Section 8 Resources

8.1 Introduction

The last and final section of survey results asks current and prospective owners about their familiarity with resources for their business, how they learn those resources, their familiarity or support from local organizations, and the kind of translation or bilingual support needed, if any. Current and prospective owners also were asked an open-ended question about resources that were helpful for their business, the resources that would be helpful to them in the future, and how they would prefer to access those resources.

Analyses to detect differences between respondents were conducted for the demographic variables of business and/or entrepreneurial role, gender, family-owned businesses, and stage of business development. We only show the results, including a graph, we are sure are real, not just by chance. However, some of the visual differences we between the groups may be due to chance. Also, just because we don’t see a difference between two groups, it doesn’t mean there isn’t a real difference. It just means we don’t have enough information to be sure.

8.2 Key Findings

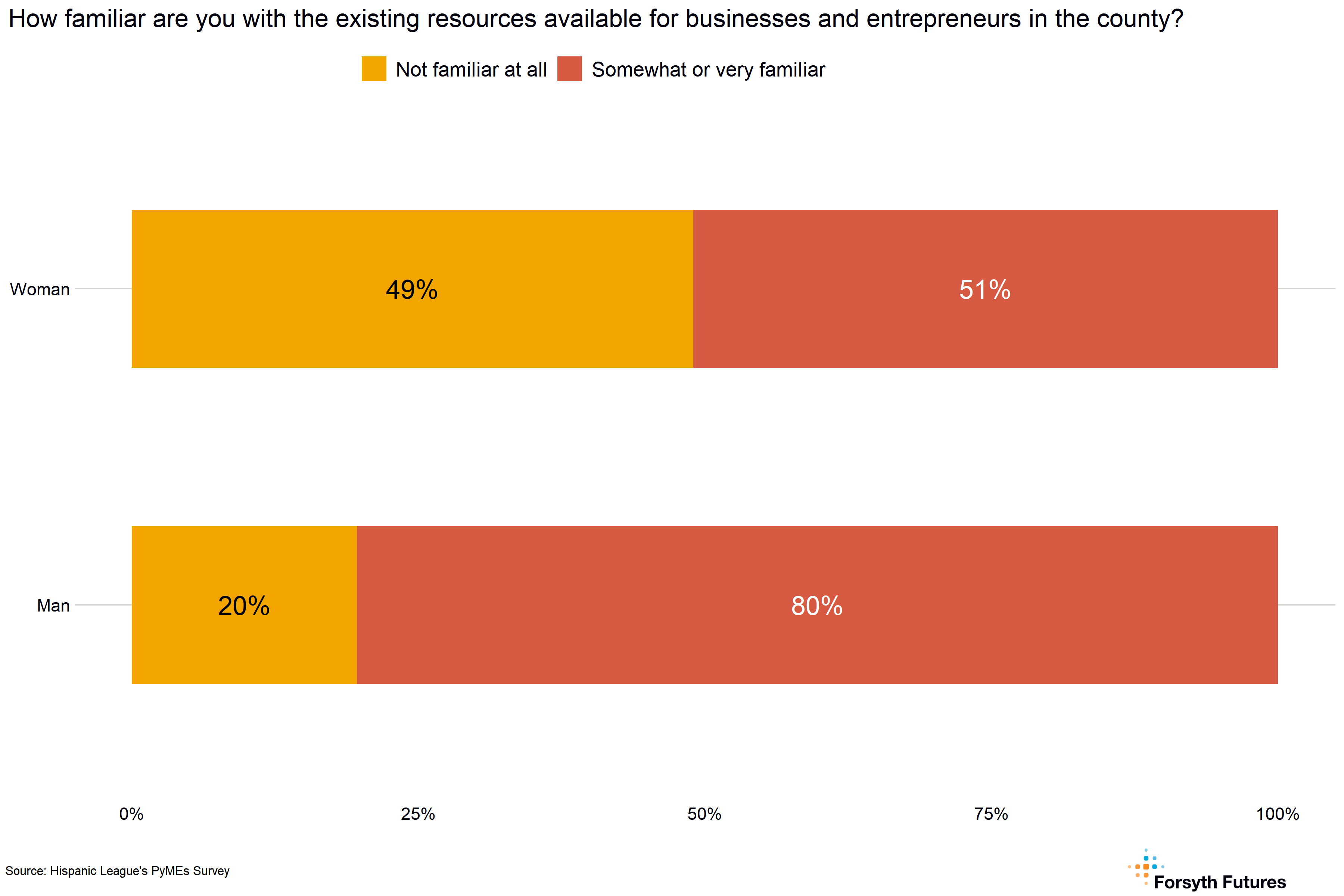

- Overall, 23% of current and prospective owners are familiar with existing resources for businesses and entrepreneurs in the county, 44% are somewhat familiar, and 33% are not familiar at all. Women were less likely to be familiar than men, as 49% of women reported they were not familiar at all with county resources compared to 20% of men.

