Section 5 Business Characteristics: Current Owners

5.1 Introduction

The following section includes the characteristics of current business owners’ businesses, broken down into two sections: business demographics and employees and financial characteristics. The business demographics section has the number of owners, non-profit or for-profit status, family-owned business, industry type, business location, length of ownership, stage of development, and total businesses owned. The employees and financial characteristics section includes the number of paid positions, revenue, consistency of business growth, business funding sources, and participation in the Paycheck Protection Program (PPP).

Analyses to detect differences between respondents were conducted for the demographic variables of gender, family-owned businesses, and stage of business development. We only show the results we are sure are real, not just by chance. However, some visual differences between the groups may be due to chance. Also, just because we do not see a difference between the two groups, it does not mean there is not a real difference. It means we do not have enough information to be sure.

5.2 Key Findings

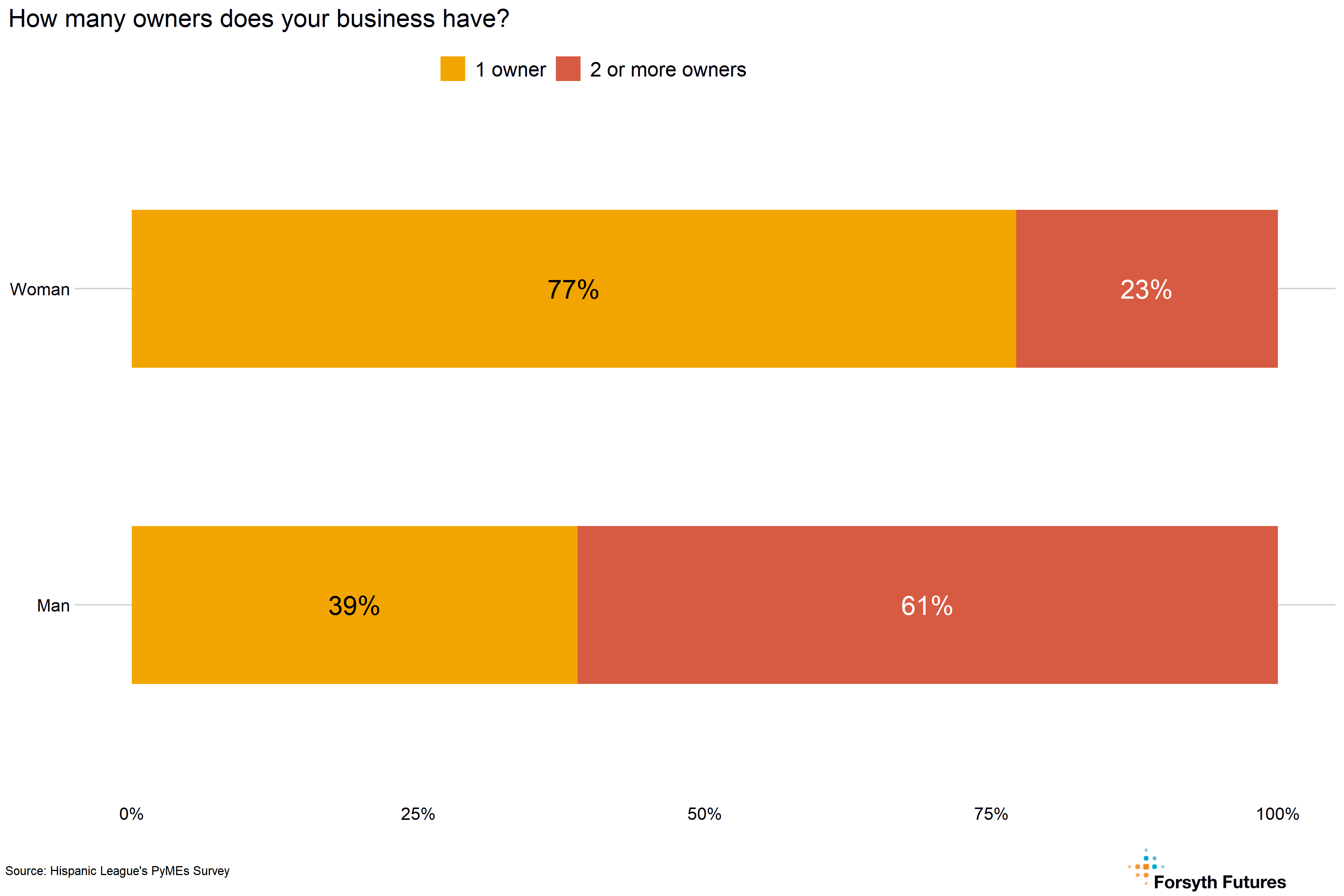

- 58% of current business owners report being their only business owners. Women are more likely to be sole owners than men; 77% of women said they were the only owner compared to 39% of men.

