6 Private Markets. Role in the Portfolio.

In these notes, we are going to look at the two major forms of private equity – venture capital and buyout funds – and the role that they play in the institutional portfolio. The notes don’t go into detail on the process of either funds – I’ll leave that for other classes.17 Our focus is going to be on the rising importance of private markets for institutional investors, measuring performance, and evaluating funds.

Our case study this week is all about measuring private equity performance. Much of this material is on the CFA Level II exam. I am also again pulling ideas from Ang (2014). We are going to see that measuring private equity returns is very difficult. Always ask two questions: First, how was that return calculated? This is especially true for private equity. Is the return your shown even a return? And, second, compared to what? If you took an lot of risk and got a high return, I’m happy for you, but I might not want to invest with you. We need a risk model for this and is why we spend so much time talking about factors.

If you invest in private equity, you are going to pay high fees, while locking up your money for a long time in a complex structure making complex investments. You want to be very sure about what you’re doing.

6.1 Shrinking Public Markets

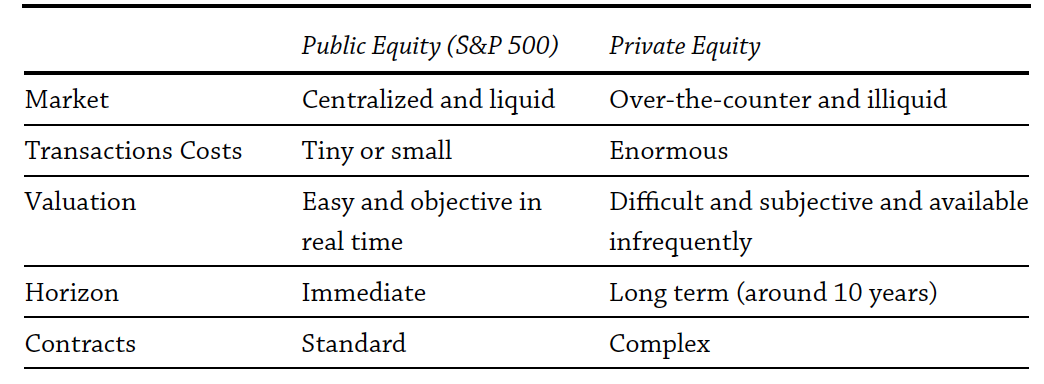

Figure 6.1: A summary of the rise of private markets. Source: Morgan Stanley

First, let’s start with the opportunity and why private equity is interesting. In short, private markets are large and have gotten larger. We discuss in AMF how firms are staying private longer. This has created new opportunities for investors. You should take a look at the report from Morgan Stanley that I have posted on Moodle. This report, excerpted above in Figure 6.1 discusses the rise of private markets. Our podcast for the week is also with one of the authors of that report, Michael Mauboussin.

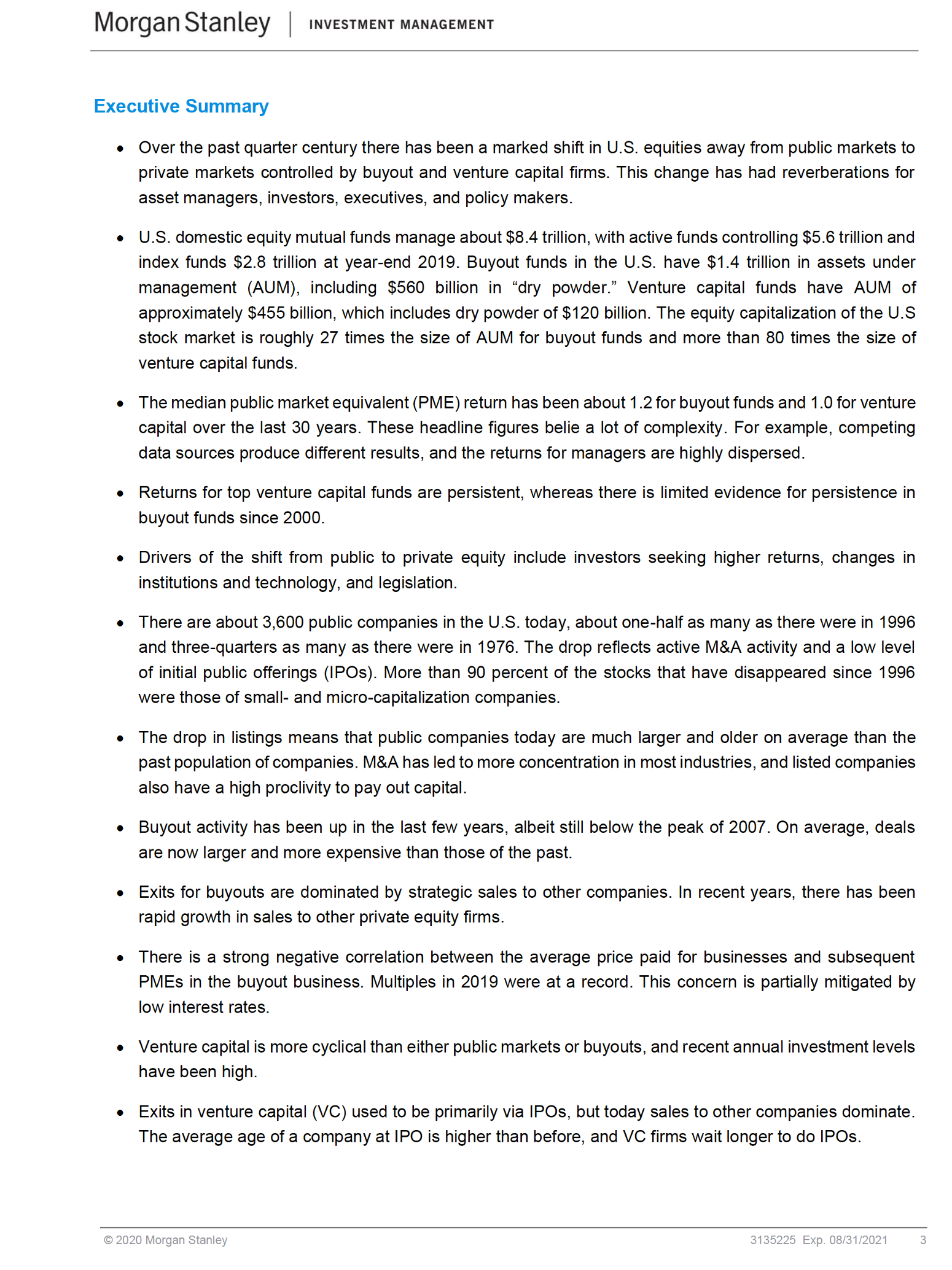

Figure 6.2: Institutional investors are seeking higher returns in private markets. Source: Morgan Stanley

Institutional investors have noticed all of this, while also wanting higher returns to meet their funding requirements. What’s kind of funny is that a lot of private equity investments have been made because allocators were expecting lower public market equity returns as the recovery from the financial crisis went on. So, investors have gone into these more complex structures hoping for magical higher returns, all the while the public markets have done just fine.

I discuss private equity – specifically, buyout funds – and venture capital below. But, there are other types of funds. For example, mezzanine funds buy junior debt in a firm’s capital structure. Infrastructure funds buy large, capital intensive operations like airports. Private equity real estate buys buildings and land. There are even forestry and farm investments. Distressed funds buy the debt of firms near or in bankruptcy and might try to help the firm return to health. A pension fund or endowment might have investments in all of these fund types.

If you want to read more about venture capital and buyout funds specifically, here are two useful links:

https://pitchbook.com/blog/private-equity-vs-venture-capital-whats-the-difference