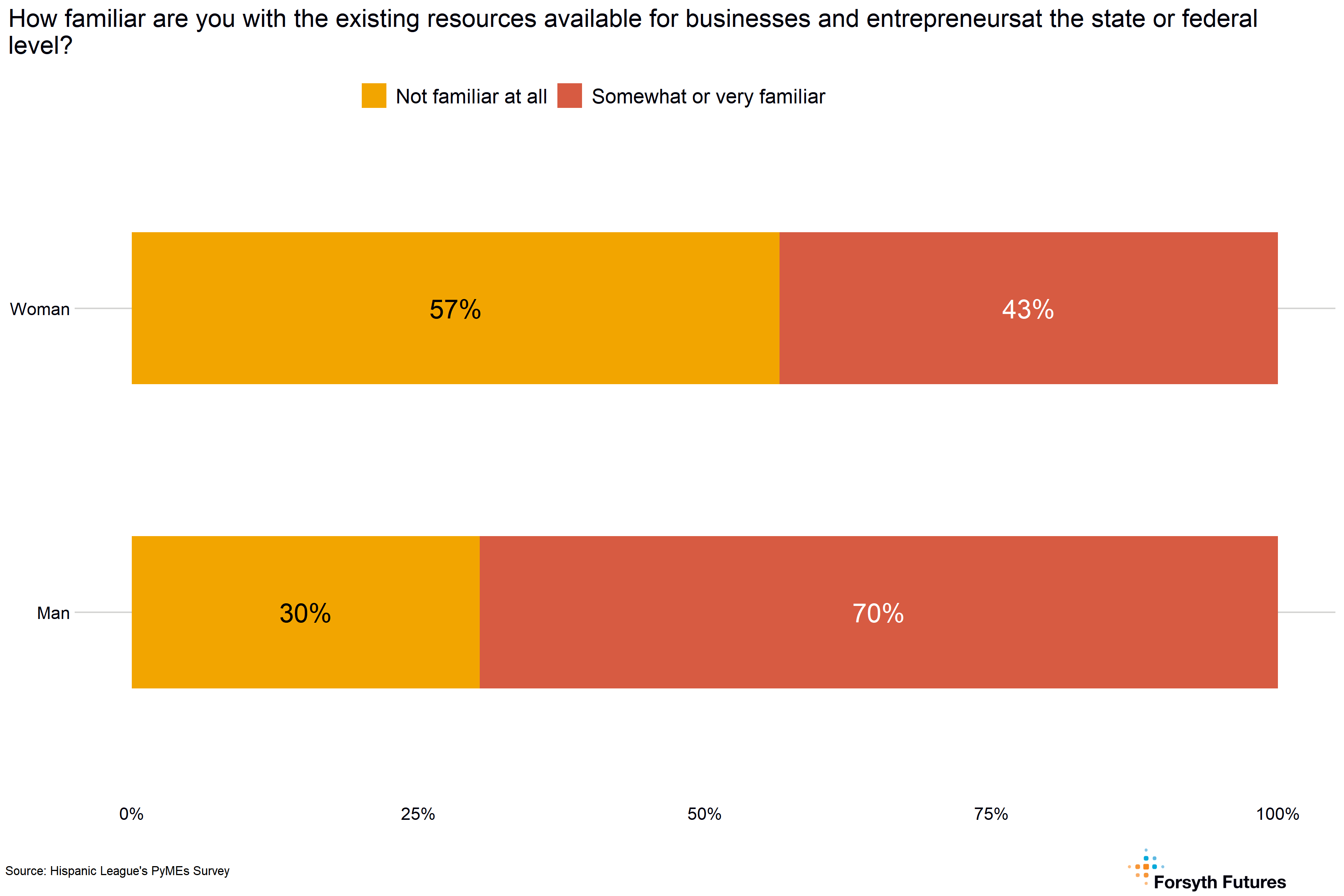

- Only 11% of current and prospective owners are familiar with existing state and federal-level resources, 48% are somewhat familiar, and 41% are not familiar. Similarly to county-level resources, 57% of women, compared to 30% of men, were not familiar at all with state resources.

