Chapter 5 Factor investing

5.1 Factor overview

Why factor models:

- decompose return into explainable and unexplainable components

- estimate abnormal returns

- simplify estimate of covariance structure

- provide portfolio risk analysis for each factor

Types of factors:

- observable (Macroeconomic factor model, Fundamental factor models)

- unobservable (Statistical factor models)

5.2 Macroeconomic factor

\[\underset{\boldsymbol{\alpha},\boldsymbol{\beta}}{\text{minimize}}\quad \sum_{t=1}^T\|\mathbf{x}_t - \boldsymbol{\alpha} - \boldsymbol{\beta}f_t\|^2\]

\[\begin{aligned} \hat{\boldsymbol{\beta}} & = {\sf cov}(\mathbf{x}_t,f_t)/{\sf var}(f_t)\\ \hat{\boldsymbol{\alpha}} & = \bar{x} - \hat{\boldsymbol{\beta}}\bar{f}\\ \hat{\boldsymbol{\epsilon}}_i & = \mathbf{x}_i - \alpha_i\mathbf{1} - \beta_i\mathbf{f}, \quad i=1,\ldots,N\\ \hat{\sigma}_i^2 & = \frac{1}{T-2}\hat{\boldsymbol{\epsilon}}_i^T\hat{\boldsymbol{\epsilon}}_i, \quad \hat{\boldsymbol{\Psi}} = \sf{diag}(\hat{\sigma}_1^2, \ldots, \hat{\sigma}_N^2)\\ \hat{\boldsymbol{\Sigma}} & = {\sf var}(f_t)\hat{\boldsymbol{\beta}}\hat{\boldsymbol{\beta}}^T + \hat{\boldsymbol{\Psi}} \end{aligned}\]

Data preparation:

from <- "2017-01-01" # do not change time period for this chapter

to <- "2020-09-30"

SP500_index <- get_data("^GSPC", from, to)

tickers <- c("AAPL", "AMD", "ADI", "ABBV", "AEZS", "A", "APD", "AA","CF")

prices <- get_data(tickers, from, to)

X <- diff(log(prices), na.pad = FALSE)

N <- ncol(X) # number of stocks

T <- nrow(X) # number of days

f <- diff(log(SP500_index), na.pad = FALSE)5.2.1 LS fitting – simple form

beta <- cov(X,f)/as.numeric(var(f))

alpha <- colMeans(X) - beta*colMeans(f)

colnames(alpha) <- "alpha"

colnames(beta) <- "beta"

sigma2 <- rep(NA, N)

for (i in 1:N) {

eps_i <- X[, i] - alpha[i] - beta[i]*f

sigma2[i] <- (1/(T-2)) * t(eps_i) %*% eps_i

}

Psi <- diag(sigma2)

Sigma <- as.numeric(var(f)) * beta %*% t(beta) + Psi

print(cbind(alpha, beta))

#> alpha beta

#> AAPL 0.0008020602 1.1758548

#> AMD 0.0021325642 1.5015398

#> ADI 0.0002235181 1.2301376

#> ABBV 0.0001306997 0.8308865

#> AEZS -0.0025614940 1.0490908

#> A 0.0003829361 1.0008615

#> APD 0.0003891594 0.9972563

#> AA -0.0011118010 1.5286561

#> CF -0.0007052049 1.24599815.2.2 LS fitting – matrix form

\[ \underset{\boldsymbol{\alpha},\boldsymbol{\beta}}{\text{minimize}}\quad \|\mathbf{X}^T - \boldsymbol{\alpha}\mathbf{1}^T - \boldsymbol{\beta}\mathbf{f}^T\|^2_F. \\ \boldsymbol{\Gamma} = [ \boldsymbol{\alpha}, \boldsymbol{\beta} ] = \mathbf{X}^T \tilde{\mathbf{F}} (\tilde{\mathbf{F}}^T \tilde{\mathbf{F}})^{-1} \] where \(\tilde{\mathbf{F}} = [\mathbf{1}, \mathbf{f}]\)

F_ <- cbind(ones = 1, f)

