18 Metric Predicted Variable with Multiple Metric Predictors

We will consider models in which the predicted variable is an additive combination of predictors, all of which have proportional influence on the prediction. This kind of model is called multiple linear regression. We will also consider nonadditive combinations of predictors, which are called interactions. (p. 509, emphasis in the original)

18.1 Multiple linear regression

If \(y \sim \operatorname{Normal} (\mu, \sigma)\) and \(\mu = \beta_0 + \beta_1 x_1 + \beta_2 x_2\), then it’s also the case that we can rewrite the formula for \(y\) as

\[y \sim \operatorname{Normal} (\beta_0 + \beta_1 x_1 + \beta_2 x_2, \sigma).\]

As Kruschke pointed out, the basic model “assumes homogeneity of variance, which means that at all values of \(x_1\) and \(x_2\), the variance \(\sigma^2\) of \(y\) is the same” (p. 510).

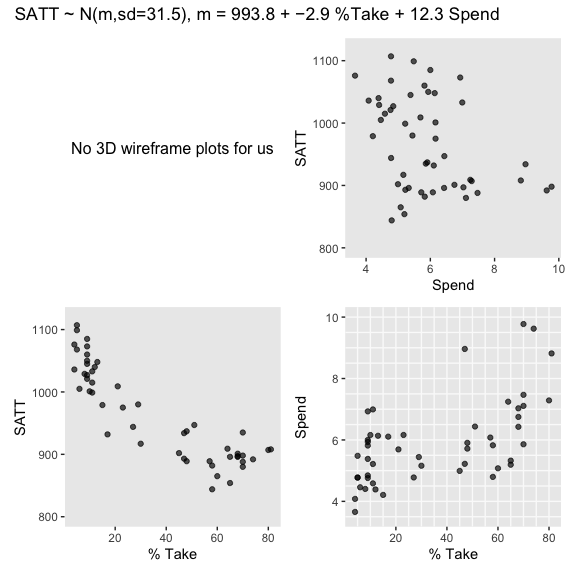

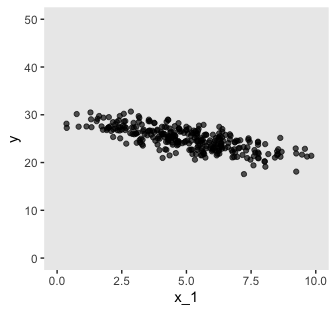

If we presume the data for the two \(x\) variables are uniformly distributed within 0 and 10, we can make the data for Figure 18.1 like this.

library(tidyverse)

n <- 300

set.seed(18)

d <-

tibble(x_1 = runif(n = n, 0, 10),

x_2 = runif(n = n, 0, 10)) %>%

mutate(y = rnorm(n = n, mean = 10 + x_1 + 2 * x_2))

head(d) ## # A tibble: 6 x 3

## x_1 x_2 y

## <dbl> <dbl> <dbl>

## 1 8.23 8.62 36.9

## 2 7.10 1.33 20.3

## 3 9.66 1.08 19.5

## 4 0.786 7.09 25.1

## 5 0.536 6.67 25.6

## 6 5.75 4.72 25.7Here are three of the scatter plots in Figure 18.1.

theme_set(theme_grey() +

theme(panel.grid = element_blank()))

d %>%

ggplot(aes(x = x_1, y = y)) +

geom_point(alpha = 2/3) +

coord_cartesian(ylim = 0:50)

d %>%

ggplot(aes(x = x_1, y = x_2)) +

geom_vline(xintercept = seq(from = 0, to = 10, by = .5), color = "grey98") +

geom_hline(yintercept = seq(from = 0, to = 10, by = .5), color = "grey98") +

geom_point(alpha = 2/3)

As in previous chapters, I’m not aware that ggplot2 allows for three-dimensional wireframe plots of the kind in the upper left panel. If you’d like to make one in base R, have at it. But with respect to the plots in the off-diagonal, I have no idea what Kruschke did with the compressed and diagonal grids. If you have that figured out, please share your code.

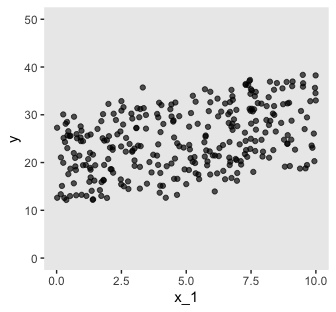

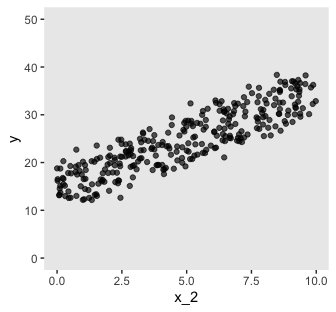

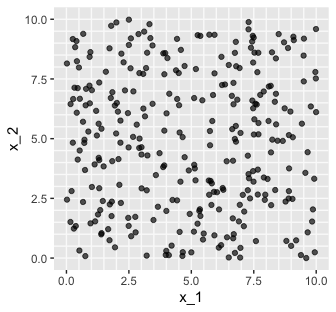

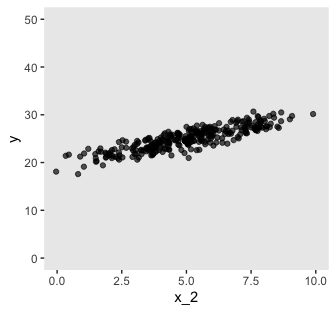

For Figure 18.2, the \(x\) variables look to be multivariate normal with a correlation of about -.95. We can simulate such data with help from the MASS package.

Sven Hohenstein’s answer to this stats.stackexchange.com question provides the steps for simulating the data. First, we’ll need to specify the desired means and standard deviations for our variables. Then we’ll make a correlation matrix with 1s on the diagonal and the desired correlation coefficient, \(\rho\) on the off-diagonal. Since the correlation matrix is symmetric, both off-diagonal positions are the same. Then we convert the correlation matrix to a covariance matrix.

## [,1] [,2]

## [1,] 1.00 -0.95

## [2,] -0.95 1.00## [,1] [,2]

## [1,] 4.0 -3.8

## [2,] -3.8 4.0Now we’ve defined our means, standard deviations, and covariance matrix, we’re ready to simulate the data with the MASS::mvrnorm() function.

# how many data points would you like to simulate?

n <- 300

set.seed(18.2)

d <-

MASS::mvrnorm(n = n,

mu = mus,

Sigma = covs,

empirical = T) %>%

as_tibble() %>%

set_names("x_1", "x_2") %>%

mutate(y = rnorm(n = n, mean = 10 + x_1 + 2 * x_2))Now we have our simulated data in hand, we’re ready for three of the four panels of Figure 18.2.

d %>%

ggplot(aes(x = x_1, y = y)) +

geom_point(alpha = 2/3) +

coord_cartesian(xlim = 0:10,

ylim = 0:50)

d %>%

ggplot(aes(x = x_2, y = y)) +

geom_point(alpha = 2/3) +

coord_cartesian(xlim = 0:10,

ylim = 0:50)

d %>%

ggplot(aes(x = x_1, y = x_2)) +

geom_vline(xintercept = seq(from = 0, to = 10, by = .5), color = "grey98") +

geom_hline(yintercept = seq(from = 0, to = 10, by = .5), color = "grey98") +

geom_point(alpha = 2/3) +

coord_cartesian(xlim = 0:10,

ylim = 0:10)

Pretty close.

18.1.2 The model and implementation.

We’ll make a custom function to standardize the criterion and predictor values.

standardize <- function(x) {

(x - mean(x)) / sd(x)

}

my_data <-

my_data %>%

mutate(prcnt_take_z = standardize(PrcntTake),

spend_z = standardize(Spend),

satt_z = standardize(SATT))Let’s open brms.

Now we’re ready to fit the model. As Kruschke pointed out, the priors on the standardized predictors are set with

an arbitrary standard deviation of 2.0. This value was chosen because standardized regression coefficients are algebraically constrained to fall between −1 and +1 in least-squares regression, [1] and therefore, the regression coefficients will not exceed those limits by much. A normal distribution with standard deviation of 2.0 is reasonably flat over the range from −1 to +1. (p. 516)

With data like this, even a prior(normal(0, 1), class = b) would be only mildly regularizing.

This is a good place to emphasize how priors in brms are given classes. If you’d like all parameters within a given class to have the prior, you can just specify one prior argument within that class. For our fit1, both parameters of class = b have a normal(0, 2) prior. So we can just include one statement to handle both. Had we wanted different priors for the coefficients for spend_z and prcnt_take_z, we’d need to include two prior() arguments with at least one including a coef argument.

fit1 <-

brm(data = my_data,

family = student,

satt_z ~ 1 + spend_z + prcnt_take_z,

prior = c(prior(normal(0, 2), class = Intercept),

prior(normal(0, 2), class = b),

prior(normal(0, 1), class = sigma),

prior(exponential(one_over_twentynine), class = nu)),

chains = 4, cores = 4,

stanvars = stanvar(1/29, name = "one_over_twentynine"),

seed = 18)Check the model summary.

## Family: student

## Links: mu = identity; sigma = identity; nu = identity

## Formula: satt_z ~ 1 + spend_z + prcnt_take_z

## Data: my_data (Number of observations: 50)

## Samples: 4 chains, each with iter = 2000; warmup = 1000; thin = 1;

## total post-warmup samples = 4000

##

## Population-Level Effects:

## Estimate Est.Error l-95% CI u-95% CI Rhat Bulk_ESS Tail_ESS

## Intercept 0.00 0.06 -0.12 0.13 1.00 4222 2585

## spend_z 0.23 0.08 0.08 0.38 1.00 3599 2990

## prcnt_take_z -1.03 0.08 -1.18 -0.87 1.00 3490 3160

##

## Family Specific Parameters:

## Estimate Est.Error l-95% CI u-95% CI Rhat Bulk_ESS Tail_ESS

## sigma 0.42 0.05 0.32 0.53 1.00 3523 2413

## nu 33.07 27.90 4.27 107.31 1.00 3398 2360

##

## Samples were drawn using sampling(NUTS). For each parameter, Eff.Sample

## is a crude measure of effective sample size, and Rhat is the potential

## scale reduction factor on split chains (at convergence, Rhat = 1).So when we use a multivariable model, increases in spending now appear associated with increases in SAT scores.

18.1.3 The posterior distribution.

Based on Equation 18.1, we can convert the standardized coefficients from our multivariable model back to their original metric as follows:

\[\begin{align*} \beta_0 & = \operatorname{SD}_y \zeta_0 + M_y - \operatorname{SD}_y \sum_j \frac{\zeta_j M_{x_j}}{\operatorname{SD}_{x_j}} \;\;\; \text{and} \\ \beta_j & = \frac{\operatorname{SD}_y \zeta_j}{\operatorname{SD}_{x_j}}. \end{align*}\]

To use them, we’ll first extract the posterior samples.

## b_Intercept b_spend_z b_prcnt_take_z sigma nu lp__

## 1 0.03332938 0.2246157 -1.044109 0.4381914 58.891563 -35.40259

## 2 -0.05051637 0.2270969 -1.076683 0.3759888 13.331876 -35.92027

## 3 -0.04916057 0.2770627 -1.092591 0.3992656 18.839407 -35.58017

## 4 0.01043252 0.3638677 -1.141387 0.4167015 5.558774 -37.95336

## 5 0.02980380 0.3671874 -1.262402 0.4401791 29.336185 -39.44394

## 6 0.00317025 0.3080994 -1.259354 0.4584194 46.137031 -39.81174Like we did in Chapter 17, let’s wrap the consequences of Equation 18.1 into two functions.

make_beta_0 <- function(zeta_0, zeta_1, zeta_2, sd_x_1, sd_x_2, sd_y, m_x_1, m_x_2, m_y) {

sd_y * zeta_0 + m_y - sd_y * ((zeta_1 * m_x_1 / sd_x_1) + (zeta_2 * m_x_2 / sd_x_2))

}

make_beta_j <- function(zeta_j, sd_j, sd_y) {

sd_y * zeta_j / sd_j

}After saving a few values, we’re ready to use our custom functions.

sd_x_1 <- sd(my_data$Spend)

sd_x_2 <- sd(my_data$PrcntTake)

sd_y <- sd(my_data$SATT)

m_x_1 <- mean(my_data$Spend)

m_x_2 <- mean(my_data$PrcntTake)

m_y <- mean(my_data$SATT)

post <-

post %>%

mutate(b_0 = make_beta_0(zeta_0 = b_Intercept,

zeta_1 = b_spend_z,

zeta_2 = b_prcnt_take_z,

sd_x_1 = sd_x_1,

sd_x_2 = sd_x_2,

sd_y = sd_y,

m_x_1 = m_x_1,

m_x_2 = m_x_2,

m_y = m_y),

b_1 = make_beta_j(zeta_j = b_spend_z,

sd_j = sd_x_1,

sd_y = sd_y),

b_2 = make_beta_j(zeta_j = b_prcnt_take_z,

sd_j = sd_x_2,

sd_y = sd_y))

