Chapter 2 Grand Strategy (Week 2)

2.1 Discussion questions

Questions denoted with an * means they are not directly related to an assigned reading. They are designed to whet your appetite for next week’s readings.

What is the main argument by Blackwill & Harris (2016)? What are their policy recommendations? Do you agree? Why?

What is the main argument by Baldwin (2020)? How does he support the argument? Do you agree? Why?

Are sanctions effective? (*)

2.2 War by Other Means

To learn more about Blackwill & Harris’ argument, their book is a good read. To give you a flavor of what they discuss, here is a quote concerning their motivation.

"It is difficult to imagine a clearer U.S. grand strategy—or one with greater success, as the USSR itself dissolved in 1991.

At the same time, it is worth stressing how much this American grand strategy became interpreted as resting fundamentally on the instruments of the U.S. military and NATO: nuclear weapons, deterrent military capability, and arms control. Economic issues entered discussions of U.S. grand strategy in the context that an America with a strong economy at home would be able to sustain a large and potent military and conduct robust security policies abroad."

— Blackwill & Harris 2016 War by Other Means

I would recommend in particular the third chapter of the book, which surveys seven primary economic tools (trade policy, investment policy, economic and financial sanctions, cyber, aid, financial and monetary policy, and energy and commodities). You can also hear about Harris’s interview at CFR here: Geoeconomics and Statecraft: A Conversation with Jennifer M. Harris. Or their interview at CFR ‘War by Other Means: Geoeconomics and Statecraft’. Instead of economic statecraft, Blackwill & Harris’ 2016 book uses a slightly different term, geoeconomics, which they define as

“The use of economic instruments to promote and defend national interests, and to produce beneficial geopolitical results; and the effects of other nations’ economic actions on a country’s geopolitical goals.”

— Blackwill & Harris 2016

Now, turning to their foreign affairs piece, they argued that geoeconomics used to be a common foreign policy tools (e.g. food blockade of Germany, Lend-Lease Act, Office of Economic Warfare, Marshall Plan, embargoes against communist countries, grants and loans to South Korea). However, starting from the Nixon era, geoeconomics gradually fell off the radar as economic interests took over geopolitical ones (e.g. lifting grain embargoes toward USSR, the Washington consensus, emphasis on political and military tools for asserting U.S. leadership). The main reason, they argue, is the dominance of neoliberalism. While this is not problematic when the U.S. faced no strategic challengers in the first two decades after the Cold War, it is no longer the case as countries such as China and Russia are becoming more capable and comfortable of applying economic tools to advance their power and interests.

Therefore, they advocate the refocus on geoeconomics. Policy makers need to think of

- new tools

- acceptable norms

- “work geoeconomics into the bloodstream of its foreign policy”

- allocate resources

In their book (available in e-book format from our library), they offer more concrete policy recommendations. For instance, shifting resources from DoD to DoS (which in 2016 has a budget of around 8.6% of the former) and concluding TPP and TTIP.

2.3 Economic statecraft

Baldwin’s book was first published in 1985. One of its intentions was to

“(C)reate an analytical framework for assessing the utility of economic techniques of statecraft.”

— Economic Statecraft

We are reading chapter 8 of this book to give you a flavor of his approach and analysis. It also serves as a good introduction to some of the most prominent cases of economic sanctions.

2.3.1 What is economic statecraft?

Here is a definition by Baldwin from Britannica.

“Economic statecraft, the use of economic means to pursue foreign policy goals. Foreign aid, trade, and policies governing the international flow of capital can be used as foreign policy tools and are considered the most common forms of economic statecraft.”

