Chapter 1 Whether All the Funds are Assigned into 6 Gorups by SEC Randomly?

According to SEC official documents, all the mutual funds are assigned into IM-01, IM-02, … IM-06 groups, and each group of mutual funds are asked to begin filing their holing firms electronically to EDGAR system in specific dates, as shown in Table 1.1.

| Group | Phase-in Dates |

|---|---|

| Group IM-01 | April 26, 1993 |

| Group IM-02 | July 19, 1993 |

| Group IM-03 | January 30, 1995 |

| Group IM-04 | March 6, 1995 |

| Group IM-05 | May 1, 1995 |

| Group IM-06 | November 6, 1995 |

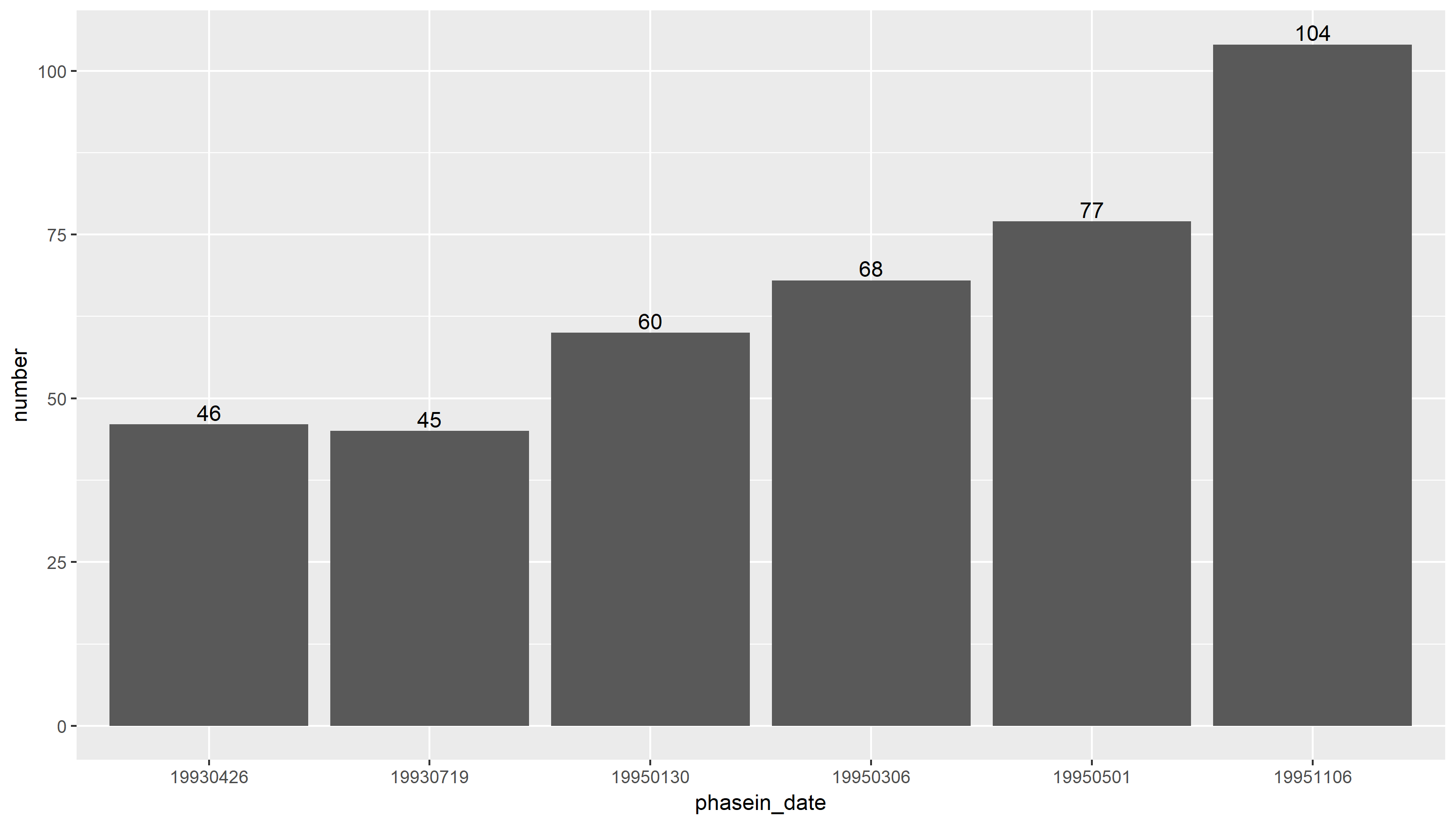

As you can see Figure 1.1, SEC did not seperate all funds into 6 groups evenly. There are only around 45 funds filed into EDGAR in the first two phase-in dates, while there are around 100 funds filed into EDGAR in the last dates. There is no clear reason why SEC did so, but this unevenly pattern could indicate a potential concern that these 6 groups are not assigned randomly.