Gamma <- t(X) %*% F_ %*% solve(t(F_) %*% F_) # better: Gamma <- t(solve(t(F_) %*% F_, t(F_) %*% X))

colnames(Gamma) <- c("alpha", "beta")

alpha <- Gamma[, 1] # or alpha <- Gamma[, "alpha"]

beta <- Gamma[, 2] # or beta <- Gamma[, "beta"]

print(Gamma)

#> alpha beta

#> AAPL 1.027794e-03 1.1840884

#> AMD 1.491217e-03 1.4464899

#> ADI 7.909772e-05 1.2282732

#> ABBV 2.062470e-04 0.8223764

#> AEZS -2.820424e-03 0.9728238

#> A 4.486762e-04 0.9668272

#> APD 4.474286e-04 0.9977766

#> AA -1.587258e-03 1.5099957

#> CF -4.558246e-04 1.2391421

E <- xts(t(t(X) - Gamma %*% t(F_)), index(X)) # residuals

Psi <- (1/(T-2)) * t(E) %*% E

Sigma <- as.numeric(var(f)) * beta %o% beta + diag(diag(Psi))5.2.3 Estimating covriacne

\[ \boldsymbol{\Sigma} = var(f_t)\boldsymbol{\beta}\boldsymbol{\beta}^T + {\sf Diag}(\boldsymbol{\Psi}) \] where \(\boldsymbol{\Psi}\) is residual term

library(corrplot)

corrplot(cov2cor(Sigma),

type="upper",

tl.col="black", tl.srt=45, #Text label color and rotation

diag=FALSE)

corrplot(cov2cor(Psi), mar = c(0,0,1,0), order = "hclust", addrect = 3,

title = "Covariance matrix of residuals", diag = FALSE, tl.col="black", tl.srt=45)

Interestingly, we can observe that the automatic clustering performed on \(\boldsymbol{\Psi}\) correctly identifies the sectors of the stocks (information tech, health care and materials).

5.2.4 Evaluating ETFs performance

In this section, we will use the S&P 500 as the explicit market factor and assume risk free rate equal to 0.

Consider following six ETFs:

- SPY - SPDR S&P 500 ETF (index tracking)

- SPHB - PowerShares S&P 500 High Beta Portfolio (high beta)

- SPLV - PowerShares S&P 500 Low Volatility Portfolio (low beta)

- USMV - iShares Edge MSCI Min Vol USA ETF

- JKD - iShares Morningstar Large-Cap ETF

index <- c("SPY","SPHB", "SPLV", "USMV", "JKD")

ETFs <- get_data(index, from, to)

X_ETFs <- diff(log(ETFs), na.pad = FALSE)

# compute the alpha and beta of all the ETFs:

F_ <- cbind(ones = 1, f)

Gamma <- t(solve(t(F_) %*% F_, t(F_) %*% X_ETFs))

colnames(Gamma) <- c("alpha", "beta")

alpha <- Gamma[, 1]

beta <- Gamma[, 2]

print(Gamma)

#> alpha beta

#> SPY 8.369995e-05 0.9774232

#> SPHB -3.626276e-04 1.3149686

#> SPLV -4.360138e-07 0.8489474

#> USMV 9.751288e-05 0.8145470

#> JKD 6.413791e-05 0.9912818

# visualization of Gamma

{ par(mfrow = c(1,2)) # two plots side by side

barplot(rev(alpha), horiz = TRUE, main = "alpha", border = NA, col = "coral", cex.names = 0.75, las = 1)

barplot(rev(beta), horiz = TRUE, main = "beta", border = NA, col = "deepskyblue", cex.names = 0.75, las = 1)} # reset to normal single plot

TODO Explanation for the above Gamma graph for all 6 etfs

Sharpe ratio follows:

\[SR = \frac{E[x_t]}{\sqrt{{\sf var}[x_t]}} = \frac{\alpha + \beta E[f_t]}{\sqrt{\beta^2 {\sf var}[f_t] + \sigma^2}} = \frac{\alpha/\beta + E[f_t]}{\sqrt{{\sf var}[f_t] + \sigma^2/\beta^2}} \approx \frac{\alpha/\beta + E[f_t]}{\sqrt{{\sf var}[f_t]}}\]

idx_sorted <- sort(alpha/beta, decreasing = TRUE, index.return = TRUE)$ix

SR <- colMeans(X)/sqrt(diag(var(X)))

ranking <- cbind("alpha/beta" = (alpha/beta)[idx_sorted],

SR = SR[idx_sorted],

alpha = alpha[idx_sorted],

beta = beta[idx_sorted])

print(ranking)

