4 Current Markets

This chapter discusses a few market-related items from the last year or so. We’ll start with a general overview of the market since the start of COVID. What types of factors have done better? Is this different from the recent past? Then, we’ll get into the so-called “meme” stocks, ARKK, GME, and the retail trader come-back. We’ll end with a discussion about pricing vs. valuation and ways to think about investment strategies.

4.1 Stonks Only Go Up

Figure 4.1: State of the Market. Source: Knives Out (2019)

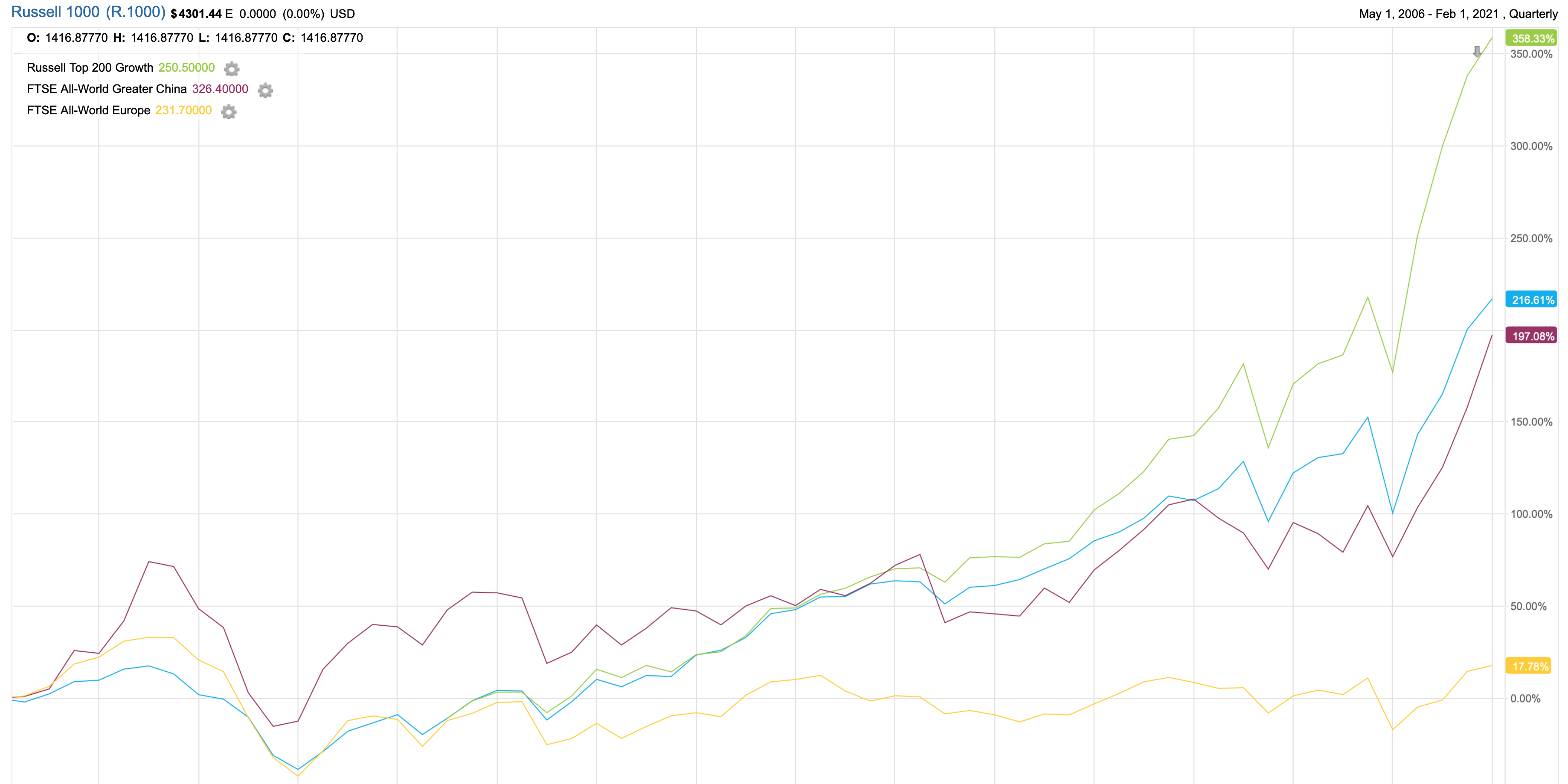

I won’t put together a complete overview of markets since, say, the 2008 – 2009 financial crisis. But, here’s my quick summary: U.S. equity markets have lead the world, with Facebook, Amazon, Apple, Google, Netflix, Microsoft, and Tesla (among others) providing a lot of the returns that you see in the headline indices. Large-cap technology firms have dominated. I believe that their margins and market power (well, Tesla aside) made them the “safe” stocks coming out of the crisis. Easier to see in hindsight, of course. You can see this from the outperformance of the Top 200 U.S. growth stocks in Figure 4.2 since the crisis. European stocks, on the other hand, have basically gone no where.

Figure 4.2: You have wanted to own large-cap U.S. tech stocks for the past decade. Source: Factset

In fixed income, yields across nearly all countries have remained low, as inflation has remained low. When thinking about inflation, don’t get confused by relative price movements. For example, inflation is not college tuition going up or housing prices going up. Inflation is about all prices going up, not supply and demand curves shifting, Baumol’s cost disease in higher ed, or supply constraints on housing in coastal cities leading to rising house prices.

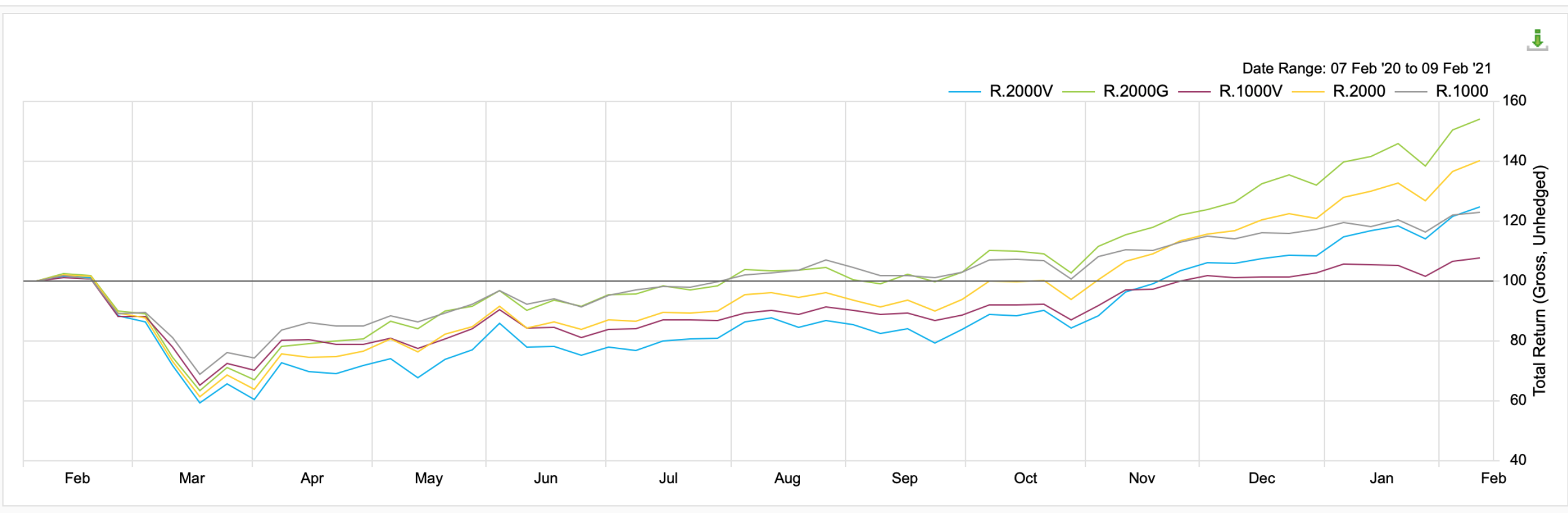

Figure 4.3: Small stocks and growth in particular have dominated since the start of the pandemic. This is different from the past decade, where large-cap growth firms, like Facebook and Netflix, outperformed. Source: Factset

Let’s turn to March 2020 and the onset of COVID. Markets went down – a lot. You can see this in Figure 4.3. But, since March 2020, there has been a change in the types of stocks that have done well. You’ve wanted to own small-cap stocks, such as tech and health care. See below for more.