https://pitchbook.com/blog/what-is-venture-capital

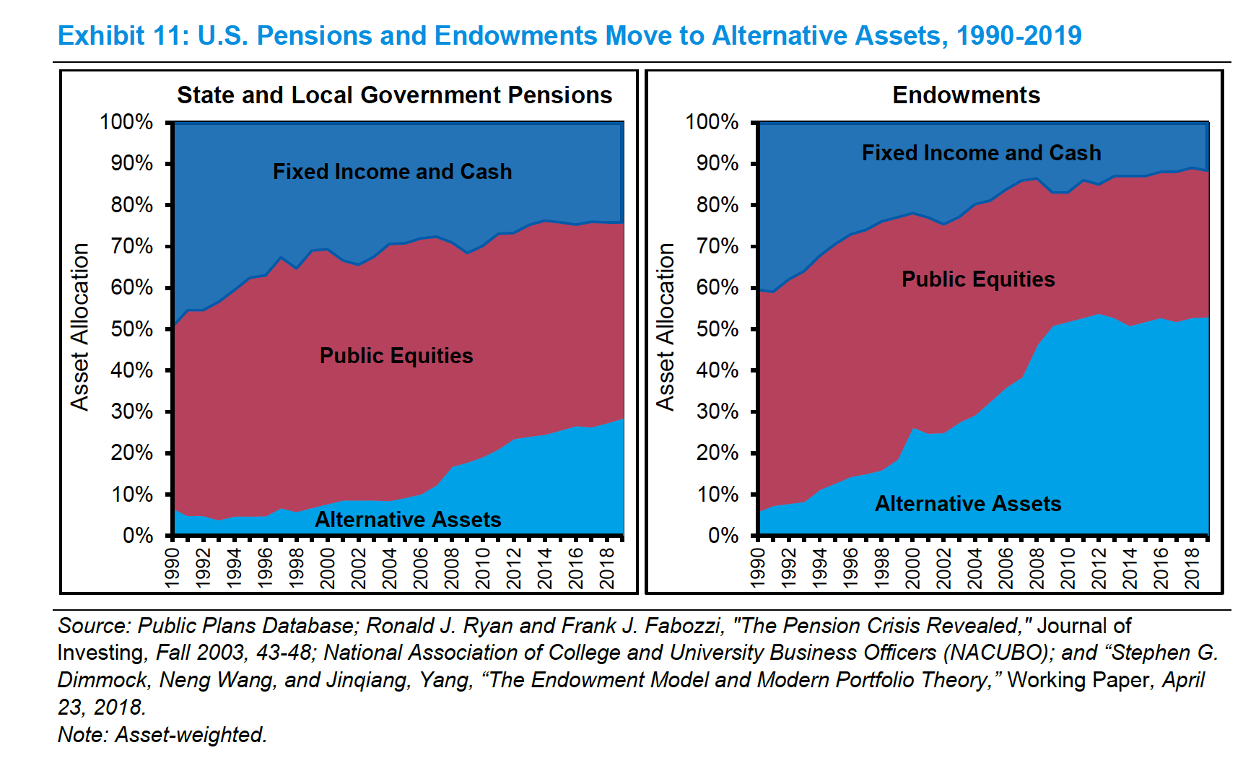

There is a basic timeline that most private equity firms follow. Note that firms raise many funds, so an investor in Fund I may be more likely to get into Fund II and so on.

Figure 6.4: Generic structure and timing of a private equity strategy. Source: CFA Level II materials

6.2 Private Equity (Buyout Funds)

You can think about private equity as a split between “passive” and “active” investors, but within the same pool of assets. The active investors are the General Partners, the GPs, the ones buying firms and taking an operational role, like a board seat. The Limited Partners, or LPs, are the passive investors who provide capital, but do not become involved. The LPs commit to provide funding over the life of the partnership. For example, an endowment might commit to a $10 million investment, where that $10 million is drawn down in pieces over the first 5 years of the fund. The GPs then return capital to the LPs over the life of the fund (e.g. 10 years). We’ll be using these cash flows to calculate returns in our case study.

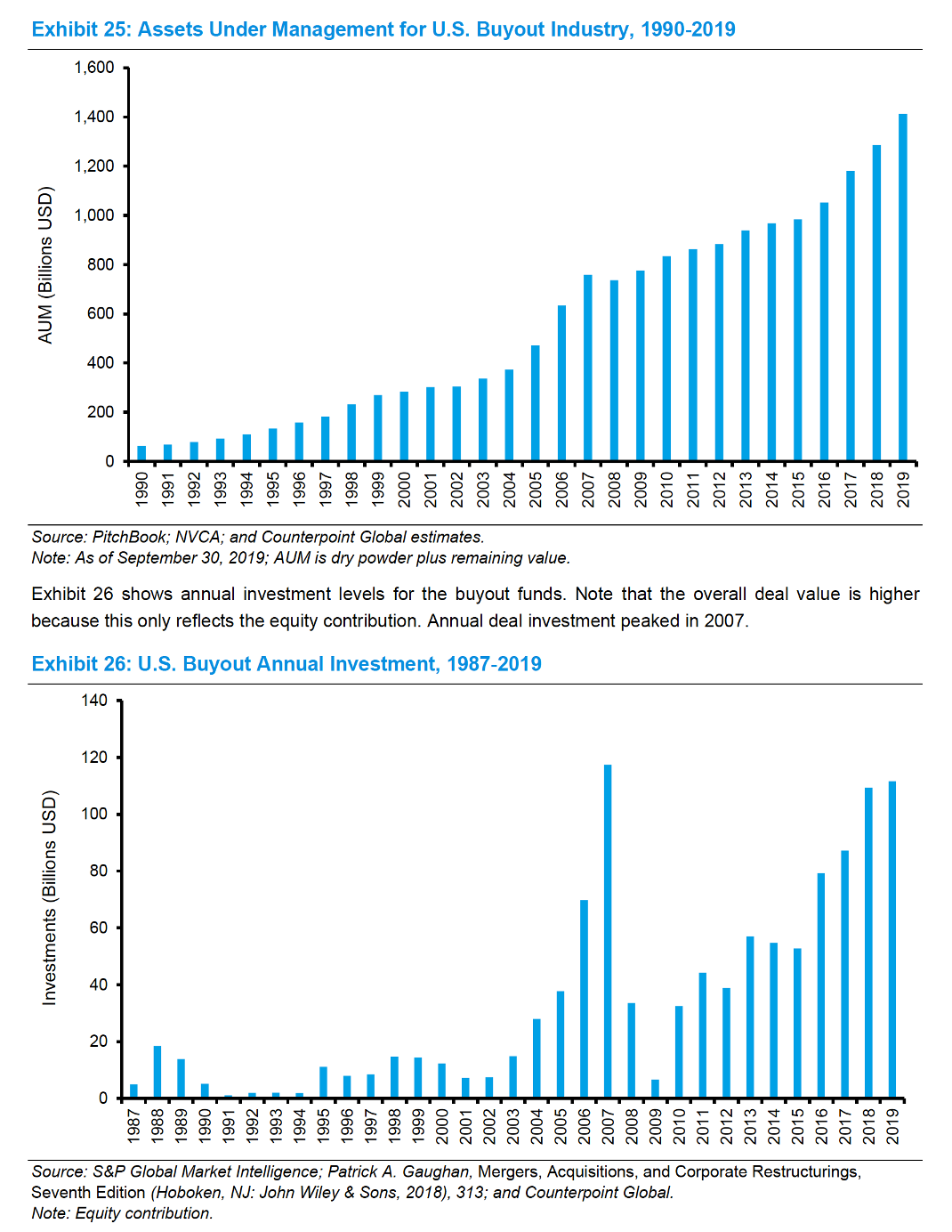

Figure 6.5: Buyout AUM has grown rapidly as investors go to private markets in the hope for higher returns. Source: Morgan Stanley

We discuss private equity and the “going private” process in AMF. Going private is the reverse of going public. Typically, the firm’s managers team up with a small group of outside investors and purchase all of the publicly held shares of the firm. The new equity holders usually use a large amount of debt financing, so such transactions are called leveraged buyouts (LBOs).

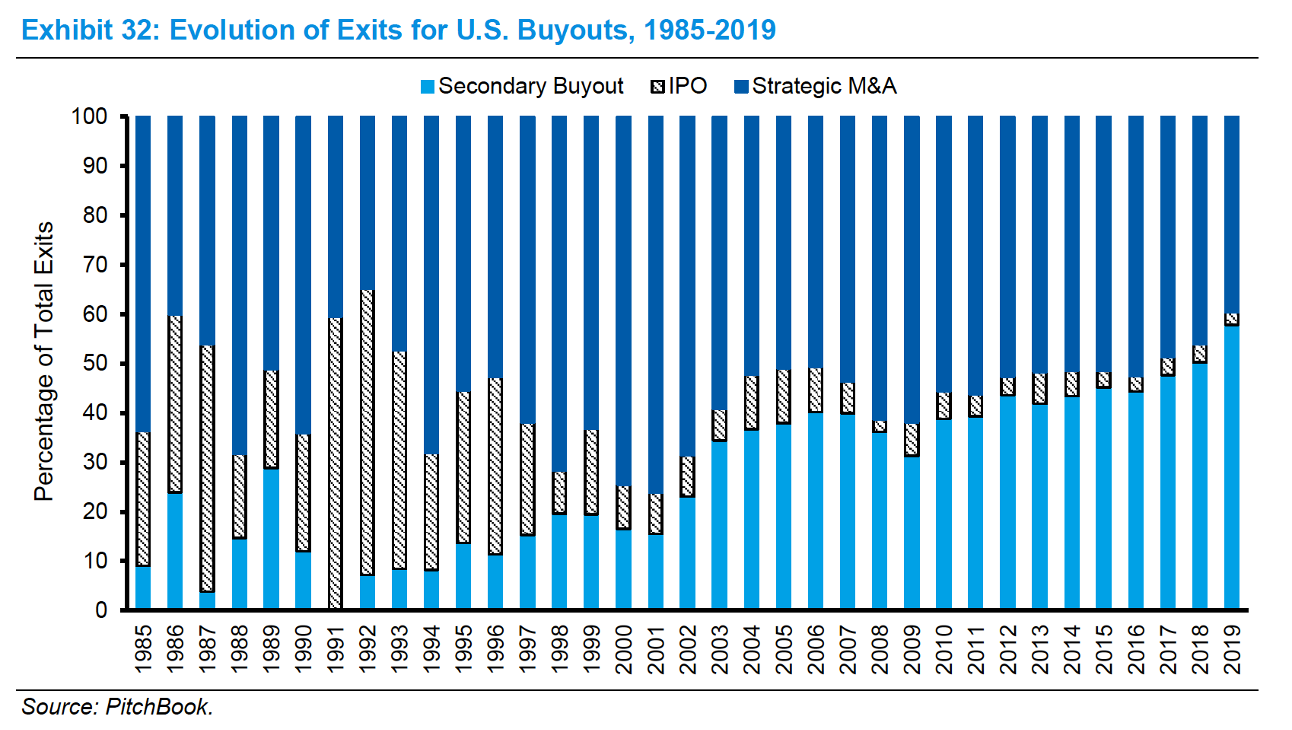

Private equity funds are often limited partnerships (although a few are publicly traded companies). Buyout funds use their own equity and a large amount of borrowed cash to purchase equity in an company (often a private company or wholly owned subsidiary/division, but sometimes a public company). The GPs will sit on boards and create contracts that provide incentives to managers to improve performance. The will (hopefully) generate cash to return to the investors through either an IPO or with a sale to another firm. This is called the “exit strategy.”

