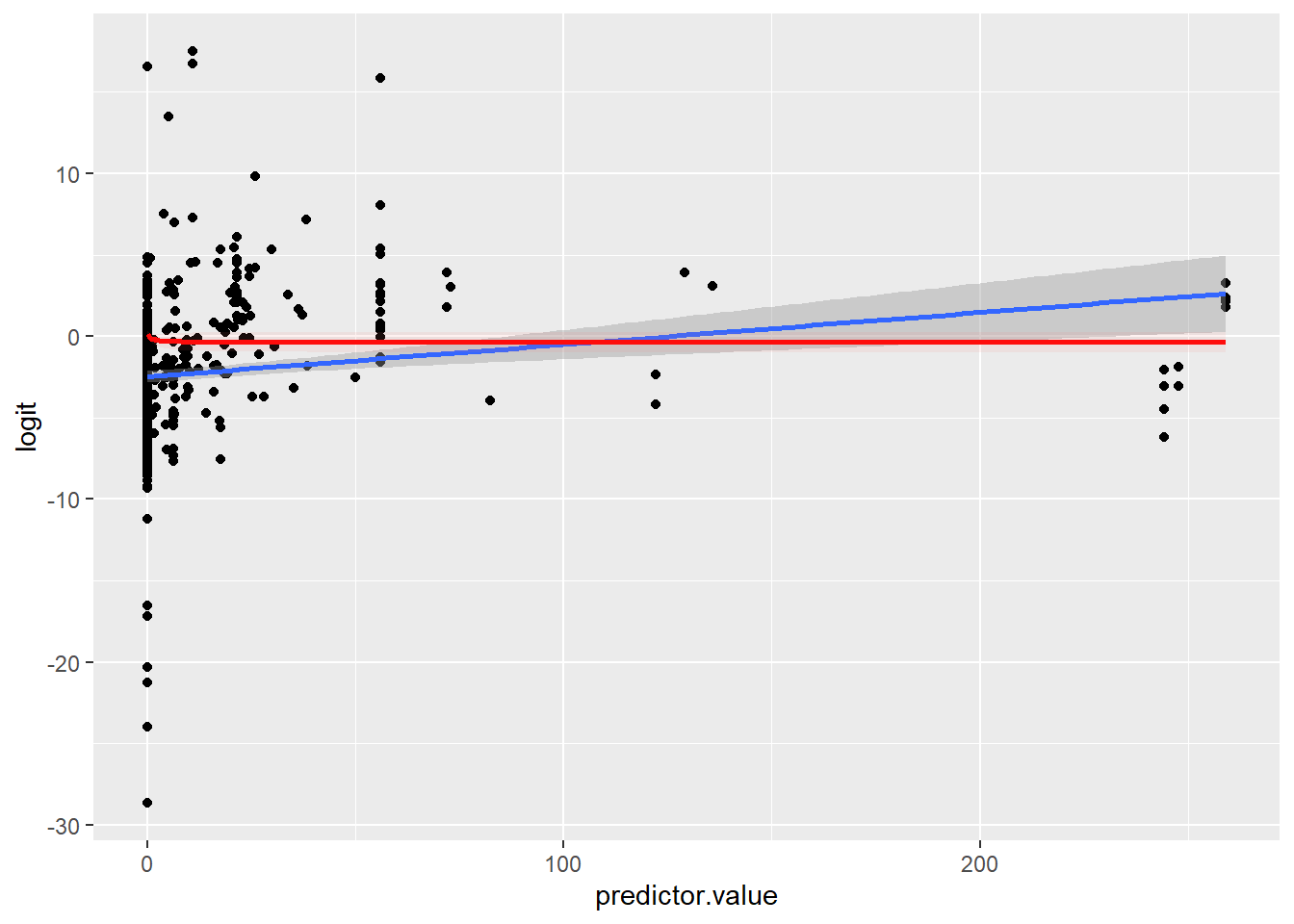

plot(bin)