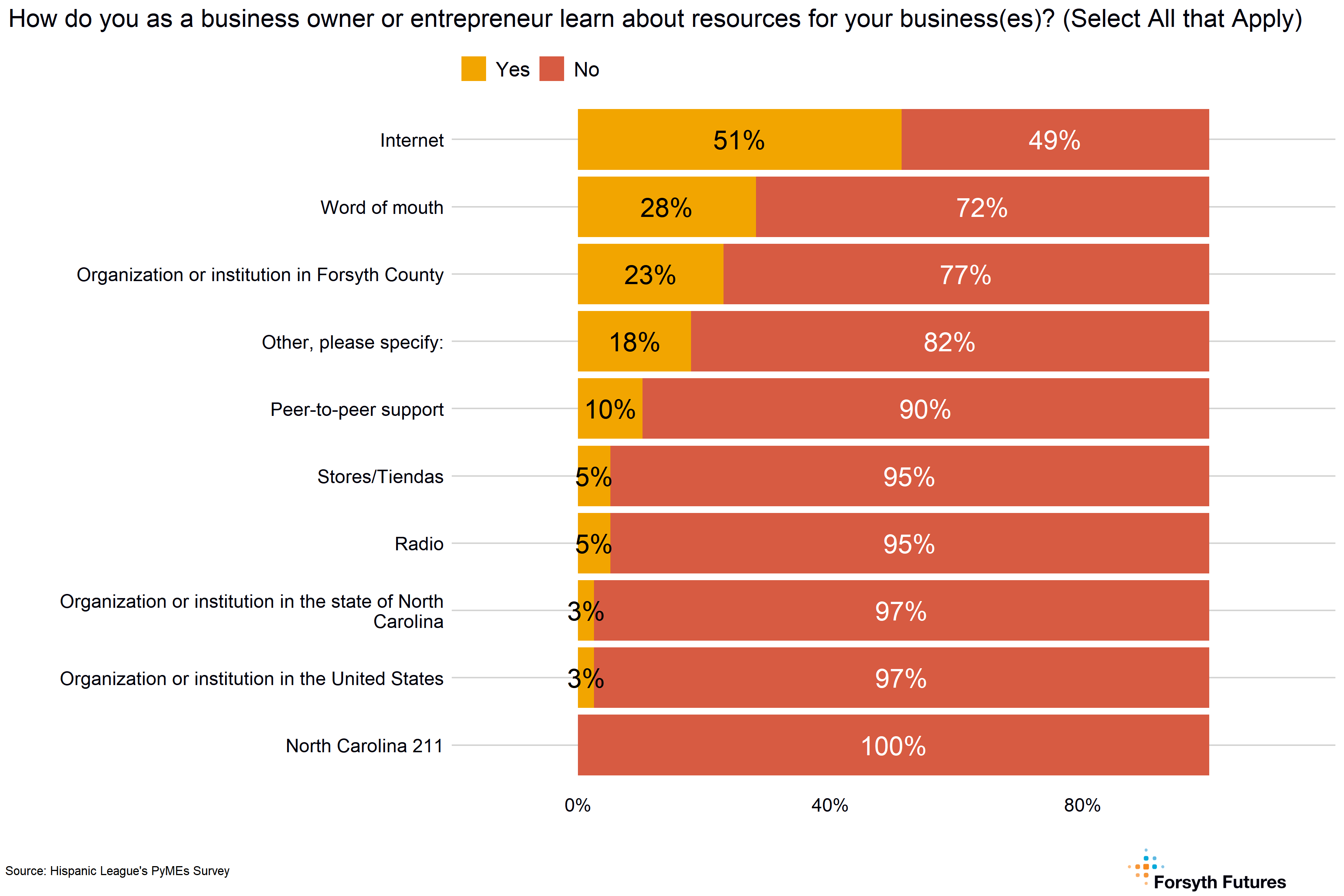

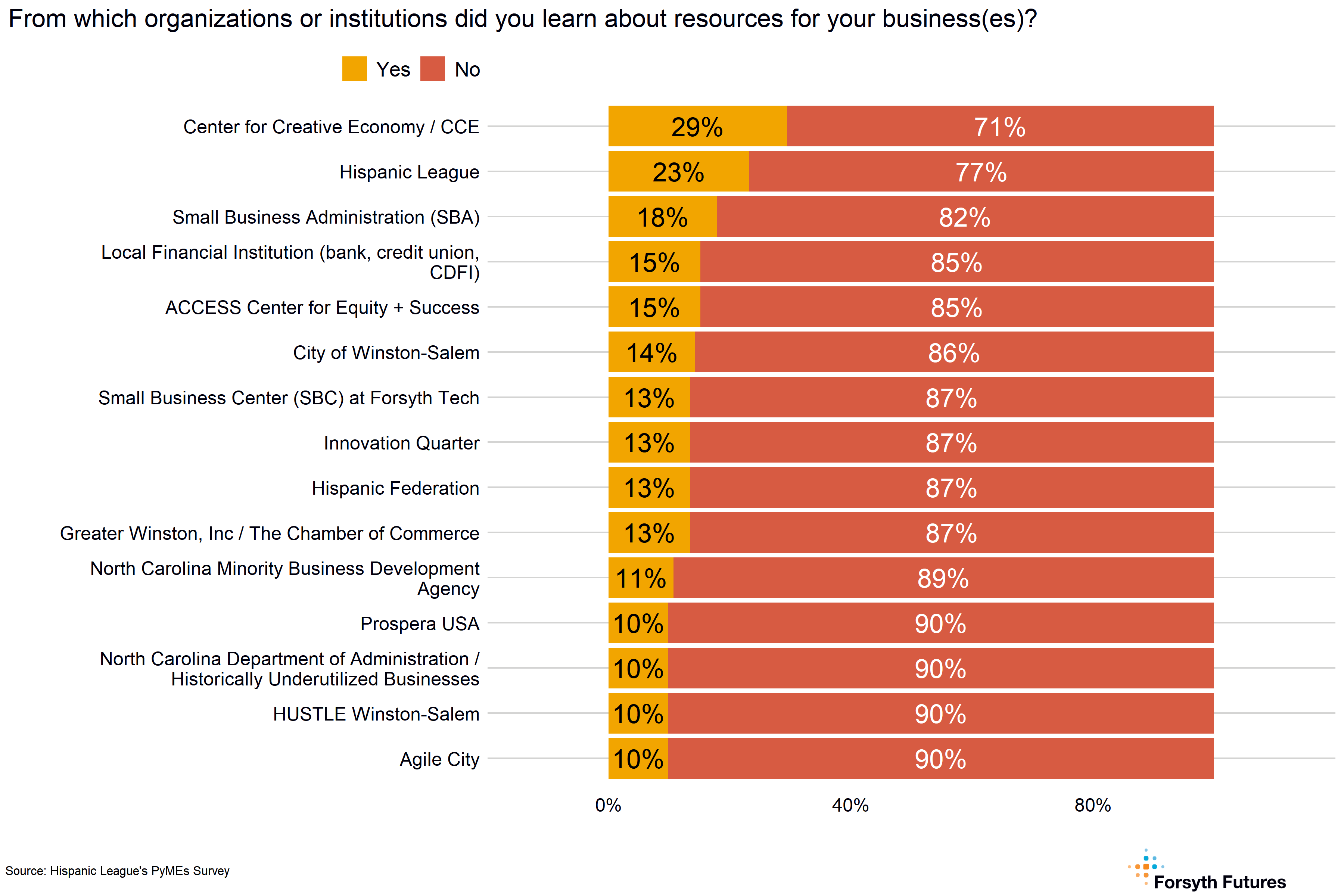

- The most common ways current and prospective owners hear about resources are the internet (51%), word of mouth (28%), and an organization or institution in Forsyth County (23%). The most common organizations / institutions current and prospective owners learn about resources are the Center for Creative Economy (29%), the Hispanic League (23%), and the Small Business Administration (18%).