Figure 6.6: More and more buyout managers exit their investments by selling the firms to another buyout firm. Source: Morgan Stanley

For the firm, there are some possible advantages to going private:

- Gives managers greater incentives and more flexibility in running the company.

- Removes pressure to report high earnings in the short run.

- After several years as a private firm, owners typically go public again. Firm is presumably operating more efficiently and sells for more.

However, there are some important disadvantages:

- Firms that have recently gone private are normally highly leveraged, so it’s difficult to raise new capital.

- Furthermore, a difficult period that normally could be weathered might bankrupt the company.

Here is work summarizing what private equity firms say that they do. They focus on capital structure decisions and how to grow the firm (as opposed to just cutting costs). They will look for firms with steady cash flows and a significant asset base that can support the new debt. The hope is then for a predictable exit strategy.

Do private equity firms add value for the firms that they invest in? I think the evidence leans yes, but there is some disagreement. There is evidence that private equity improves the performance of the underlying firms. And venture capital firms provide more than just financing, they provide expertise. But, there is a dark side. Firms controlled by private equity shed jobs, though new jobs are created. Recent, disturbing work has found that mortality rates increase at long-term care homes owned by private equity firms.

In this course, we want to think about private equity firms from the perspective of the LPs. How can we assess their performance? How do we measure their returns? Our case study will work through these issues.

6.3 Venture Capital

How are start-up firms usually financed? In AMF, we give you some examples: the founder’s resources, angel investors (i.e. smaller investors who fund very early stage private firms), and, most importantly, venture capital funds. In a VC fund, most of the capital in the fund is provided by institutional investors, or the LPs. The venture capital fund principals, or the GPs, provide the rest. Like with buyout funds, VCs sit on the boards of the firms that they invest in, providing advice and guidance as the firms mature.

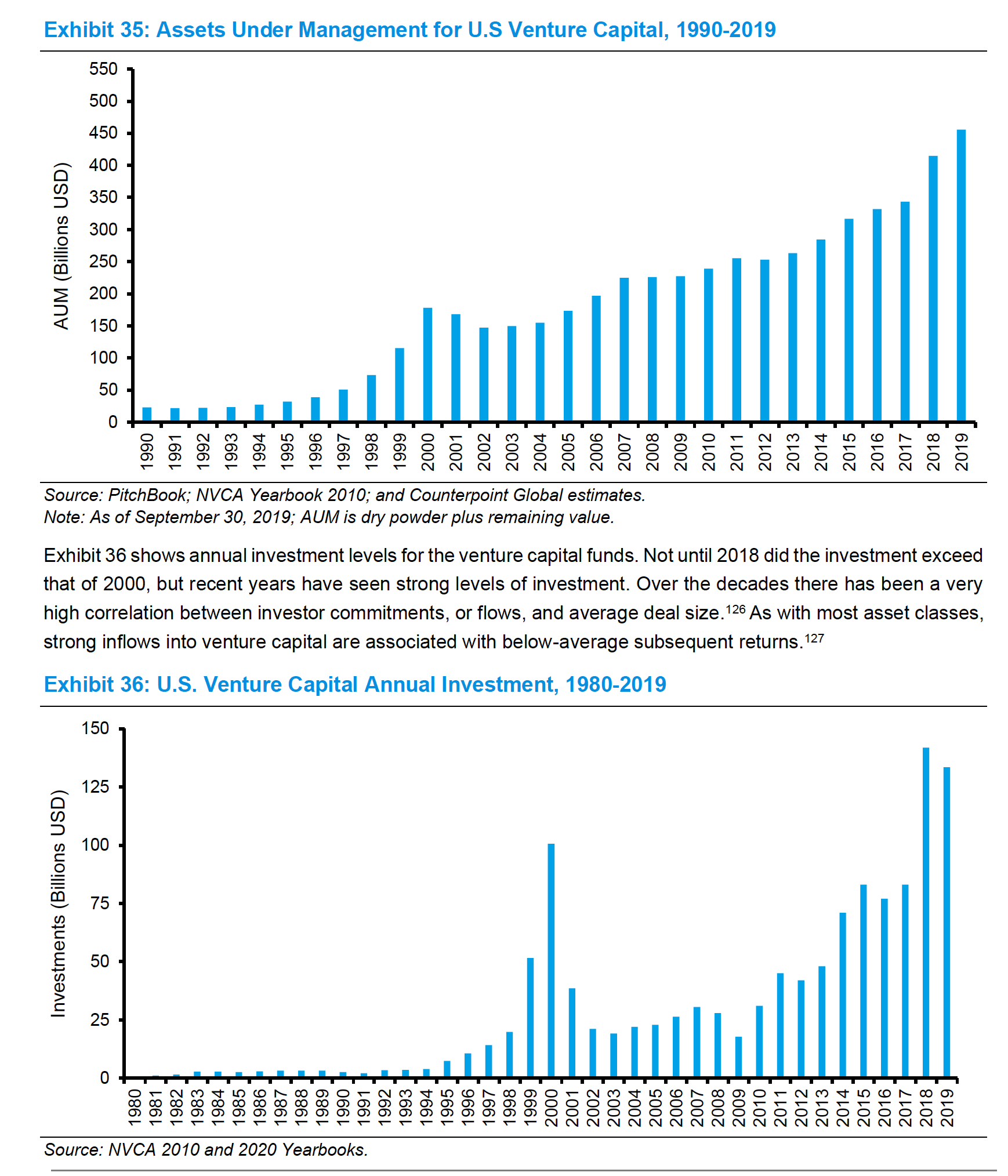

Figure 6.7: Both AUM at and investments made by VCs has grown rapidly the past decade. Source: Morgan Stanley

This is another example of a two-sided market, where VCs choose firms to invest in, the firm chooses the VCs that they want to work with, the VCs choose their investors, and the LPs select the funds that they want to invest in. This is very different from public markets!

