Sec 1 Example of Time Series Data

1.1 Characteristics of Time Series

1.1.1 Practical data

判斷以下範例為何不是 (weakly) stationary

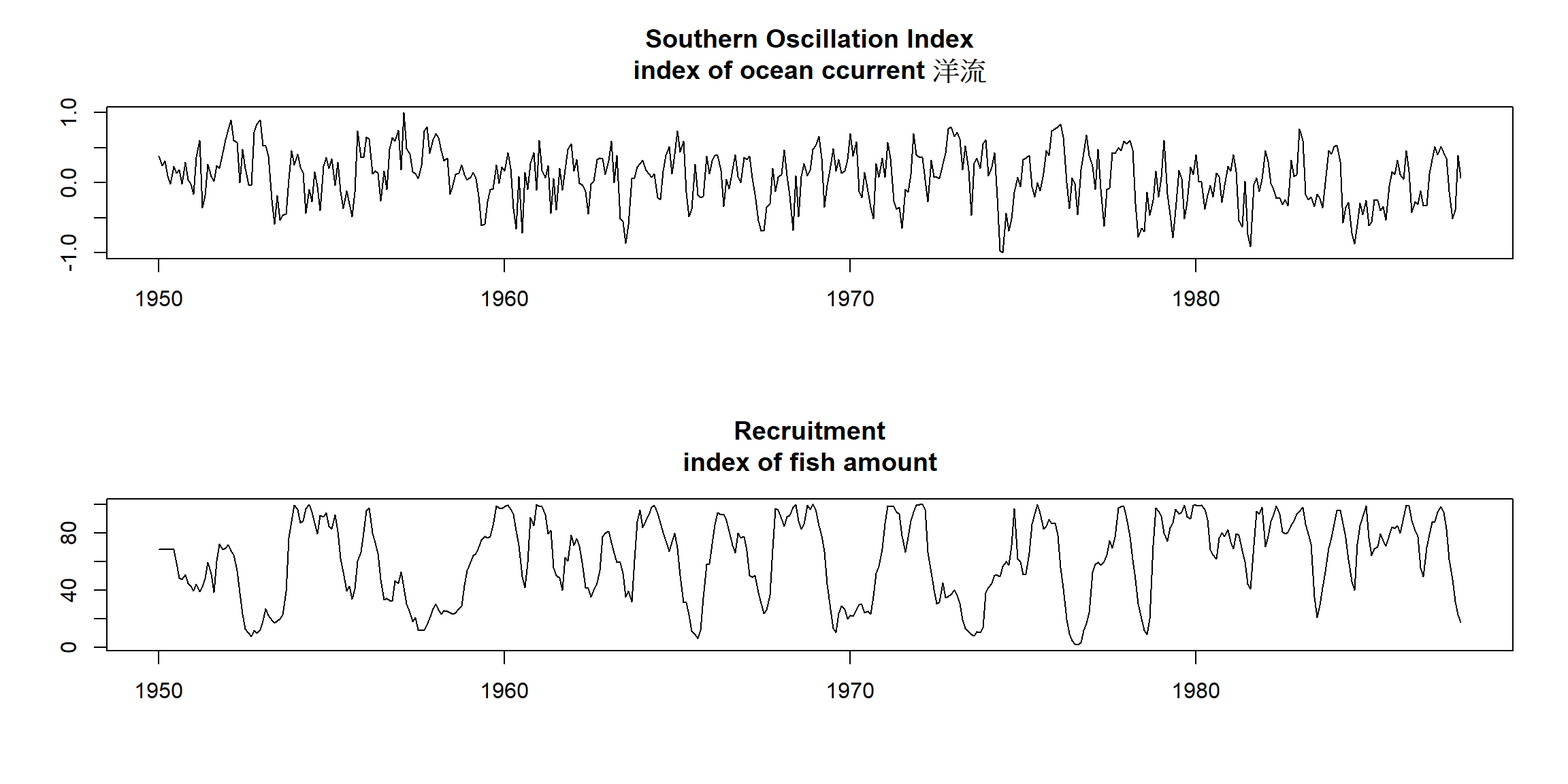

Example 1.1 (p.2)

Example 1.2 (p.3)

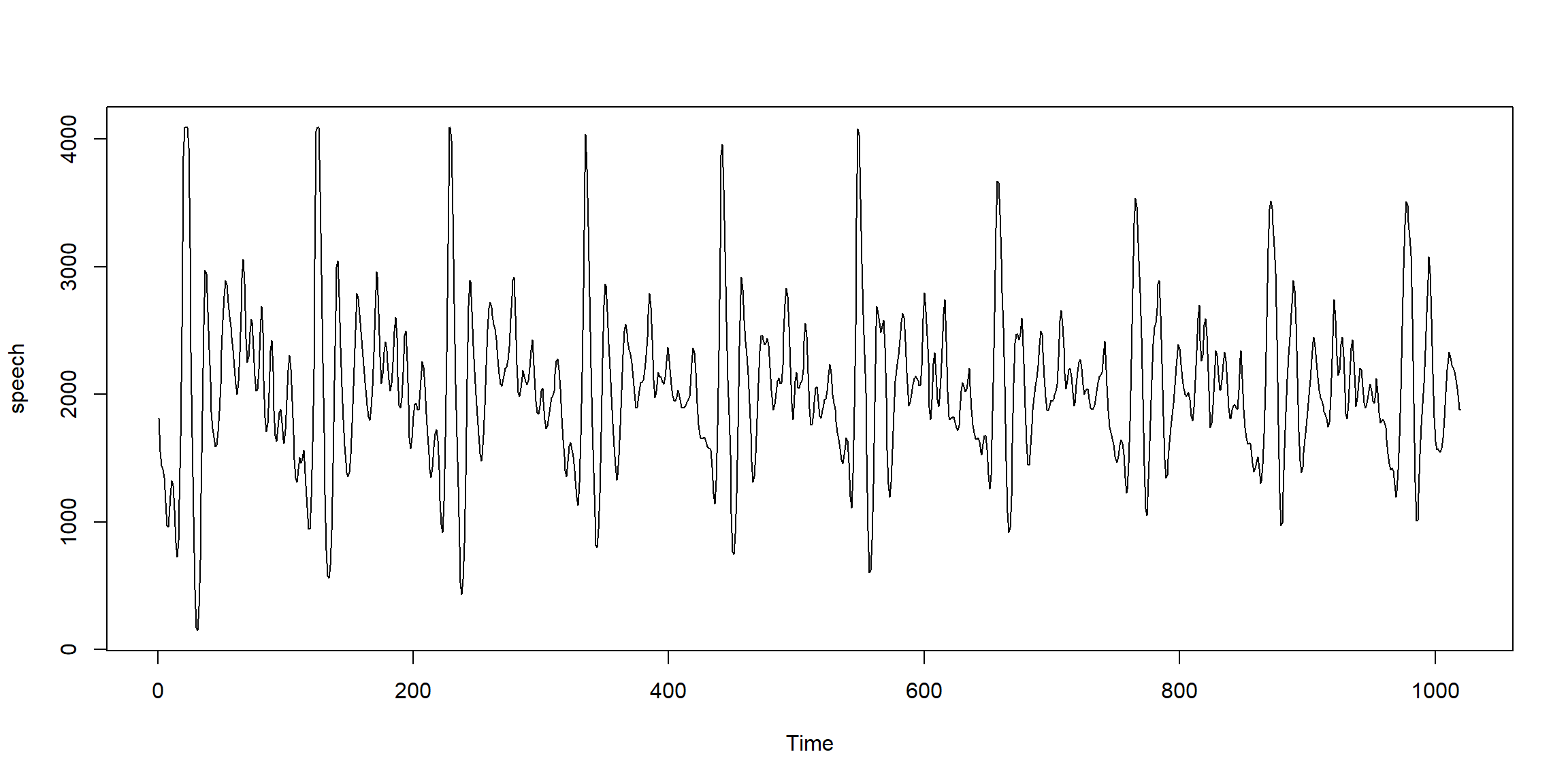

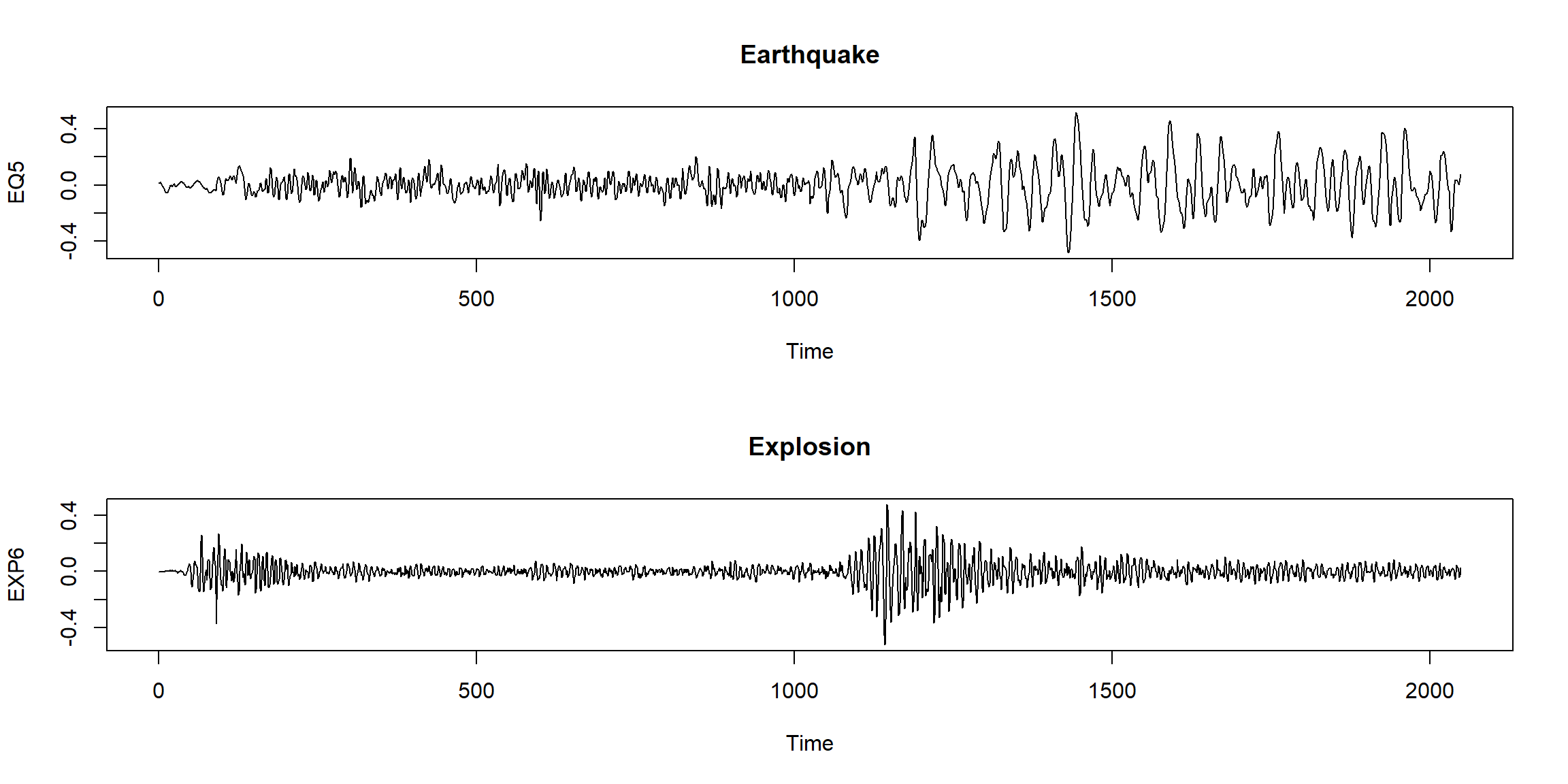

Example 1.3 (p.3) Voice record

Example 1.5 (p.5)

par(mfrow = c(2,1)) # set up the graphics

plot(soi, ylab="", xlab="", main="Southern Oscillation Index\nindex of ocean ccurrent 洋流")

plot(rec, ylab="", xlab="", main="Recruitment\nindex of fish amount")

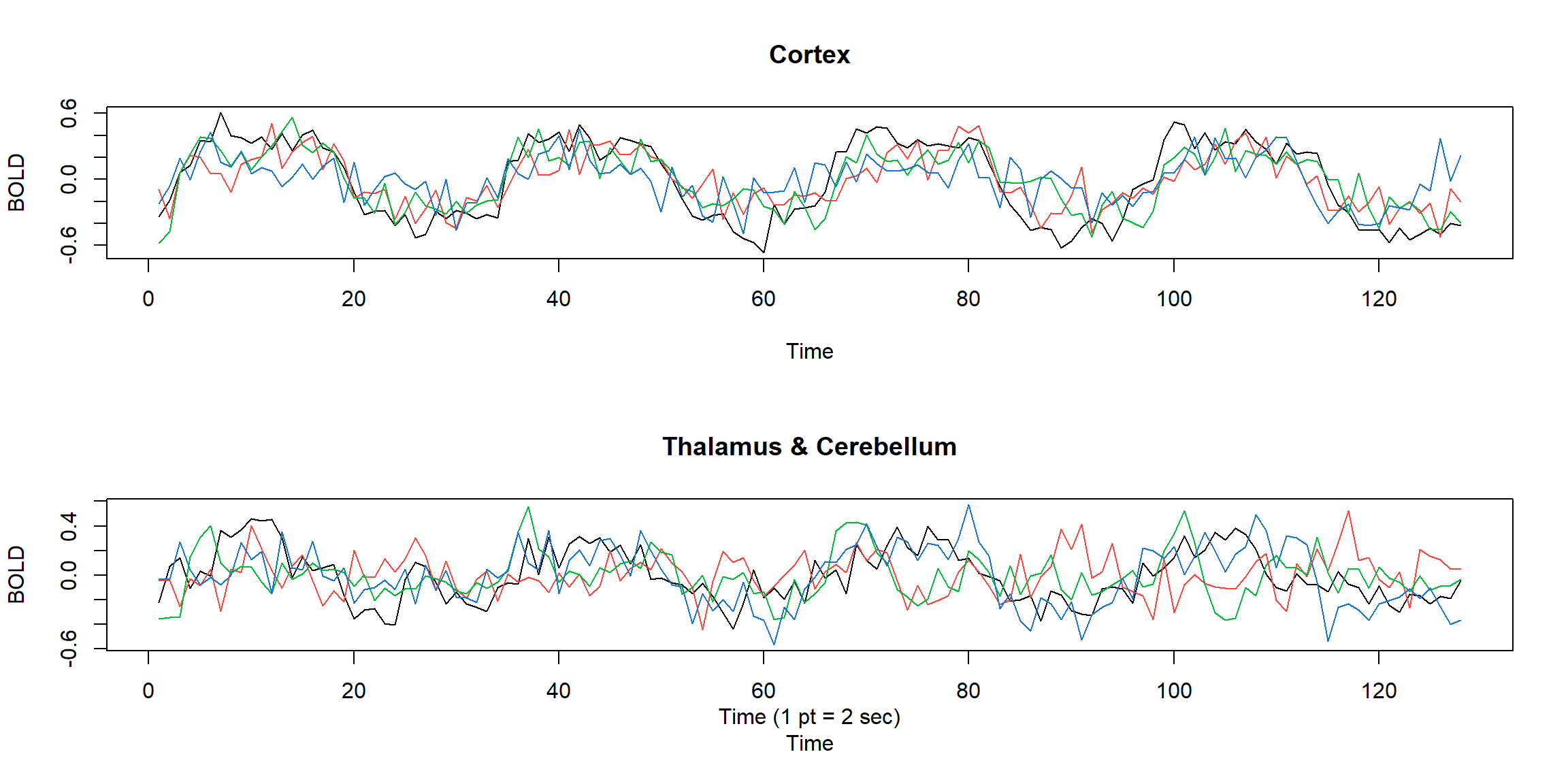

Example 1.6 (p.5) MRI data

par(mfrow=c(2,1))

ts.plot(fmri1[,2:5], col=1:4, ylab="BOLD", main="Cortex")

ts.plot(fmri1[,6:9], col=1:4, ylab="BOLD", main="Thalamus & Cerebellum")

mtext("Time (1 pt = 2 sec)",side = 1,line = 2)

Example 1.7 (p.6)

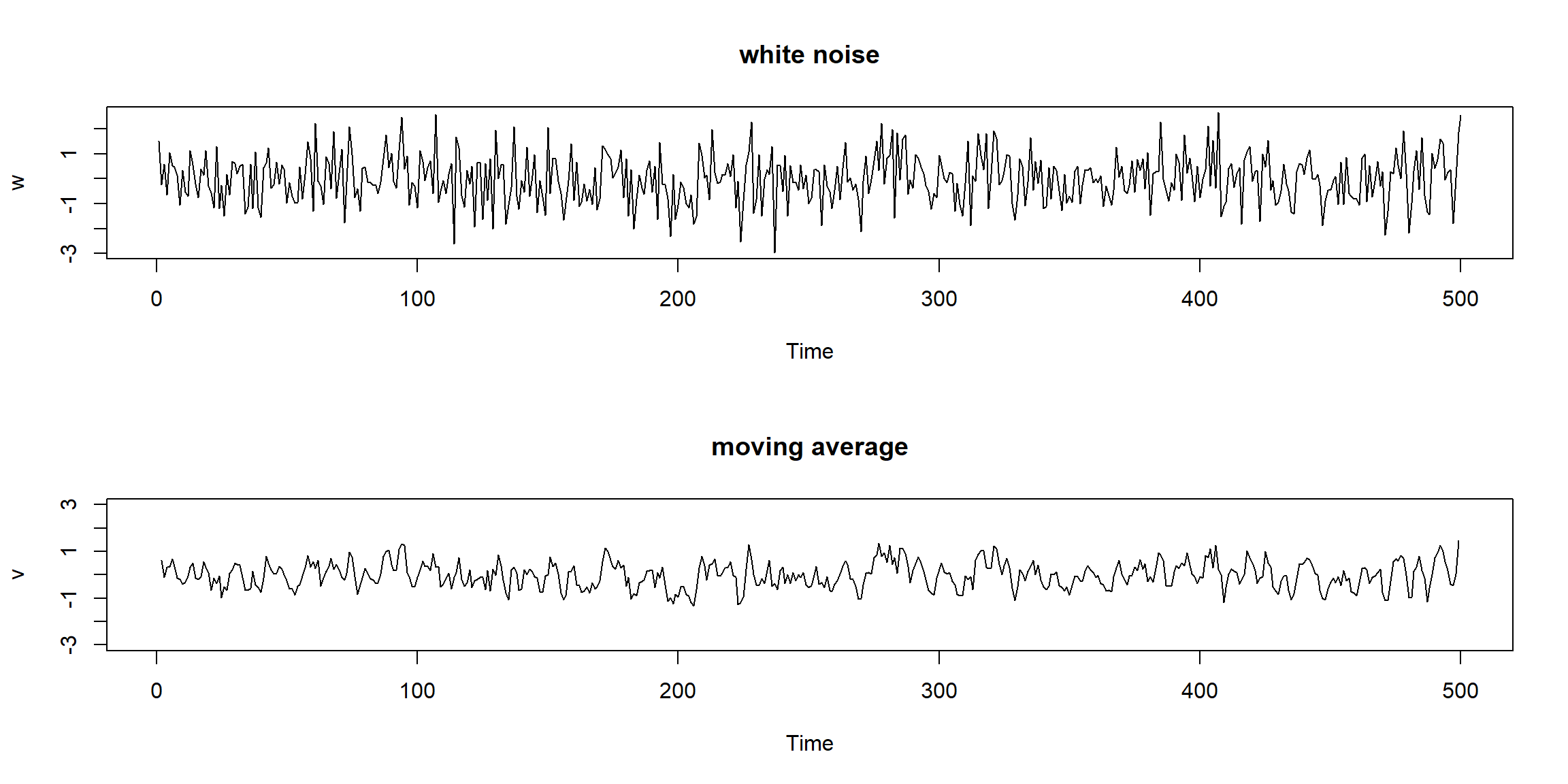

1.1.2 White Noise (WN)

Example 1.9 (p.10)

set.seed(0921)

w = rnorm(500,0,1) # 500 N(0,1) variates

v = filter(w, sides=2, filter=rep(1/3,3)) # moving average

par(mfrow=c(2,1))

plot.ts(w, main="white noise")

plot.ts(v, ylim=c(-3,3), main="moving average") \[W_t\sim N(0,1)\]

\[W_t\sim N(0,1)\]

- sides=2, center at lag 0

\[V_t=\frac1 3(W_{t-1}+W_t+W_{t+1})\]

- sides=1, for past value only

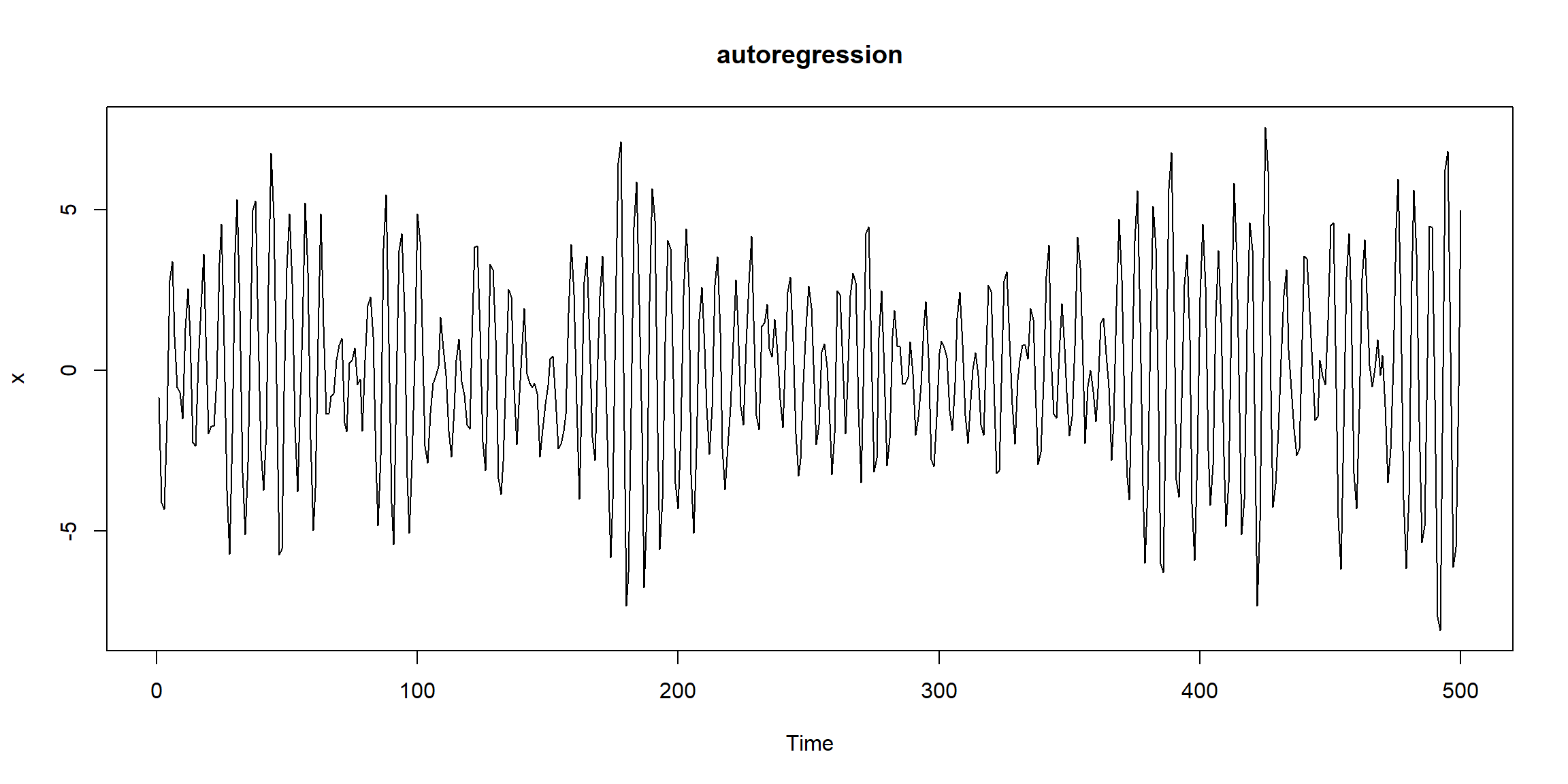

Example 1.10 (p.11)

set.seed(0921)

w = rnorm(550,0,1) # 50 extra to avoid startup problems

x = filter(w, filter=c(1,-.9), method="recursive")[-(1:50)] # remove first 50

plot.ts(x, main="autoregression") \[W_t\sim N(0,1)\]

\(X_t=W_t-0.9W_{t-1}\) (default sides=1)

\[W_t\sim N(0,1)\]

\(X_t=W_t-0.9W_{t-1}\) (default sides=1)

- \(X_t\uparrow\:\Rightarrow X_{t+1}\downarrow\)

- \(X_t\downarrow\:\Rightarrow X_{t+1}\uparrow\)

1.1.3 Random Walk

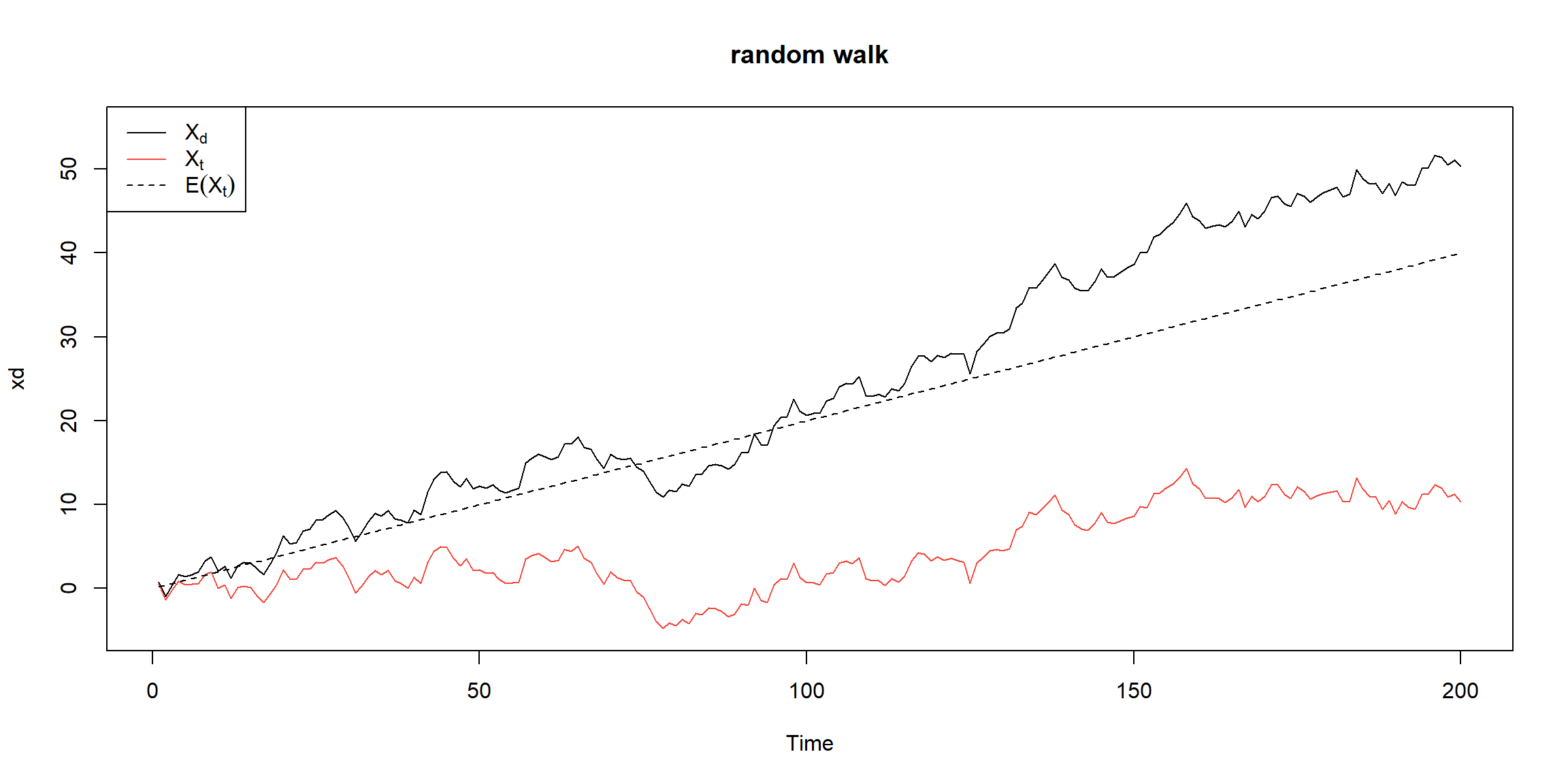

Example 1.11 (p.11)

set.seed(154) # so you can reproduce the results

w = rnorm(200,0,1); x = cumsum(w) # two commands in one line

wd = w +.2; xd = cumsum(wd)

plot.ts(xd, ylim=c(-5,55), main="random walk")

lines(x, col=2)

lines(.2*1:200,lty="dashed")

legend('topleft', col=c(1,2,1), lty=c(1,1,2),

legend = c(expression(X[d]),expression(X[t]),expression(E(X[t])))) \(X_t\) is not stationary, \(\because Var(X_t)\) depends on t.

