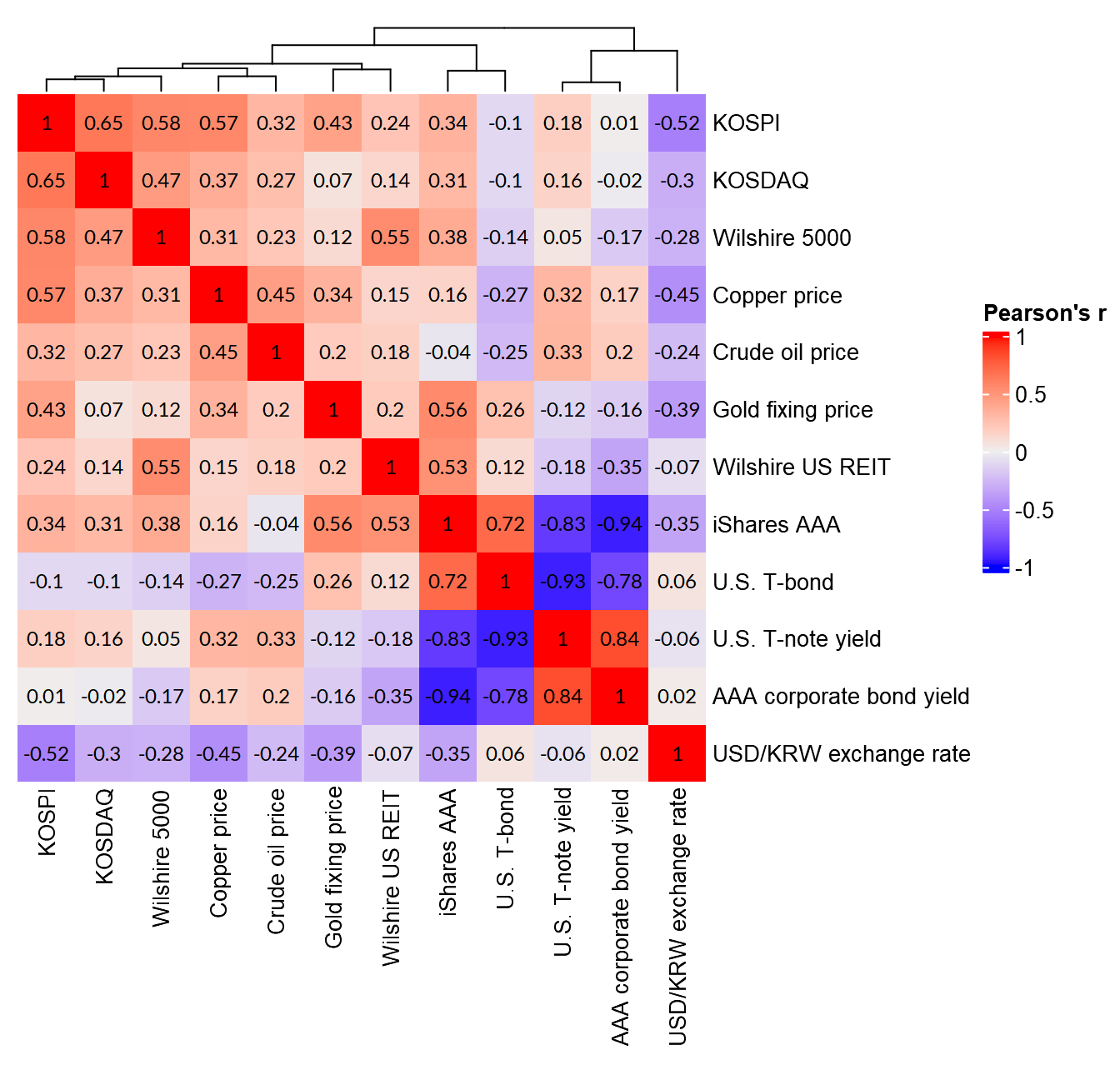

Chapter 10 Index evaluation

10.1 Index trend (2 years)10

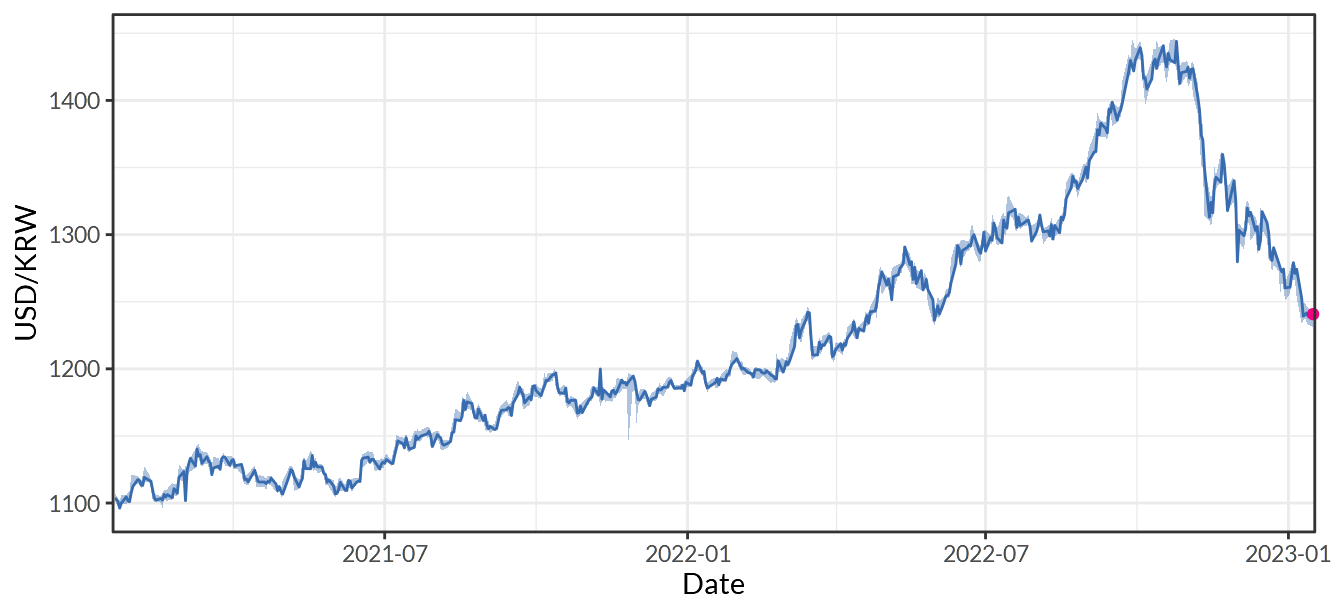

Figure 10.1: South Korea/U.S. Foreign Exchange Rate

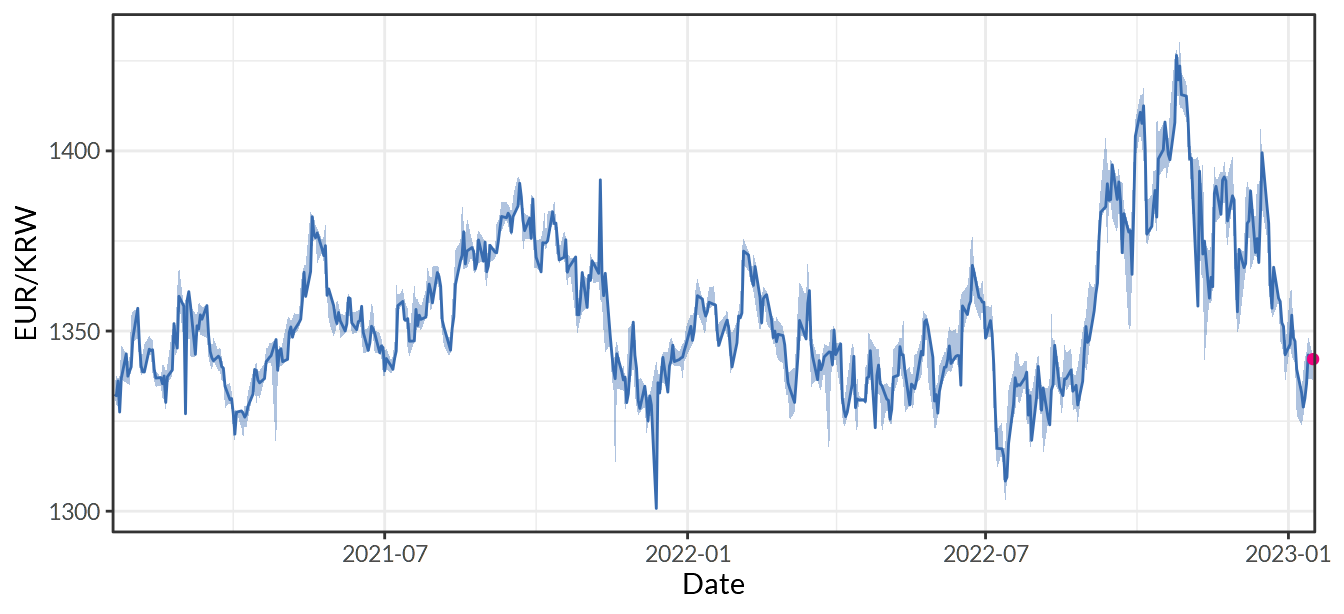

Figure 10.2: South Korea/Europe Foreign Exchange Rate

