Chapter 6 Robust portfolio design

6.1 Motivation

A convex optimization problem is written as

\[\begin{array}{ll} \underset{\mathbf{x}}{\textsf{minimize}} & f_{0}\left(\mathbf{x}\right)\\ \textsf{subject to} & f_{i}\left(\mathbf{x}\right)\leq0\qquad i=1,\ldots,m\\ & \mathbf{h}\left(\mathbf{x}\right)=\mathbf{A}\mathbf{x}-\mathbf{b}=0 \end{array}\]

where \(f_{0},\,f_{1},\ldots,f_{m}\) are convex and equality constraints are affine.

Convex problems enjoy a rich theory (KKT conditions, zero duality gap, etc.) as well as a large number of efficient numerical algorithms guaranteed to deliver an optimal solution. However, the obtained optimal solution typically performs very poorly (or even useless!) in practice.

The question is whether a small error in the parameters is going to be detrimental or can be ignored. That depends on each particular type of problem.

To make explicit the fact that the functions depend on parameters \(\boldsymbol{\theta}\), we can write explicitly write \(f_{i}\left(\mathbf{x};\boldsymbol{\theta}\right)\) and \(h_{i}\left(\mathbf{x};\boldsymbol{\theta}\right)\). The naive approach is to pretend that \(\hat{\boldsymbol{\theta}}\) is close enough to \(\boldsymbol{\theta}\) and solve the approximated problem.

Markowitz’s portfolio suffers from:

it is highly sensitive to parameter estimation errors (i.e., to the covariance matrix Σ and especially to the mean vector μ): solution is robust optimization and improved parameter estimation,

variance is not a good measure of risk in practice since it penalizes both the unwanted high losses and the desired low losses: the solution is to use alternative measures for risk, e.g., VaR and CVaR,

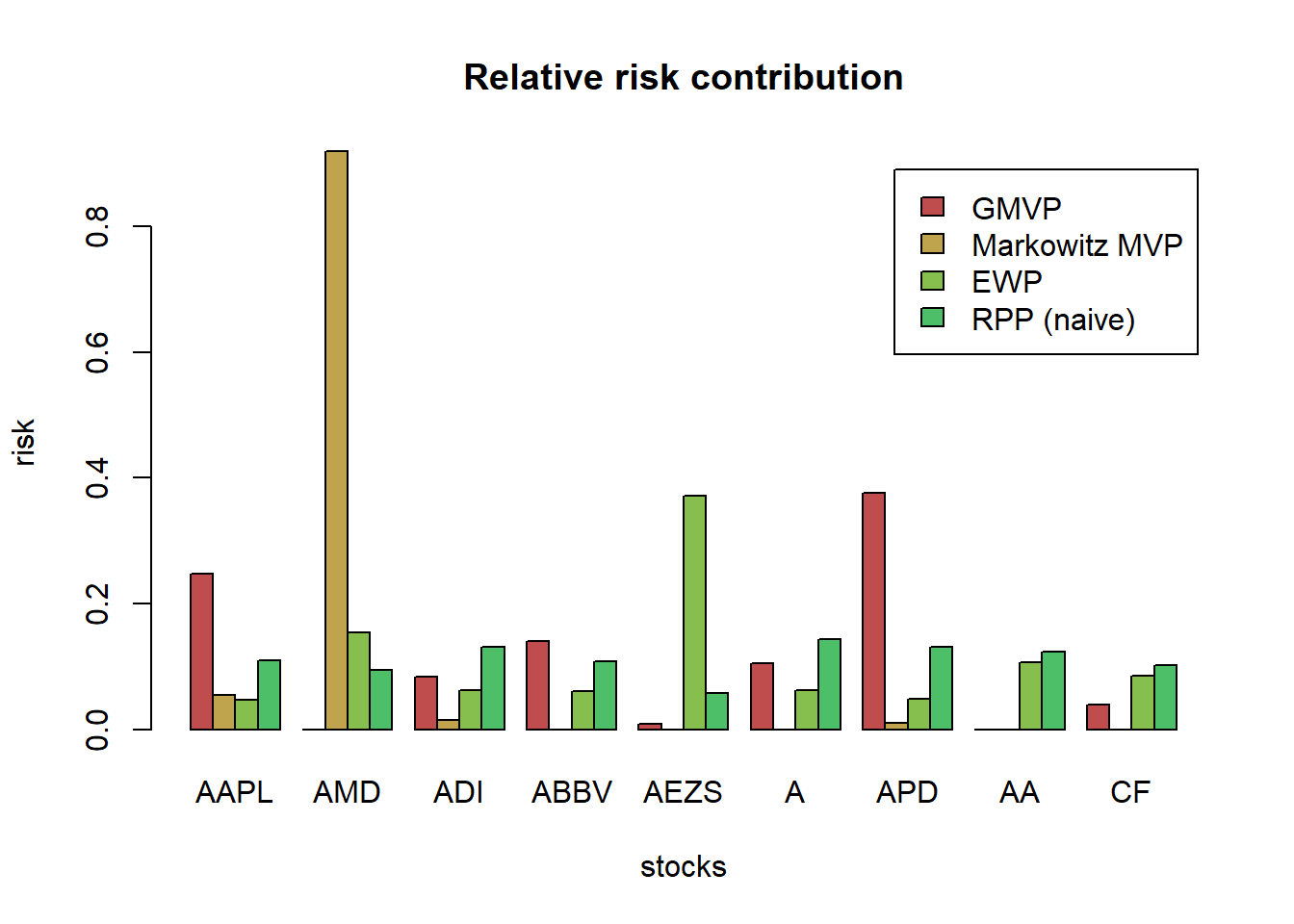

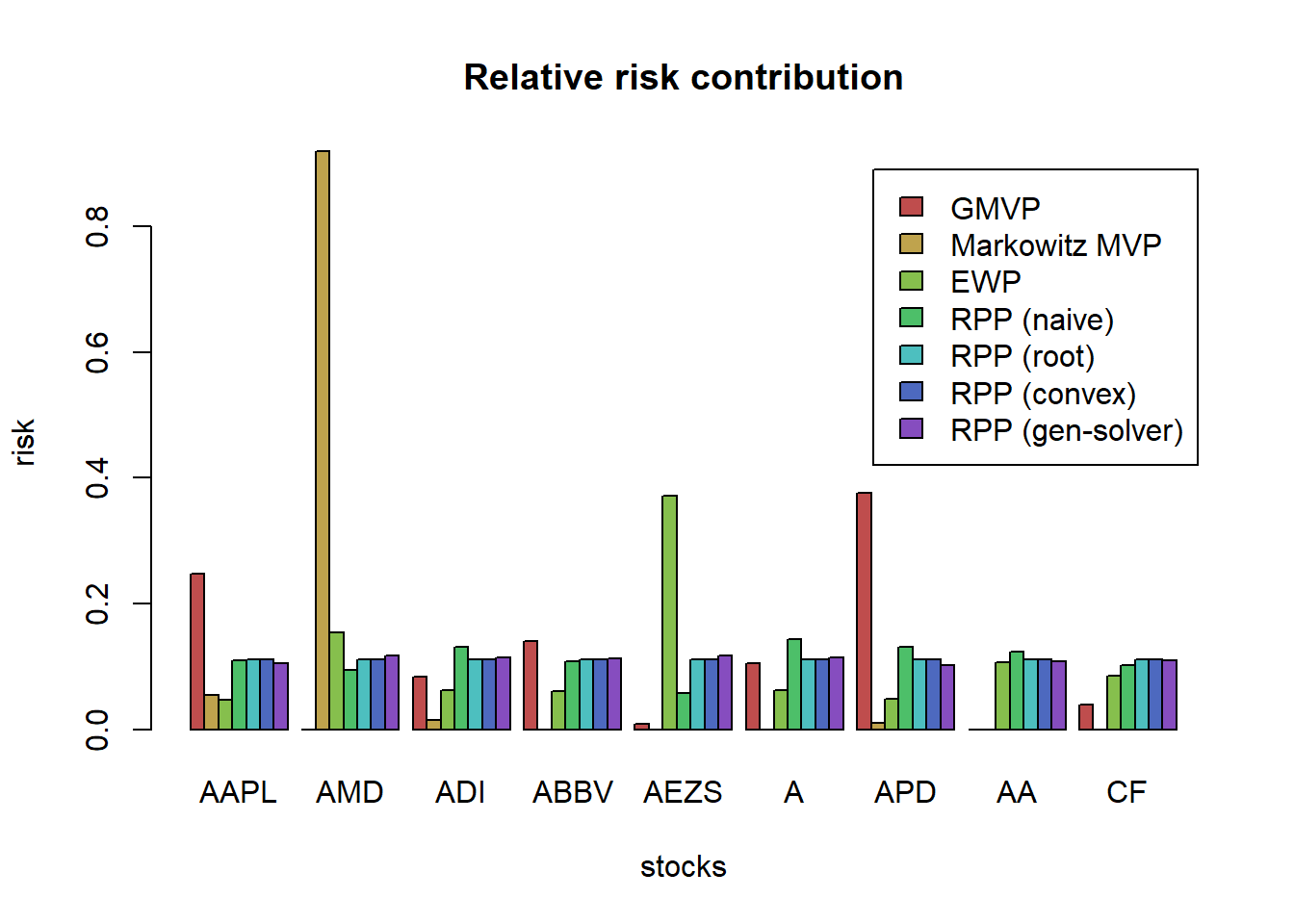

it only considers the risk of the portfolio as a whole and ignores the risk diversification (i.e., concentrates risk too much in few assets, this was observed in the 2008 financial crisis): solution is the risk parity portfolio.

In this chapter, we focus on the first issue (parameter estimation errors). There are several ways to make the problem robust to parameters errors, mainly:

Stochastic robust optimization (involving expectations):

The problem with expectations is that only the average behavior is concerned and nothing is under control about the realizations worse than the average. For example, on average some constraint will be satisfied but it will be violated for many realizations

Worst-case robust optimization:

The problem with worst-case programming is that it is too conservative as one deals with the worst possible case.

Chance programming or chance robust optimization:

The naive constraint \(f(\mathbf{x};\hat{\boldsymbol{\theta}})\leq0\) is replaced with \(\mathsf{Pr}_{\boldsymbol{\theta}}\left[f(\mathbf{x};\boldsymbol{\theta})\leq0\right]\geq1-\epsilon=0.95\)Chance programming tries to find a compromise. In particular, it also models the estimation errors statistically but instead of focusing on the average it guarantees a performance for, say, 95% of the cases. Chance or probabilistic constraints are generally very hard to deal with and one typically has to resort to approximations.