- The most common industries reported were auto shop or auto-related (11%), restaurant or food service (11%), professional services (10%), grocery store (9%), and construction (9%).

- 14% of current owners reported owning a business in the 27107 zip code, 10% in the 27106 zip code, and 8% in the 27127 zip code.

- Most current owners have owned their businesses for 1-8 years.

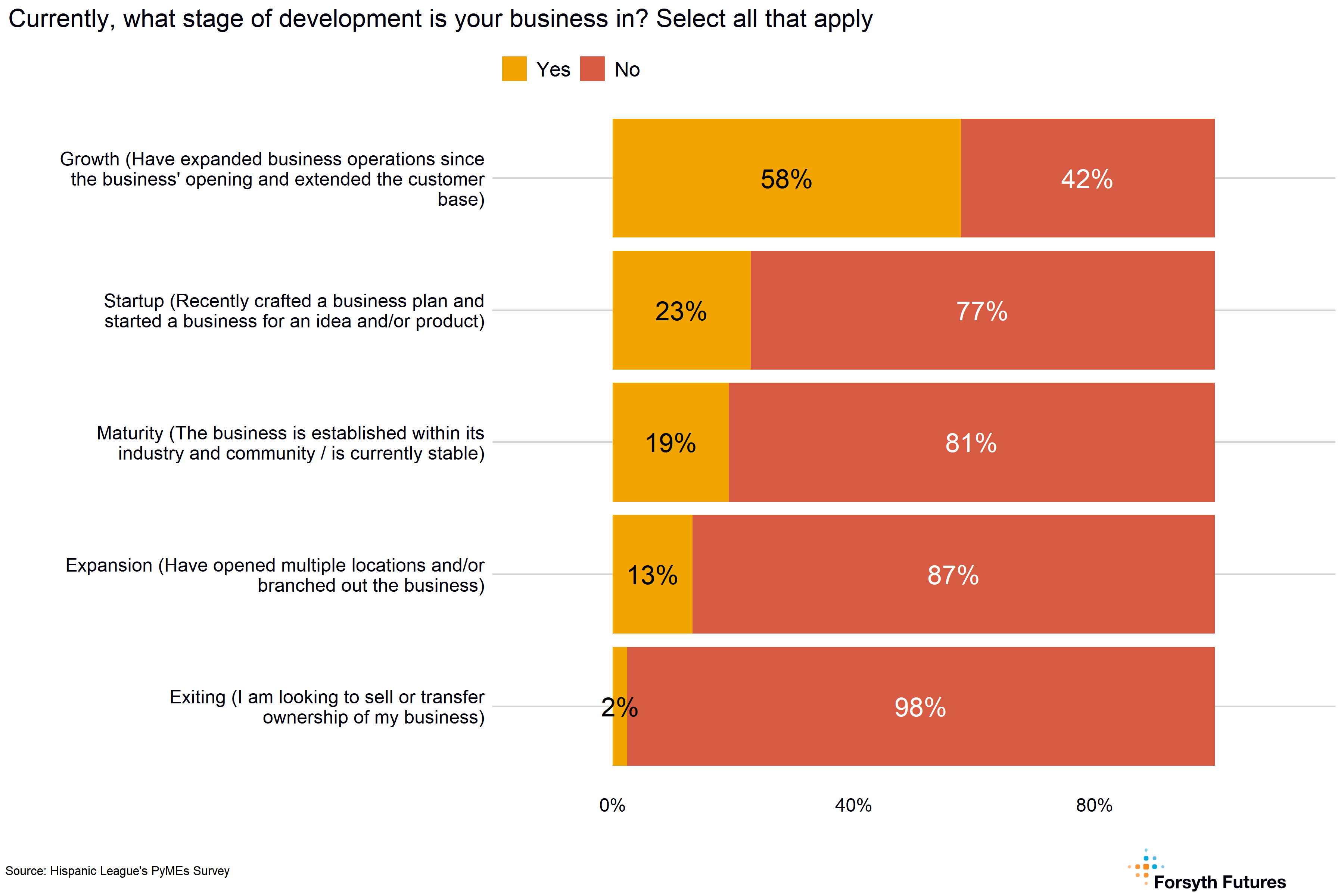

- 58% of current owners describe their business as being in the growth stage, and 23% describe their business as being in the startup stage.