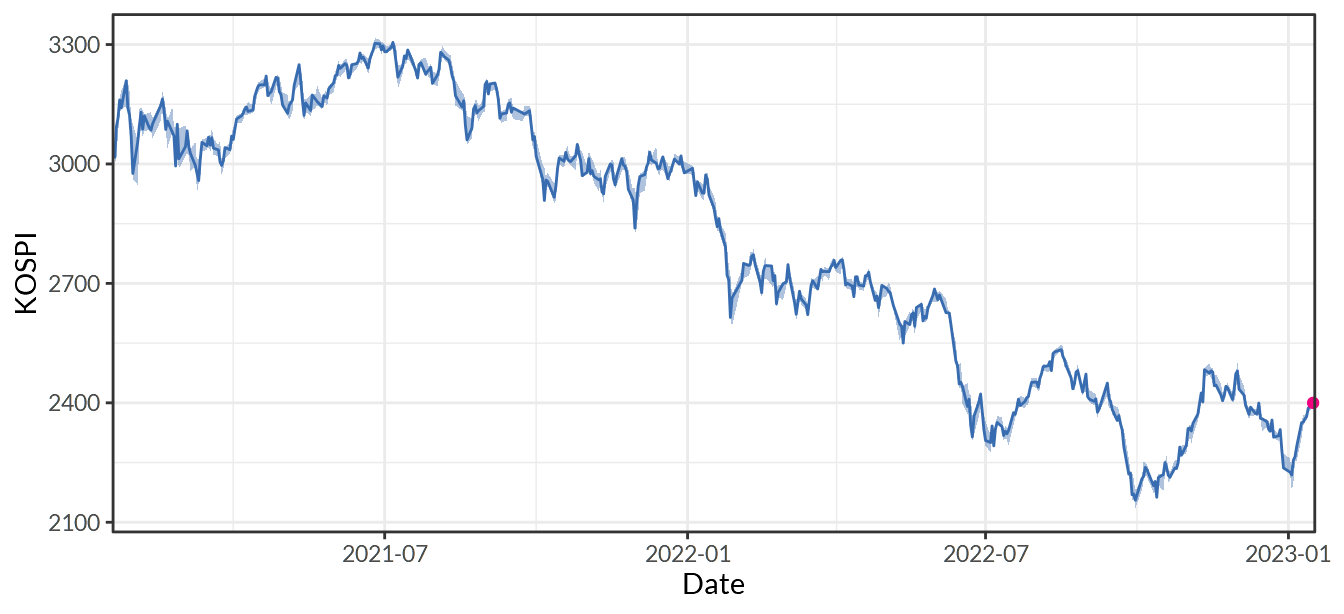

Figure 10.3: KOSPI Index

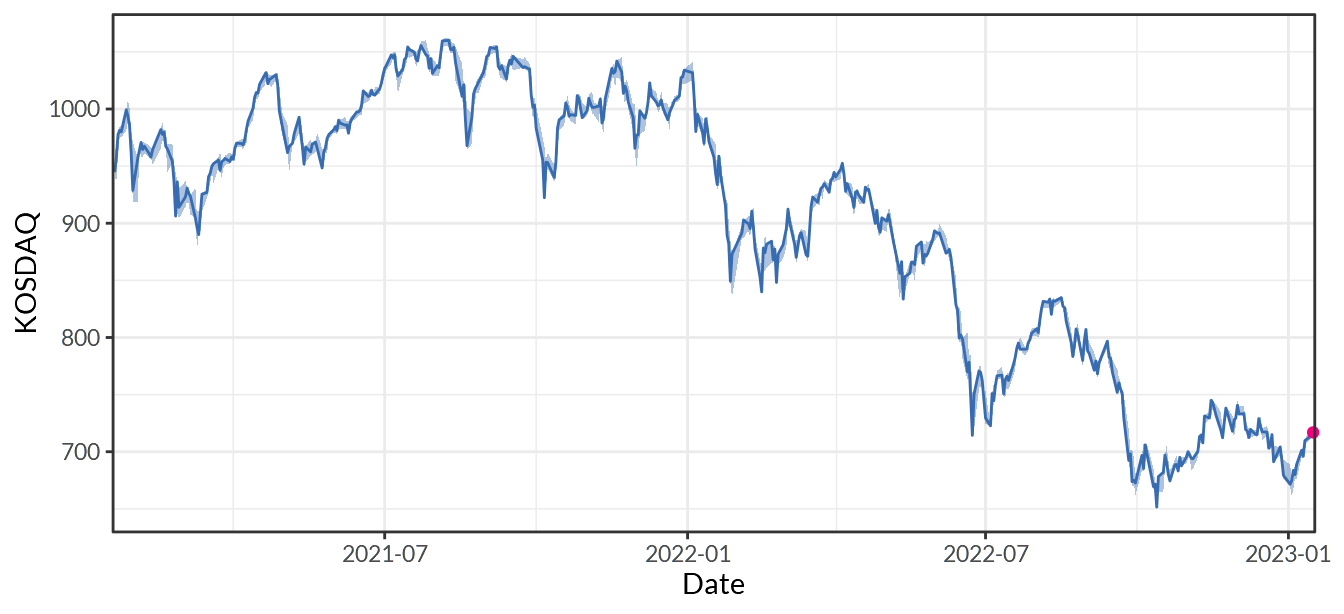

Figure 10.4: KOSDAQ Index

Figure 10.5: S&P 500 Index

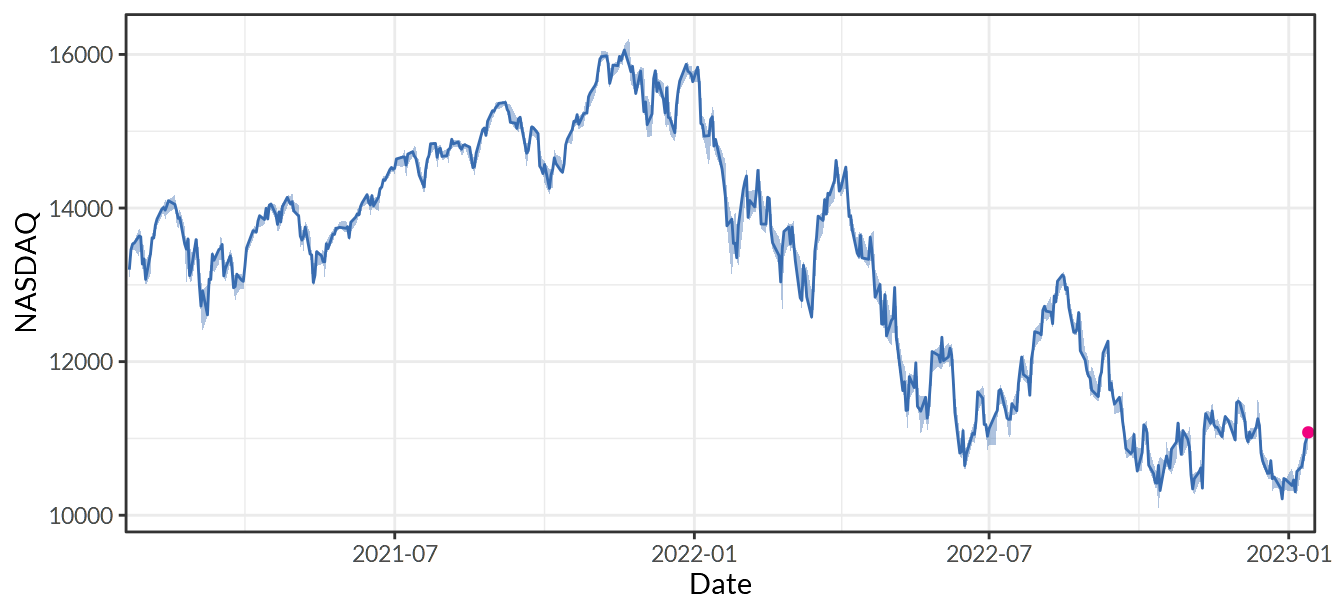

Figure 10.6: NASDAQ Composite Index

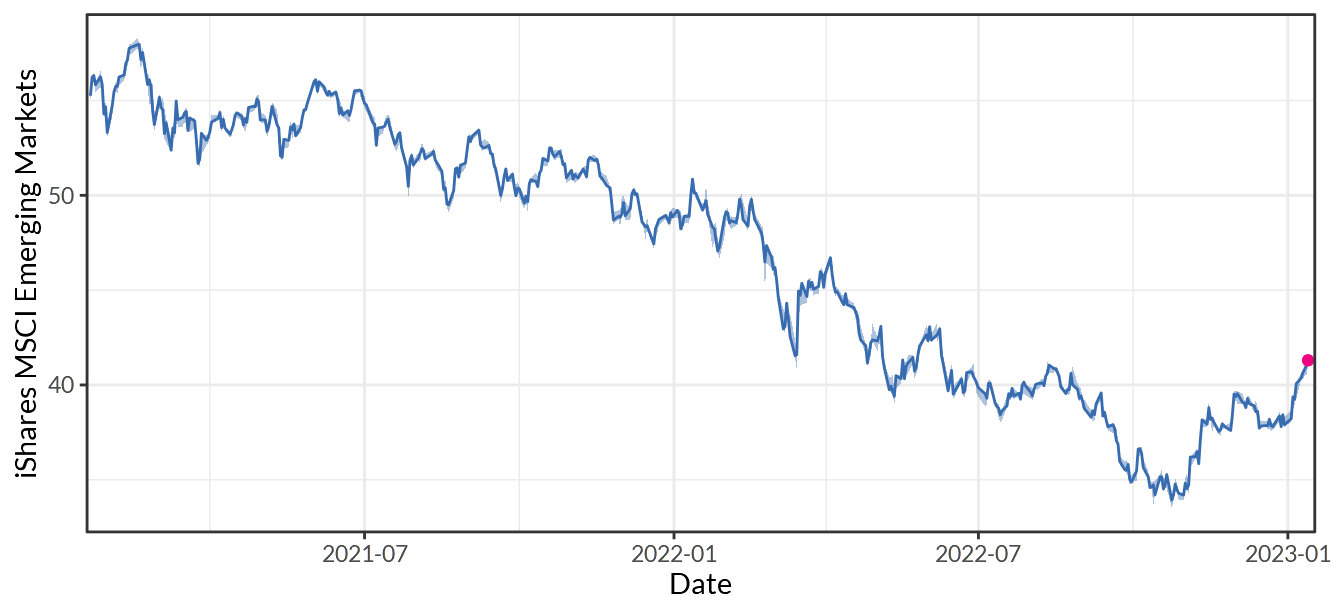

Figure 10.7: iShares MSCI Emerging Markets ETF