And, more recently, fixed income markets have started reacting to expectations of expansionary fiscal and continued accommodative monetary policy. For example, break-even rates, calculated using the nominal 10-Year and 10-Year TIPS yields, have reached a the highest levels in nearly a decade, after dropping dramatically at the start of Covid. So, markets are pricing in higher expected inflation, but inflation that is still far below any levels that would worry policy makers at the Federal Reserve. High bond yields go hand-in-hand with higher expected economic growth. We’ll see if we finally get that “hot” economy and tight labor market that we really haven’t seen since the late 1990’s. Recovering from a financial crisis, like what we saw in 2008 – 2009, takes a long time, even if policy makers were able to avoid a Great Depression 2.0.

Figure 4.4: Expected inflation over the next 10-Years is near a decade high, but that is not saying much. Source: FRED

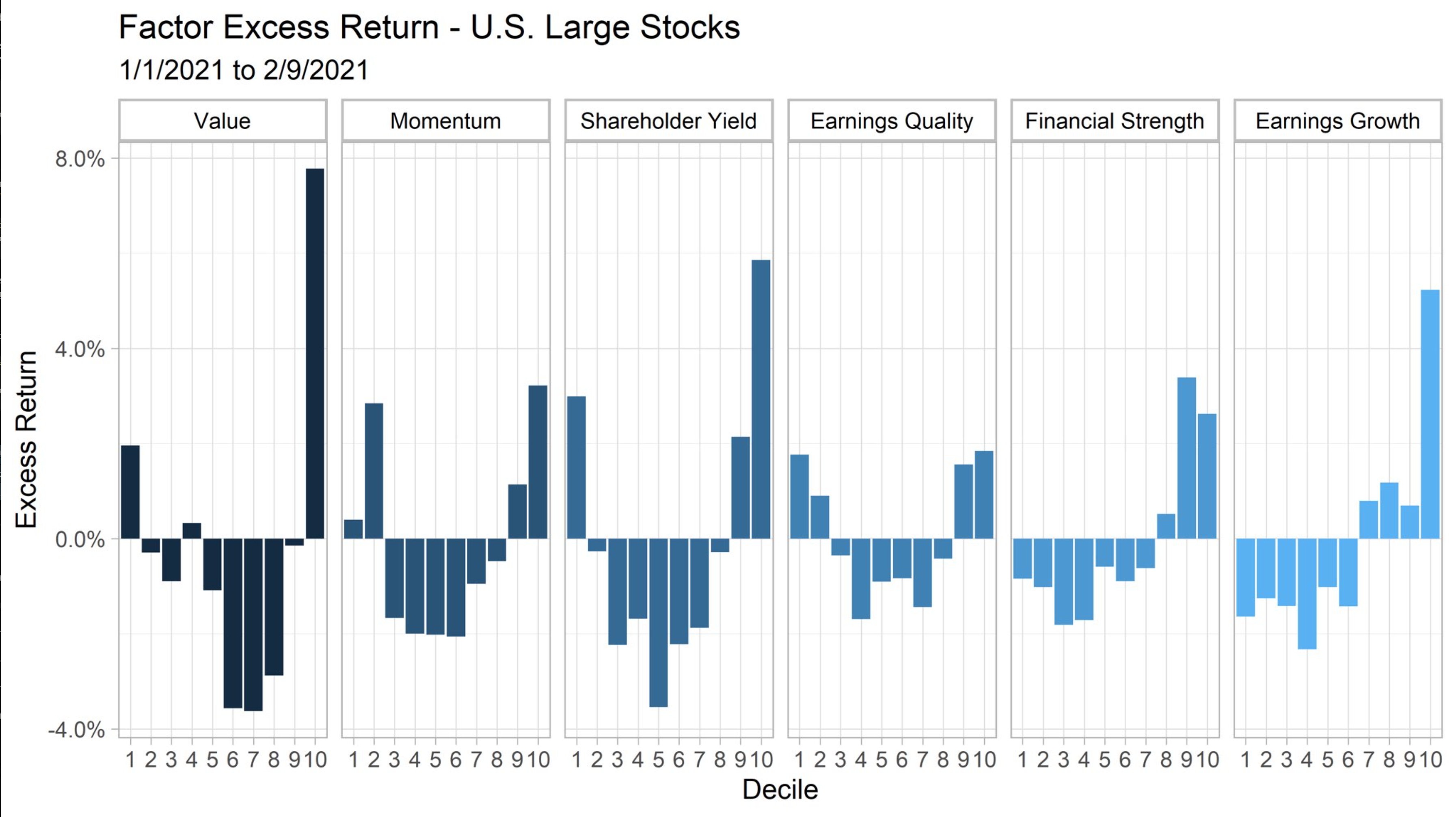

Finally, let’s link things back to the factors and premiums that we’ve discussed. Value has done poorly for a while. But, what about since the start of 2021? Figure 4.5 shows something interesting. The cheapest stocks have done well this year (decile 10). But, so have the most expensive stocks (decile 1). You can see something similar in momentum. What’s going on here? I think this is likely a version of the “risk on” trade that you hear discussed. Investors are more hopeful about economic growth and so are buying some of the cheapest, most cyclical stocks (e.g. banks and energy), as well as buying the small-cap growth stocks mentioned above.

Figure 4.5: Value has done better as expected growth has risen in the last month or two. Source: FactorInvestor

You can pull up FTW on the Bloomberg terminals to see more of this. You can also see values “comeback” in the recent returns for the Alpha Architect Quantitative Value ETF, which is up 29.23% over the past 6 months, but only 7% over the past year. You can see a similar pattern in the performance of Southeastern’s Longleaf Partners mutual fund, a very traditional-syle, stock-picking, fundamental value fund.

4.2 Meme Stocks and Thematic ETFs

Meme stocks are a new term for an old idea. Basically, these are stocks that investors get excited about. In 1999, this would have been anything with a “.com” in the name. We had the “nifty-fifty” in the late 60’s and early 70’s U.S. markets.

Figure 4.6: Deep value ETFs are very happy with WSB.