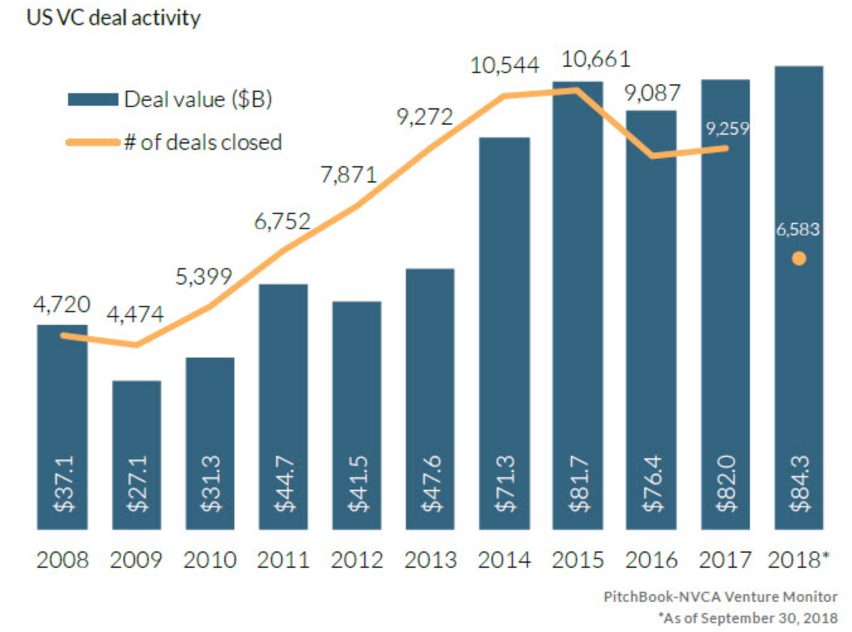

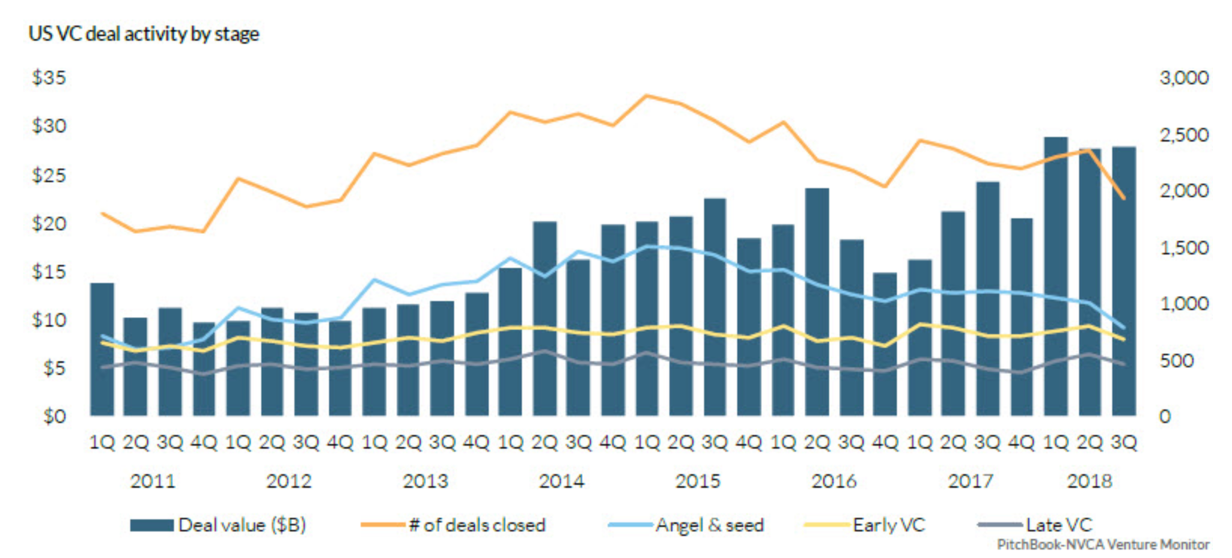

Figure 6.8: There has been an increase in VC activity. Source: Pitchbook

Seed stage. When a venture capitalist provides an early-stage company with a relatively small about of capital to be used for product development, market research or business plan development, it’s called a seed round. As its name suggests, a seed round is often the company’s first official round of funding. Seed round investors are typically given convertible notes, equity or preferred stock options in exchange for their investment.

Early stage. The early stage of venture capital funding is intended for companies in the development phase. This stage of financing is usually larger in sum than the seed stage because new businesses need more capital to start operations once they have a viable product or service. Venture capital is invested in rounds, or series, designated by letters: Series A, Series B, Series C and so on.

Later stage. The later stage of venture capital funding is for more mature companies that may or may not be profitable yet, but have proven growth and are generating revenue. Like the early stage, each round or series is designated by a letter. If a company a VC firm has invested in is successfully acquired or goes public, the firm makes a profit and distributes returns to the limited partners that invested in its fund. The firm could also make a profit by selling some of its shares to another investor in what’s called the secondary market. Of course, many investments are written off as the firm ends up worth nothing.

Figure 6.9: VC activity by round type. Source: Pitchbook

VC firms raise funds that then go out and invest. They will raise money for a few months or a year, close the fund, and then draw down capital, invest, and then return capital for perhaps a 3-10 years. While they are doing this, they might raise their next fund. So, Elon Fund I, Elon Fund II, etc. VCs often specialize in early stage, late stage, and/or by sector (e.g. biotech). This paper summarizes how VCs make their decisions.

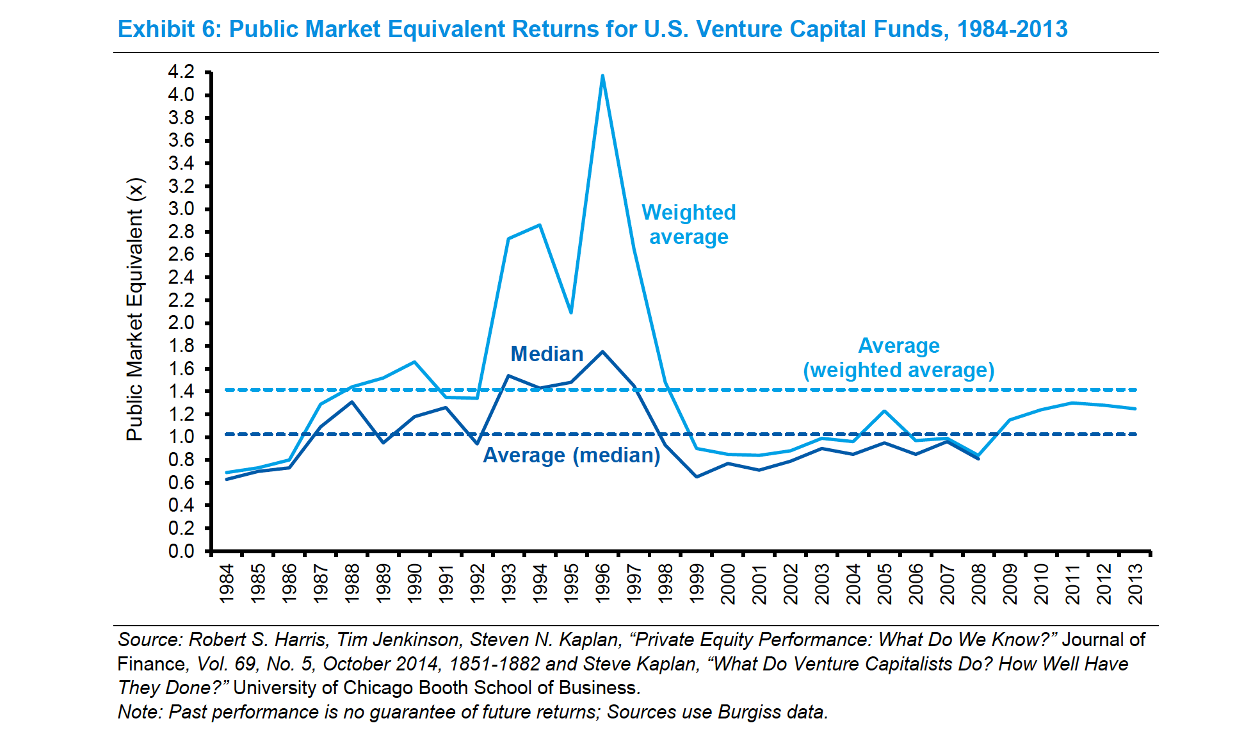

You’ll often here the term public market equivalent (PME) when talking about VC (and other private equity) returns. This is because the IRR and multiple on invested capital measures often reported by VC firms are very flawed. From the Morgan Stanley report: “Say a fund drew $200 million from its investors in January 2013 and paid out $500 million in December 2017. An investor could have alternatively invested the $200 million in the S&P 500, which would have returned $416 million over the same period. The PME would be 1.2 ($500/$416). Academics and practitioners often make adjustments for risk to make the returns more comparable.”