Figure 1.1: Numbers of mutual funds that are filed in each of scheduled-date

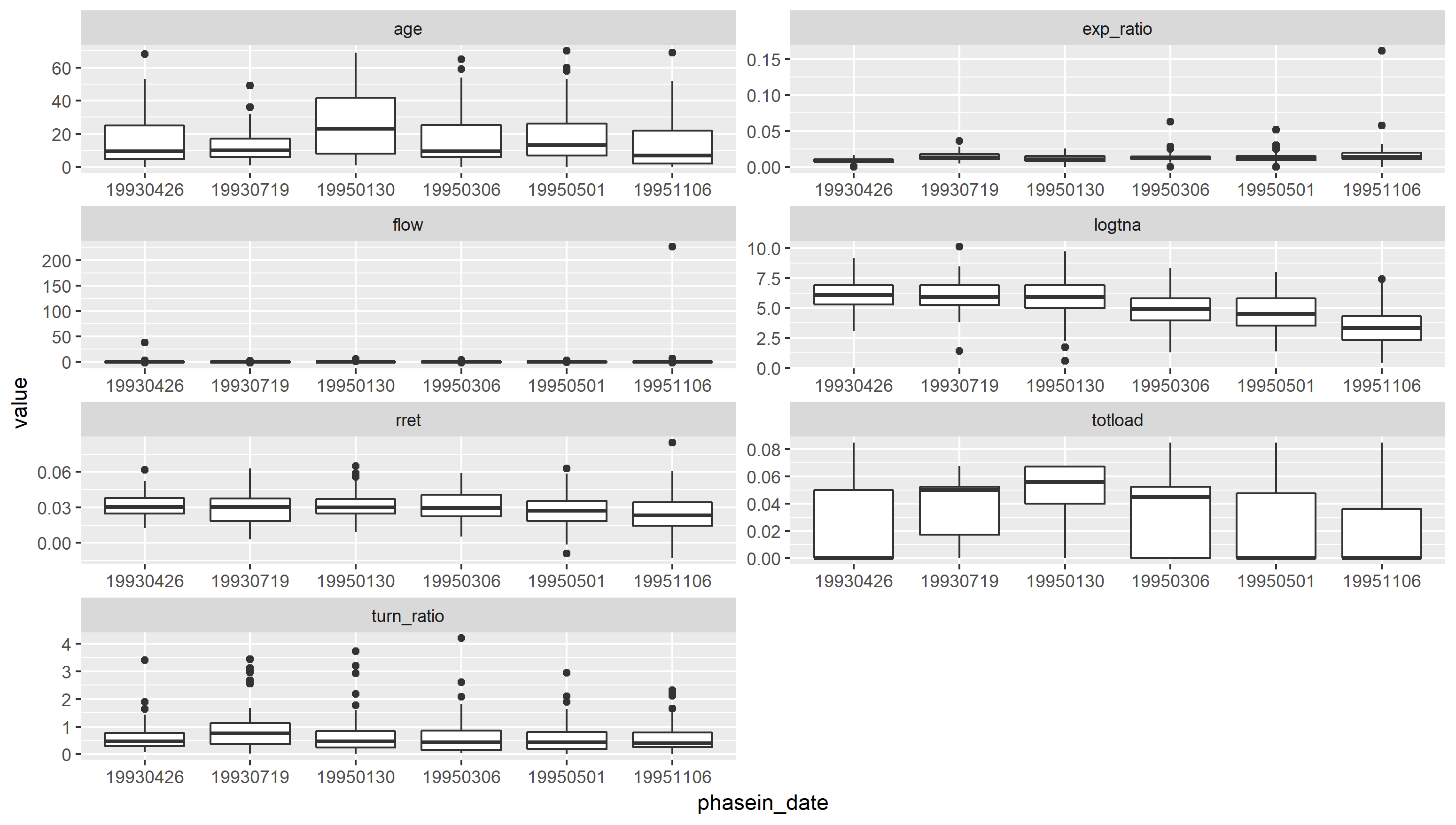

To check its randomness, I check most of important fund chrarcteristics among 6 groups at the last month before any funds filing into EDGAR, say, March 1993. The fund characteristics include fund age, fund flow, fund return, fund turnover ratio, fund expense ratio, log of fund size, and fund total loads.

Figure 1.2: Mutual funds characteristics among 6 groups

As shown in Figure 1.2, most of characteristics remain similar level across 6 groups. However, there are two potential concerns that we can observe from the boxplot. One, the fund total load seems to vary a lot across the groups, and therefore, it might require more investigation why it happened. Second, it is clear that there are outliers from the perspective of fund flow, and therefore it is important to remeber to remove those samples before we conduct a more formal DID analsis.