#> alpha/beta SR alpha beta

#> USMV 1.043183e-04 0.02551718 8.379048e-05 0.8032196

#> SPY 8.468943e-05 0.06748293 8.293078e-05 0.9792342

#> JKD 7.614433e-05 -0.03192726 7.503134e-05 0.9853831

#> SPLV 1.161154e-05 0.03593687 9.657503e-06 0.8317158

#> SPHB -1.338772e-04 0.06790832 -1.800427e-04 1.3448349TODO Explain the resul

5.3 Fama-French

Data preparation: select a wider time period

# download Fama-French factors from website

# url <- "http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/ftp/F-F_Research_Data_Factors_daily_CSV.zip"

# temp <- tempfile()

# download.file(url, temp, method = "libcurl", mode = "wb")

# unzip(temp, "F-F_Research_Data_Factors_daily.CSV")

# unlink(temp)

mydata <- read.csv("F-F_Research_Data_Factors_daily.CSV", skip = 4)

mydata <- mydata[-nrow(mydata), ] # remove last row

fama_lib <- xts(x = mydata[, c(2,3,4)], order.by = as.Date(paste(mydata[, 1]), "%Y%m%d"))

# compute the log-returns of the stocks and the Fama-French factors

F <- fama_lib[index(X)]/100\[\underset{\boldsymbol{\alpha},\boldsymbol{\beta}}{\text{minimize}}\quad \|\mathbf{X}^T - \boldsymbol{\Gamma}\tilde{\mathbf{F}}^T\|^2_F\] \[\boldsymbol{\Gamma} = \mathbf{X}^T \tilde{\mathbf{F}} (\tilde{\mathbf{F}}^T \tilde{\mathbf{F}})^{-1}\]

F_ <- cbind(ones = 1, F)

Gamma <- t(solve(t(F_) %*% F_, t(F_) %*% X))

colnames(Gamma) <- c("alpha", "b1", "b2", "b3")

alpha <- Gamma[, 1]

B <- Gamma[, 2:4]

print(Gamma)

#> alpha b1 b2 b3

#> AAPL 4.529985e-04 1.2487004 -0.2968196 -0.48086724

#> AMD 5.563015e-04 1.5721623 0.4135192 -1.01094408

#> ADI -8.001184e-05 1.2270888 0.4161068 -0.08642737

#> ABBV -8.212337e-05 0.8426005 -0.1908989 -0.20413363

#> AEZS -2.750911e-03 0.9389405 1.3673192 -0.01580922

#> A 1.393237e-04 0.9947335 -0.0606518 -0.22647058

#> APD 3.359118e-04 0.9894165 -0.3798878 0.07924767

#> AA -8.503783e-04 1.3720189 0.8666502 0.99663332

#> CF -4.388933e-05 1.1492337 0.5454800 0.603095415.4 Statistical/principal factor models

Recall the principal factor method for the model \(\mathbf{X}^T = \boldsymbol{\alpha}\mathbf{1}^T + \mathbf{B}\mathbf{F}^T + \mathbf{E}^T\) with K factors:

- PCA:

- sample mean: \(\hat{\boldsymbol{\alpha}} = \bar{\mathbf{x}} = \frac{1}{T}\mathbf{X}^T\mathbf{1}_T\)

- demeaned matrix: \(\bar{\mathbf{X}} = \mathbf{X} - \mathbf{1}_T\bar{\mathbf{x}}^T\)

- eigen-decomposition: \(\hat{\boldsymbol{\Sigma}} = \hat{\boldsymbol{\Gamma}} \hat{\boldsymbol{\Lambda}} \hat{\boldsymbol{\Gamma}}^T\)

- Estimates:

- \(\hat{\mathbf{B}} = \hat{\boldsymbol{\Gamma}_1} \hat{\boldsymbol{\Lambda}}_1^{1/2}\)