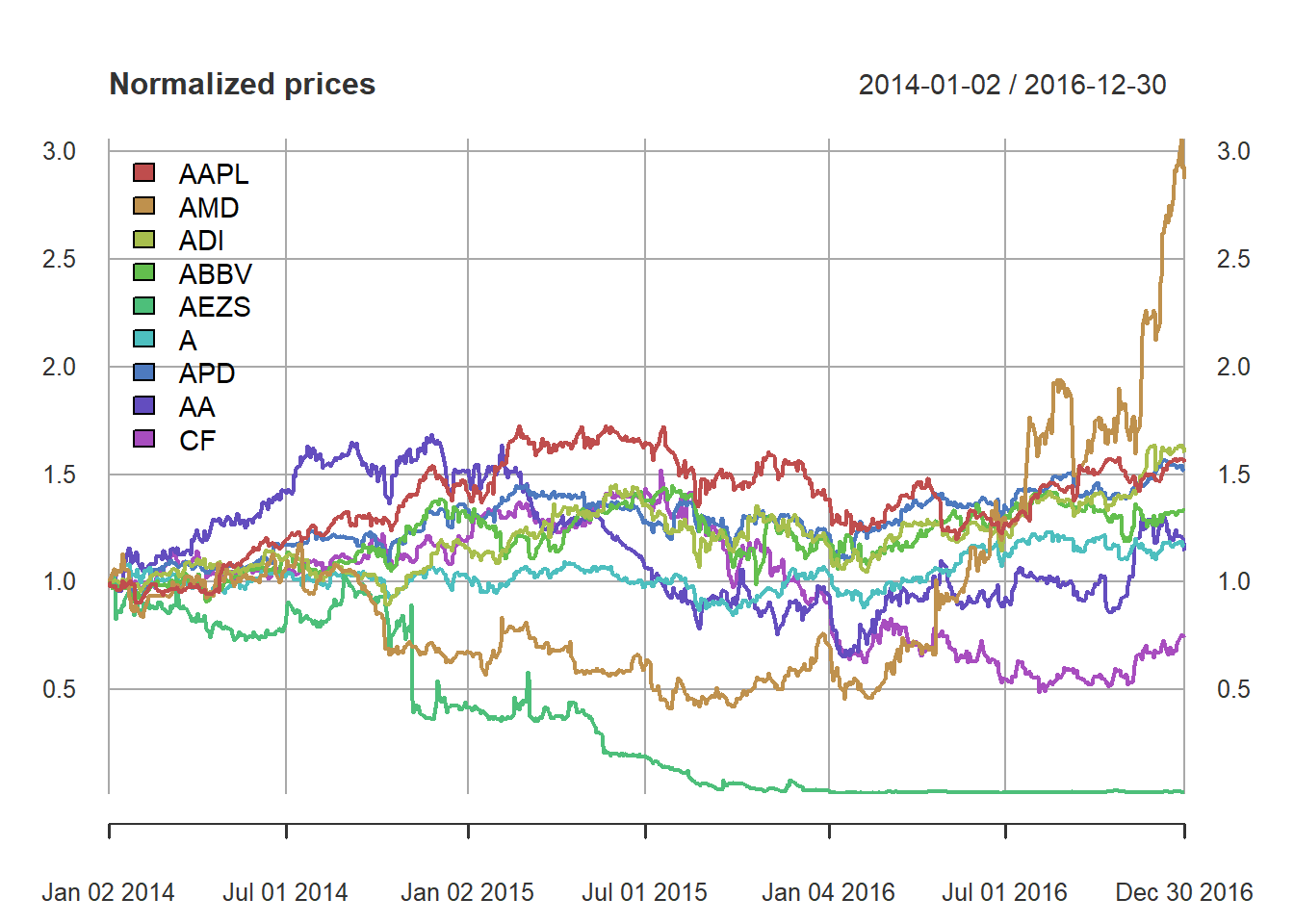

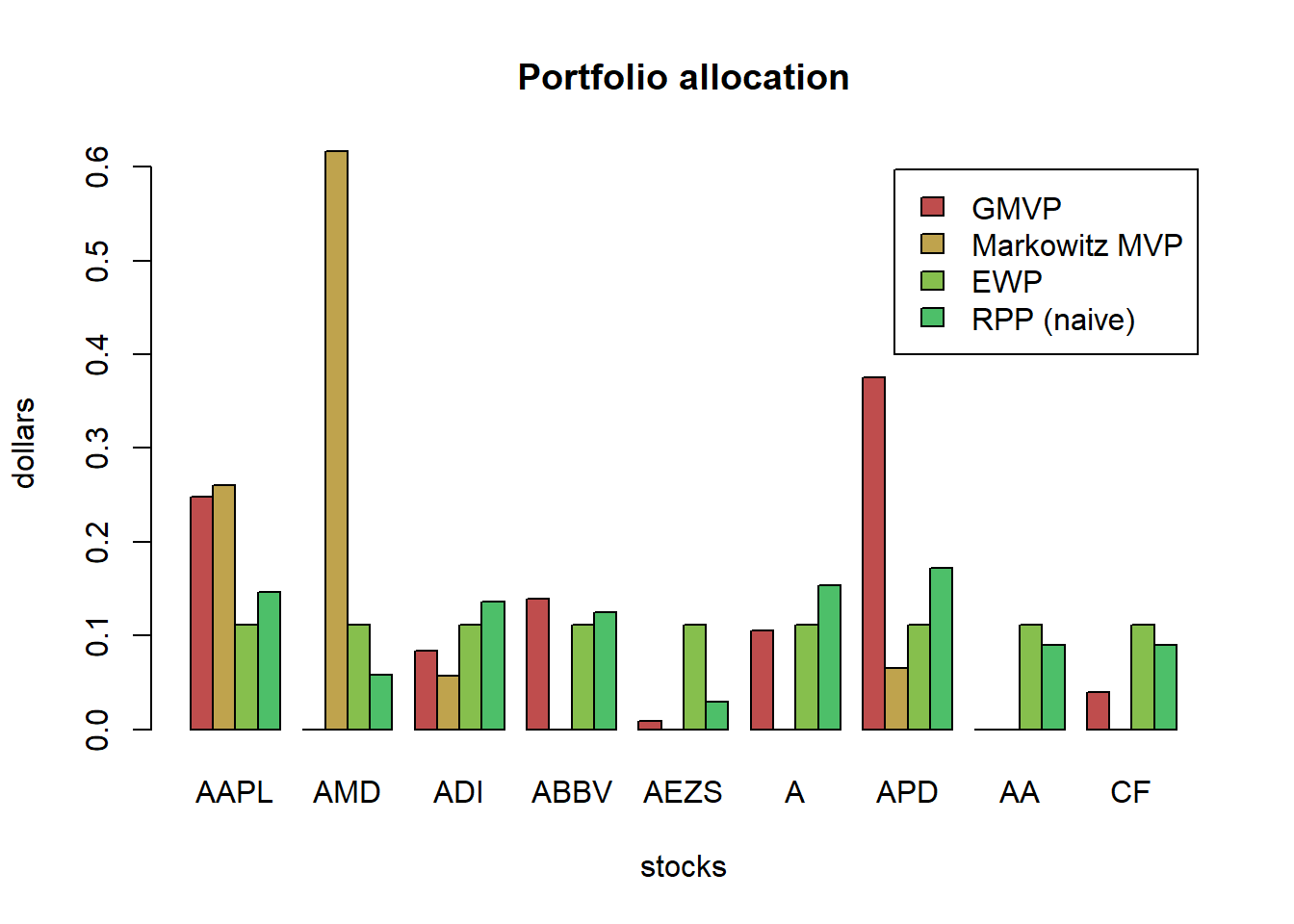

_Data preparation__:

from = "2013-01-01"

to = "2018-12-31"

tickers <- c("AAPL", "AMD", "ADI", "ABBV", "AEZS", "A", "APD", "AA","CF")

prices <- get_data(tickers, from, to)

N <- ncol(prices)

T <- nrow(prices)

X <- diff(log(prices)) %>% na.omit()

mu <- colMeans(X)

Sigma <- cov(X)

plot(prices/rep(prices[1, ], each = nrow(prices)), col = rainbow10equal, legend.loc = "topleft",

main = "Normalized prices")