- 64% of current owners have fewer than ten paid positions in their business, and about half report an annual revenue of less than $250,000.

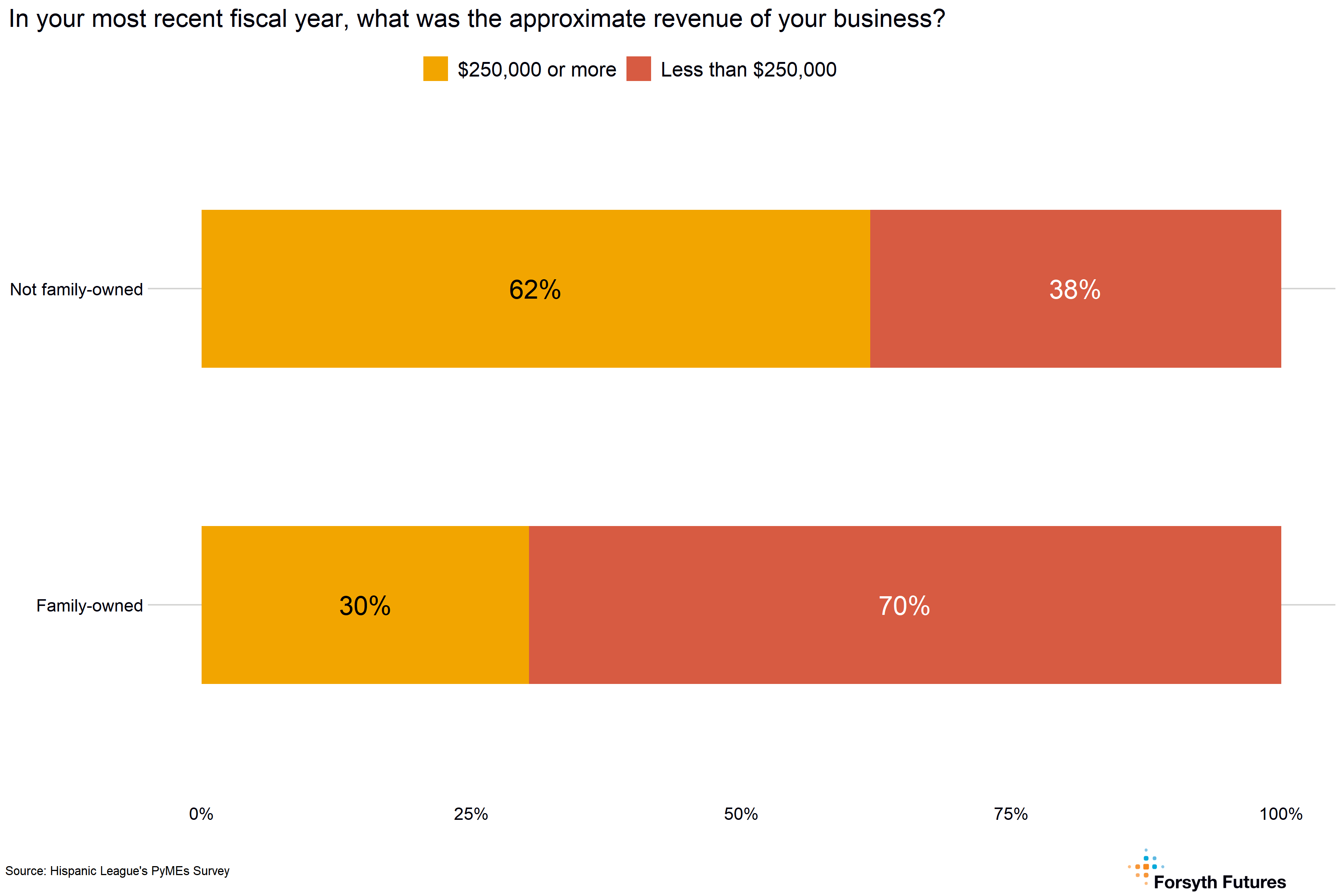

- Businesses that are not family-owned are about twice as likely as those that are to report $250,000 or more in revenue in the most recent fiscal year.

- 47% of current owners report consistent, steady growth, but 28% report dramatic up-and-down swings in growth from year-to-year.