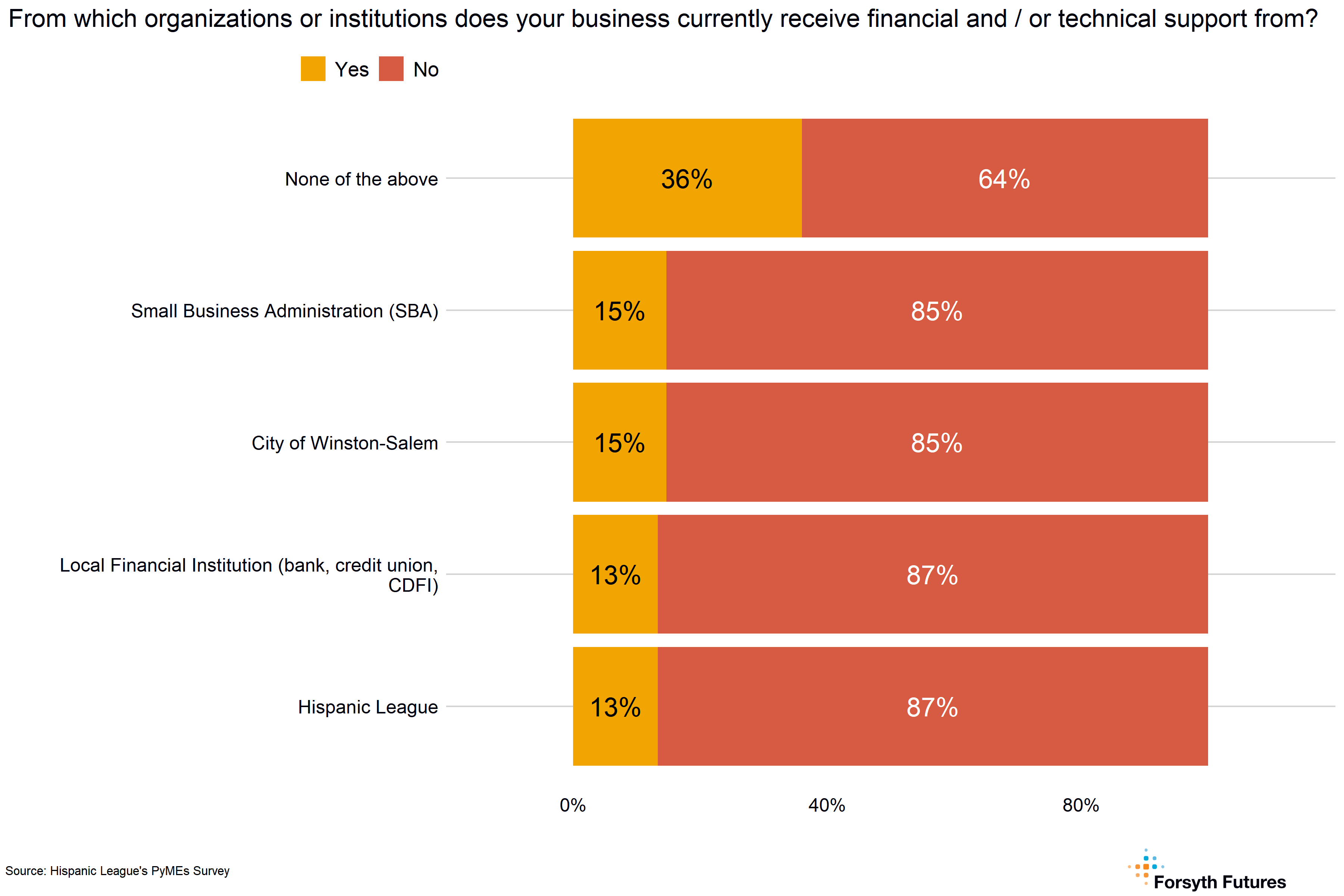

- Over a third (36%) of current and prospective owners do not receive financial or technical support from any local organizations.

- About half of current owners or entrepreneurs indicate a need for translation or bilingual support in English or Spanish.

- Current and prospective owners report that training available virtually and in-person and offered in Spanish covering topic areas such as starting / scaling a business, financial resources such as lending, taxes and grants, marketing/advertising strategies, legal requirements and licenses, and other administrative aspects of business would have been helpful over the past year and would be useful in the future.

8.3 Familiarity with Resources

8.3.1 In the County

Among current and prospective owners, the familiarity with existing resources for businesses and entrepreneurs in the county was mixed, with 23% indicating they were very familiar, 44% somewhat familiar, and 33% not familiar.

Men were more likely to be either somewhat familiar or very familiar (80%) with business resources in the county than women (51%).

8.3.2 In the State or Federal

Only 11% of all current and prospective owners were very familiar with existing state or federal level resources for their business. In comparison, 48% were somewhat familiar, and 41% were not familiar at all.

