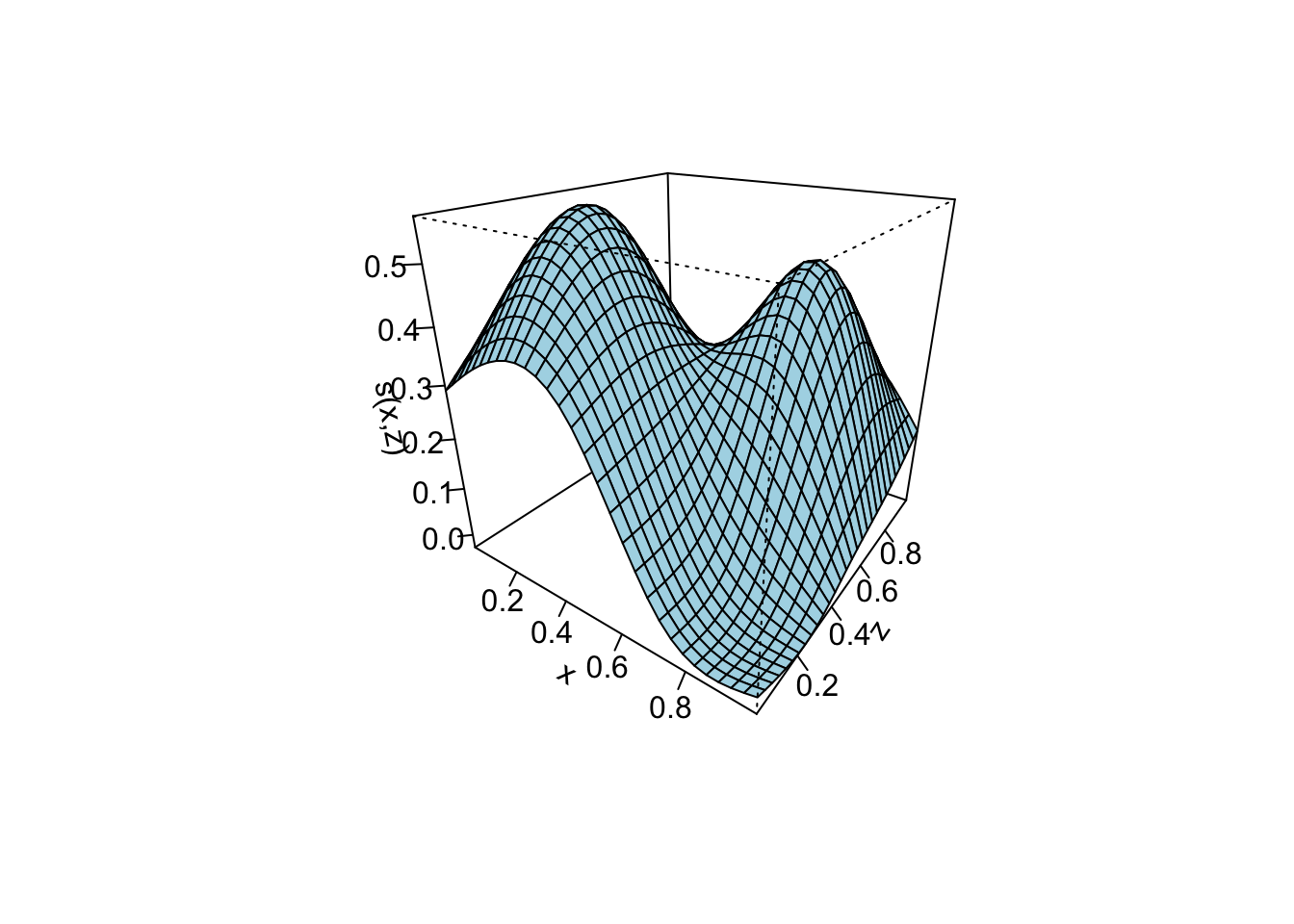

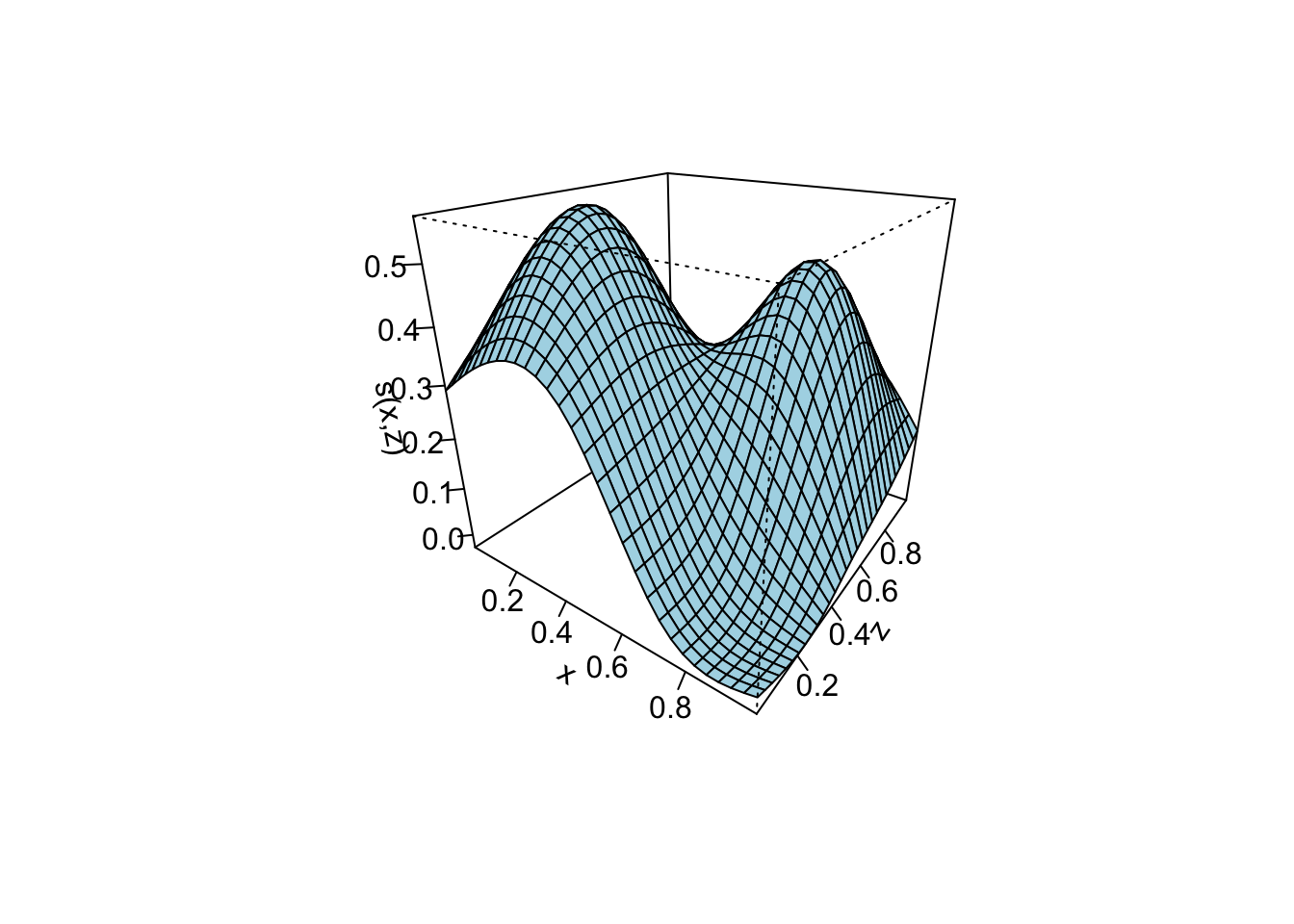

Bivariate smoothing example

Module 5A focused on additive nonlinear effects, \[ g(\mathbb{E}[Y]) = \beta_0 + \sum_{j=1}^p s_j(X_j), \] which assumes that each predictor \(j\) has its own smooth effect, but those smooth functions do not interact or vary by group. This rules out two common features of real data:

(1) Smooth Interactions: the effect of \(X\) may change smoothly across levels of another variable \(Z\). In other words, the shape of a smooth function \(s(X)\) depends on \(Z\), meaning the joint effect is a smooth surface rather than two separate additive curves.