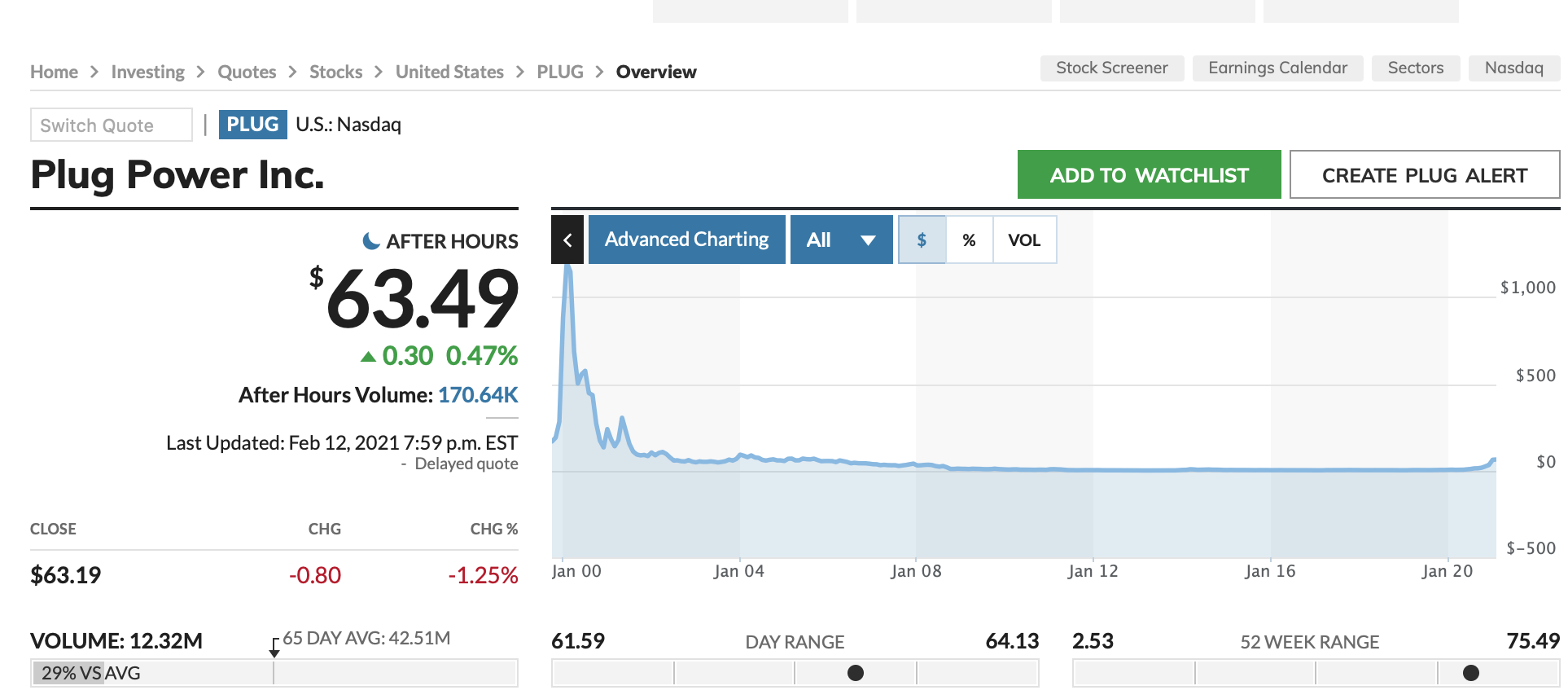

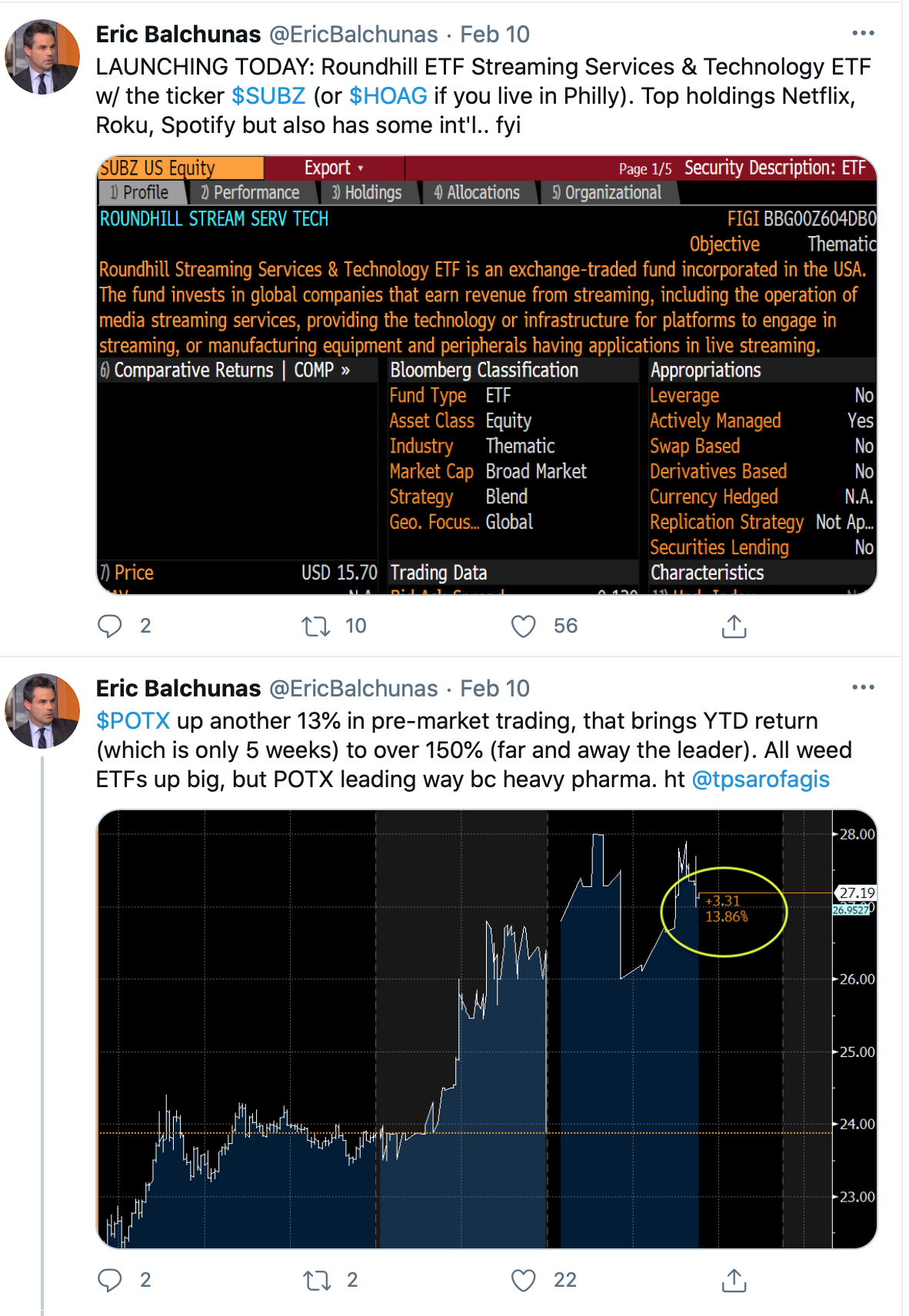

The last few years, however, have seen the rise of thematic investing, most prominently by Cathie Wood and ARK. Thematic investing often uses ETFs and allows investors to easily own a portfolio with a particular theme, whether that is renewable energy, space travel, or cannabis. Single stocks, like PLUG, which was one of the “free” stocks included with a Robinhood account, are also used to play these themes.

Figure 4.7: PLUG still has a ways to go to reach their 2000 highs. Source: Marketwatch