Men were more likely to be either somewhat familiar or very familiar (70%) with state and federal level resources than women (43%).

8.4 Learning about Resources

The most common ways that current and prospective owners hear about resources is via the internet (51%), by word of mouth (28%), and by an organization or institution in Forsyth County (23%). Other reported ways not listed included the Hispanic League and taking the survey.

8.5 Familiarity or Support from Local Organizations

8.5.1 Familiarity with Local Organizations

The graph above displays only the organizations with ten or more responses; there were 21 total Forsyth County organizations / groups for respondents to select, and they could choose all that applied. The most common organizations / institutions that respondents learned about resources from were the Center for Creative Economy (29%), the Hispanic League (23%), and the Small Business Administration (18%).

Below are the 21 organizations or groups included as response options:

- ACCESS Center for Equity + Success, Agile City, Center for Creative Economy / CCE, City of Winston-Salem, Flywheel. Greater Winston, Inc / The Chamber of Commerce, Hispanic Federation, Hispanic League, HUSTLE Winston-Salem, Innovation Quarter, Local Financial Institution (bank, credit union, CDFI), North Carolina Department of Administration / Historically Underutilized Businesses, North Carolina Department of Revenue (NC DOR), North Carolina Minority Business Development Agency, North Carolina Office of Civil Rights, Small Business Administration (SBA), Small Business Center (SBC) at Forsyth Tech, Small Business and Technology Development Center (SBTDC) at Winston Salem State University, Prospera USA, Sparq and Winston Starts.

8.5.2 Support from Local Organizations

As with the previous graph, the one above displays only the organizations with ten or more responses; there were 21 total Forsyth County organizations or groups as response options.

A minority of respondents indicated that their business currently receives financial aid or technical support from the Small Business Administration (15%), City of Winston-Salem (15%), a local financial institution (13%), and the Hispanic League (13%). A little over one-third of owners or entrepreneurs (36%) reported that none of the groups listed provided their business with any financial or technical report.

Below are the 21 organizations or groups included as response options:

- ACCESS Center for Equity + Success, Agile City, Center for Creative Economy / CCE, City of Winston-Salem, Flywheel. Greater Winston, Inc / The Chamber of Commerce, Hispanic Federation, Hispanic League, HUSTLE Winston-Salem, Innovation Quarter, Local Financial Institution (bank, credit union, CDFI), North Carolina Department of Administration / Historically Underutilized Businesses, North Carolina Department of Revenue (NC DOR), North Carolina Minority Business Development Agency, North Carolina Office of Civil Rights, Small Business Administration (SBA), Small Business Center (SBC) at Forsyth Tech, Small Business and Technology Development Center (SBTDC) at Winston Salem State University, Prospera USA, Sparq and Winston Starts.

8.6 Translation or Bilingual Support

8.6.1 Translation or Bilingual Need

About half of the current business owners indicated that they require translation or bilingual support in English or Spanish. No statistically significant differences existed between a respondent’s business need for translation or bilingual support in English or Spanish and their family-owned status, gender, or stage of business development.

8.6.2 Type of Translation or Bilingual Support Needed

The most significant percentage of current owners (49%) indicated they needed translation or bilingual support for services, products, and/or marketing purposes and interpretation or bilingual support for conversation or communication with staff, customers, or business partners/affiliates.

8.7 Additional Comments on Resources in the County

8.7.1 Introduction

Current business owners and/or entrepreneurs were asked about what resources were or would have been useful for business operations. Additionally, they were asked if they anticipated needing any resources this year and how they would prefer to access them. The following is a summary of those responses.

8.7.2 Summary

Useful business resources in the past year varied from employee training, financial resources, and knowledge of taxes and legal requirements. Over the next year, some respondents anticipate needing increased space and equipment, continued financial resources, growth strategies, relevant industry information, more networking opportunities, and tax assistance. Respondents emphasized that trainings available virtually and in-person and offered in Spanish covering topic areas such as starting / scaling a business, financial resources such as lending, taxes and grants, marketing/advertising strategies, legal requirements and licenses, and other administrative aspects of business would have been useful over the past year and would be useful in the future. Respondents indicated a preference for both in-person and virtual support trainings, resources, and professional networks. Respondents mentioned accessing or wanting to access resources for their business online; this includes email lists, online chats, and using the Internet to search or access resources.