(2) Group-specific smooth functions and clustering: Smooth functions may differ by group (effect modification across individuals, regions, clinics, etc.). These situations introduce clustering that cannot be handled by a simply additive GAM. They require either (a) varying-coefficient smooths (smooths allowed to differ by group), or (b) explcit random effects.

Goal of Module 5B: add (1) smooth interactions via tensor products; (2) varying-coefficient smooths.

First, consider the setting where we have two continuous predictors, \(x\) and \(z\), and the outcome \(y\) depends on them in a jointly nonlinear way. In this situation, modeling the effect of \(x\) and the effect of \(z\) separately is not enough; instead, we need a smooth bivariate surface \(s_{12}(x,z)\) that captures how the effect of one variable changes smoothly across levels of the other.

This scenario arises in many applications. For example:

In all of these settings, the two variables interact in a way that cannot be represented by a single univariate smooth, nor by smoothing the product \(xz\). Instead, we need a flexible framework for estimating a smooth surface over the \((x,z)\) plane.

Tensor-product smooths provide exactly this framework. They are built by combining the univariate spline bases for \(x\) and \(z\) and then penalizing curvature separately in each direction.

The next section explains how these smooth surfaces are constructed using spline bases and anisotropic penalties.

For two continuous predictors \(x\) and \(z\), the model is given by \[ g(\mathbb{E}[Y]) = \beta_0 + s_1(x) + s_2(z) + s_{12}(x,z), \] where

\(s_{12}(x,z)\) is not a smooth of the product \((xz)\). Instead it is a bivariate smooth function- a flexible surface over the 2D plane formed by \((x,z)\).

Bivariate smoothing example

To construct a smooth surface \(s_{12}(x,z)\), we begin with the same building blocks used in univariate GAMs: basis functions and smoothness penalties. A tensor-product smooth represents a bivariate surface by combining the marginal spline bases for \(x\) and \(z\).

Let

For example, these could be cubic B-splines.

A tensor-product smooth constructs a bivariate basis by pairing every basis function in \(x\) with every basis function in \(z\). This is achieved using the row-wise Kronecker product:

\[ \mathbf{b}_{xz}(x,z) = \mathbf{b}_x(x) \otimes \mathbf{b}_z(z), \]

Using this construction, the smooth surface is:

\[ s_{12}(x,z) = \mathbf{b}_{xz}(x,z)^\top \boldsymbol{\beta}. \]

From Module 5A, we learned about penalties for curvature:

\[ \text{Penalty} = \lambda \int [s''(x)]^2 \, dx \]

where \(s''(x)\) is the second derivative (curvature).

The smoothing parameter \(\lambda\) controls wiggliness: larger \(\lambda\) values produce smoother functions.

For a spline written as \(s(x) = \mathbf{b}_x(x)^\top \boldsymbol{\beta}\), the curvature penalty becomes

\[ \text{Penalty} = \lambda\, \boldsymbol{\beta}^\top \mathbf{K} \boldsymbol{\beta}. \]

Here:

In one dimension, each smooth has its own penalty matrix. For the marginal smooths:

For a bivariate smooth, we now have a grid of \(Q \times P\) tensor-product basis functions. To smooth the full surface, we must extend the 1D penalties across this grid.

The idea is:

This extension is achieved using Kronecker products with identity matrices.