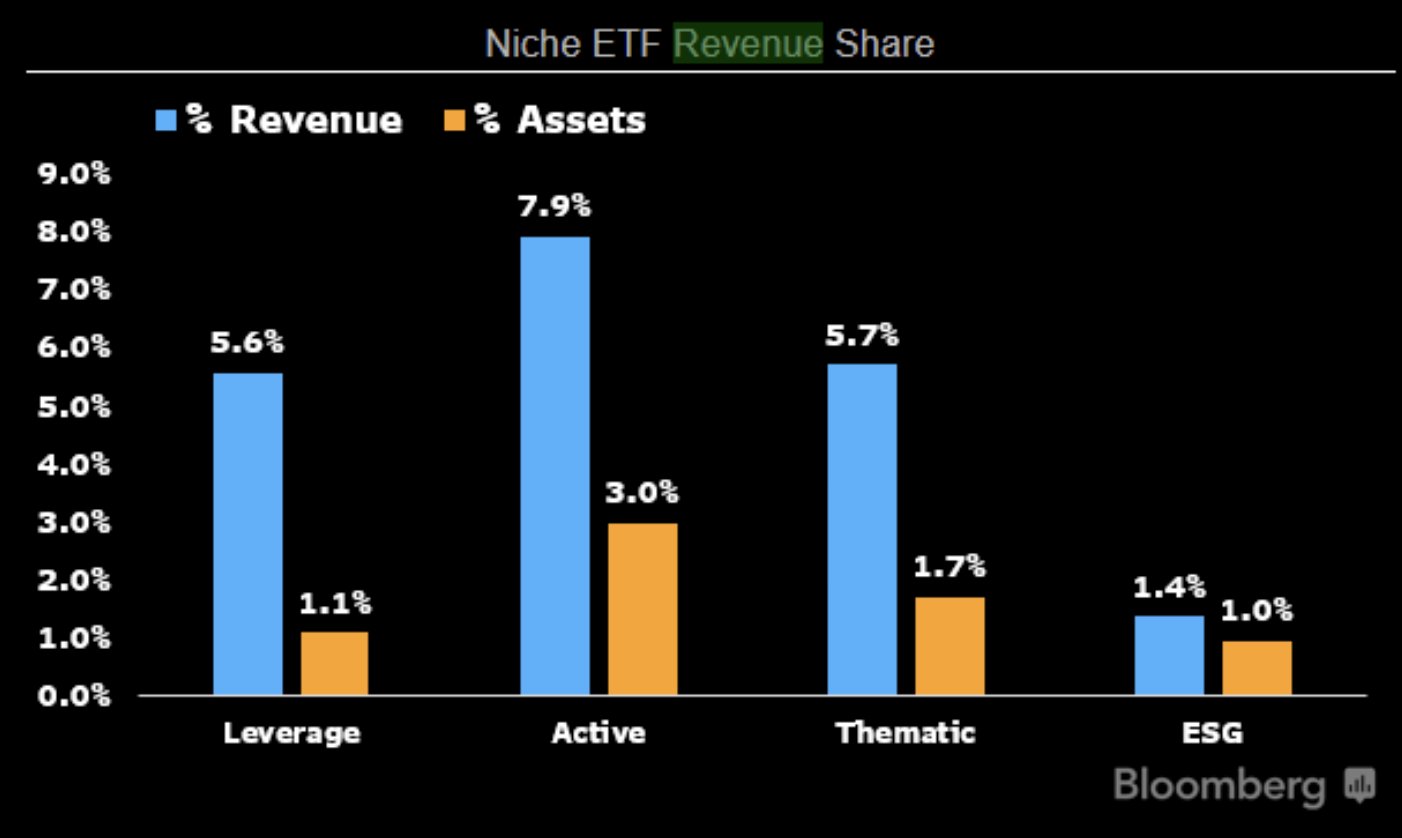

Why are ETF providers offering these types of ETFs? Investor demand, of course. They are providing a product that people want. Also, there margins on these products are much, much higher than on traditional ETFs. Figure 4.8 shows that thematic ETFs are just 1.7% of AUM, but 5.7% of revenue for the ETF industry. This is why the ETF industry is dominated by a few firms – you need massive scale to make such a low margin business work. We’ll see if the demand for more “bespoke” products leads to more new entrants, like ARK.

Figure 4.8: Margins are much higher on active and thematic ETFs. Source: Bloomberg

How well have thematic ETFs done? We don’t have that much data, but overall, not that well. There are cheap ETFs that mimic an index and there are a thematic or more active ETFs that try to grab investor intention. This latter group has underperformed, ARK notwithstanding. We’ll see if they are the exception that proves the rule, kind of like Warren Buffett or Jim Simons and active management.15

Why do investors want these thematic, or “meme,” stocks and ETFs? For some, like ARK, the story is easy. New technologies, like decarbonizing energy, space travel, and mRNA vaccines, are exciting. Big themes have always lead to more investment. There’s even an argument that bubbles that form around new technologies can be good, since we get a lot of investment and, even if the firms disappear, the economy is left with all of this good stuff.

For both ETFs and single stocks (as well as options), there’s also plenty of evidence that more active trading by investors is linked to sensation seeking. Basically, gambling behavior. Recent studies have looked at the behavior of Robinhood investors. For example, Robinhood investors are swayed by “hot stocks” and tend to herd together. They also tend to buy both stocks with extreme gains and extreme losses, which is different from other retail investor behavior that tends to focus more on the gains. Overall, the Top 0.5% of stocks bought each month by Robinhood users lose an average of over 4% the following month. Research that focuses on the full buying and selling behavior of Robinhood investors finds no relationship between trading and future returns, suggesting that, overall, Robinhood investors are true noise traders. More on what that means for markets and order execution below.

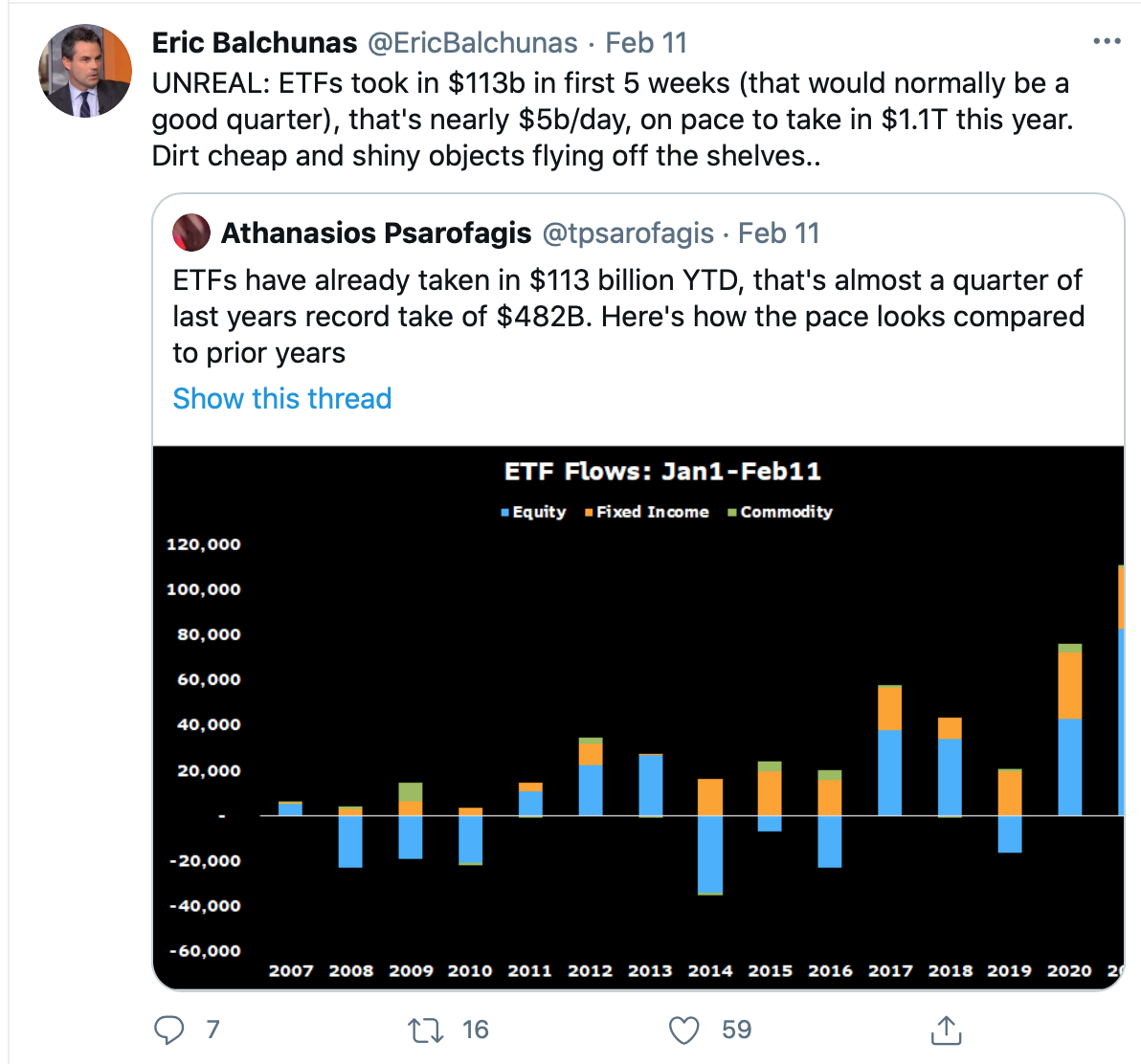

Eric Balchunas is the Senior ETF Analyst at Bloomberg is a great person to follow if you are interested in the ETF world and how it is changing from SPDR and QQQ to a wide-range of thematic and, essentially, active products. Remember, the ETF is just the legal wrapper!

