Chapter 15 Linear regression

The goal in this chapter is to introduce linear regression, the standard tool that statisticians rely on when analysing the relationship between interval scale predictors and interval scale outcomes. Stripped to its bare essentials, linear regression models are basically a slightly fancier version of the Pearson correlation (Section 5.7) though as we’ll see, regression models are much more powerful tools.

15.1 What is a linear regression model?

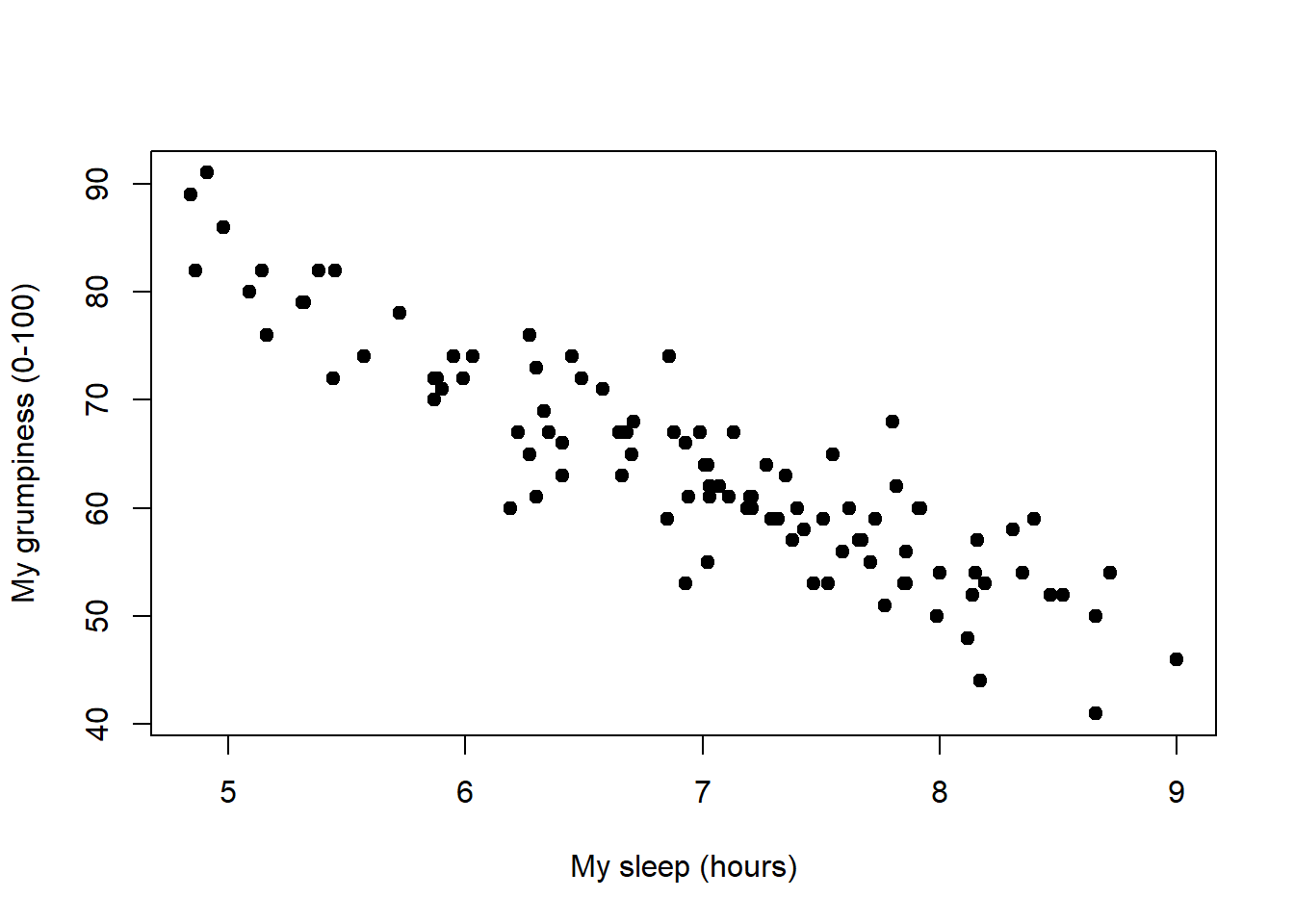

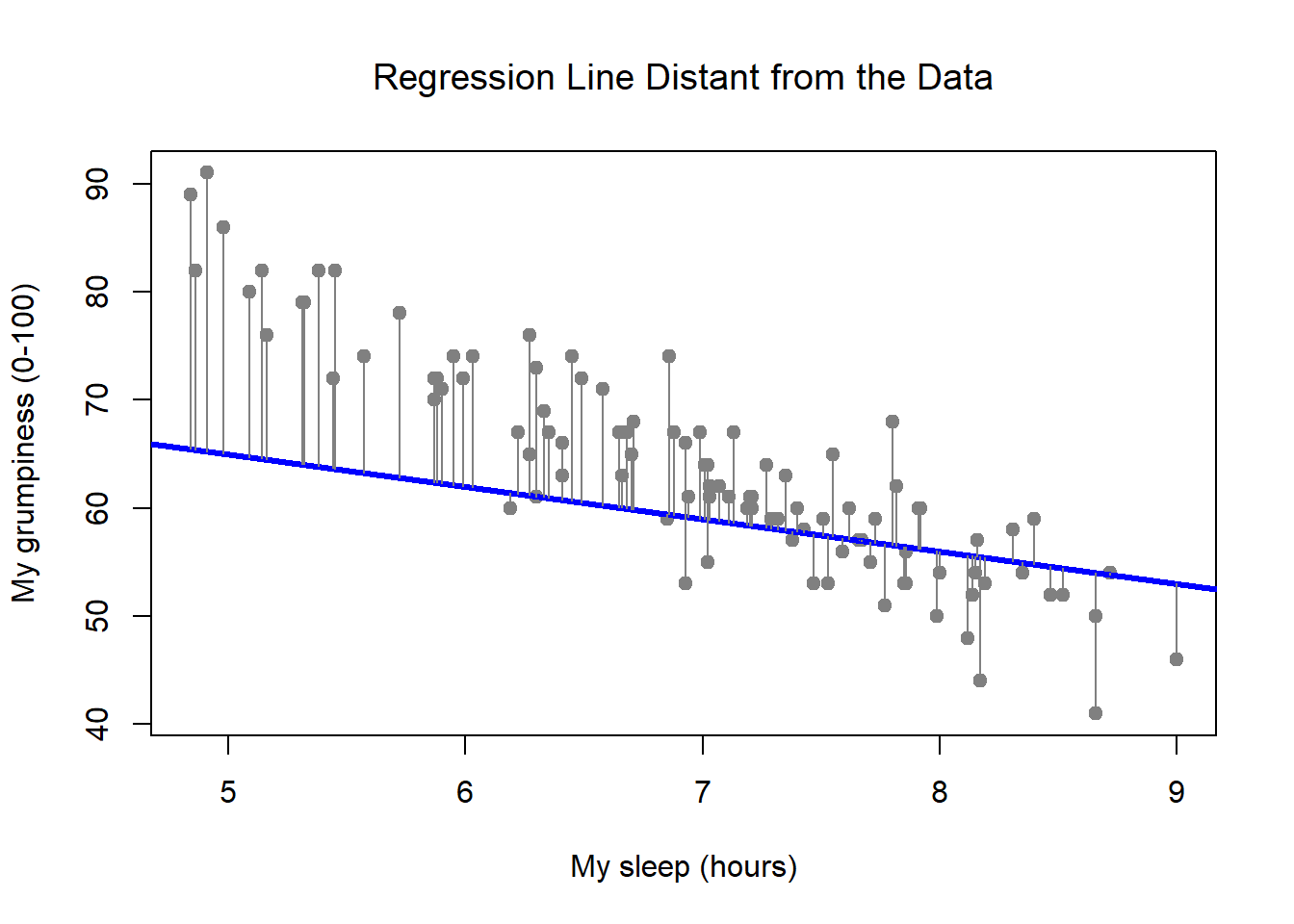

Figure 15.1: Scatterplot showing grumpiness as a function of hours slept.