glimpse(post)## Observations: 4,000

## Variables: 9

## $ b_Intercept <dbl> 0.033329378, -0.050516372, -0.049160566, 0.010432…

## $ b_spend_z <dbl> 0.22461570, 0.22709693, 0.27706273, 0.36386773, 0…

## $ b_prcnt_take_z <dbl> -1.0441089, -1.0766835, -1.0925912, -1.1413875, -…

## $ sigma <dbl> 0.4381914, 0.3759888, 0.3992656, 0.4167015, 0.440…

## $ nu <dbl> 58.891563, 13.331876, 18.839407, 5.558774, 29.336…

## $ lp__ <dbl> -35.40259, -35.92027, -35.58017, -37.95336, -39.4…

## $ b_0 <dbl> 998.4585, 994.5899, 980.0592, 961.1825, 973.4781,…

## $ b_1 <dbl> 12.331810, 12.468035, 15.211248, 19.977000, 20.15…

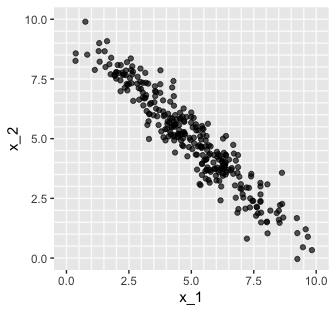

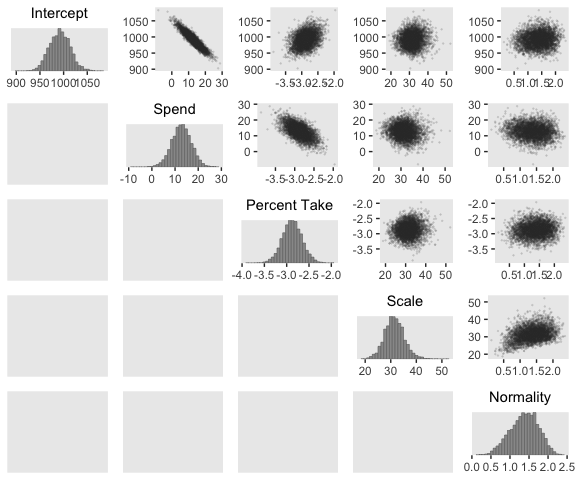

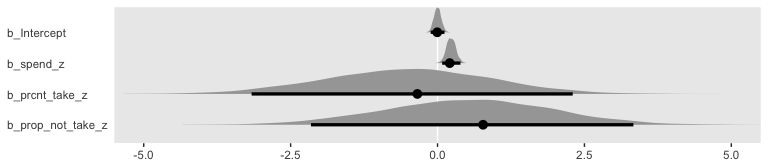

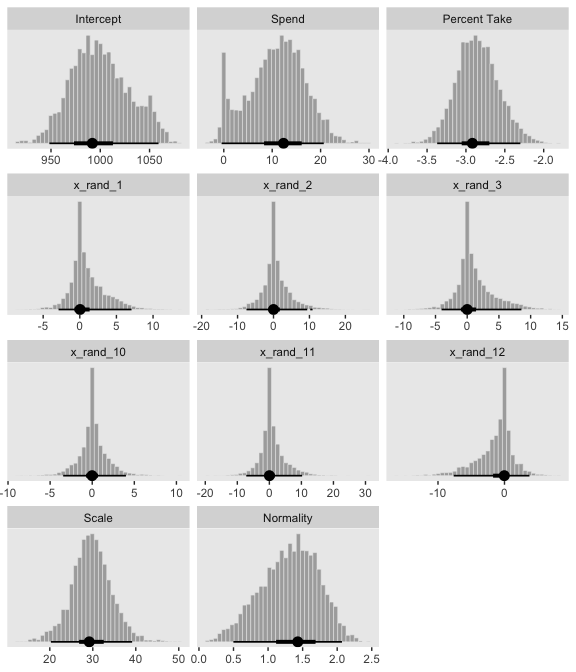

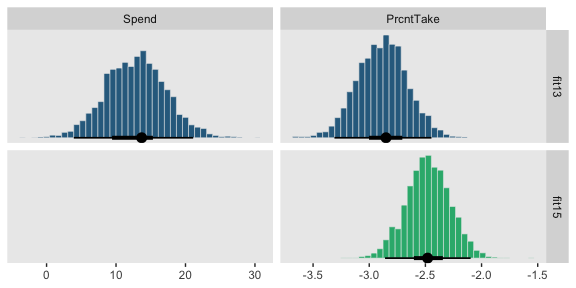

## $ b_2 <dbl> -2.919049, -3.010119, -3.054593, -3.191014, -3.52…Here’s the top panel of Figure 18.5.

library(tidybayes)

# here are the primary data

post %>%

transmute(Intercept = b_0,

Spend = b_1,

`Percent Take` = b_2,

Scale = sigma * sd_y,

Normality = nu %>% log10()) %>%

gather() %>%

# the plot

ggplot(aes(x = value)) +

geom_histogram(color = "grey92", fill = "grey67",

size = .2, bins = 40) +

stat_pointintervalh(aes(y = 0),

point_interval = mode_hdi, .width = c(.95, .5)) +

scale_y_continuous(NULL, breaks = NULL) +

xlab(NULL) +

facet_wrap(~key, scales = "free", ncol = 3)

The slope on spending has a mode of about 13, which suggests that SAT scores rise by about 13 points for every extra $1000 spent per pupil. The slope on percentage taking the exam (PrcntTake) is also credibly non-zero, with a mode around −2.8, which suggests that SAT scores fall by about 2.8 points for every additional 1% of students who take the test. (p. 517)

If you want those exact modes and, say, 50% intervals around them, you can just use tidybayes::mode_hdi().

post %>%

transmute(Spend = b_1,

`Percent Take` = b_2) %>%

gather() %>%

group_by(key) %>%

mode_hdi(value, .width = .5)## # A tibble: 2 x 7

## key value .lower .upper .width .point .interval

## <chr> <dbl> <dbl> <dbl> <dbl> <chr> <chr>

## 1 Percent Take -2.86 -3.04 -2.74 0.5 mode hdi

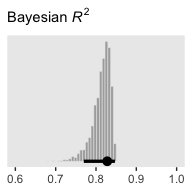

## 2 Spend 12.9 10.3 15.9 0.5 mode hdiThe brms::bayes_R2() function makes it easy to compute a Bayesian \(R^2\). Simply feed a brm() fit object into bayes_R2() and you’ll get back the posterior mean, \(SD\), and 95% intervals.

## Estimate Est.Error Q2.5 Q97.5

## R2 0.8139321 0.02239821 0.7572305 0.8429055I’m not going to go into the technical details here, but you should be aware that the Bayeisan \(R^2\) returned from the bayes_R2() function is not calculated the same as it is with OLS. If you want to dive in, check out the paper by Gelman, Goodrich, Gabry, and Vehtari. Anyway, if you’d like to view the Bayesian \(R^2\) distribution rather than just get the summaries, specify summary = F, convert the output to a tibble, and plot as usual.

bayes_R2(fit1, summary = F) %>%

as_tibble() %>%

ggplot(aes(x = R2)) +

geom_histogram(color = "grey92", fill = "grey67",

size = .2, bins = 25) +

stat_pointintervalh(aes(y = 0),

point_interval = mode_hdi, .width = .95) +

scale_y_continuous(NULL, breaks = NULL) +

labs(subtitle = expression(paste("Bayesian ", italic(R)^2)),

x = NULL) +

coord_cartesian(xlim = c(.6, 1))

Since the brms::bayes_R2() function is not identical with Kruschke’s method in the text, the results might differ a bit.

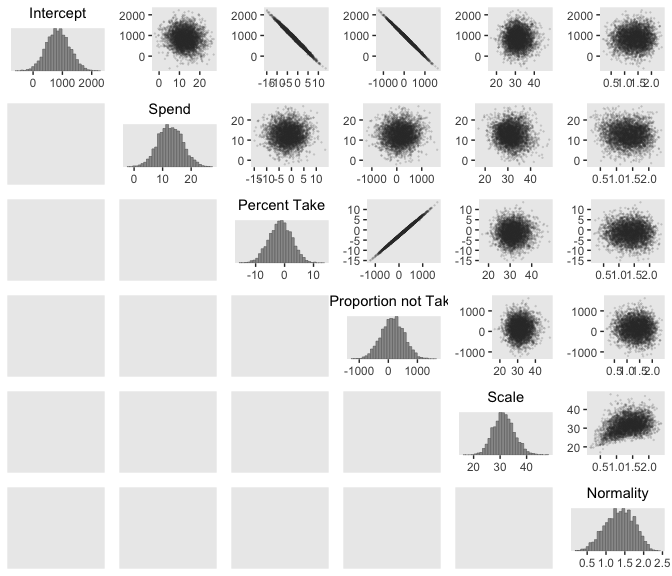

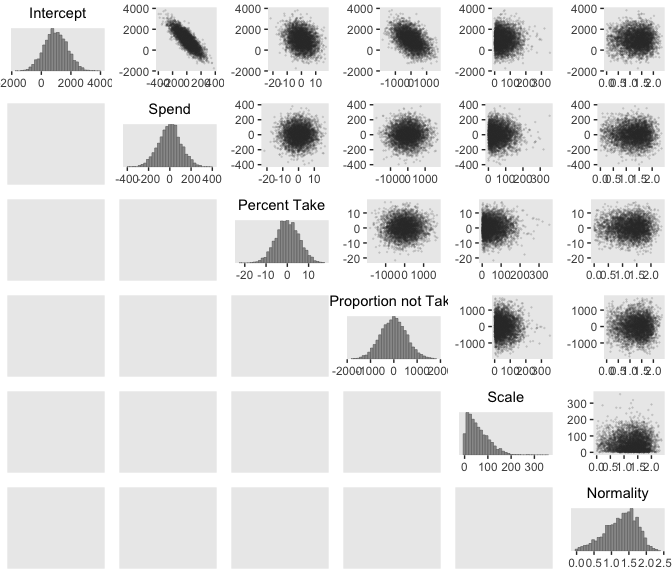

We can get a sense of the scatter plots with bayesplot::mcmc_pairs().

library(bayesplot)

color_scheme_set("gray")

post %>%

transmute(Intercept = b_0,

Spend = b_1,

`Percent Take` = b_2,

Scale = sigma * sd_y,

Normality = nu %>% log10()) %>%

mcmc_pairs(off_diag_args = list(size = 1/8, alpha = 1/8))

One way to get the Pearson’s correlation coefficients among the parameters is with psych::lowerCor().

post %>%

transmute(Intercept = b_0,

Spend = b_1,

`Percent Take` = b_2,

Scale = sigma * sd_y,

Normality = nu %>% log10()) %>%

psych::lowerCor(digits = 3)## Intrcp Spend PrcntT Scale Nrmlty

## Intercept 1.000

## Spend -0.934 1.000

## Percent Take 0.349 -0.613 1.000

## Scale 0.076 -0.083 0.080 1.000

## Normality 0.099 -0.108 0.089 0.342 1.000Kruschke finished the subsection with the observation: “Sometimes we are interested in using the linear model to predict \(y\) values for \(x\) values of interest. It is straight forward to generate a large sample of credible \(y\) values for specified \(x\) values” (p. 519).

Like we practiced with in the last chapter, the simplest way to do so in brms is with the fitted() function. For a quick example, say we wanted to know what the model would predict if we were to have a standard-score increase in spending and a simultaneous standard-score decrease in the percent taking the exam. We’d just specify those values in a tibble and feed that tibble into fitted() along with the model.

## Estimate Est.Error Q2.5 Q97.5

## [1,] 1.262009 0.1547968 0.9596958 1.56814718.1.4 Redundant predictors.

As a simplified example of correlated predictors, think of just two data points: Suppose \(y = 1 \text{ for } \langle x_1, x_2 \rangle = \langle 1, 1 \rangle \text{ and } y = 2 \text{ for } \langle x_1, x_2 \rangle = \langle 2, 2 \rangle\). The linear model, \(y = \beta_1 x_1 + \beta_2 x_2\) is supposed to satisfy both data points, and in this case both are satisfied by \(1 = \beta_1 + \beta_2\). Therefore, many different combinations of \(\beta_1\) and \(\beta_2\) satisfy the data. For example, it could be that \(\beta_1 = 2\) and \(\beta_2 = -1\), or \(\beta_1 = 0.5\) and \(\beta_2 = 0.5\), or \(\beta_1 = 0\) and \(\beta_2 = 1\). In other words, the credible values of \(\beta_1\) and \(\beta_2\) are anticorrelated and trade-off to fit the data. (p. 519)

Here are what those data look like. You would not want to fit a regression model with these data.

## # A tibble: 2 x 3

## x_1 x_2 y

## <int> <int> <int>

## 1 1 1 1

## 2 2 2 2We can take percentages and turn them into their inverse re-expressed as a proportion.

## [1] 0.63Let’s make a redundant predictor and then standardize() it.

my_data <-

my_data %>%

mutate(prop_not_take = (100 - PrcntTake) / 100) %>%

mutate(prop_not_take_z = standardize(prop_not_take))

glimpse(my_data)## Observations: 50

## Variables: 13

## $ State <chr> "Alabama", "Alaska", "Arizona", "Arkansas", "Cal…

## $ Spend <dbl> 4.405, 8.963, 4.778, 4.459, 4.992, 5.443, 8.817,…

## $ StuTeaRat <dbl> 17.2, 17.6, 19.3, 17.1, 24.0, 18.4, 14.4, 16.6, …

## $ Salary <dbl> 31.144, 47.951, 32.175, 28.934, 41.078, 34.571, …

## $ PrcntTake <dbl> 8, 47, 27, 6, 45, 29, 81, 68, 48, 65, 57, 15, 13…

## $ SATV <dbl> 491, 445, 448, 482, 417, 462, 431, 429, 420, 406…

## $ SATM <dbl> 538, 489, 496, 523, 485, 518, 477, 468, 469, 448…

## $ SATT <dbl> 1029, 934, 944, 1005, 902, 980, 908, 897, 889, 8…

## $ prcnt_take_z <dbl> -1.0178453, 0.4394222, -0.3078945, -1.0925770, 0…

## $ spend_z <dbl> -1.10086058, 2.24370805, -0.82716069, -1.0612364…

## $ satt_z <dbl> 0.8430838, -0.4266207, -0.2929676, 0.5223163, -0…

## $ prop_not_take <dbl> 0.92, 0.53, 0.73, 0.94, 0.55, 0.71, 0.19, 0.32, …

## $ prop_not_take_z <dbl> 1.0178453, -0.4394222, 0.3078945, 1.0925770, -0.…We’re ready to fit the redundant-predictor model.

fit2 <-

brm(data = my_data,

family = student,

satt_z ~ 0 + Intercept + spend_z + prcnt_take_z + prop_not_take_z,

prior = c(prior(normal(0, 2), class = b, coef = "Intercept"),

prior(normal(0, 2), class = b, coef = "spend_z"),

prior(normal(0, 2), class = b, coef = "prcnt_take_z"),

prior(normal(0, 2), class = b, coef = "prop_not_take_z"),

prior(normal(0, 1), class = sigma),

prior(exponential(one_over_twentynine), class = nu)),

chains = 4, cores = 4,

stanvars = stanvar(1/29, name = "one_over_twentynine"),

seed = 18,

# this will let us use `prior_samples()` later on

sample_prior = "yes")You might notice a few things about the brm() code. First, we have used the ~ 0 + Intercept + ... syntax instead of the default syntax for intercepts. In normal situations, we would have been in good shape using the typical ~ 1 + ... syntax for the intercept, especially given our use of standardized data. However, since brms version 2.5.0, using the sample_prior argument to draw samples from the prior distribution will no longer allow us to return samples from the typical brms intercept. Bürkner addressed the issue on the Stan forums. As he pointed out, if you want to get prior samples from an intercept, you’ll have to use the alternative syntax. The other thing to point out is that even though we used the same prior on all the predictors, including the intercept, we still explicitly spelled each out with the coef argument. If we hadn’t been explicit like this, we would only get a single b vector from the prior_samples() function. But since we want separate vectors for each of our predictors, we used the verbose code. If you’re having a difficult time understanding these two points, experiment. Fit the model in a few different ways with either the typical or the alternative intercept syntax and with either the verbose prior code or the simplified prior(normal(0, 2), class = b) code. And after each, execute prior_samples(fit2). You’ll see.