ETF growth YTD is stunning. Investors want the cheap risk factor exposure and thematic funds. No idea if the same people are buying both!

Figure 4.9: ETFs are how individuals are investing now. Source: Twitter

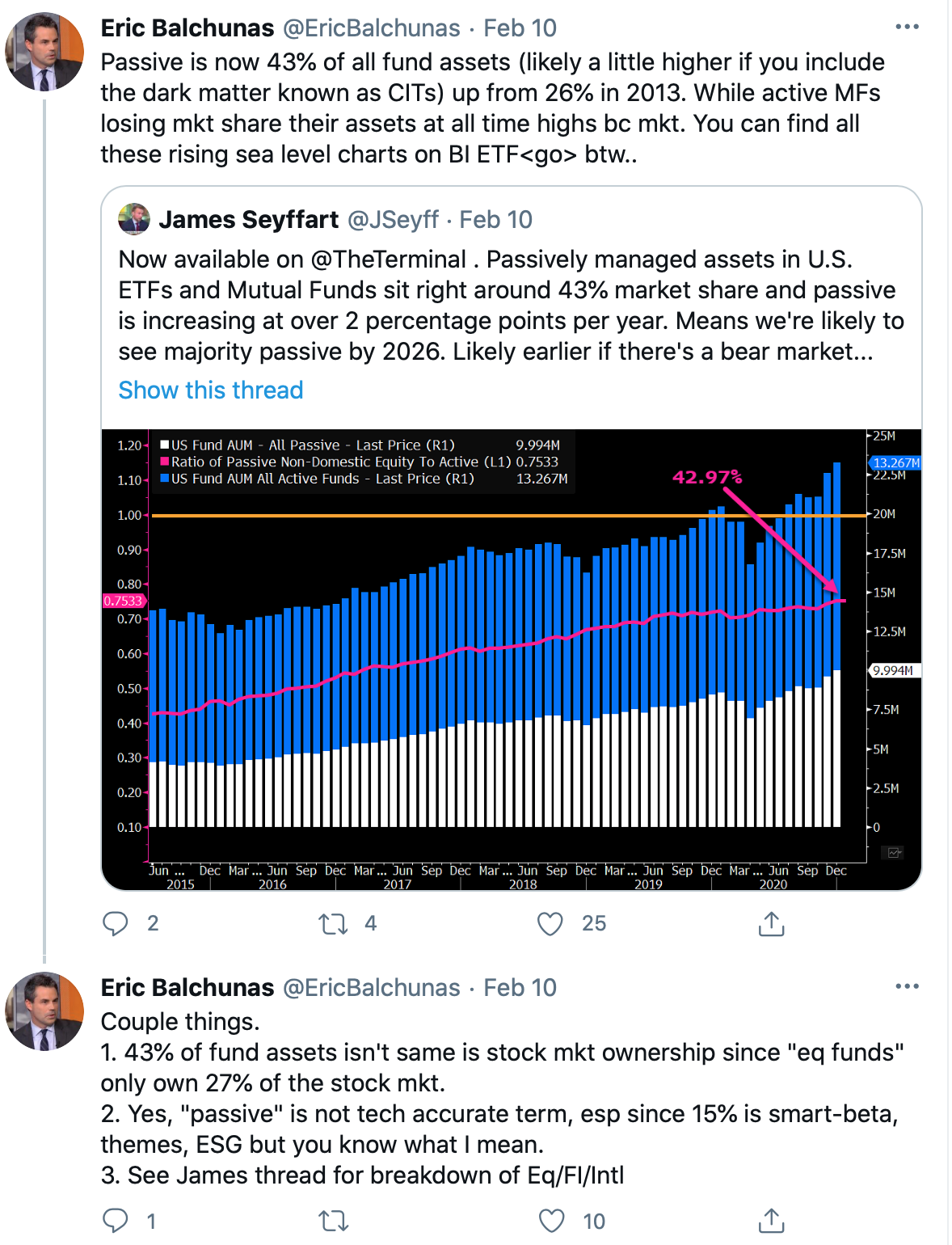

The rise of ETFs goes a long with the rise in passive investing.

Figure 4.10: Passive investing keeps growing. Source: Twitter

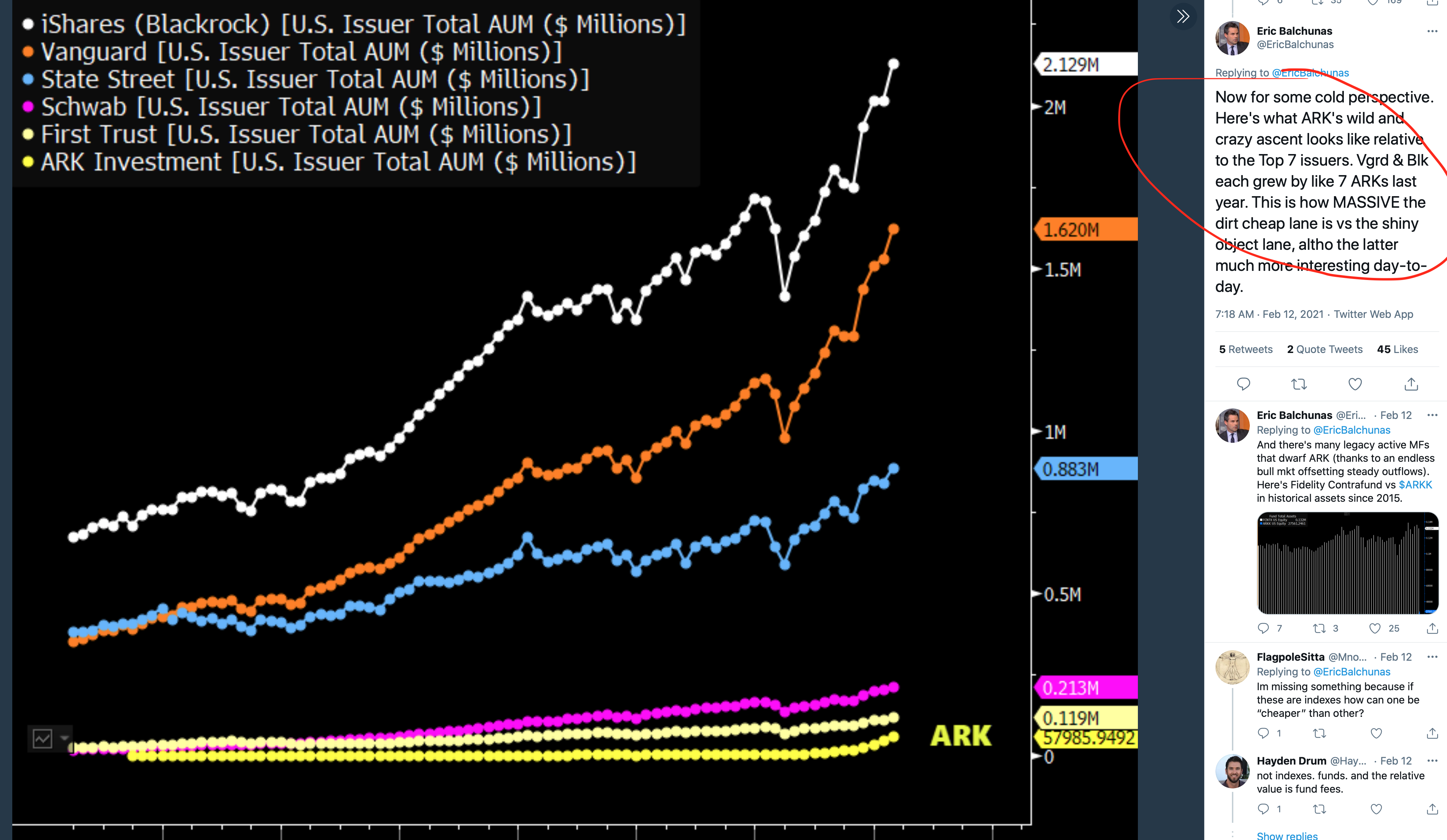

Aside from the usual suspects, like Blackrock, ARK is the story.