The full penalty for a bivariate tensor-product smooth is

\[ \mathcal{P}(\boldsymbol{\beta}) = \lambda_x\, \boldsymbol{\beta}^\top (\mathbf{K}_x \otimes \mathbf{I}_{P})\, \boldsymbol{\beta} \;+\; \lambda_z\, \boldsymbol{\beta}^\top (\mathbf{I}_{Q} \otimes \mathbf{K}_z)\, \boldsymbol{\beta}. \]

Below we break this expression into two interpretable pieces—one for the \(x\)-direction and one for the \(z\)-direction.

\[ \lambda_x\, \boldsymbol{\beta}^\top (\mathbf{K}_x \otimes \mathbf{I}_{P})\, \boldsymbol{\beta}. \]

Components:

\(\mathbf{K}_x\)

The univariate curvature penalty matrix for the \(x\)-basis functions

(size \(Q \times Q\)).

\(\mathbf{I}_{P}\)

Identity matrix of size \(P \times P\), one for each \(z\)-basis function.

\(\mathbf{K}_x \otimes \mathbf{I}_P\)

Kronecker product that repeats \(\mathbf{K}_x\) across all \(P\) columns of the \(Q \times P\) tensor-product grid.

This applies the \(x\)-direction curvature penalty to every \(z\)-basis function.

\(\lambda_x\)

Smoothing parameter controlling how much we penalize wiggliness in the \(x\)-direction.

Interpretation:

This term smooths the surface horizontally. It controls how wiggly the surface can be if we vary \(x\) while holding \(z\) fixed.

\[ \lambda_z\, \boldsymbol{\beta}^\top (\mathbf{I}_{Q} \otimes \mathbf{K}_z)\, \boldsymbol{\beta}. \]

Components:

\(\mathbf{K}_z\)

The univariate curvature penalty matrix for the \(z\)-basis functions

(size \(P \times P\)).

\(\mathbf{I}_{Q}\)

Identity matrix of size \(Q \times Q\), one for each \(x\)-basis function.

\(\mathbf{I}_Q \otimes \mathbf{K}_z\)

Kronecker product that repeats \(\mathbf{K}_z\) down all \(Q\) rows of the tensor-product grid.

This applies the \(z\)-direction curvature penalty to every \(x\)-basis function.

\(\lambda_z\)

Smoothing parameter controlling how much we penalize wiggliness in the \(z\)-direction.

Interpretation:

This term smooths the surface vertically. It controls how wiggly the surface can be if we vary \(z\) while holding \(x\) fixed.

A tensor-product smooth is a \(Q \times P\) grid of basis functions.

To make the resulting surface smooth:

\(\mathbf{K}_x \otimes \mathbf{I}_P\)

smooths along the \(x\)-direction (left–right across the grid)

\(\mathbf{I}_Q \otimes \mathbf{K}_z\)

smooths along the \(z\)-direction (up–down across the grid)

Together, these two terms allow the model to control smoothness separately in each direction—important when \(x\) and \(z\) are measured on very different scales or units.

Coming back to the example in Module 5A, we are interested in the association between daily variation in mortality counts and daily variation in air pollution exposure (PM\(_{2.5}\)). In a time-series design, the population serves as the unit of analysis—our outcome represents total daily deaths in a defined area.

As before, time-varying confounders such as temperature, humidity, and long-term/seasonal trends must be controlled flexibly using smooth functions of time and weather. In this dataset, we have:

alldeaths: total daily deathspm25: daily PM\(_{2.5}\) (or pm25.lag1 for lagged exposure)Temp: daily mean temperatureDpTemp: daily mean dew point temperature (a proxy for humidity)date2: numeric time indexfdow: day-of-week factorWe model the expected daily deaths using a log–link Poisson GAM:

\[ \begin{aligned} \log \mathbb{E}[y_t] &= \beta_0 \;+\; f_{\text{Temp,PM}}\!\big(\text{Temp}_t,\, \text{PM}_{t-1}\big) \;+\; \boldsymbol{\alpha}^\top \mathbf{1}\{\text{DOW}_t\} \\[4pt] &\quad+\; f_{\text{Season}}(\text{DOY}_t) \;+\; f_{\text{Trend}}(t), \end{aligned} \]

where:

alldeaths),pm25.lag1),s(doy, bs = "cc")),s(date2)).The bivariate smooth interaction is represented as

\[ f_{\text{Temp,PM2.5}}(x, z) = \sum_{q=1}^{Q} \sum_{p=1}^{P} \beta_{qp}\, b_{xq}(x)\, b_{zp}(z), \]

where

Smoothness in each direction is controlled separately via anisotropic penalties:

\[ \lambda_x\, \boldsymbol{\beta}^\top (\mathbf{K}_x \otimes \mathbf{I}_{P})\, \boldsymbol{\beta} \;+\; \lambda_z\, \boldsymbol{\beta}^\top (\mathbf{I}_{Q} \otimes \mathbf{K}_z)\, \boldsymbol{\beta}, \]

library(mgcv)

load(paste0(getwd(), '/data/NYC.RData'))

health$date2 <- order(health$date)

health$pm25.lag1 <- c(NA, health$pm25[1:1825])

health$doy <- as.integer(format(health$date, "%j")) # Day of year

health$fdow <- factor(health$dow)

health$fdow <- relevel(health$fdow, ref = "Sunday")

mod_tensor <- gam(

alldeaths ~

te(Temp, pm25.lag1) + # smooth interaction: temperature × air pollution. Deafult k=10

s(doy, bs = "cc", k = 30) + # cyclic annual seasonality

s(date2, k = 100) + # long-term trend

fdow, # day-of-week

family = poisson,

data = health

)

summary(mod_tensor)

Family: poisson

Link function: log

Formula:

alldeaths ~ te(Temp, pm25.lag1) + s(doy, bs = "cc", k = 30) +

s(date2, k = 100) + fdow

Parametric coefficients:

Estimate Std. Error z value Pr(>|z|)

(Intercept) 4.952756 0.005220 948.832 < 2e-16 ***

fdowFriday 0.009615 0.007355 1.307 0.1911

fdowMonday 0.033186 0.007314 4.538 5.69e-06 ***

fdowSaturday 0.003926 0.007360 0.533 0.5938

fdowThursday 0.013130 0.007352 1.786 0.0741 .

fdowTuesday 0.016740 0.007340 2.281 0.0226 *

fdowWednesday 0.014038 0.007349 1.910 0.0561 .

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Approximate significance of smooth terms:

edf Ref.df Chi.sq p-value

te(Temp,pm25.lag1) 5.135 6.091 63.6 < 2e-16 ***

s(doy) 16.684 28.000 22.0 2.79e-06 ***

s(date2) 58.397 68.874 371.2 < 2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

R-sq.(adj) = 0.48 Deviance explained = 50.2%

UBRE = 0.12532 Scale est. = 1 n = 1825Interpretation:

The tensor‐product smooth for Temp × pm25.lag1 is statistically significant \((p < 2e−16)\), indicating that the joint effect of temperature and lagged PM\(_{2.5}\) on daily mortality is not simply additive. Certain combinations of higher PM\(_{2.5}\) and temperature are associated with elevated mortality risk, consistent with known temperature-pollution interactions. You can inspect the marginal basis dimensions via:

mod_tensor$smooth[[1]]$margin[[1]]$bs.dim # basis size for Temp[1] 5mod_tensor$smooth[[1]]$margin[[2]]$bs.dim # basis size for pm25.lag1[1] 5The maximum dimension of the tensor-product basis in \(Q \times P = 5 \times 5 = 25\), but the penalty shrinks many directions towards zero. Because the smooth is penalized, only a subset of these directions are used in the final fit. Inspecting the \(EDF \approx 5.1\), this means after penalization, the estimated surface behaves like a smooth with roughly 5 free parameters.

Note: In the univariate case (s(x)), the default basis size is \(k = 10\). This is not the default for tensor-product smooths. For te(x, z), mgcv does not automatically use \(k = 10\) for each marginal smooth. Instead, it typically assigns smaller default basis sizes (often \(k = 5\) for each margin) unless the user specifies k = c(k_x, k_z) explicitly.