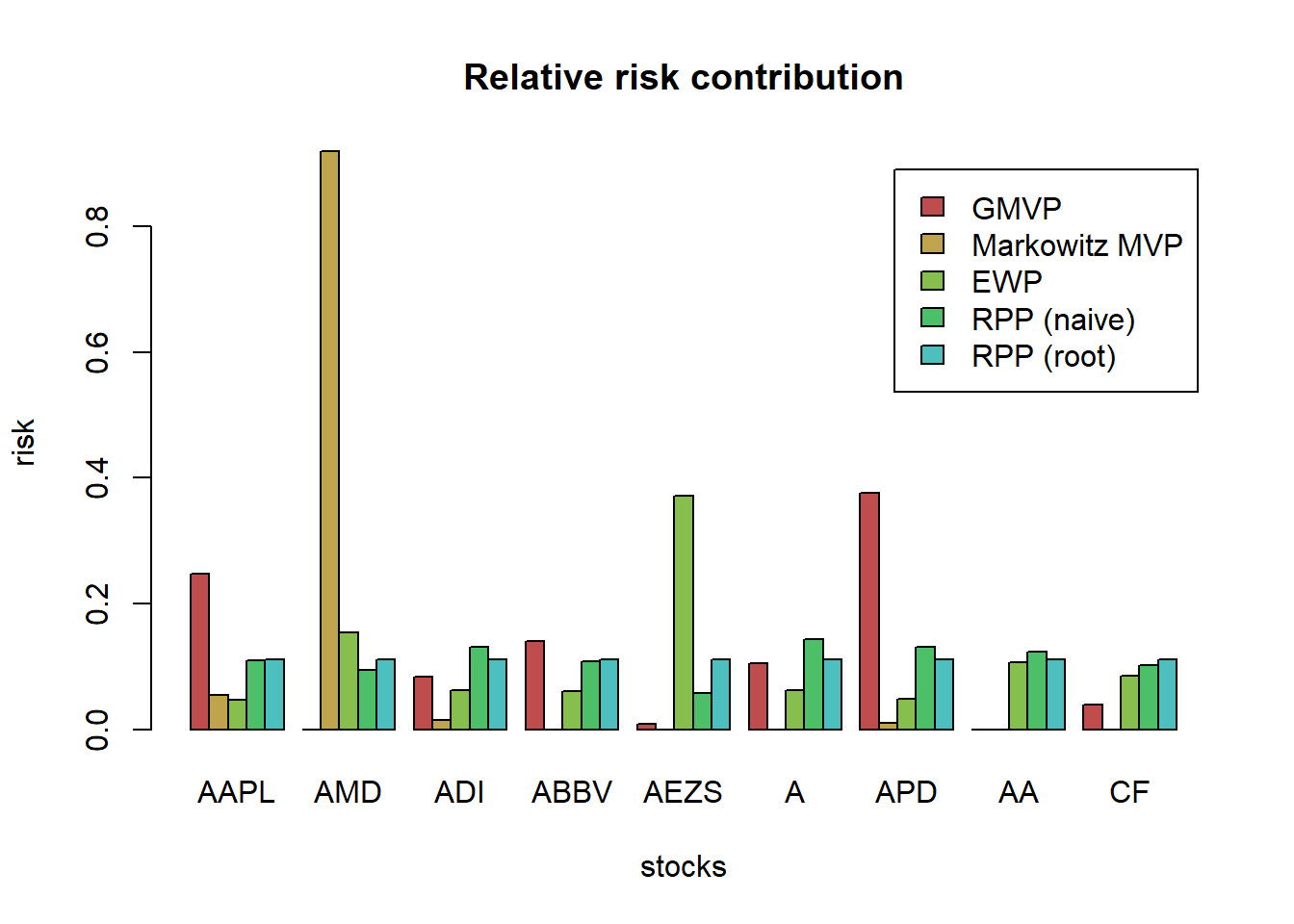

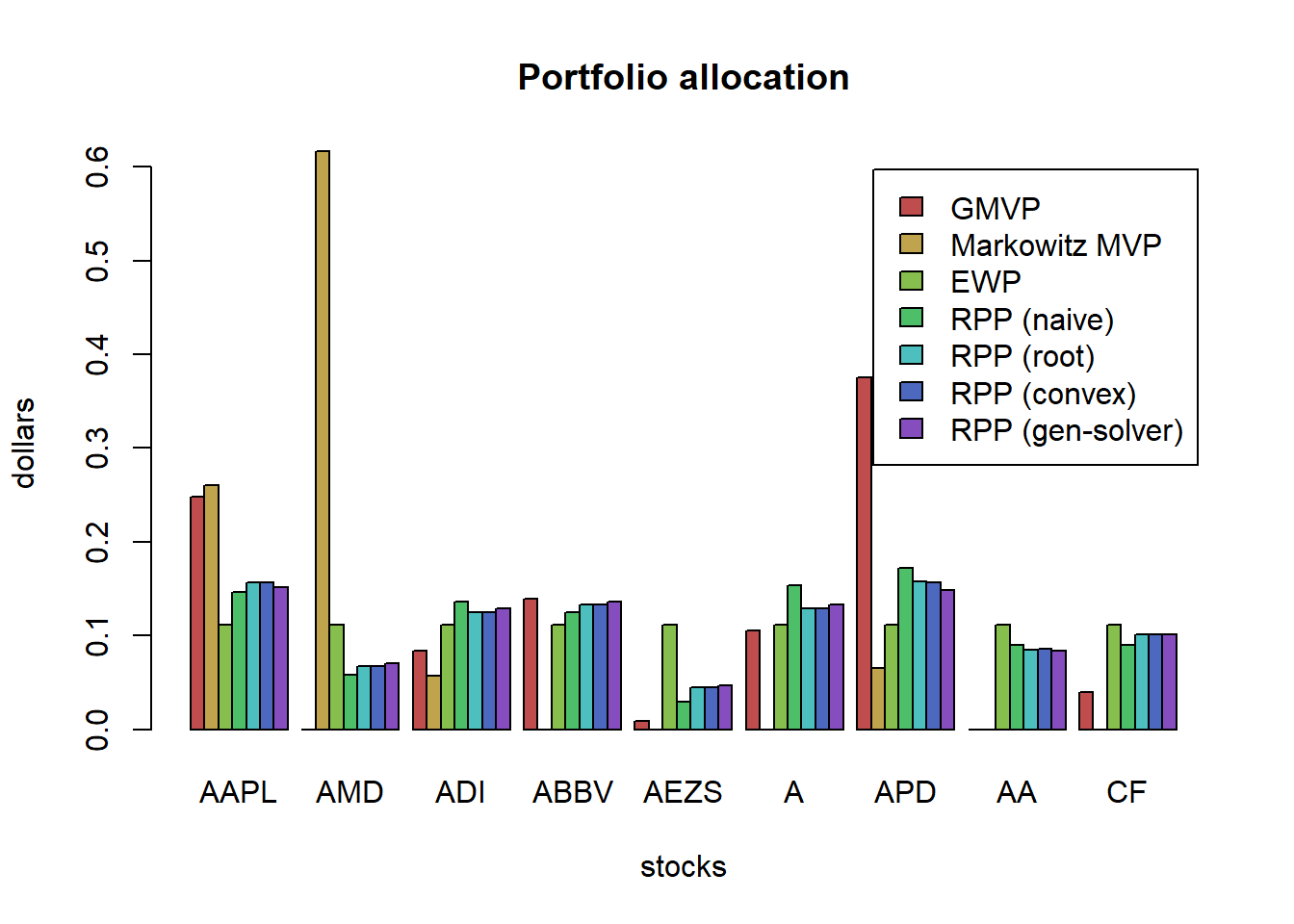

6.2 Sensitivity of different portfolio design

6.2.1 Global Maximum Return Portfolio

w_GMRP <- GMRP(mu)

w_all_GMRP <- cbind(w_GMRP)

barplot(t(w_all_GMRP), col = rainbow8equal[1], legend = colnames(w_all_GMRP), beside = TRUE,

main = "Global maximum return portfolio allocation", xlab = "stocks", ylab = "dollars") Let’s now introduce some estimation error in \(\boldsymbol{\mu}\) to see the effect:

Let’s now introduce some estimation error in \(\boldsymbol{\mu}\) to see the effect:

library(mvtnorm)

# generate a few noisy estimations of mu

for (i in 1:6) {

mu_noisy <- as.vector(rmvnorm(n = 1, mean = mu, sigma = (1/T)*Sigma))

w_GMRP_noisy <- GMRP(mu_noisy)

w_all_GMRP <- cbind(w_all_GMRP, w_GMRP_noisy)

}

# plot to compare the allocations

barplot(t(w_all_GMRP), col = rainbow8equal[1:7], legend = colnames(w_all_GMRP), beside = TRUE,

main = "Global maximum return portfolio allocation", xlab = "stocks", ylab = "dollars") We can see that the optimal allocation changes totally from realization to realization, which is highly undesirable (in fact, it is totally unacceptable).

We can see that the optimal allocation changes totally from realization to realization, which is highly undesirable (in fact, it is totally unacceptable).

6.2.2 Global Minimum Variance Portfolio

Let’s continue with the GMVP formulated as

\[\begin{array}{ll} \underset{\mathbf{w}}{\textsf{minimize}} & \mathbf{w}^T\mathbf{\Sigma}\mathbf{w}\\ {\textsf{subject to}} & \mathbf{1}^T\mathbf{w} = 1\\ & \mathbf{w}\ge\mathbf{0} \end{array}\]

w_GMVP <- GMVP(Sigma, long_only = TRUE)

w_all_GMVP <- cbind(w_GMVP)

# plot allocation

barplot(t(w_all_GMVP), col = rainbow8equal[1], legend = colnames(w_all_GMVP), beside = TRUE,

main = "Global minimum variance portfolio allocation", xlab = "stocks", ylab = "dollars")

The GMVP is totally different from the maximum return portfolio. It’s quite the opposite: the budget is allocated to most of the stocks to diversity the risk.

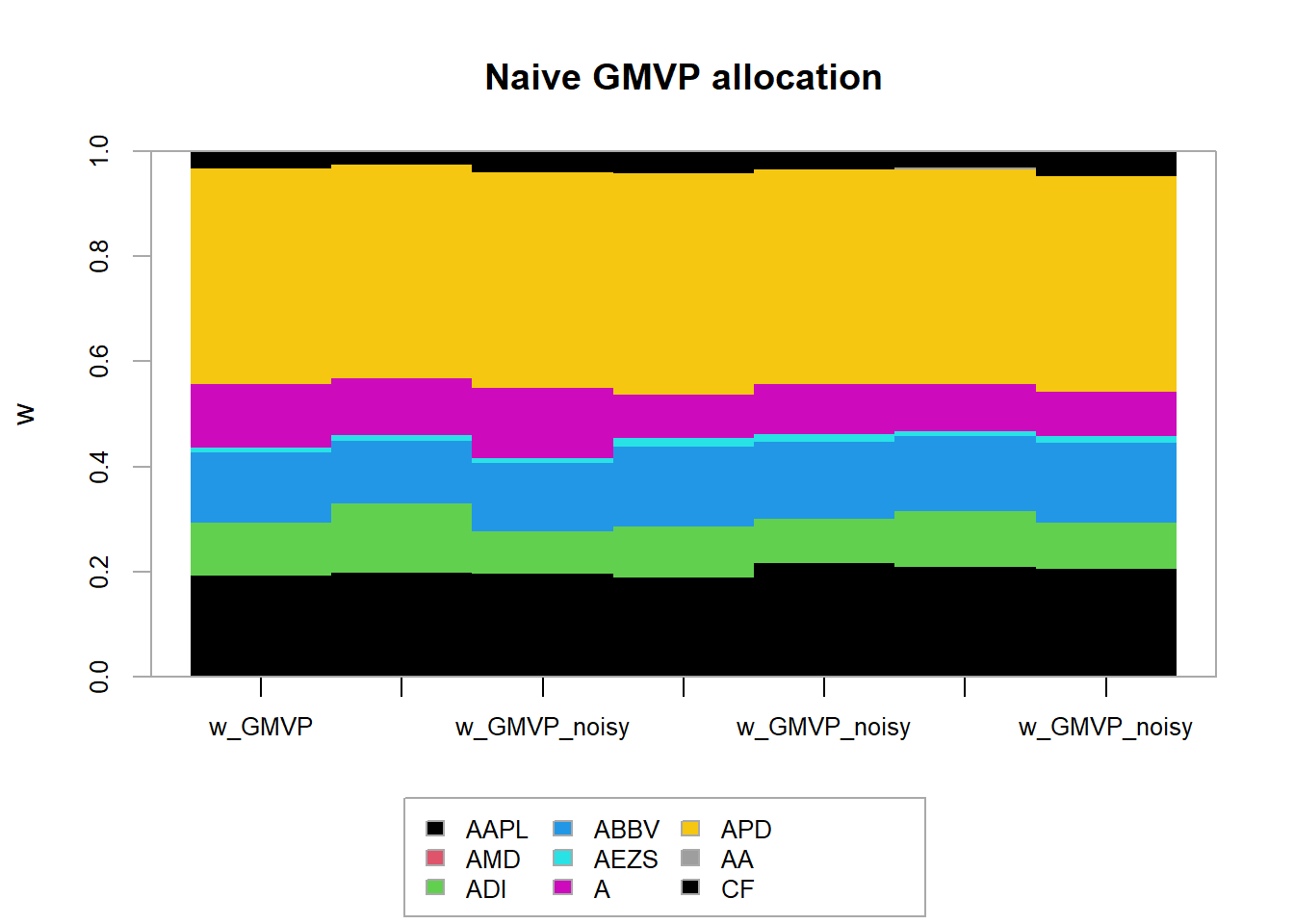

Let’s now introduce some estimation error in \(\boldsymbol{\Sigma}\) to see the effect:

library(PerformanceAnalytics)

set.seed(357)

N <- ncol(X)

for (i in 1:6) {

X_noisy <- rmvnorm(n = T, mean = rep(0, N), sigma = Sigma)

Sigma_noisy <- cov(X_noisy)

w_GMVP_noisy <- GMVP(Sigma_noisy, long_only = TRUE)

w_all_GMVP <- cbind(w_all_GMVP, w_GMVP_noisy)

}

# plot to compare the allocations

chart.StackedBar(t(w_all_GMVP), main = "GMVP allocation", ylab = "w", space = 0, border = NA) We can see that the optimal allocation still changes from realization to realization, although in this case is not that extreme.

We can see that the optimal allocation still changes from realization to realization, although in this case is not that extreme.