Figure 4.11: The growth at ARK is incredible. Their fees are 75 bps, so not as high as some traditional active funds, but much higher than an index fund. Source: Twitter

How impressive is ARK vs. the big ETF firms? The big players are still taking in much more in new assets, but ARK’s growth is still very impressive. I will admit it - I made fun of their TSLA valuation a few years ago in class.

Figure 4.12: ARK vs. the rest of the ETF universe. ETFs are still dominated by the big players. Source: Twitter

Finally, ARK isn’t the only fund getting in on thematic ETF investing. Blackrock and many others have new products. To believe in thematic investing, I think you have to believe that the market is not properly pricing in how important these industries will be in a systematic way. So, it isn’t about one firm. The concern is, of course, that these sorts of investments are also what get people excited and can lead to overvaluation. Where are we in the cycle? If I knew, I wouldn’t have made fun of ARK’s TSLA valuation a few years ago.

Figure 4.13: We are getting pretty specific now on certain ETF themes. Source: Twitter

Figure 4.14: More examples of specific ETF themes. Source: Twitter

4.2.1 What happened to GME?

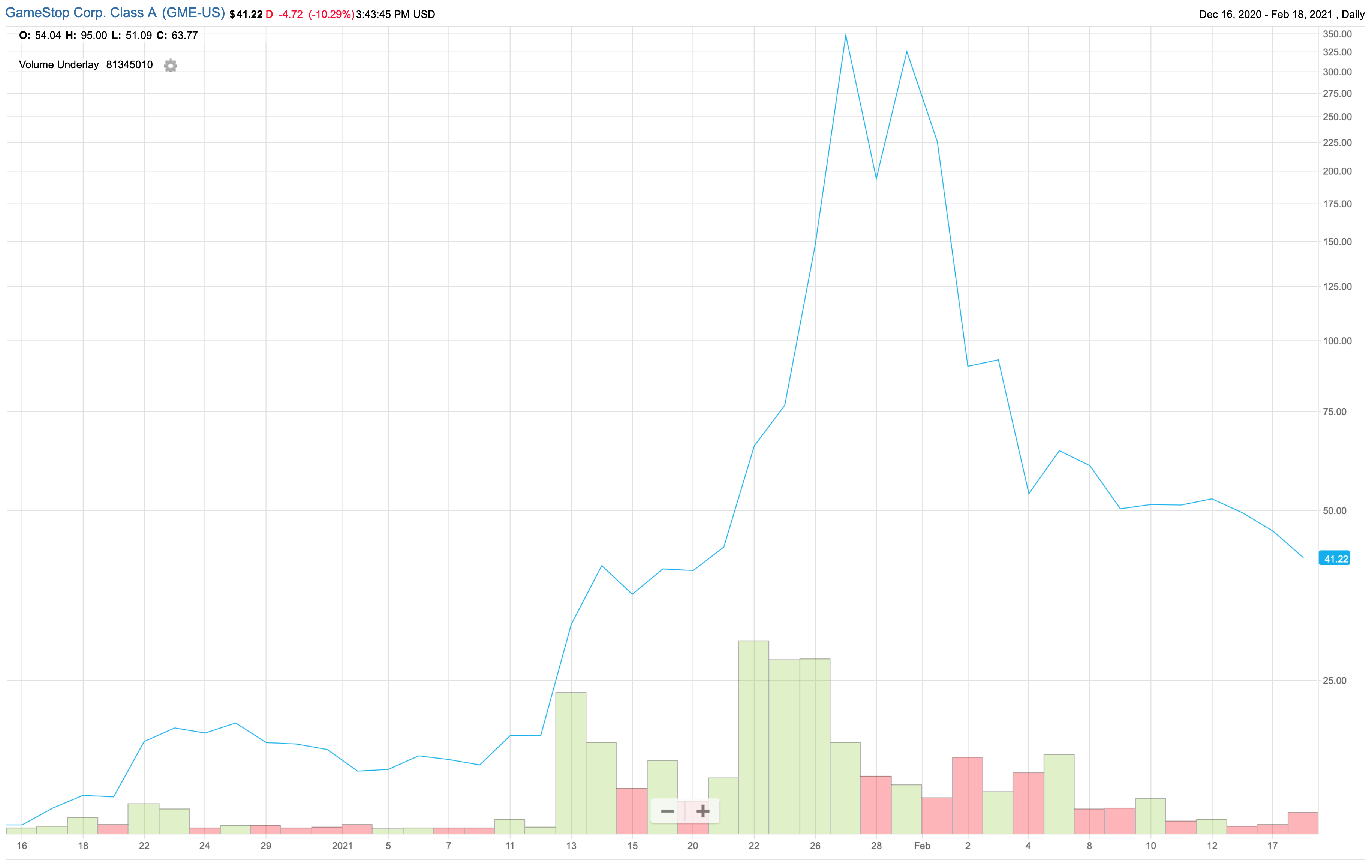

So, that was really weird! And it seems like it was a year ago at this point to me, but I think we should think a bit about what happened. Our protagonist, RoarringKitty (or D*V), posted his GME stock pitch back in July.16 The stock was at $4. It’s at about $40 right now. It got up to a little over $480 on January 28th. What happened?

Figure 4.15: That was fun while it lasted. Source: Factset

This was a combination of a legitimate thesis about a possibly undervalued stock, the rise of free trading on our phones and the payment for order flow that makes that possible, noise traders coordinating on social media, gambling behavior as old as time, a short squeeze, options, something called gamma hedging, and perhaps some underlying sociology about resentment towards the financial sector. The whole episode lasted about as long as it could have and now we have Congressional hearings.

There are going to be books and movies about all of this, so I’ll keep my explanation brief. For whatever reason, the Reddit forum WallStreetBets served as a focal point to organize trading about a certain set of stocks, like GME. Part of this was driven by the desire to hurt hedge funds, though many hedge funds ended up making money from the frenzy. Twitters got involved, as Elon Musk and Chamath Palihapitiya joined the Reddit fray, in part because of their dislike of short sellers.

Then, as more and more people bought the stock over the span of a few days, two additional things were happening. First, the short sellers were losing money. When this happens, you get a margin call and can be forced to close or cover your short. This means buying the stock back. So, buying can create more buying, temporarily. Here’s Matt Levine of Bloomberg on this mechanic:

… There are lots of short sellers who think that GameStop is in fact a dying business, and that its prospects to improve are not great. Some of them, including Andrew Left of Citron Research, are quite vocal about it. They are betting that the current stock price is way too high. That’s how markets work; some people think a stock is good and buy it, some people think it’s bad and sell it, and the market balances supply and demand. Recently people have become much more enthusiastic about the future, and the stock has gone up.

Here is a technical story. It has two parts. First, a lot of people are short a lot of GameStop stock. (Notoriously, they are short more than GameStop’s entire float; Bloomberg tells me that short interest is 71.2 million shares, while GameStop has only 69.7 million shares outstanding.) They are short for the fundamental reasons we talked about above: dying mall retailer with huge valuation, etc. When you short a stock, you borrow shares and sell them, promising to return them later. You have to pay a fee to borrow shares, you have to post collateral based on the value of the borrowed shares, and you (generally) have to return the shares you borrowed if the lender asks for them back. When the stock goes up a lot, short sellers start feeling “squeezed”: Their borrow costs go up, they have to post more collateral, and lenders might asking for their stock back. Some short sellers might have to capitulate, and they will close their positions by buying back stock. There is a feedback loop: The stock goes up, short sellers give up, they buy stock to surrender, and their buying pushes the stock up more.