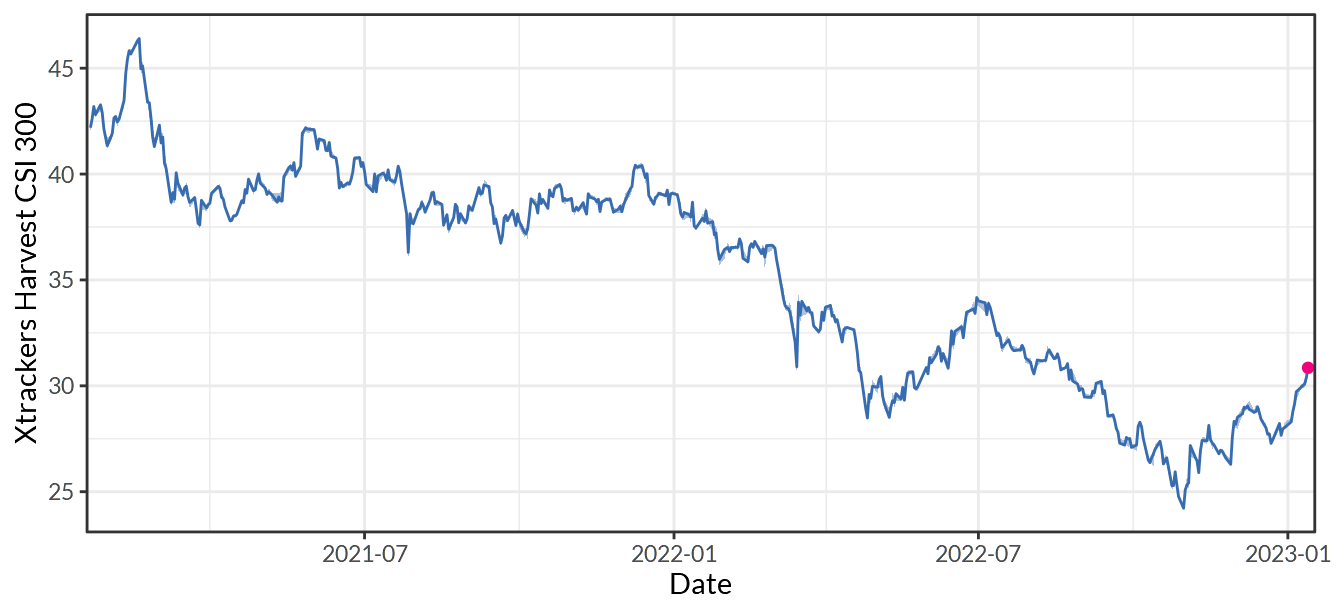

Figure 10.8: Xtrackers Harvest CSI 300 China A-Shares ETF

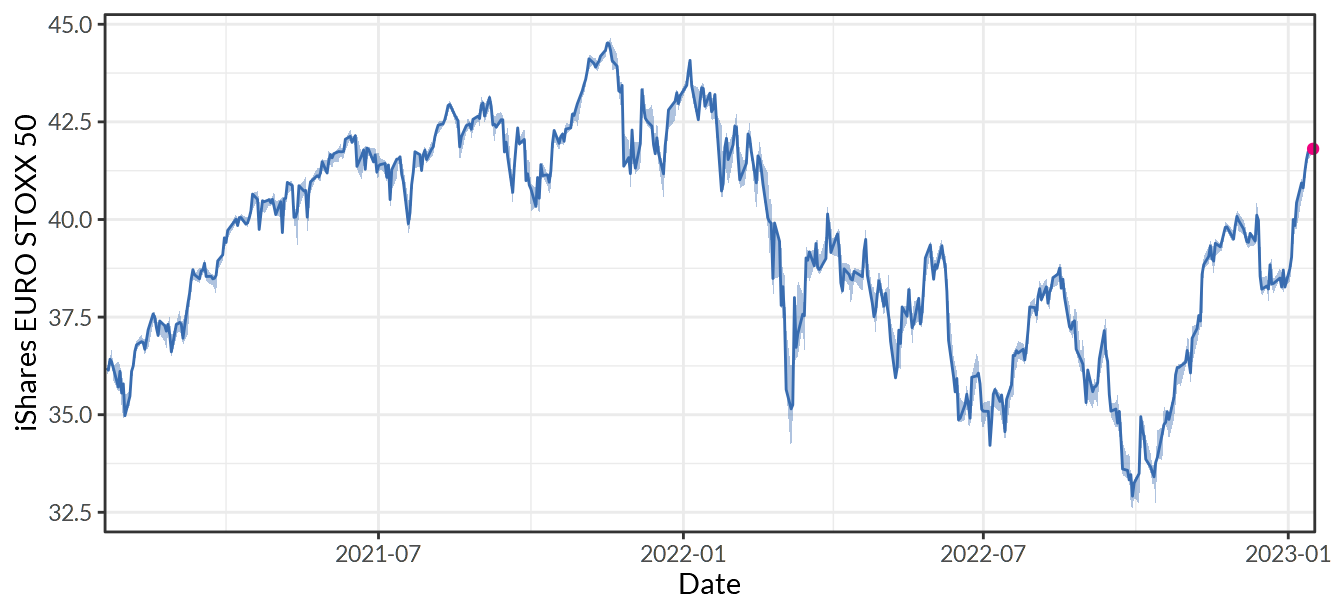

Figure 10.9: iShares EURO STOXX 50 UCITS ETF (DE)

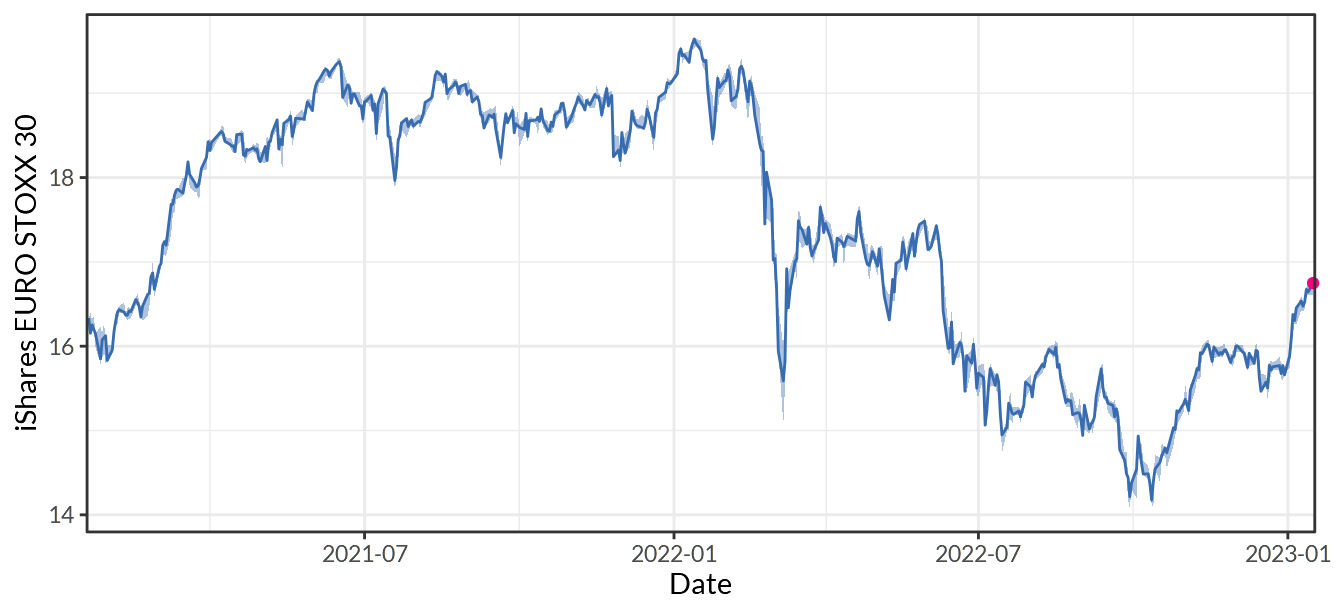

Figure 10.10: iShares EURO STOXX Select Dividend 30 UCITS ETF (DE)