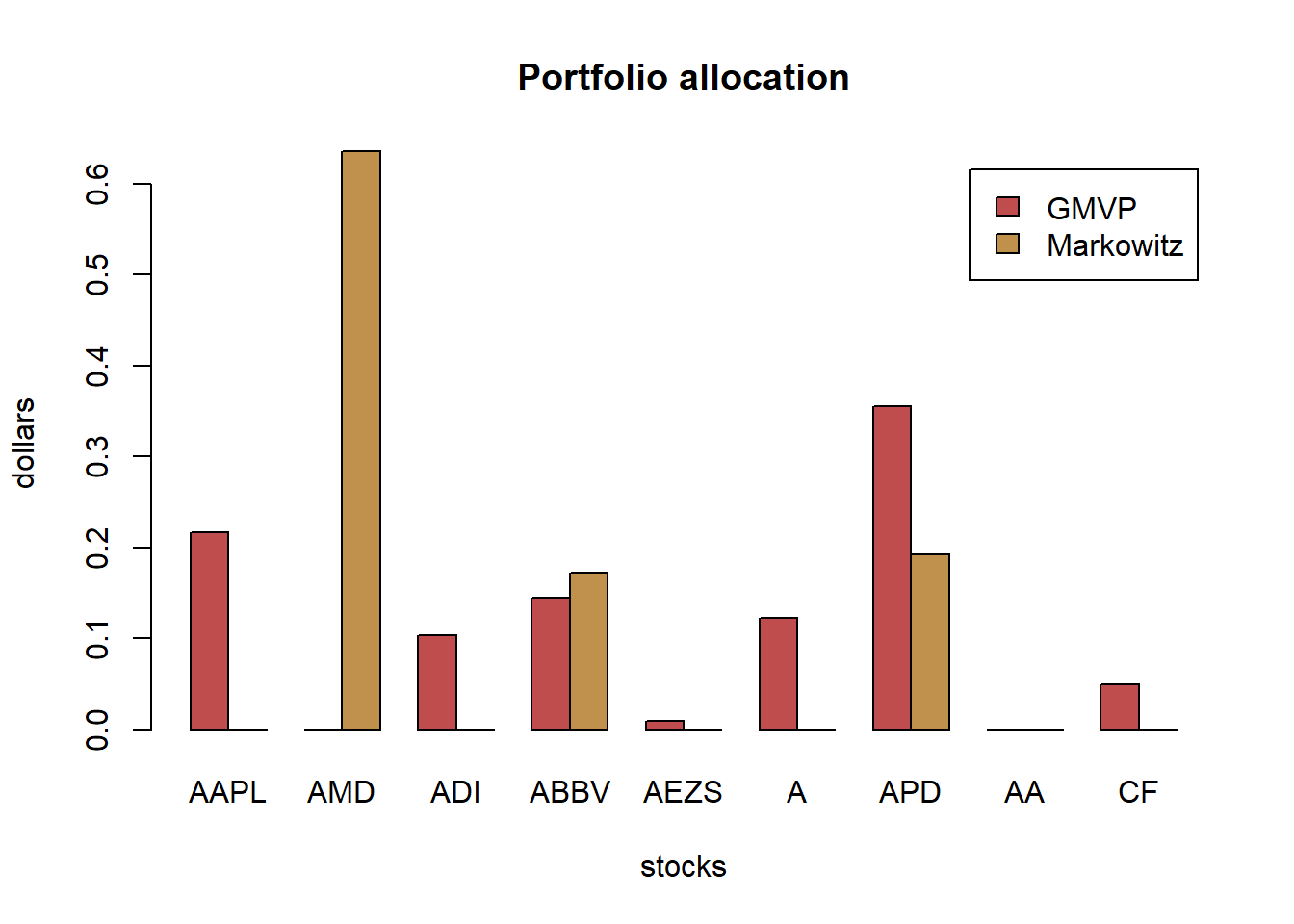

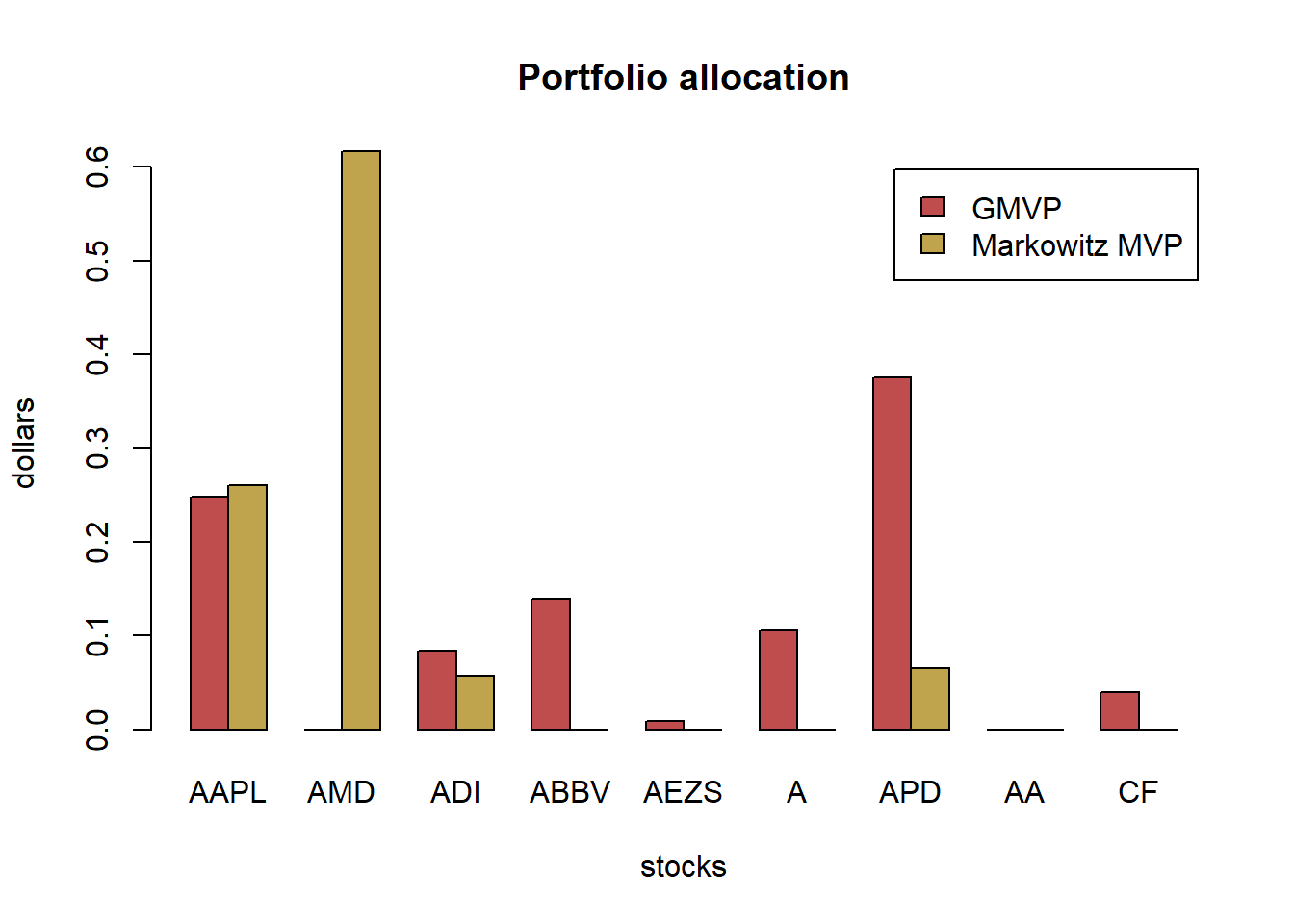

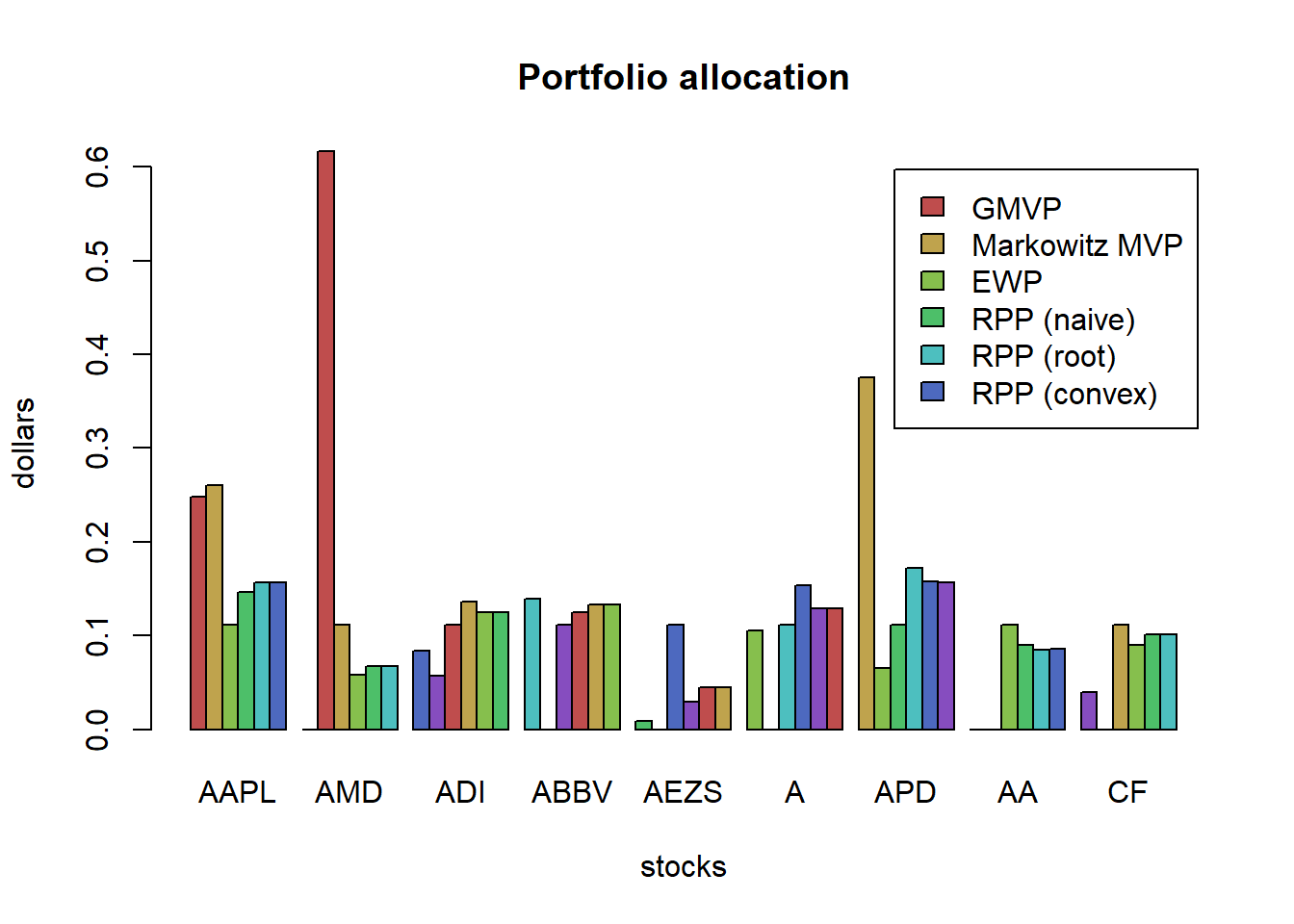

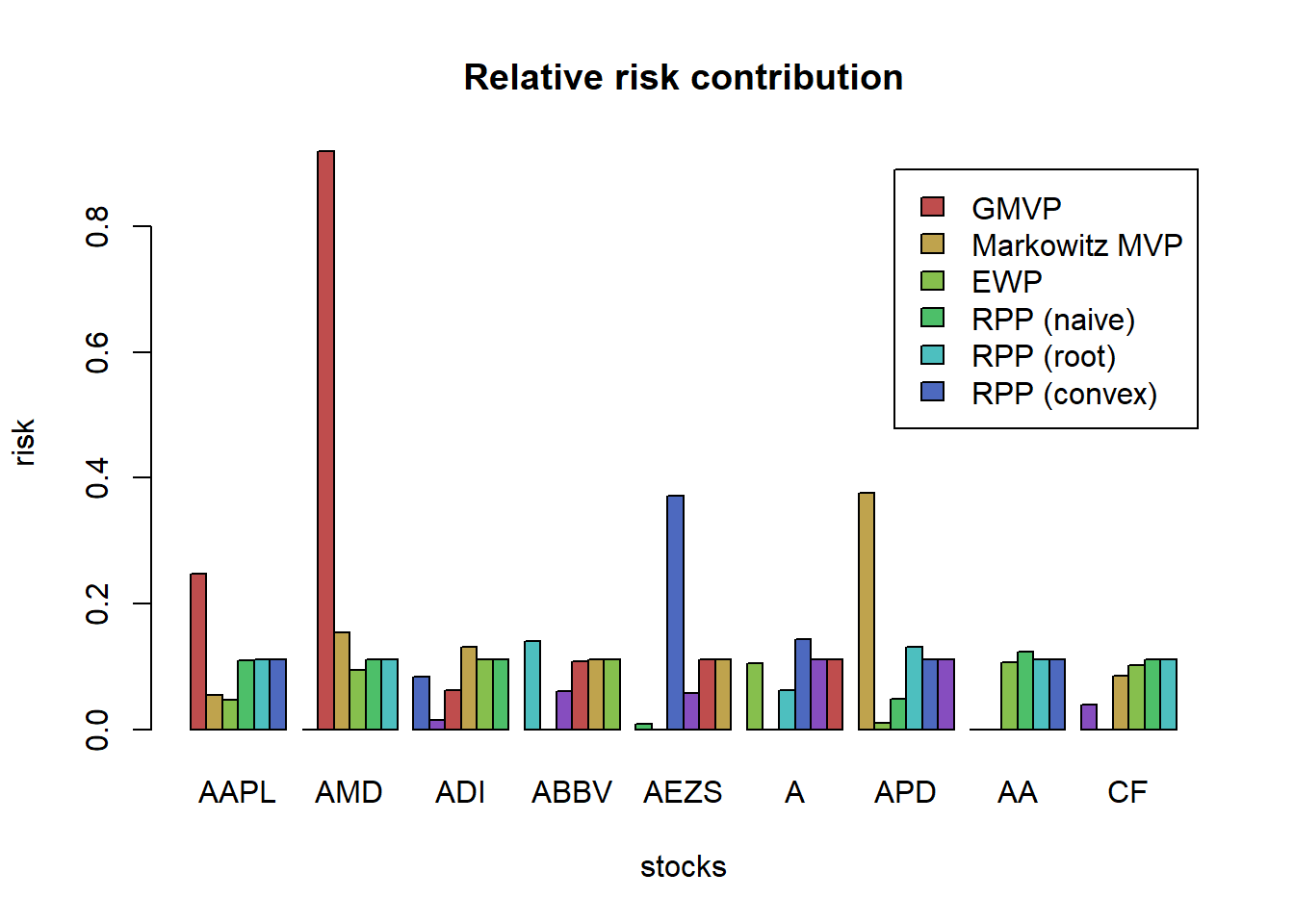

6.2.3 Markowitz’s mean-variance portfolio

w_Markowitz <- MVP(mu, Sigma, long_only = TRUE)

w_all_Markowitz <- cbind(w_Markowitz)