\(X_t\) is not stationary, \(\because Var(X_t)\) depends on t.

\(X_d\) is not stationary, \(\because E(X_d)\) depends on t.

- \(W_t\sim N(0,1)\)

- \(X_t=W_1+W_2+...+W_t\)

- \(Var(X_t)=Var(W_1)+Var(W_2)+...+Var(W_t)=1\cdot t=t\)

- \(W_d=W_t+0.2\)

- \(X_d=\sum W_d=\sum W_t+0.2\cdot t\)

- \(E(X_d)=0.2\cdot t\)

\(E(aX+b)=aE(X)+b\)

\(Var(aX+b)=a^2Var(X)\)

1.1.4 Noise influence periodic

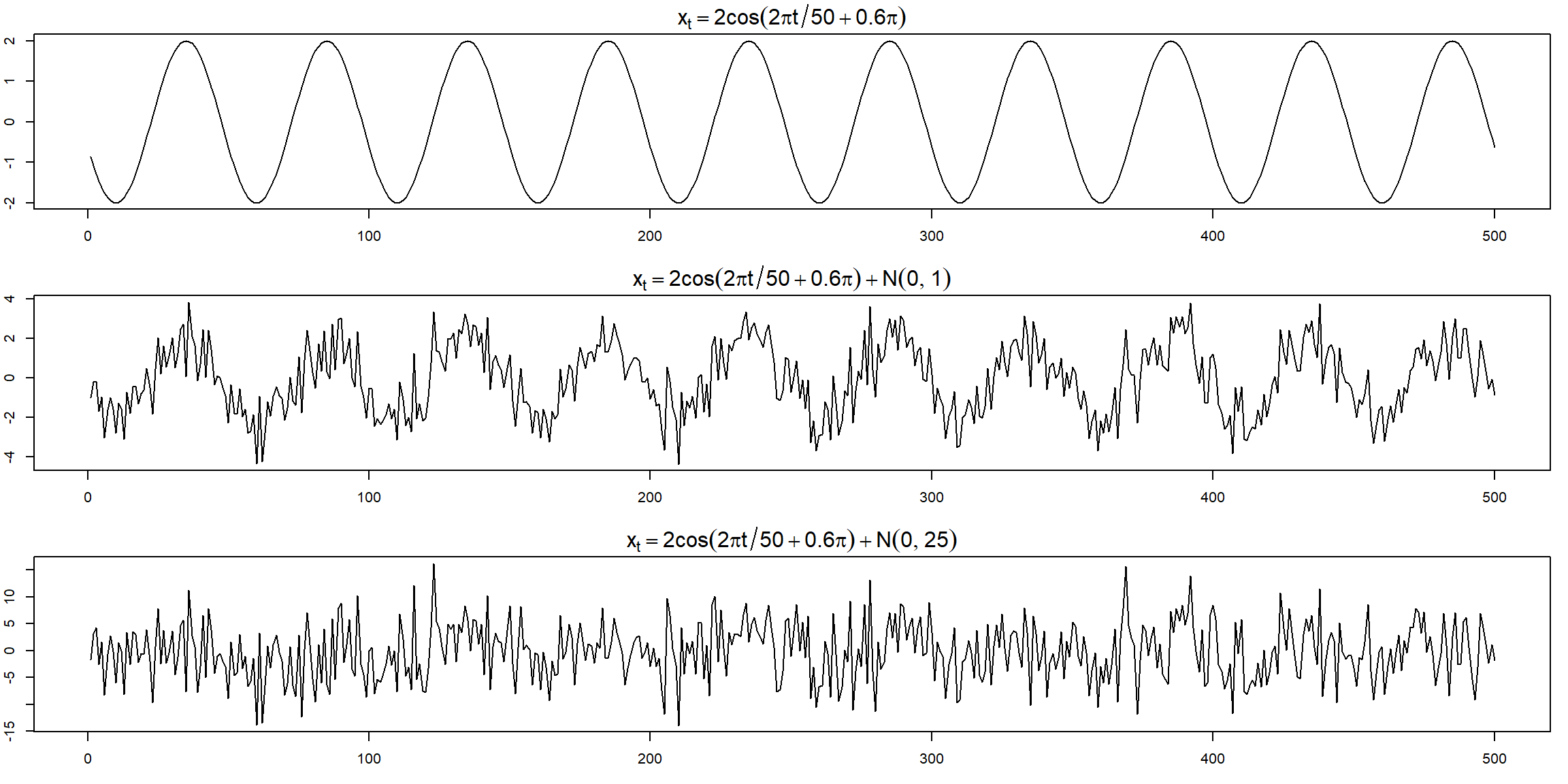

Example 1.12 (p.12)

cs = 2*cos(2*pi*1:500/50 + .6*pi); w = rnorm(500,0,1)

par(mfrow=c(3,1), mar=c(3,2,2,1), cex.main=1.5) # help(par) for info

plot.ts(cs, main=expression(x[t]==2*cos(2*pi*t/50+.6*pi)))

plot.ts(cs+w, main=expression(x[t]==2*cos(2*pi*t/50+.6*pi) + N(0,1)))

plot.ts(cs+5*w, main=expression(x[t]==2*cos(2*pi*t/50+.6*pi) + N(0,25))) The periodic behavior became less obvious when the noise is large.

The periodic behavior became less obvious when the noise is large.

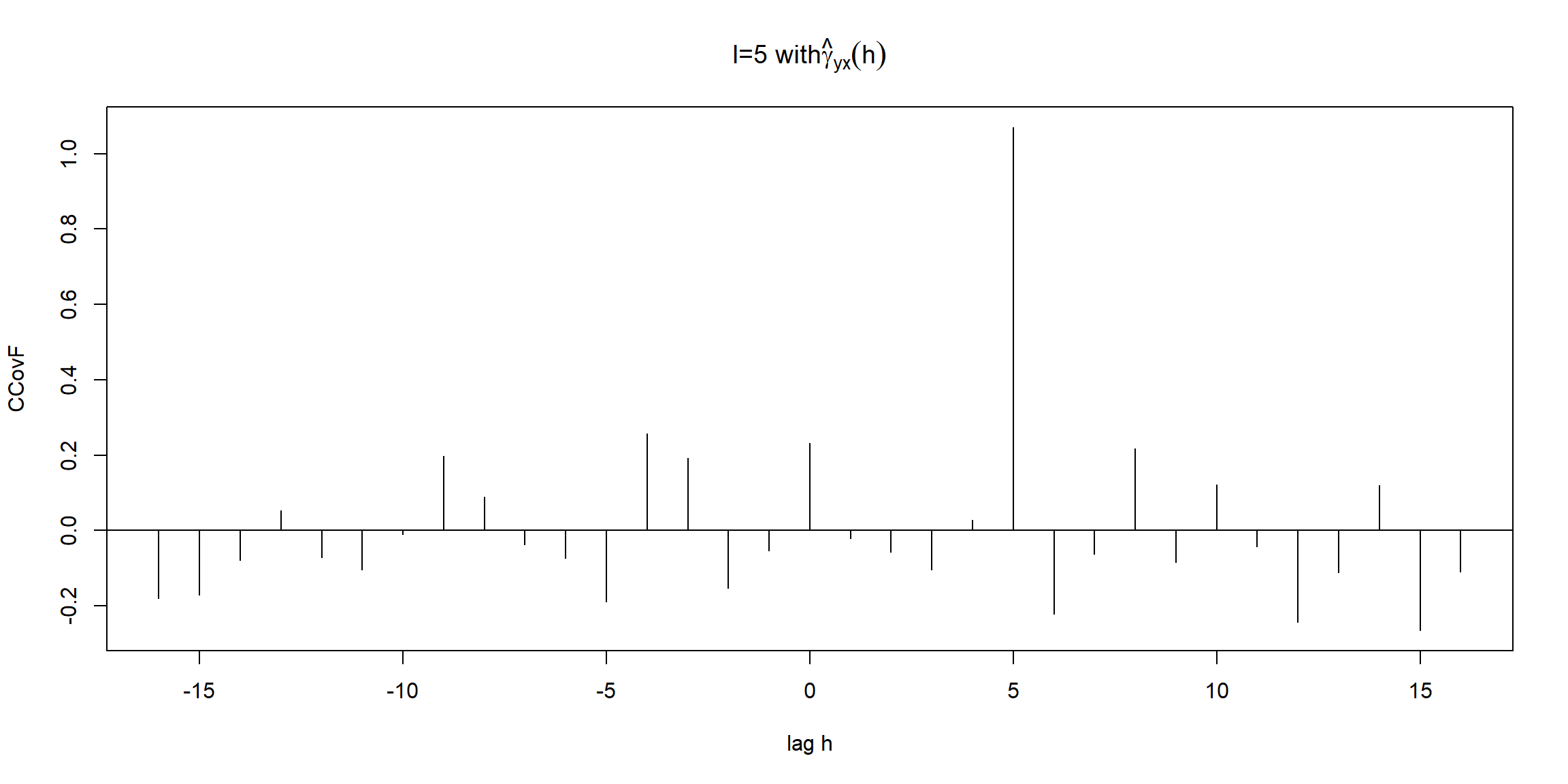

1.1.5 How lag influence plot

Example 1.24 (p.24) \[y_t=Ax_{t-l}+w_t\]

- \(l>0\), \(x_t\) lead \(y_t\)

- \(y_t=x_{t-1}+w_t\)

- \(x\) lead \(y\)

- \(l<0\), \(x_t\) lag \(y_t\)

- \(y_t=x_{t+1}+w_t\)

- \(x\) lag \(y\)

Assume \(w_t\) is uncorrelated with \(x_t\), the cross-covariance function is \[\gamma_{yx}(h)=cov(y_{t+h},x_t)=cov(Ax_{t+h-l}+w_{t+h},x_t)\\=cov(Ax_{t+h-l},x_t)=A\gamma_x(h-l)\]

When \(h=l\), \(\gamma_{yx}(h)=\gamma_x(0)\)

x = rnorm(100)

y = lag(x, -5) + rnorm(100)

par(mfrow=c(1,1))

ccf <- ccf(y, x, type='covariance',

ylab='CCovF', xlab='lag h', main=expression(paste('l=5 with', hat(gamma)[yx](h))))

- \(X\sim N(0,1)\)

- \(y_t=X_{t-5}+W_t, W_t\sim N(0,1)\)

- \(\require{enclose} \enclose{horizontalstrike}{Corr(y_t, X_{t+h})=\big\{\substack{1,\:h=5\\0,\:o.w.}}\)

- \(l=5\to\gamma_{yx}(h)=\gamma_x(h-5)\)

- \(lag\:h=5 \to\gamma_{yx}(5)=\gamma_x(0)=variance(X)=1\)

- \(y_{t+h}=Ax_{t+h-5}+w_{t+h}\)

- \(i=|h-l|=|h-5|\)

- \(h>5\to\gamma_{yx}(h)=cov(Ax_{t+i},x_t)\to x\:leads\)

- \(h<5\to\gamma_{yx}(h)=cov(Ax_{t-i},x_t)\to y\:leads\)

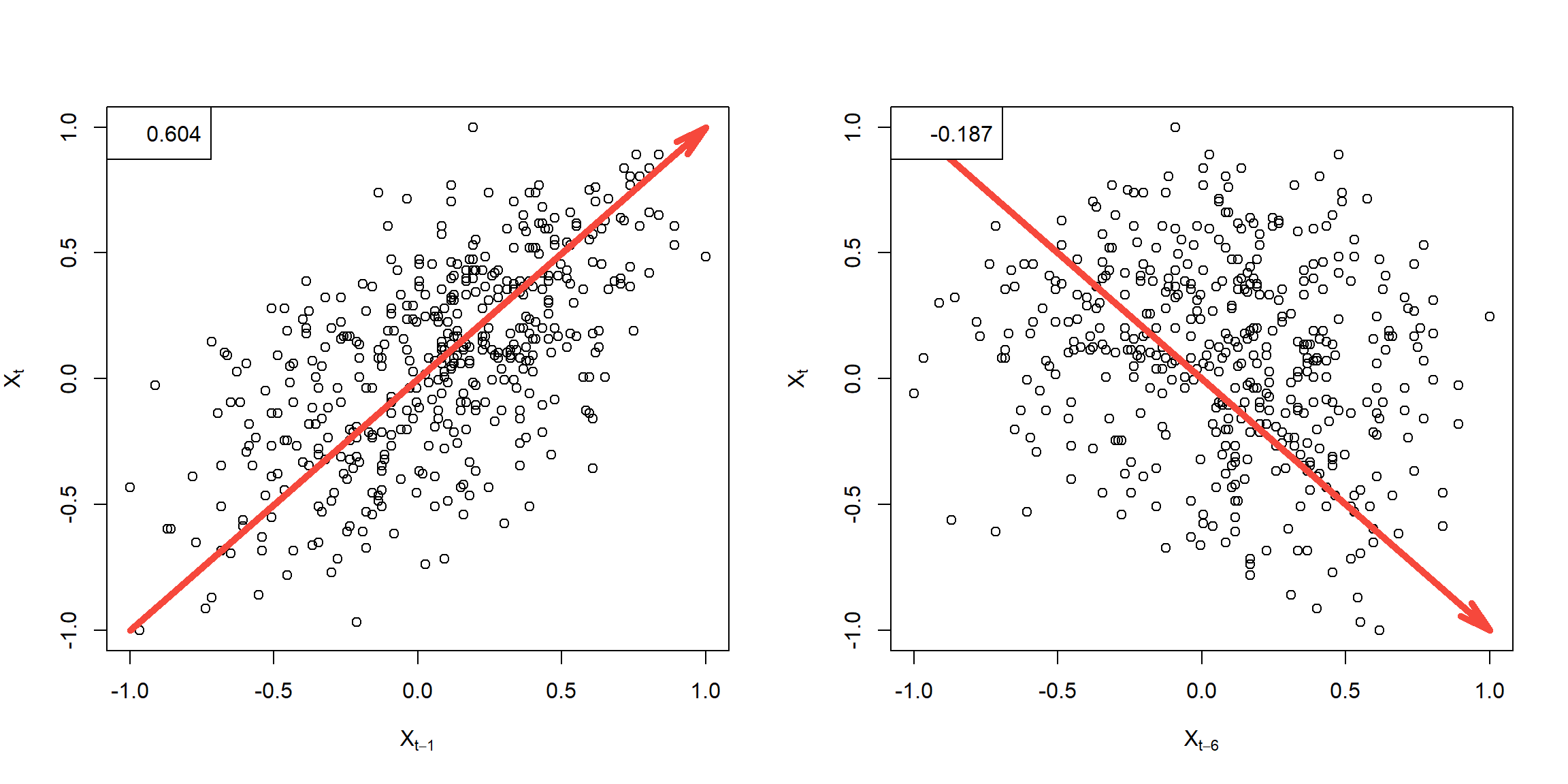

Example 1.25 (p.28)

par(mfrow=c(1,2))

r = round(acf(soi, 6, plot=FALSE)$acf[-1], 3)

plot(lag(soi,-1), soi, ylab=expression(X[t]), xlab=expression(X[t-1]))

arrows(-1,-1,1,1, col=2, angle = 15, lwd=5)

legend('topleft', legend=r[1])

plot(lag(soi,-6), soi, ylab=expression(X[t]), xlab=expression(X[t-6]))

arrows(-1,1,1,-1, col=2, angle = 15, lwd=5)

legend('topleft', legend=r[6])

1.2 Explore Data

1.2.1 Estimate a linear trend

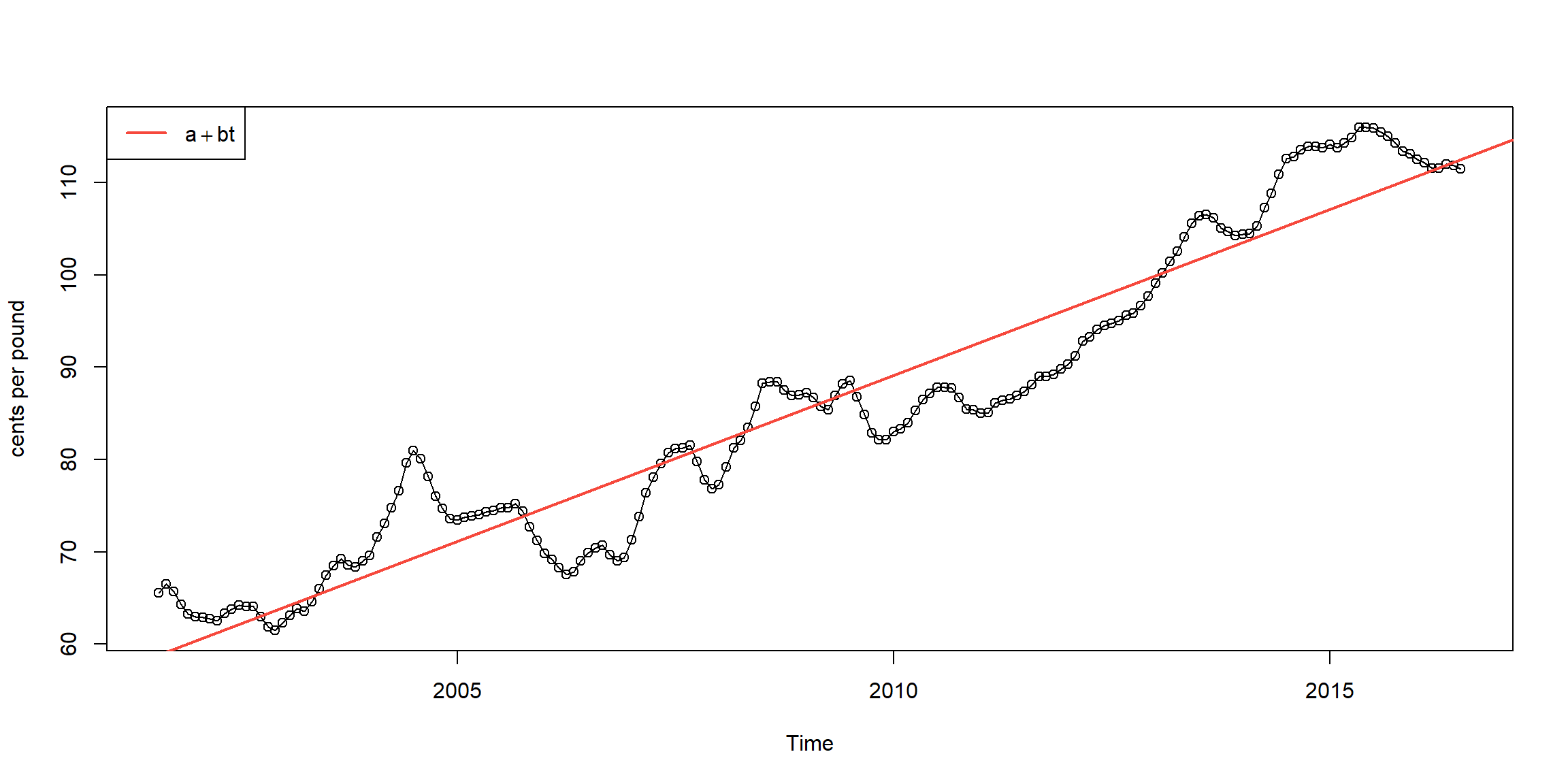

Example 2.1 (p.45) \[x_t=a+b\cdot t+W_t\]

##

## Call:

## lm(formula = chicken ~ time(chicken))

##

## Residuals:

## Min 1Q Median 3Q Max

## -8.7411 -3.4730 0.8251 2.7738 11.5804

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) -7.131e+03 1.624e+02 -43.91 <2e-16 ***

## time(chicken) 3.592e+00 8.084e-02 44.43 <2e-16 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 4.696 on 178 degrees of freedom

## Multiple R-squared: 0.9173, Adjusted R-squared: 0.9168

## F-statistic: 1974 on 1 and 178 DF, p-value: < 2.2e-16plot(chicken, type="o",ylab="cents per pound")

abline(fit, lwd=2, col=2) # add regression line to the plot

legend('topleft', expression(a+bt), lwd=2, col=2)

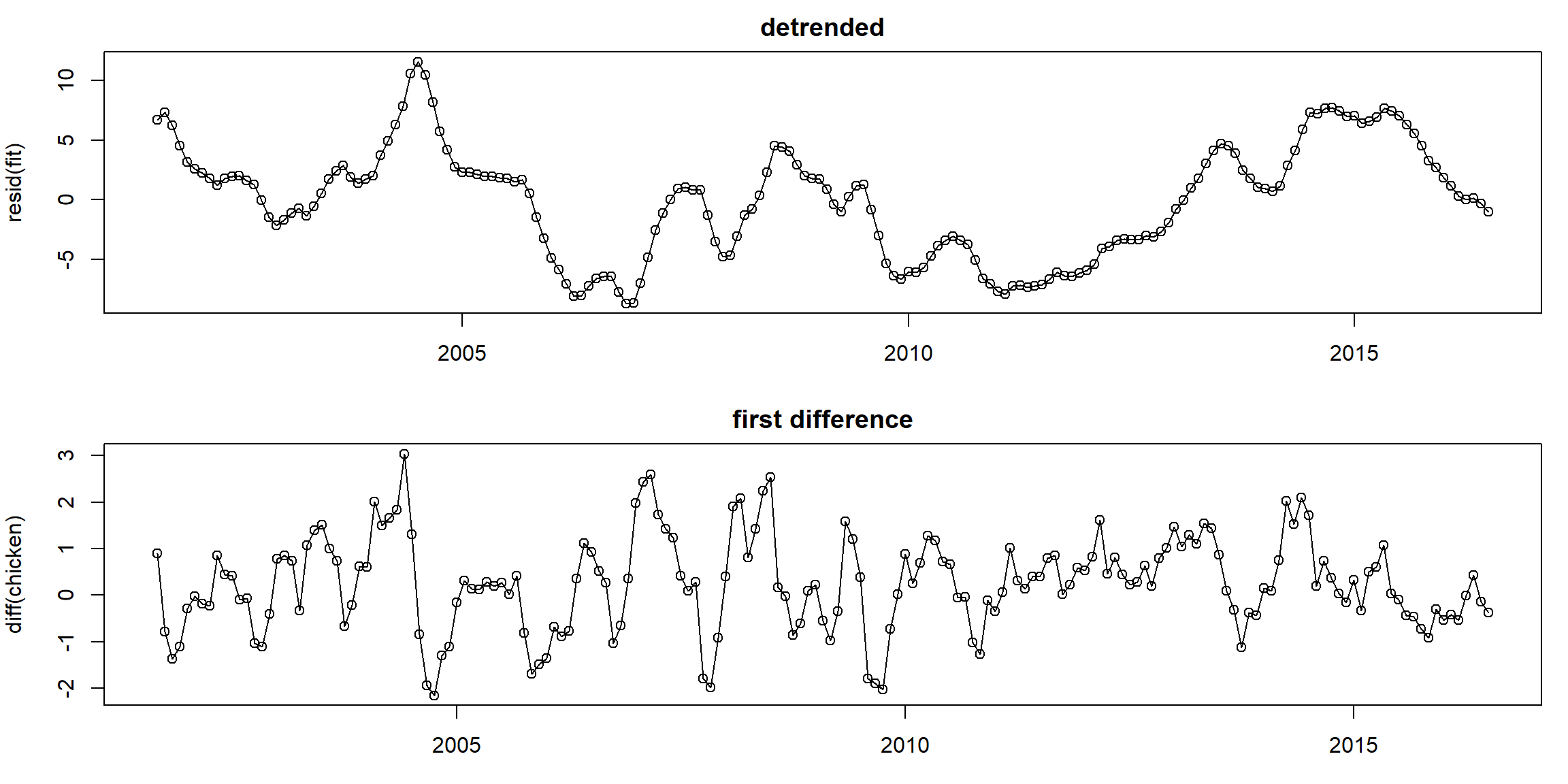

1.2.2 Detrend and Differencing

Example 2.4 and 2.5 (p.54, 58) \[x_t=a+b\cdot t+W_t\]