- \(\hat{\boldsymbol{\Psi}} = {\sf Diag}\left(\hat{\boldsymbol{\Sigma}} - \hat{\mathbf{B}} \hat{\mathbf{B}}^T\right)\)

- \(\hat{\boldsymbol{\Sigma}} = \hat{\mathbf{B}} \hat{\mathbf{B}}^T + \hat{\boldsymbol{\Psi}}\)

Update the eigen-decomposition: \(\hat{\boldsymbol{\Sigma}} - \hat{\boldsymbol{\Psi}} = \hat{\boldsymbol{\Gamma}} \hat{\boldsymbol{\Lambda}} \hat{\boldsymbol{\Gamma}}^T\)

Repeat Steps 2-3 until convergence.

K <- 3

alpha <- colMeans(X)

X_ <- X - matrix(alpha, T, N, byrow = TRUE)

Sigma_prev <- matrix(0, N, N)

Sigma <- (1/(T-1)) * t(X_) %*% X_

eigSigma <- eigen(Sigma)

while (norm(Sigma - Sigma_prev, "F")/norm(Sigma, "F") > 1e-3) {

B <- eigSigma$vectors[, 1:K, drop = FALSE] %*% diag(sqrt(eigSigma$values[1:K]), K, K)

Psi <- diag(diag(Sigma - B %*% t(B)))

Sigma_prev <- Sigma

Sigma <- B %*% t(B) + Psi

eigSigma <- eigen(Sigma - Psi)

}

cbind(alpha, B)

#> alpha

#> AAPL 1.518806e-03 0.004423866 -0.013661448 -1.788346e-05

#> AMD 2.091040e-03 0.009061167 -0.027857022 2.320626e-02

#> ADI 5.884322e-04 0.005641178 -0.015542966 -1.490695e-03

#> ABBV 5.472661e-04 0.003349058 -0.008726896 -6.934982e-04

#> AEZS -2.417018e-03 0.071585588 0.011675066 6.196286e-04

#> A 8.495955e-04 0.003759136 -0.010820120 -1.278586e-03

#> APD 8.611818e-04 0.003264547 -0.010724091 -2.846693e-03

#> AA -9.611000e-04 0.009394316 -0.023328796 -1.770902e-02

#> CF 5.801694e-05 0.006801149 -0.016344844 -9.315729e-035.5 Comparison of covariance matrix estimations

# prepare Fama-French factors

F_FamaFrench <- F # rename for easily knowing the meaning of variable

# prepare index

f_SP500 <- f # rename for easily knowing the meaning of variable

# split data into training and set data

T_trn <- round(0.45*T)

X_trn <- X[1:T_trn, ]

X_tst <- X[(T_trn+1):T, ]

F_FamaFrench_trn <- F_FamaFrench[1:T_trn, ]

F_FamaFrench_tst <- F_FamaFrench[(T_trn+1):T, ]

f_SP500_trn <- f_SP500[1:T_trn, ]

f_SP500_tst <- f_SP500[(T_trn+1):T, ]# sample covariance matrix

Sigma_SCM <- cov(X_trn)

# 1-factor model

F_ <- cbind(ones = 1, f_SP500_trn)

Gamma <- t(solve(t(F_) %*% F_, t(F_) %*% X_trn))

colnames(Gamma) <- c("alpha", "beta")

alpha <- Gamma[, 1]

beta <- Gamma[, 2]

E <- xts(t(t(X_trn) - Gamma %*% t(F_)), index(X_trn))

Psi <- (1/(T_trn-2)) * t(E) %*% E

Sigma_SP500 <- as.numeric(var(f_SP500_trn)) * beta %o% beta + diag(diag(Psi))

# Fama-French 3-factor model

F_ <- cbind(ones = 1, F_FamaFrench_trn)

Gamma <- t(solve(t(F_) %*% F_, t(F_) %*% X_trn))

colnames(Gamma) <- c("alpha", "beta1", "beta2", "beta3")

alpha <- Gamma[, 1]

B <- Gamma[, 2:4]

E <- xts(t(t(X_trn) - Gamma %*% t(F_)), index(X_trn))