# plot allocation

barplot(t(w_all_Markowitz), col = rainbow8equal[1], legend = colnames(w_all_Markowitz), beside = TRUE, main = "Markowitz portfolio allocation", xlab = "stocks", ylab = "dollars")

for (i in 1:6) {

X_noisy <- rmvnorm(n = T, mean = mu, sigma = Sigma)

mu_noisy <- colMeans(X_noisy)

Sigma_noisy <- cov(X_noisy)

w_Markowitz_noisy <- MVP(mu_noisy, Sigma_noisy, long_only = TRUE)

w_all_Markowitz <- cbind(w_all_Markowitz, w_Markowitz_noisy)

}

# plot to compare the allocations

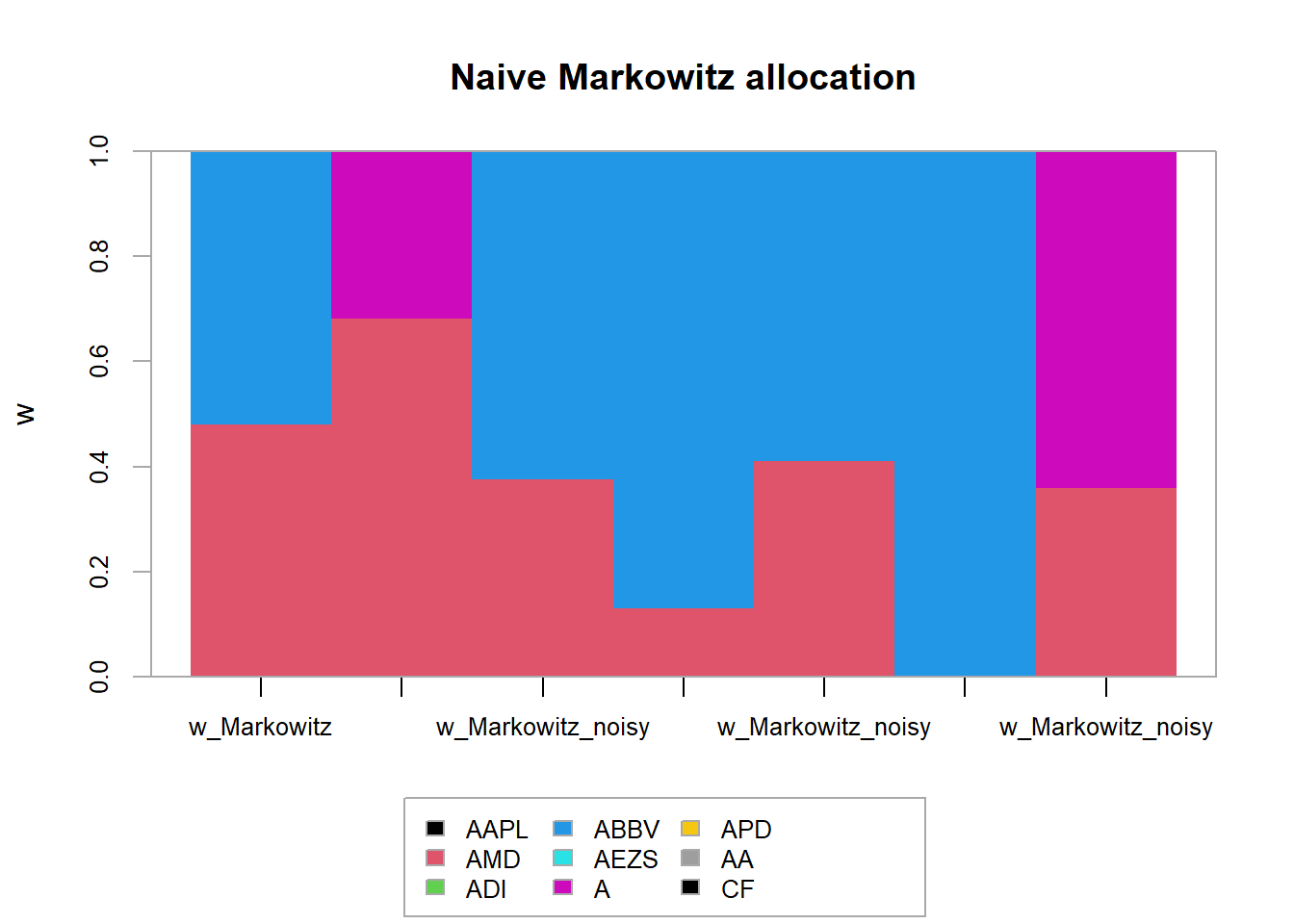

chart.StackedBar(t(w_all_Markowitz), main = "Markowitz portfolio allocation", ylab = "w", space = 0, border = NA) Again, the allocations are totally different from realization to realization. Totally unacceptable. Who is going to trust these allocations to invest their money?

Again, the allocations are totally different from realization to realization. Totally unacceptable. Who is going to trust these allocations to invest their money?

6.3 Robust portfolio optimization

6.3.1 Worst-case robust GMRP

\[\begin{array}{ll} \underset{\mathbf{w}}{\textsf{maximize}} & \underset{\boldsymbol{\mu}\in\mathcal{U}_{\boldsymbol{\mu}}}{\min}\mathbf{w}^{T}\boldsymbol{\mu}\\ \textsf{subject to} & \mathbf{1}^{T}\mathbf{w}=1. \end{array}\]

For an elliptical uncertainty set \[\mathcal{U}_{\boldsymbol{\mu}} = \left\{\boldsymbol{\mu}=\hat{\boldsymbol{\mu}}+\kappa\mathbf{S}^{1/2}\mathbf{u}\mid\left\Vert \mathbf{u}\right\Vert _{2}\leq1\right\}\]

For a box uncertainty set \[\mathcal{U}_\boldsymbol{\mu}^b = \{\boldsymbol{\mu}\ | -\boldsymbol{\delta}\leq\boldsymbol{\mu}-\hat{\boldsymbol{\mu}}\leq\boldsymbol{\delta}\}\] where typically \(\delta_i = \kappa\hat{\sigma}_i\), the the robust formulation becomes \[\begin{array}{ll} \underset{\mathbf{w}}{\textsf{maximize}} & \mathbf{w}^T\hat{\boldsymbol{\mu}} - |\mathbf{w}|^T\boldsymbol{\delta}\\ {\textsf{subject to}} & \mathbf{1}^T\mathbf{w} = 1\\ & \mathbf{w}\ge\mathbf{0}. \end{array}\] We have gone from an LP to an SOCP.

portfolioMaxReturnRobustBox <- function(mu_hat, delta) {

w <- Variable(length(mu_hat))

prob <- Problem(Maximize( t(w) %*% mu_hat - t(abs(w)) %*% delta ),

constraints = list(w >= 0, sum(w) == 1))

result <- solve(prob)

w <- as.vector(result$getValue(w))

names(w) <- names(mu_hat)

return(w)

}

# clairvoyant solution

w_GMRP <- GMRP(mu)

names(w_GMRP) <- colnames(X)

w_all_GMRP_robust_box <- cbind(w_GMRP)

# multiple robust solutions

kappa <- 0.1

delta <- kappa*sqrt(diag(Sigma_noisy))

set.seed(357)

for (i in 1:6) {

X_noisy <- rmvnorm(n = T, mean = mu, sigma = Sigma)

mu_noisy <- colMeans(X_noisy)

Sigma_noisy <- cov(X_noisy)

w_GMRP_robust_box_noisy <- portfolioMaxReturnRobustBox(mu_noisy, delta)

w_all_GMRP_robust_box <- cbind(w_all_GMRP_robust_box, w_GMRP_robust_box_noisy)

}

# plot to compare the allocations

barplot(t(w_all_GMRP_robust_box), col = rainbow8equal[1:7], legend = colnames(w_all_GMRP_robust_box),

beside = TRUE, args.legend = list(bg = "white"),

main = "Robust (box) global maximum return portfolio allocation", xlab = "stocks", ylab = "dollars")

portfolioMaxReturnRobustEllipsoid <- function(mu_hat, S, kappa = 0.1) {

S12 <- chol(S) # t(S12) %*% S12 = Sigma

w <- Variable(length(mu_hat))

prob <- Problem(Maximize( t(w) %*% mu_hat - kappa*norm2(S12 %*% w) ),

constraints = list(w >= 0, sum(w) == 1))

result <- solve(prob)

return(as.vector(result$getValue(w)))

}

# clairvoyant solution

w_GMRP <- GMRP(mu)

w_all_GMRP_robust_ellipsoid <- cbind(w_GMRP)

# multiple robust solutions

kappa <- 0.2

set.seed(357)

for (i in 1:6) {

X_noisy <- rmvnorm(n = T, mean = mu, sigma = Sigma)

mu_noisy <- colMeans(X_noisy)

Sigma_noisy <- cov(X_noisy)

w_GMRP_robust_ellipsoid_noisy <- portfolioMaxReturnRobustEllipsoid(mu_noisy, Sigma_noisy, kappa)

w_all_GMRP_robust_ellipsoid <- cbind(w_all_GMRP_robust_ellipsoid, w_GMRP_robust_ellipsoid_noisy)

}

# plot to compare the allocations

chart.StackedBar(t(w_all_GMRP_robust_ellipsoid),

main = "Robust (ellipsoid) global maximum return portfolio allocation",

ylab = "w", space = 0, border = NA)