- detrended: \(X_t-a-b\cdot t\)

- first difference: \(\nabla X_t=X_t-X_{t-1}\)

fit = lm(chicken~time(chicken), na.action=NULL) # regress chicken on time

par(mfrow=c(2,1), mar=c(3,4,2,1))

plot(resid(fit), type="o", main="detrended")

plot(diff(chicken), type="o", main="first difference")

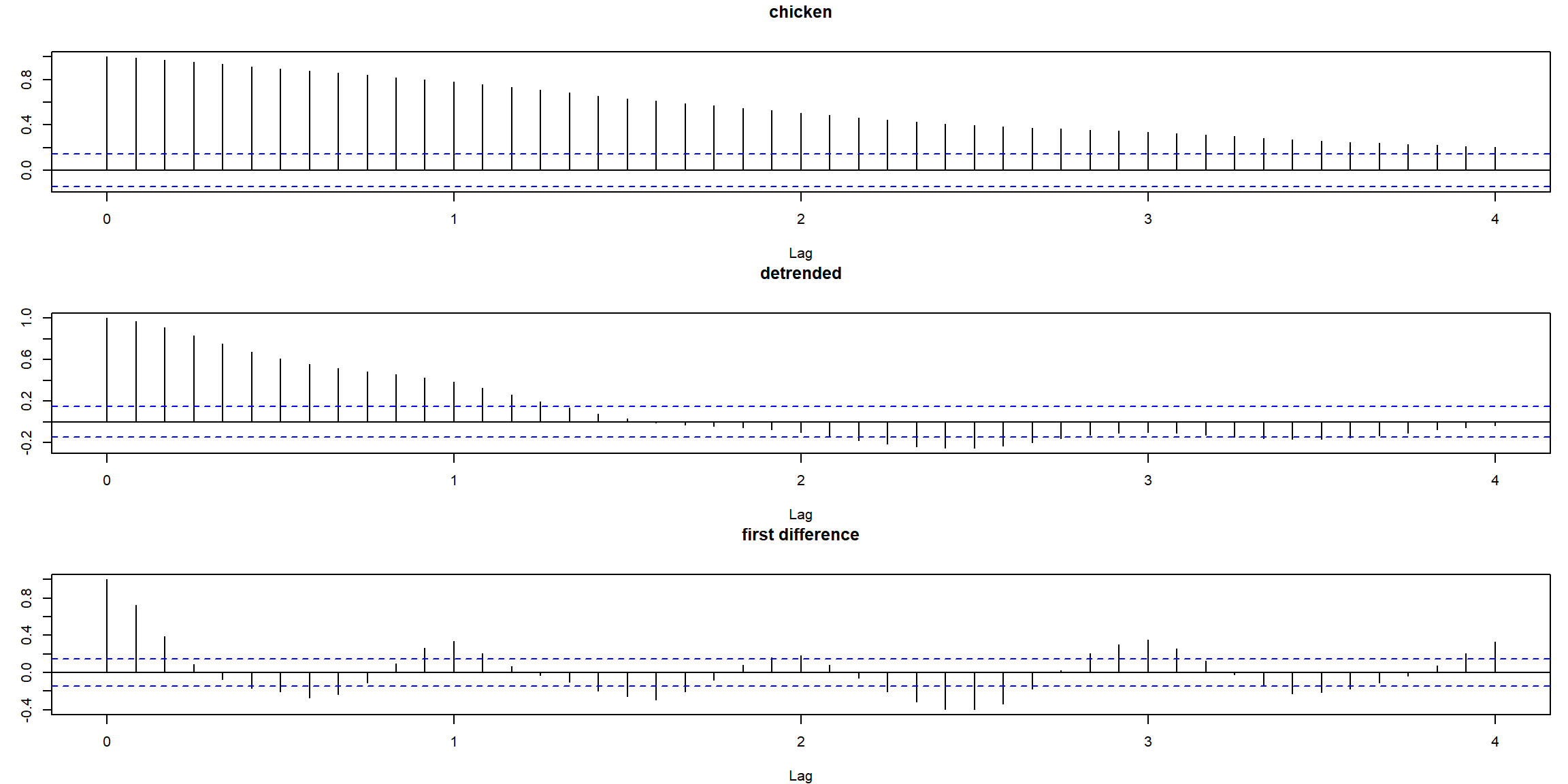

par(mfrow=c(3,1), mar=c(4,3,3,1)) # plot ACFs

acf(chicken, 48, main="chicken")

acf(resid(fit), 48, main="detrended")

acf(diff(chicken), 48, main="first difference")

- first difference does better than regression

- ACF of stationary process decays fast to zero

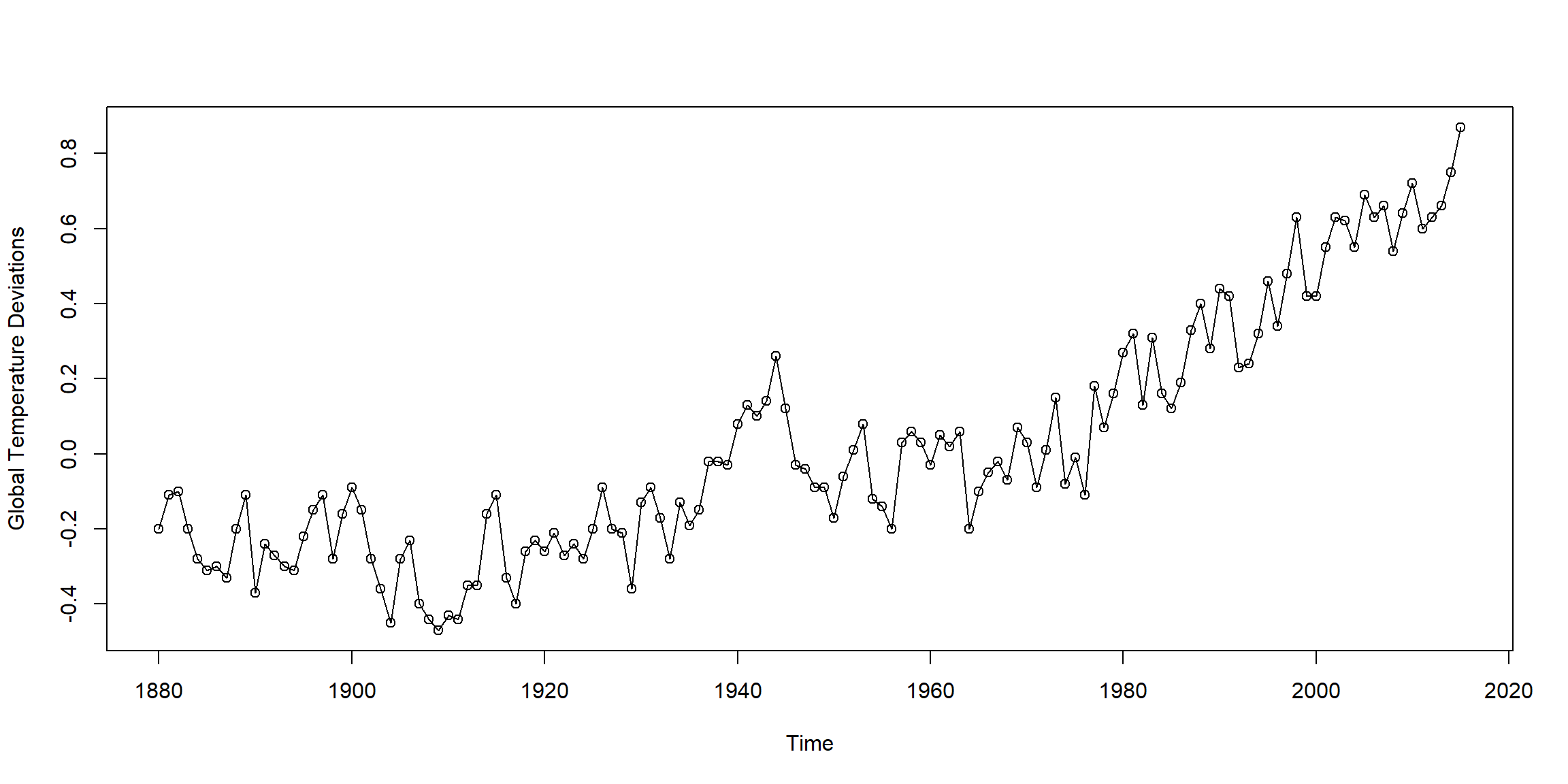

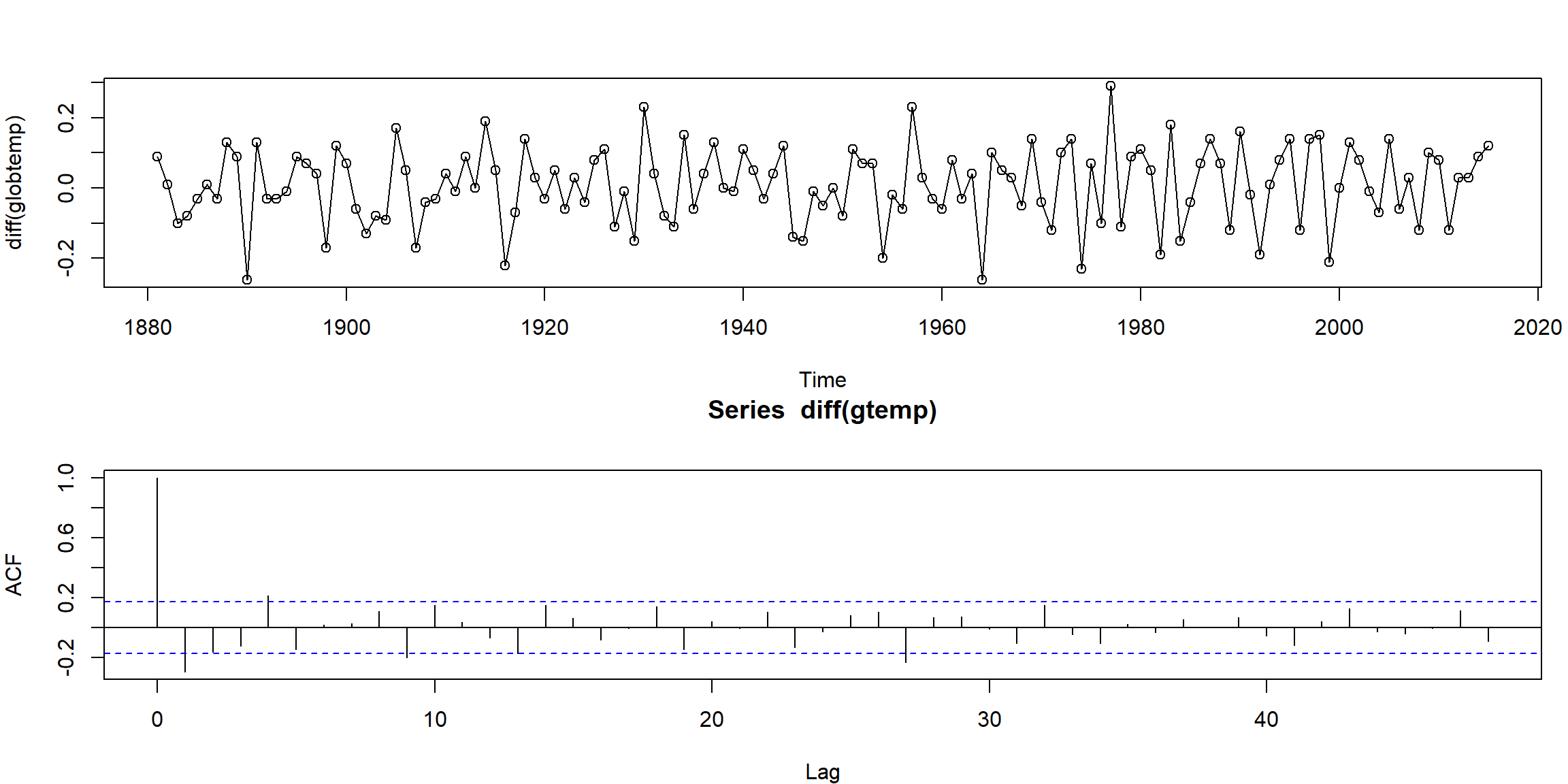

Example 2.6 (p.58)

par(mfrow=c(2,1), mar=c(4,4,3,1))

plot(diff(globtemp), type="o")

mean(diff(globtemp)) # drift estimate = .008## [1] 0.007925926

- look stationary after first-order differencing

1.2.3 Smoothing

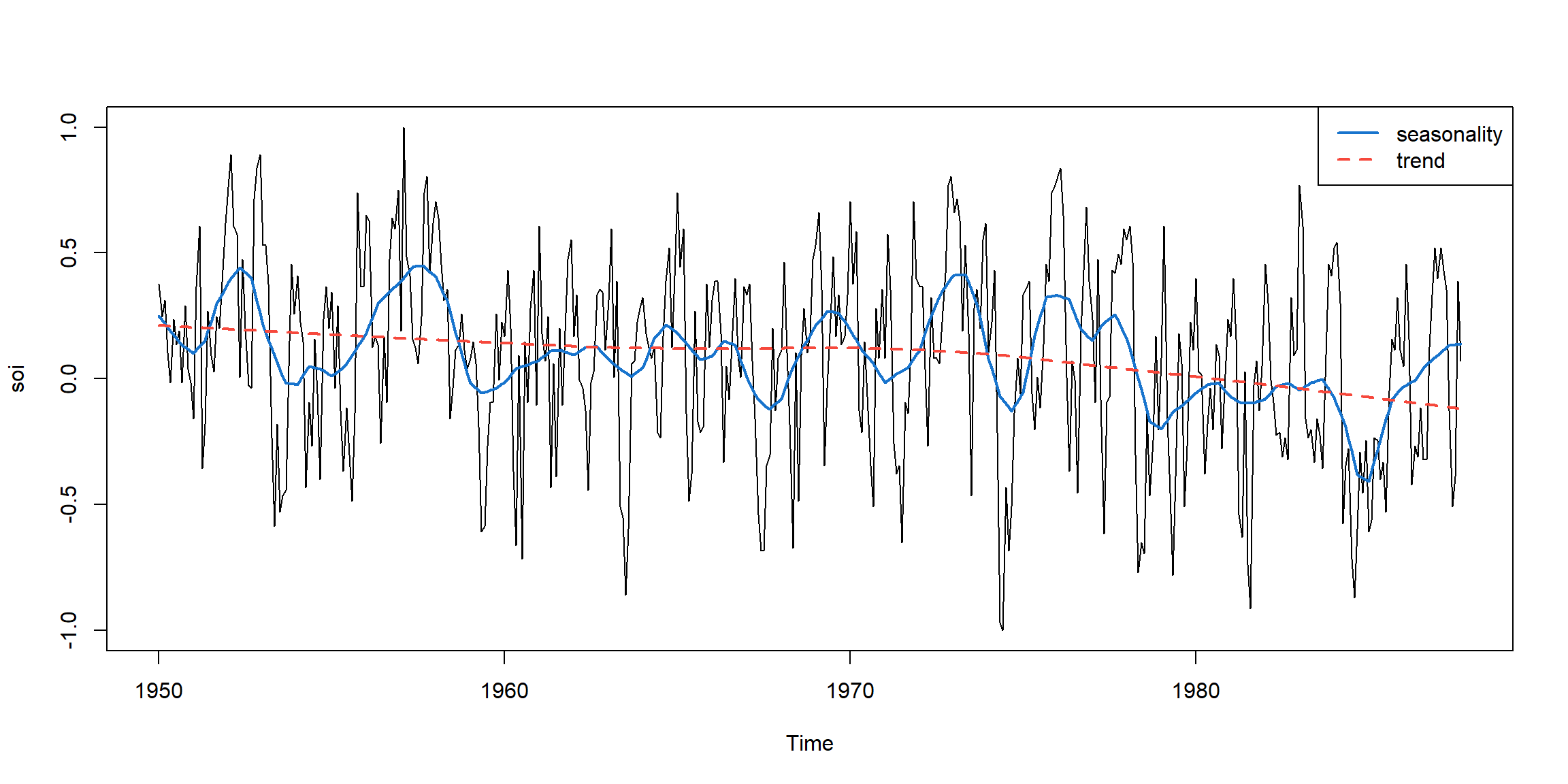

Example 2.13 (p.67) lowess

lowess(x, y = NULL, f = 2/3)f: the smoother span (band width)

plot(soi)

lines(lowess(soi, f=.05), lwd=2, col=4) # El Nino cycle

lines(lowess(soi), lty=2, lwd=2, col=2) # trend (with default span)

legend('topright', c('seasonality','trend'), col=c(4,2), lty=c(1,2), lwd=2)

- seasonality: small band width

- trend: large band width

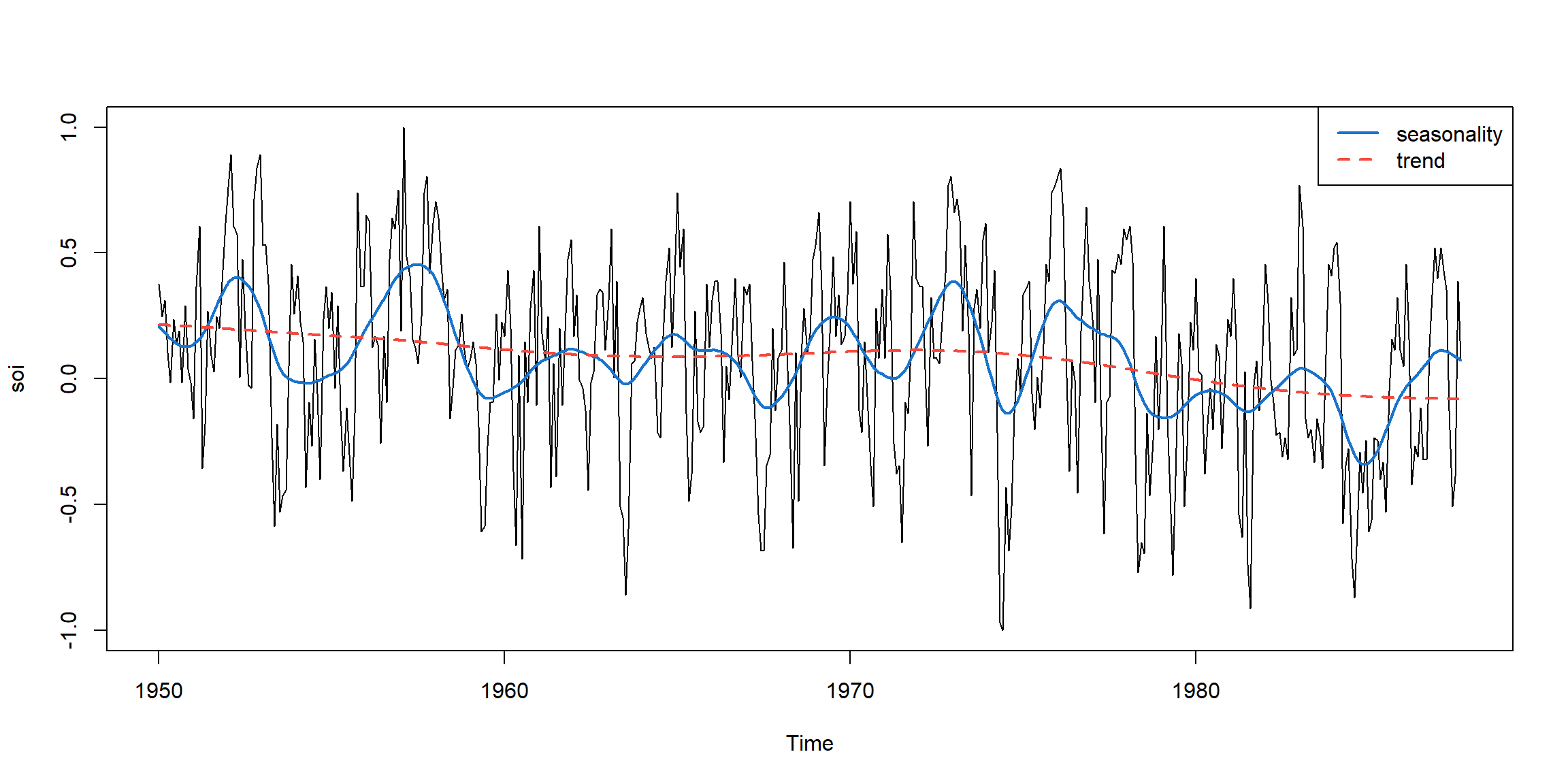

Example 2.14 (p.68) smooth.spline

smooth.spline(x, y, spar = NULL)x: predictory: responsespar: smoothing parameter, typically (but not necessarily) in (0,1]

plot(soi)

lines(smooth.spline(time(soi), soi, spar=.5), lwd=2, col=4)

lines(smooth.spline(time(soi), soi, spar= 1), lty=2, lwd=2, col=2)

legend('topright', c('seasonality','trend'), col=c(4,2), lty=c(1,2), lwd=2)

1.3 Time Series model

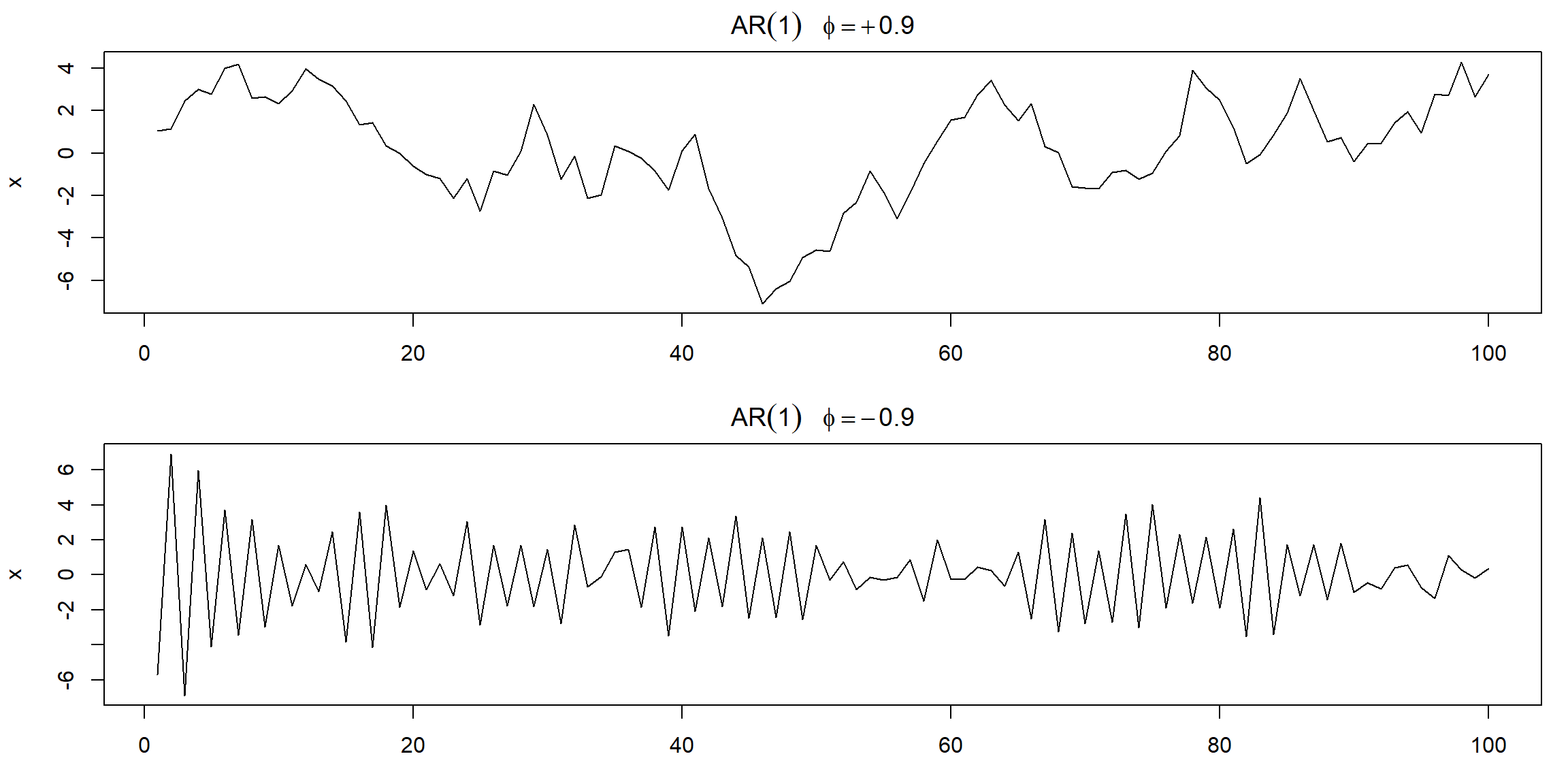

Example 3.2 (p.78) AR(1)

arima.sim: Simulate from an ARIMA model.order:c(p, d, q)\(\to\) AR order, degree of differencing, MA order.- ARIMA(0,0,0) is white noise.

