3.1 Signaling Theory

See (Connelly et al. 2010; Kirmani and Rao 2000) for review in management and marketing

When do we diverge? When choices signal identity (observability, functional benefits, etc.)

People diverge to signal identity, which based on:

- Observability

- Functional benefits

“The more costly something is, the more likely it is to retain its value as a clear and accurate signal.” (Berger 2016) Costs in this case could be:

- Monetary

- Opportunity

- Time

Price and branding (brand prominence) has an inverted-U relationship The higher the price is, the more brand prominence it possess. However, for the ultra rich class, the highest price does not command highest brand prominence, but actually lowest brand prominence. (a small set of ultra rich people know)

“The identity-signaling drives things to both catch on and die out… Counterfeiting helps speed up the process”

Counterfeit and piracy are good because it keeps consumers crave for a new one (Berger 2016)

We know that the mere exposure can increase our preference towards an object. Interestingly, the similarity between a new object and one that we are familiarity with also have the same effect. Novel but don’t be too novel.

2 parties:

Sender: chooses whether and how to communicate (signal) information

Receiver: chooses how to interpret the signal

Signaling theory is about reducing information asymmetry between two parties. (Spence 2002)

(Stiglitz 2000) find two types of information where asymmetry is important:

Info about quality: where quality is defined as “the underlying, unobservable ability of the signaler to fulfill the needs or demands of an outsider observing the signal” (p. 43). This is different from reputation or prestige (because the latter two are socially constructed as the consequence of the signaler’s unobserved quality.

info about intent

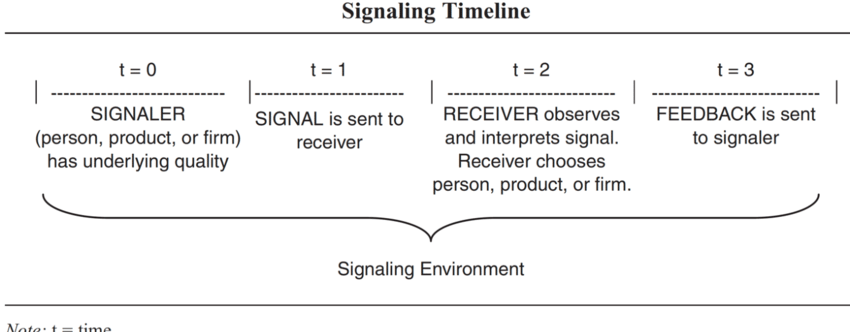

Figure 2 (p. 44)

Signaler: insiders who possess full information about something that receiver want to obtain information

Signal: typically insiders reveal positive information to close the information asymmetry gap (not negative one). Two characteristics of efficacious signals

Signal observability: “the extent to which outsiders are able to notice the signal” (p. 45)

Signal cost:

Receiver: outsiders who lack info about the organization

See Table2 for key constructs for this theory.

(Kirmani and Rao 2000) Review of signaling in marketing