6.3.1 What about SPACs?

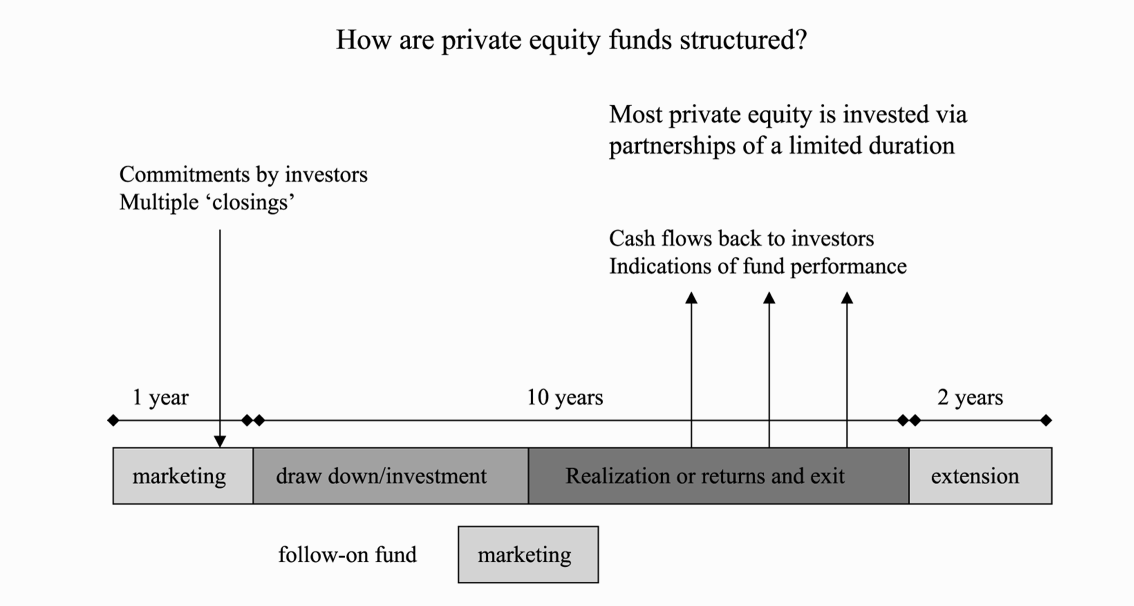

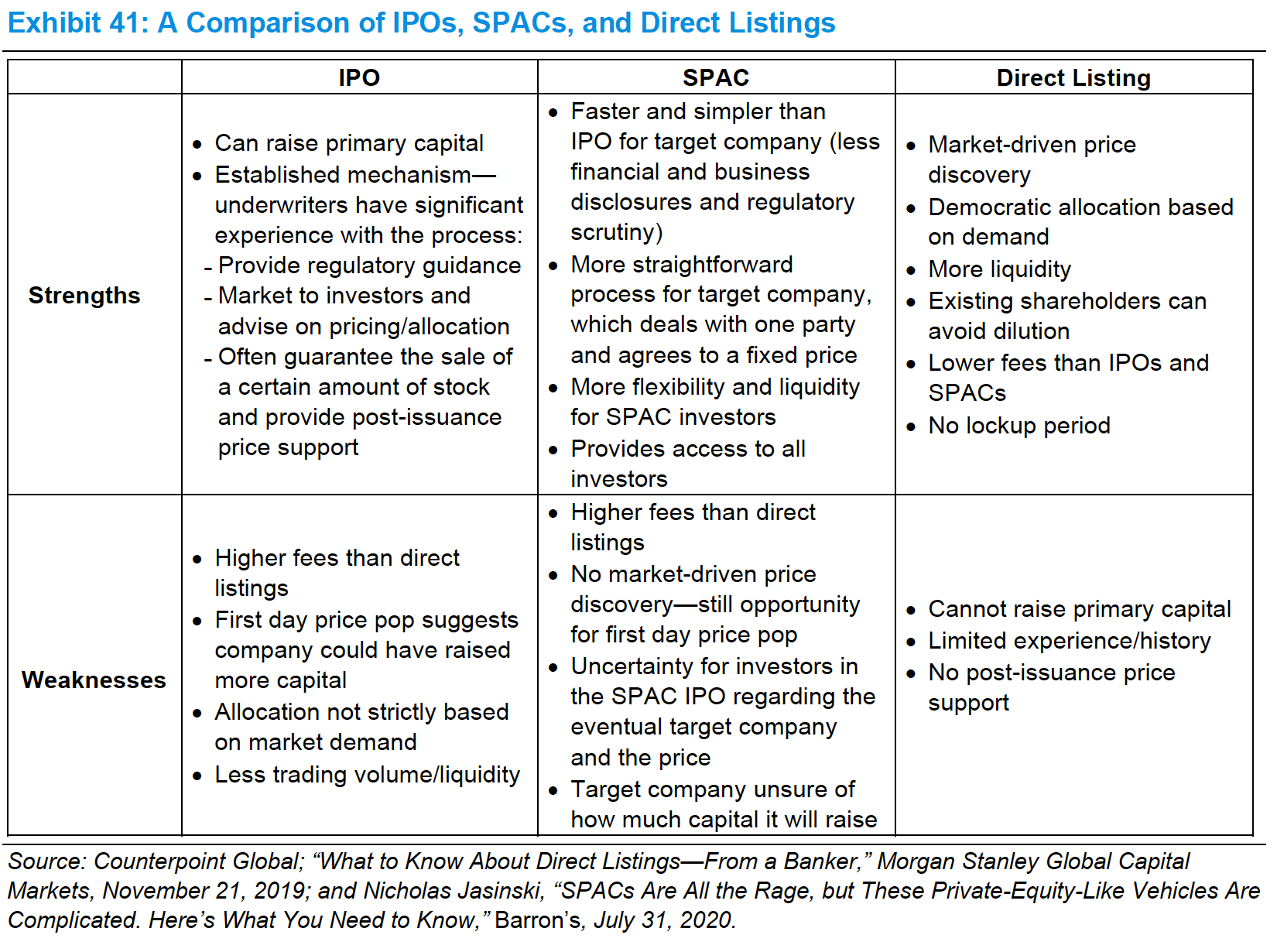

Figure 6.10: Comparing IPOs, Direct Listings, and SPACs. Source: Morgan Stanley

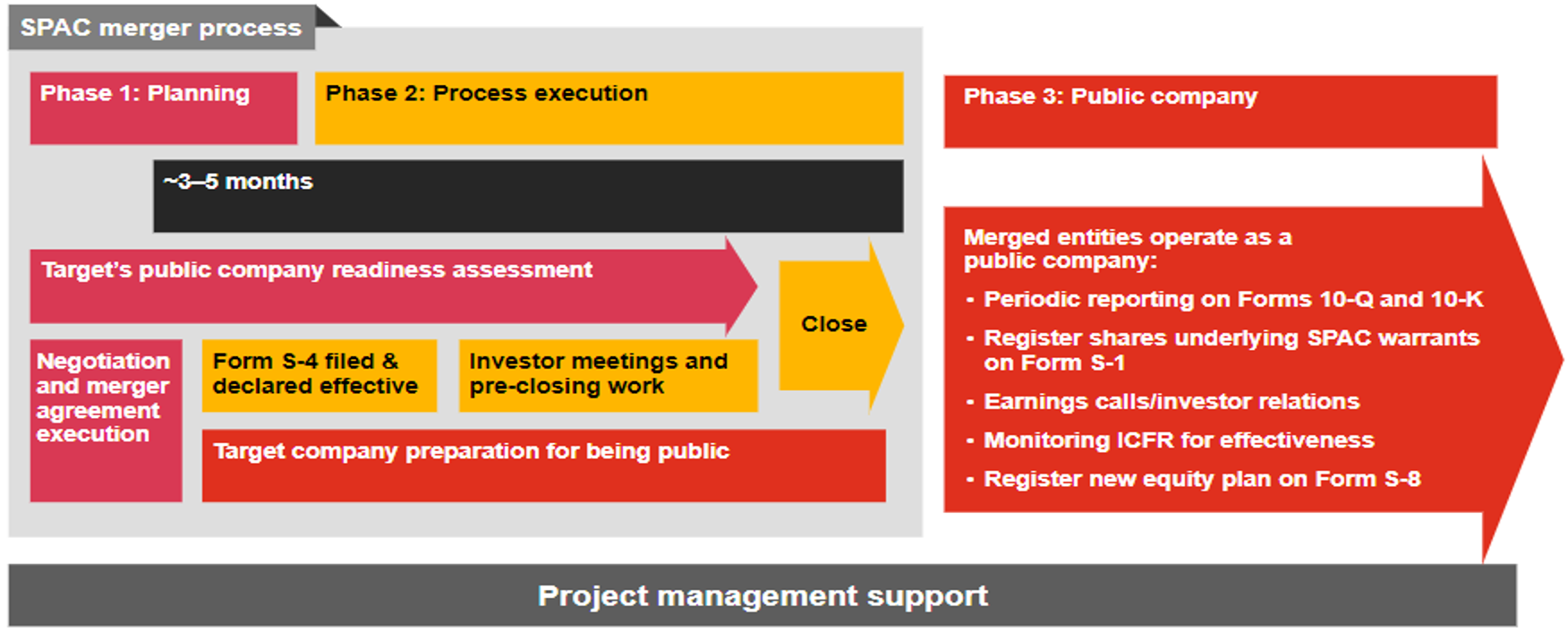

While SPACs are an alternative to the traditional IPO, it is unclear how much of a role they are playing in institutional portfolios. They are a potential exist strategy for VC firms, so returns generated from the acquisition would accrue to LPs. Just in case you are unsure what a SPAC is, here’s Morgan Stanley again with a basic definition:

A Special Purpose Acquisition Company (SPAC) is a company that goes public with the goal of using the offering proceeds to make an acquisition. In an IPO, a SPAC offers a unit that includes a common share at a set price and warrants. SPACs are sometimes referred to as “blank-check” companies and can provide public market investors access to private companies. Because a deal involves negotiation only between the SPAC and the target, the transaction tends to be more straightforward, sure, and transparent.

With a direct listing, a company creates no new shares, existing holders offer their shares, and there are no underwriters. Enthusiasts point out that companies can get the benefits of being public without the cost of underwriting and other common frictions such as lockups. For example, IPOs of companies backed by venture capital firms from mid-2009 through mid-2019 saw an average price increase of 21 percent on their first day of trading, suggesting sellers left substantial profits on the table.

… a stock exchange builds an order book, whereby buyers and sellers express their interests in terms of price and volume. The exchanges do this every day for every stock. The opening price reflects the intersection of supply and demand. Buyers include any investor, and sellers include shareholders, such as employees and early-stage investors. Neither buyer nor seller has an obligation to transact.

Figure 6.11: The SPAC process. Source: PWC

6.4 Thinking About Returns

Our case this week is going to have you calculate several different return measures for private equity firms as part of the assessement process. I’ll summarize the historical data here – look in the Excel template for the case for the calculations needed to measure a single fund’s performance. Those calculations are on the CFA Level II exam.

We are going to look at three types of measures:

- IRRs based on cash flows put into the fund and then received back out.

- Performance measured as multiples of cash invested.

- Comparing performance of the private equity fund to a public market equivalent (PME).

We need to be clear, though – none of these are true return measures.