- If AR(2) \(\to\)

order=c(2,0,0), ar=c(.5, .1)

par(mfrow=c(2,1), mar=c(3,4,2,1))

plot(arima.sim(list(order=c(1,0,0), ar=.9), n=100), ylab="x",

main=(expression(AR(1)~~~phi==+.9)))

plot(arima.sim(list(order=c(1,0,0), ar=-.9), n=100), ylab="x",

main=(expression(AR(1)~~~phi==-.9)))

| top | bottom |

|---|---|

| \(\rho(h)=\color{red}{(0.9)}^h, h\geq0\) | \(\rho(h)=\color{red}{(-0.9)}^h, h\geq0\) |

| positively correlated | negatively correlated |

| look like trend | fluctuate rapidly |

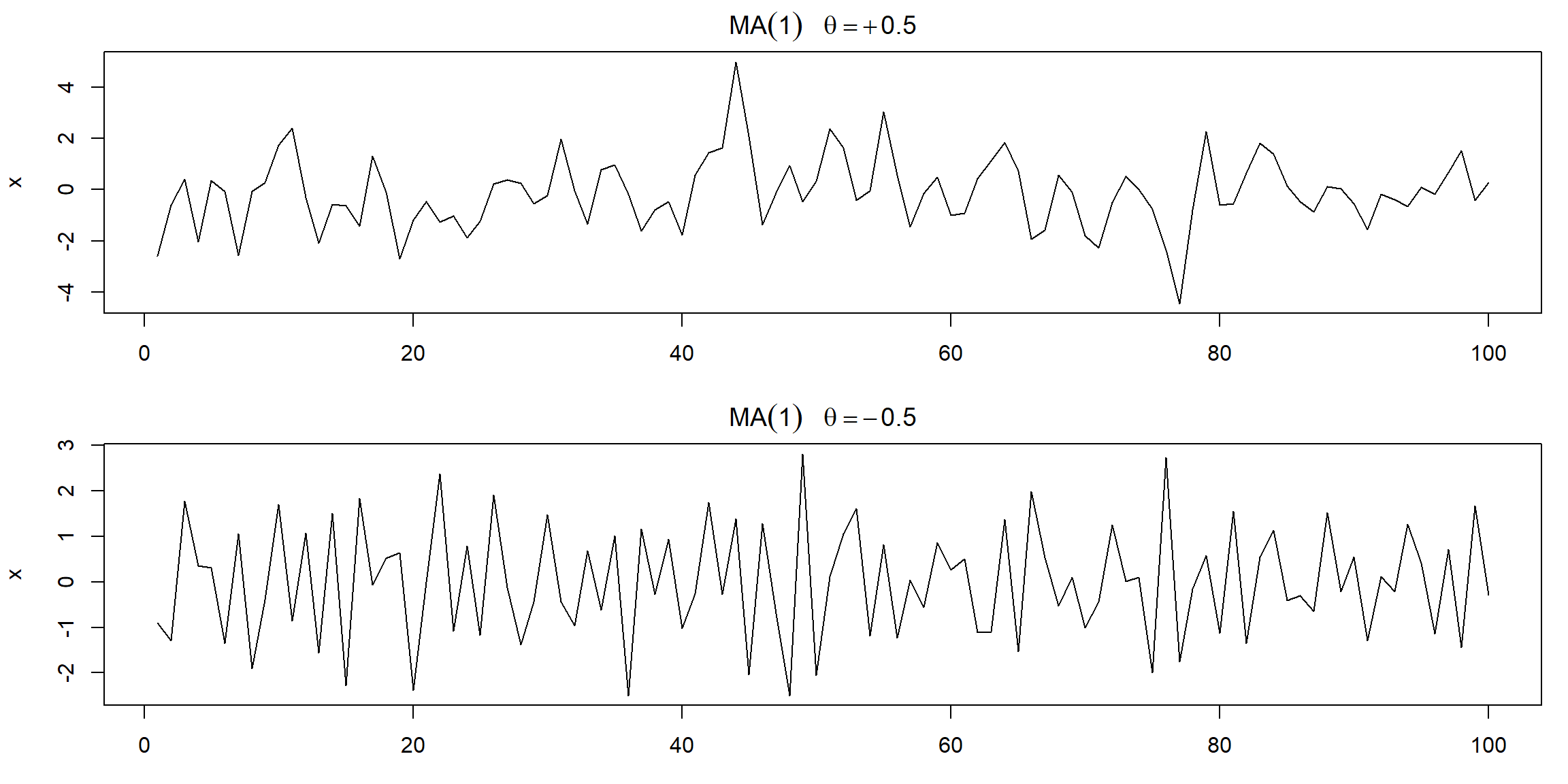

Example 3.5 (p.82) MA MA(1) model \(x_t=w_t+\theta w_{t-1}\) \[ E(x_t)=0\\ \gamma(h)=\Bigg\{\begin{array}{ll} (1+\theta^2)\sigma^2_w,&h=0\\ \theta\sigma^2_w,&h=1\\ 0,&h>1 \end{array}\\ \rho(h)=\Big\{\begin{array}{ll} \frac{\theta}{1+\theta^2},&h=1\\ 0,&h>1 \end{array} \]

par(mfrow = c(2,1), mar=c(3,4,2,1))

plot(arima.sim(list(order=c(0,0,1), ma=.9), n=100), ylab="x",

main=(expression(MA(1)~~~theta==+.5)))

plot(arima.sim(list(order=c(0,0,1), ma=-.9), n=100), ylab="x",

main=(expression(MA(1)~~~theta==-.5)))

| top | bottom |

|---|---|

| \(\theta=0.5\Rightarrow x_t, x_{t-1}\) are positively correlated | \(\theta=-0.5\Rightarrow x_t, x_{t-1}\) are negatively correlated |

| \(\rho(1)=\frac{0.5}{1+0.5^2}=0.4\Rightarrow\) weak dependence |

- The series for which \(\theta=0.5\) is smoother than the series for \(\theta=-0.5\).

Example 3.7 (p.84) parameter redundency If we were unaware of parameter redundancy, we might claim the data are correlated when in fact they are not

\[ X_t\sim N(5,1),\text{ fit ARIMA(1,1) to X}\\ X_t=\phi X_{t-1}+W_t+\theta W_{t-1} \]

set.seed(8675309)

x = rnorm(150, mean=5) # generate iid N(5,1)s

out <- arima(x, order=c(1,0,1)); out # estimation##

## Call:

## arima(x = x, order = c(1, 0, 1))

##

## Coefficients:

## ar1 ma1 intercept

## -0.9595 0.9527 5.0462

## s.e. 0.1688 0.1750 0.0727

##

## sigma^2 estimated as 0.7986: log likelihood = -195.98, aic = 399.96- \(\phi=\) -0.96, \(\theta=\) 0.95

- \((1+0.96B)X_t=(1+0.95B)W_t\)

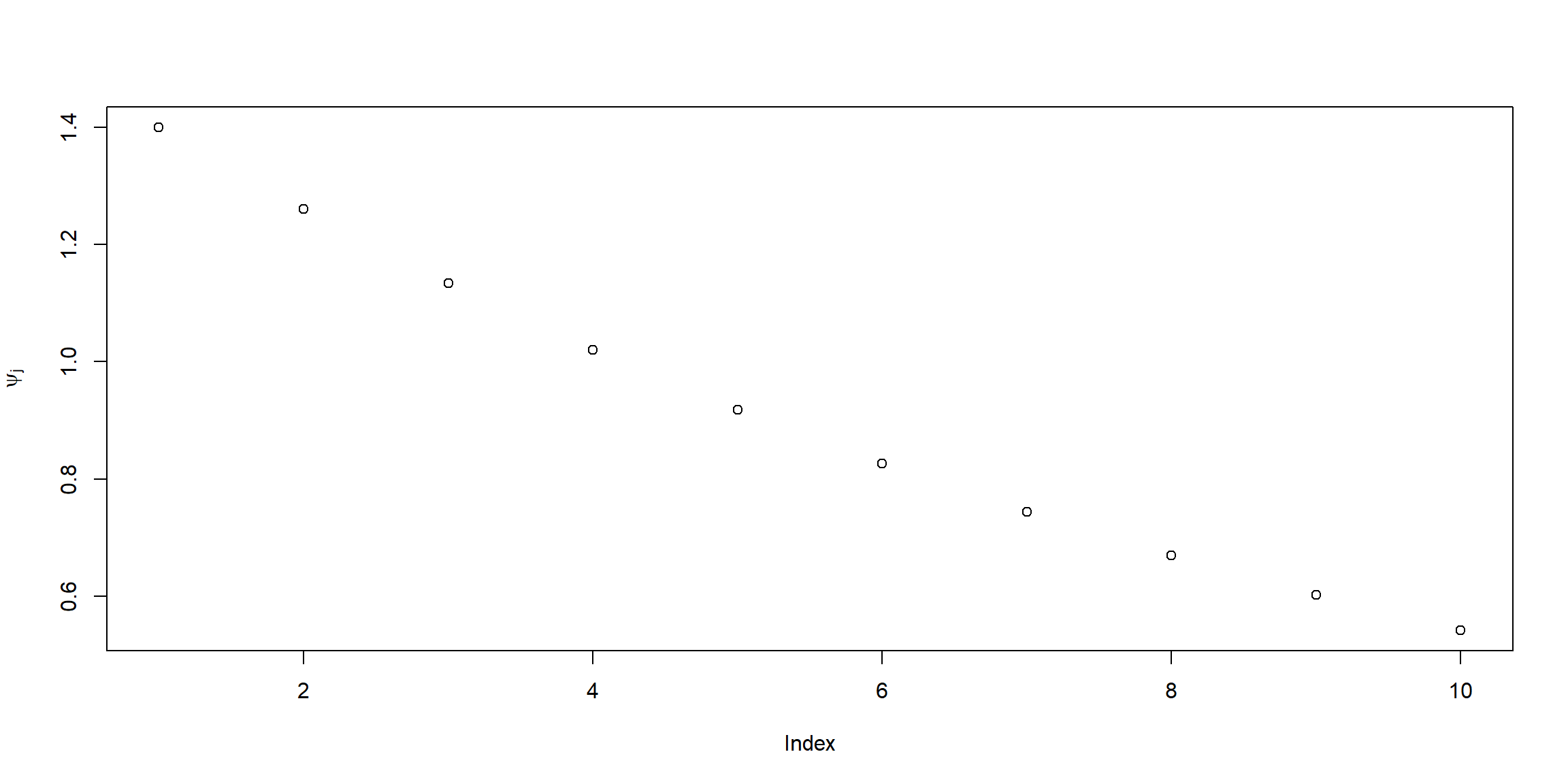

Example 3.8 (p.86) ARMA to MA

## [1] 1.4000000 1.2600000 1.1340000 1.0206000 0.9185400 0.8266860 0.7440174

## [8] 0.6696157 0.6026541 0.5423887

## [1] -1.400000000 0.700000000 -0.350000000 0.175000000 -0.087500000

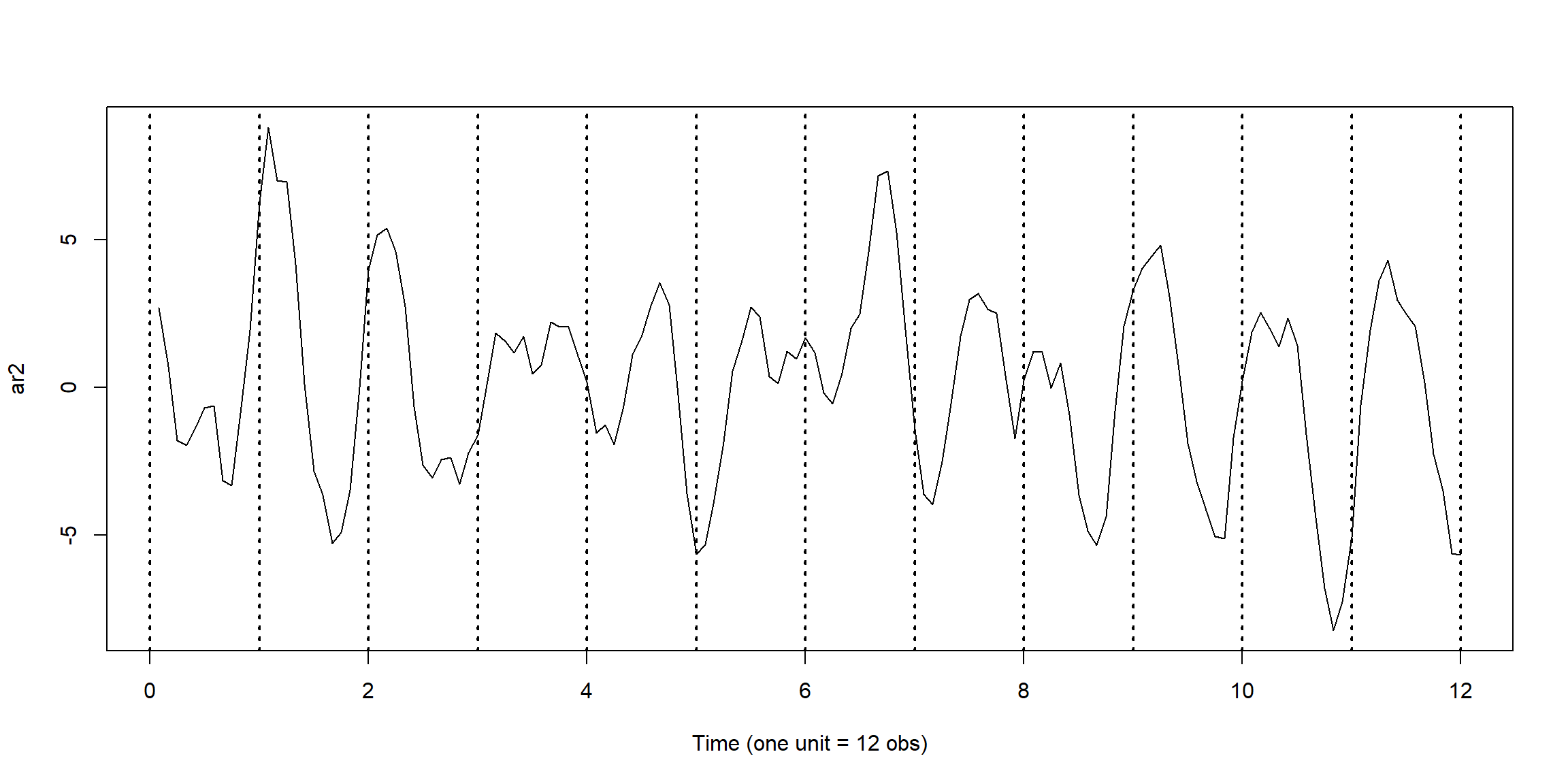

## [6] 0.043750000 -0.021875000 0.010937500 -0.005468750 0.002734375Example 3.11 (p.92) AR(2)

z = c(1,-1.5,.75) # coefficients of the polynomial

(a = polyroot(z)[1]) # = 1+0.57735i,print one root = 1 + i/sqrt(3)## [1] 1+0.57735ipolyroot: 解根

\[f(x)=1-1.5x+0.75x^2\]

## [1] 12\[ z=x+iy\\ r=\sqrt{x^2+y^2}\\ \phi=Arg(z)\\ x=r\cdot cos(\phi),\;y=r\cdot sin(\phi) \]

set.seed(90210)

ar2 = arima.sim(list(order=c(2,0,0), ar=c(1.5,-.75)), n = 144) # simulated data

plot(1:144/12,ar2,type="l",xlab="Time (one unit = 12 obs)")

abline(v=0:12, lty="dotted",lwd=2)

\[X_t=1.5X_{t-1}-0.75X_{t-2}+W_t\]

- has seasonality with period \(d=12\)

- AR(2) process is not stationary

- MA(q) process is always stationary

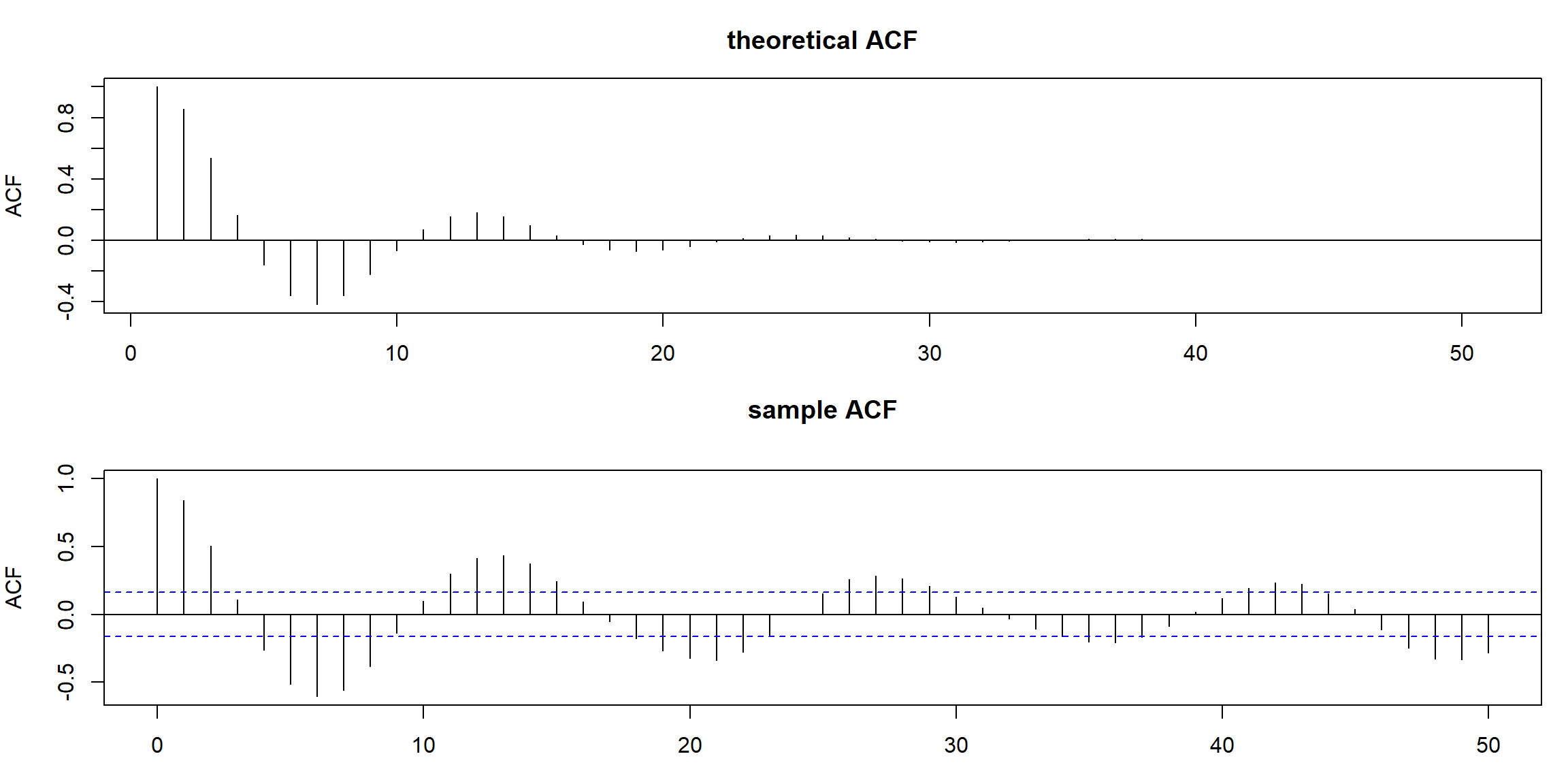

ACF = ARMAacf(ar=c(1.5,-.75), ma=0, 50) # theoretical

par(mfrow = c(2,1), mar=c(3,4,3,1))

plot(ACF, type="h", xlab="lag", main="theoretical ACF")

abline(h=0)

acf(ar2, lag.max = 50, main="sample ACF")

ARMAacf: theoretical ACF (when model is given)acf: sample ACF (when data is given)- ACF has periodic pattern

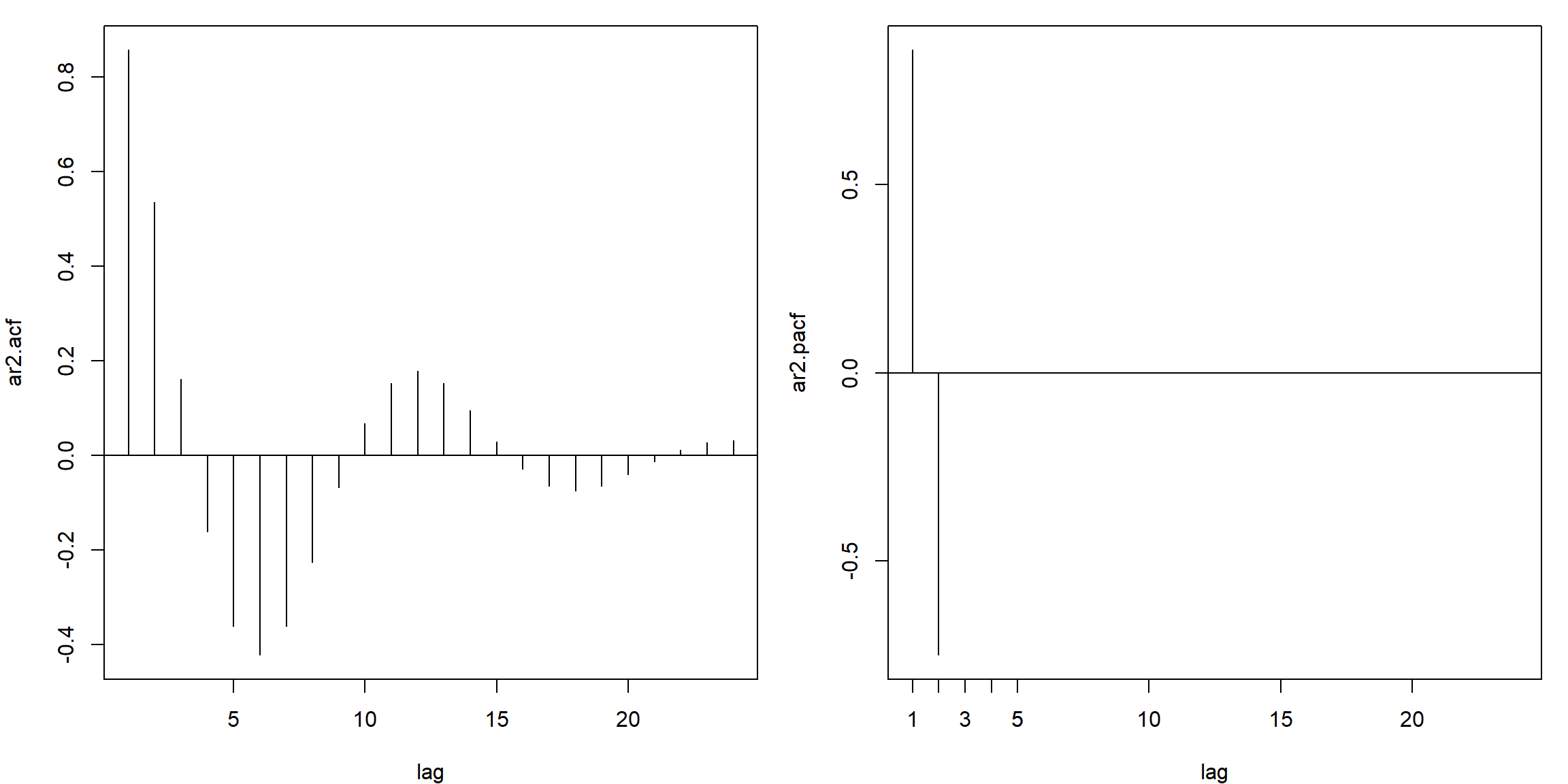

Example 3.16 (p.98) PACF of AR(p)

ar2.acf = ARMAacf(ar=c(1.5,-.75), ma=0, 24)[-1]

ar2.pacf = ARMAacf(ar=c(1.5,-.75), ma=0, 24, pacf=TRUE)

par(mfrow=c(1,2), mar=c(4,4,1,1))

plot(ar2.acf, type="h", xlab="lag"); abline(h=0)

plot(ar2.pacf, type="h", xlab="lag")

abline(h=0); axis(1, at=c(1:5))