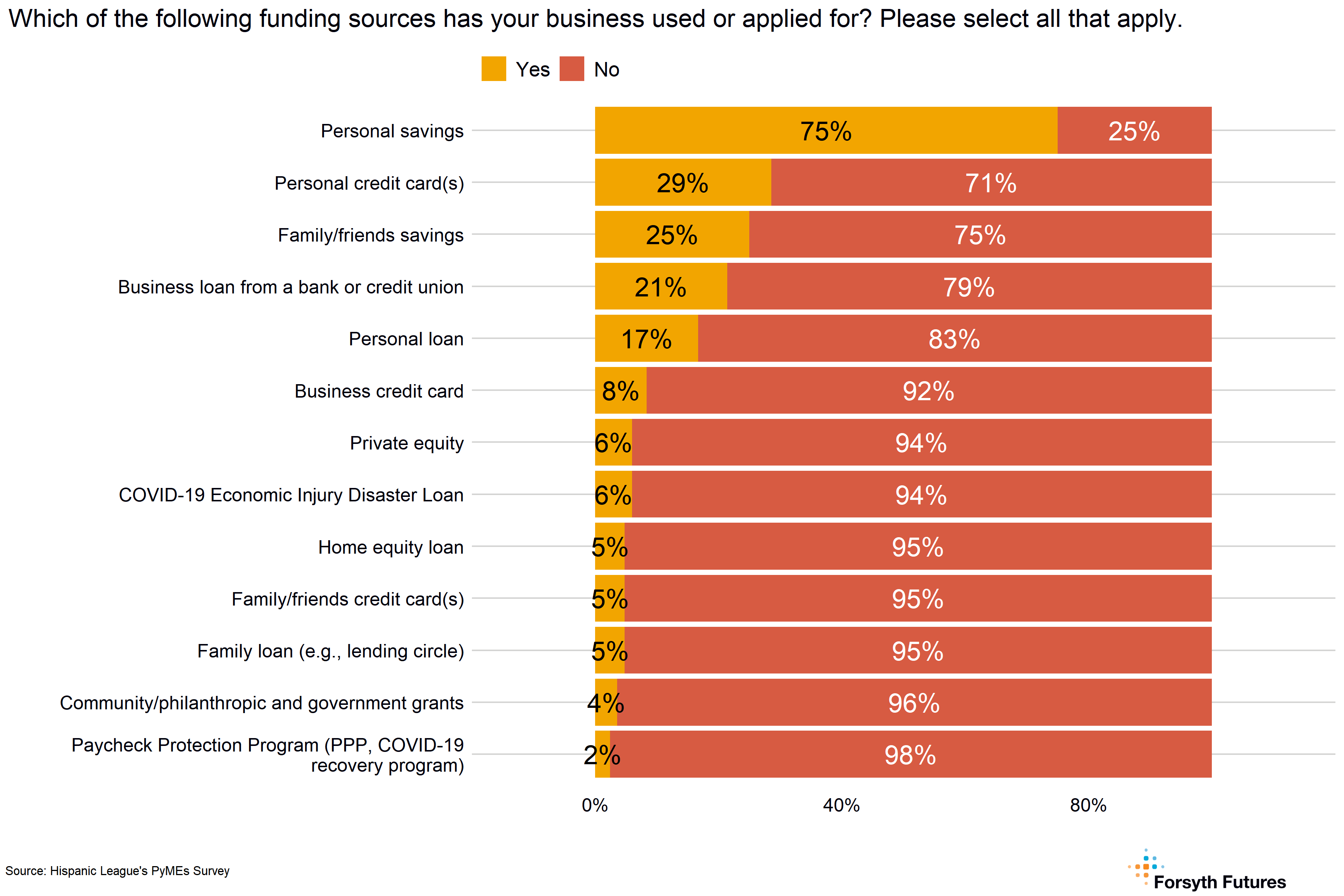

- 75% of current owners use personal savings as a business funding source. Other common funding sources include personal credit cards (29%), family / friend’s savings (25%), and a business loan from a bank or credit union (21%).

5.3 Business Demographics

5.3.1 Introduction

This section presents the business demographics of current business owners, which includes the number of owners, non-profit or for-profit status, family-owned business, industry type, location of the business, length of ownership, stage of development, and the number of total owned businesses.

Analyses to detect differences between respondents were conducted for the demographic variables of gender, family-owned businesses, and stage of business development. We only show the results we are sure are real, not just by chance. However, some visual differences between the groups may be due to chance. Also, just because we do not see a difference between the two groups, it does not mean there is not a real difference. It means we do not have enough information to be sure.