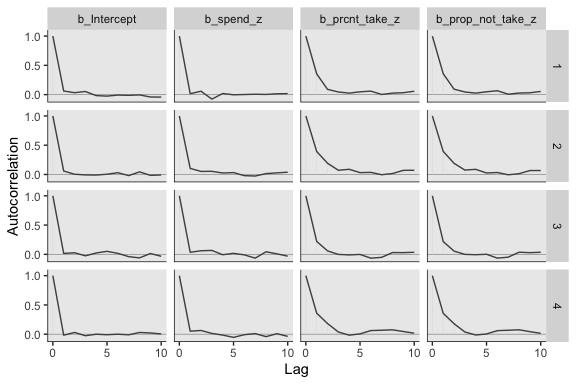

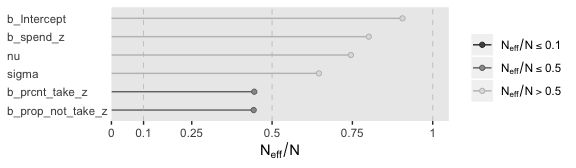

Let’s move on. Kruschke mentioned high autocorrelations in the prose. Here are the autocorrelation plots for our \(\beta\)s.

post <- posterior_samples(fit2, add_chain = T)

mcmc_acf(post,

pars = c("b_Intercept", "b_spend_z", "b_prcnt_take_z", "b_prop_not_take_z"),

lags = 10)

Looks like HMC made a big difference. The \(N_{eff}/N\) ratios weren’t terrible, either.

The brms::vcov() function returns a variance/covariance matrix–or a correlation matrix when you set correlation = T–of the population-level parameters (i.e., the fixed effects). It returns the values to a decadent level of precision, so we’ll simplify the output with round().

## Intercept spend_z prcnt_take_z prop_not_take_z

## Intercept 1.000 0.026 0.028 0.029

## spend_z 0.026 1.000 0.013 0.048

## prcnt_take_z 0.028 0.013 1.000 0.998

## prop_not_take_z 0.029 0.048 0.998 1.000Notice how much lower our Spend_z correlations are than those Kruschke displayed on page 520 of the text. However, it turns out the correlations among the redundant predictors were still very high.

If any of the nondiagonal correlations are high (i.e., close to +1 or close to −1), be careful when interpreting the posterior distribution. Here, we can see that the correlation of PrcntTake and PropNotTake is −1.0, which is an immediate sign of redundant predictors. (p. 520)

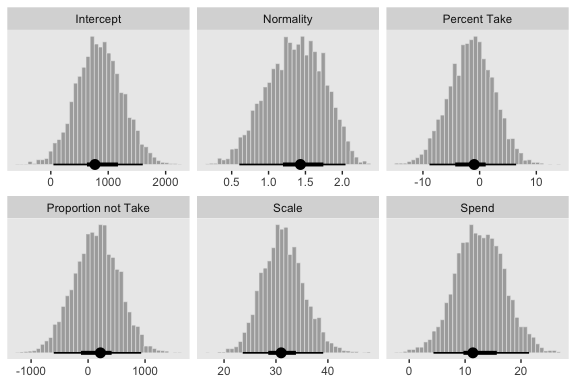

You can really get a sense of the silliness of the parameters if you plot them. We’ll use geom_halfeyeh() to get a sense of densities and summaries of the \(\beta\)s.

post %>%

select(b_Intercept:b_prop_not_take_z) %>%

gather() %>%

# this line isn't necessary, but it does allow us to arrange the parameters on the y-axis

mutate(key = factor(key, levels = c("b_prop_not_take_z", "b_prcnt_take_z", "b_spend_z", "b_Intercept"))) %>%

ggplot(aes(x = value, y = key)) +

geom_vline(xintercept = 0, color = "white") +

geom_halfeyeh(point_interval = mode_hdi,

.width = .95,

# the next two lines are purely aesthetic

scale = "width",

relative_scale = .9) +

labs(x = NULL,

y = NULL) +

coord_cartesian(xlim = -5:5) +

theme(axis.text.y = element_text(hjust = 0),

axis.ticks.y = element_blank())

Yeah, on the standardized scale those are some ridiculous estimates. Let’s update our make_beta_0() function.

make_beta_0 <- function(zeta_0, zeta_1, zeta_2, zeta_3, sd_x_1, sd_x_2, sd_x_3, sd_y, m_x_1, m_x_2, m_x_3, m_y) {

sd_y * zeta_0 + m_y - sd_y * ((zeta_1 * m_x_1 / sd_x_1) + (zeta_2 * m_x_2 / sd_x_2) + (zeta_3 * m_x_3 / sd_x_3))

}sd_x_1 <- sd(my_data$Spend)

sd_x_2 <- sd(my_data$PrcntTake)

sd_x_3 <- sd(my_data$prop_not_take)

sd_y <- sd(my_data$SATT)

m_x_1 <- mean(my_data$Spend)

m_x_2 <- mean(my_data$PrcntTake)

m_x_3 <- mean(my_data$prop_not_take)

m_y <- mean(my_data$SATT)

post <-

post %>%

transmute(Intercept = make_beta_0(zeta_0 = b_Intercept,

zeta_1 = b_spend_z,

zeta_2 = b_prcnt_take_z,

zeta_3 = b_prop_not_take_z,

sd_x_1 = sd_x_1,

sd_x_2 = sd_x_2,

sd_x_3 = sd_x_3,

sd_y = sd_y,

m_x_1 = m_x_1,

m_x_2 = m_x_2,

m_x_3 = m_x_3,

m_y = m_y),

Spend = make_beta_j(zeta_j = b_spend_z,

sd_j = sd_x_1,

sd_y = sd_y),

`Percent Take` = make_beta_j(zeta_j = b_prcnt_take_z,

sd_j = sd_x_2,

sd_y = sd_y),

`Proportion not Take` = make_beta_j(zeta_j = b_prop_not_take_z,

sd_j = sd_x_3,

sd_y = sd_y),

Scale = sigma * sd_y,

Normality = nu %>% log10())

glimpse(post)## Observations: 4,000

## Variables: 6

## $ Intercept <dbl> 1061.1824, 280.0482, 873.1032, 551.0707, 6…

## $ Spend <dbl> 5.454006, 17.469214, 15.816227, 12.931905,…

## $ `Percent Take` <dbl> -3.1303938, 3.9409313, -1.8844443, 1.47699…

## $ `Proportion not Take` <dbl> -26.318716, 682.212440, 105.706334, 432.37…

## $ Scale <dbl> 30.16235, 32.49213, 26.98000, 36.66645, 28…

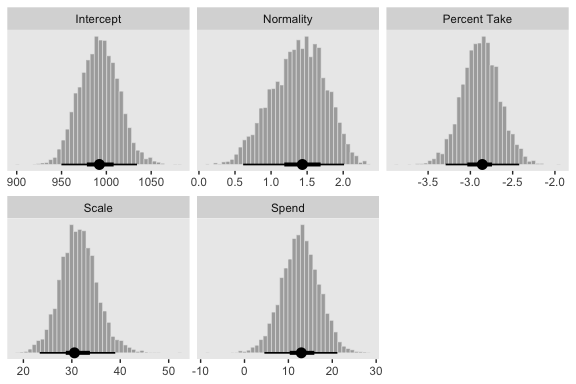

## $ Normality <dbl> 1.1409028, 1.3884920, 1.8217587, 1.0168820…Now we’ve done the conversions, here are the histograms of Figure 18.6.

post %>%

gather() %>%

ggplot() +

geom_histogram(aes(x = value),

color = "grey92", fill = "grey67",

size = .2, bins = 40) +

stat_pointintervalh(aes(x = value, y = 0),

point_interval = mode_hdi, .width = c(.95, .5)) +

scale_y_continuous(NULL, breaks = NULL) +

xlab(NULL) +

facet_wrap(~key, scales = "free", ncol = 3)

Their scatter plots are as follows:

Since brms::vcov() only computes the Pearson’s correlations among the untransformed population-level intercepts and slopes, it will be of limited use computing the correlations among all our parameters of interest. So here we’ll use psych::lowerCor() to compute the correlations among the full range of our parameters.

## Intrcp Spend PrcntT PrprnT Scale Nrmlty

## Intercept 1.000

## Spend -0.100 1.000

## Percent Take -0.996 0.013 1.000

## Proportion not Take -0.998 0.048 0.998 1.000

## Scale 0.002 -0.086 0.007 0.003 1.000

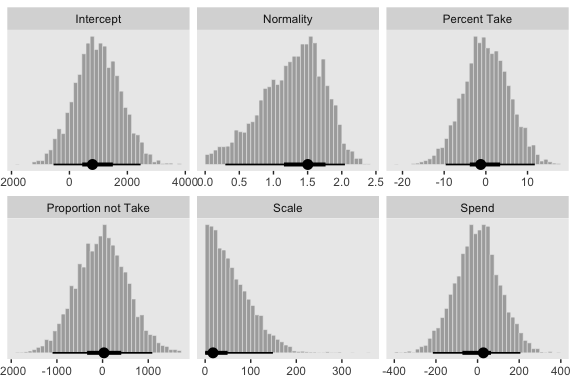

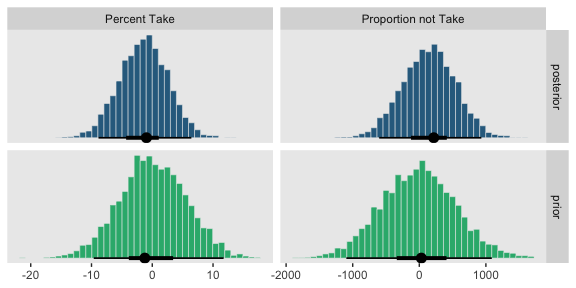

## Normality 0.033 -0.082 -0.024 -0.030 0.373 1.000Figure 18.7 is all about the prior predictive distribution. Here we’ll extract the priors with prior_samples() and wrangle all in one step.

prior <-

prior_samples(fit2) %>%

transmute(Intercept = make_beta_0(zeta_0 = b_Intercept,

zeta_1 = b_spend_z,

zeta_2 = b_prcnt_take_z,

zeta_3 = b_prop_not_take_z,

sd_x_1 = sd_x_1,

sd_x_2 = sd_x_2,

sd_x_3 = sd_x_3,

sd_y = sd_y,

m_x_1 = m_x_1,

m_x_2 = m_x_2,

m_x_3 = m_x_3,

m_y = m_y),

Spend = make_beta_j(zeta_j = b_spend_z,

sd_j = sd_x_1,

sd_y = sd_y),

`Percent Take` = make_beta_j(zeta_j = b_prcnt_take_z,

sd_j = sd_x_2,

sd_y = sd_y),

`Proportion not Take` = make_beta_j(zeta_j = b_prop_not_take_z,

sd_j = sd_x_3,

sd_y = sd_y),

Scale = sigma * sd_y,

Normality = nu %>% log10())

glimpse(prior)## Observations: 4,000

## Variables: 6

## $ Intercept <dbl> 1462.43927, 664.21947, 1289.22313, 1476.56…

## $ Spend <dbl> -38.749588, 13.362327, -49.410718, -93.439…

## $ `Percent Take` <dbl> 1.2899620, 6.4475454, 7.1217195, 1.7590988…

## $ `Proportion not Take` <dbl> -310.88980, 63.95417, -280.14134, 101.8131…

## $ Scale <dbl> 2.822765, 6.293331, 67.317724, 11.692913, …

## $ Normality <dbl> 1.5678380, 1.5254245, 1.2846292, 0.6427115…Now we’ve wrangled the priors, we’re ready to make the histograms at the top of Figure 18.7.

prior %>%

gather() %>%

ggplot(aes(x = value)) +

geom_histogram(color = "grey92", fill = "grey67",

size = .2, bins = 40, boundary = 0) +

stat_pointintervalh(aes(y = 0),

point_interval = mode_hdi, .width = c(.95, .5)) +

scale_y_continuous(NULL, breaks = NULL) +

xlab(NULL) +

facet_wrap(~key, scales = "free", ncol = 3)

Since we used the half-Gaussian prior for our \(\sigma\), our Scale histogram looks different from Kruschke’s. Otherwise, everything’s on the up and up. Here are the scatter plots at the bottom of Figure 18.7.

And finally, here are those Pearson’s correlation coefficients for the priors.

## Intrcp Spend PrcntT PrprnT Scale Nrmlty

## Intercept 1.000

## Spend -0.826 1.000

## Percent Take -0.256 0.003 1.000

## Proportion not Take -0.486 0.020 0.019 1.000

## Scale -0.007 0.005 0.024 -0.017 1.000

## Normality 0.007 -0.006 -0.006 -0.001 -0.001 1.000At the top of page 523, Kruschke asked us to “notice that the posterior distribution in Figure 18.6 has ranges for the redundant parameters that are only a little smaller than their priors.” With a little wrangling, we can compare the prior/posterior distributions for our redundant parameters more directly.

post %>%

gather(parameter, posterior) %>%

bind_cols(

prior %>%

gather() %>%

transmute(prior = value)

) %>%

gather(key, value, -parameter) %>%

filter(parameter %in% c("Percent Take", "Proportion not Take")) %>%

ggplot(aes(x = value, fill = key)) +

geom_histogram(color = "grey92",

size = .2, bins = 40, boundary = 0) +

stat_pointintervalh(aes(y = 0),

point_interval = mode_hdi, .width = c(.95, .5)) +

scale_fill_viridis_d(option = "D", begin = .35, end = .65) +

scale_y_continuous(NULL, breaks = NULL) +

xlab(NULL) +

theme(legend.position = "none") +

facet_grid(key~parameter, scales = "free")

Kruschke was right. The posterior distributions are only slightly narrower than the priors for those two. With our combination of data and model, we learned virtually nothing beyond the knowledge we encoded in those priors.