- PACF: cut off after lag 2

Example 3.29 (p.115) Simulate 50 obs. from MA(1) with \(\theta_1=0.9\)

set.seed(2)

ma1 = arima.sim(list(order = c(0,0,1), ma = 0.9), n = 50)

acf(ma1, plot=FALSE)[1] # = .507 (lag 1 sample ACF)##

## Autocorrelations of series 'ma1', by lag

##

## 1

## 0.507- True ACF: \(\rho(1)=\frac{\theta_1}{1+\theta_1^2}=\) 0.4972376

1.4 Fit model with different method

在對資料進行建模前,可以用ACF, PACF初步分析,判斷p, q需要選多少

1.4.1 Preliminary Analysis

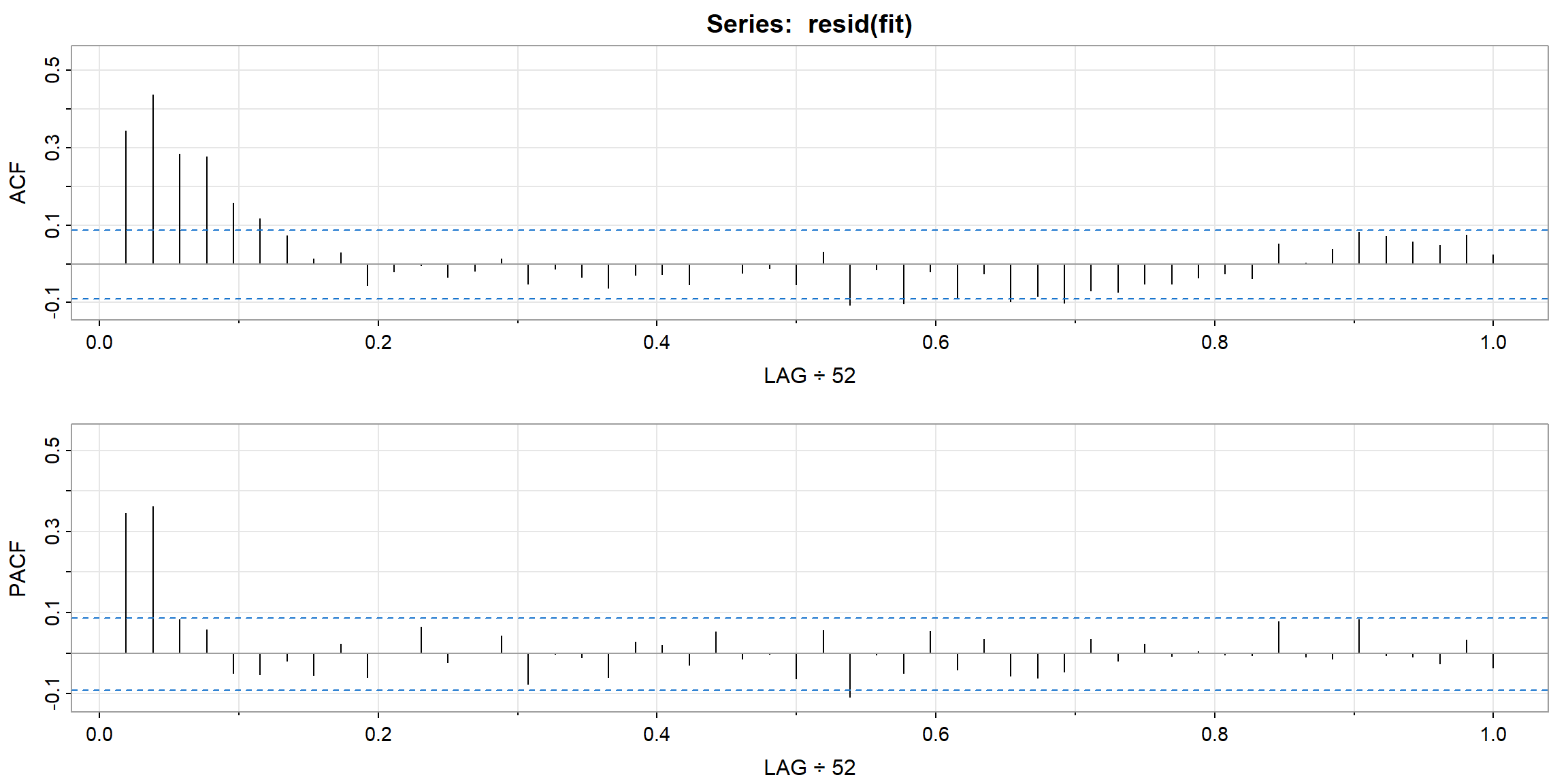

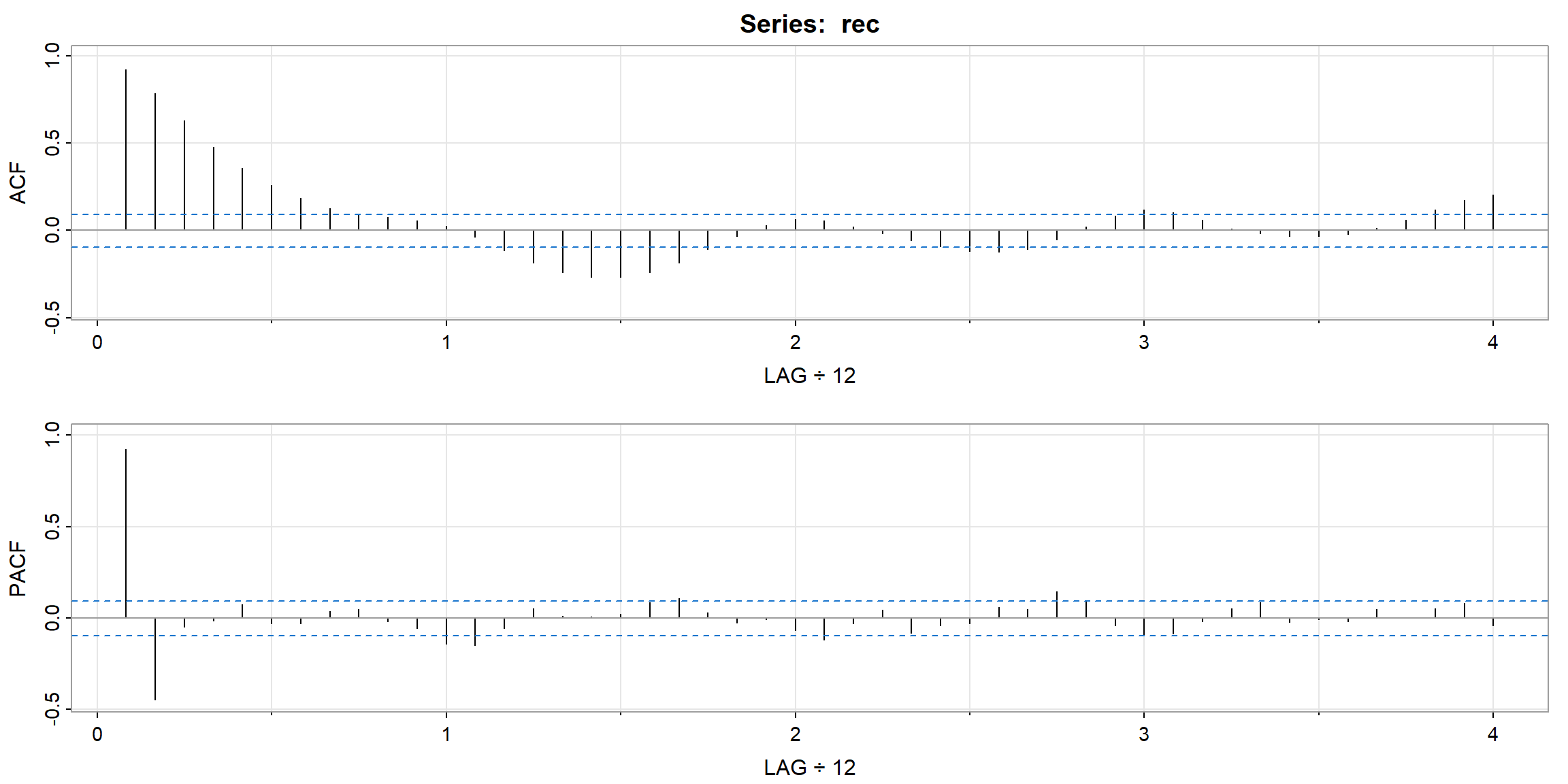

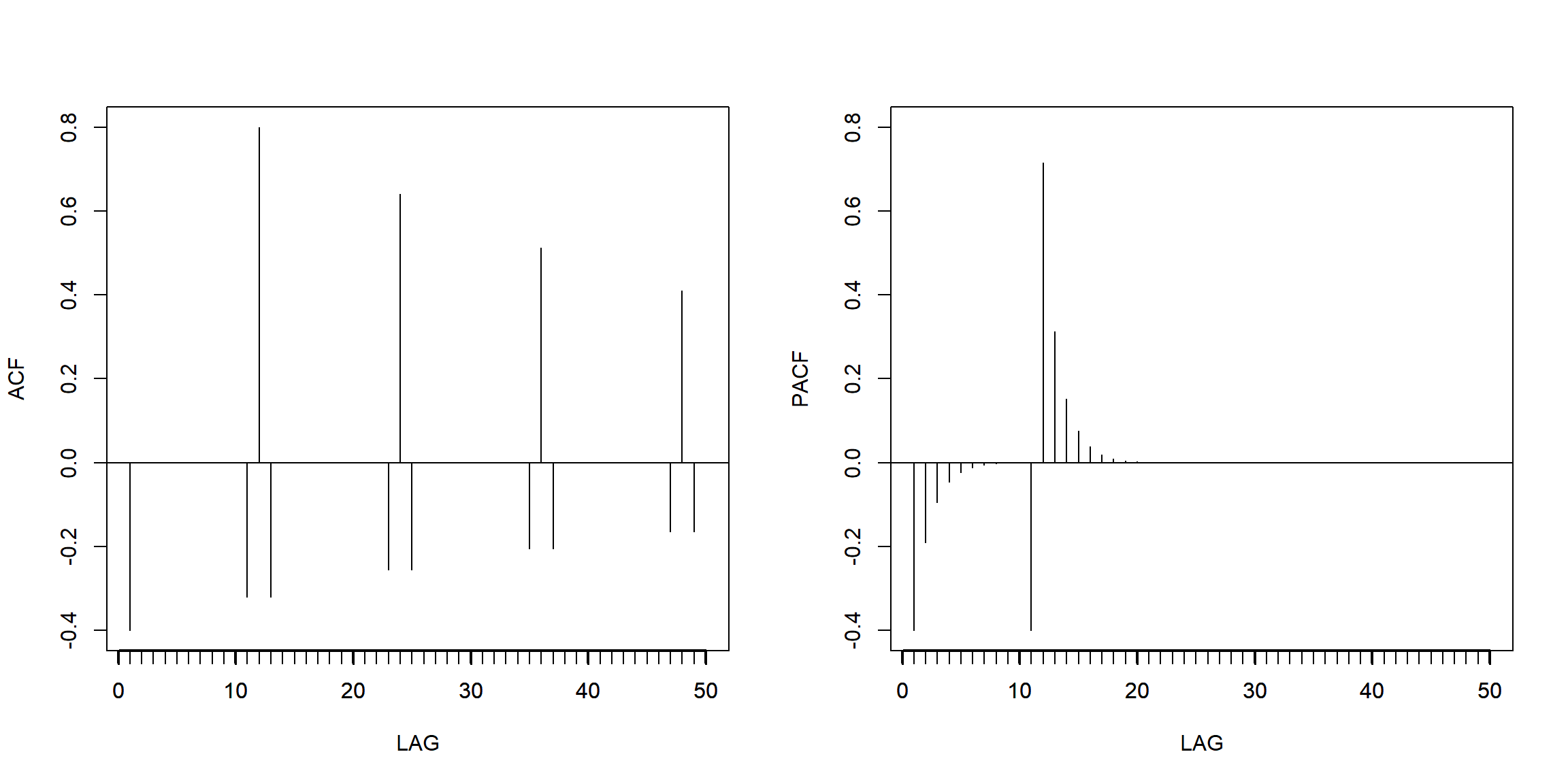

Example 3.18 (p.99) Preliminary Analysis of the Recruitment Series

- ACF decay very fast \(\to\) stationary

- PACF cut-off after lag 2 (its PACF \(\approx\) 0 after lag 2) \(\to\) AR(2) is suitable for the data

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ACF | 0.92 | 0.78 | 0.63 | 0.48 | 0.36 | 0.26 | 0.18 | 0.13 | 0.09 | 0.07 | 0.06 | 0.02 | -0.04 | -0.12 | -0.19 | -0.24 |

| PACF | 0.92 | -0.44 | -0.05 | -0.02 | 0.07 | -0.03 | -0.03 | 0.04 | 0.05 | -0.02 | -0.05 | -0.14 | -0.15 | -0.05 | 0.05 | 0.01 |

| 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 | 32 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ACF | -0.27 | -0.27 | -0.24 | -0.19 | -0.11 | -0.03 | 0.03 | 0.06 | 0.06 | 0.02 | -0.02 | -0.06 | -0.09 | -0.12 | -0.13 | -0.11 |

| PACF | 0.01 | 0.02 | 0.09 | 0.11 | 0.03 | -0.03 | -0.01 | -0.07 | -0.12 | -0.03 | 0.05 | -0.08 | -0.04 | -0.03 | 0.06 | 0.05 |

| 33 | 34 | 35 | 36 | 37 | 38 | 39 | 40 | 41 | 42 | 43 | 44 | 45 | 46 | 47 | 48 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ACF | -0.05 | 0.02 | 0.08 | 0.12 | 0.10 | 0.06 | 0.01 | -0.02 | -0.03 | -0.03 | -0.02 | 0.01 | 0.06 | 0.12 | 0.17 | 0.20 |

| PACF | 0.15 | 0.09 | -0.04 | -0.10 | -0.09 | -0.02 | 0.05 | 0.08 | -0.02 | -0.01 | -0.02 | 0.05 | 0.01 | 0.05 | 0.08 | -0.04 |

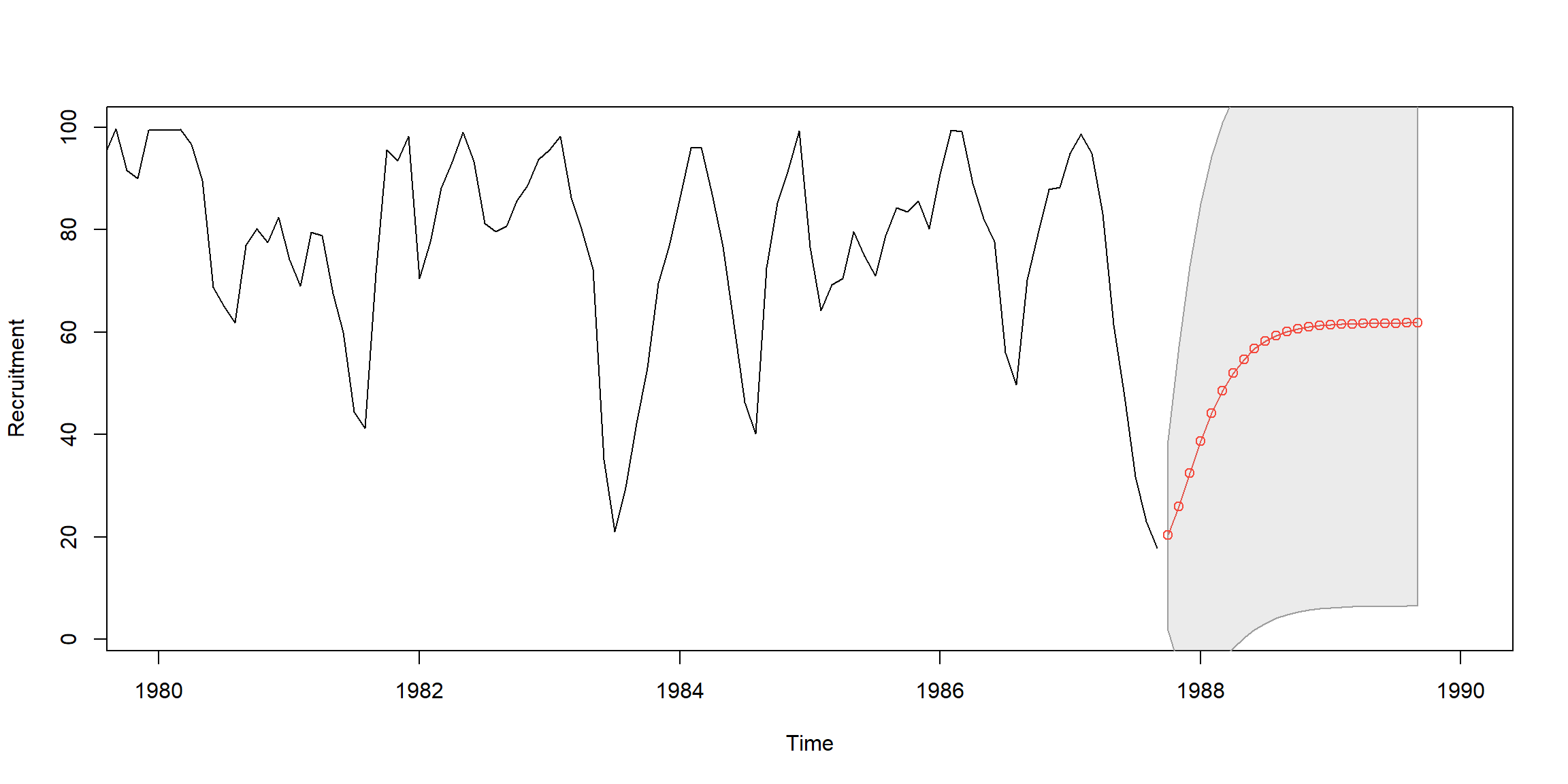

1.4.2 Fit AR(2) model to Recruitment Series

Example 3.25 (p.110) Fit AR(2) to rec data by OLS

regr = ar.ols(rec, order=2, demean=FALSE, intercept=TRUE)

fore = predict(regr, n.ahead=24)

ts.plot(rec, fore$pred, col=1:2, xlim=c(1980,1990), ylab="Recruitment")

# 95% CI

U = fore$pred+1.96*fore$se; L = fore$pred-1.96*fore$se

xx = c(time(U), rev(time(U))); yy = c(L, rev(U))

polygon(xx, yy, border = 8, col = gray(.6, alpha = .2))

lines(fore$pred, type="p", col=2)

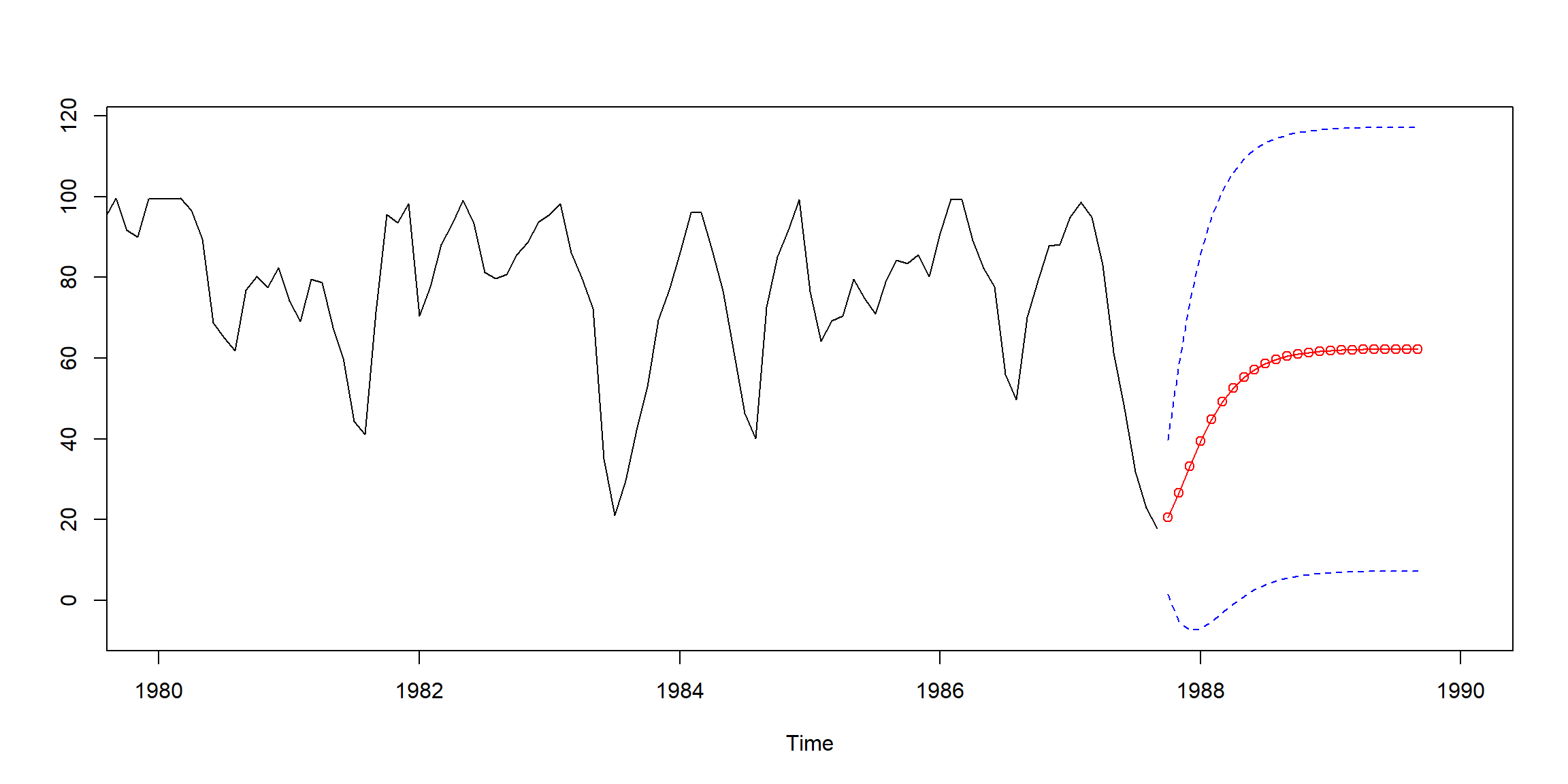

Example 3.28 (p.115) Fit AR(2) to rec data by Yule-Walker

rec.yw = ar.yw(rec, order=2)

rec.yw$x.mean # = 62.26278 (mean estimate)

rec.yw$ar # = 1.3315874, -.4445447 (coefficient estimates)

sqrt(diag(rec.yw$asy.var.coef)) # = .04222637, .04222637 (standard errors)

rec.yw$var.pred # = 94.79912 (error variance estimate)rec.pr = predict(rec.yw, n.ahead=24)

# 95% CI

U=rec.pr$pred+1.96*rec.pr$se

L=rec.pr$pred-1.96*rec.pr$se

minx=min(rec,L);maxx=max(rec,U)

ts.plot(rec, rec.pr$pred, xlim=c(1980,1990),ylim=c(minx,maxx))

lines(rec.pr$pred,col="red",type="o")

lines(U, col="blue", lty="dashed")

lines(L, col="blue", lty="dashed")