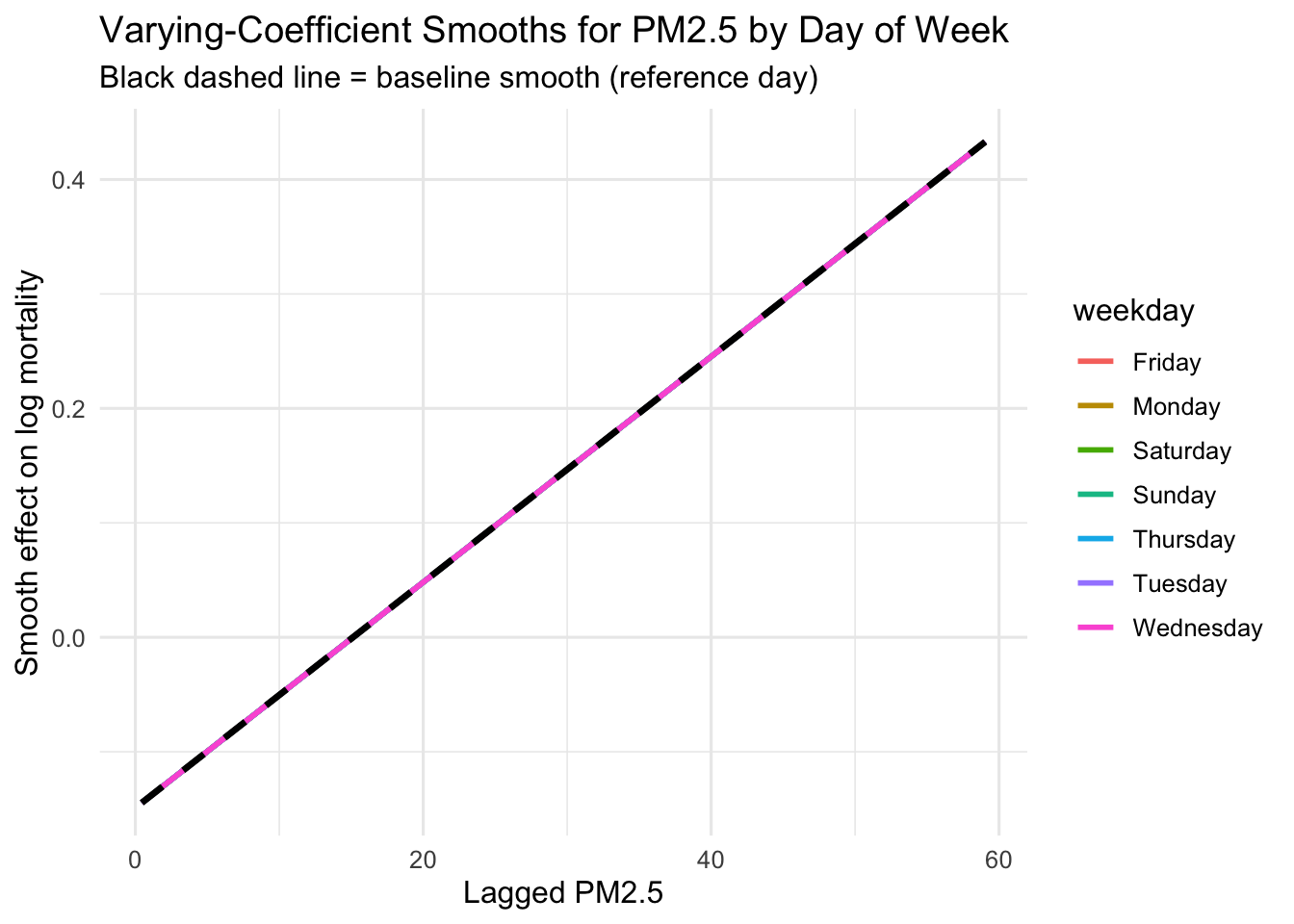

Tensor-product smooths allow a fully flexible two-dimensional surface when two continuous predictors jointly influence the outcome. However, many applied problems require a different—but related—form of flexibility: the effect of a predictor may change across groups, but not in a fully two-dimensional continuous way.