Kruschke mentioned SEM as a possible solution to multicollinearity. brms isn’t fully capable of SEM, at the moment, but its multivariate syntax does allow for path analysis and IRT models. However, you can currently fit a variety of Bayesian SEMs with the blavaan package. I’m not aware of any textbooks highlighting blavaan. If you’ve seen any, please share.

18.2 Multiplicative interaction of metric predictors

From page 526:

Formally, interactions can have many different specific functional forms. We will consider multiplicative interaction. This means that the nonadditive interaction is expressed by multiplying the predictors. The predicted value is a weighted combination of the individual predictors and, additionally, the multiplicative product of the predictors. For two metric predictors, regression with multiplicative interaction has these algebraically equivalent expressions:

\[\begin{align*} \mu & = \beta_0 + \beta_1 x_1 + \beta_2 x_2 + \beta_{1 \times 2} x_1 x_2 \\ & = \beta_0 + \underbrace{(\beta_1 + \beta_{1 \times 2} x_2)}_{\text{slope of } x_1} x_1 + \beta_2 x_2 \\ & = \beta_0 + \beta_1 x_1 + \underbrace{(\beta_2 + \beta_{1 \times 2} x_1)}_{\text{slope of } x_2} x_2. \end{align*}\]

Figure 18.8 is out of our ggplot2 repertoire.

18.2.1 An example.

With brms, you can specify an interaction with either the x_i*x_j syntax or the x_i:x_j syntax. I typically use x_i:x_j. It’s often the case that you can just make the interaction term right in the model formula. But since we’re fitting the model with standardized predictors and then using Kruschke’s equations to convert the parameters back to the unstandardized metric, it seems easier to make the interaction term in the data, first.

my_data <-

my_data %>%

mutate(interaction = Spend * PrcntTake) %>%

mutate(interaction_z = standardize(interaction))Now we’ll fit the model.

fit3 <-

brm(data = my_data,

family = student,

satt_z ~ 1 + spend_z + prcnt_take_z + interaction_z,

prior = c(prior(normal(0, 2), class = Intercept),

prior(normal(0, 2), class = b),

prior(normal(0, 1), class = sigma),

prior(exponential(one_over_twentynine), class = nu)),

chains = 4, cores = 4,

stanvars = stanvar(1/29, name = "one_over_twentynine"),

seed = 18)Note that even though an interaction term might seem different kind from other regression terms, it’s just another coefficient of class = b as far as the prior() statements are concerned. Anyway, let’s inspect the summary().

## Family: student

## Links: mu = identity; sigma = identity; nu = identity

## Formula: satt_z ~ 1 + spend_z + prcnt_take_z + interaction_z

## Data: my_data (Number of observations: 50)

## Samples: 4 chains, each with iter = 2000; warmup = 1000; thin = 1;

## total post-warmup samples = 4000

##

## Population-Level Effects:

## Estimate Est.Error l-95% CI u-95% CI Rhat Bulk_ESS Tail_ESS

## Intercept -0.00 0.06 -0.12 0.11 1.00 2779 2427

## spend_z 0.04 0.14 -0.24 0.32 1.00 1484 2038

## prcnt_take_z -1.48 0.29 -2.03 -0.90 1.00 1336 1985

## interaction_z 0.59 0.37 -0.12 1.30 1.00 1217 1696

##

## Family Specific Parameters:

## Estimate Est.Error l-95% CI u-95% CI Rhat Bulk_ESS Tail_ESS

## sigma 0.41 0.05 0.33 0.52 1.00 2837 2503

## nu 34.38 28.67 4.52 110.70 1.00 2685 2567

##

## Samples were drawn using sampling(NUTS). For each parameter, Eff.Sample

## is a crude measure of effective sample size, and Rhat is the potential

## scale reduction factor on split chains (at convergence, Rhat = 1).The correlations among our parameters are about as severe as those in the text.

## Intercept spend_z prcnt_take_z interaction_z

## Intercept 1.000 -0.009 0.003 -0.001

## spend_z -0.009 1.000 0.713 -0.835

## prcnt_take_z 0.003 0.713 1.000 -0.962

## interaction_z -0.001 -0.835 -0.962 1.000We can see that the interaction variable is strongly correlated with both predictors. Therefore, we know that there will be strong trade-offs among the regression coefficients, and the marginal distributions of single regression coefficients might be much wider than when there was no interaction included. (p. 528)

Let’s convert the posterior draws to the unstandardized metric.

sd_x_3 <- sd(my_data$interaction)

m_x_3 <- mean(my_data$interaction)

post <-

posterior_samples(fit3) %>%

transmute(Intercept = make_beta_0(zeta_0 = b_Intercept,

zeta_1 = b_spend_z,

zeta_2 = b_prcnt_take_z,

zeta_3 = b_interaction_z,

sd_x_1 = sd_x_1,

sd_x_2 = sd_x_2,

sd_x_3 = sd_x_3,

sd_y = sd_y,

m_x_1 = m_x_1,

m_x_2 = m_x_2,

m_x_3 = m_x_3,

m_y = m_y),

Spend = make_beta_j(zeta_j = b_spend_z,

sd_j = sd_x_1,

sd_y = sd_y),

`Percent Take` = make_beta_j(zeta_j = b_prcnt_take_z,

sd_j = sd_x_2,

sd_y = sd_y),

`Spend : Percent Take` = make_beta_j(zeta_j = b_interaction_z,

sd_j = sd_x_3,

sd_y = sd_y),

Scale = sigma * sd_y,

Normality = nu %>% log10())

glimpse(post)## Observations: 4,000

## Variables: 6

## $ Intercept <dbl> 1072.273, 1052.266, 1051.125, 1068.692, 1…

## $ Spend <dbl> -1.6619618, 4.1428271, 2.3548164, -1.6373…

## $ `Percent Take` <dbl> -4.815437, -4.600243, -4.150411, -4.25895…

## $ `Spend : Percent Take` <dbl> 0.31441969, 0.22608990, 0.21413414, 0.255…

## $ Scale <dbl> 28.15976, 32.34262, 29.09982, 29.94091, 2…

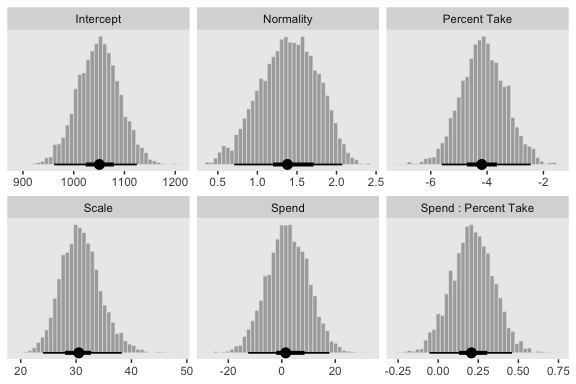

## $ Normality <dbl> 1.6180165, 1.1979350, 1.5089735, 1.569651…Now we’ve done the conversions, here are the histograms of Figure 18.9.

post %>%

gather() %>%

ggplot(aes(x = value)) +

geom_histogram(color = "grey92", fill = "grey67",

size = .2, bins = 40) +

stat_pointintervalh(aes(y = 0),

point_interval = mode_hdi, .width = c(.95, .5)) +

scale_y_continuous(NULL, breaks = NULL) +

xlab(NULL) +

facet_wrap(~key, scales = "free", ncol = 3)

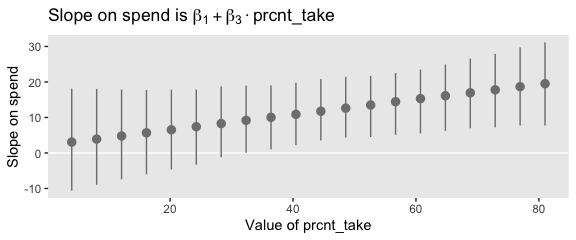

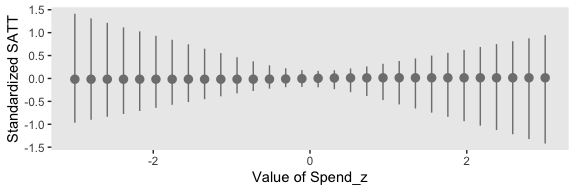

“To properly understand the credible slopes on the two predictors, we must consider the credible slopes on each predictor as a function of the value of the other predictor” (p. 528). This is our motivation for the middle panel of Figure 18.9. To make it, we’ll need to expand() our post, wrangle a bit, and plot with geom_pointrange().

# this will come in handy in `expand()`

bounds <- range(my_data$PrcntTake)

# wrangle

post %>%

expand(nesting(Spend, `Spend : Percent Take`),

PrcntTake = seq(from = bounds[1], to = bounds[2], length.out = 20)) %>%

mutate(slope = Spend + `Spend : Percent Take` * PrcntTake) %>%

group_by(PrcntTake) %>%

median_hdi(slope) %>%

# plot

ggplot(aes(x = PrcntTake, y = slope,

ymin = .lower, ymax = .upper)) +

geom_hline(yintercept = 0, color = "white") +

geom_pointrange(color = "grey50") +

labs(x = "Value of prcnt_take",

y = "Slope on spend",

title = expression(paste("Slope on spend is ", beta[1] + beta[3] %.% "prcnt_take")))

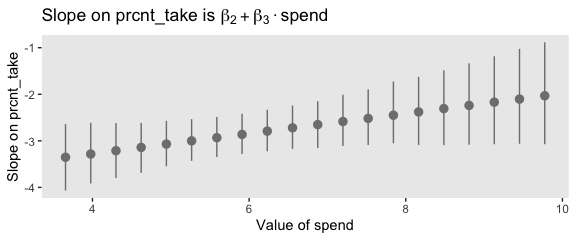

That worked like a charm. We’ll follow the same basic order of operations for the final panel.

# this will come in handy in `expand()`

bounds <- range(my_data$Spend)

# wrangle

post %>%

expand(nesting(`Percent Take`, `Spend : Percent Take`),

Spend = seq(from = bounds[1], to = bounds[2], length.out = 20)) %>%

mutate(slope = `Percent Take` + `Spend : Percent Take` * Spend) %>%

group_by(Spend) %>%

median_hdi(slope) %>%

# plot

ggplot(aes(x = Spend, y = slope,

ymin = .lower, ymax = .upper)) +

geom_pointrange(color = "grey50") +

labs(x = "Value of spend",

y = "Slope on prcnt_take",

title = expression(paste("Slope on prcnt_take is ", beta[2] + beta[3] %.% "spend")))

Kruschke outlined all this in the opening paragraphs of page 530. His parting words of this subsection warrant repeating: “if you include an interaction term, you cannot ignore it even if its marginal posterior distribution includes zero” (p. 530).

18.3 Shrinkage of regression coefficients

In some research, there are many candidate predictors which we suspect could possibly be informative about the predicted variable. For example, when predicting college GPA, we might include high-school GPA, high-school SAT score, income of student, income of parents, years of education of the parents, spending per pupil at the student’s high school, student IQ, student height, weight, shoe size, hours of sleep per night, distance from home to school, amount of caffeine consumed, hours spent studying, hours spent earning a wage, blood pressure, etc. We can include all the candidate predictors in the model, with a regression coefficient for every predictor. And this is not even considering interactions, which we will ignore for now.

With so many candidate predictors of noisy data, there may be some regression coefficients that are spuriously estimated to be non-zero. We would like some protection against accidentally nonzero regression coefficients. (p. 530)

That’s what this section is all about. We’ll make our random noise predictors with rnorm().

set.seed(18)

my_data <-

my_data %>%

mutate(x_rand_1 = rnorm(n = n(), 0, 1),

x_rand_2 = rnorm(n = n(), 0, 1),

x_rand_3 = rnorm(n = n(), 0, 1),

x_rand_4 = rnorm(n = n(), 0, 1),

x_rand_5 = rnorm(n = n(), 0, 1),

x_rand_6 = rnorm(n = n(), 0, 1),

x_rand_7 = rnorm(n = n(), 0, 1),

x_rand_8 = rnorm(n = n(), 0, 1),

x_rand_9 = rnorm(n = n(), 0, 1),

x_rand_10 = rnorm(n = n(), 0, 1),

x_rand_11 = rnorm(n = n(), 0, 1),

x_rand_12 = rnorm(n = n(), 0, 1))

glimpse(my_data)## Observations: 50

## Variables: 27

## $ State <chr> "Alabama", "Alaska", "Arizona", "Arkansas", "Cal…

## $ Spend <dbl> 4.405, 8.963, 4.778, 4.459, 4.992, 5.443, 8.817,…

## $ StuTeaRat <dbl> 17.2, 17.6, 19.3, 17.1, 24.0, 18.4, 14.4, 16.6, …

## $ Salary <dbl> 31.144, 47.951, 32.175, 28.934, 41.078, 34.571, …

## $ PrcntTake <dbl> 8, 47, 27, 6, 45, 29, 81, 68, 48, 65, 57, 15, 13…

## $ SATV <dbl> 491, 445, 448, 482, 417, 462, 431, 429, 420, 406…

## $ SATM <dbl> 538, 489, 496, 523, 485, 518, 477, 468, 469, 448…

## $ SATT <dbl> 1029, 934, 944, 1005, 902, 980, 908, 897, 889, 8…

## $ prcnt_take_z <dbl> -1.0178453, 0.4394222, -0.3078945, -1.0925770, 0…

## $ spend_z <dbl> -1.10086058, 2.24370805, -0.82716069, -1.0612364…

## $ satt_z <dbl> 0.8430838, -0.4266207, -0.2929676, 0.5223163, -0…

## $ prop_not_take <dbl> 0.92, 0.53, 0.73, 0.94, 0.55, 0.71, 0.19, 0.32, …

## $ prop_not_take_z <dbl> 1.0178453, -0.4394222, 0.3078945, 1.0925770, -0.…

## $ interaction <dbl> 35.240, 421.261, 129.006, 26.754, 224.640, 157.8…

## $ interaction_z <dbl> -0.94113720, 0.93111798, -0.48635915, -0.9822954…

## $ x_rand_1 <dbl> 0.92645924, 1.82282117, -1.61056690, -0.28510975…

## $ x_rand_2 <dbl> -0.90258025, -1.13163679, 0.49708131, -0.5477187…

## $ x_rand_3 <dbl> 0.51576102, 0.30710965, 0.66199996, 2.21990655, …

## $ x_rand_4 <dbl> 1.08730491, -1.23909473, 0.43161390, 1.06733141,…

## $ x_rand_5 <dbl> -0.23846777, 0.15702031, -1.02132795, 0.75395217…

## $ x_rand_6 <dbl> 0.06014956, 1.00555800, 1.47981871, -0.82827890,…

## $ x_rand_7 <dbl> 1.46961709, 0.51790320, -2.33110353, 0.11339996,…

## $ x_rand_8 <dbl> 0.03463437, -1.48737599, -0.01528284, 0.48480309…

## $ x_rand_9 <dbl> -0.4556078, -0.7035475, -0.5001913, -0.6526022, …

## $ x_rand_10 <dbl> 1.2858586, -0.7474640, -0.3107255, -1.1037468, 0…

## $ x_rand_11 <dbl> 0.17236599, -0.37956084, 0.31982301, 0.29678108,…

## $ x_rand_12 <dbl> -0.53048519, 0.92465424, 0.66876661, 0.30935146,…Here’s the naïve model.

fit4 <-

update(fit1,

newdata = my_data,

formula = satt_z ~ 1 + prcnt_take_z + spend_z + x_rand_1 + x_rand_2 + x_rand_3 + x_rand_4 + x_rand_5 + x_rand_6 + x_rand_7 + x_rand_8 + x_rand_9 + x_rand_10 + x_rand_11 + x_rand_12,

seed = 18)Here we’ll examine the posterior with posterior_summary().