5.3.2 Key Findings

- 58% of current business owners report being their only business owners. Women are more likely to be sole owners than men; 77% of women said they were the only owner compared to 39% of men.

- 93% of current owners reported that their businesses are for-profit.

- 64% of current owners described their businesses as family-owned.

- The most common industries reported were auto shop or auto-related (11%), restaurant or food service (11%), professional services (10%), grocery store (9%), and construction (9%).

- 14% of current owners reported owning a business in the 27107 zip code, 10% in the 27106 zip code, and 8% in the 27127 zip code.

- Most current owners have owned their businesses for 1-8 years.

- 58% of current owners describe their business as being in the growth stage, and 23% describe their business as being in the startup stage.

- 82% of current business owners own one business.

5.3.3 Number of Owners

Most current business owners reported having a single business owner (58%), while 17% had two business owners, 12% had three business owners, and 13% had four or more business owners. Gender was the only disaggregation with statistically significant differences in the number of business owners, with men being more likely to have two or more business owners at 61% compared to 23% for women respondents.

5.3.5 Family-Owned Business

Most current business owners answered that they were family-owned businesses (64%). No statistically significant differences existed between family-owned or not family-owned businesses and their gender or stage of development.

5.3.6 Industry Type

The five most common types of businesses owned by current owners were auto shop or auto-related (11%), restaurant or food service (11%), professional services (10%), grocery store (9%), and construction (9%). Other industries reported but not listed above include landscaping, event planning, handyperson, cleaning services, Zumba, and social impact designing.