Examples include:

In these settings we are not modeling a smooth surface over the continuous \((x,z)\) plane. Instead, we want the univariate smooth \(s(x)\) to vary by group in a structured and parsimonious way. This is called a varying-coefficient smooth.

Suppose we believe the effect of PM\(_{2.5}\) on mortality differs between weekdays and weekends. A single smooth \(s(\text{PM})\) cannot represent two different shapes. Instead, we allow:

\[ s_{\text{weekday}}(\text{PM}) \quad\text{and}\quad s_{\text{weekend}}(\text{PM}). \]

But we should not fit two unrelated smooths. Instead, we build them as:

This preserves identifiability and allows the two curves to share information.

Let \(G\) be a binary or categorical grouping variable.

A varying-coefficient smooth model is:

\[ g(\mathbb{E}[Y]) = \beta_0 + \beta_G G + s(x) + s(x,\text{by}=G). \]

Interpretation:

This is the smooth analogue of an interaction between \(x\) and \(G\).

Mathematically, a varying-coefficient smooth expands the basis functions across groups. Let \(G\) have \(C\) categories and let \(b_m(x)\) be the \(k\) basis functions for \(s(x)\). Then

\[ s(x) + s(x,\text{by}=G) = \sum_{m=1}^k \beta_m\, b_m(x) \;+\; \sum_{c=1}^{C-1} \sum_{m=1}^k \gamma_{mc}\, b_m(x)\, I(G=c), \]

where \(I(G=c)\) is the group indicator. The first term is the baseline smooth (for the reference group). The second term contains \((C-1)\) group-specific deviation smooths, each using the same basis functions but different coefficients. Adding the baseline and deviation smooths yields a complete smooth for every group.

Each smooth term in a varying–coefficient model receives its own smoothing penalty. If \(G\) has \(C\) categories, then s(x) has one penalty \(\lambda_{\text{base}}\), and the \((C-1)\) deviation smooths s(x, by = G) have their own penalties $,* , `. Thus the full penalty is

\[ \lambda_{\text{base}}\,\boldsymbol{\beta}^\top K \boldsymbol{\beta} \;+\; \sum_{c=1}^{C-1} \lambda_c\,\boldsymbol{\gamma}_c^\top K \boldsymbol{\gamma}_c. \] Each group (except the reference) has its own deviation smooth:

\(\boldsymbol{\gamma}_c\)

Coefficient vector for the deviation smooth of group \(c\).

This describes how group \(c\)’s smooth curve differs from the baseline smooth.

Same penalty matrix \(K\)

The deviation smooths use the same spline basis as the baseline,so the same curvature penalty applies.

\(\boldsymbol{\gamma}_c^\top K \boldsymbol{\gamma}_c\)

Measures how wiggly the deviation curve is for group \(c\).

\(\lambda_c\)

Smoothing parameter for the deviation smooth of group \(c\).

Large \(\lambda_c\) shrinks the deviation toward zero (group curve becomes similar to the baseline).

Small \(\lambda_c\) allows a flexible, group-specific shape.

Using the NYC mortality data, suppose we want the PM\(_{2.5}\)–mortality relationship to differ across days of the week.

mod_vc <- gam(

alldeaths ~

s(pm25.lag1) +# baseline smooth

s(pm25.lag1, by = fdow) + # day-of-week differences

s(doy, bs = "cc", k = 30) +

s(date2, k = 100),

family = poisson,

data = health

)

summary(mod_vc)

Family: poisson

Link function: log

Formula:

alldeaths ~ s(pm25.lag1) + s(pm25.lag1, by = fdow) + s(doy, bs = "cc",

k = 30) + s(date2, k = 100)

Parametric coefficients:

Estimate Std. Error z value Pr(>|z|)