Ludovic Phalippou (2011), a professor at Oxford University specializing in PE, states it bluntly: “The most frequently used performance measure IRR is uninformative and can be highly misleading; it typically exaggerates true performance.”

In short, we need to be very careful with IRRs. They can be gamed. Remember, IRR calculations assume that any cash flows received from the fund can be reinvested at the IRR. This is clearly false! They can also be distorted by the timing of cash flows. We’ll do more in our Excel files for this chapter.

From the CFA Level II material on private equity:

The IRR, a cash-flow-weighted rate of return, is deemed the most appropriate measure of private equity performance by the Global Investment Performance Standards (GIPS), Venture Capital and Private Equity Valuation Principles, and by other venture capital and private equity standards. The interpretation of IRR in private equity should, however, be subject to caution because an implicit assumption behind the IRR calculation is that the fund is fully liquid, whereas a significant portion of the NAV is illiquid during a substantial part of a private equity fund’s life. Therefore, valuation of portfolio companies according to industry standards is important to ensure the quality of the IRR figures.

They continue with a discussion of net vs. gross IRR:

The distinction between gross and net IRR is also important. Gross IRR relates cash flows between the private equity fund and its portfolio companies and is often considered a good measure of the investment management team’s track record in creating value. Net IRR relates cash flows between the private equity fund and LPs, and so captures the returns enjoyed by investors. Fees and profit shares create significant deviations between gross and net IRRs. IRR analysis is often combined with a benchmark IRR analysis, i.e., the median IRR for the relevant peer group of comparable private equity funds operating with a similar investment strategy and vintage year.

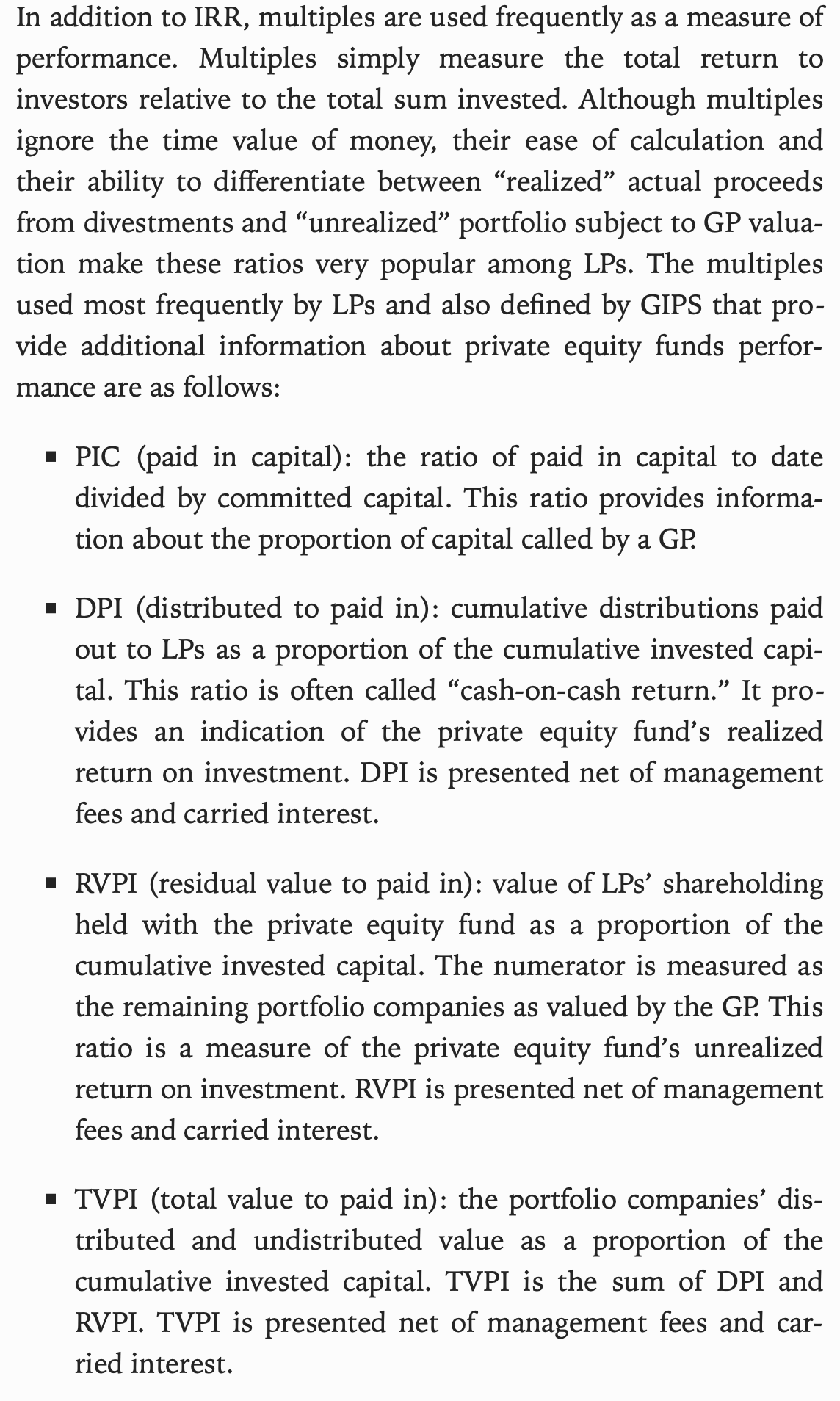

In our case study, we’ll look at multiples to go along with IRRs. I have excerpted the CFA Level II definitions in Figure 6.12.

Figure 6.12: You will find similar definitions in our case study. Source: CFA Level II

What does the literature say about performance? This comprehensive work does find evidence of outperformance for both VC and buyout funds, though this performance has declined after 2000 as more and more money has entered the area. Here is a more recent paper by the same authors that updates the data and comes to similar conclusions. Here is very recent work that looks at the holdings of private equity firms using unique, comprehensive data. Finally, here is recent survey work on private equity during COVID.

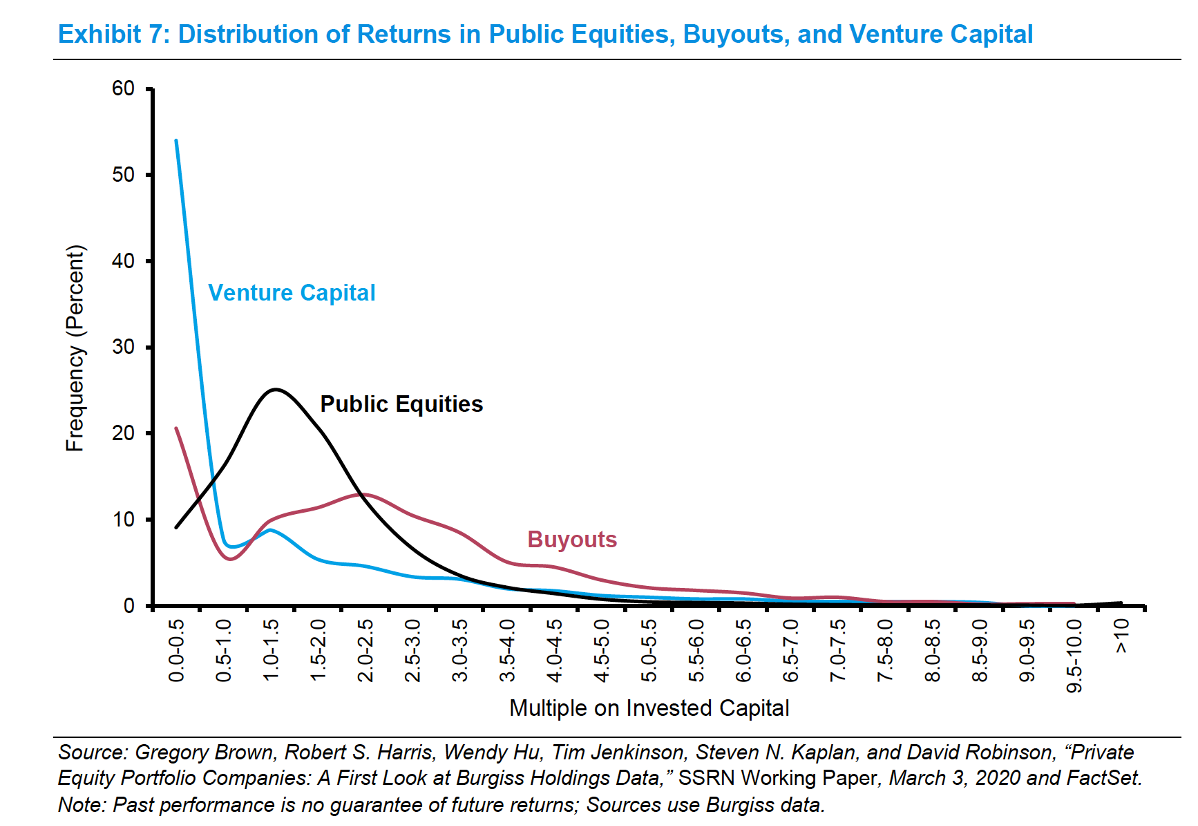

Let’s summarize things. What does the distribution of returns look like for private equity and VC?