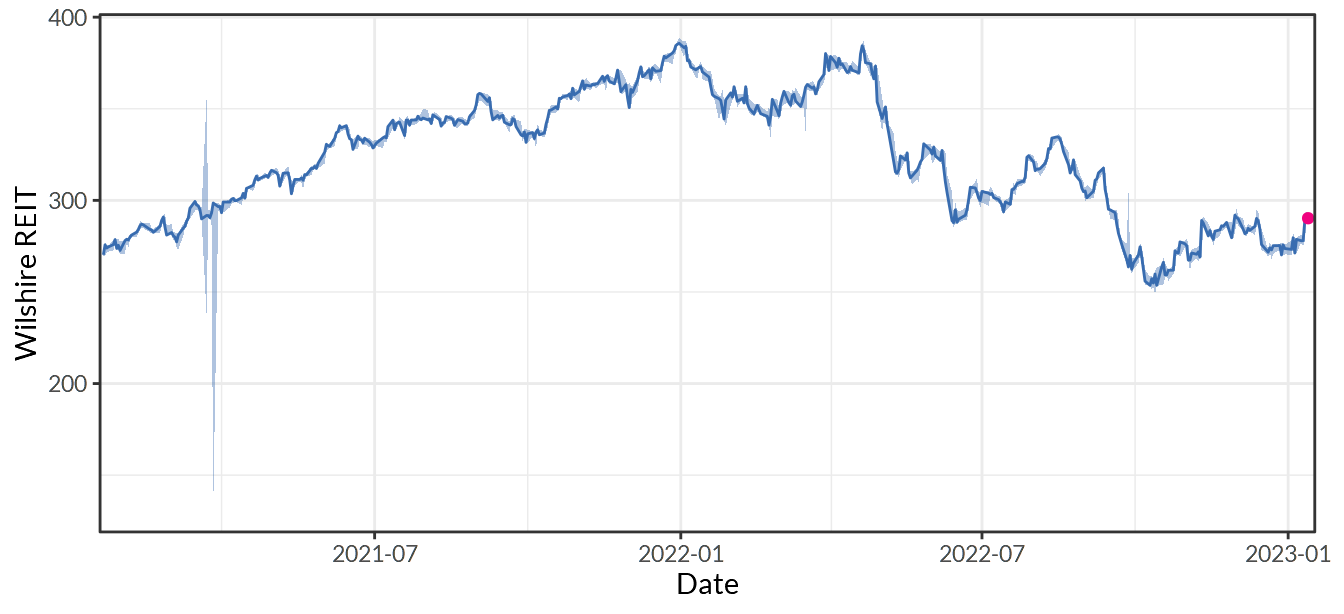

Figure 10.11: Wilshire US REIT Index

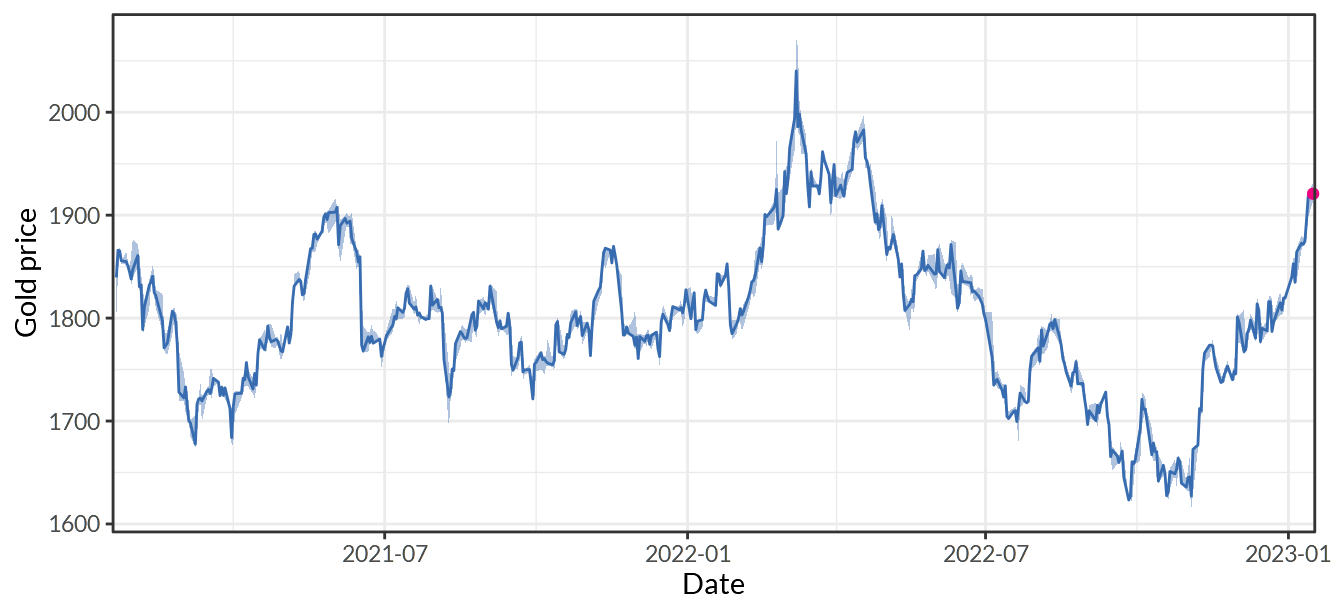

Figure 10.12: Gold

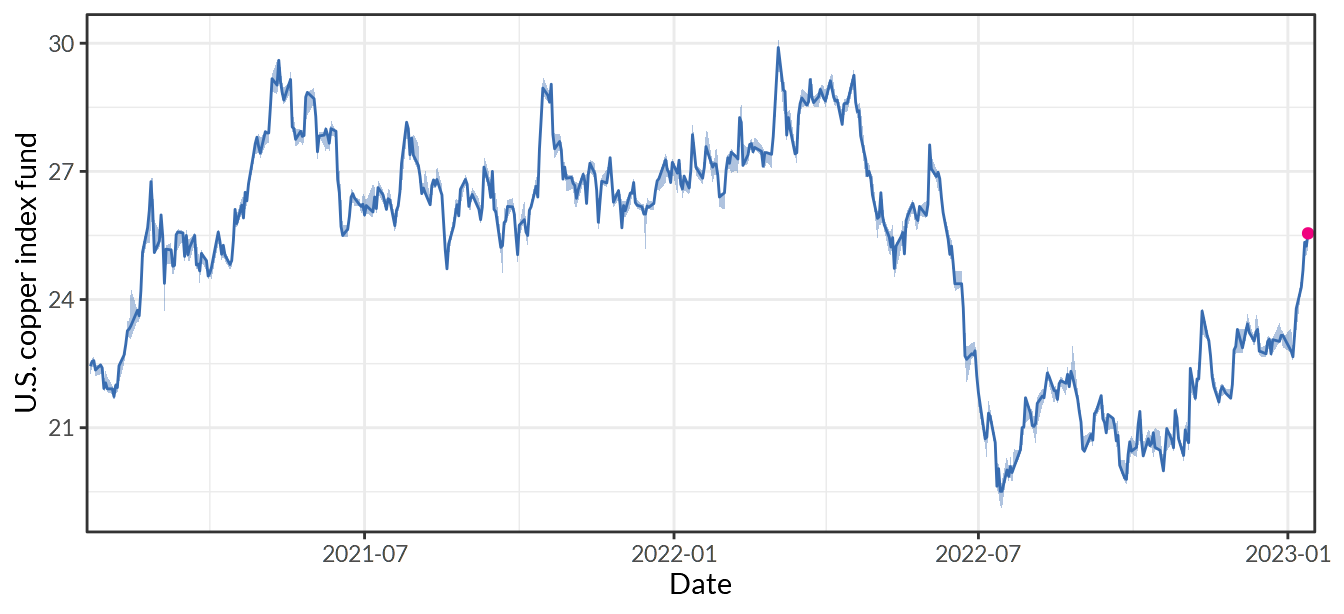

Figure 10.13: U.S Copper Index Fund, LP

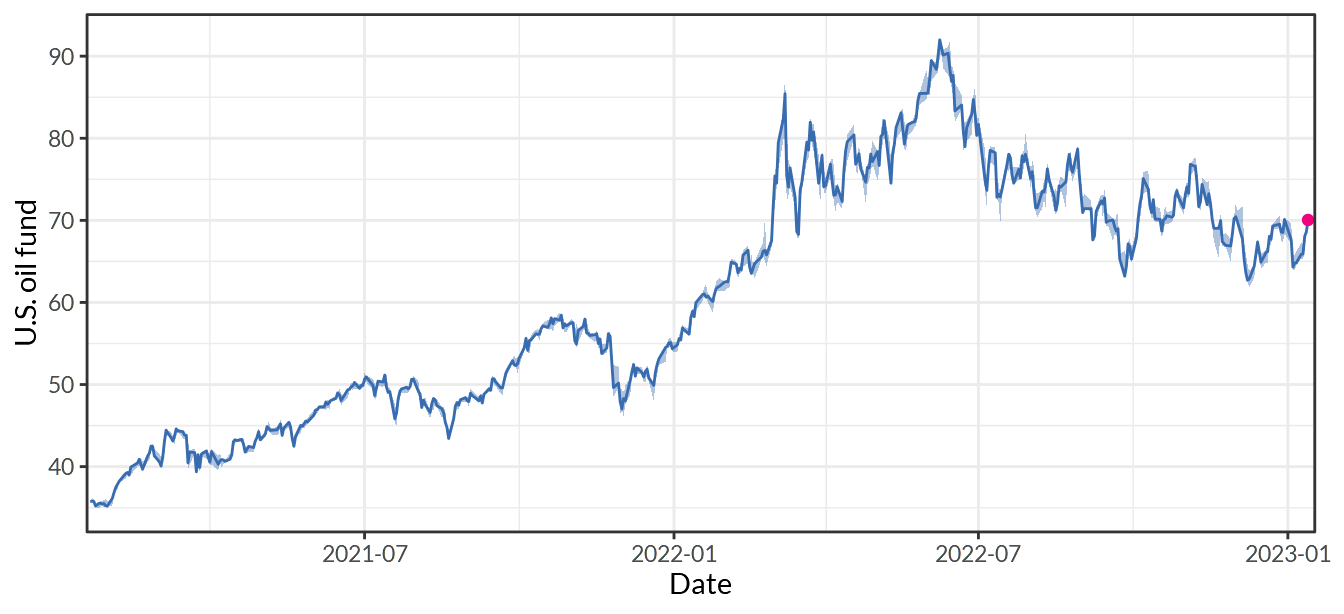

Figure 10.14: U.S. Oil Fund, LP

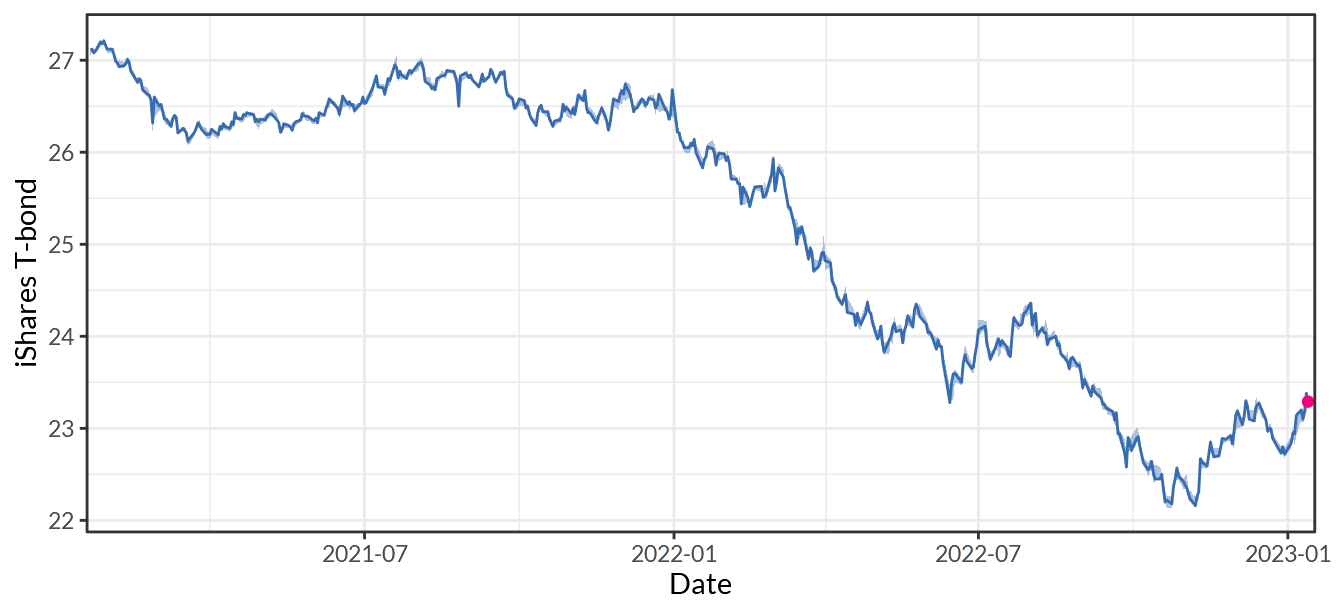