— David A. Baldwin

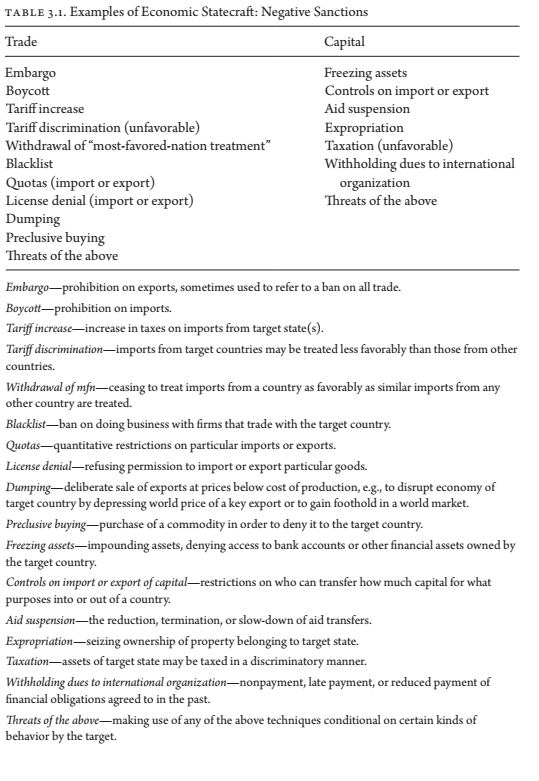

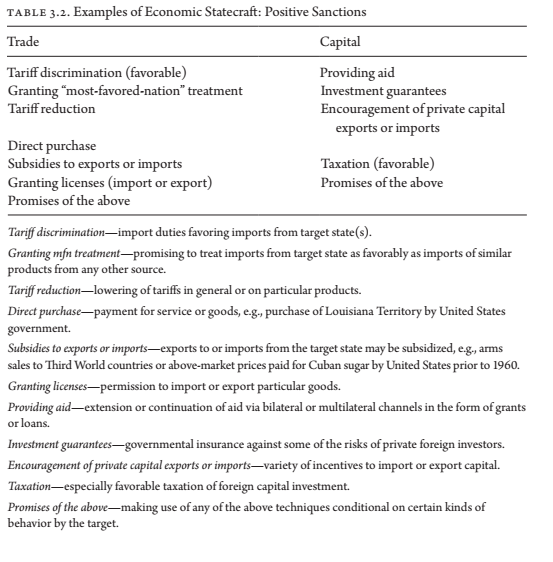

Baldwin defines it in a broad manner so as to " subsume all of the economic means by which foreign policy makers might try to influence other international actors" (Baldwin 2020, p.39). In the book, he divides economic statecraft into two broad categories: negative and positive sanctions. Positive sanctions are actual or promised rewards, while negative sanctions are actual or threatened punishments. Note that in this new edition he acknowledge that term “positive sanctions” can cause confusion and that “positive incentives” can be a better term. Here are some examples (Baldwin 2020, pp.40-41).

2.4 Baldwin’s argument

Baldwin was writing in response to the wave of studies that question the effectiveness of sanctions (recall the changing role of geoeconomics traced by Blackwill & Harris (2016)). He emphasizes the tendency for one to exaggerate the role of military forces and to underestimate the efficacy of economic statecraft. Throughout the readings, he reconsider the following cases

- Athens’ trade boycott on Megara and whether this precipitated the Great Peloponnesian War

- The League of Nations’ sanctions on Italy in response to the latter’s invasion of Ethiopia in 1935 and whether this leads to the League’s breakdown and the outbreak of WWII

- U.S. sanctions of Japan in 1941 and whether this provokes conflict

- U.S. embargoes on Cuba since 1960s and scholars’ evaluations that this was largely feckless

- UN sanctions on Rhodesia in 1966 was ineffective in bringing majority rule

He concludes that

“(S)tudies of these cases tend to be based on selective evidence that ignores relevant plausible hypotheses, oversimplified and inadequate specification of the structure of goals and targets, failure to consider the level of difficulty of the undertaking, the absence of serious consideration of alternative courses of action, failure to consider varying degrees of success, a propensity to overgeneralize, and an overall tendency to underestimate the effectiveness and utility of economic sanctions.”

— Economic Statecraft p. 212

2.5 Sanctions

We will spend a good part of our semester on sanctions. For background information, CFR has a good introduction piece on What Are Economic Sanctions. They define sanctions as “the withdrawal of customary trade and financial relations for foreign- and security-policy purposes.” Morgan et al. (2014, 542-543) define sanctions as “actions that one or more countries take to limit or end their economic relations with a target country in an effort to persuade that country to change its policies.” Sanctions can be comprehensive (e.g. full embargoes) or targeted. The later is also called “smart sanctions”, which have been used more often in the past two decades and aims at minimizing civilian suffering.