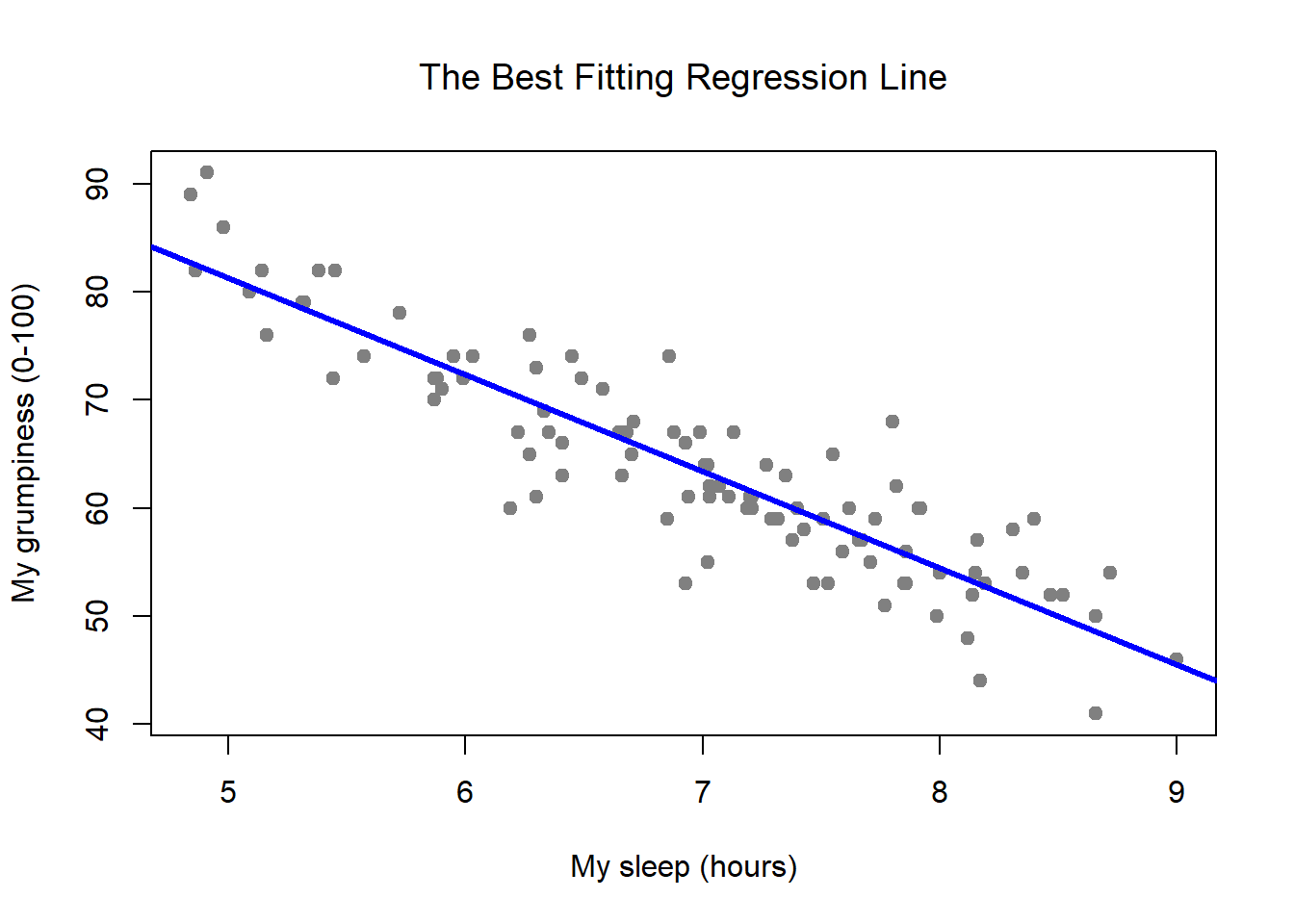

Figure 15.2: Panel a shows the sleep-grumpiness scatterplot from above with the best fitting regression line drawn over the top. Not surprisingly, the line goes through the middle of the data.