Psi <- (1/(T_trn-4)) * t(E) %*% E

Sigma_FamaFrench <- B %*% cov(F_FamaFrench_trn) %*% t(B) + diag(diag(Psi))

# Statistical 1-factor model

K <- 1

alpha <- colMeans(X_trn)

X_trn_ <- X_trn - matrix(alpha, T_trn, N, byrow = TRUE)

Sigma_prev <- matrix(0, N, N)

Sigma <- (1/(T_trn-1)) * t(X_trn_) %*% X_trn_

eigSigma <- eigen(Sigma)

while (norm(Sigma - Sigma_prev, "F")/norm(Sigma, "F") > 1e-3) {

B <- eigSigma$vectors[, 1:K, drop = FALSE] %*% diag(sqrt(eigSigma$values[1:K]), K, K)

Psi <- diag(diag(Sigma - B %*% t(B)))

Sigma_prev <- Sigma

Sigma <- B %*% t(B) + Psi

eigSigma <- eigen(Sigma - Psi)

}

Sigma_PCA1 <- Sigma

# Statistical 3-factor model

K <- 3

alpha <- colMeans(X_trn)

X_trn_ <- X_trn - matrix(alpha, T_trn, N, byrow = TRUE)

Sigma_prev <- matrix(0, N, N)

Sigma <- (1/(T_trn-1)) * t(X_trn_) %*% X_trn_

eigSigma <- eigen(Sigma)

while (norm(Sigma - Sigma_prev, "F")/norm(Sigma, "F") > 1e-3) {

B <- eigSigma$vectors[, 1:K] %*% diag(sqrt(eigSigma$values[1:K]), K, K)

Psi <- diag(diag(Sigma - B %*% t(B)))

Sigma_prev <- Sigma

Sigma <- B %*% t(B) + Psi

eigSigma <- eigen(Sigma - Psi)

}

Sigma_PCA3 <- Sigma

# Statistical 5-factor model

K <- 5

alpha <- colMeans(X_trn)

X_trn_ <- X_trn - matrix(alpha, T_trn, N, byrow = TRUE)

Sigma_prev <- matrix(0, N, N)

Sigma <- (1/(T_trn-1)) * t(X_trn_) %*% X_trn_

eigSigma <- eigen(Sigma)

while (norm(Sigma - Sigma_prev, "F")/norm(Sigma, "F") > 1e-3) {

B <- eigSigma$vectors[, 1:K] %*% diag(sqrt(eigSigma$values[1:K]), K, K)

Psi <- diag(diag(Sigma - B %*% t(B)))

Sigma_prev <- Sigma

Sigma <- B %*% t(B) + Psi

eigSigma <- eigen(Sigma - Psi)