Figure 6.13: Most VC deals don’t work out, though the long right tail hopefully makes up for it. Source: Morgan Stanley

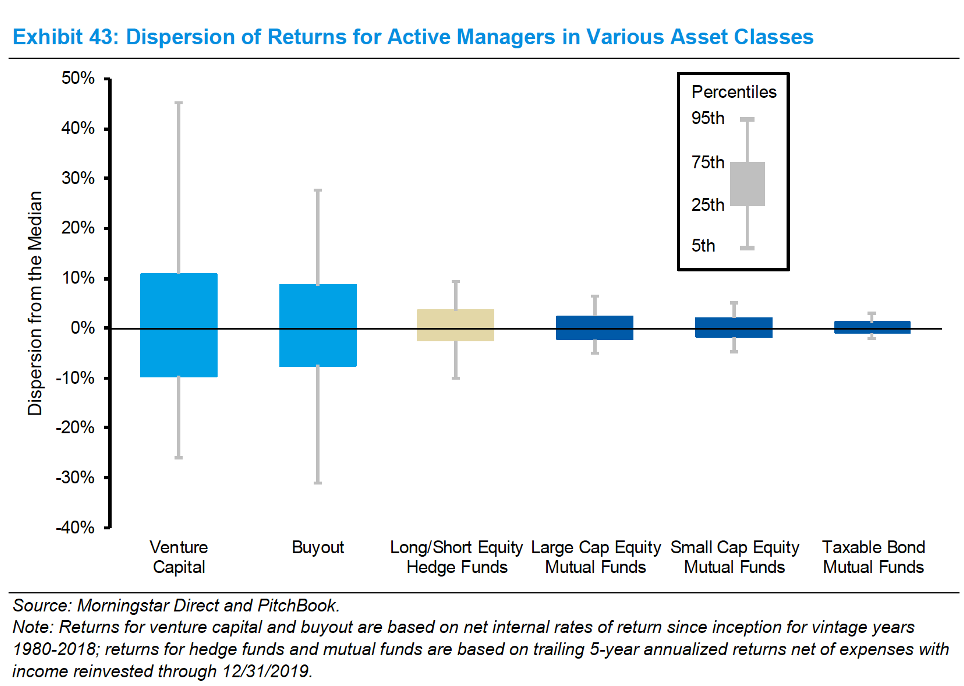

How about dispersion? In other words, is there a large spread between the best and worst funds? High dispersion might mean more of a chance for alpha. It also increases your chance of disappointment.

Figure 6.14: There is more dispersion in VC and buyout returns. If you can both find and access skilled managers, then maybe there is some alpha to capture. Source: Morgan Stanley

How have PME returns for VC varied over time?

Figure 6.15: VC returns were very high during the late 1990’s. Though not shown on this graph, they have picked up lately. Data issues and lags make real-time returns difficult to calculate. Source: Morgan Stanley

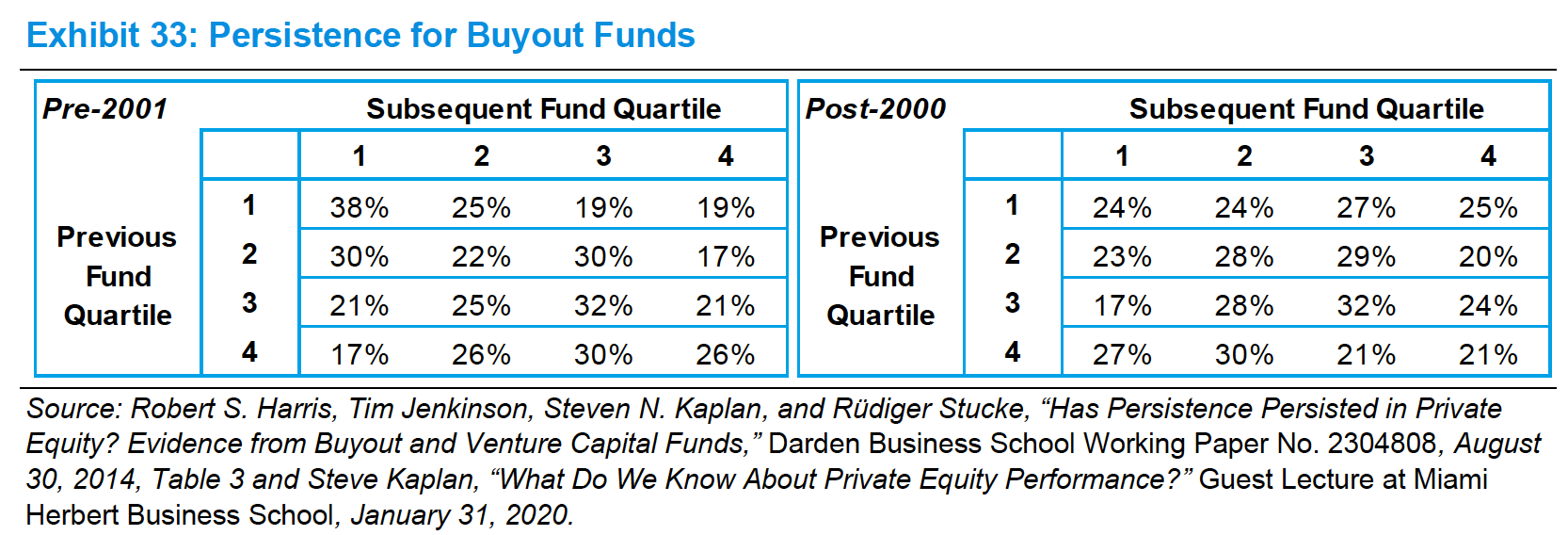

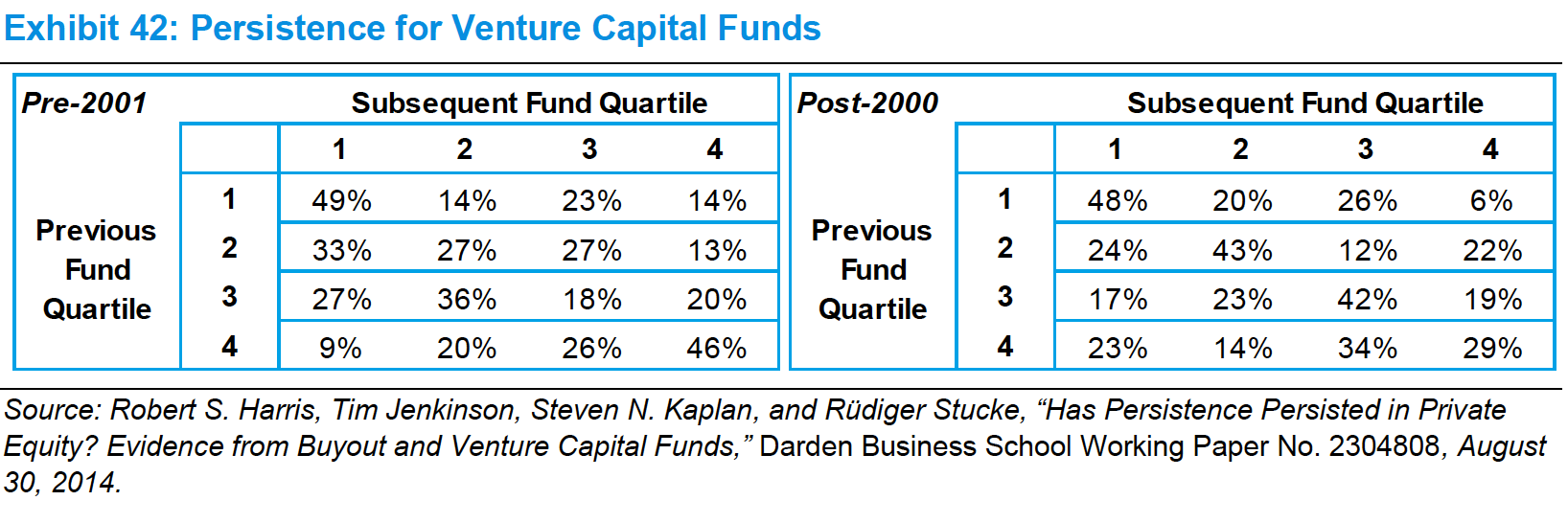

When trying to decide if managers have skill, we often think in terms of persistence. In other words, if you did well last year and it was because of your skill, you should be more likely to do better next year. Is this true in the buyout world?

Figure 6.16: Returns for buyout funds are not persistent. Fund size hurts future returns. Source: Morgan Stanley

How about the venture capital world?

Figure 6.17: There is still some performance persistance in VC funds. In other words, the top funds in the past tend to have better future performance. But, can you access these funds? Source: Morgan Stanley

I won’t show you a lot of graphs with how private equity improves your portfolio’s risk return trade-off by pushing out the efficient frontier up and to the left. Plenty of industry pitches have that. I’ll just add that the illiquidity of these investments makes measuring risk difficult. The assets are marked-to-market by a third-pary, typically every quarter. This artificially lowers the fund’s standard deviation and makes Sharpe Ratios unreliable.

