Chapter 2 Participants

Money saved must be invested

2.1 Data gathering preamble

Table 2.1 provides a list of reliable sources of data

on economics and markets. Most of the below sources are not only

reliable but also allow for API access to their data. Most api below

enjoy wrappers in common languages such as

![]() or

or

![]() .

.

Figure 2.1: Reliable data sources

Some data prepared for you here.

In what follows, text displayed in this environment is quoted. Otherwise differently stated, quotations come from Wikipedia.

2.2 Accounting preamble

In the double-entry accounting system, at least two accounting entries are required to record each financial transaction. These entries may occur in asset, liability, equity, expense, or revenue accounts. Recording of a debit amount to one or more accounts and an equal credit amount to one or more accounts results in total debits being equal to total credits when considering all accounts in the general ledger.

If the accounting entries are recorded without error, the aggregate balance of all accounts having Debit balances will be equal to the aggregate balance of all accounts having Credit balances. Accounting entries that debit and credit related accounts typically include the same date and identifying code in both accounts, so that in case of error, each debit and credit can be traced back to a journal and transaction source document, thus preserving an audit trail. The accounting entries are recorded in the “Books of Accounts”. Regardless of which accounts and how many are involved by a given transaction, the fundamental accounting equation of assets equal liabilities plus equity will hold.

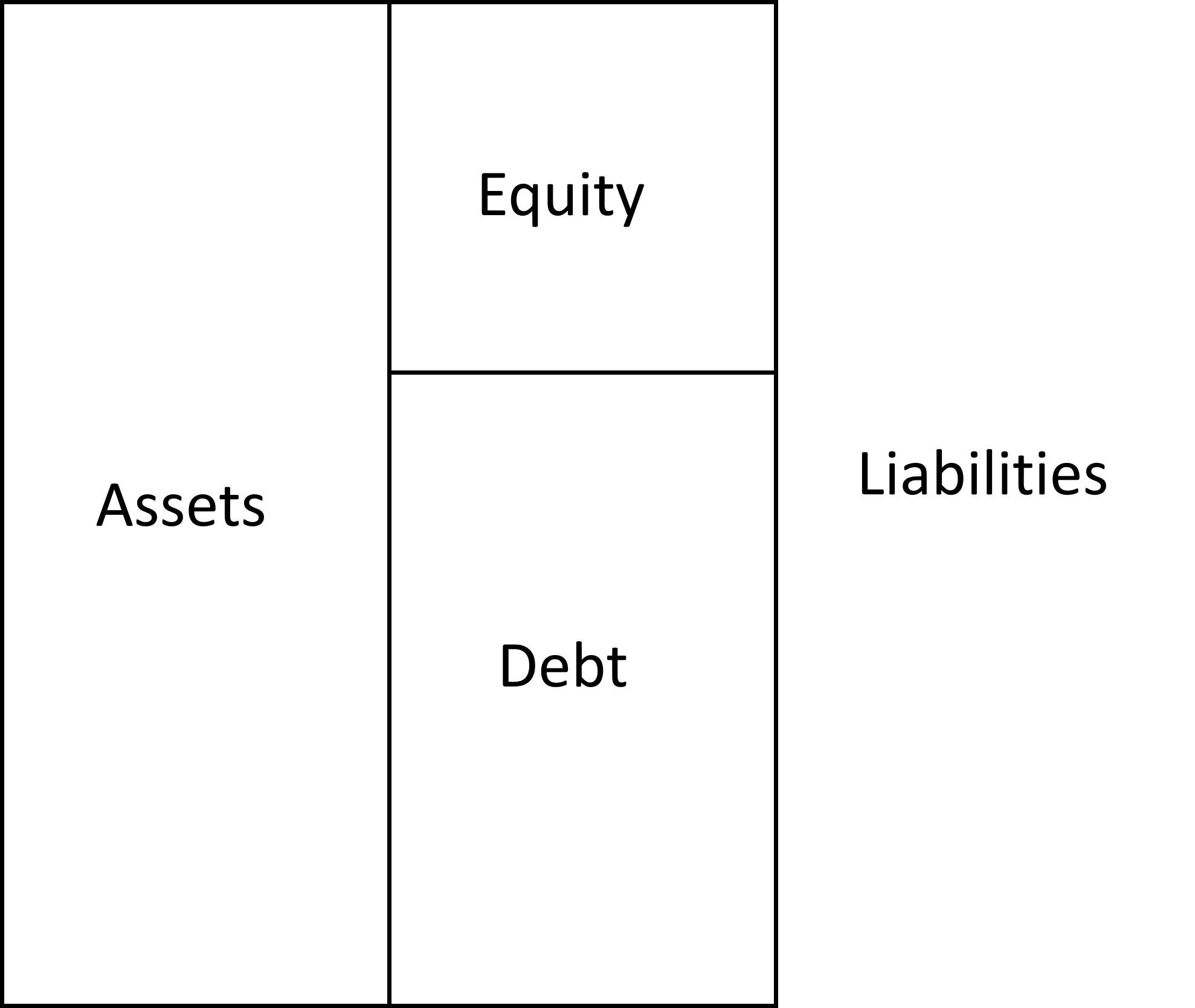

Different type of accounts

Accounting equation \(Assets = Equity+Debt\)

The equity of a company is the ownership interest. The book value of equity, which for a corporation is often referred to as shareholders’ equity or stockholders’ equity, is basically the amount that investors paid the company for their ownership interest, plus any earnings (or less any losses), and minus any distributions to owners.