}

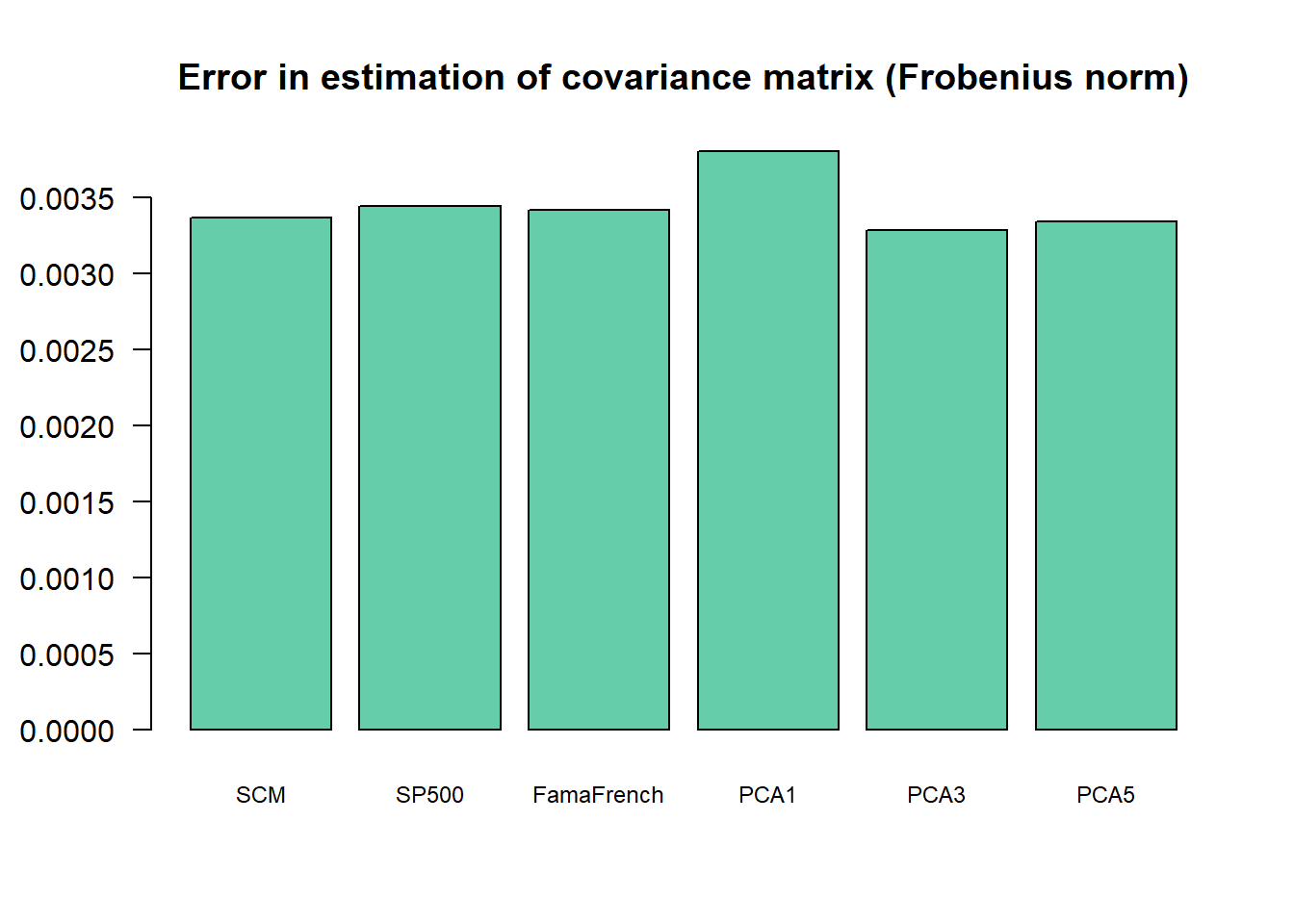

Sigma_PCA5 <- SigmaSigma_true <- cov(X_tst)

error <- c(SCM = norm(Sigma_SCM - Sigma_true, "F"),

SP500 = norm(Sigma_SP500 - Sigma_true, "F"),

FamaFrench = norm(Sigma_FamaFrench - Sigma_true, "F"),

PCA1 = norm(Sigma_PCA1 - Sigma_true, "F"),

PCA3 = norm(Sigma_PCA3 - Sigma_true, "F"),

PCA5 = norm(Sigma_PCA5 - Sigma_true, "F"))

print(error)

#> SCM SP500 FamaFrench PCA1 PCA3 PCA5

#> 0.003366215 0.003444389 0.003417521 0.003804895 0.003288151 0.003343664

barplot(error, main = "Error in estimation of covariance matrix (Frobenius norm)",

col = "aquamarine3", cex.names = 0.75, las = 1)