## Estimate Est.Error Q2.5 Q97.5

## b_Intercept -0.02 0.07 -0.16 0.10

## b_prcnt_take_z -1.12 0.09 -1.28 -0.95

## b_spend_z 0.33 0.09 0.16 0.50

## b_x_rand_1 0.03 0.06 -0.08 0.15

## b_x_rand_2 0.02 0.09 -0.16 0.20

## b_x_rand_3 0.09 0.07 -0.06 0.22

## b_x_rand_4 -0.09 0.07 -0.22 0.05

## b_x_rand_5 0.01 0.06 -0.12 0.13

## b_x_rand_6 -0.02 0.08 -0.17 0.12

## b_x_rand_7 -0.03 0.07 -0.17 0.11

## b_x_rand_8 -0.18 0.07 -0.31 -0.04

## b_x_rand_9 0.13 0.06 0.02 0.25

## b_x_rand_10 0.00 0.05 -0.10 0.11

## b_x_rand_11 0.05 0.09 -0.13 0.22

## b_x_rand_12 -0.08 0.06 -0.21 0.04

## sigma 0.38 0.07 0.23 0.52

## nu 25.09 26.21 2.15 95.21

## lp__ -54.70 3.49 -62.56 -49.11Before we can make Figure 18.11, we’ll need to update our make_beta_0() function to accommodate this model.

make_beta_0 <-

function(zeta_0, zeta_1, zeta_2, zeta_3, zeta_4, zeta_5, zeta_6, zeta_7, zeta_8, zeta_9, zeta_10, zeta_11, zeta_12, zeta_13, zeta_14,

sd_x_1, sd_x_2, sd_x_3, sd_x_4, sd_x_5, sd_x_6, sd_x_7, sd_x_8, sd_x_9, sd_x_10, sd_x_11, sd_x_12, sd_x_13, sd_x_14, sd_y,

m_x_1, m_x_2, m_x_3, m_x_4, m_x_5, m_x_6, m_x_7, m_x_8, m_x_9, m_x_10, m_x_11, m_x_12, m_x_13, m_x_14, m_y) {

sd_y * zeta_0 + m_y - sd_y * ((zeta_1 * m_x_1 / sd_x_1) +

(zeta_2 * m_x_2 / sd_x_2) +

(zeta_3 * m_x_3 / sd_x_3) +

(zeta_4 * m_x_4 / sd_x_4) +

(zeta_5 * m_x_5 / sd_x_5) +

(zeta_6 * m_x_6 / sd_x_6) +

(zeta_7 * m_x_7 / sd_x_7) +

(zeta_8 * m_x_8 / sd_x_8) +

(zeta_9 * m_x_9 / sd_x_9) +

(zeta_10 * m_x_10 / sd_x_10) +

(zeta_11 * m_x_11 / sd_x_11) +

(zeta_12 * m_x_12 / sd_x_12) +

(zeta_13 * m_x_13 / sd_x_13) +

(zeta_14 * m_x_14 / sd_x_14))

}Sigh, our poor make_beta_0() and make_beta_1() code is getting obscene. I don’t have the energy to think of how to wrap this into a simpler function. But someone probably should. If that ends up as you, do share your code.

sd_x_1 <- sd(my_data$Spend)

sd_x_2 <- sd(my_data$PrcntTake)

sd_x_3 <- sd(my_data$x_rand_1)

sd_x_4 <- sd(my_data$x_rand_2)

sd_x_5 <- sd(my_data$x_rand_3)

sd_x_6 <- sd(my_data$x_rand_4)

sd_x_7 <- sd(my_data$x_rand_5)

sd_x_8 <- sd(my_data$x_rand_6)

sd_x_9 <- sd(my_data$x_rand_7)

sd_x_10 <- sd(my_data$x_rand_8)

sd_x_11 <- sd(my_data$x_rand_9)

sd_x_12 <- sd(my_data$x_rand_10)

sd_x_13 <- sd(my_data$x_rand_11)

sd_x_14 <- sd(my_data$x_rand_12)

sd_y <- sd(my_data$SATT)

m_x_1 <- mean(my_data$Spend)

m_x_2 <- mean(my_data$PrcntTake)

m_x_3 <- mean(my_data$x_rand_1)

m_x_4 <- mean(my_data$x_rand_2)

m_x_5 <- mean(my_data$x_rand_3)

m_x_6 <- mean(my_data$x_rand_4)

m_x_7 <- mean(my_data$x_rand_5)

m_x_8 <- mean(my_data$x_rand_6)

m_x_9 <- mean(my_data$x_rand_7)

m_x_10 <- mean(my_data$x_rand_8)

m_x_11 <- mean(my_data$x_rand_9)

m_x_12 <- mean(my_data$x_rand_10)

m_x_13 <- mean(my_data$x_rand_11)

m_x_14 <- mean(my_data$x_rand_12)

m_y <- mean(my_data$SATT)

post <-

posterior_samples(fit4) %>%

transmute(Intercept = make_beta_0(zeta_0 = b_Intercept,

zeta_1 = b_spend_z,

zeta_2 = b_prcnt_take_z,

zeta_3 = b_x_rand_1,

zeta_4 = b_x_rand_2,

zeta_5 = b_x_rand_3,

zeta_6 = b_x_rand_4,

zeta_7 = b_x_rand_5,

zeta_8 = b_x_rand_6,

zeta_9 = b_x_rand_7,

zeta_10 = b_x_rand_8,

zeta_11 = b_x_rand_9,

zeta_12 = b_x_rand_10,

zeta_13 = b_x_rand_11,

zeta_14 = b_x_rand_12,

sd_x_1 = sd_x_1,

sd_x_2 = sd_x_2,

sd_x_3 = sd_x_3,

sd_x_4 = sd_x_4,

sd_x_5 = sd_x_5,

sd_x_6 = sd_x_6,

sd_x_7 = sd_x_7,

sd_x_8 = sd_x_8,

sd_x_9 = sd_x_9,

sd_x_10 = sd_x_10,

sd_x_11 = sd_x_11,

sd_x_12 = sd_x_12,

sd_x_13 = sd_x_13,

sd_x_14 = sd_x_14,

sd_y = sd_y,

m_x_1 = m_x_1,

m_x_2 = m_x_2,

m_x_3 = m_x_3,

m_x_4 = m_x_4,

m_x_5 = m_x_5,

m_x_6 = m_x_6,

m_x_7 = m_x_7,

m_x_8 = m_x_8,

m_x_9 = m_x_9,

m_x_10 = m_x_10,

m_x_11 = m_x_11,

m_x_12 = m_x_12,

m_x_13 = m_x_13,

m_x_14 = m_x_14,

m_y = m_y),

Spend = make_beta_j(zeta_j = b_spend_z,

sd_j = sd_x_1,

sd_y = sd_y),

`Percent Take` = make_beta_j(zeta_j = b_prcnt_take_z,

sd_j = sd_x_2,

sd_y = sd_y),

x_rand_1 = make_beta_j(zeta_j = b_x_rand_1,

sd_j = sd_x_3,

sd_y = sd_y),

x_rand_2 = make_beta_j(zeta_j = b_x_rand_2,

sd_j = sd_x_4,

sd_y = sd_y),

x_rand_3 = make_beta_j(zeta_j = b_x_rand_3,

sd_j = sd_x_5,

sd_y = sd_y),

x_rand_4 = make_beta_j(zeta_j = b_x_rand_4,

sd_j = sd_x_6,

sd_y = sd_y),

x_rand_5 = make_beta_j(zeta_j = b_x_rand_5,

sd_j = sd_x_7,

sd_y = sd_y),

x_rand_6 = make_beta_j(zeta_j = b_x_rand_6,

sd_j = sd_x_8,

sd_y = sd_y),

x_rand_7 = make_beta_j(zeta_j = b_x_rand_7,

sd_j = sd_x_9,

sd_y = sd_y),

x_rand_8 = make_beta_j(zeta_j = b_x_rand_8,

sd_j = sd_x_10,

sd_y = sd_y),

x_rand_9 = make_beta_j(zeta_j = b_x_rand_9,

sd_j = sd_x_11,

sd_y = sd_y),

x_rand_10 = make_beta_j(zeta_j = b_x_rand_10,

sd_j = sd_x_12,

sd_y = sd_y),

x_rand_11 = make_beta_j(zeta_j = b_x_rand_11,

sd_j = sd_x_13,

sd_y = sd_y),

x_rand_12 = make_beta_j(zeta_j = b_x_rand_12,

sd_j = sd_x_14,

sd_y = sd_y),

Scale = sigma * sd_y,

Normality = nu %>% log10())

glimpse(post)## Observations: 4,000

## Variables: 17

## $ Intercept <dbl> 978.2629, 954.1022, 936.3345, 927.7583, 964.4377,…

## $ Spend <dbl> 16.23816, 21.85959, 26.38032, 26.63065, 18.40972,…

## $ `Percent Take` <dbl> -3.123617, -3.470104, -3.496485, -3.622503, -3.31…

## $ x_rand_1 <dbl> 0.37557071, 0.47578746, 2.01992361, -2.49333200, …

## $ x_rand_2 <dbl> -2.747509054, -0.637063446, 3.112304494, -4.64025…

## $ x_rand_3 <dbl> 8.9258844, 1.5485414, 3.0112088, 0.4144604, 11.01…

## $ x_rand_4 <dbl> -8.1747088, -9.1809834, -13.4576786, -14.0589291,…

## $ x_rand_5 <dbl> -0.5797268, 0.1277984, 0.6989087, -2.2552537, -0.…

## $ x_rand_6 <dbl> -6.499016480, 2.006864887, 2.694773713, 0.7167073…

## $ x_rand_7 <dbl> -7.4236507, 2.4005544, 0.5063171, 0.9188742, 10.2…

## $ x_rand_8 <dbl> -11.9493748, -12.7780330, -12.2361496, -16.807961…

## $ x_rand_9 <dbl> 4.132977, 11.727639, 12.163225, 6.259811, 13.0476…

## $ x_rand_10 <dbl> 0.19896636, 4.15941187, 4.02509269, 1.58380409, -…

## $ x_rand_11 <dbl> 9.3111126, -4.5582639, -8.9587840, -9.6417867, -4…

## $ x_rand_12 <dbl> -8.3675915, -2.5825711, -3.9334521, -3.8179492, -…

## $ Scale <dbl> 26.16620, 19.98710, 20.51592, 26.75018, 32.71402,…

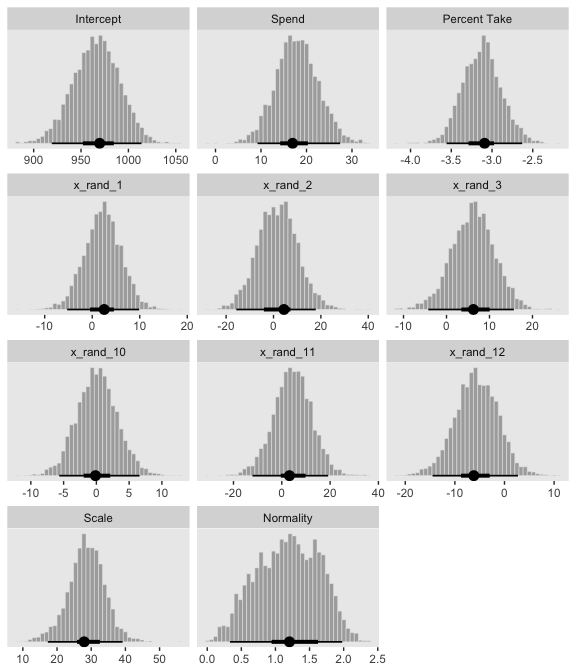

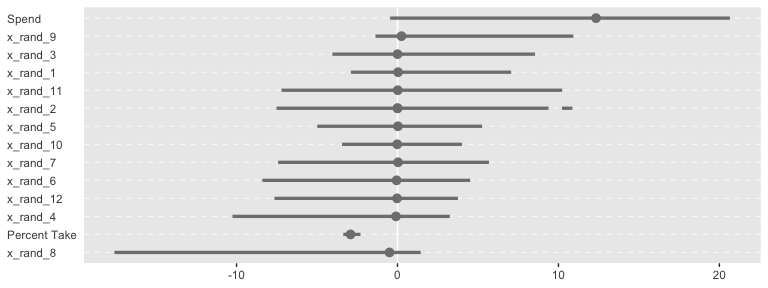

## $ Normality <dbl> 0.7053100, 0.7184234, 0.9159173, 0.4871434, 1.752…Okay, here are the histograms of Figure 18.11.

post %>%

select(Intercept:x_rand_3, x_rand_10:Normality) %>%

gather() %>%

mutate(key = factor(key,

levels = c("Intercept", "Spend", "Percent Take",

"x_rand_1", "x_rand_2", "x_rand_3",

"x_rand_10", "x_rand_11", "x_rand_12",

"Scale", "Normality"))) %>%

ggplot(aes(x = value)) +

geom_histogram(color = "grey92", fill = "grey67",

size = .2, bins = 40) +

stat_pointintervalh(aes(y = 0),

point_interval = mode_hdi, .width = c(.95, .5)) +

scale_y_continuous(NULL, breaks = NULL) +

xlab(NULL) +

facet_wrap(~key, scales = "free", ncol = 3)

And here’s the final histogram depicting the Bayesian \(R^2\).

bayes_R2(fit4, summary = F) %>%

as_tibble() %>%

ggplot(aes(x = R2)) +

geom_histogram(color = "grey92", fill = "grey67",

size = .2, bins = 25) +

stat_pointintervalh(aes(y = 0),

point_interval = mode_hdi, .width = .95) +

scale_y_continuous(NULL, breaks = NULL) +

labs(subtitle = expression(paste("Bayesian ", italic(R)^2)),

x = NULL) +

coord_cartesian(xlim = c(.6, 1))

Note that unlike the one Kruschke displayed in the text, our brms::bayes_R2()-based \(R^2\) distribution did not exceed the logical right bound of 1.