# Looking at the IVs and the plot, binning is not such a

# good idea ...

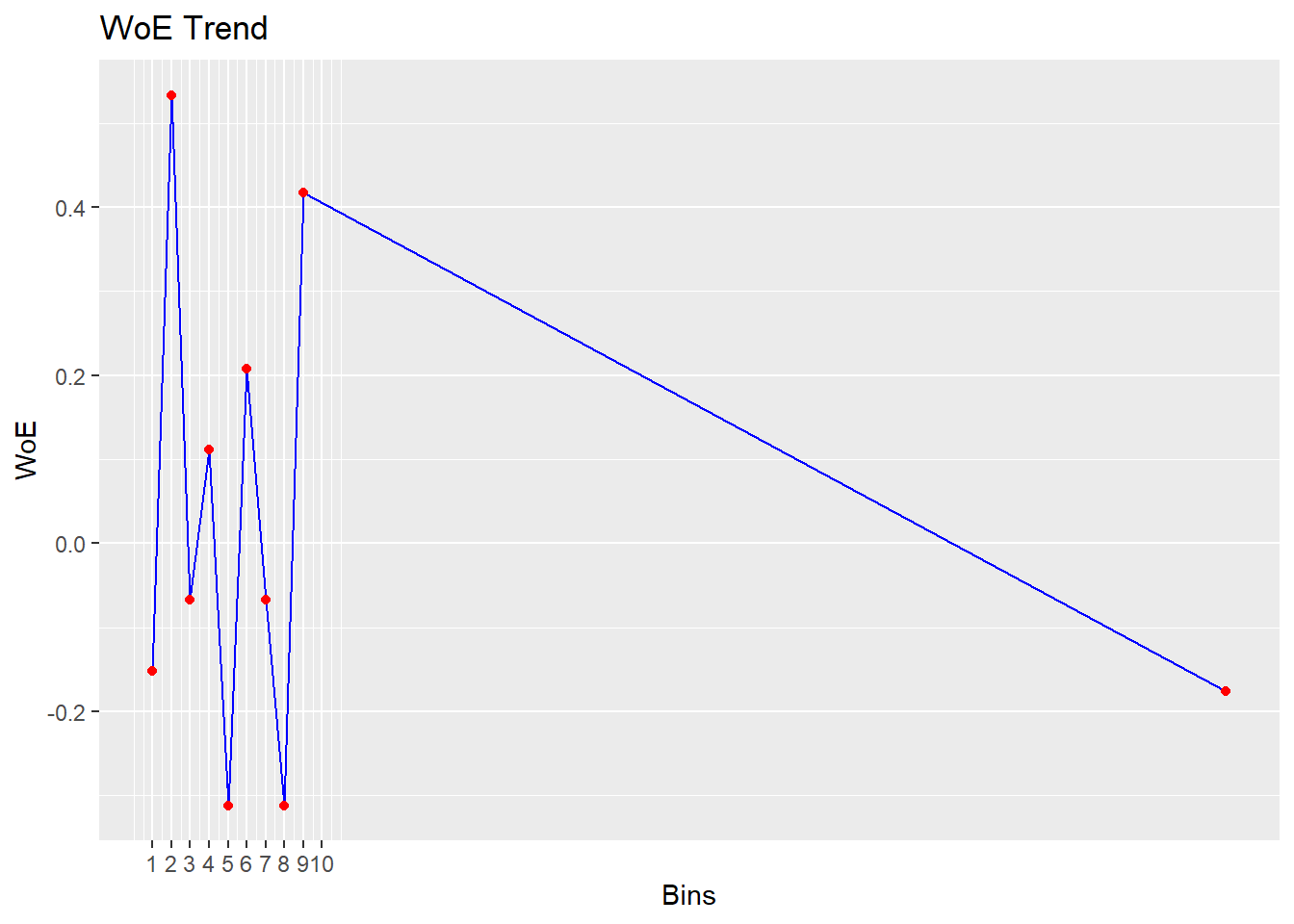

# Equal interval/width binning Because there are a lot of

# elderly people a lot of equal length bins is impossible

bin <- rbin_equal_length(data = train_imp, response = churn,

predictor = Age, bins = 3)