5.3.7 Physical Location of Business

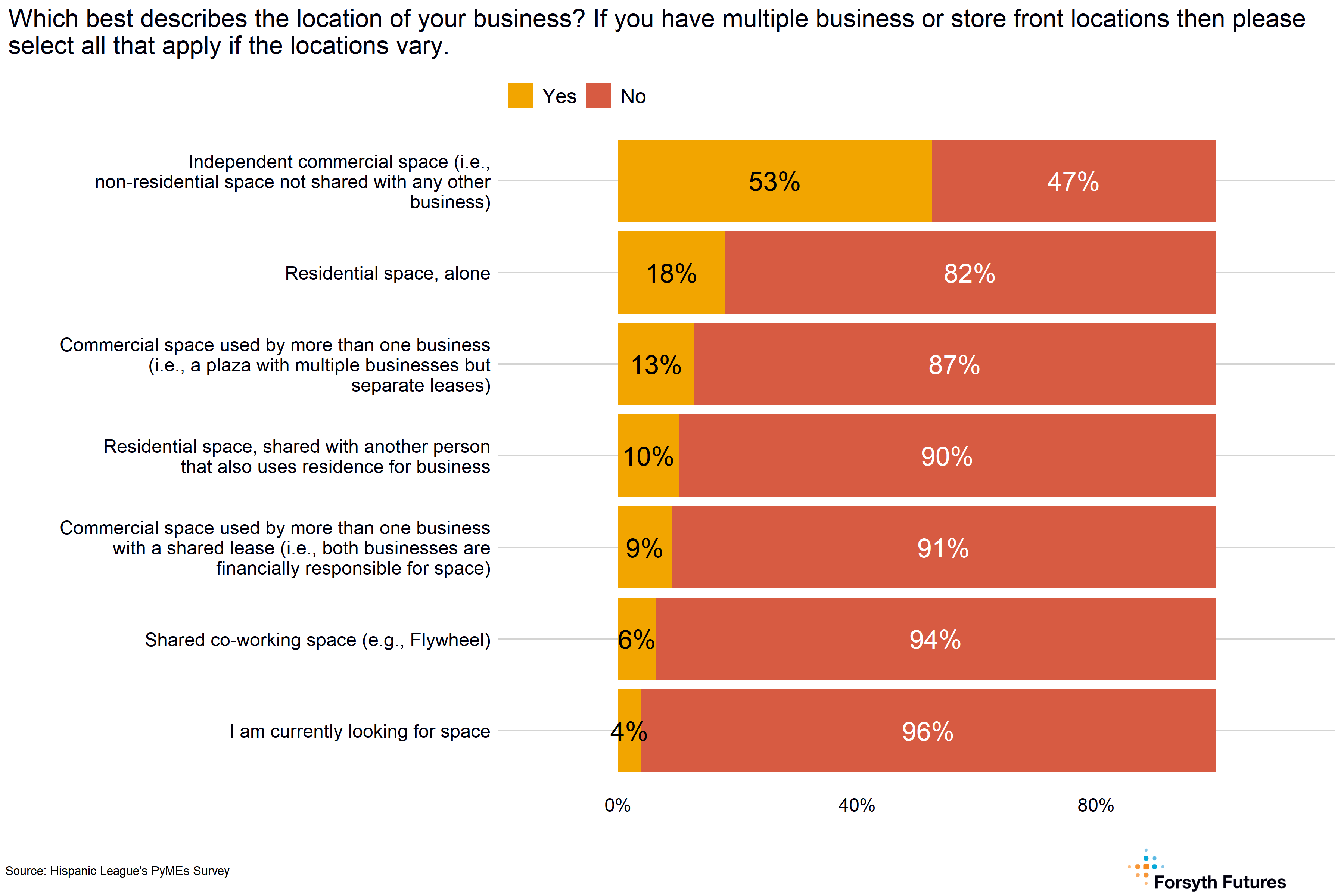

Most current owners indicated that their business location was in an independent commercial space (53%). Still, many respondents answered they had their business in a residential area where no other businesses were operating (18%).

5.3.8 Zip Code

The zip codes that had the highest percentage of respondents were 27107 (14%), 27106 (10%), 27127 (8%), 27105 (6%), and 27103 (6%).

5.3.9 Length of Ownership

Many current owners have owned their businesses for 1-8 years, with the most common amount of time a respondent has owned their business being 3-5 years (31%). No statistically significant differences existed between the amount of time respondents have owned their business and their family-owned status, gender, or stage of development.

5.3.10 Stage of Development

Most current owners indicated that their business was in the Growth stage of development (58%), with the next most common stage of business development being Startup (23%). No statistically significant differences existed between the stage of development of a respondent’s business and their family-owned status or gender.

5.4 Employees and Financial Characteristics

5.4.1 Introduction

This section presents the employees and financial characteristics of current owners’ businesses, including the number of paid positions, revenue, consistency of business growth, business funding sources, and participation in the Paycheck Protection Program (PPP).

Analyses to detect differences between respondents were conducted for the demographic variables of gender, family-owned businesses, and stage of business development. We only show the results we are sure are real, not just by chance. However, some visual differences between the groups may be due to chance. Also, just because we do not see a difference between the two groups, it does not mean there is not a real difference. It means we do not have enough information to be sure.

5.4.2 Key Findings

- 64% of current owners have fewer than ten paid positions in their business, and about half report an annual revenue of less than $250,000.

- Businesses that are not family-owned are about twice as likely as those that are to report $250,000 or more in revenue in the most recent fiscal year.

- 47% of current owners report consistent, steady growth, but 28% report dramatic up-and-down swings in growth from year-to-year.

- 75% of current owners use personal savings as a funding source for their business. Other common funding sources include personal credit cards (29%), family / friend’s savings (25%), and a business loan from a bank or credit union (21%).

- 39% of current owners applied for the Paycheck Protection Program (PPP). 82% of these business owners received financial assistance, and 89% of those owners had their loans forgiven.

5.4.3 Number of Paid Positions

Most current indicated they had fewer than ten paid positions in their business (64%).

5.4.4 Revenue

About half (48%) of respondents reported annual revenue of less than $250,000. Notably, 17% of respondents did not know or preferred not to share this information.

There is a statistically significant relationship between whether or not a business is family-owned and whether its revenue is more or less than $250,000. Businesses that are not family-owned are about twice as likely as those that are to report $250,000 or more in revenue in the most recent fiscal year.

5.4.5 Consistency of Business Growth

The most common growth among current business owners was consistent, steady growth (47%). However, a significant percentage of respondents indicated their business had dramatic, up-and-down swings in growth from year-to-year (28%).

5.4.6 Business Funding Sources

Most current owners reported using personal savings (75%) as a funding source for their business. The subsequent most common funding sources respondents used for their business were personal credit card(s) (29%), family/friend’s savings (25%), and a business loan from a bank or credit union (21%).

5.4.7 Paycheck Protection Program (PPP) Participants

5.4.7.1 Applied for Loan

Approximately 39% of current owners applied for the Paycheck Protection Program (PPP), 33% did not apply, and 21% did not know about the program. No statistically significant differences existed between applying for the Paycheck Protection Program (PPP) and their family-owned status, gender, or stage of development.