We generally use the terms “liability” and “debt” as synonymous terms, though “liability” is actually a broader term, encompassing not only the explicit contracts that a company has, in terms of short-term and long-term debt obligations, but also includes obligations that are not specified in a contract, such as environmental obligations or asset retirement obligations.

\[l \equiv \frac{A}{E}\] is called the leverage effect

Variation of the accounting equation provides the P&L equation:

\[\begin{align*} \frac{\Delta E}{E} & =l\frac{\Delta A}{A}+\left(1-l\right)\frac{\Delta B}{B}\\ ROE & =l\times ROA+\left(1-l\right)\times Financing\;Costs \end{align*}\]2.3 Those who need money

2.3.2 Debt needs of corporates, governments and households

This is a list of countries by external debt, it is the total public and private debt owed to nonresidents repayable in internationally accepted currencies, goods or services, where the public debt is the money or credit owed by any level of government, from central to local, and the private debt the money or credit owed by private households or private corporations based on the country under consideration.

2.4 Those who save money

2.4.1 Asset manager / Investment manager

Investment management is the professional asset management of various securities, including shareholdings, bonds, and other assets, such as real estate, to meet specified investment goals for the benefit of investors. Investors may be institutions, such as insurance companies, pension funds, corporations, charities, educational establishments, or private investors, either directly via investment contracts or, more commonly, via collective investment schemes like mutual funds, exchange-traded funds, or REITs.

The term asset management is often used to refer to the management of investment funds, while the more generic term fund management may refer to all forms of institutional investment, as well as investment management for private investors. Investment managers who specialize in advisory or discretionary management on behalf of (normally wealthy) private investors may often refer to their services as money management or portfolio management within the context of “private banking”. Wealth management by financial advisors takes a more holistic view of a client, with allocations to particular asset management strategies.

2.4.2 Insurance Companies

An entity which provides insurance is known as an insurer, an insurance company, an insurance carrier or an underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. Policyholder and insured are often used as but are not necessarily synonyms, as coverage can sometimes extend to additional insureds who did not buy the insurance. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer’s promise to compensate the insured in the event of a covered loss.

2.4.2.1 Examples of insurance types

Business insurance can take a number of different forms, such as the various kinds of professional liability insurance, also called professional indemnity (PI), which are discussed below under that name; and the business owner’s policy (BOP), which packages into one policy many of the kinds of coverage that a business owner needs.

Vehicle insurance protects the policyholder against financial loss in the event of an incident involving a vehicle they own, such as in a traffic collision.

Health insurance policies cover the cost of medical treatments. Dental insurance, like medical insurance, protects policyholders for dental costs. In most developed countries, all citizens receive some health coverage from their governments, paid through taxation. In most countries, health insurance is often part of an employer’s benefits.

Income protection insurance provide financial support in the event of the policyholder becoming unable to work because of disabling illness or injury. It provides monthly support to help pay such obligations as mortgage loans and credit cards. Short-term and long-term disability policies are available to individuals. Short-term disability insurance covers a person for a period typically up to six months, paying a stipend each month to cover medical bills and other necessities. Long-term disability insurance covers an individual’s expenses for the long term.

Casualty insurance: a broad spectrum of insurance that a number of other types of insurance could be classified, such as auto, workers compensation, and some liability insurances.

Life insurance provides a monetary benefit to a decedent’s family or other designated beneficiary, and may specifically provide for income to an insured person’s family, burial, funeral and other final expenses. Life insurance policies often allow the option of having the proceeds paid to the beneficiary either in a lump sum cash payment or an annuity. Annuities provide a stream of payments and are generally classified as insurance because they are issued by insurance companies, are regulated as insurance, and require the same kinds of actuarial and investment management expertise that life insurance requires. In many countries, the tax law provides that the interest on this cash value is not taxable under certain circumstances. This leads to widespread use of life insurance as a tax-efficient method of saving as well as protection in the event of early death.

Property insurance provides protection against risks to property, such as fire, theft or weather damage. This may include specialized forms of insurance such as fire insurance, flood insurance, earthquake insurance, home insurance, inland marine insurance or boiler insurance.

Credit insurance repays some or all of a loan when the borrower is insolvent. Mortgage insurance is a form of credit insurance, although the name “credit insurance” more often is used to refer to policies that cover other kinds of debt. Many credit cards offer payment protection plans which are a form of credit insurance.

Reinsurance is an insurance purchased by an insurance company to insulate itself (at least in part) from the risk of a major claims event. With reinsurance, the company passes on (“cedes”) some part of its own insurance liabilities to the other insurance company.

2.4.3 Pension funds

A pension fund, also known as a superannuation fund in some countries, is any plan, fund, or scheme which provides retirement income.

Pension funds typically have large amounts of money to invest and are the major investors in listed and private companies. They are especially important to the stock market where large institutional investors dominate. The largest 300 pension funds collectively hold about $6 trillion in assets

2.4.4 Endowment and foundations

A financial endowment is a legal structure for managing, and in many cases indefinitely perpetuating, a pool of financial, real estate, or other investments for a specific purpose according to the will of its founders and donors.

Endowments are often governed and managed either as a nonprofit corporation, a charitable foundation, or a private foundation that, while serving a good cause, might not qualify as a public charity. In some jurisdictions, it is common for endowed funds to be established as a trust independent of the organizations and the causes the endowment is meant to serve. Institutions that commonly manage endowments include academic institutions, cultural institutions, service organizations as well as religious organizations.

Private endowments are some of the wealthiest entities in the world, notably private higher education endowments.

2.4.5 Sovereign funds

A sovereign wealth fund (SWF), sovereign investment fund, or social wealth fund is a state-owned investment fund that invests in real and financial assets such as stocks, bonds, real estate, precious metals, or in alternative investments such as private equity fund or hedge funds. Sovereign wealth funds invest globally. Most SWFs are funded by revenues from commodity exports or from foreign-exchange reserves held by the central bank.

:::