As mentioned, all of private equity is a two-sided market. These top quartile funds must be willing to take your assets. As Ang (2014) notes:

Just knowing about the firm ABC turns out not to be enough. Relationships and talent matter considerably in PE. Many top quartile funds are not available for general entry; the funds that are open are far below top quartile. Moreover, it is not so much the firm that matters – it is the partners who comprise the firm.

We also need to be careful with selection bias in private equity returns. Do we really know how all private funds are doing, like we do with ETFs or mutual funds (at least to some approximiation)? Absolutely not! We are likely only observing the best, surviving funds. This will bias any kind of performance evaluation upward.

Asset owners are warned: trusting research published by PE firms stating that PE outperforms is like believing in research conducted by cigarette companies concluding that smoking doesn’t cause cancer.

David Swenson, Yale’s long-time CIO and proponent of their move into alternatives, like private equity:

The large majority of buyout funds fail to add sufficient value to overcome a grossly unreasonable fee structure.

What are the fees paid? You have management fees paid on the basis of committed capital. These might be 1.5% to 2.5% and are paid annually during the life of the fund. Carried interest is the term for the performance fee. There is also typically a hurdle rate, like with hedge funds. You will also hear the term vintage year, for the year the fund was started. Different vintages can have very different returns, depending on the economic environment.

Are these fees worth it? Research shows that gross-of-fees private equity alpha might be around 4%. But, like with other forms of active management, the fees make the alpha disappear. Ang (2014) notes that only about 30-40% of the fees paid to private equity firms comes from the cary, or the incentive fee. These fees are similiar to the performance fees in the hedge fund world and is paid only after the fund has met a certain hurdle IRR, like 8%. The rest of the fees to the GP come from management fees, which go up as a simple function of fund size. And we know that larger funds perform worse.

There is also evidence that poor performing managers try to inflate their returns, but that investors see through this and the GPs then have a harder time raising their next fund.

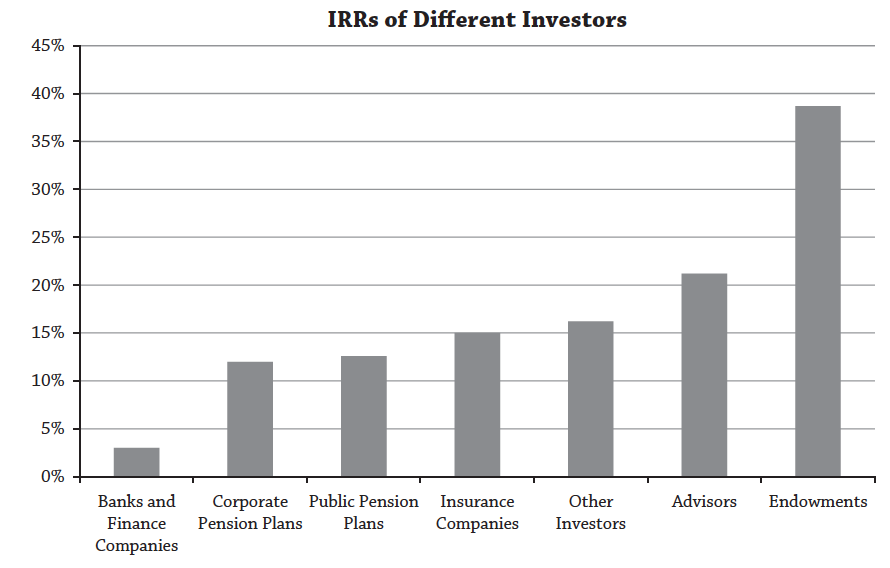

So, what should we do as institutional allocators? I would say: If you think you understand the industry, have a strong network that helps you identify smaller funds lead by talented managers who are willing to take your capital because they view you as a good partner – you might have a shot. Yale’s endowment, considered the model for many other university endowments, has access to managers that most investors can not replicate. Some funds, like CALPERS, are so large that they can’t even invest with smaller, newer funds. They have to go with the “mega” funds or none at all. They should not be expected to earn magical alpha doing this. And, the ability of university endowments to select funds that do well is also in doubt, as every endowment and other “sophisticated” investor tries to do the same thing.

Other large funds invest directly in private equity and not just private equity funds. You need a large staff to do this. But, it cuts out all of the fees.

Here’s a recent, brief paper by just about everyone doing research in this area on whether or not defined contribution plans, like 401(k)s should include private equity investments.

Figure 6.18: Endowment funds have by far the best performance in selecting private equity managers. Source: Ang (2014)

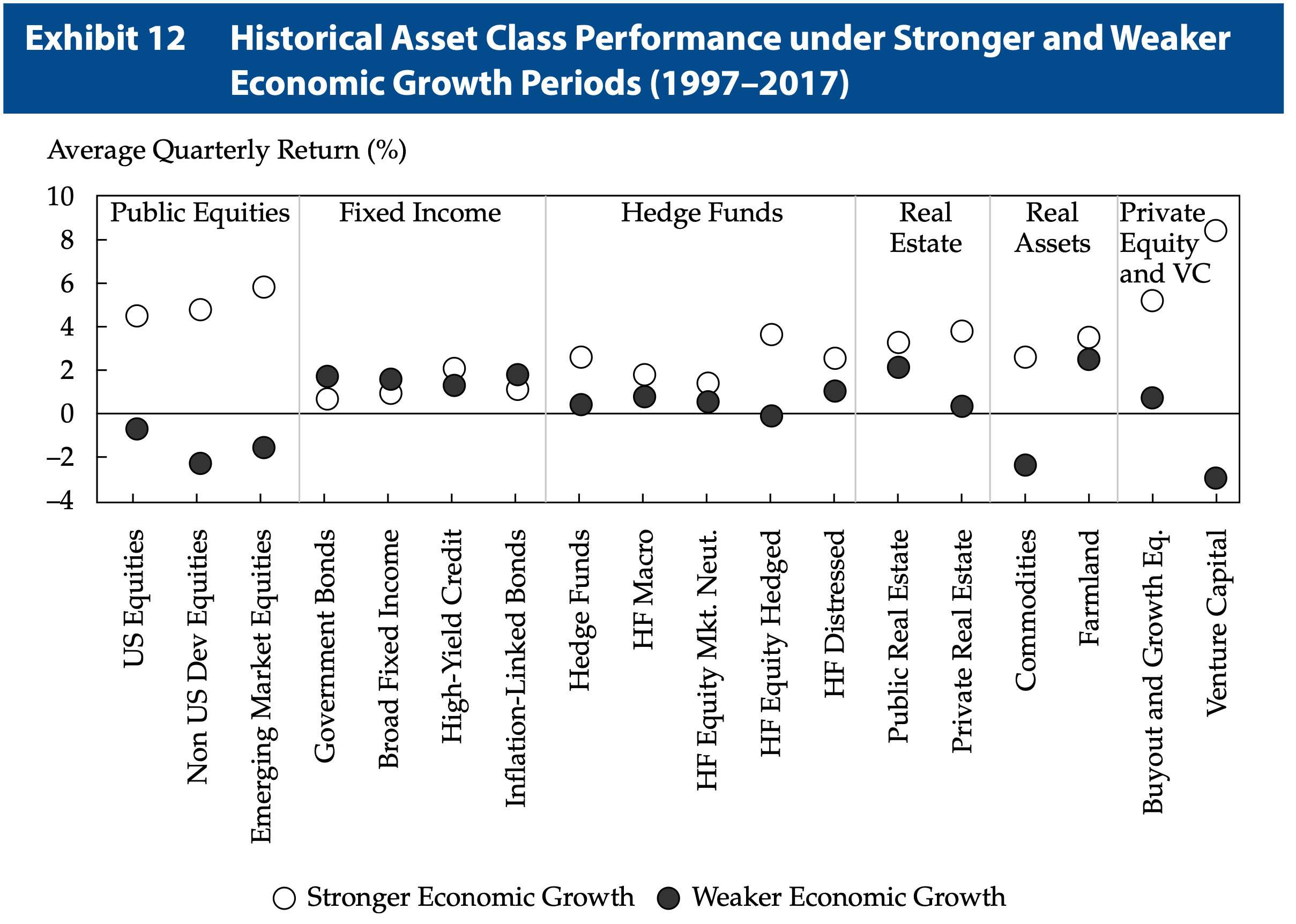

Can we, as institutional allocators, time our private equity exposure, perhaps taking advantage of markets when opportunities look particularily attractive? It looks doubtful. We can time our committments to funds, but we can’t time when the funds actually use our cash.

Figure 6.19: Different investments under different economic growth regimes. Source: CFA Level III

Finally, returning to our “roots” in factor investing, here is a paper that demonstrates how to replicate private equity returns using public market securities. The paper was actually recently published, though I think it has been floating around for at least a decade.

AMF actually has a lot of the material needed to understand buyout funds from an operational perspective, since they often make capital structure, payout, and governance changes. If you want to understand more about modeling these transactions, this is the go-to book. Read it before any banking or private equity interview.↩︎