Figure 10.15: iShares U.S. Treasury Bond ETF

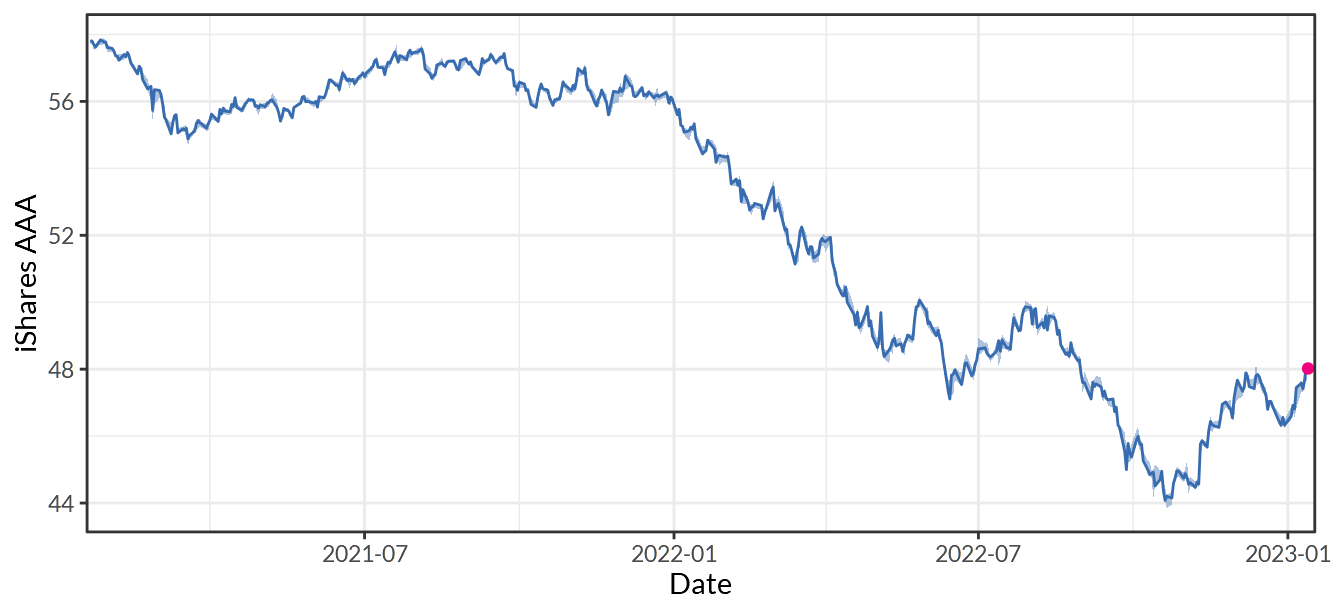

Figure 10.16: iShares Aaa - A Rated Corporate Bond ETF

Figure 10.17: Treasury Yield 10 Years

10.2 Index trend (30 years)11

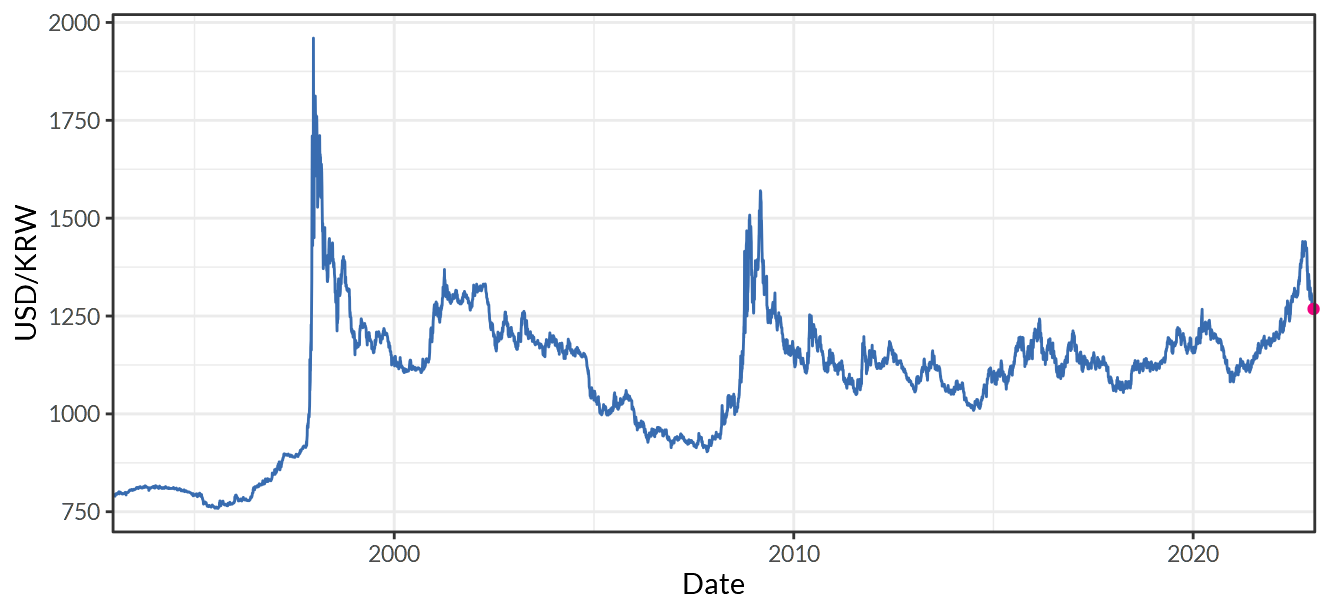

Figure 10.18: South Korea/U.S. Foreign Exchange Rate

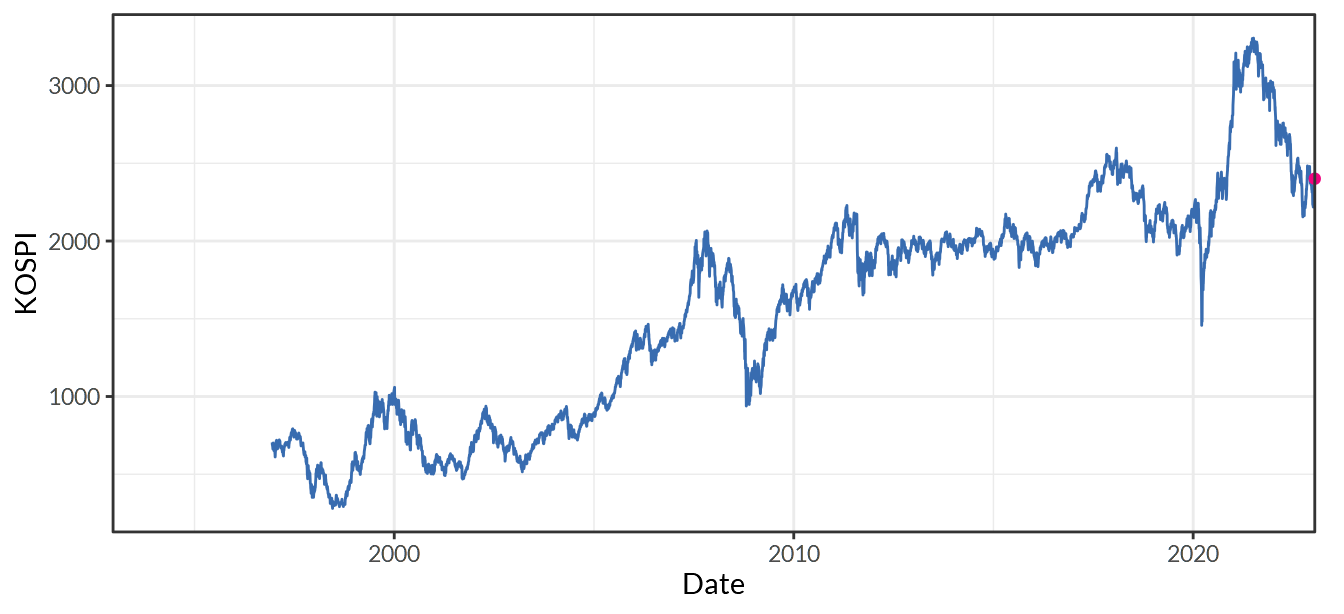

