Chapter 3 W4 Class

3.1 Options

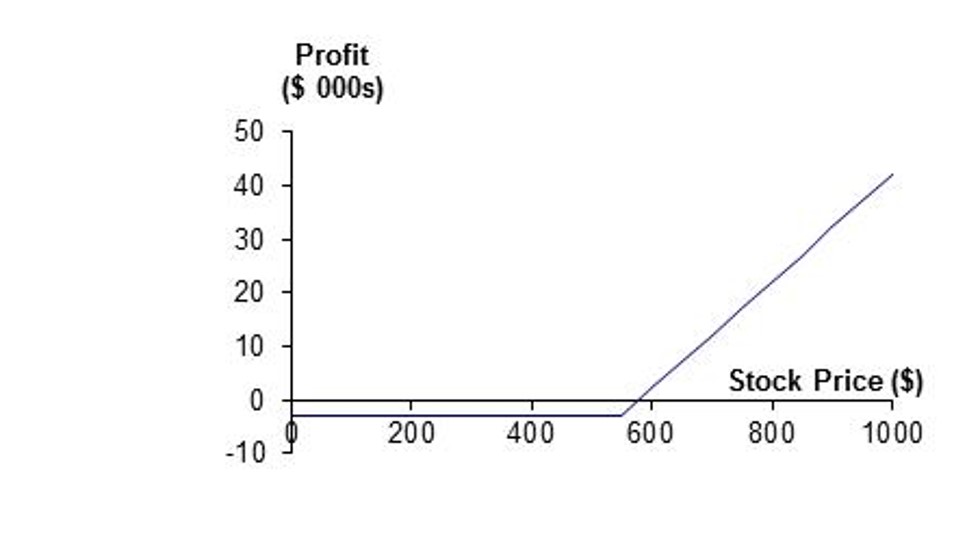

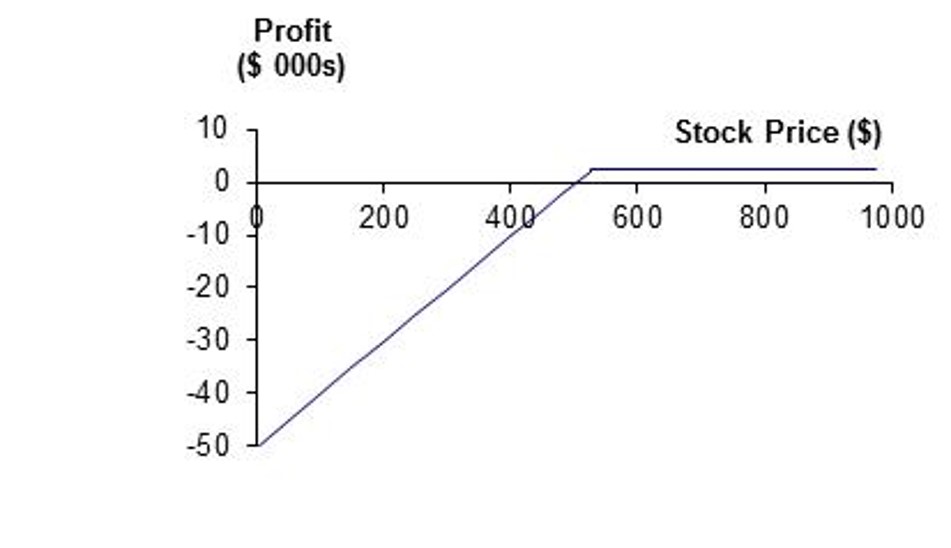

Do you know what kind of option they are?

Answer

First: Long Call; Second: Short Put

Definition

- A call is an option to buy

- A put is an option to sell

- European option: Exercisable only at expiration

- American option: Exercisable at any time

3.1.1 Option positions

- Long Call

- Long Put

- Short Call

- Short Put

3.1.2 Specification of Options

- Expiration Date

- Strike Price X

- E or A

- C or P

3.1.3 Moneyness:

- At-the-money

- In-the-money

- Out-of-the money option

| \(c\): European call option price | \(C\) American call option price |

| \(p\): European put option price | \(P\) American put option price |

| \(S_0\): Stock Price today | \(S_T\) Stock price at option maturity |

| \(K\): Strike price | \(D\) PV of dividends during option’s life |

| \(T\): Life of option | \(r\) risk-free rate for maturity T with cts compounding |

| \(\sigma\): Volatility of stock |

3.1.4 Stock Split

Suppose you own options with a strike price of K to buy (or sell) N shares: - No adjustments are made to the option terms for cash dividends - When there is an n-for-m stock split, - the strike price is reduced to mK/n - the no. of shares that can be bought (or sold) is increased to nN/m - Stock dividends are handled in a manner similar to stock splits

3.1.5 Market Makers

- Most exchanges use market makers to facilitate options trading

- A market maker quotes both bid and ask prices when requested

- The market maker does not know whether the individual requesting the quotes wants to buy or sell ### Margin

- Margin is required when options are sold (Example:A total of 100% of the proceeds of the sale plus 10% of the underlying share price (call) or exercise price (put))

3.1.6 Other information

- Warrants: options that are issued by a corporation or a financial institution

- Employee stock options: Employee stock options are a form of remuneration issued by a company to its executives

3.1.7 Effect of Variables on Option Pricing

| Var | c | p | C | P |

|---|---|---|---|---|

| \[ S_0 \] | + | - | + | - |

| \[ K \] | - | + | - | + |

| \[ T \] | ?? | ?? | + | + |

| \[ \sigma \] | + | + | + | + |

| \[ r \] | + | - | + | - |

| \[ D \] | - | + | - | + |

Explanation:

Keep other things unchanged, a higher S0 will be more likely to pass K, thus it’ll be price higher. Other logics follow

T for European options are murky. Since it’s exercisable only at a certain date, you never know what happens closer or on that date. The story is totally different in American options.

3.1.8 Option Bounds

- An American option is worth at least as much as the corresponding

European option

C>=c; P>=p

| Case | Eur opean call | Eur opean put | Ame rican | Put-call Parity |

|---|---|---|---|---|

| Basic | c>=m ax(So - Xe ^(-r T),0) | p> =max( Xe^( -rT)- So,0) | S0 - X < C - P < S0 - Xe^ (-rT) | c + Xe^(-rT) = p + S0 |

| Discrete Dividend | c ≥ m ax(S0 -D-Xe ^(-r T),0) | p ≥ m ax(D+ Xe^( -rT)- S0,0) | S0 - D - X < C - P < S0 - Xe^( –rT) | c + D + Xe^(-rT) = p + S0 |

| Dividend Yield | c ≥ max( S0e^ (-qT) - Xe^( -rT), 0) | p ≥ max (Xe^ (-rT) – S 0e^( -qT), 0) | - | c+ X e^(-rT)=p + S0e^(-qT) |

| Futures Options | c ≥ m ax((F 0-X)e ^(-r T),0) | p ≥ m ax((X -F0)e ^(-r T),0) | F0e C ≥F0-X and P ≥X-F0 |

c+ X e^(-rT)=p + F0e^(-rT) |