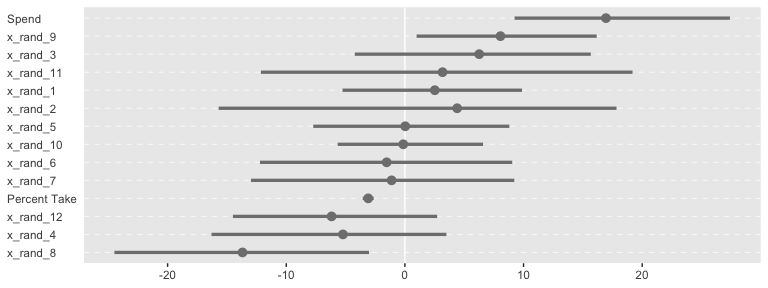

Sometimes when you have this many parameters you’d like to compare, it’s better to display their summaries with an ordered coefficient plot.

post %>%

select(Spend:x_rand_12) %>%

gather() %>%

ggplot(aes(x = value, y = reorder(key, value))) +

geom_vline(xintercept = 0, color = "white") +

stat_pointintervalh(point_interval = mode_hdi, .width = .95, color = "grey50") +

labs(x = NULL,

y = NULL) +

theme(axis.text.y = element_text(hjust = 0),

axis.ticks.y = element_blank(),

panel.grid.major.y = element_line(color = "grey98", linetype = 2))

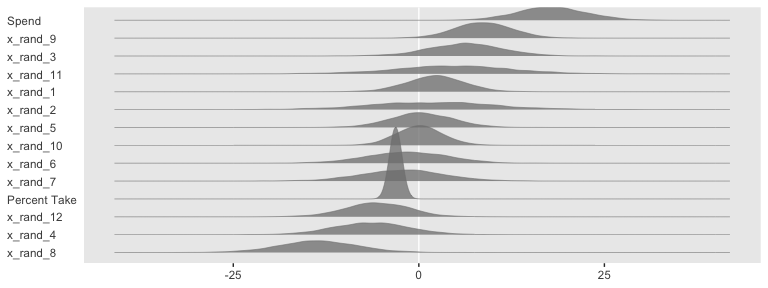

Now we can see that by chance alone, the coefficients for x_rand_8 and x_rand_9 are clearly distinct from zero. The geom_density_ridges() function from the ggridges package can be informative, too.

library(ggridges)

post %>%

select(Spend:x_rand_12) %>%

gather() %>%

ggplot(aes(x = value, y = reorder(key, value), group = reorder(key, value))) +

geom_vline(xintercept = 0, color = "white") +

geom_density_ridges(scale = 4, fill = "grey50", color = "grey50", alpha = 3/4, size = 1/5) +

labs(x = NULL,

y = NULL) +

theme(axis.text.y = element_text(hjust = 0),

axis.ticks.y = element_blank())

With brms, we can fit something like the model Kruschke displayed in Figure 18.12 with the horseshoe() prior. From the horseshoe section of the brms (version 2.10.3) reference manual:

The horseshoe prior is a special shrinkage prior initially proposed by Carvalho et al. (2009). It is symmetric around zero with fat tails and an infinitely large spike at zero. This makes it ideal for sparse models that have many regression coefficients, although only a minority of them is non-zero. The horseshoe prior can be applied on all population-level effects at once (excluding the intercept) by using

set_prior("horseshoe(1)"). The1implies that the student-t prior of the local shrinkage parameters has 1 degrees of freedom.

Based on the quote, here’s how to fit our horseshoe-prior model.

fit5 <-

update(fit4,

newdata = my_data,

formula = satt_z ~ 1 + prcnt_take_z + spend_z + x_rand_1 + x_rand_2 + x_rand_3 + x_rand_4 + x_rand_5 + x_rand_6 + x_rand_7 + x_rand_8 + x_rand_9 + x_rand_10 + x_rand_11 + x_rand_12,

prior = c(prior(normal(0, 2), class = Intercept),

prior(horseshoe(1), class = b),

prior(normal(0, 1), class = sigma),

prior(exponential(one_over_twentynine), class = nu)),

seed = 18)Check the parameter summary.

## Estimate Est.Error Q2.5 Q97.5

## b_Intercept -0.02 0.06 -0.14 0.11

## b_prcnt_take_z -1.02 0.10 -1.20 -0.82

## b_spend_z 0.20 0.11 0.00 0.39

## b_x_rand_1 0.02 0.04 -0.05 0.10

## b_x_rand_2 0.01 0.04 -0.08 0.11

## b_x_rand_3 0.02 0.04 -0.06 0.12

## b_x_rand_4 -0.03 0.05 -0.14 0.04

## b_x_rand_5 0.00 0.04 -0.07 0.09

## b_x_rand_6 -0.02 0.04 -0.13 0.05

## b_x_rand_7 -0.01 0.04 -0.09 0.07

## b_x_rand_8 -0.09 0.07 -0.24 0.02

## b_x_rand_9 0.05 0.05 -0.02 0.17

## b_x_rand_10 0.00 0.03 -0.06 0.07

## b_x_rand_11 0.01 0.04 -0.07 0.12

## b_x_rand_12 -0.02 0.04 -0.12 0.05

## sigma 0.40 0.06 0.27 0.52

## nu 30.80 28.89 2.86 108.14

## lp__ -105.49 6.71 -119.76 -93.33

## hs_c2 1.89 3.56 0.35 7.79Our make_beta_0() and make_beta_1() code remains obscene.

post <-

posterior_samples(fit5) %>%

transmute(Intercept = make_beta_0(zeta_0 = b_Intercept,

zeta_1 = b_spend_z,

zeta_2 = b_prcnt_take_z,

zeta_3 = b_x_rand_1,

zeta_4 = b_x_rand_2,

zeta_5 = b_x_rand_3,

zeta_6 = b_x_rand_4,

zeta_7 = b_x_rand_5,

zeta_8 = b_x_rand_6,

zeta_9 = b_x_rand_7,

zeta_10 = b_x_rand_8,

zeta_11 = b_x_rand_9,

zeta_12 = b_x_rand_10,

zeta_13 = b_x_rand_11,

zeta_14 = b_x_rand_12,

sd_x_1 = sd_x_1,

sd_x_2 = sd_x_2,

sd_x_3 = sd_x_3,

sd_x_4 = sd_x_4,

sd_x_5 = sd_x_5,

sd_x_6 = sd_x_6,

sd_x_7 = sd_x_7,

sd_x_8 = sd_x_8,

sd_x_9 = sd_x_9,

sd_x_10 = sd_x_10,

sd_x_11 = sd_x_11,

sd_x_12 = sd_x_12,

sd_x_13 = sd_x_13,

sd_x_14 = sd_x_14,

sd_y = sd_y,

m_x_1 = m_x_1,

m_x_2 = m_x_2,

m_x_3 = m_x_3,

m_x_4 = m_x_4,

m_x_5 = m_x_5,

m_x_6 = m_x_6,

m_x_7 = m_x_7,

m_x_8 = m_x_8,

m_x_9 = m_x_9,

m_x_10 = m_x_10,

m_x_11 = m_x_11,

m_x_12 = m_x_12,

m_x_13 = m_x_13,

m_x_14 = m_x_14,

m_y = m_y),

Spend = make_beta_j(zeta_j = b_spend_z,

sd_j = sd_x_1,

sd_y = sd_y),

`Percent Take` = make_beta_j(zeta_j = b_prcnt_take_z,

sd_j = sd_x_2,

sd_y = sd_y),

x_rand_1 = make_beta_j(zeta_j = b_x_rand_1,

sd_j = sd_x_3,

sd_y = sd_y),

x_rand_2 = make_beta_j(zeta_j = b_x_rand_2,

sd_j = sd_x_4,

sd_y = sd_y),

x_rand_3 = make_beta_j(zeta_j = b_x_rand_3,

sd_j = sd_x_5,

sd_y = sd_y),

x_rand_4 = make_beta_j(zeta_j = b_x_rand_4,

sd_j = sd_x_6,

sd_y = sd_y),

x_rand_5 = make_beta_j(zeta_j = b_x_rand_5,

sd_j = sd_x_7,

sd_y = sd_y),

x_rand_6 = make_beta_j(zeta_j = b_x_rand_6,

sd_j = sd_x_8,

sd_y = sd_y),

x_rand_7 = make_beta_j(zeta_j = b_x_rand_7,

sd_j = sd_x_9,

sd_y = sd_y),

x_rand_8 = make_beta_j(zeta_j = b_x_rand_8,

sd_j = sd_x_10,

sd_y = sd_y),

x_rand_9 = make_beta_j(zeta_j = b_x_rand_9,

sd_j = sd_x_11,

sd_y = sd_y),

x_rand_10 = make_beta_j(zeta_j = b_x_rand_10,

sd_j = sd_x_12,

sd_y = sd_y),

x_rand_11 = make_beta_j(zeta_j = b_x_rand_11,

sd_j = sd_x_13,

sd_y = sd_y),

x_rand_12 = make_beta_j(zeta_j = b_x_rand_12,

sd_j = sd_x_14,

sd_y = sd_y),

Scale = sigma * sd_y,

Normality = nu %>% log10())

glimpse(post)## Observations: 4,000

## Variables: 17

## $ Intercept <dbl> 979.2471, 1023.5298, 1005.1208, 1019.9144, 987.87…

## $ Spend <dbl> 10.433664, 6.800388, 8.659539, 6.694374, 13.33200…

## $ `Percent Take` <dbl> -2.647076, -2.530614, -2.792637, -2.863597, -2.82…

## $ x_rand_1 <dbl> -0.122140323, -1.158510122, 4.129300096, 2.557700…

## $ x_rand_2 <dbl> -0.08683436, -7.80656229, -0.29081925, -0.4379702…

## $ x_rand_3 <dbl> -0.52525371, 4.52651239, -1.31939726, -1.97089650…

## $ x_rand_4 <dbl> -0.14436314, 0.16171124, 1.24412546, 1.66430716, …

## $ x_rand_5 <dbl> -1.00575083, 7.17913473, -0.49749734, -0.80289945…

## $ x_rand_6 <dbl> -7.70462095, -2.23838325, -1.33121990, -2.0296176…

## $ x_rand_7 <dbl> -0.52338825, -0.97967618, -1.66890548, -3.6052574…

## $ x_rand_8 <dbl> -16.30586010, -4.60620698, 0.95248757, 1.40157515…

## $ x_rand_9 <dbl> -0.06430865, 14.47257381, 0.02975212, 0.24323983,…

## $ x_rand_10 <dbl> -0.693127222, 0.282968557, -0.575203802, 0.764815…

## $ x_rand_11 <dbl> 0.61800434, -0.14365478, 9.95488153, 13.63182415,…

## $ x_rand_12 <dbl> 0.004654011, -9.772196168, 0.691943833, 2.6793078…

## $ Scale <dbl> 32.13506, 27.57153, 36.89317, 37.52294, 37.52031,…

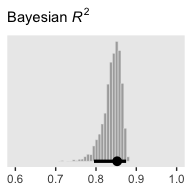

## $ Normality <dbl> 1.5010222, 1.2281283, 1.4576176, 1.5595392, 1.448…And here are the majority of the histograms of Figure 18.12.

post %>%

select(Intercept:x_rand_3, x_rand_10:Normality) %>%

gather() %>%

mutate(key = factor(key,

levels = c("Intercept", "Spend", "Percent Take",

"x_rand_1", "x_rand_2", "x_rand_3",

"x_rand_10", "x_rand_11", "x_rand_12",

"Scale", "Normality"))) %>%

ggplot(aes(x = value)) +

geom_histogram(color = "grey92", fill = "grey67",

size = .2, bins = 40) +

stat_pointintervalh(aes(y = 0),

point_interval = mode_hdi, .width = c(.95, .5)) +

scale_y_continuous(NULL, breaks = NULL) +

xlab(NULL) +

facet_wrap(~key, scales = "free", ncol = 3)

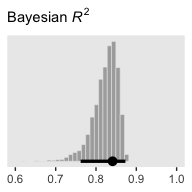

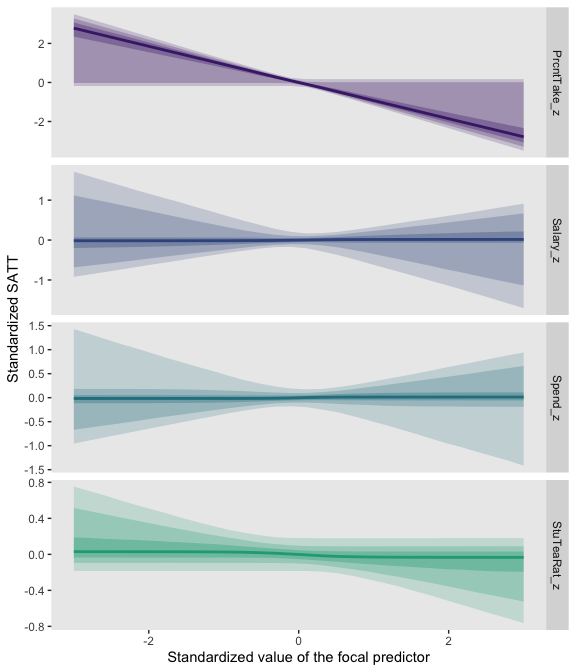

Based on the distributions for the random predictors, it looks like our brms horseshoe prior regularized more aggressively than Kruschke’s hierarchical prior in the text. And interestingly, look how our marginal posterior for Spend is bimodal.