Figure 10.19: KOSPI Index

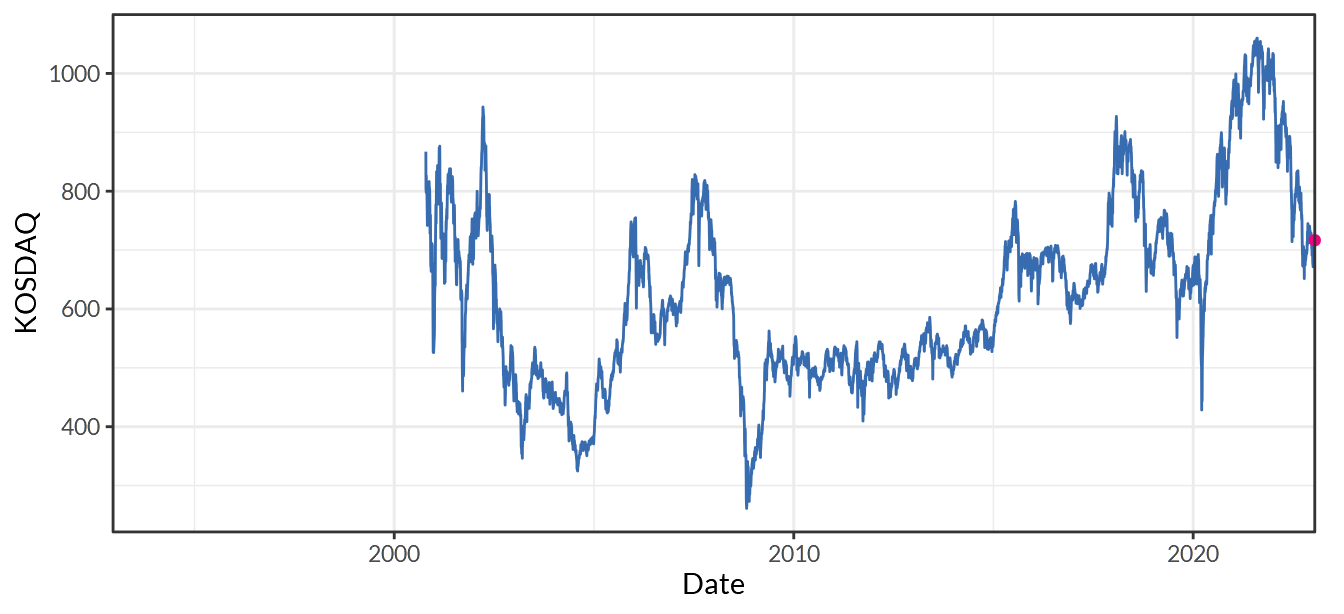

Figure 10.20: KOSDAQ Index

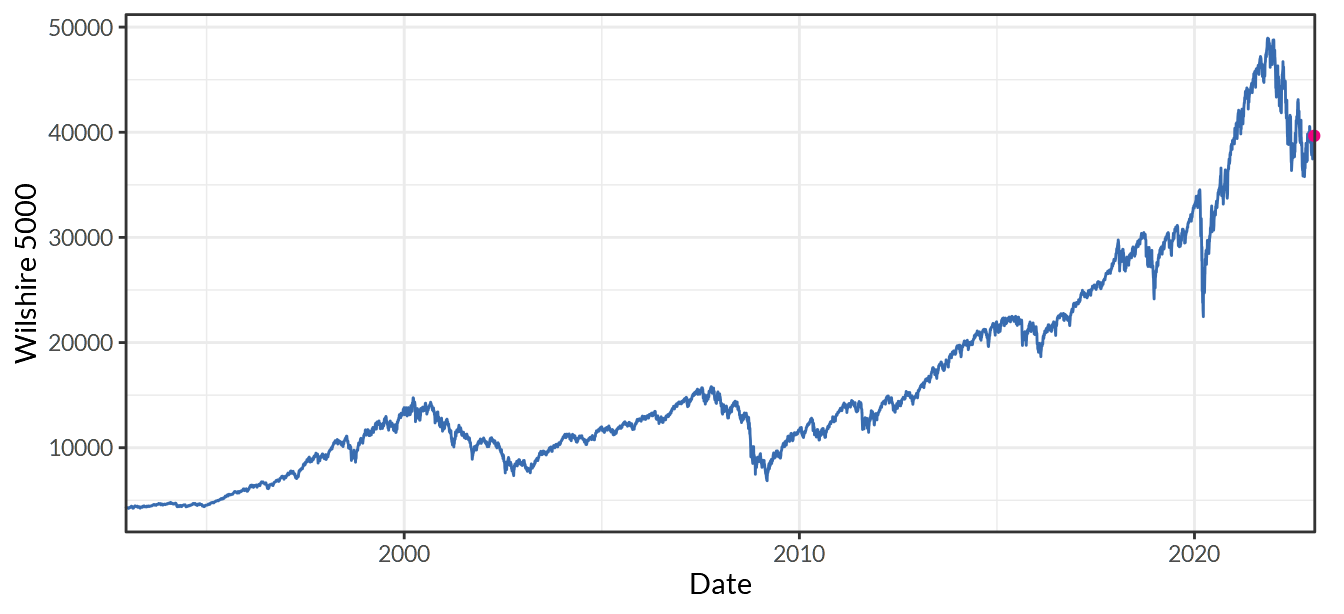

Figure 10.21: Wilshire 5000 Full Cap Price Index

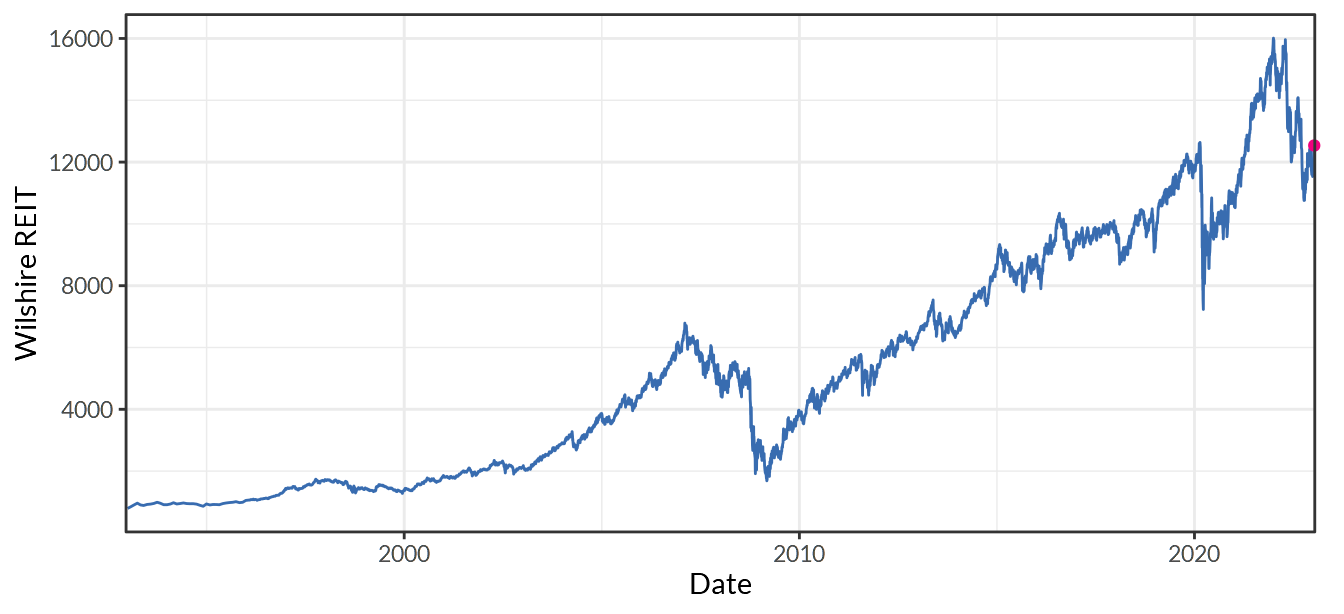

Figure 10.22: Wilshire US REIT Total Market Index

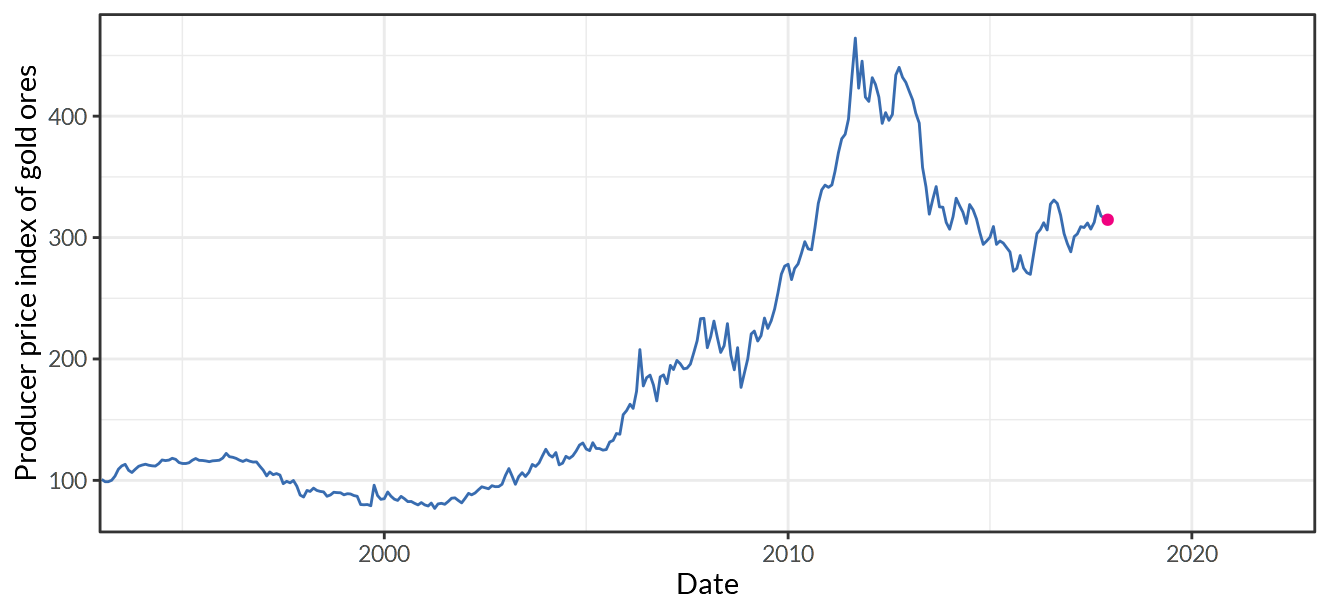