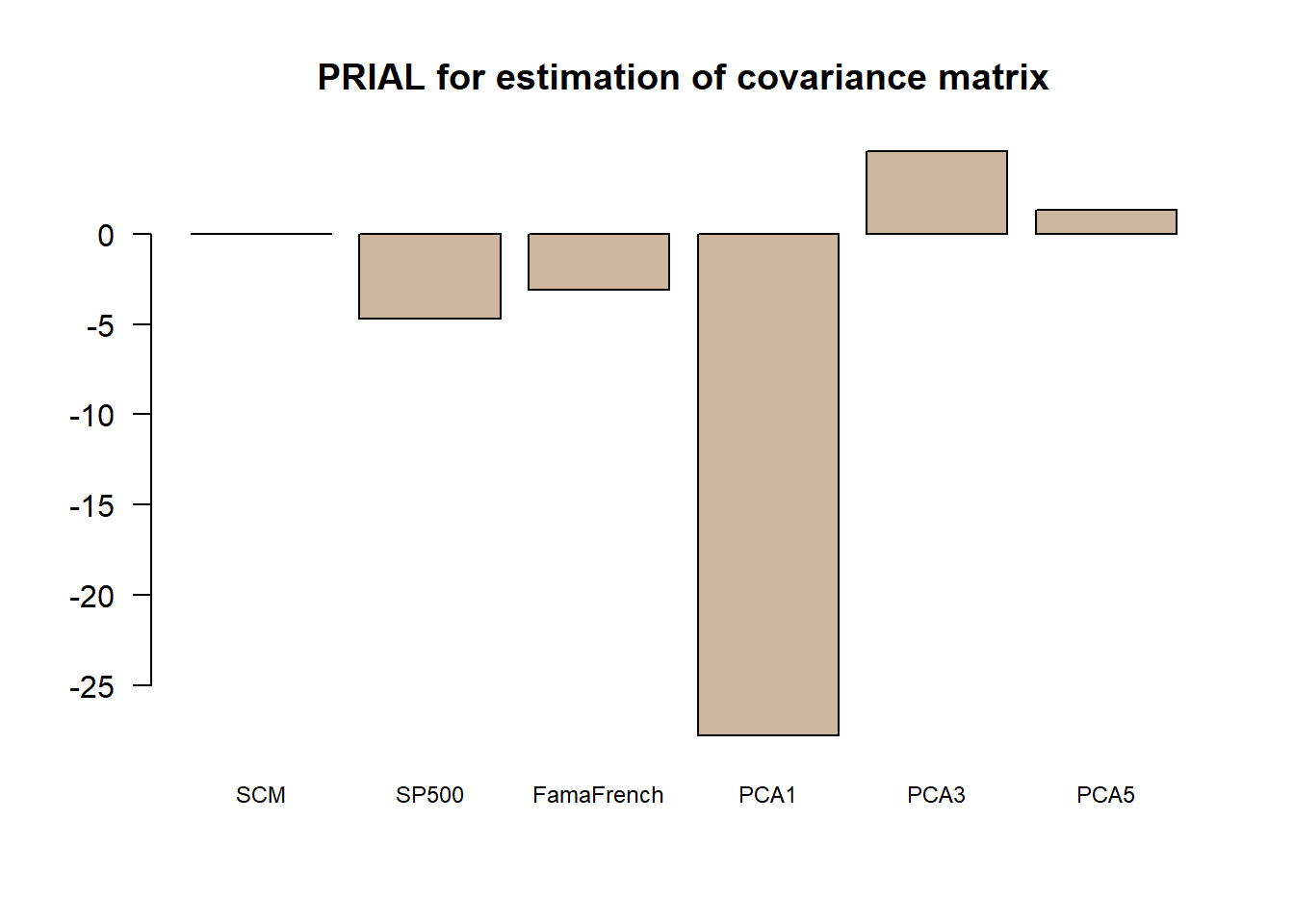

\[{\sf PRIAL} = 100\times \frac{\|\boldsymbol{\Sigma}_{\sf scm} - \boldsymbol{\Sigma}_{\sf true}\|_F^2 - \|\hat{\boldsymbol{\Sigma}} - \boldsymbol{\Sigma}_{\sf true}\|_F^2}{\|\boldsymbol{\Sigma}_{\sf scm} - \boldsymbol{\Sigma}_{\sf true}\|_F^2}\]

ref <- norm(Sigma_SCM - Sigma_true, "F")^2

PRIAL <- 100*(ref - error^2)/ref

print(PRIAL)

#> SCM SP500 FamaFrench PCA1 PCA3 PCA5

#> 0.000000 -4.698549 -3.071516 -27.761956 4.584330 1.335386

barplot(PRIAL, main = "PRIAL for estimation of covariance matrix",

col = "bisque3", cex.names = 0.75, las = 1) The final conclusion is that using factor models for covariance matrix estimation may help. In addition, it is not clear that using explicit factors helps as compared to the statistical factor modeling.

The final conclusion is that using factor models for covariance matrix estimation may help. In addition, it is not clear that using explicit factors helps as compared to the statistical factor modeling.