Example 3.31 (p.120) Fit AR(2) to rec data by MLE

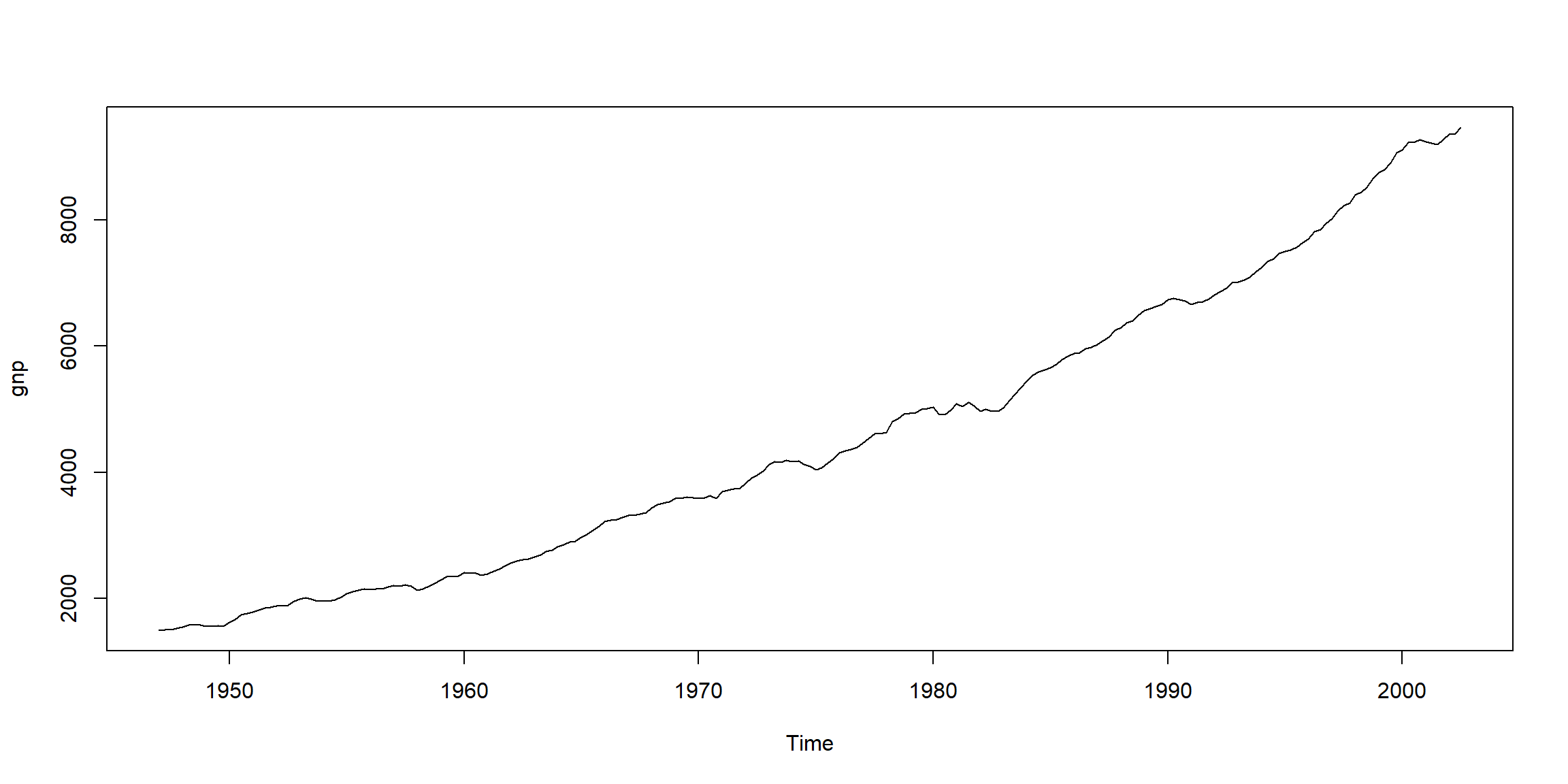

1.5 Analysis of GNP Data

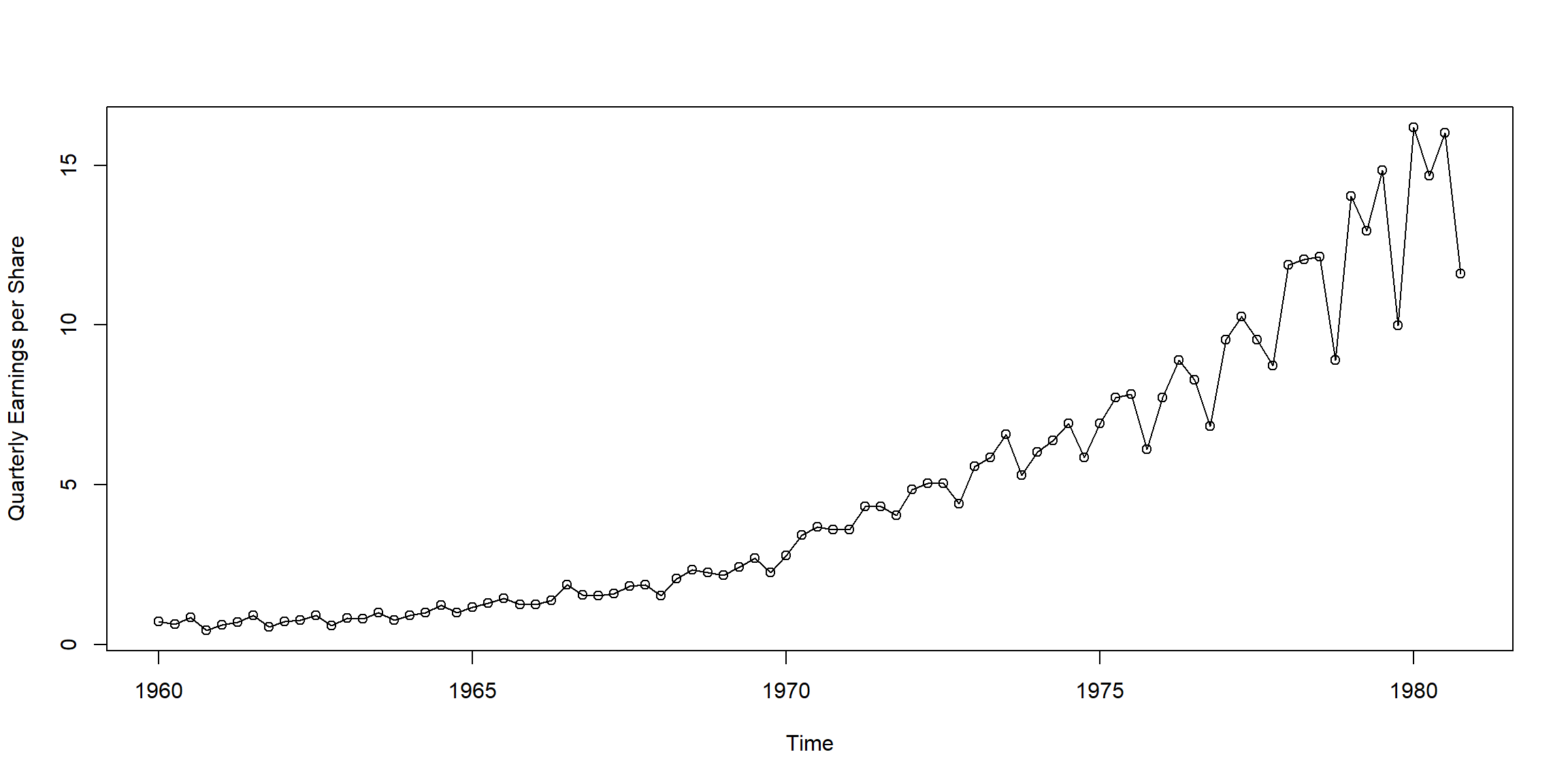

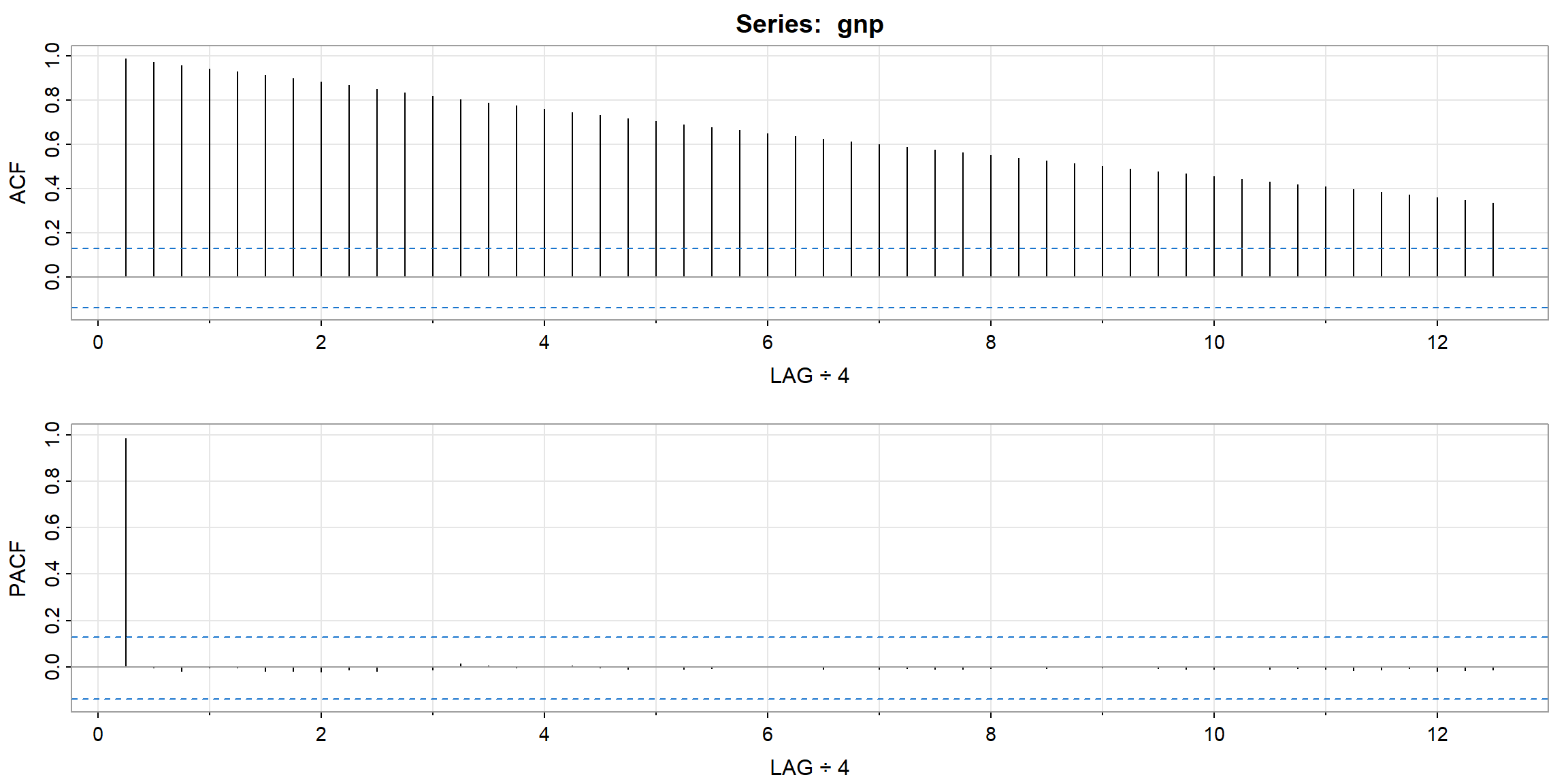

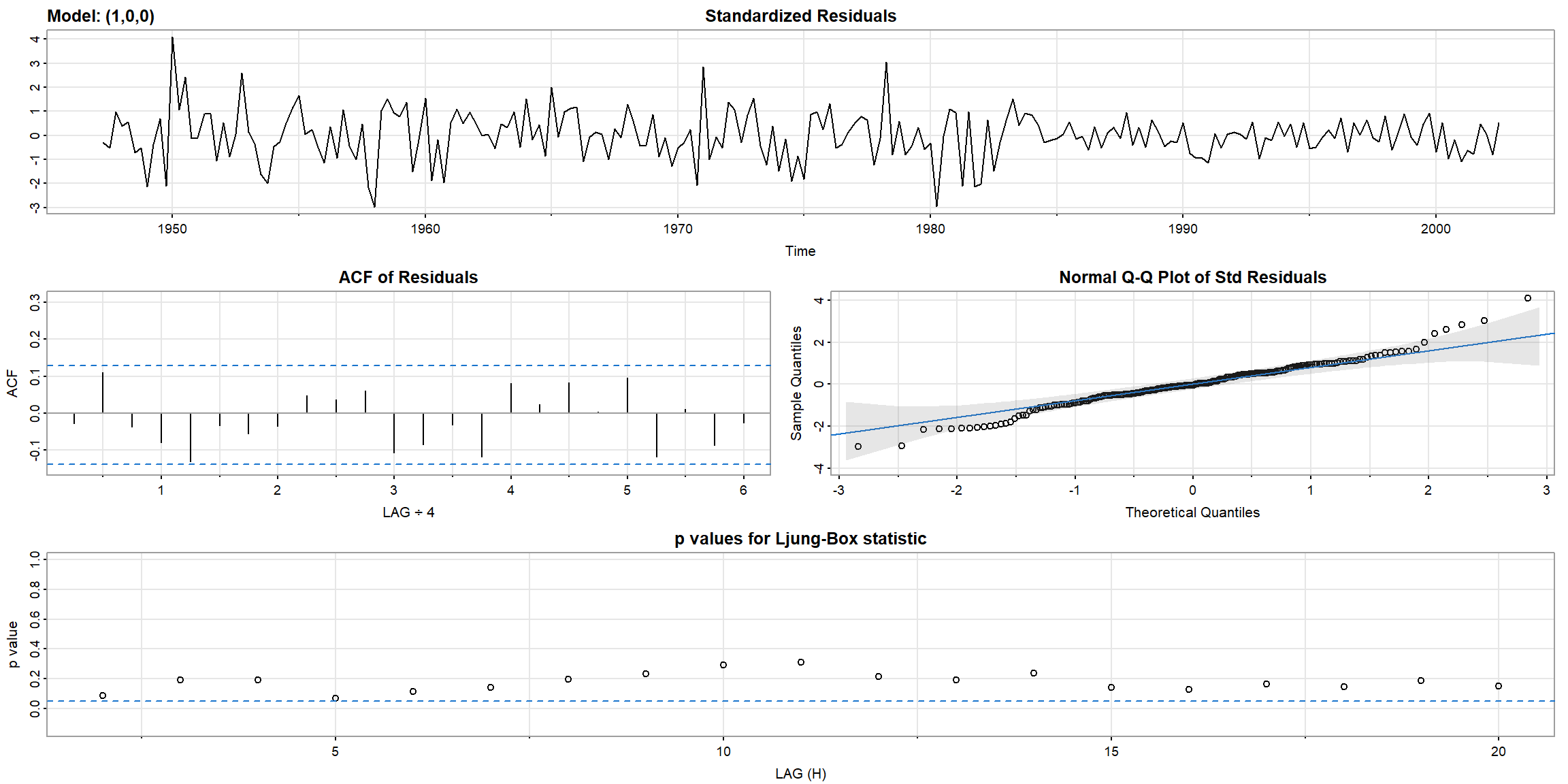

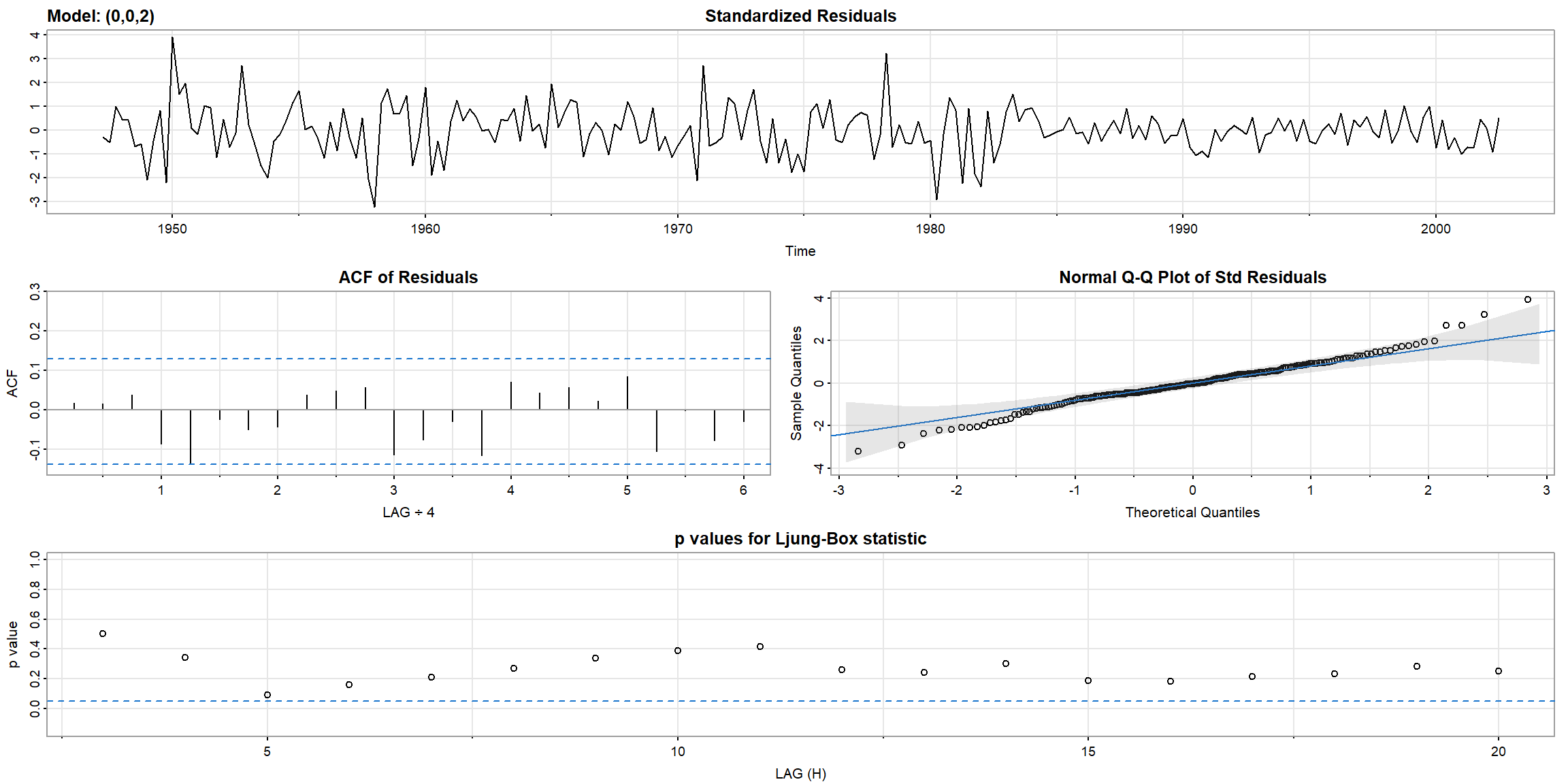

Example 3.39, 3.40 (p.136, 139)

- ACF looks not stationary

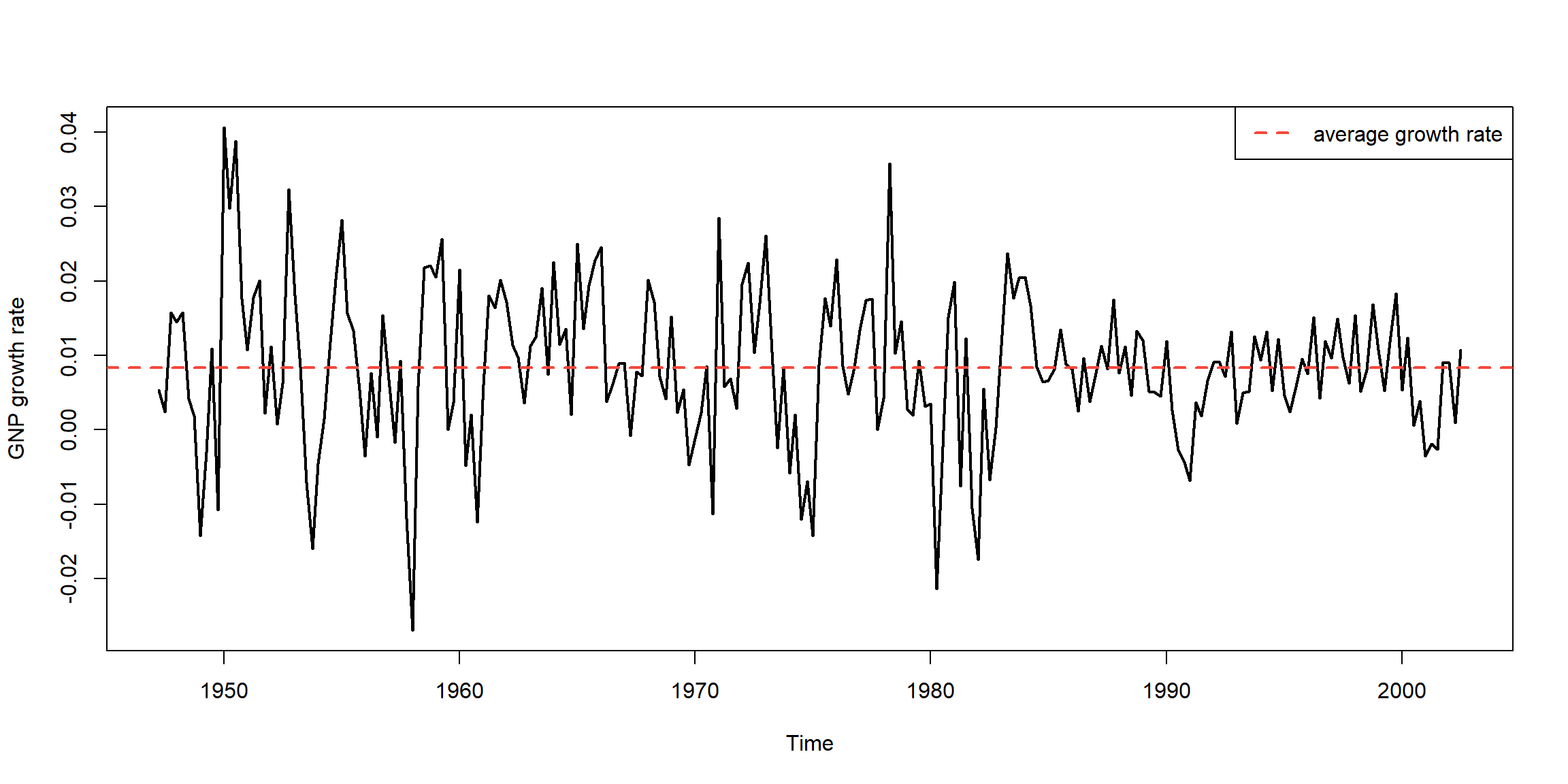

- \(diff(log(X_t))=logX_t-logX_{t-1}=log\frac{X_t}{X_{t-1}}, \;growth\)

- \(diff(log(X_t))>0, \uparrow\)

- \(diff(log(X_t))<0, \downarrow\)

plot(gnpgr, ylab="GNP growth rate", lwd=2)

abline(h=mean(gnpgr), lty=2, col=2, lwd=2)

legend("topright", legend = "average growth rate", lty=2, lwd=2, col=2)

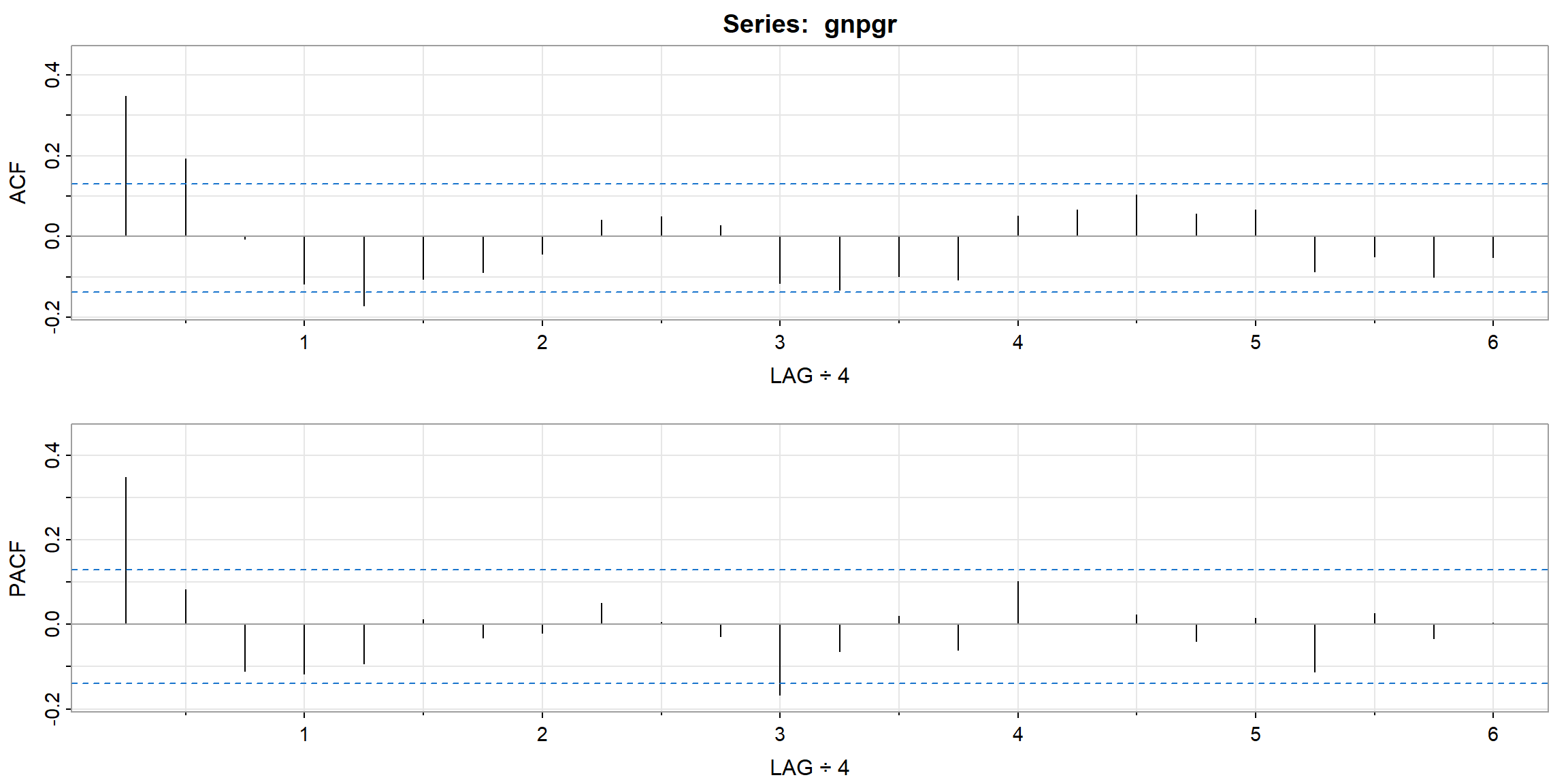

- ACF cut-off after lag 2 \(\Rightarrow\) MA(2)

- PACF cut-off after lag 1 \(\Rightarrow\) AR(1)