Figure 10.23: Gold Fixing Price 10:30 A.M. (London time) in London Bullion Market, based in U.S. Dollars

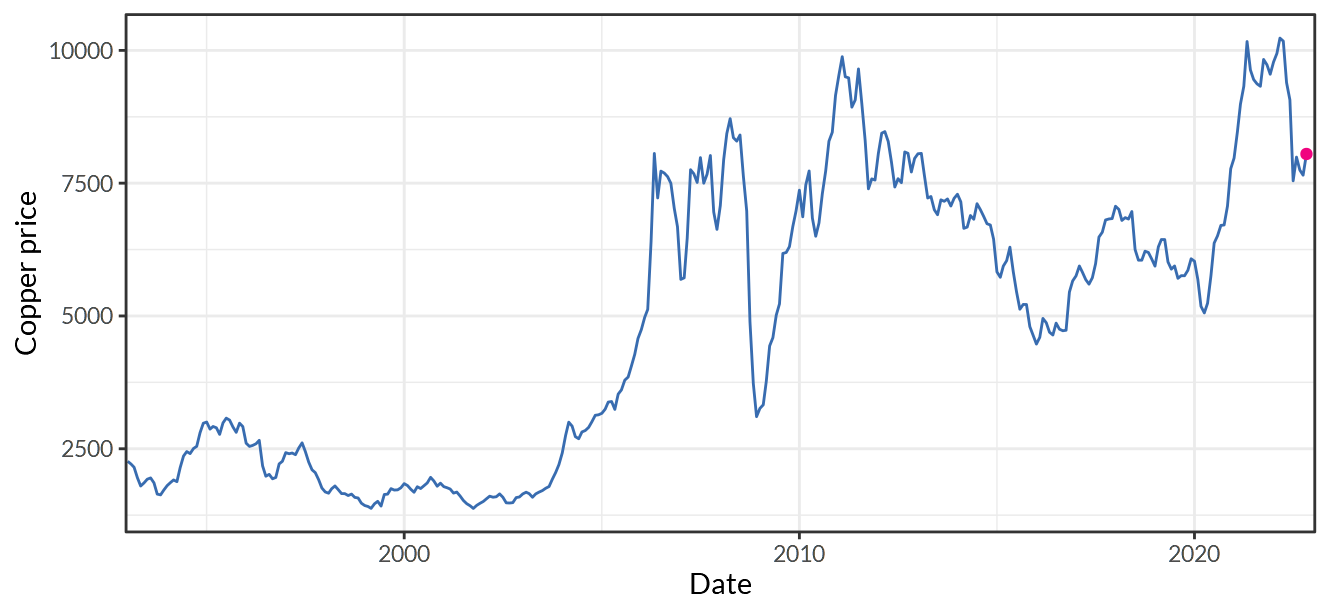

Figure 10.24: Global Price of Copper (U.S. Dollars per Metric Ton)

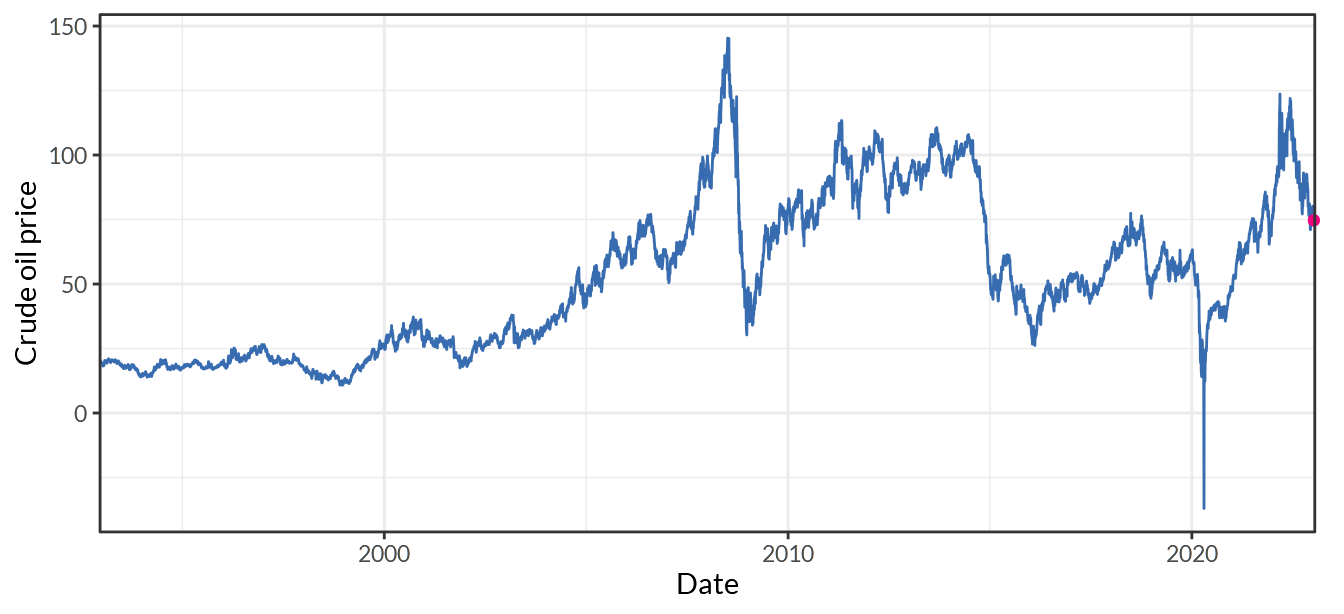

Figure 10.25: Crude Oil Prices: West Texas Intermediate (WTI) - Cushing, Oklahoma