But, there’s also another part of the story. Retail investors are buying options. This kind of casual option buying is new. Here’s Matt Levine again on the gamma-squeeze, options-induced part of this story. Essentially, because retail traders were buying call options in large volumes, this created additional upward, temporary price pressure on the stock.

Second, a lot of people (on Reddit) who like GameStop don’t buy stock; they buy call options. If you are a retail trader looking to gamble on a stock, you can buy call options to get leveraged exposure to the stock. For instance, last Tuesday (Jan. 19), you could have bought a $50-strike call option on 100 shares of GameStop stock expiring this coming Friday (Jan. 29). Bloomberg tells me this option would have cost you about $3.35 per share, or about $335 for a 100-share option contract; the stock closed that day at $39.36. If you sold the options on Friday (Jan. 22), when the stock closed at $65.01, they were worth $18.16 per share. You put in $335 and got back $1,816; you made a 442% return in four days. If you had just bought 100 shares of stock instead, you would have had to put in $3,936 to get back $6,501, a 65% return. Of course if the stock had stayed flat instead of going up to $65.01, you’d have lost 0% by buying shares and 100% by buying the options. So options are great if you have a relatively small amount of money and want to take a lot of risk with it. If, for instance, you are a retail trader on WallStreetBets.

Meanwhile the market maker who sold you the options would have hedged its option exposure by buying about 40 shares of GameStop stock, for about $1,575. (This—the fraction of the underlying shares that the market maker buys to hedge the option—is called “delta.”) Your $335 of option premium caused $1,575 of stock buying. More important, as the stock goes up, the market maker will adjust its hedge by buying more stock—by the end of the day on Friday, the market maker would have owned about 80 shares. (The change in delta as the stock price changes is called “gamma,” and people who like this sort of technical explanation love talking about “gamma.”) You haven’t done anything else—you bought the options on Tuesday, and then stopped trading—but the market maker kept buying hundreds of dollars more stock as the stock went up to keep the option hedged. Multiply that by the extreme popularity of GameStop options, and you get a lot of stock being bought as the price goes up—which, of course, pushes the price up more.

All of these mechanics, the meme-based trading, the Tweets, the squeezes, all contributed to a very volatile few days for the stock. This led to exchanges halting trading. It also led many brokerage firms to stop their users from trading the stock. Why? Basically, platforms like Robinhood got margin calls that required them to put up billions of dollars in collateral because of the risky trades that their users were making, all in the same direction. From the WSJ:

Mr. Denier at Webull said the restrictions originated Thursday morning when the Depository Trust & Clearing Corp. instructed his clearing firm, Apex, that it was increasing the collateral it needed to put up to help settle the trades for stocks like GameStop. In turn, Apex told Webull to restrict the ability to open new positions in order to prevent trades from failing, Mr. Denier said.

DTCC, which operates the clearinghouses for U.S. stock and bond trades, is a key part of the plumbing of financial markets. Usually drawing little notice, it facilitates the movement of stocks and bonds among buyers and sellers and provides data and analytics services.

In a statement, DTCC said the volatility in stocks like GameStop and AMC has “generated substantial risk exposures at firms that clear these trades” at its clearinghouse for stock trades. Those risks were especially pronounced for firms whose clients were ”predominantly on one side of the market,” a reference to brokers whose customers were heavily betting for stocks to rise or fall, rather than having a mix of positions.

The statement added that when volatility increases, it increases margin that DTCC collects from the banks and brokers that use its clearing services. “Margin requirements protect the entire industry against defaults and systemic risk in volatile markets,” it said.

Basically, GME was an edge case for the clearinghouses and the “plumbing” of our financial system. It was, however, not a systematic risk to the whole system. Weird things can happen in markets. And then it all kind of ended, just like it had to. The market clearning price started dropping, rapidly, even after trading started again. Stock prices should have a reasonable relationship with something real and here we are now. And here’s the story of a hedge fund that actually made money on all of this. Again, Matt Levine:

The Wall Street Journal came through in a big way with this story about Senvest Management LLC, a (now) $2.4 billion equity hedge fund that made almost $700 million on GameStop. Their process for deciding how to buy GameStop was sort of boring and normal and pre-nonsense: They got interested in the stock after hearing “a presentation from the new GameStop chief executive at a consumer investment conference in January 2020,” did research, “spoke with management, sussed out competitors and noted the involvement of activists in the stock.” It took them until September to start buying, and “by the end of October, Senvest owned more than 5% of the company, paying under $10 a share for the bulk of the stock.”

Their process for deciding how to sell GameStop, however, really rose to the weird occasion:

After the market’s close on Jan. 26, Tesla Chief Executive Elon Musk tweeted “GameStonk!!” a rallying cry to users of Reddit’s WallStreetBets forum, who had put their support behind GameStop.

Senvest, which had slowly been trimming its position, decided to get out completely.

“Given what was going on, it was hard to imagine it getting crazier,” Mr. Mashaal said.

That implies that they got out mostly on Jan. 27, when GameStop closed at its all-time high. They got into this stock based on fundamental research conducted over months; they called the top perfectly based on an Elon Musk tweet.

Honestly I am tearing up a little? These guys get it. What a great investment process. I hope someone is working on a revised edition of Graham & Dodd that incorporates the Did Elon Musk Tweet Yet metric. The best time to buy a stock is a few months before Elon Musk tweets about it; the best time to sell it is the day after he tweets. If Elon Musk just sold advance notice of his tweets to hedge funds, he could be the richest person in the world.

How much of this is truly new? We’ve even seen very odd short-squeezes before. In October of 2008, Volkswagon’s stock rose rapidly, as Porsche announced that they had increased their stake in the firm. Funds that were short VW stock then starting covering, since this was good news and had caused the stock to go up. For a very brief time, on October 28th, VW was the most valuable firm in the world by market capitalization.

Figure 4.16: Back in 2008, VW was briefly the most valuable company in the world due to a short squeeze.

I’ll also point out that we’ve seen a combination of online retail traders and excitement over particular stocks before, though certainly not to the degree that occurred with GME. During the late 1990’s, online trading developed along with the internet and many of us had tickers streaming across our CRT monitors in our dorm rooms. There were even message boards pushing penny stocks and all of the other fun things you see on the WSB sub-Reddit. We weren’t trading commission free, though, and we weren’t trading options. Those are important differences, I think, and helped drive the GME madness.

Figure 4.17: From the late 1990s. Different mechanism, but some things never change. There is even a headline about data mining!

What are the main lessons to take away from GME? First, understanding the plumbing and mechanics of markets is important! What is operational risk? Counterparty risk? What role do market makers play? How do they manage risk? How can trading be free? These are the details of markets that are usually hidden from the retail investor, but suddenly became very important. Second, I would question how we categorize platforms like Robinhood. They don’t really have anything to do with investing and have more in common with sports gambling platforms, such as Fan Duels. Which is fine! Sportsbooks are fun. Trading is fun. But a fun gaming app isn’t really about “Democratizing” investing, even if the firm itself ends up very valuable. Casinos are also very valuable.

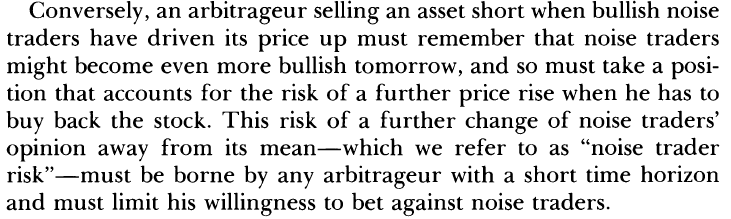

Finally, will much change after GME? I don’t know. We’ve had Congressional hearings now and the SEC is looking at what happened. I’d like to think that billionaires who should have known better think twice about Tweeting out their thoughts on “diamond hands” and “Gamestonk.” Maybe they will shorten the settlement cycle, but this really doesn’t matter for most people. But, in the end, markets basically did what they are suppose to do. Noise traders will always be there and weird things can happen to prices. And then things go back to something approaching normal.