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ACF | 0.35 | 0.19 | -0.01 | -0.12 | -0.17 | -0.11 | -0.09 | -0.04 | 0.04 | 0.05 | 0.03 | -0.12 |

| PACF | 0.35 | 0.08 | -0.11 | -0.12 | -0.09 | 0.01 | -0.03 | -0.02 | 0.05 | 0.01 | -0.03 | -0.17 |

| 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ACF | -0.13 | -0.10 | -0.11 | 0.05 | 0.07 | 0.10 | 0.06 | 0.07 | -0.09 | -0.05 | -0.10 | -0.05 |

| PACF | -0.06 | 0.02 | -0.06 | 0.10 | 0.00 | 0.02 | -0.04 | 0.01 | -0.11 | 0.03 | -0.03 | 0.00 |

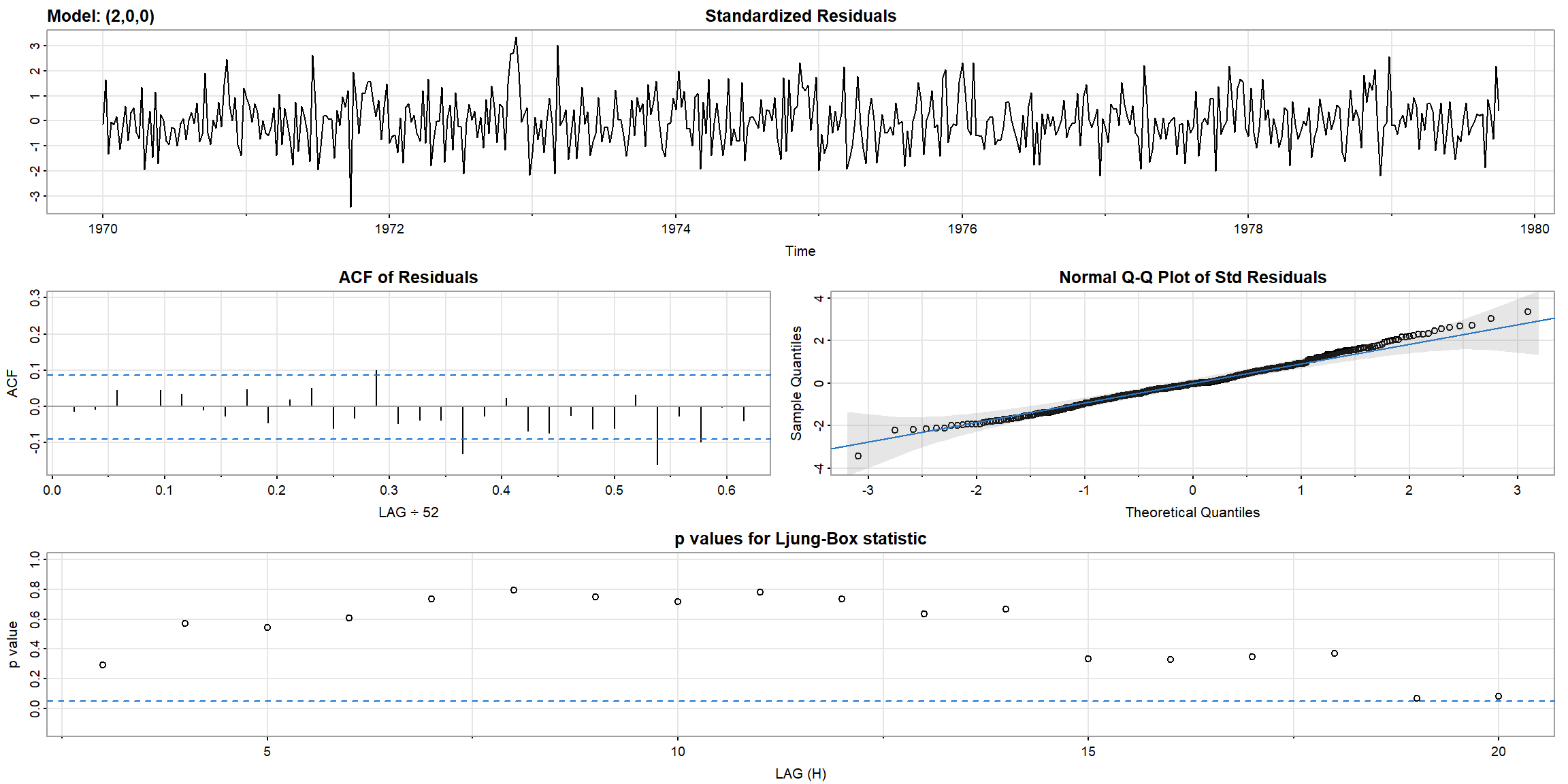

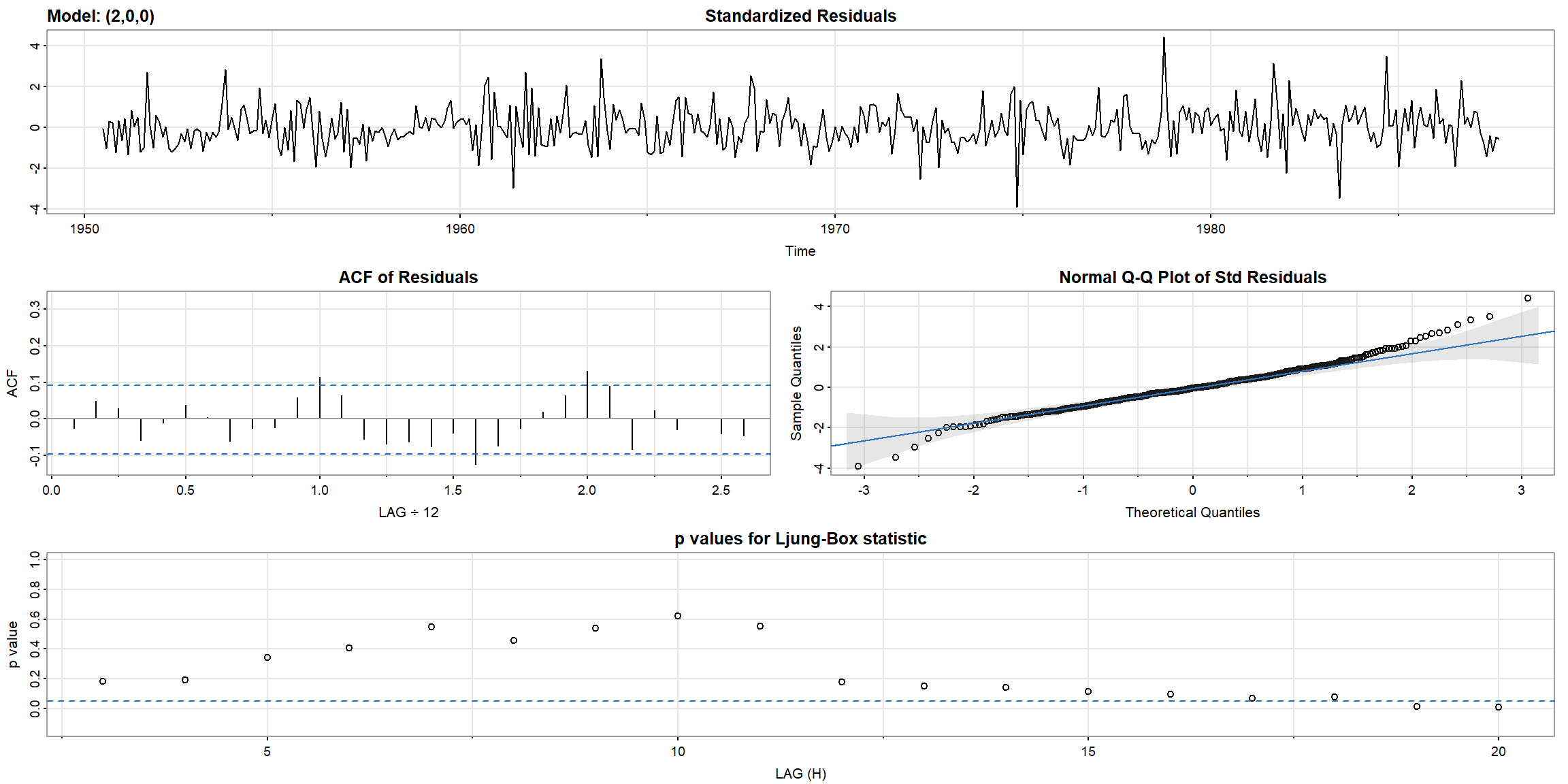

1.5.1 Diagnostics

- In Ljung-Box statistic, both model’s p-value>0.05, \(\therefore\) AR(1) is suitable for

gnpgr

## [1] 3.500000e-01 1.225000e-01 4.287500e-02 1.500625e-02 5.252187e-03

## [6] 1.838266e-03 6.433930e-04 2.251875e-04 7.881564e-05 2.758547e-051.5.2 model selection

Both AR(1) and MA(2) are suitable. Then, which one is better?

- Use AIC, AICC or BIC, the smaller the better.

| model | AIC | AICc | BIC |

|---|---|---|---|

| AR(1) | -6.44694 | -6.4466932 | -6.4009579 |

| MA(2) | -6.4501328 | -6.4496369 | -6.3888233 |

- Since MA(2) model’s AIC, AICC and BIC are smaller than AR(1) model’s, MA(2) is better.

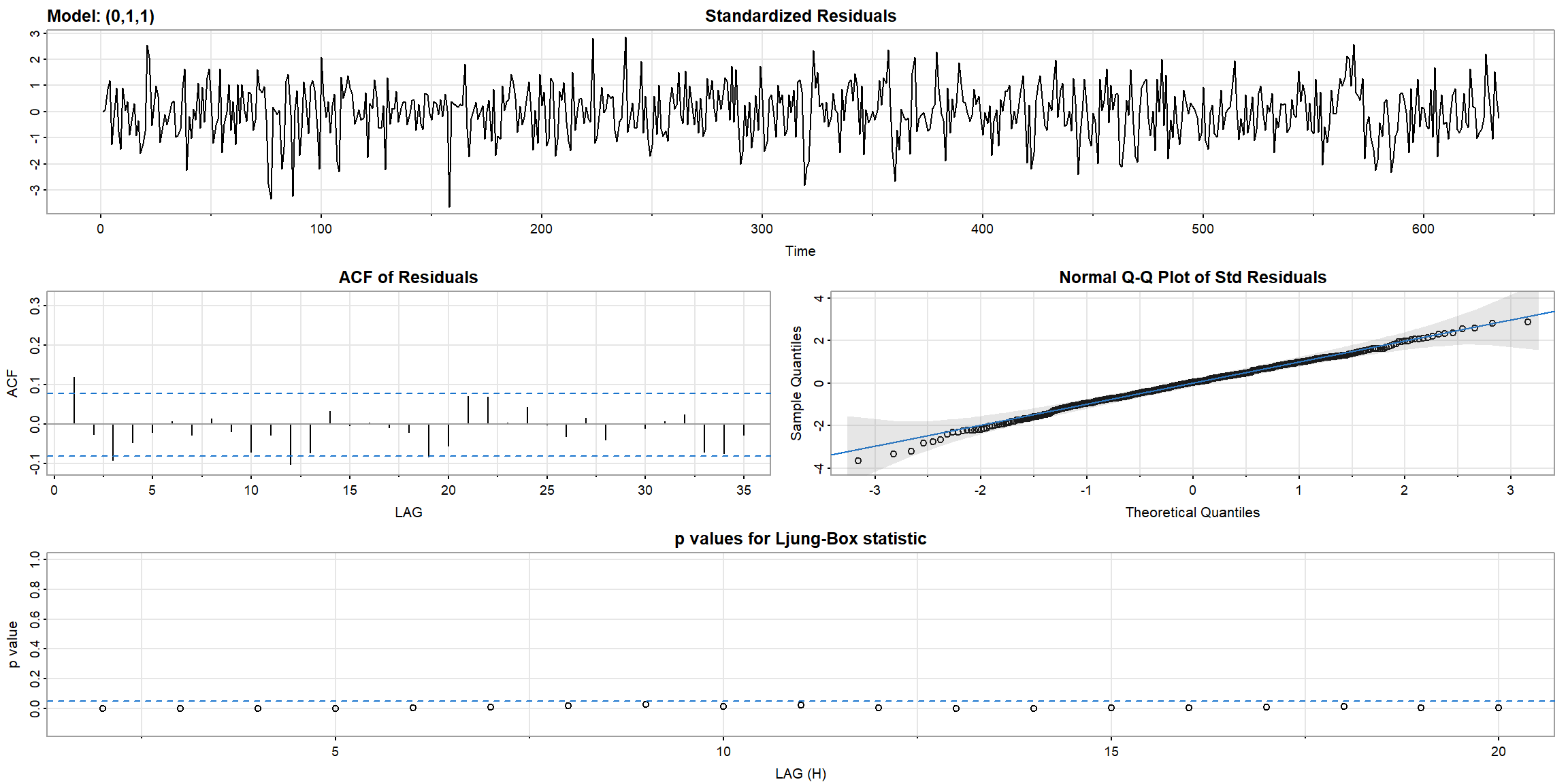

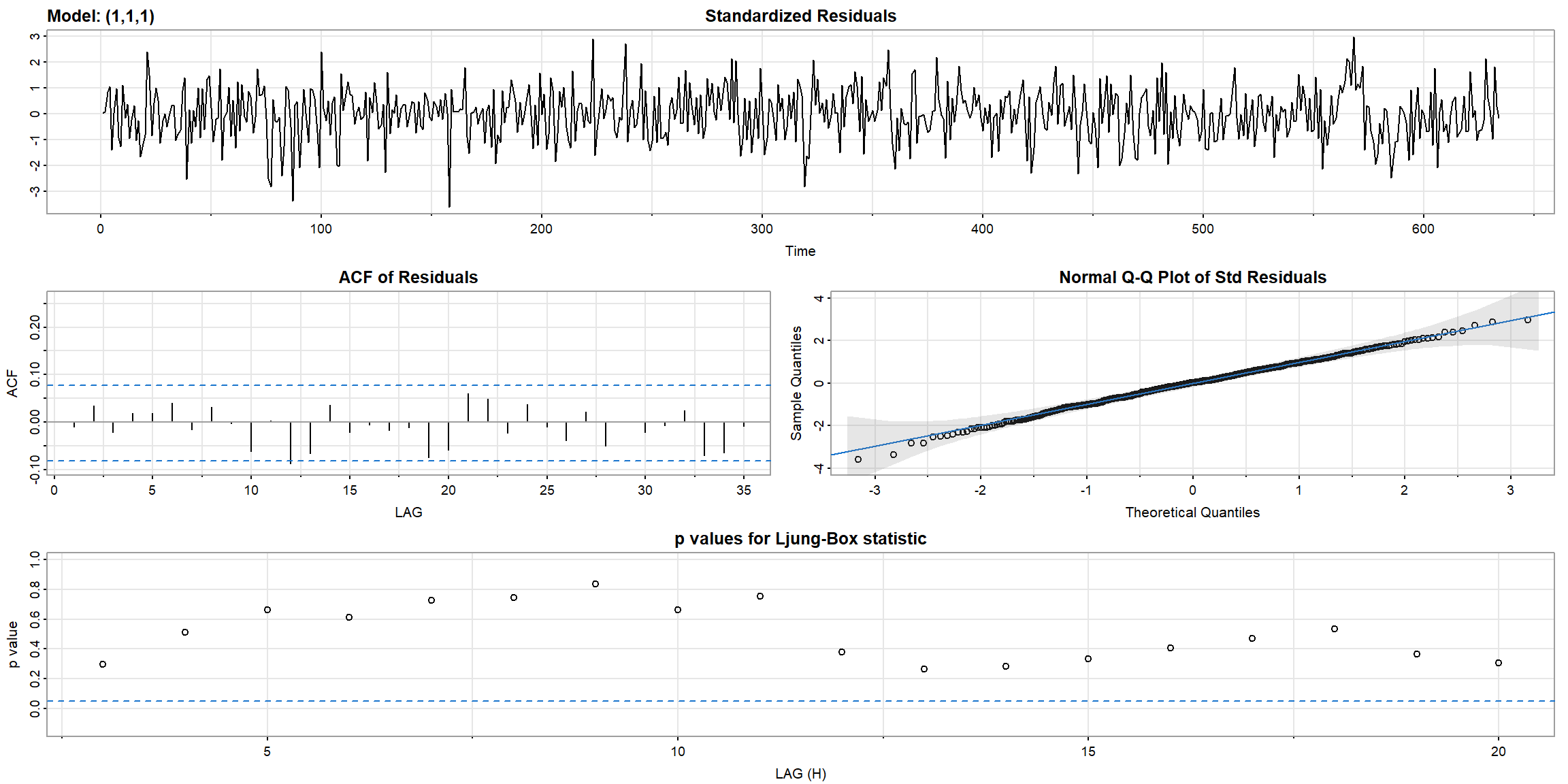

1.6 Model Diagnostics

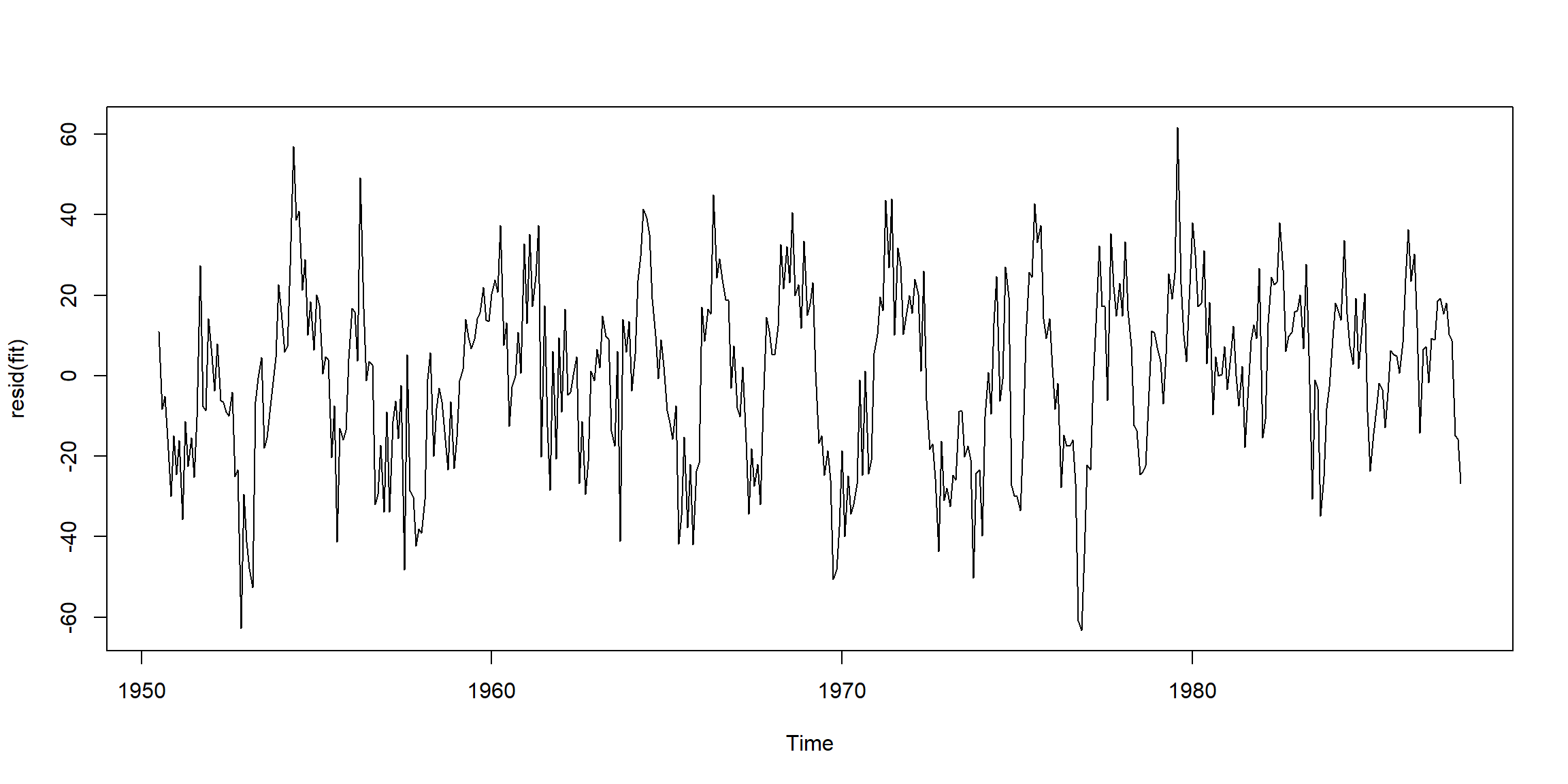

Example 3.41 (p.140) Diagnostics for the Glacial Varve Series

- ACF outside the CI, and p-value$$0.05, \(\therefore\) ARIMA(0,1,1) is not suitable for

log(varve)

- all ACF inside the CI, and all p-value above 0.05, \(\therefore\) ARIMA(1,1,1) is suitable for

log(varve).

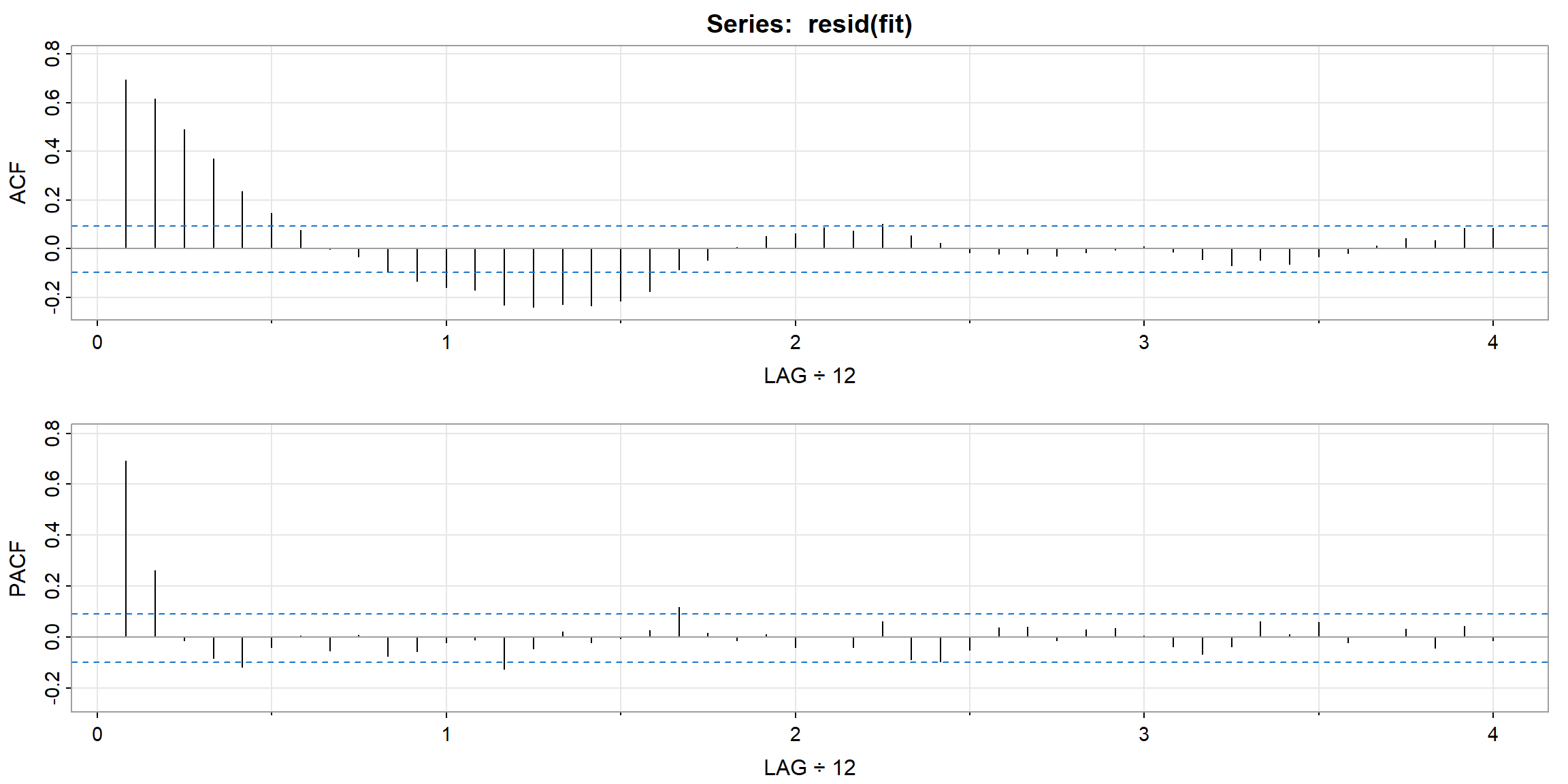

1.8 Multiplicative Seasonal ARIMA Models

- 先一階差分再看季節性

* 季節性資料優先處理季節性,再看需不需要差分

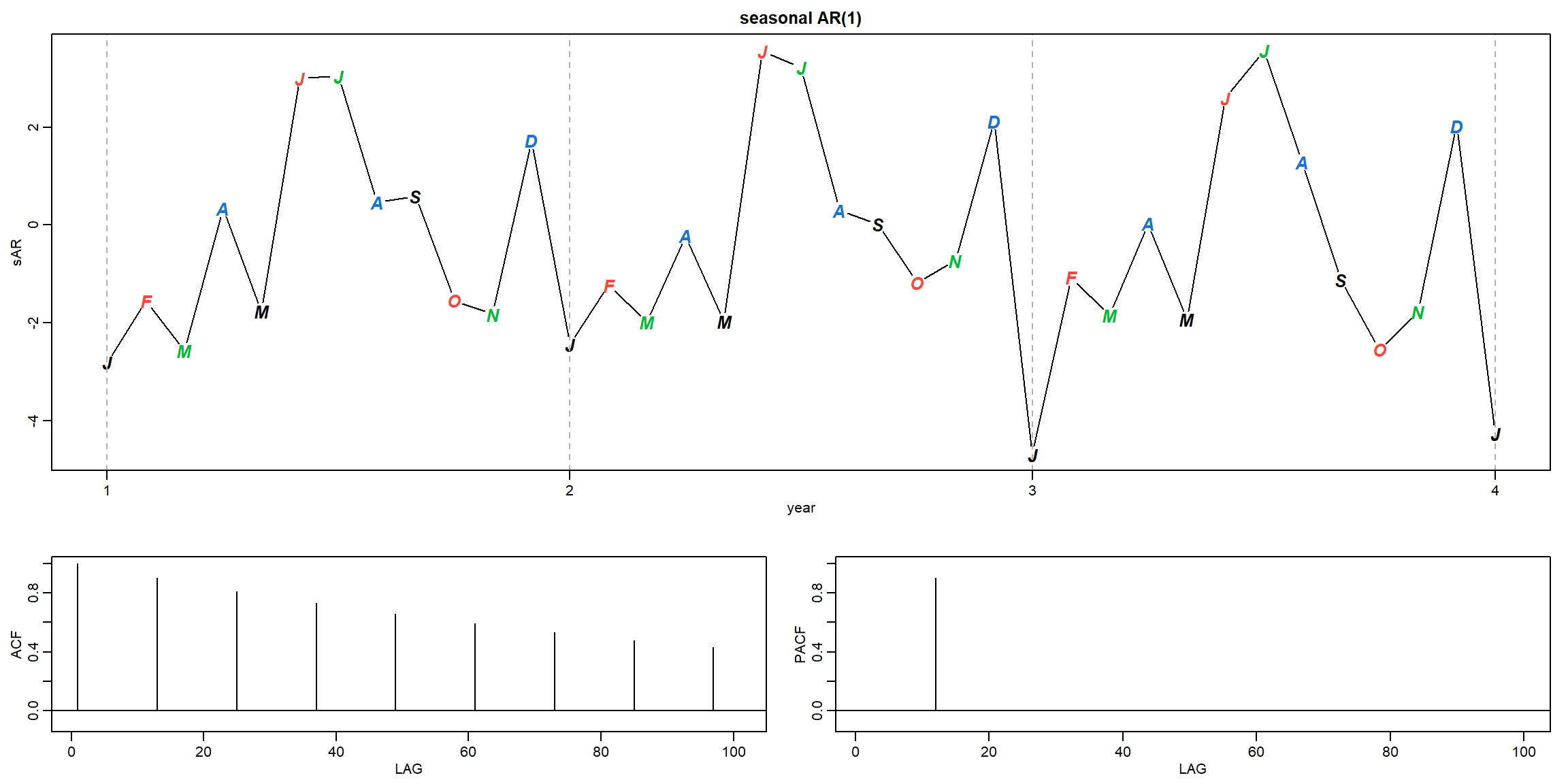

Example 3.46 (p.146) A Seasonal AR Series

\[(1 − 0.9\cdot B^{12})x_t = w_t\]

set.seed(666)

phi = c(rep(0,11),.9)

sAR = arima.sim(list(order=c(12,0,0), ar=phi), n=37)

sAR = ts(sAR, freq=12)

layout(matrix(c(1,1,2, 1,1,3), nc=2))

par(mar=c(3,3,2,1), mgp=c(1.6,.6,0))

plot(sAR, axes=FALSE, main='seasonal AR(1)', xlab="year", type='c')

Months = c("J","F","M","A","M","J","J","A","S","O","N","D")

points(sAR, pch=Months, cex=1.25, font=4, col=1:4)

axis(1, 1:4); abline(v=1:4, lty=2, col=gray(.7))

axis(2); box()

ACF = ARMAacf(ar=phi, ma=0, 100)

PACF = ARMAacf(ar=phi, ma=0, 100, pacf=TRUE)

plot(ACF,type="h", xlab="LAG", ylim=c(-.1,1)); abline(h=0)

plot(PACF, type="h", xlab="LAG", ylim=c(-.1,1)); abline(h=0)

- Theoretical ACF tails off at lag 12, 24, 36, …

- Theoretical PACF cut-off at lag 12

- Those patterns are also observed in the sample ACF and PACF.