bin## Binning Summary

## ---------------------------------

## Method Equal Length

## Response churn

## Predictor Age

## Bins 3

## Count 589

## Goods 152

## Bads 437

## Entropy 0.82

## Information Value 0.03

##

##

## cut_point bin_count good bad

## 1 < 31.6666666666667 8 4 4

## 2 < 62.3333333333333 438 117 321

## 3 >= 62.3333333333333 143 31 112

## woe iv entropy

## 1 -1.05605267 0.018124474 1.0000000

## 2 -0.04678549 0.001646057 0.8373064

## 3 0.22845899 0.011958809 0.7542501plot(bin)

# The trend is more clear in this case, but the IV is still

# low So let's keep it like this for nowDiscrete categorization

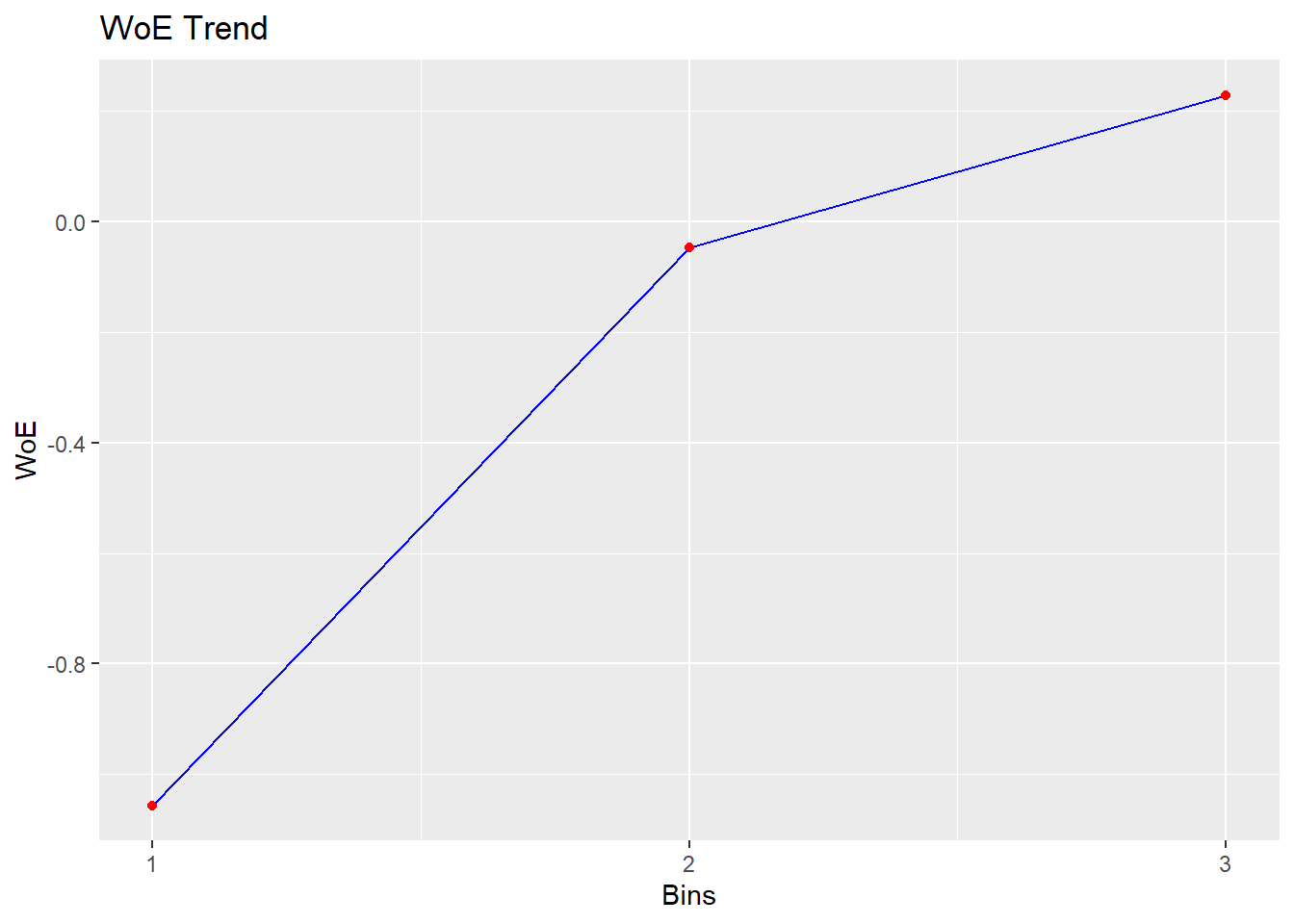

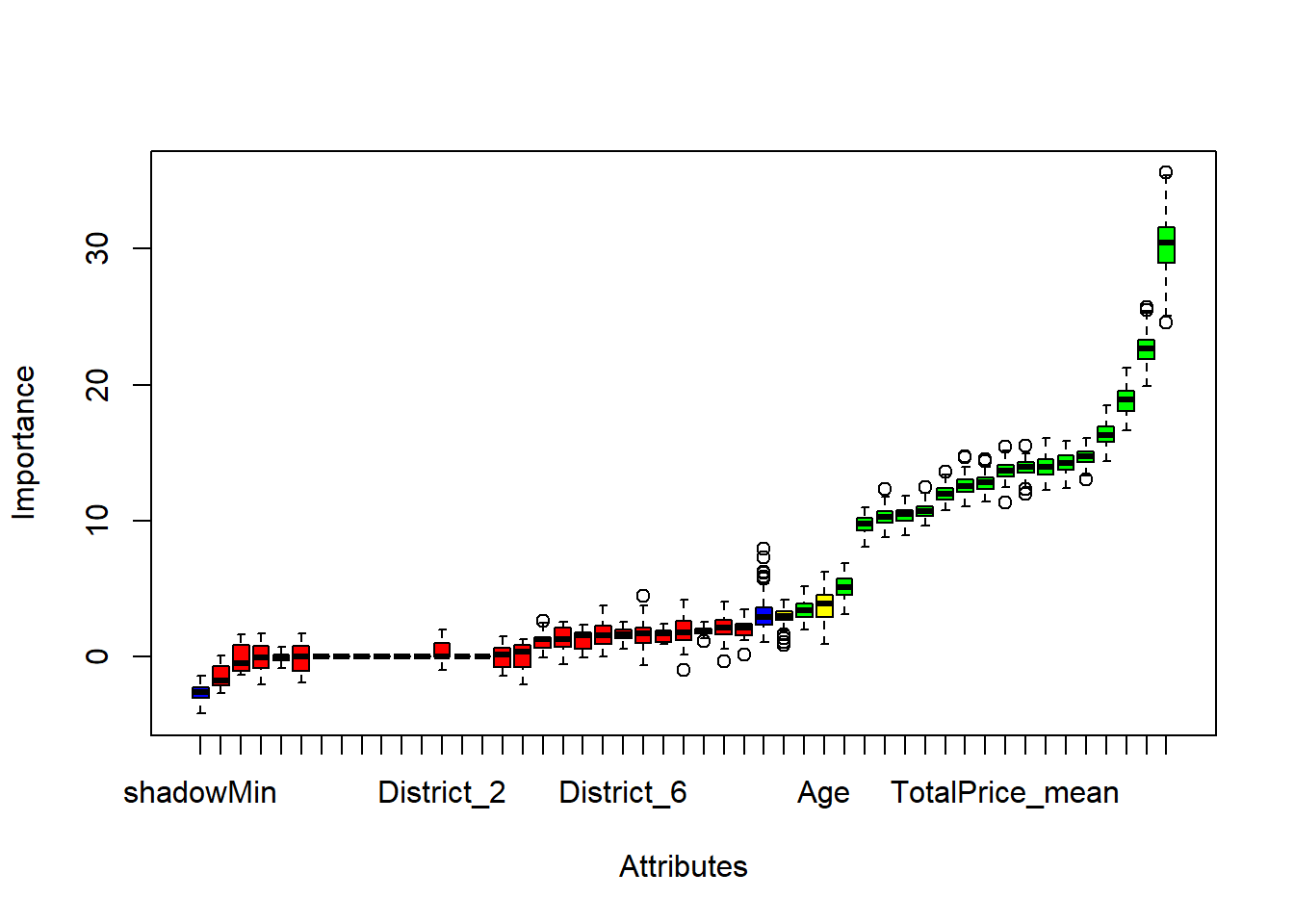

Binning discrete variables is a bit more difficult in R and not all packages support factors. One of the best packages available is woeBinning. This package bins discrete and numeric (!) variables in an automated fashion: categories will be joined together as long as the information value is not decreased by a certain factor, in the end the optimal solution in terms of IV is shown. Furthermore, it also has support for a predictive context, so in that sense it is superior to the rbin package.