Figure 4.18: Noise trader risk! Source: Delong et al. (1990)

Would you like to learn more about trading, options, and derivatives more generally? If you’re a junior taking this class, we will be offering our derivatives and fixed income courses next year. If you’d like some reading let me suggest a few. You can search around for cheap versions.

Hull, the classic text and what I would probably teach from. It’s what we used when I took derivatives way back as an undergrad.

Sinclair, popular among traders and perhaps a little more practical.

Natenberg, also popular among practitioners.

Note that the you do not have to be a math Ph.D. to trade options – however, you should know the basics, have some notion of the first-order Greeks, and be aware of what more sophisticated traders are doing, even if you aren’t doing that. It’s dangerous out there!

4.3 Investment Styles

There is a long-standing argument among investors and traders. One group, let’s call them “CFAs,” argues that an asset is the discounted value of its expected future cash flows. Fundamentals determine value and should, eventually, be reflected in prices. If you are engaging in active management, you want to find the assets that are mispriced, that are misunderstood, own them (or short them, depending), and wait for the market to catch up to your view. Hopefully the price doesn’t move to far against you as you wait for that catalyst, like next quarter’s earnings.

There’s another group, let’s call them “traders,” who say that this is nonsense and that the value of something is the price that someone will pay you. This may or may not have any connection with the present value of cash flows, but who cares. Traders, roughly speaking, are going to be more interested in flows, trends, and the price behavior of the asset. This focus is also typically shorter in time frame.

For a high frequency trader (HFT), where everything is done via computer algorithm, speed is measured in fractions of a second, as order imbalances causes small, temporary price dislocations. Competition among HFTs is fierce and speed matters. And, high frequency trading is not just about generating alpha from small, fleeting price discrepancies. They are making markets, providing liquidity, and performing the functions of the more traditional exchange floor broker. They earn the bid-ask spread by doing this and managing the risks that they accumulate by holding securities to eventually sell (their inventory).

So, who’s right? Is there still alpha to be had from studying financial statements? Or, is everything beeps and boops and algos now? I’d argue both are valuable and that alpha is hard to find no matter what your strategy is. This gets at what Aswath Damodaran calls pricing vs. valuation. We teach you the tools to value assets, like DCF models, and the art of thinking about the inputs into these models, like growth rates, margins, and discount rates. To do this well and have an actual edge, you need to understand an industry and the economics behind it. You need quality data, like on our Bloomberg machines. You need experience to know what matters and what doesn’t. And you need to know when your experience might no longer be a great guide for the future.

But, value-based has struggled recently, as discussed above. What does this say about valuation? I want to, again, draw a clear distinction between value investing and valuation methods. Valuation methods, like a DCF model, can be used anywhere, even for young firms with a lot of potential growth and not much current cash flow. Eventually, all firms need to generate cash! Value investing, however, tends to come with a certain mindset. Recent work by Cornell and Damodaran looks at the big picture behind the struggles of value investing. They note that value investing has often struggled, with high book-to-market stocks (growth stocks) beating value stocks in 44 of the 93 years in their sample, even if value outperforms overall. The returns to value investing can be “lumpy,” to use my own term. They argue that growth investing beats value investing in periods of lower overall economic growth and flatter yield curves (often associated with lower inflation). Well, that describes the last decade! In times like these, investors are willing to pay more for growth opportunities, so they bid up the prices of stocks like Netflix, Tesla, and Amazon. If you think of yourself as a value investor, someone who views stocks through a free cash flow lens, they have a number of thoughts:

Yes, value has underperformed for long stretches in the past. However, it is very difficult to withstand long periods of underperformance as a professional investor. Be mindful of this risk and aware that the value strategies of the past might not be the value strategies that work today.

Don’t blame the Fed. The Fed influences rates, but doesn’t control them. Rates are low because economic growth has been slow since the 2008 – 2009 crisis. And, I’ll repeat my own mantra - if the Fed just makes stocks go up, then go buy stocks. Why are you even reading this?

Don’t blame the accounting. Accounting is focused on book values. You can make adjustments, but it is not their job to give you better measures of future growth opportunities. That’s our job as analysts.

Everyone has the same basic information now and any, seemingly special information edge will disappear quickly. You’ll need to be creative and thoughtful to find mispriced securities.

Technology shocks matter. Some simple value strategies often seem to rely on mean reversion – what goes up must go down, and vice-versa. But, is that true for certain stocks and industries? Thinking carefully about how the underlying economics of an industry has changed will help you to avoid value traps, or stocks that are cheap and then stay that way because they just don’t have a bright future.

Be clear about the difference between value and price. This will help you avoid shorting a stock like Tesla. Tesla’s entire value comes from growth options far into the future. It’s price is driven by how people feel about these growth options. This makes the stock susceptible to momentum and other, more behavioral factors. Take it from someone who’s thought the stock’s been overvalued since the day it first traded – sometimes price dynamics dominate and you just need to walk away.

Be careful with margin of safety. Margin of safety is a term coined, I believe, Benjamin Graham and then used by Seth Klarman, a well-known value-style hedge fund manager, as the title of his sought-after book. The idea is that you only buy a stock that is sufficiently mispriced that you could still be wrong about certain aspects of your thesis, or that unforeseen events could cause the price to move against you, and you could still make money. Cornell and Damodaran note that you can only come up with a margin of safety after you value the firm and, in order to value the firm, you need a measure of risk to get the discount rate. So, you need to think about the firm’s risk, no matter what the margin of safety ends up being.

Be careful with concentrated portfolios. In times of technological change, our usual valuation tools become more difficult to apply, even if the tools themselves are still sound.

Together with pricing vs. valuation, we also have systematic vs. discretionary. Systematic means algorithmic, in a sense, and covers many of the strategies that we’ve discussed already, like Blackrock ETFs that try to capture certain risk premiums or a risk parity strategy. A systematic strategy can also try to capture alphas by implementing a method that exploits a risky arbitrage strategy (e.g. price drift after earnings announcements, analyzing Twitter mentions to predict price changes, or small mispricings in swap spreads). These systematic strategies could be longer-term and involve simple quarterly and annual rebalancing. Others might trade more frequently, as the arbitrage opportunities disappear or close in your favor. Finally, some systematic strategies are very high frequency and are captured by proprietary trading firms, like Citadel and the other HFT, discussed above. They are often trading supply and demand imbalances and using quantitative models to track their trading book’s risk very closely. These strategies are impossible to replicate for any individual trader and even for most firms. For example, the high frequency trading arms-race for technology and talent means that a handful of firms dominate the market.

In short, you can have a discretionary, traditional finance perspective and spend your time studying a firm and their industry. You can also look at charts and think about who the buyers and sellers might be, without worrying about the firm’s margins. Or, you can go systematic and create a algorithmic strategy to exploit different mispricings or to take advantage of different risk premiums. In this case, you are, in a sense, trying to automate what traditional analysts and portfolio managers do. Finally, you can view the whole world as one big limit order book and derive alpha from supply and demand imbalances, without even really knowing what the companies you trade do. All are possible and all are difficult. The competition across all strategies limits the alpha that is available. Think about your own strengths and weaknesses, what your comparative advantage might be, when devising your own strategies. If you don’t have one and/or you don’t find the process of developing one fun - there’s an index fund that lets you skip the whole game and just earn those risk premiums.

One thing to keep in mind: Good companies aren’t always good investments. Same for important industries. There were a lot of “.com” stocks that you could buy in 1999 that ended up horrible investments, even as the internet obviously changed our entire society.↩︎

I haven’t watched the whole thing, but the parts I’ve seen seem like very traditional CFA-style fundamental analysis. As legit as any other stock pitch.↩︎