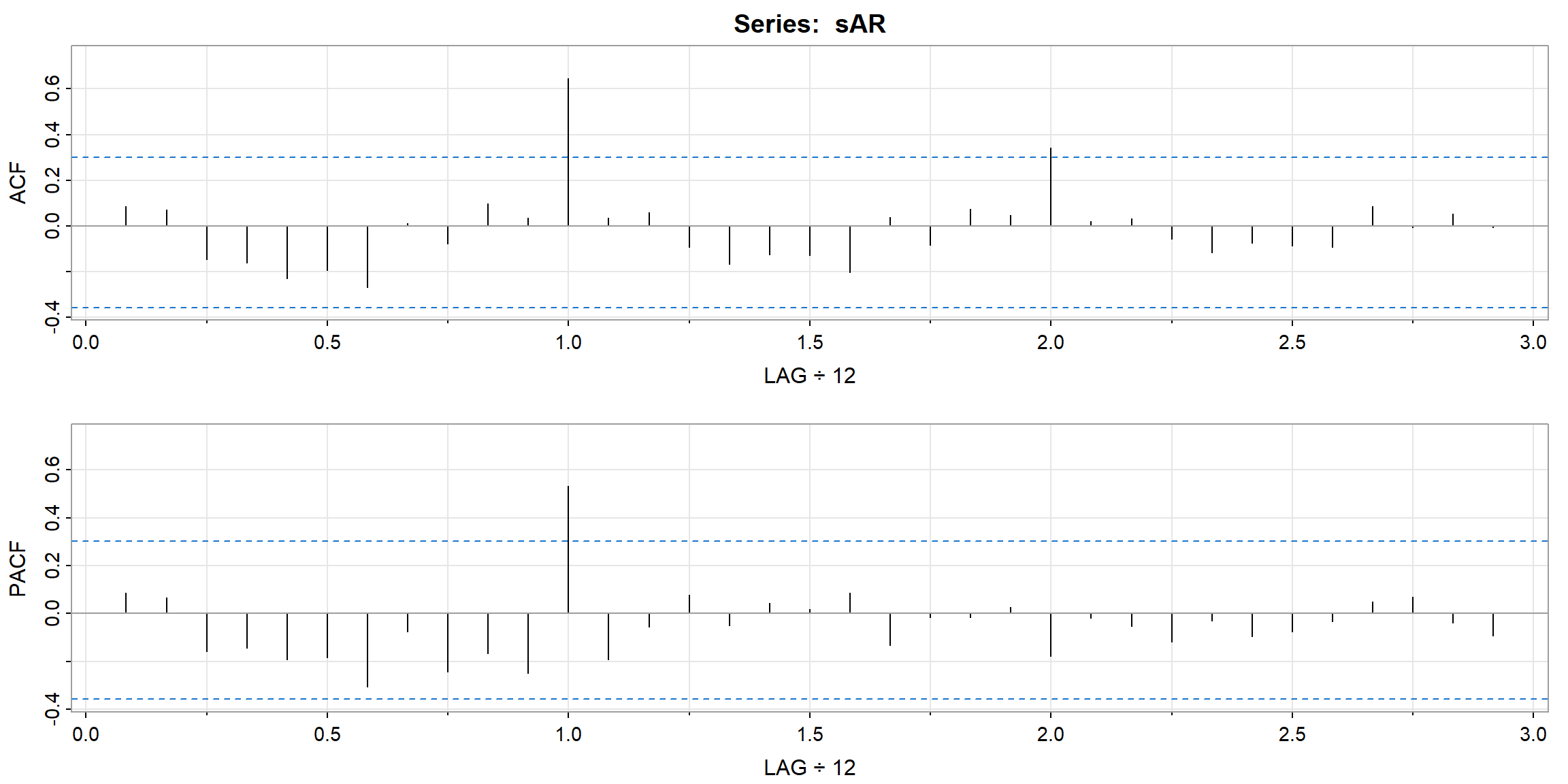

Example 3.47 (p.145) seasonal ARMA

\[X_t-.8X_{t-12}=W_t-.5W_{t-1}\]

phi = c(rep(0,11),.8)

ACF = ARMAacf(ar=phi, ma=-.5, 50)[-1] # [-1] removes 0 lag

PACF = ARMAacf(ar=phi, ma=-.5, 50, pacf=TRUE)

par(mfrow=c(1,2))

plot(ACF, type="h", xlab="LAG", ylim=c(-.4,.8)); abline(h=0)

axis(1, at=0:50, label=F); axis(1, at=seq(0,50,by=10), lwd=2)

plot(PACF, type="h", xlab="LAG", ylim=c(-.4,.8)); abline(h=0)

axis(1, at=0:50, label=F); axis(1, at=seq(0,50,by=10), lwd=2)

- PACF cut-off at lag 12, so \(AR(1)_{12}\) is suitable.

- ACF cut-off at lag 1, so \(MA(1)\) is suitable.

1.9 Periodogram

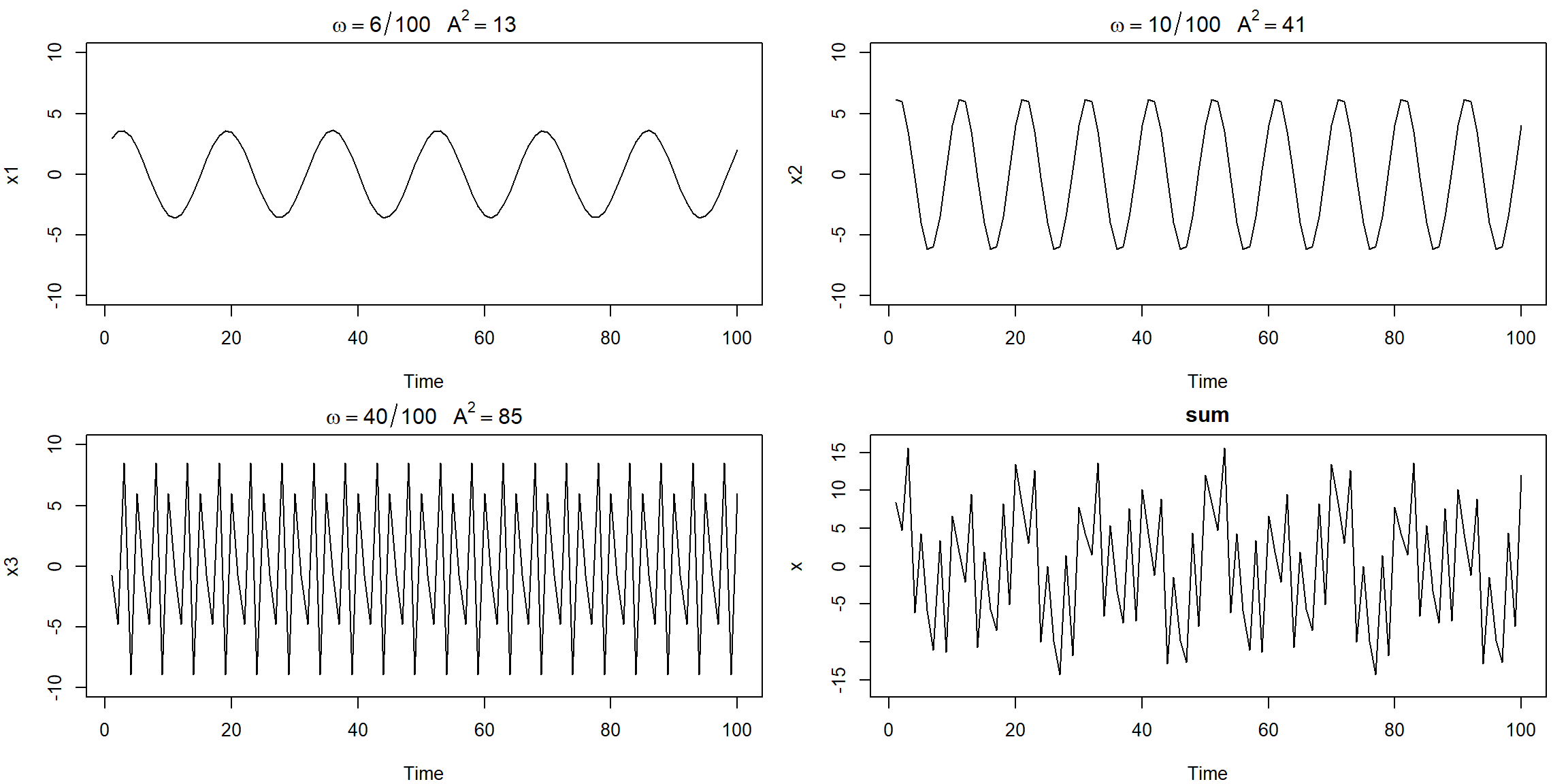

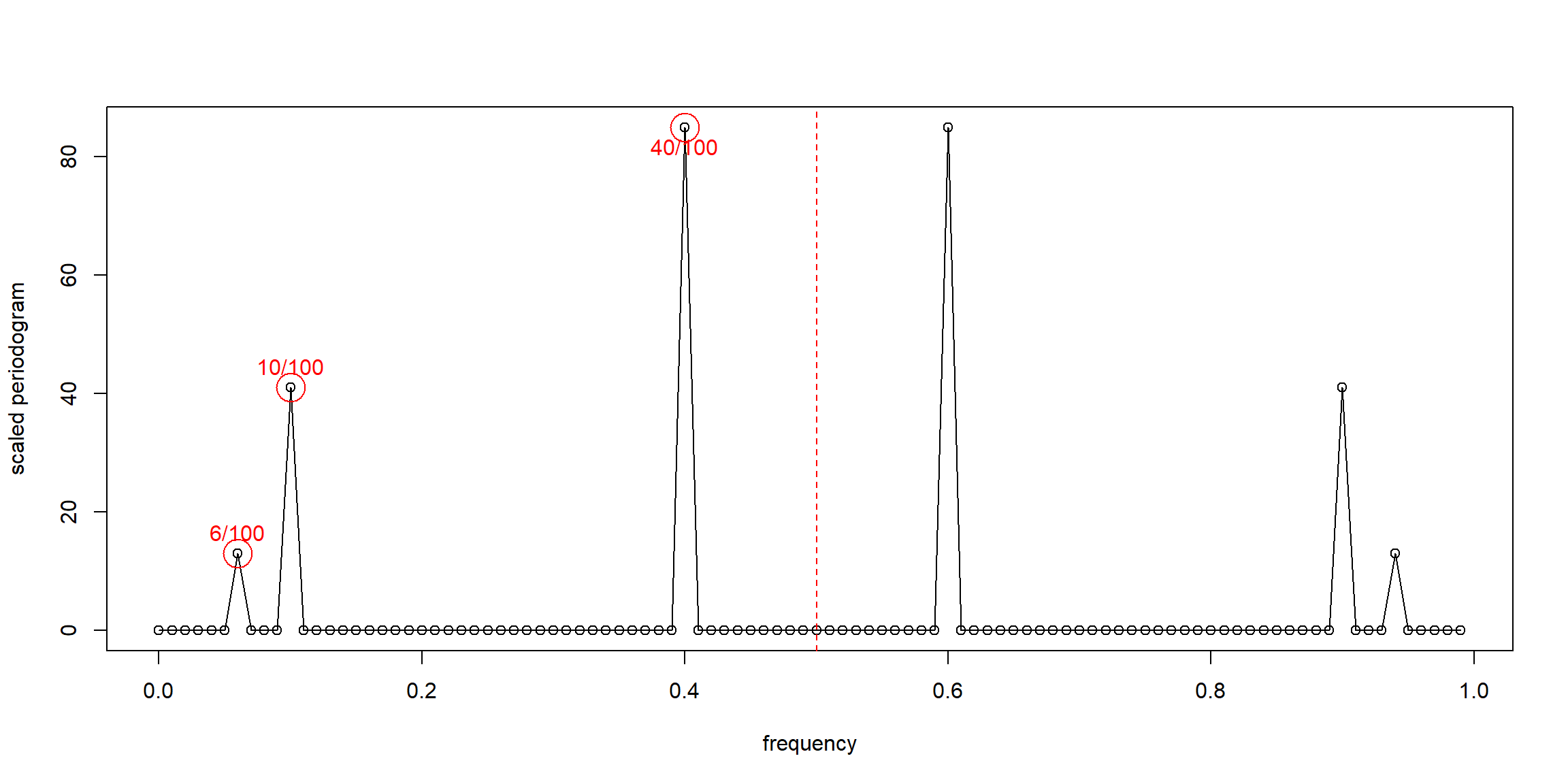

Example 4.1 (p.167) A Periodic Series

x1 = 2*cos(2*pi*1:100*6/100) + 3*sin(2*pi*1:100*6/100)

x2 = 4*cos(2*pi*1:100*10/100) + 5*sin(2*pi*1:100*10/100)

x3 = 6*cos(2*pi*1:100*40/100) + 7*sin(2*pi*1:100*40/100)

x = x1 + x2 + x3

par(mfrow=c(2,2), mar=c(4,4,2,1))

plot.ts(x1, ylim=c(-10,10), main=expression(omega==6/100~~~A^2==13))

plot.ts(x2, ylim=c(-10,10), main=expression(omega==10/100~~~A^2==41))

plot.ts(x3, ylim=c(-10,10), main=expression(omega==40/100~~~A^2==85))

plot.ts(x, ylim=c(-16,16), main="sum")

when there is many periodic, it is hard to see

- A: height of the peak

- for \(x_1\), \(A^2=2^2+3^2=13\), the maximum and minimum values that \(x_1\) will attain are \(\pm\sqrt{13}=\pm3.61\)

- \(\omega=\frac jn\): j = repeated times

Example 4.2 (p.169) Estimation and the Periodogram

P = Mod(2*fft(x)/100)^2; Fr = 0:99/100

plot(Fr, P, type="o", xlab="frequency", ylab="scaled periodogram")

abline(v=0.5, col="red", lty=2)

points(x=Fr[7], y=P[7], col="red", pch=1, cex=3);text(x=Fr[7], y=P[7], labels = "6/100", pos=3, col="red")

points(x=Fr[11], y=P[11], col="red", pch=1, cex=3);text(x=Fr[11], y=P[11], labels = "10/100", pos=3, col="red")

points(x=Fr[41], y=P[41], col="red", pch=1, cex=3);text(x=Fr[41], y=P[41], labels = "40/100", pos=1, col="red")

- the plot is symmetric: \(I(\omega_j)=I(\omega_{n-j})\)

- period: \(T=\frac nj\)

- \(T_1=\frac {100}6\), \(T_2=\frac{100}{10}\), \(T_3=\frac{100}{40}\)

- \(\omega_j=\frac jn\)

- \(\omega_1=\frac 6{100}\), \(\omega_2=\frac {10}{100}\), \(\omega_3=\frac {40}{100}\)

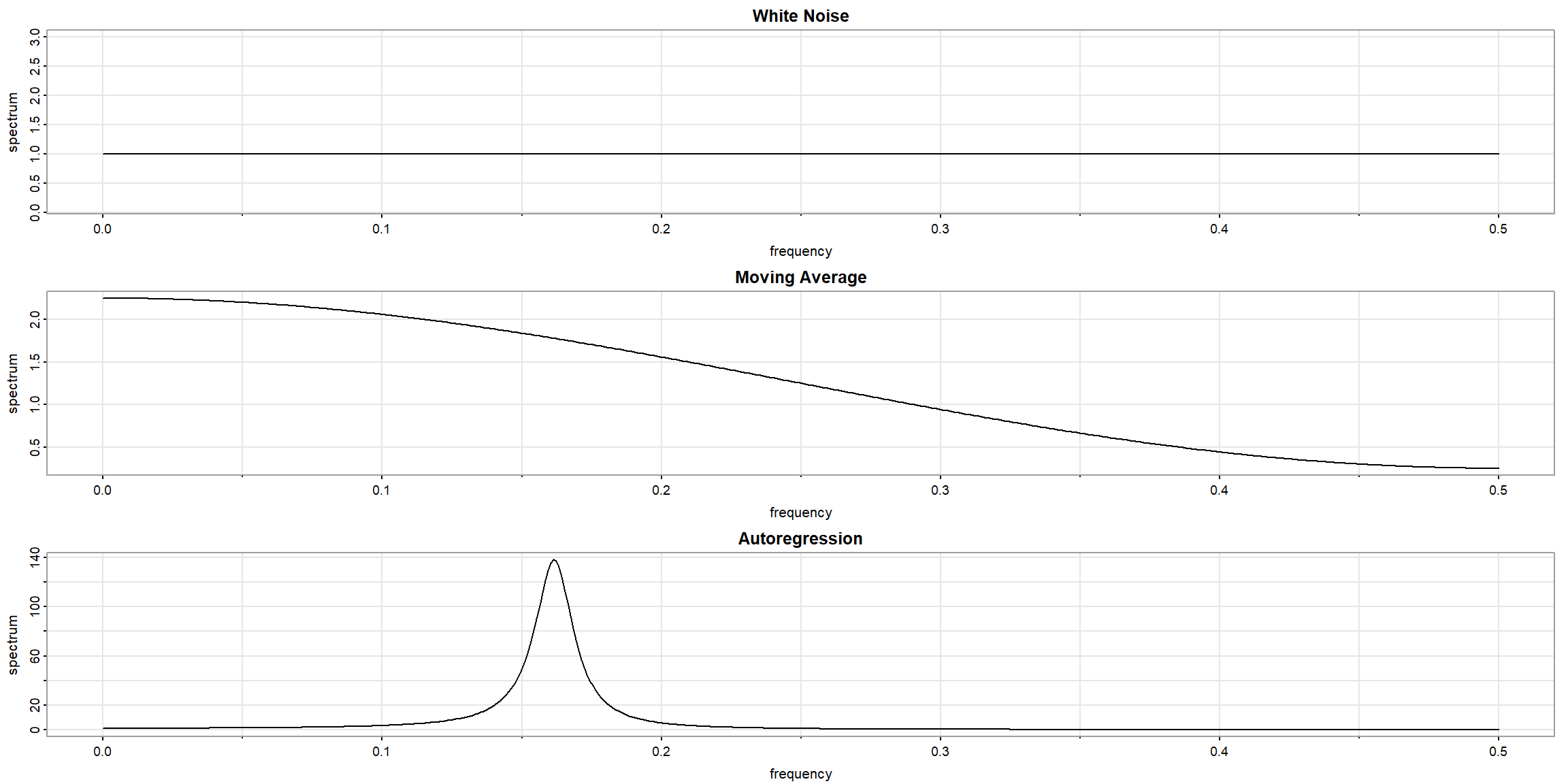

Example 4.7 (p.176) spectral density

par(mfrow=c(3,1), mar=c(4,4,1,1))

arma.spec(main="White Noise")

arma.spec(ma=.5, main="Moving Average")

arma.spec(ar=c(1,-.9), main="Autoregression")

- Top: White Noise

- Middle: MA(1), \(\theta_1=0.5\)

- Bottom: AR(2), \(\phi_1=1, \phi_2=-0.9\)

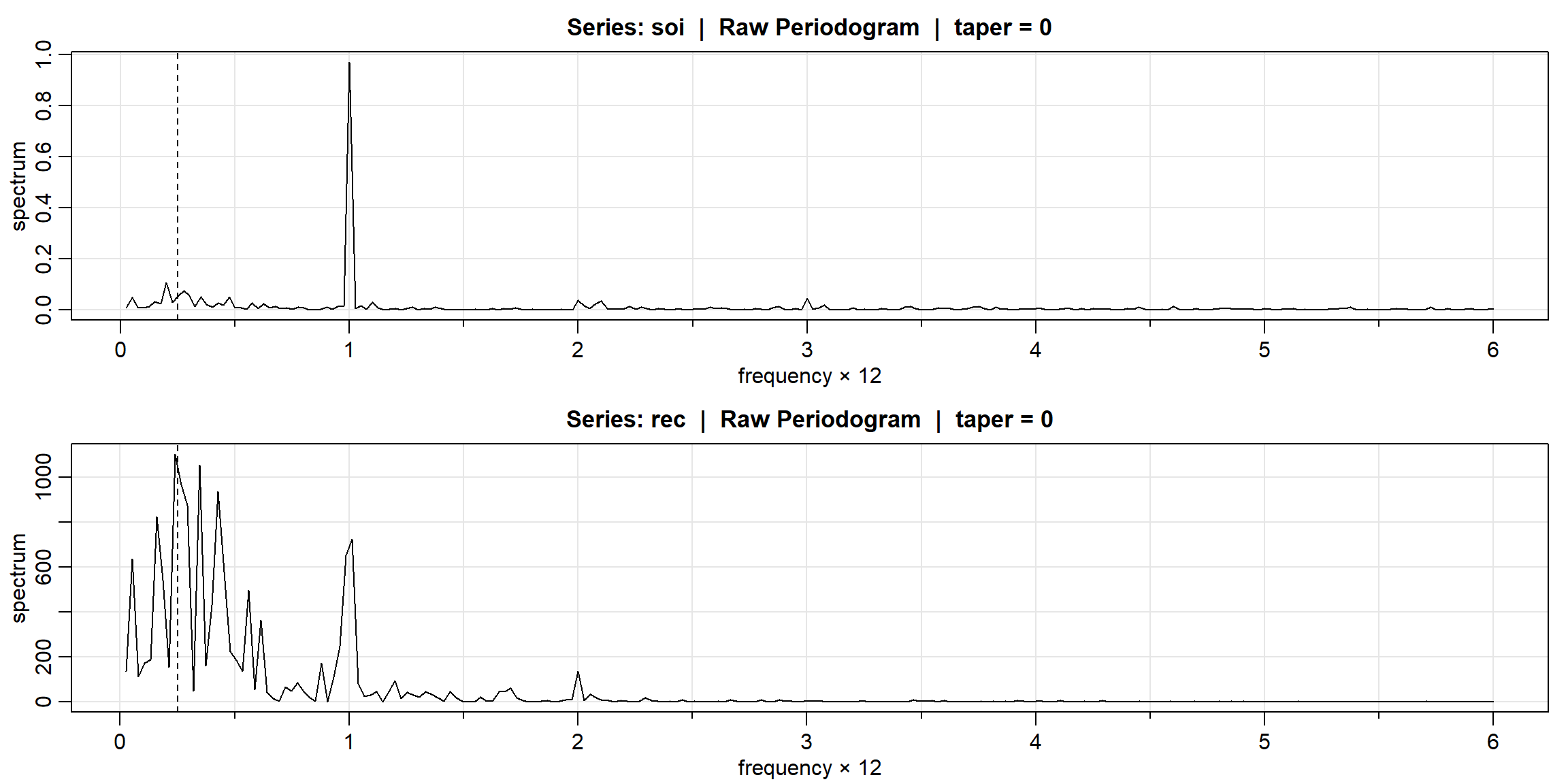

Example 4.10 (p.182) Spectral ANOVA

periodogram is symmetric

\[\omega_1=\frac15,\omega_2=\frac25\]

\[SS=2\cdot I(\omega_j)\]

x = c(1, 2, 3, 2, 1)

c1 = cos(2*pi*1:5*1/5); s1 = sin(2*pi*1:5*1/5)

c2 = cos(2*pi*1:5*2/5); s2 = sin(2*pi*1:5*2/5)

omega1 = cbind(c1, s1); omega2 = cbind(c2, s2)

anova(lm(x~omega1+omega2)) # ANOVA Table## Analysis of Variance Table

##

## Response: x

## Df Sum Sq Mean Sq F value Pr(>F)

## omega1 2 2.74164 1.37082 NaN NaN

## omega2 2 0.05836 0.02918 NaN NaN

## Residuals 0 0.00000 NaN- \(2.74=2\cdot I(\frac15)=2\cdot1.37\)

\(\downarrow\) \(I(0)\) \(I(\frac15)\) \(I(\frac25)\) \(I(\frac35)\) \(I(\frac45)\)

## [1] 16.20000000 1.37082039 0.02917961 0.02917961 1.37082039Example 4.13 (p.187) CI

- n=480, \(\because\) periodogram is symmatric, only need to print half of them

- 1 unit = 40

par(mfrow=c(2,1), mar=c(4,4,1,1))

soi.per = mvspec(soi, log="no")

abline(v=1/4, lty=2)

rec.per = mvspec(rec, log="no")

abline(v=1/4, lty=2)

- the peak appear at j=10, 40

\[\frac{2I(\omega_j)}{f(\omega_j)}\sim\chi^2(2)\]

\[\text{95% CI for }f(\omega_j)=[\frac{2I(\omega_j)}{\chi^2_.975}, \frac{2I(\omega_j)}{\chi^2_.025}]\]

- \(\downarrow I(\omega_j)\)

soi.per$spec[40] # 0.97223; soi pgram at freq 1/12 = 40/480

soi.per$spec[10] # 0.05372; soi pgram at freq 1/48 = 10/480## [1] 0.9722312

## [1] 0.05372962- \(\downarrow CI\): huge interval is a useless interval

U = qchisq(.025,2) # 0.05063

L = qchisq(.975,2) # 7.37775

2*soi.per$spec[10]/L # 0.01456

2*soi.per$spec[10]/U # 2.12220

2*soi.per$spec[40]/L # 0.26355

2*soi.per$spec[40]/U # 38.40108## [1] 0.0145653

## [1] 2.122207

## [1] 0.2635573

## [1] 38.40108