For kicks and giggles, here’s the corresponding coefficient plot for \(\beta_1\) through \(\beta_{14}\).

post %>%

select(Spend:x_rand_12) %>%

gather() %>%

ggplot(aes(x = value, y = reorder(key, value))) +

geom_vline(xintercept = 0, color = "white") +

stat_pointintervalh(point_interval = mode_hdi, .width = .95, color = "grey50") +

labs(x = NULL,

y = NULL) +

theme(axis.text.y = element_text(hjust = 0),

axis.ticks.y = element_blank(),

panel.grid.major.y = element_line(color = "grey98", linetype = 2))

But anyways, here’s that final Bayesian \(R^2\) histogram for Figure 18.12.

bayes_R2(fit5, summary = F) %>%

as_tibble() %>%

ggplot(aes(x = R2)) +

geom_histogram(color = "grey92", fill = "grey67",

size = .2, bins = 25) +

stat_pointintervalh(aes(y = 0),

point_interval = mode_hdi, .width = .95) +

scale_y_continuous(NULL, breaks = NULL) +

labs(subtitle = expression(paste("Bayesian ", italic(R)^2)),

x = NULL) +

coord_cartesian(xlim = c(.6, 1))

Just recall, though, that our fit5 was not exactly like Kruschke’s model. Whereas we hard coded the scale of our Student-\(t\) horseshoe prior to be 1, Kruschke estimated it with help from the gamma distribution. I’m not aware that’s currently possible in brms. If I’m at fault and you know how to do it, please share your code.

18.4 Variable selection

We can rewrite the linear regression model to accommodate whether it includes a predictor as

\[\mu_i = \beta_0 + \sum_j \delta_j \beta_j x_{j, i},\]

where \(\delta\) is a dummy for which 0 = not included 1 = included. I’m not aware of a way to use \(\delta\) as an inclusion indicator in brms the way Kruschke implemented it in JAGS. And in fact, it appears this might be unfeasible within the Stan framework. But if you know of a way, please share your code. However, this issue can lead to a similar approach: information criteria. To do so, let’s follow Kruschke’s basic flow and use the first model from way back in subsection 18.1.1 as a starting point. The model formula was as follows.

## satt_z ~ 1 + spend_z + prcnt_take_zTaking interactions off the table for a moment, we can specify four model types with various combinations of the two predictors, prcnt_take_z and spend_z. fit1 was the first, which we might denote as \(\langle 1, 1 \rangle\). That leads to the remaining possibilities as

- \(\langle 1, 0 \rangle:\)

satt_z ~ 1 + spend_z - \(\langle 0, 1 \rangle:\)

satt_z ~ 1 + prcnt_take_z - \(\langle 0, 0 \rangle:\)

satt_z ~ 1

Let’s fit those models.

fit6 <-

update(fit1,

formula = satt_z ~ 1 + spend_z,

seed = 18)

fit7 <-

update(fit1,

formula = satt_z ~ 1 + prcnt_take_z,

seed = 18)

fit8 <-

brm(data = my_data,

family = student,

satt_z ~ 1,

prior = c(prior(normal(0, 2), class = Intercept),

prior(normal(0, 1), class = sigma),

prior(exponential(one_over_twentynine), class = nu)),

chains = 4, cores = 4,

stanvars = stanvar(1/29, name = "one_over_twentynine"),

seed = 18)We’ll compare our models with the LOO information criterion. Like other information criteria, the LOO values aren’t of interest in and of themselves. However, the values of one model’s LOO relative to that of another is of great interest. We generally prefer models with lower estimates.

fit1 <- add_criterion(fit1, "loo")

fit6 <- add_criterion(fit6, "loo")

fit7 <- add_criterion(fit7, "loo")

fit8 <- add_criterion(fit8, "loo")

loo_compare(fit1, fit6, fit7, fit8) %>%

print(simplify = F)## elpd_diff se_diff elpd_loo se_elpd_loo p_loo se_p_loo looic se_looic

## fit1 0.0 0.0 -31.9 5.4 4.0 0.7 63.8 10.7

## fit7 -3.3 2.8 -35.2 4.4 2.8 0.5 70.4 8.8

## fit6 -37.7 6.3 -69.6 4.0 2.1 0.3 139.3 8.1

## fit8 -40.9 5.7 -72.7 3.1 1.4 0.2 145.5 6.1In this case, fit1 and fit7 clearly have the lowest estimates, but the standard error of their difference score is about the same size as their difference. So the LOO difference score puts them on similar footing. Recall that you can do a similar analysis with the waic() function.

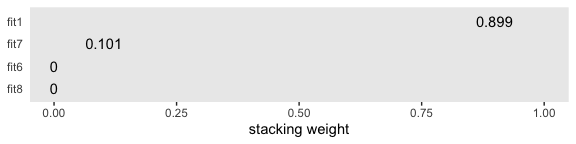

Let’s compare that with the insights from the model_weights() function.

## fit1 fit6 fit7 fit8

## 8.985310e-01 8.464204e-08 1.014689e-01 1.081172e-08If you don’t like scientific notation, you can always wrangle and plot.

mw %>%

as.data.frame() %>%

rownames_to_column() %>%

set_names("fit", "estimate") %>%

ggplot(aes(x = estimate, y = reorder(fit, estimate))) +

geom_text(aes(label = estimate %>% round(3) %>% as.character())) +

scale_x_continuous("stacking weight", limits = c(0, 1)) +

ylab(NULL) +

theme(axis.ticks.y = element_blank())

Based on this weighting scheme, almost all the weight went to the full model, fit1. But note, in the intro of their vignette on the topic, Vehtari and Gabry opined:

Ideally, we would avoid the Bayesian model combination problem by extending the model to include the separate models as special cases, and preferably as a continuous expansion of the model space. For example, instead of model averaging over different covariate combinations, all potentially relevant covariates should be included in a predictive model (for causal analysis more care is needed) and a prior assumption that only some of the covariates are relevant can be presented with regularized horseshoe prior (Piironen and Vehtari, 2017a). For variable selection we recommend projective predictive variable selection (Piironen and Vehtari, 2017a; projpred package).

Perhaps unsurprisingly, their thoughts on the topic are similar with the Gelman et al quotation Kruschke provided on page 536:

Some prominent authors eschew the variable-selection approach for typical applications in their fields. For example, Gelman et al. (2013, p. 369) said, “For the regressions we typically see, we do not believe any coefficients to be truly zero and we do not generally consider it a conceptual (as opposed to computational) advantage to get point estimates of zero—but regularized estimates such as obtained by lasso can be much better than those resulting from simple least squares and flat prior distributions …we are not comfortable with an underlying model in which the coefficients can be exactly zero.”

For more on some of these methods, check out Vehtari’s GitHub repository, Tutorial on model assessment, model selection and inference after model selection.

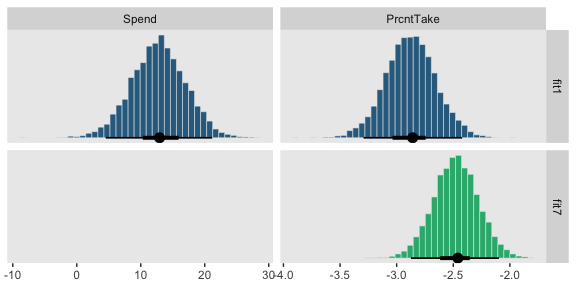

But anyways, our model weighting methods cohered with Kruschke’s \(\delta\)-inclusion-indicator method in that both suggested the full model, fit1, and the model with prcnt_take as the sole predictor, fit7, were given the greatest weight. I’m not aware that our information criteria weighting/model stacking methods provide probability distributions of the type Kruschke displayed in the left portions of Figure 18.13. But we can at least recreate the plots in the other panels.

# first we'll get the posterior draws from `fit1` and wrangle them

posterior_samples(fit1) %>%

transmute(Spend = make_beta_j(zeta_j = b_spend_z,

sd_j = sd_x_1,

sd_y = sd_y),

PrcntTake = make_beta_j(zeta_j = b_prcnt_take_z,

sd_j = sd_x_2,

sd_y = sd_y)) %>%

gather() %>%

# within `bind_rows()`, we extract and wrangle the posterior draws from `fit7` and them insert them below those from `fit1`

bind_rows(

posterior_samples(fit7) %>%

transmute(value = make_beta_j(zeta_j = b_prcnt_take_z,

sd_j = sd_x_2,

sd_y = sd_y)) %>%

mutate(key = "PrcntTake")

) %>%

# now we just need a little indexing and factor ordering

mutate(model = rep(c("fit1", "fit7"), times = c(8000, 4000)),

key = factor(key, levels = c("Spend", "PrcntTake"))) %>%

# we finally plot!

ggplot(aes(x = value, fill = model)) +

geom_histogram(color = "grey92",

size = .2, bins = 40) +

stat_pointintervalh(aes(y = 0),

point_interval = mode_hdi, .width = c(.95, .5)) +

scale_fill_viridis_d(option = "D", begin = .35, end = .65) +

scale_y_continuous(NULL, breaks = NULL) +

xlab(NULL) +

theme(legend.position = "none") +

facet_grid(model~key, scales = "free")

18.4.1 Inclusion probability is strongly affected by vagueness of prior.

To follow along, let’s fit the models with the updated \(SD = 1\) on the \(\beta_{1+}\) priors code.

fit9 <-

update(fit1,

prior = c(prior(normal(0, 1), class = Intercept),

prior(normal(0, 1), class = b),

prior(normal(0, 1), class = sigma),

prior(exponential(one_over_twentynine), class = nu)),

chains = 4, cores = 4,

stanvars = stanvar(1/29, name = "one_over_twentynine"),

seed = 18)

fit10 <-

update(fit9,

formula = satt_z ~ 1 + spend_z,

seed = 18)

fit11 <-

update(fit9,

formula = satt_z ~ 1 + prcnt_take_z,

seed = 18)

fit12 <-

update(fit8,

prior = c(prior(normal(0, 1), class = Intercept),

prior(normal(0, 1), class = sigma),

prior(exponential(one_over_twentynine), class = nu)),

seed = 18)And now we’ll fit the models with the updated \(SD = 10\).

fit13 <-

update(fit9,

prior = c(prior(normal(0, 10), class = Intercept),

prior(normal(0, 10), class = b),

prior(normal(0, 10), class = sigma),

prior(exponential(one_over_twentynine), class = nu)),

seed = 18)

fit14 <-

update(fit13,

formula = satt_z ~ 1 + spend_z,

seed = 18)

fit15 <-

update(fit13,

formula = satt_z ~ 1 + prcnt_take_z,

seed = 18)

fit16 <-

update(fit12,

prior = c(prior(normal(0, 10), class = Intercept),

prior(normal(0, 10), class = sigma),

prior(exponential(one_over_twentynine), class = nu)),

seed = 18)Now we’ve fit the models, we’re ready to examine how altering the \(SD\)s on the \(\beta_j\) priors influenced the model comparisons via model_weights(). Here we’ll use the default stacking method.

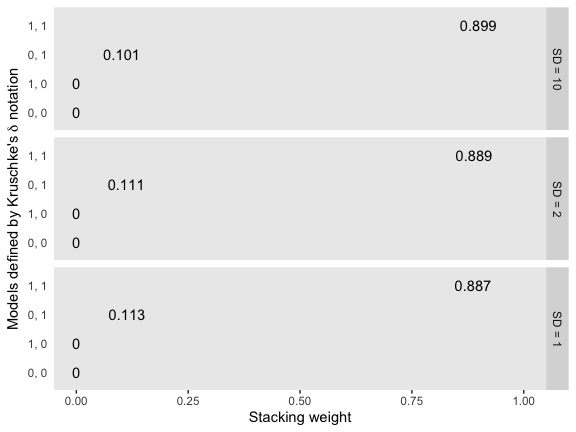

mw %>%

rbind(model_weights(fit9, fit10, fit11, fit12),

model_weights(fit13, fit14, fit15, fit16)) %>%

as_tibble() %>%

set_names("1, 1", "1, 0", "0, 1", "0, 0") %>%

gather() %>%

mutate(prior = rep(str_c("SD = ", c(10, 2, 1)), times = 4) %>%

factor(., levels = str_c("SD = ", c(10, 2, 1)))) %>%

ggplot(aes(x = value, y = reorder(key, value))) +

geom_text(aes(label = value %>% round(3) %>% as.character())) +

coord_cartesian(xlim = 0:1) +

labs(x = "Stacking weight",

y = expression(paste("Models defined by Kruschke's ", delta, " notation"))) +

theme(axis.ticks.y = element_blank()) +

facet_grid(prior~.)

So unlike in the depictions in Figure 18.14, the stacking method was insensitive to the \(SD\)s on our \(\beta_j\) priors. We might compare LOO difference scores, too.

fit9 <- add_criterion(fit9, "loo")

fit10 <- add_criterion(fit10, "loo")

fit11 <- add_criterion(fit11, "loo")

fit12 <- add_criterion(fit12, "loo")

fit13 <- add_criterion(fit13, "loo")

fit14 <- add_criterion(fit14, "loo")

fit15 <- add_criterion(fit15, "loo")

fit16 <- add_criterion(fit16, "loo")

loo_compare(fit1, fit6, fit7, fit8) %>%

print(simplify = F)## elpd_diff se_diff elpd_loo se_elpd_loo p_loo se_p_loo looic se_looic

## fit1 0.0 0.0 -31.9 5.4 4.0 0.7 63.8 10.7

## fit7 -3.3 2.8 -35.2 4.4 2.8 0.5 70.4 8.8

## fit6 -37.7 6.3 -69.6 4.0 2.1 0.3 139.3 8.1

## fit8 -40.9 5.7 -72.7 3.1 1.4 0.2 145.5 6.1## elpd_diff se_diff elpd_loo se_elpd_loo p_loo se_p_loo looic se_looic

## fit9 0.0 0.0 -32.0 5.4 4.0 0.7 63.9 10.7

## fit11 -3.2 2.8 -35.1 4.4 2.7 0.4 70.2 8.8

## fit10 -37.6 6.3 -69.5 4.0 2.1 0.3 139.0 8.1

## fit12 -40.7 5.7 -72.7 3.1 1.3 0.2 145.3 6.1## elpd_diff se_diff elpd_loo se_elpd_loo p_loo se_p_loo looic se_looic

## fit13 0.0 0.0 -31.9 5.4 3.9 0.7 63.8 10.7

## fit15 -3.2 2.9 -35.1 4.4 2.7 0.5 70.3 8.8

## fit14 -37.6 6.3 -69.5 4.0 2.0 0.3 139.1 8.0

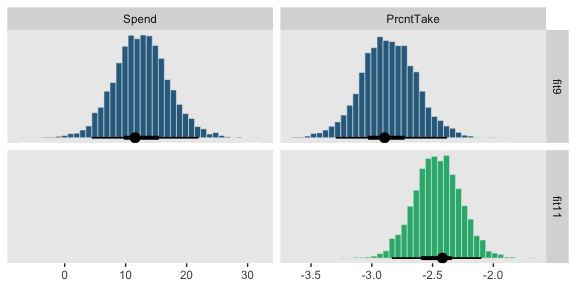

## fit16 -40.9 5.7 -72.8 3.0 1.4 0.2 145.7 6.0The LOO difference score patterns were also about the same across the \(SD\)s on our \(\beta_j\) priors. Let’s finish up with the histograms comparing the model predictors. Here’s the code for those in the top portion of Figure 18.14.