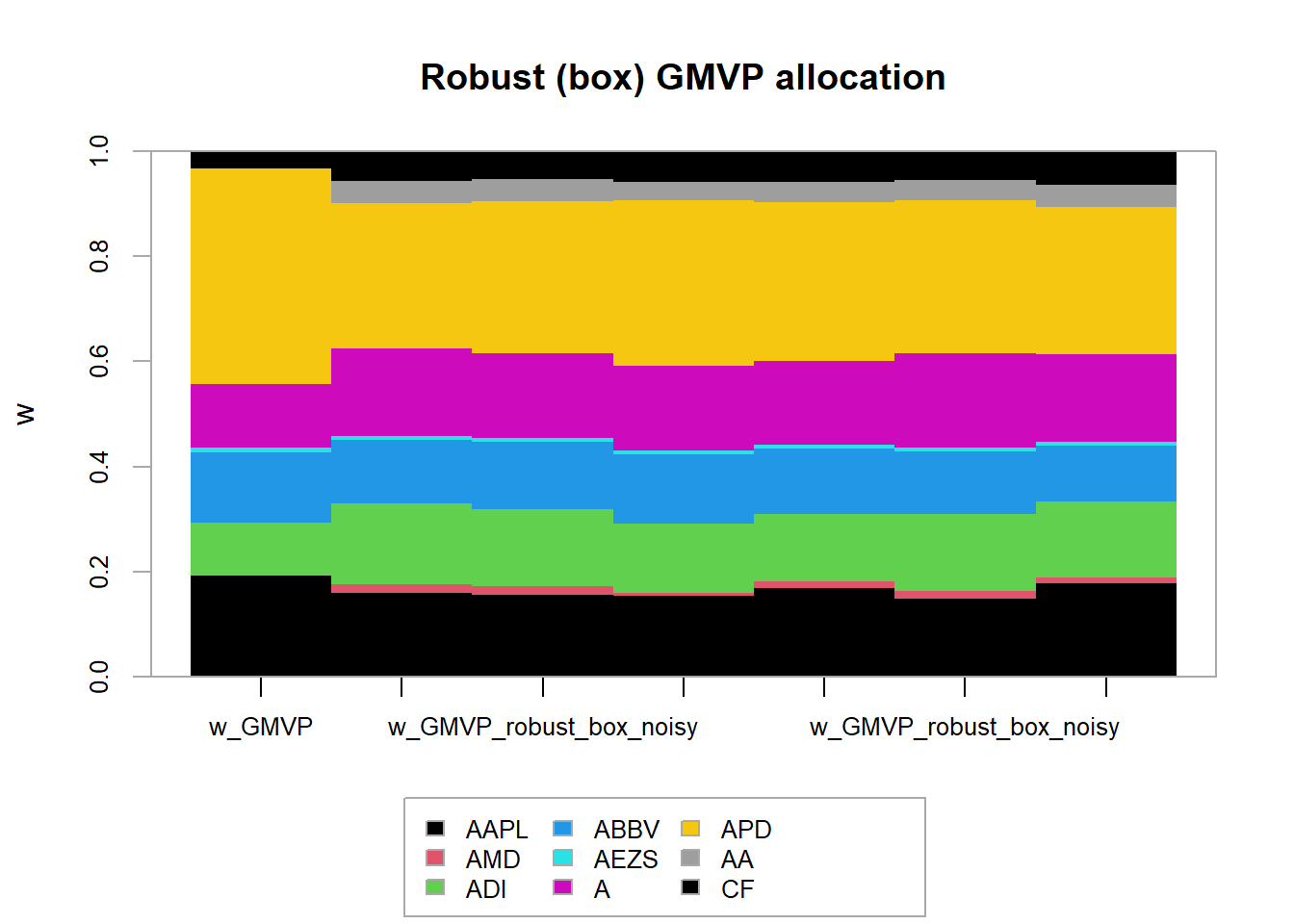

6.3.2 Worst-case robust GMVP

\[\begin{array}{ll} \underset{\mathbf{w}}{\textsf{minimize}} & \underset{\boldsymbol{\Sigma}\in\mathcal{U}_{\boldsymbol{\Sigma}}}{\max}\mathbf{w}^{T}\boldsymbol{\Sigma}\mathbf{w}\\ \textsf{subject to} & \mathbf{1}^{T}\mathbf{w}=1. \end{array}\]

we will then model the data matrix as

\[\mathcal{U}_{\mathbf{X}} =\left\{\mathbf{X}\mid\left\Vert\mathbf{X}-\hat{\mathbf{X}}\right\Vert_{F}\leq\delta_{\mathbf{X}}\right\}\]

The robust problem formulation finally becomes:

\[\begin{array}{ll} \underset{\mathbf{w},\mathbf{X},\mathbf{Z}}{\textsf{minimize}} & \textsf{Tr}\left(\hat{\boldsymbol{\Sigma}}\left(\mathbf{X}+\mathbf{Z}\right)\right) + \delta\left\Vert \mathbf{S}_{\boldsymbol{\Sigma}}^{1/2}\left(\textsf{vec}(\mathbf{X})+\textsf{vec}(\mathbf{Z})\right)\right\Vert _{2}\\ \textsf{subject to} & \mathbf{w}^{T}\mathbf{1}=1,\quad \mathbf{w}\ge\mathbf{0}\\ & \left[\begin{array}{cc}\mathbf{X} & \mathbf{w}\\ \mathbf{w}^{T} & 1\end{array} \right]\succeq\mathbf{0}\\ & \mathbf{Z}\succeq\mathbf{0}. \end{array}\]

# define function (check: https://cvxr.rbind.io/post/cvxr_functions/)

portfolioGMVPRobustBox <- function(Sigma_lb, Sigma_ub) {

N <- nrow(Sigma_lb)

w <- Variable(N)

Lambda_ub <- Variable(N, N)

Lambda_lb <- Variable(N, N)

prob <-

Problem(

Minimize(

matrix_trace(Lambda_ub %*% Sigma_ub) - matrix_trace(Lambda_lb %*% Sigma_lb)

),

constraints = list(

w >= 0,

sum(w) == 1,

Lambda_ub >= 0,

Lambda_lb >= 0,

bmat(list(list(

Lambda_ub - Lambda_lb, w

),

list(t(

w

), 1))) == Variable(c(N + 1, N + 1), PSD=TRUE)

)

)

result <- solve(prob)

return(as.vector(result$getValue(w)))

}

# clairvoyant solution

w_GMVP <- GMVP(Sigma, long_only = TRUE)

names(w_GMVP) <- colnames(X)

w_all_GMVP_robust_box <- cbind(w_GMVP)

# multiple robust solutions

delta <- 3

set.seed(357)

for (i in 1:6) {

X_noisy <- rmvnorm(n = T, mean = mu, sigma = Sigma)

mu_noisy <- colMeans(X_noisy)

Sigma_noisy <- cov(X_noisy)

Sigma_lb <- (1/delta)*Sigma_noisy

#diag(Sigma_lb) <- diag(Sigma_noisy)

Sigma_ub <- (1/delta)*Sigma_noisy

diag(Sigma_ub) <- diag(Sigma_noisy)

w_GMVP_robust_box_noisy <- portfolioGMVPRobustBox(Sigma_lb, Sigma_ub)

w_all_GMVP_robust_box <- cbind(w_all_GMVP_robust_box, w_GMVP_robust_box_noisy)

}

# plot to compare the allocations

barplot(t(w_all_GMVP_robust_box), col = rainbow8equal[1:7], legend = colnames(w_all_GMVP_robust_box),

beside = TRUE, args.legend = list(bg = "white", x = "topleft"),

main = "Robust (box) GMVP allocation", xlab = "stocks", ylab = "dollars")

chart.StackedBar(t(w_all_GMVP_robust_box),

main = "Robust (box) GMVP allocation", ylab = "w", space = 0, border = NA) The naive GMVP was already kind of stable. Nevertheless, the robust GMVP becomes even more stable (less sensitive to the estimation errors).

The naive GMVP was already kind of stable. Nevertheless, the robust GMVP becomes even more stable (less sensitive to the estimation errors).

portfolioGMVPRobustSphereX <- function(X_hat, delta) {

N <- ncol(X_hat)

w <- Variable(N)

X_ <- scale(X_hat, center = TRUE, scale = FALSE) # demean

prob <- Problem(Minimize(norm2(X_ %*% w) + delta*norm2(w)),

constraints = list(w >= 0, sum(w) == 1))

result <- solve(prob)

return(as.vector(result$getValue(w)))

}

# clairvoyant solution

w_GMVP <- GMVP(Sigma, long_only = TRUE)

names(w_GMVP) <- colnames(X)

w_all_GMVP_robust_sphereX <- cbind(w_GMVP)

# multiple robust solutions

delta <- 0.1

set.seed(357)

for (i in 1:6) {

X_noisy <- rmvnorm(n = T, mean = mu, sigma = Sigma)

w_GMVP_robust_sphereX_noisy <- portfolioGMVPRobustSphereX(X_noisy, delta)

w_all_GMVP_robust_sphereX <- cbind(w_all_GMVP_robust_sphereX, w_GMVP_robust_sphereX_noisy)

}

# plot to compare the allocations

chart.StackedBar(t(w_all_GMVP), main = "Naive GMVP allocation", ylab = "w", space = 0, border = NA)

chart.StackedBar(t(w_all_GMVP_robust_sphereX), main = "Robust (sphere in X) GMVP allocation", ylab = "w", space = 0, border = NA) Finally, let’s consider the robust formulation for the elliptical uncertainty region on the covariance matrix

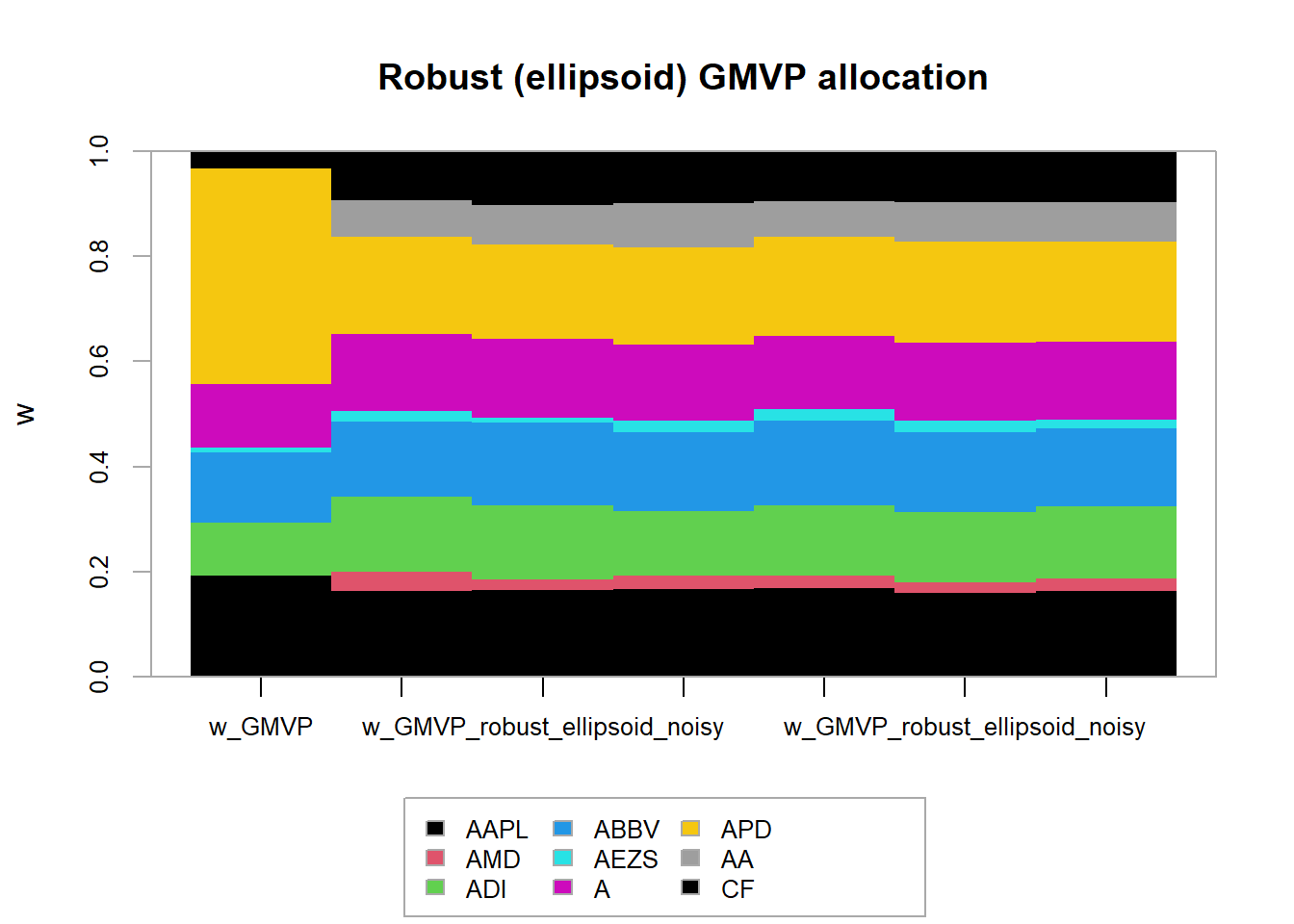

Finally, let’s consider the robust formulation for the elliptical uncertainty region on the covariance matrix

portfolioGMVPRobustEllipsoid <- function(Sigma_hat, S, delta) {

N <- ncol(Sigma_hat)