The workhorse function is woe.binning, which allows you to bin one variable, two variables or even all variables. It also allows you to perform Laplacian smoothing to handle 0 frequencies.

Let’s work out an example on the District variable.

p_load(woeBinning)

# ?woe.binning Min.perc.total = 0.05 This parameter defines

# the number of initial classes before any merging is

# applied for numeric variables (0.05 implies 20 initial

# classes) this means that for factors that the original

# categories with less observations will be joined in

# 'miscellaneous' group stop.limit = 0.1 if the resulting

# IV decreases with more than 0.10, stop binning even.class

# = 1, this is the target class (in the package called

# negative event) that we predict (in our case churn)

binning <- woe.binning(train_imp, "churn", "District", min.perc.total = 0.05,

min.perc.class = 0, stop.limit = 0.1, abbrev.fact.levels = 50,

event.class = 1)

# Look at the solution

woe.binning.table(binning)## $`WOE Table for District`

## Final.Bin Total.Count Total.Distr.

## 1 misc. level neg. 35 5.9%

## 2 5 + 1 552 93.7%

## 3 misc. level pos. 2 0.3%

## 4 Total 589 100.0%

## 0.Count 1.Count 0.Distr. 1.Distr. 1.Rate WOE

## 1 15 20 3.4% 13.2% 57.1% -134.2

## 2 420 132 96.1% 86.8% 23.9% 10.1

## 3 2 0 0.5% 0.0% 0.0% 384.5

## 4 437 152 100.0% 100.0% 25.8% NA

## IV

## 1 0.130

## 2 0.009

## 3 0.018

## 4 0.157woe.binning.plot(binning)

# We can see that the algorithm decided to join district 5

# and 1 The other categories are joined together in a Misc

# group for the negatives (churn) and the positives (no

# churn)

# Now we still need to add the binning solution to the data

# frame We can use the woe.binning.deploy function This can

# be used on the training and the test set, so very useful

# for predictive context You can also choose to add dummies

# (var = 'dum') or add woe (var = 'dum')

train_binned_district <- woe.binning.deploy(train_imp, binning,

add.woe.or.dum.var = "dum")