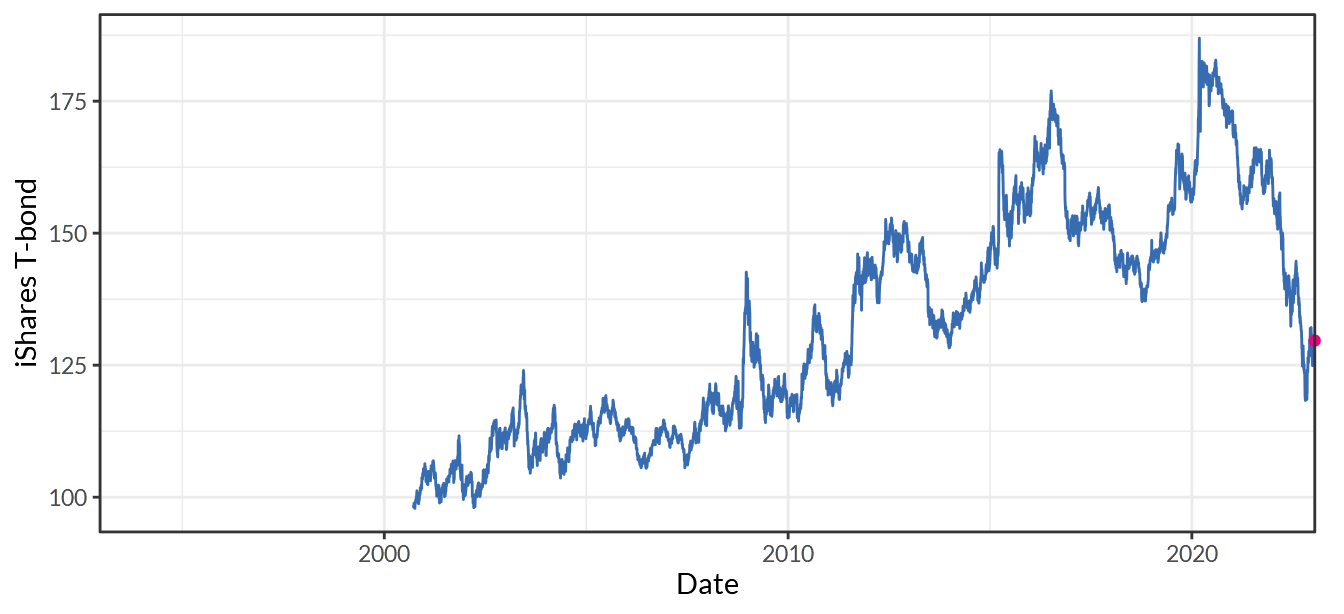

Figure 10.26: iShares U.S. Treasury Bond ETF

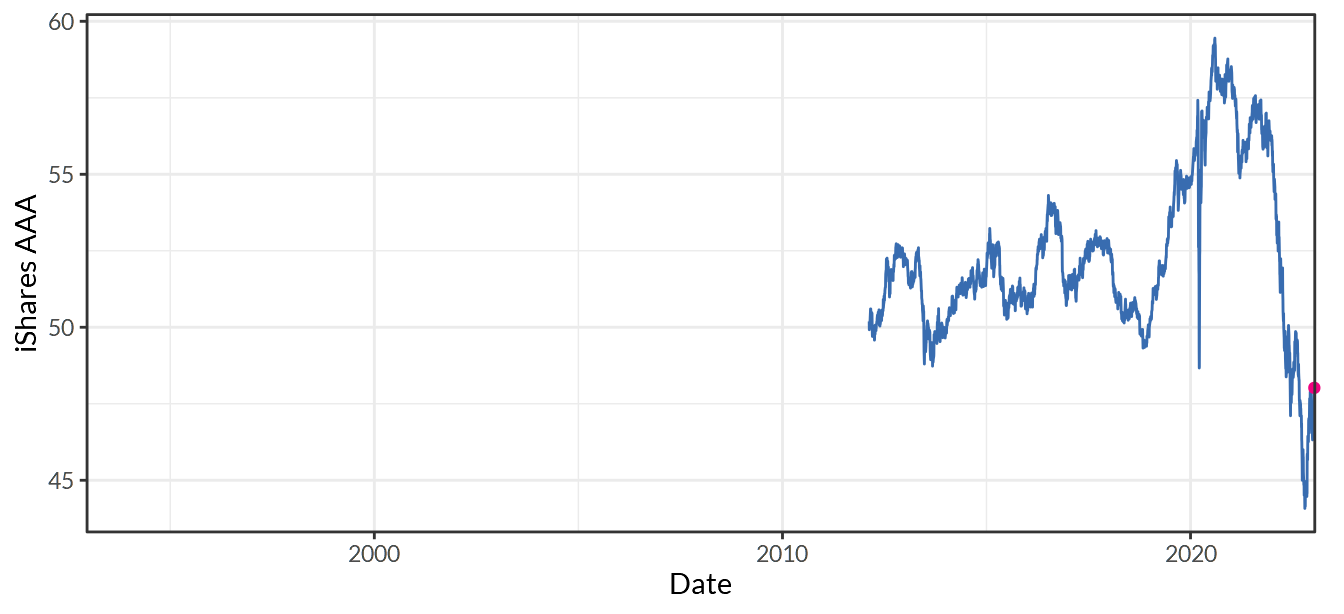

Figure 10.27: iShares Aaa - A Rated Corporate Bond ETF

Figure 10.28: Long-Term Government Bond Yields: 10-year: Main (Including Benchmark) for the United States

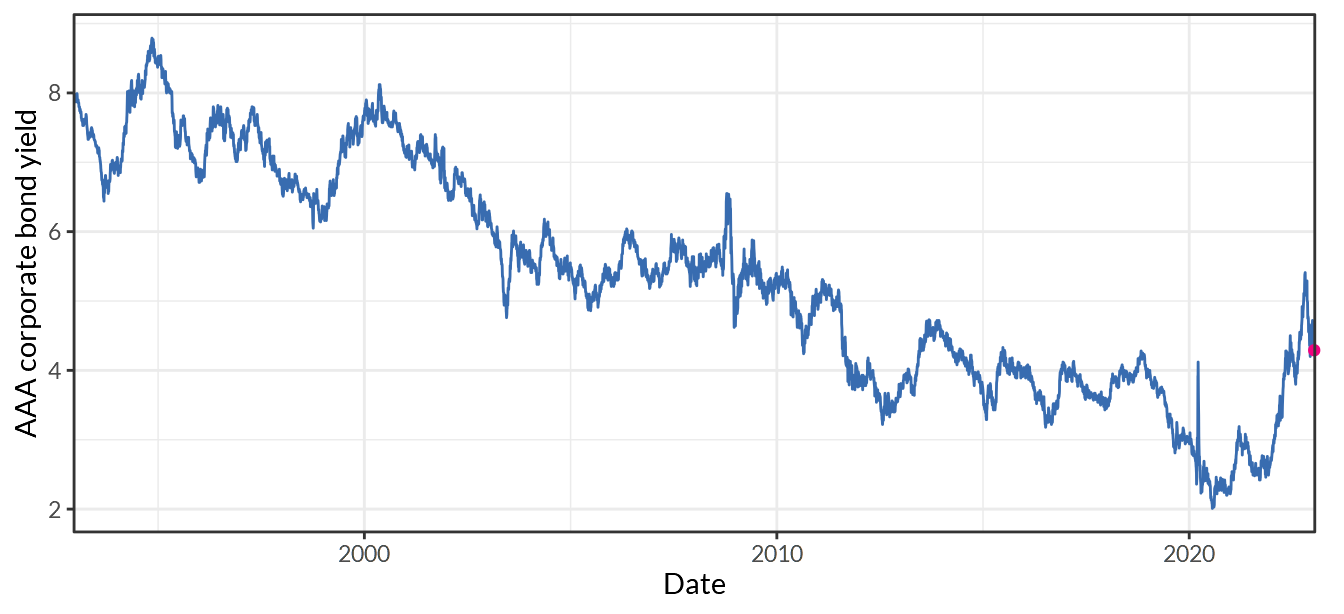

Figure 10.29: Moody’s Seasoned AAA Corporate Bond Yield

Data are from Yahoo Finance.↩︎

Data are from Federal Reserve Bank of St. Louis.↩︎