S12 <- chol(S) # t(S12) %*% S12 = Sigma

w <- Variable(N)

X <- Variable(N, N)

Z <- Variable(N, N)

prob <-

Problem(

Minimize(matrix_trace(Sigma_hat %*% (X + Z)) + delta * norm2(S12 %*% (vec(X) + vec(Z)))),

constraints = list(

w >= 0,

sum(w) == 1,

bmat(list(list(X, w),

list(t(w), 1))) == Variable(c(N + 1, N + 1), PSD = TRUE),

Z == Variable(c(N, N), PSD = TRUE)

)

)

result <- solve(prob)

return(as.vector(result$getValue(w)))

}

# clairvoyant solution

w_GMVP <-GMVP(Sigma, long_only = TRUE)

names(w_GMVP) <- colnames(X)

w_all_GMVP_robust_ellipsoid <- cbind(w_GMVP)

# multiple robust solutions

delta <- 0.0005

set.seed(357)

for (i in 1:6) {

X_noisy <- rmvnorm(n = T, mean = mu, sigma = Sigma)

Sigma_noisy <- cov(X_noisy)

w_GMVP_robust_ellipsoid_noisy <- portfolioGMVPRobustEllipsoid(Sigma_noisy, diag(N^2), delta)

w_all_GMVP_robust_ellipsoid <- cbind(w_all_GMVP_robust_ellipsoid, w_GMVP_robust_ellipsoid_noisy)

}

# plot to compare the allocations

chart.StackedBar(t(w_all_GMVP), main = "Naive GMVP allocation", ylab = "w", space = 0, border = NA)

chart.StackedBar(t(w_all_GMVP_robust_ellipsoid),

main = "Robust (ellipsoid) GMVP allocation", ylab = "w", space = 0, border = NA)

6.3.3 Worst-case Markowitz’s portfolio

\[\begin{array}{ll} \underset{\mathbf{w},\mathbf{X},\mathbf{Z}}{\textsf{maximize}} & \begin{array}{r} \underset{\boldsymbol{\mu}\in\mathcal{U}_{\boldsymbol{\mu}}}{\min}\mathbf{w}^{T}\boldsymbol{\mu}-\lambda\left(\mathsf{Tr}\left(\hat{\boldsymbol{\Sigma}}\left(\mathbf{X}+\mathbf{Z}\right)\right)\right.\hspace{2cm}\\ \left.+\delta_{\boldsymbol{\Sigma}}\left\Vert \mathbf{S}_{\boldsymbol{\Sigma}}^{1/2}\left(\mathsf{vec}(\mathbf{X})+\mathsf{vec}(\mathbf{Z})\right)\right\Vert _{2}\right) \end{array}\\ \textsf{subject to} & \mathbf{w}^{T}\mathbf{1}=1,\quad\mathbf{w}\in\mathcal{W}\\ &\left[\begin{array}{cc} \mathbf{X} & \mathbf{w}\\ \mathbf{w}^{T} & 1 \end{array}\right]\succeq\mathbf{0}\\ & \mathbf{Z}\succeq\mathbf{0}. \end{array}\]

Consider the two uncertainty sets: \[\begin{aligned} \mathcal{U}_{\boldsymbol{\mu}}^{b} &= \left\{\boldsymbol{\mu}\mid-\boldsymbol{\delta}\leq\boldsymbol{\mu}-\hat{\boldsymbol{\mu}}\leq\boldsymbol{\delta}\right\},\\ \mathcal{U}_{\boldsymbol{\Sigma}}^{b} &= \left\{\boldsymbol{\Sigma}\mid\underline{\boldsymbol{\Sigma}}\leq\boldsymbol{\Sigma}\leq\overline{\boldsymbol{\Sigma}},\boldsymbol{\Sigma}\succeq\mathbf{0}\right\} \end{aligned}\]

\[\begin{array}{ll} \underset{\mathbf{w},\overline{\boldsymbol{\Lambda}},\underline{\boldsymbol{\Lambda}}}{\textsf{maximize}} & \mathbf{w}^{T}\hat{\boldsymbol{\mu}}-|\mathbf{w}|^{T}\boldsymbol{\delta}-\lambda\left(\textsf{Tr}(\overline{\boldsymbol{\Lambda}}\,\overline{\boldsymbol{\Sigma}})-\textsf{Tr}(\underline{\boldsymbol{\Lambda}}\,\underline{\boldsymbol{\Sigma}})\right)\\ \textsf{subject to} & \mathbf{w}^{T}\mathbf{1}=1,\quad\mathbf{w}\in\mathcal{W},\\ & \begin{bmatrix}\overline{\boldsymbol{\Lambda}}-\underline{\boldsymbol{\Lambda}} & \mathbf{w}\\ \mathbf{w}^{T} & 1 \end{bmatrix}\succeq\mathbf{0},\\ & \overline{\boldsymbol{\Lambda}}\geq\mathbf{0},\quad\underline{\boldsymbol{\Lambda}}\geq\mathbf{0}. \end{array}\]

\[\begin{array}{ll} \underset{\mathbf{w}}{\textsf{maximize}} & \mathbf{w}^T\hat{\boldsymbol{\mu}} - \kappa\|\hat{\mathbf{\Sigma}}^{1/2}\mathbf{w}\|_{2} - \lambda\left(\|\hat{\mathbf{\Sigma}}^{1/2}\mathbf{w}\|_2 + \frac{\delta}{\sqrt(T-1)} \|\mathbf{w}\|_2\right)^2\\ {\textsf{subject to}} & \mathbf{1}^T\mathbf{w} = 1\\ & \mathbf{w}\ge\mathbf{0}. \end{array}\]

portfolioMarkowitzRobust <- function(mu_hat, Sigma_hat, kappa, delta_, lmd = 0.5) {

N <- length(mu_hat)

S12 <- chol(Sigma_hat) # t(S12) %*% S12 = Sigma

w <- Variable(N)

prob <- Problem(Maximize(t(w) %*% mu_hat - kappa*norm2(S12 %*% w)

- lmd*(norm2(S12 %*% w) + delta_*norm2(w))^2),

constraints = list(w >= 0, sum(w) == 1))

result <- solve(prob)

return(as.vector(result$getValue(w)))

}

# clairvoyant solution

w_Markowitz <- MVP(mu, Sigma, long_only = TRUE)

names(w_Markowitz) <- colnames(X)

w_all_Markowitz_robust <- cbind(w_Markowitz)

# multiple robust solutions

kappa <- 1.0

delta <- 0.1*sqrt(T)

set.seed(357)

for (i in 1:6) {

X_noisy <- rmvnorm(n = T, mean = mu, sigma = Sigma)

mu_noisy <- colMeans(X_noisy)

Sigma_noisy <- cov(X_noisy)

w_Markowitz_robust_noisy <- portfolioMarkowitzRobust(mu_noisy, Sigma_noisy, kappa, delta/sqrt(T-1))

w_all_Markowitz_robust <- cbind(w_all_Markowitz_robust, w_Markowitz_robust_noisy)

}

# plot to compare the allocations

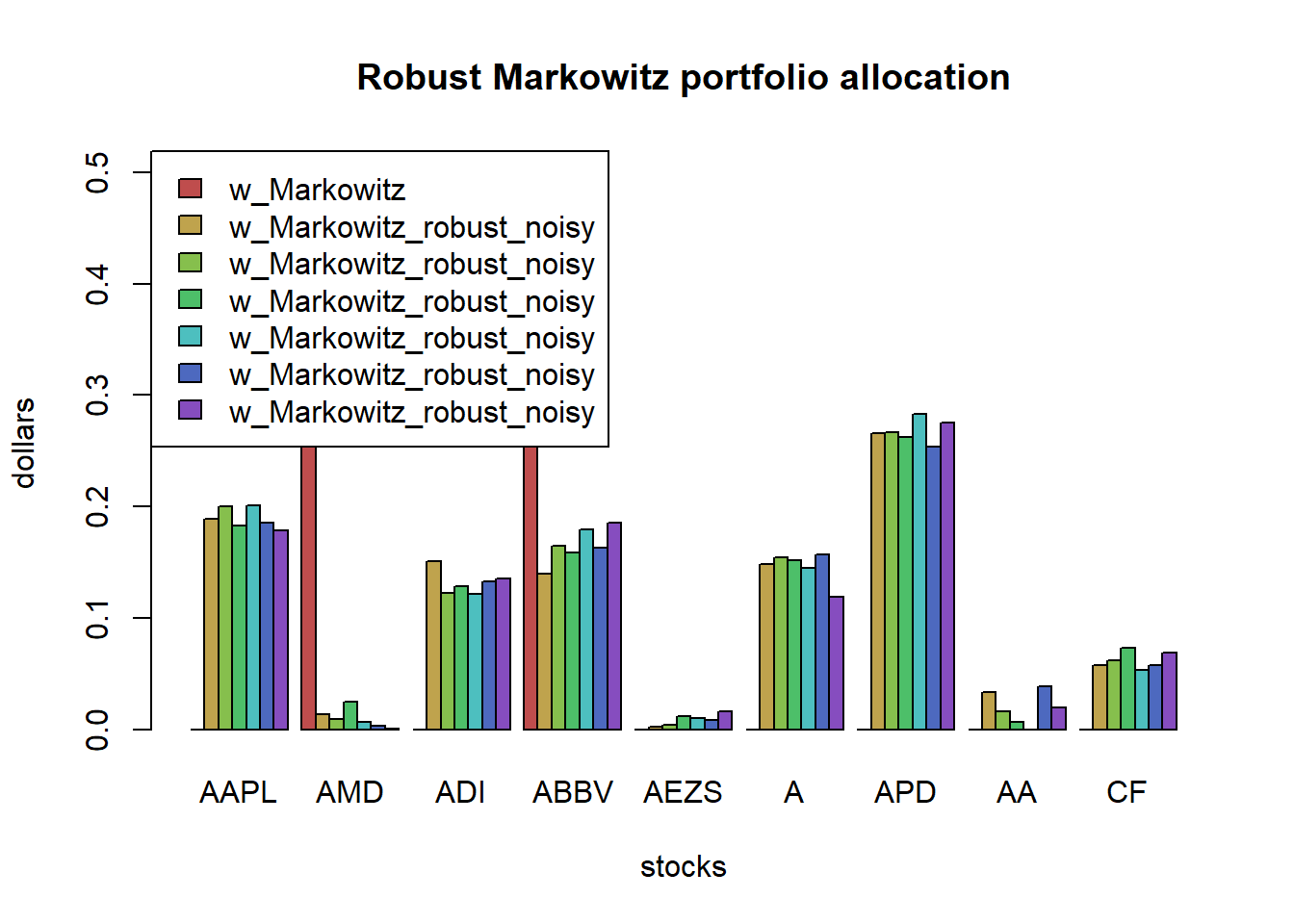

barplot(t(w_all_Markowitz_robust), col = rainbow8equal[1:7], legend = colnames(w_all_Markowitz_robust),

beside = TRUE, args.legend = list(bg = "white", x = "topleft"),

main = "Robust Markowitz portfolio allocation", xlab = "stocks", ylab = "dollars")

chart.StackedBar(t(w_all_Markowitz),

main = "Naive Markowitz allocation", ylab = "w", space = 0, border = NA)