head(train_binned_district)## CustomerID ProductID_1_sum ProductID_2_sum

## 503 497954 0 0

## 985 855200 0 0

## 1004 870967 0 1

## 919 800576 0 0

## 470 459730 0 0

## 823 746052 0 0

## ProductID_3_sum ProductID_4_sum

## 503 0 0

## 985 0 0

## 1004 0 2

## 919 0 0

## 470 0 0

## 823 0 0

## ProductID_5_sum ProductID_6_sum

## 503 0 0

## 985 0 0

## 1004 0 0

## 919 0 3

## 470 0 0

## 823 0 0

## ProductID_7_sum ProductID_8_sum

## 503 0 4

## 985 0 2

## 1004 0 0

## 919 0 0

## 470 0 4

## 823 0 3

## Pattern_0000010_sum Pattern_0000100_sum

## 503 0 0

## 985 0 0

## 1004 0 0

## 919 0 0

## 470 0 0

## 823 0 0

## Pattern_0001000_sum Pattern_0010000_sum

## 503 0 0

## 985 0 0

## 1004 0 0

## 919 0 0

## 470 0 0

## 823 0 0

## Pattern_0100010_sum Pattern_1000010_sum

## 503 0 0

## 985 0 0

## 1004 0 0

## 919 0 0

## 470 0 0

## 823 0 0

## Pattern_1001010_sum Pattern_1111110_sum

## 503 0 4

## 985 0 2

## 1004 0 3

## 919 0 3

## 470 0 4

## 823 0 3

## PaymentType_BT_sum PaymentType_DD_sum

## 503 4 0

## 985 2 0

## 1004 3 0

## 919 3 0

## 470 4 0

## 823 3 0

## PaymentStatus_Paid_sum

## 503 4

## 985 2

## 1004 3

## 919 3

## 470 4

## 823 3

## PaymentStatus_Not.Paid_sum StartDate_rec

## 503 0 62

## 985 0 78

## 1004 0 359

## 919 0 318

## 470 0 86

## 823 0 96

## RenewalDate_rec PaymentDate_rec

## 503 91 68

## 985 101 53

## 1004 390 370

## 919 349 339

## 470 117 105

## 823 126 115

## NbrNewspapers_mean NbrStart_mean

## 503 310.2500 15.00000

## 985 46.5000 7.50000

## 1004 304.6667 16.66667

## 919 313.0000 16.66667

## 470 304.0000 15.00000

## 823 219.3333 15.00000

## GrossFormulaPrice_mean NetFormulaPrice_mean

## 503 247.7075 243.0000

## 985 45.1000 45.1000

## 1004 237.6667 237.6667

## 919 237.6667 237.6667

## 470 243.0000 243.0000

## 823 185.5600 168.7067

## NetNewspaperPrice_mean ProductDiscount_mean

## 503 0.7850320 0.00000

## 985 0.9647820 1.56055

## 1004 0.7801140 0.00000

## 919 0.7599373 0.00000

## 470 0.7993303 0.00000

## 823 0.7109210 0.00000

## FormulaDiscount_mean TotalDiscount_mean

## 503 4.70750 4.70750

## 985 0.00000 1.56055

## 1004 0.00000 0.00000

## 919 0.00000 0.00000

## 470 0.00000 0.00000

## 823 16.85333 16.85333

## TotalPrice_mean TotalCredit_mean Gender

## 503 243.0000 0.0000000 M

## 985 38.5000 -7.7894500 F

## 1004 237.6667 0.0000000 M

## 919 237.3333 -0.3333333 F

## 470 243.0000 0.0000000 M

## 823 168.7067 0.0000000 M

## District ZIP StreeID Age churn

## 503 5 3920 46886 61 1

## 985 5 3530 38415 61 1

## 1004 1 2930 29121 55 0

## 919 1 2430 20879 57 0

## 470 5 3640 42237 61 1

## 823 5 3670 43000 60 1

## RenewalDate_rec_flag PaymentDate_rec_flag

## 503 0 0

## 985 0 0

## 1004 0 0

## 919 0 0

## 470 0 0

## 823 0 0

## Gender_flag District.binned

## 503 0 5 + 1

## 985 0 5 + 1

## 1004 0 5 + 1

## 919 0 5 + 1

## 470 1 5 + 1

## 823 0 5 + 1

## dum.District.51.binned

## 503 1

## 985 1

## 1004 1

## 919 1

## 470 1

## 823 1

## dum.District.misclevelneg.binned

## 503 0

## 985 0

## 1004 0

## 919 0

## 470 0

## 823 0

## dum.District.misclevelpos.binned

## 503 0

## 985 0

## 1004 0

## 919 0

## 470 0

## 823 0# Just be sure the delete the District.binned variable and

# and the original District variable in the final solution

# Applying this on the test set, is straightforward

test_binned_district <- woe.binning.deploy(test_imp, binning,

add.woe.or.dum.var = "dum")