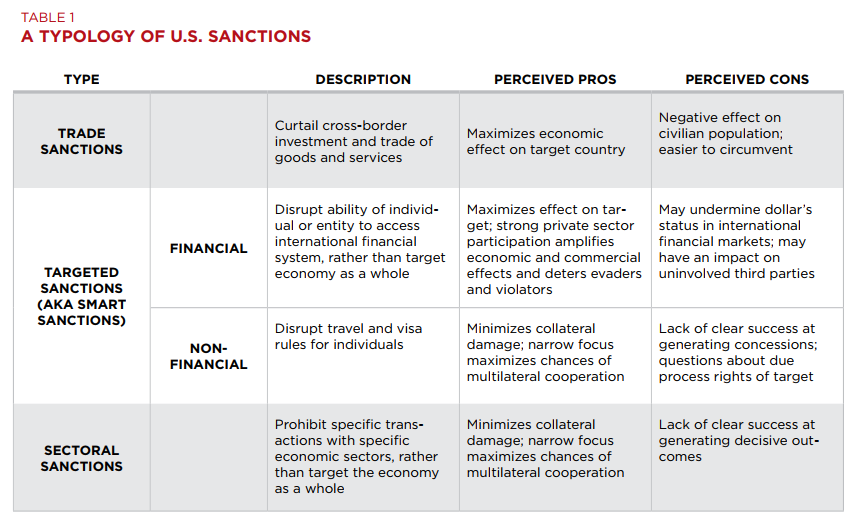

It is also worth mentioning that financial sanctions have been gaining momentum in recent decades, which can be attributed to the dominance of U.S. financial power. We will discuss more on this later. For a shorter read, here is a policy brief by CNAS that talks about financial sanctions: Economic Dominance, Financial Technology, and the Future of U.S. Economic Coercion. They also have a relatively more recent report The New Tools of Economic Warfare Effects and Effectiveness of Contemporary U.S. Financial Sanctions. In their report, they code and ask sanctions experts to rate 22 sanctions cases since September 11, 2011. They find that recent sanctions appear to have a much higher success rate (9 out of 22, or 40.9%). As a side note, they categorize sanctions into three broad types: trade sanctions, targeted or smart sanctions (financial and non-financial), and sectoral sanctions. You can check table 1 (shown below) of their report for further details about the pros and cons.

2.5.1 Databases

There are several readily available datasets for you to learn more about sanctions. The Threat and Imposition of Economic Sanctions (TIES) Data offers comprehensive data for sanctions from 1945 to 2005. One downside, however, is that it has not been updated recently.

The Global Sanctions Database (GSDB) covers data from 1950 to 2019. The variables you can get from this dataset are more limited than TIES. Aside from actors and years, the dataset offers information on the types, objectives, and outcomes of sanctions. You can get a glimpse of this data here: The ‘Global Sanctions Data Base’: Mapping international sanction policies from 1950-2019.

The EUSANCT Dataset covers sanctions by the European Union, the United States and the United Nations from 1989 to 2015. This dataset mirrors the structure and variables of TIES. Aside from TIES, it also include information from GIGA sanctions dataset, which covers sanctions by the UN, US and EU from 1990 to 2010. It also builds on the HSE dataset. The latter’s update in 2017 is also called HSEO. A relatively recent article has called into question case selection and (re)coding of HSEO: Biased Sanctions? Methodological Change in Economic Sanctions Reconsidered and Its Implications.

The Targeted Sanctions Initiative covers UN targeted sanctions imposed between 1991 and 2014. It has interactive tool that can help you examine these sanctions episodes here: unsanctionsapp.com, which is also available in app store or google play.

There is also an interactive EU Sanctions Map, which covers sanctions under EU jurisdiction. Unlike the previous datasets, this data offers more detailed information on the lists of persons, entities and items under sanctions, as well as the legal acts and guidelines.

The SanctionsExplorer offers data on entities sanctioned by the US Office of Foreign Assets Control (OFAC), EU, and UN since 1994. As a side note, the OFAC (under the US Department of the Treasury) administers and enforces sanctions. It regularly publishes lists of individuals and companies under US sanctions. For more details on OFAC lists, check here. Persons or entities that are under full blocking sanctions are listed on the OFAC’s List of Specially Designated Nationals and Blocked Persons (SDN List). If they are under sanctions short of full blocking, they will be listed on the Non-SDN Menu-Based Sanctions List (NS-MBS List).

2.6 Additional resources

For TPP, see China’s CPTPP bid puts Biden on the spot.

Grandstanding or sincere? China’s move to join the CPTPP

For discussion on AUKUS, Will AUKUS Hit China Where It Hurts? The submarine deal could reshape the balance of power in the Pacific—and draw Australia into future conflicts.

Could the AUKUS Deal Strengthen Deterrence Against China—And Yet Come at a Real Cost to Australia?.

China, Asia, and the Changing Strategic Importance of the Gulf and MENA Region

And also Stephen M. Walt’s FP article: The AUKUS Dominoes Are Just Starting to Fall The world’s newest security partnership is a window into how the world works—and the unpredictable places it’s heading.. Check also his book The Origins of Alliance.

See ProfTalmadge twitter thread on how SSNs can help the US blockade the chokepoint of China’s oil supplies.

See the twitter threads by Van Jackson and Dave Kang on why Asia is changing in a faster pace than US policy makers can keep up and also here.