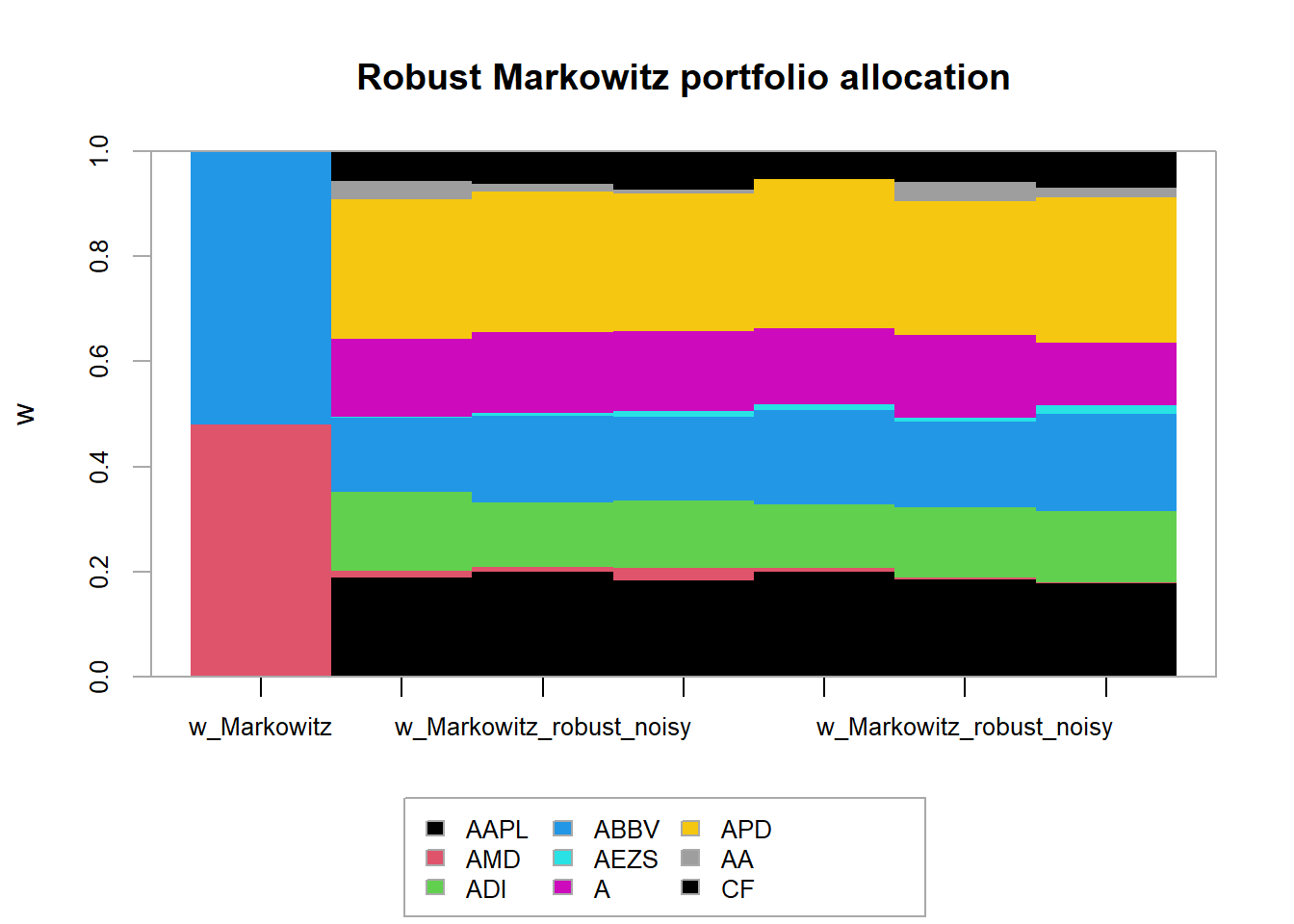

chart.StackedBar(t(w_all_Markowitz_robust),

main = "Robust Markowitz portfolio allocation", ylab = "w", space = 0, border = NA)

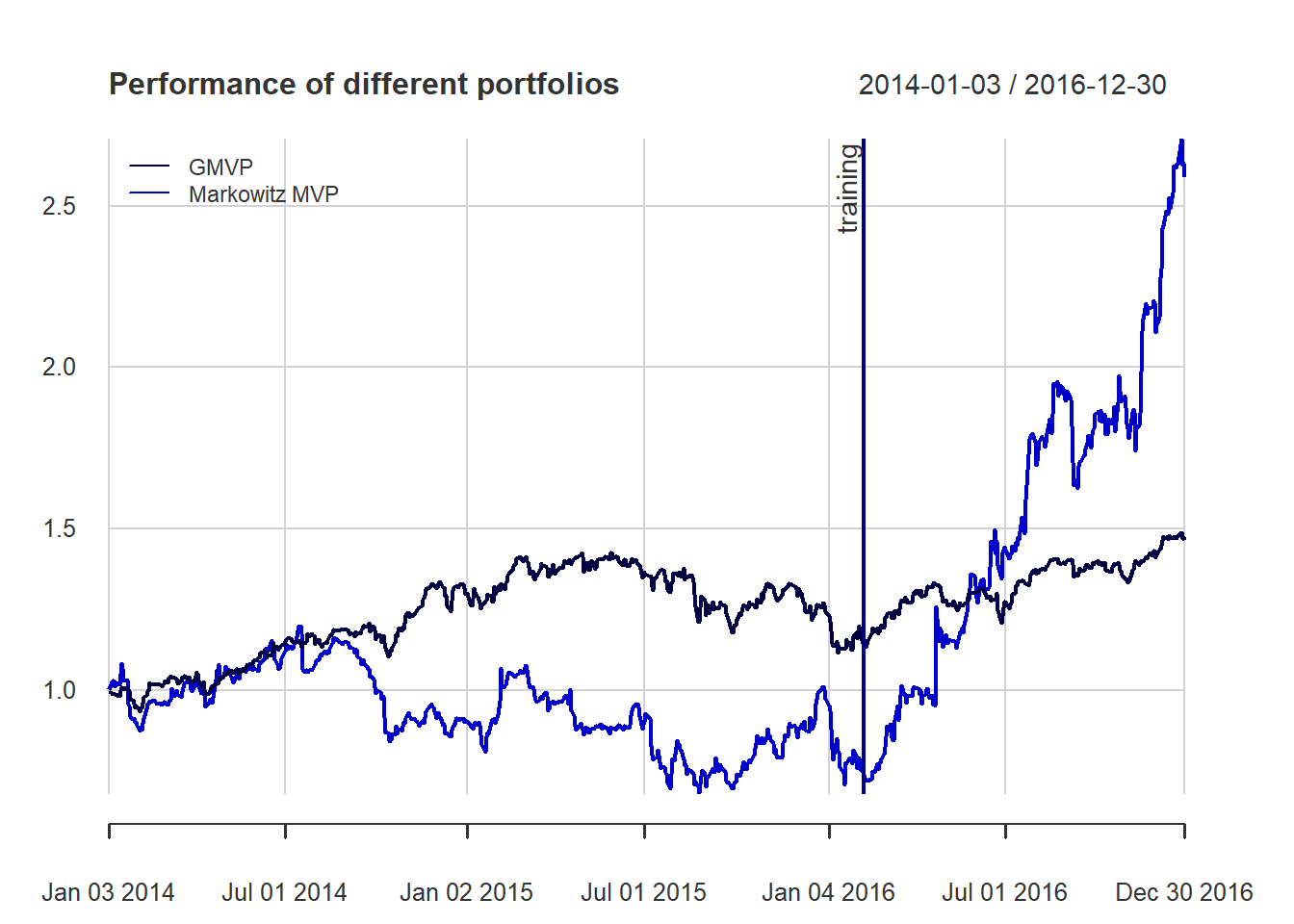

# clairvoyant solutions

w_Markowitz <- MVP(mu, Sigma, long_only = TRUE)

names(w_Markowitz) <- colnames(X)

portfolioMaxSharpeRatio <- function(mu, Sigma) {

w_ <- Variable(nrow(Sigma))

prob <- Problem(Minimize(quad_form(w_, Sigma)),

constraints = list(w_ >= 0, t(mu) %*% w_ == 1))

result <- solve(prob)

w <- as.vector(result$getValue(w_)/sum(result$getValue(w_)))

names(w) <- colnames(Sigma)

return(w)

}

w_MaxSR <- portfolioMaxSharpeRatio(mu, Sigma)

names(w_MaxSR) <- colnames(X)

# multiple naive and robust solutions

kappa <- 0.25 # smaller gives some bad outliers

delta <- 0.01*sqrt(T) #larger gives a much more stable performance

w_all_Markowitz_naive <- NULL

w_all_Markowitz_robust <- NULL

set.seed(357)

for (i in 1:10) {

X_noisy <- rmvnorm(n = T, mean = mu, sigma = Sigma)

mu_noisy <- colMeans(X_noisy)

Sigma_noisy <- cov(X_noisy)

w_Markowitz_noisy <- MVP(mu_noisy, Sigma_noisy, long_only = TRUE)

w_Markowitz_robust_noisy <- portfolioMarkowitzRobust(mu_noisy, Sigma_noisy, kappa, delta/sqrt(T-1))

w_all_Markowitz_naive <- cbind(w_all_Markowitz_naive, w_Markowitz_noisy)

w_all_Markowitz_robust <- cbind(w_all_Markowitz_robust, w_Markowitz_robust_noisy)

}

# performance

mean_variance <- function(w, mu, Sigma)

return(t(w) %*% mu - 0.5 * t(w) %*% Sigma %*% w)

Sharpe_ratio <- function(w, mu, Sigma)

return(t(w) %*% mu / sqrt(t(w) %*% Sigma %*% w))

mean_variance_clairvoyant <- mean_variance(w_Markowitz, mu, Sigma)

mean_variance_naive <- apply(w_all_Markowitz_naive, MARGIN = 2, FUN = mean_variance, mu, Sigma)

mean_variance_robust <- apply(w_all_Markowitz_robust, MARGIN = 2, FUN = mean_variance, mu, Sigma)

SR_clairvoyant <- Sharpe_ratio(w_MaxSR, mu, Sigma)

SR_naive <- apply(w_all_Markowitz_naive, MARGIN = 2, FUN = Sharpe_ratio, mu, Sigma)

SR_robust <- apply(w_all_Markowitz_robust, MARGIN = 2, FUN = Sharpe_ratio, mu, Sigma)library(rbokeh)

figure(width = 800, title = "Performance Markowitz",

xlab = "realization", ylab = "mean-variance", legend_location = "bottom_right") %>%

ly_points(mean_variance_naive, color = "blue", legend = "naive") %>%

ly_points(mean_variance_robust, color = "red", legend = "robust") %>%

ly_abline(h = mean_variance_clairvoyant, legend = "clairvoyant")figure(width = 800, title = "Performance Markowitz",

xlab = "realization", ylab = "Sharpe-ratio", legend_location = "bottom_right") %>%

ly_points(SR_naive, color = "blue", legend = "naive") %>%

ly_points(SR_robust, color = "red", legend = "robust") %>%

ly_abline(h = SR_clairvoyant, legend = "clairvoyant")6.3.4 Variance uncertainty based on factor model

\[\begin{array}{ll} \underset{\mathbf{w}}{\textsf{minimize}} & \left(\left\Vert \mathbf{V}_{0}\mathbf{w}\right\Vert +\rho\left\Vert \mathbf{w}\right\Vert \right)^{2}+\mathbf{w}^{T}\overline{\mathbf{D}}\mathbf{w}\\ \textsf{subject to} & \boldsymbol{\mu}_{0}^{T}\mathbf{w}-\boldsymbol{\gamma}^{T}\left|\mathbf{w}\right|\geq\beta\\ & \mathbf{1}^{T}\mathbf{w}=1. \end{array}\]