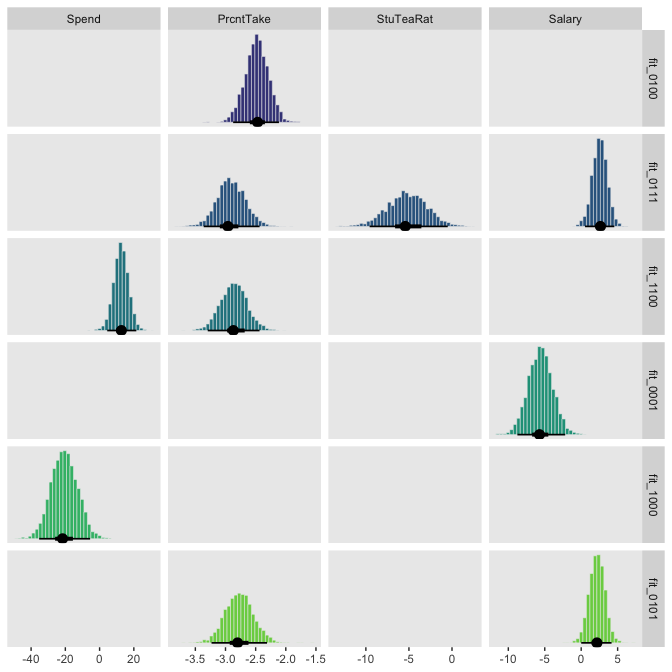

# first we'll get the posterior draws from `fit9` and wrangle them

posterior_samples(fit9) %>%

transmute(Spend = make_beta_j(zeta_j = b_spend_z,

sd_j = sd_x_1,

sd_y = sd_y),

PrcntTake = make_beta_j(zeta_j = b_prcnt_take_z,

sd_j = sd_x_2,

sd_y = sd_y)) %>%

gather() %>%

# within `bind_rows()`, we extract and wrangle the posterior draws from `fit11` and

# then insert them below those from `fit9`

bind_rows(

posterior_samples(fit11) %>%

transmute(value = make_beta_j(zeta_j = b_prcnt_take_z,

sd_j = sd_x_2,

sd_y = sd_y)) %>%

mutate(key = "PrcntTake")

) %>%

# now we just need a little indexing and factor ordering

mutate(model = rep(c("fit9", "fit11"), times = c(8000, 4000)) %>%

factor(., levels = c("fit9", "fit11")),

key = factor(key, levels = c("Spend", "PrcntTake"))) %>%

# we finally plot!

ggplot(aes(x = value, fill = model)) +

geom_histogram(color = "grey92",

size = .2, bins = 40) +

stat_pointintervalh(aes(y = 0),

point_interval = mode_hdi, .width = c(.95, .5)) +

scale_fill_viridis_d(option = "D", begin = .35, end = .65) +

scale_y_continuous(NULL, breaks = NULL) +

xlab(NULL) +

theme(legend.position = "none") +

facet_grid(model~key, scales = "free")

And now we’ll do the histograms for the bottom portion of Figure 18.14.

posterior_samples(fit13) %>%

transmute(Spend = make_beta_j(zeta_j = b_spend_z,

sd_j = sd_x_1,

sd_y = sd_y),

PrcntTake = make_beta_j(zeta_j = b_prcnt_take_z,

sd_j = sd_x_2,

sd_y = sd_y)) %>%

gather() %>%

bind_rows(

posterior_samples(fit15) %>%

transmute(value = make_beta_j(zeta_j = b_prcnt_take_z,

sd_j = sd_x_2,

sd_y = sd_y)) %>%

mutate(key = "PrcntTake")

) %>%

mutate(model = rep(c("fit13", "fit15"), times = c(8000, 4000)) %>%

factor(., levels = c("fit13", "fit15")),

key = factor(key, levels = c("Spend", "PrcntTake"))) %>%

ggplot(aes(x = value, fill = model)) +

geom_histogram(color = "grey92",

size = .2, bins = 40) +

stat_pointintervalh(aes(y = 0),

point_interval = mode_hdi, .width = c(.95, .5)) +

scale_fill_viridis_d(option = "D", begin = .35, end = .65) +

scale_y_continuous(NULL, breaks = NULL) +

xlab(NULL) +

theme(legend.position = "none") +

facet_grid(model~key, scales = "free")

Kurschke concluded this subsection with

Bayesian model comparison can be strongly affected by the degree of vagueness in the priors, even though explicit estimates of the parameter values may be minimally affected. Therefore, be very cautious when interpreting the results of Bayesian variable selection. The next section discusses a way to inform the prior by using concurrent data instead of previous data. (p. 542)

We should note that while the method in text was “strongly affected by the degree of vagueness in the priors”, the information-criteria and model weighting methods, above, were not. If you’re interested in comparing models within the Bayesian paradigm, choose your method with care.

18.4.2 Variable selection with hierarchical shrinkage.

Kruschke opened the subsection with a few good points:

If you have strong previous research that can inform the prior, then it should be used. But if previous knowledge is weak, then the uncertainty should be expressed in the prior. This is an underlying mantra of the Bayesian approach: Any uncertainty should be expressed in the prior. (p. 543)

Here we’ll standardize our new predictors, StuTeaRat and Salary.

my_data <-

my_data %>%

mutate(stu_tea_rat_z = standardize(StuTeaRat),

salary_z = standardize(Salary))We can use Kruschke’s gamma_s_and_r_from_mode_sd() function to return the exact shape and rate parameters to make a gamma with a mode of 1 and an \(SD\) of 10.

gamma_s_and_r_from_mode_sd <- function(mode, sd) {

if (mode <= 0) stop("mode must be > 0")

if (sd <= 0) stop("sd must be > 0")

rate <- (mode + sqrt(mode^2 + 4 * sd^2)) / (2 * sd^2)

shape <- 1 + mode * rate

return(list(shape = shape, rate = rate))

}Here are the values.

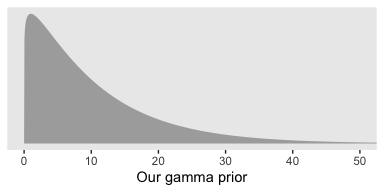

## [1] 1.1051249 0.1051249That gamma distribution looks like this.

tibble(x = seq(from = 0, to = 55, length.out = 1e3)) %>%

ggplot(aes(x = x, ymin = 0, ymax = dgamma(x, p[1], p[2]))) +

geom_ribbon(size = 0, fill = "grey67") +

scale_y_continuous(NULL, breaks = NULL) +

xlab("Our gamma prior") +

coord_cartesian(xlim = 0:50)

We can code those values in with arbitrary precision with the stanvar() function.

stanvars <-

stanvar(1/29, name = "one_over_twentynine") +

stanvar(p[1], name = "my_shape") +

stanvar(p[2], name = "my_rate") +

stanvar(scode = " real<lower=0> tau;", block = "parameters")Note that last stanvar() line. Bürkner recently posted an exemplar of how to set a hierarchical prior on a regression coefficient in a brm() model:

# define a hierachical prior on the regression coefficients

bprior <- set_prior("normal(0, tau)", class = "b") +

set_prior("target += normal_lpdf(tau | 0, 10)", check = FALSE)

stanvars <- stanvar(scode = " real<lower=0> tau;", block = "parameters")

make_stancode(count ~ Trt + log_Base4_c, epilepsy,

prior = bprior, stanvars = stanvars)Following the method, we tell brm() we’d like to estimate the \(SD\) of our \(\beta_{1+}\) priors with prior(normal(0, tau), class = b), where the tau is a stand-in for the \(SD\). In the next line, set_prior("target += gamma_lpdf(tau | my_shape, my_rate)", check = FALSE), we tell brm() we’d like to estimate tau with a gamma(my_shape, my_rate), the values for which were saved in our stanvars object, above. And it’s that stanvar() line in that code wherein we told brm() we’d like that parameter to have a lower bound of 0. Let’s put it to use.

fit_1111 <-

brm(data = my_data,

family = student,

satt_z ~ 1 + spend_z + prcnt_take_z + stu_tea_rat_z + salary_z,

prior = c(prior(normal(0, 2), class = Intercept),

prior(normal(0, tau), class = b),

set_prior("target += gamma_lpdf(tau | my_shape, my_rate)", check = FALSE),

prior(normal(0, 1), class = sigma),

prior(exponential(one_over_twentynine), class = nu)),

chains = 4, cores = 4,

control = list(adapt_delta = .99),

stanvars = stanvars,

seed = 18)

fit_0111 <-

update(fit_1111,

formula = satt_z ~ 1 + prcnt_take_z + stu_tea_rat_z + salary_z)

fit_1011 <-

update(fit_1111,

formula = satt_z ~ 1 + spend_z + stu_tea_rat_z + salary_z)

fit_1101 <-

update(fit_1111,

formula = satt_z ~ 1 + spend_z + prcnt_take_z + salary_z)

fit_1110 <-

update(fit_1111,

formula = satt_z ~ 1 + spend_z + prcnt_take_z + stu_tea_rat_z )

fit_0011 <-

update(fit_1111,

formula = satt_z ~ 1 + stu_tea_rat_z + salary_z)

fit_0101 <-

update(fit_1111,

formula = satt_z ~ 1 + prcnt_take_z + salary_z)

fit_0110 <-

update(fit_1111,

formula = satt_z ~ 1 + prcnt_take_z + stu_tea_rat_z )

fit_1001 <-

update(fit_1111,

formula = satt_z ~ 1 + spend_z + salary_z)

fit_1010 <-

update(fit_1111,

formula = satt_z ~ 1 + spend_z + stu_tea_rat_z )

fit_1100 <-

update(fit_1111,

formula = satt_z ~ 1 + spend_z + prcnt_take_z )

fit_0001 <-

update(fit_1111,

formula = satt_z ~ 1 + salary_z)

fit_0010 <-

update(fit_1111,

formula = satt_z ~ 1 + stu_tea_rat_z )

fit_0100 <-

update(fit_1111,

formula = satt_z ~ 1 + prcnt_take_z )

fit_1000 <-

update(fit_1111,

formula = satt_z ~ 1 + spend_z )

fit_0000 <-

update(fit_1111,

formula = satt_z ~ 1 )In order to keep track of the next 16 models, we switched our usual naming convention. Instead of continuing on keeping on calling them fit17 through fit33, we used Kruschke’s \(\delta\) 0/1 convention. If we set the formula for the full model as satt_z ~ 1 + spend_z + prcnt_take_z + stu_tea_rat_z + salary_z, the name becomes fit_1111. Accordingly, we called the model omitting spend_z, the first predictor, fit_0111, and so on.

Before we go any further, here are the correlations among the \(\beta\)s for the full model, fit_1111.

## Intercept spend_z prcnt_take_z stu_tea_rat_z salary_z

## Intercept 1.000 0.009 -0.007 0.019 -0.023

## spend_z 0.009 1.000 0.039 0.688 -0.883

## prcnt_take_z -0.007 0.039 1.000 0.242 -0.344

## stu_tea_rat_z 0.019 0.688 0.242 1.000 -0.683

## salary_z -0.023 -0.883 -0.344 -0.683 1.000Once again, the HMC correlations differ from Kruschke’s JAGS correlations. Moving on–behold the model weights.

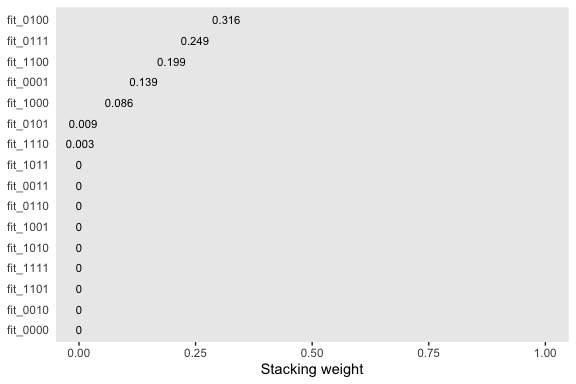

(

mw <-

model_weights(fit_1111,

fit_0111, fit_1011, fit_1101, fit_1110,

fit_0011, fit_0101, fit_0110, fit_1001, fit_1010, fit_1100,

fit_0001, fit_0010, fit_0100, fit_1000,

fit_0000)

)## fit_1111 fit_0111 fit_1011 fit_1101 fit_1110

## 6.863750e-06 2.487864e-01 1.805001e-05 3.950442e-06 2.701096e-03

## fit_0011 fit_0101 fit_0110 fit_1001 fit_1010

## 1.533369e-05 8.946392e-03 1.508780e-05 1.320403e-05 1.184423e-05

## fit_1100 fit_0001 fit_0010 fit_0100 fit_1000

## 1.985399e-01 1.387202e-01 3.212120e-06 3.161577e-01 8.606082e-02

## fit_0000

## 1.024098e-08We’ll plot our model weights like before.

mw %>%

as.data.frame() %>%

rownames_to_column() %>%

set_names("fit", "weight") %>%

ggplot(aes(x = weight, y = reorder(fit, weight))) +

geom_text(aes(label = weight %>% round(3) %>% as.character()),

size = 3) +

coord_cartesian(xlim = 0:1) +

labs(x = "Stacking weight",

y = NULL) +

theme(axis.ticks.y = element_blank())