(Intercept) 4.966015 0.001974 2516 <2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Approximate significance of smooth terms:

edf Ref.df Chi.sq p-value

s(pm25.lag1) 1.000 1.000 1.544 0.214

s(pm25.lag1):fdowSunday 3.664 4.717 7.035 0.292

s(pm25.lag1):fdowFriday 4.445 5.422 8.916 0.142

s(pm25.lag1):fdowMonday 1.000 1.000 1.183 0.277

s(pm25.lag1):fdowSaturday 1.000 1.000 1.237 0.266

s(pm25.lag1):fdowThursday 1.000 1.001 1.254 0.263

s(pm25.lag1):fdowTuesday 1.719 2.171 1.793 0.398

s(pm25.lag1):fdowWednesday 1.000 1.000 1.413 0.235

s(doy) 17.981 28.000 27.149 <2e-16 ***

s(date2) 54.108 64.497 343.777 <2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Rank: 199/200

R-sq.(adj) = 0.465 Deviance explained = 48.7%

UBRE = 0.15709 Scale est. = 1 n = 1825PM\(_{2.5}\) effects

The baseline smooth s(pm25.lag1) has edf = 1.0, meaning the smooth pooled across all days of the week is effectively linear.

All group-specific deviation smooths (s(pm25.lag1, by = fdowX)) have very low EDFs (mostly 1–2) and are not statistically significant.

There is no evidence that the PM\(_{2.5}\)–mortality relationship is nonlinear and no evidence that this relationship varies by day of week.

PM\(_{2.5}\) appears to have a consistent linear effect across weekdays.

Seasonality and long-term trend

s(doy) (day-of-year) has edf ≈ 18, p < 2e−16 → strong seasonal mortality pattern.s(date2) has edf ≈ 54, p < 2e−16 → substantial smooth long-term trend over the study period.Conclusion

| Topic | Summary |

|---|---|

| What is new? | Module 5B extends Module 5A by introducing: (1) tensor-product smooths for smooth interactions between two continuous variables, producing a bivariate surface \(s_{12}(x,z)\); and (2) varying-coefficient smooths using by= to allow the effect of a predictor to differ across categorical groups. |

| Tensor-product basis | A bivariate smooth is constructed from the tensor (Kronecker) product of the marginal spline bases. If \(\mathbf{b}_x(x)\in\mathbb{R}^Q\) and \(\mathbf{b}_z(z)\in\mathbb{R}^P\), then the surface basis is: |

| Anisotropic penalties | Smoothness in each direction is controlled separately. Let \(\mathbf{K}_x\) and \(\mathbf{K}_z\) be the marginal curvature penalty matrices. The tensor-product penalty is: |

| Varying-coefficient smooths | When the effect of a predictor varies by group, the model uses a baseline smooth plus group-specific deviation smooths: |

| Penalties for varying-coefficient terms | Each smooth receives its own curvature penalty: |

| Estimation | All smoothing parameters—\(\lambda_x,\lambda_z\), the baseline smooth penalty, and group-specific penalties—are estimated using REML (preferred) or GCV. Penalization controls smooth complexity and prevents overfitting. |

| Uncertainty | mgcv provides approximate Bayesian covariance for spline coefficients, yielding pointwise confidence bands for univariate smooths and uncertainty surfaces for tensor-product smooths. |

| Diagnostics | Use gam.check() to assess whether the basis dimension \(k\) is adequate. Inspect EDF to understand smooth complexity. Use concurvity() to detect nonlinear dependencies across smooth terms. |

| Interpretation | Tensor-product interactions are interpreted via 2D heatmaps or 3D perspective surfaces of \(s_{12}(x,z)\). Varying-coefficient models are interpreted by comparing the baseline smooth and group-specific deviation curves. Interpretations occur on the link scale. |

| Key takeaway | GAMs allow effects to be nonlinear, interactive, and group-specific, while penalization maintains interpretability. Tensor-product smooths model flexible 2D surfaces; varying-coefficient smooths model structured effect modification—greatly extending the GAM framework introduced in Module 5A. |