Chapter 2 Definitions

2.1 How to define a customer portfolio?

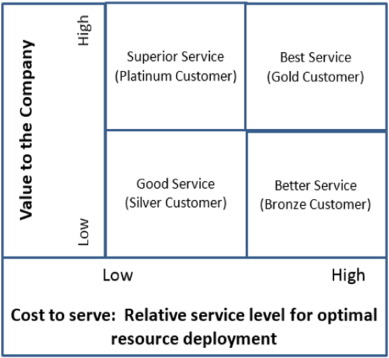

The notion of portfolio has greatly evolved before a firm’s consumer base was considered as a set of portfolios. In chapter 3 a part of the literature review depicts an evolution of the portfolio management notion. A customer portfolio can be defined as a set of customers divided into several segments (or clusters) based on similar attributes. These discriminant features can be both economic - willingness to pay, budget constraint, etc. - and sociological - gender, age, socio-professional category, etc. . The underlying objective of this segmentation is to optimally allocate the company’s resources. When dealing with customer portfolio management (CPM), two dimensions can be considered. On the one hand, it can be assumed that a customer stays in the same segment throughout their life in the firm’s portfolio. On the other hand, a dynamic approach can be adopted as suggested by Homburg on dynamics in customer portfolios (Homburg, Steiner, and Totzek 2009). In their article, the authors question the static analysis by assuming that a customer can switch between segments. They explain that one of the firm’s objectives is to convert less valuable customers into more valuable ones. In this context, customers can also be segmented depending on their value to the firm and their cost to serve (Thakur and Workmanb 2016), as depicted by figure 2.1.

Figure 2.1: CPM Matrix

2.2 What is attrition?

Customer attrition or churn occurs when a client discontinues using a service or a product offered by a firm. Churn analysis corresponds to measuring the attrition rate in the customer base of any company. However, evaluating attrition depends on the type of relationship between the firm and its clients. When it is defined by a contract, the customer has to inform the firm about their service termination. In the telecom industry, a consumer is required to notify their telecommunications service provider (TSP) before going to a competing company. In an opposite way, the firm/client relationship can be non-contractual. In that case, the service termination does not need to be notified. Attrition then becomes a latent variable and more advanced models are used to make forecasts.

2.3 What does customer “value” mean?

In customer portfolio management, one client’s value is represented by the customer lifetime value (CLV). CLV is the present value of all future purchases made by a customer over their lifetime in the firm’s portfolio, taking into account the attrition risk. CLV depends both on the purchase recency as well as on the purchasing rate and aims at identifying the most valuable customer groups. Formally, Gupta and Lehmann (Gupta and Lehmann 2003) define CLV for customer \(i\) as follows: \[CLV_i = \sum_{t=0}^{T_i} \frac{(p_t - c_t)r_{i,t}}{(1+a)^t} - AC_i\]

with,

- \(p_t\) the price paid by customer \(i\) at time \(t\)

- \(c_t\) the cost at time \(t\)

- \(r_{i,t}\) the probability that customer \(i\) be active at time \(t\)

- \(a\) the discount rate

- \(AC_i\) the acquisition cost of customer \(i\)

- \(T_i\) the duration of observation

An estimation of the portfolio’s overall value can be calculated through customer equity (CE) which amounts to the sum of all the CLVs. Since CE appears to be a good proxy of the firm’s value, the profit maximization program can be rewritten as: \[ \begin{aligned} \max_{p} \quad & \textrm{CE} = \sum_{i=1}^{N} \sum_{t=0}^{T_i} \frac{(p_t - c_t)r_{i,t}}{(1+a)^t} - AC_i\\ \textrm{s.t.} \quad & r_{i,t} \in [0, 1]\\ &p_t > c_t \\ \end{aligned} \]