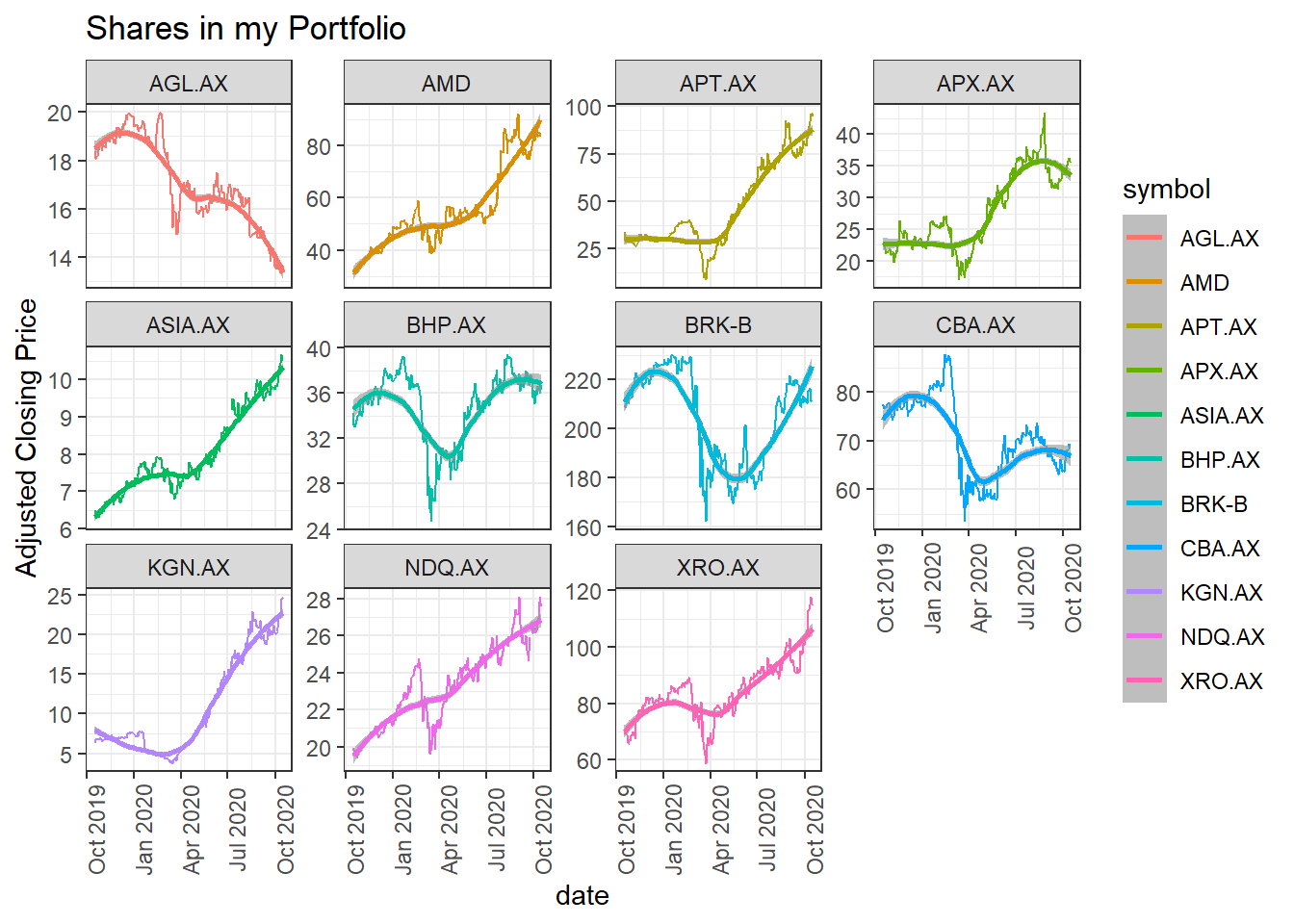

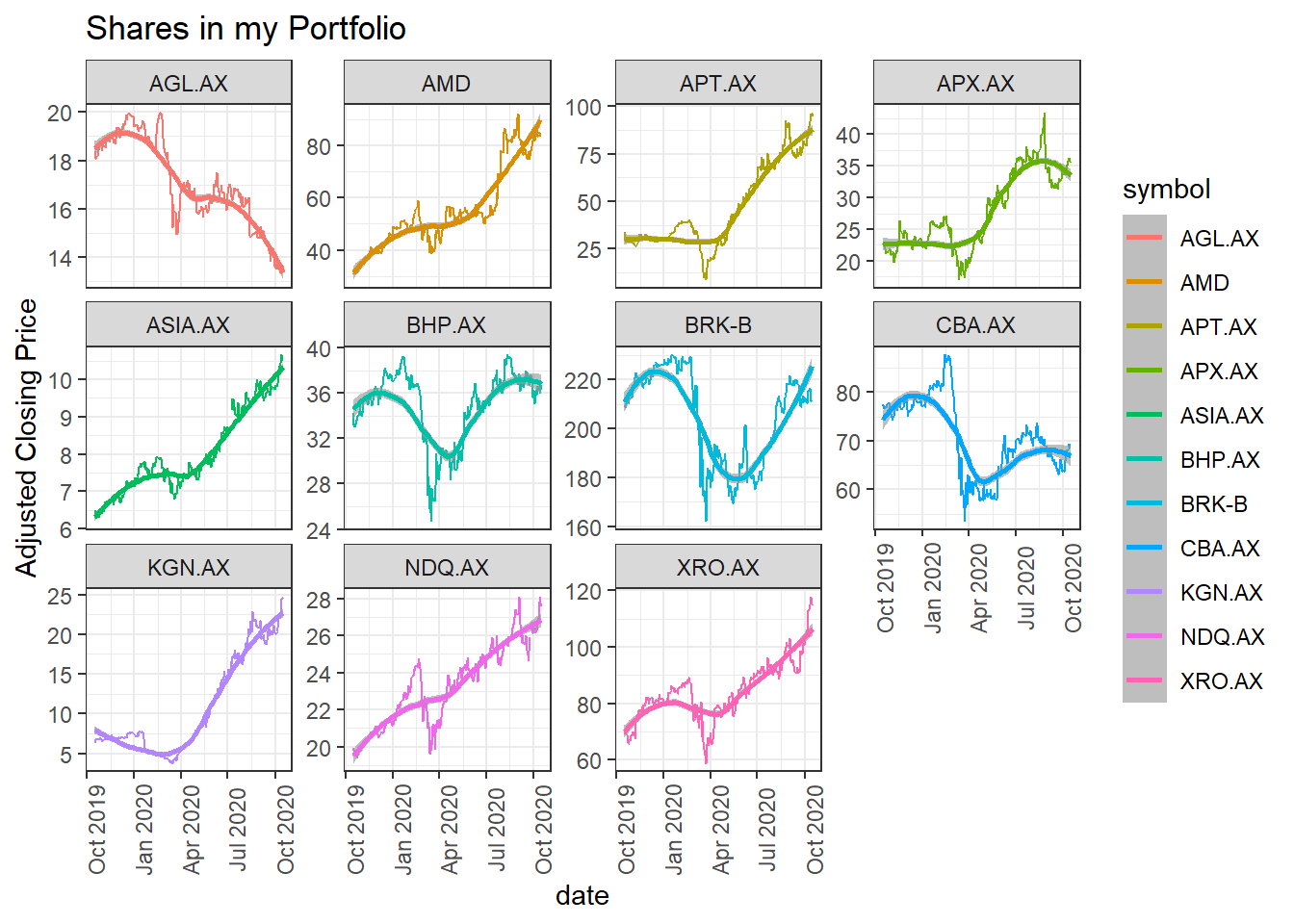

A quick analysis my portofio holdings 2020

today = Sys.time()

last_year = today - years(1)

tickers = c("ASIA.AX", "XRO.AX", "APX.AX", "BRK-B","CBA.AX","BHP.AX", "AGL.AX", "KGN.AX","NDQ.AX","AMD","APT.AX")

prices %>% group_by(symbol) %>% slice(1)

## # A tibble: 11 x 8

## # Groups: symbol [11]

## symbol date open high low close volume adjusted

## <chr> <date> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 AGL.AX 2019-10-16 19.4 19.5 19.3 19.5 1521437 18.4

## 2 AMD 2019-10-16 30.6 31.4 30.5 30.8 42804400 30.8

## 3 APT.AX 2019-10-16 36.1 36.1 33.5 33.9 4824840 33.9

## 4 APX.AX 2019-10-16 22.7 22.9 22.5 22.8 897485 22.8

## 5 ASIA.AX 2019-10-16 6.48 6.52 6.48 6.52 28847 6.49

## 6 BHP.AX 2019-10-16 36.1 36.3 35.9 36.0 5716652 34.3

## 7 BRK-B 2019-10-16 208. 210. 208. 209. 3233900 209.

## 8 CBA.AX 2019-10-16 79.8 80.5 79.7 80.4 2907048 77.6

## 9 KGN.AX 2019-10-16 6.04 6.55 6.04 6.55 1159868 6.41

## 10 NDQ.AX 2019-10-16 20.0 20 19.9 20.0 56111 19.9

## 11 XRO.AX 2019-10-16 69 70.5 69 70.1 524000 70.1

prices %>% ggplot() + aes(x = date, y = adjusted, color = symbol) +

geom_line() + facet_wrap(~symbol, scales = "free") + geom_smooth(method= "loess") + ylab("Adjusted Closing Price") +

facet_wrap(~symbol,scales = 'free_y') + theme_bw() +geom_smooth(formula = y~x, method = loess) + ggtitle("Shares in my Portfolio")+

theme(axis.text.x = element_text(angle = 90))