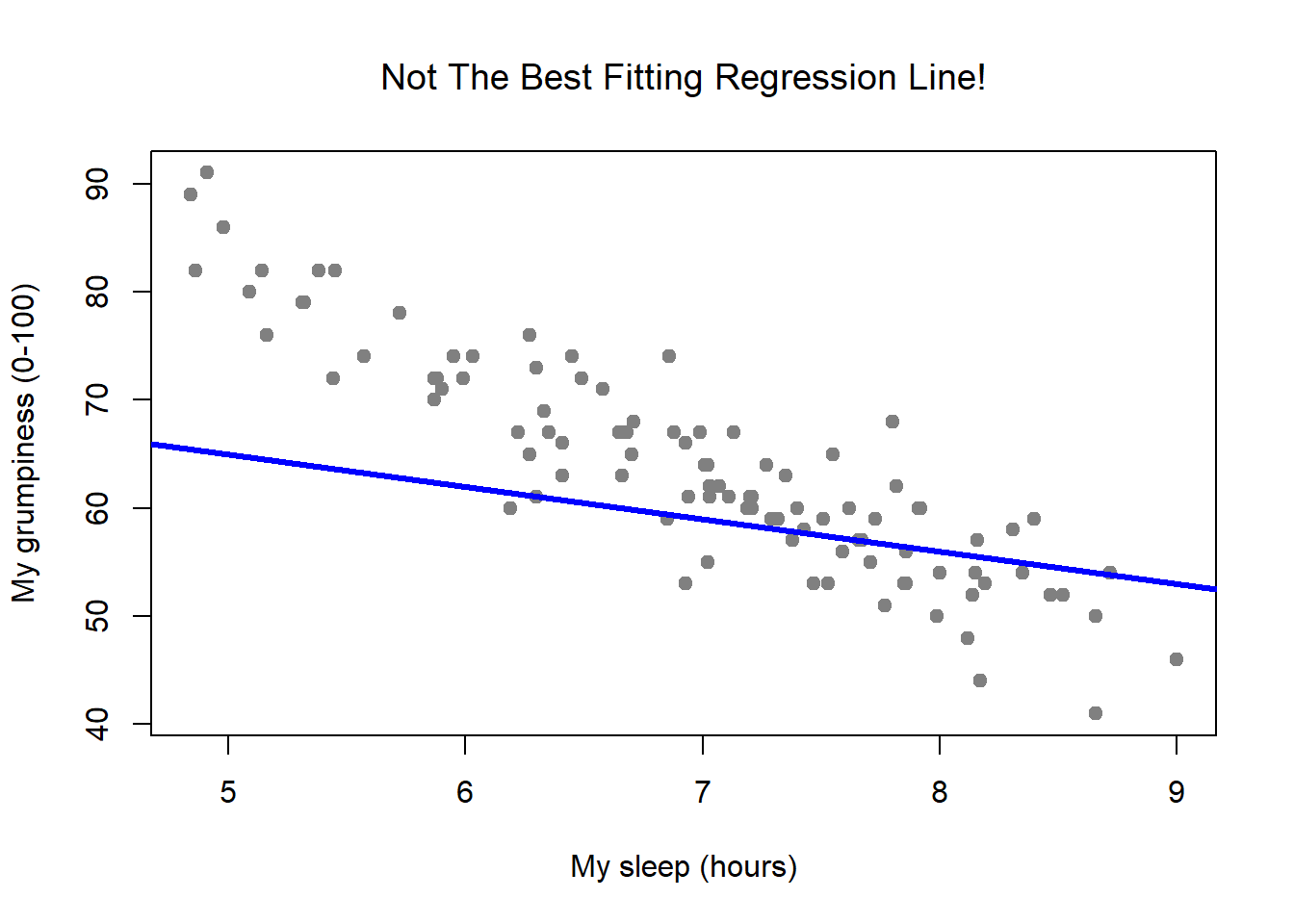

Figure 15.3: In contrast, this plot shows the same data, but with a very poor choice of regression line drawn over the top.

Since the basic ideas in regression are closely tied to correlation, we’ll return to the parenthood.Rdata file that we were using to illustrate how correlations work. Recall that, in this data set, we were trying to find out why Dan is so very grumpy all the time, and our working hypothesis was that I’m not getting enough sleep. We drew some scatterplots to help us examine the relationship between the amount of sleep I get, and my grumpiness the following day. The actual scatterplot that we draw is the one shown in Figure 15.1, and as we saw previously this corresponds to a correlation of \(r=-.90\), but what we find ourselves secretly imagining is something that looks closer to Figure 15.2. That is, we mentally draw a straight line through the middle of the data. In statistics, this line that we’re drawing is called a regression line. Notice that – since we’re not idiots – the regression line goes through the middle of the data. We don’t find ourselves imagining anything like the rather silly plot shown in Figure 15.3.

This is not highly surprising: the line that I’ve drawn in Figure 15.3 doesn’t “fit” the data very well, so it doesn’t make a lot of sense to propose it as a way of summarising the data, right? This is a very simple observation to make, but it turns out to be very powerful when we start trying to wrap just a little bit of maths around it. To do so, let’s start with a refresher of some high school maths. The formula for a straight line is usually written like this: \[ y = mx + c \] Or, at least, that’s what it was when I went to high school all those years ago. The two variables are \(x\) and \(y\), and we have two coefficients, \(m\) and \(c\). The coefficient \(m\) represents the slope of the line, and the coefficient \(c\) represents the \(y\)-intercept of the line. Digging further back into our decaying memories of high school (sorry, for some of us high school was a long time ago), we remember that the intercept is interpreted as “the value of \(y\) that you get when \(x=0\)”. Similarly, a slope of \(m\) means that if you increase the \(x\)-value by 1 unit, then the \(y\)-value goes up by \(m\) units; a negative slope means that the \(y\)-value would go down rather than up. Ah yes, it’s all coming back to me now.

Now that we’ve remembered that, it should come as no surprise to discover that we use the exact same formula to describe a regression line. If \(Y\) is the outcome variable (the DV) and \(X\) is the predictor variable (the IV), then the formula that describes our regression is written like this: \[ \hat{Y_i} = b_1 X_i + b_0 \] Hm. Looks like the same formula, but there’s some extra frilly bits in this version. Let’s make sure we understand them. Firstly, notice that I’ve written \(X_i\) and \(Y_i\) rather than just plain old \(X\) and \(Y\). This is because we want to remember that we’re dealing with actual data. In this equation, \(X_i\) is the value of predictor variable for the \(i\)th observation (i.e., the number of hours of sleep that I got on day \(i\) of my little study), and \(Y_i\) is the corresponding value of the outcome variable (i.e., my grumpiness on that day). And although I haven’t said so explicitly in the equation, what we’re assuming is that this formula works for all observations in the data set (i.e., for all \(i\)). Secondly, notice that I wrote \(\hat{Y}_i\) and not \(Y_i\). This is because we want to make the distinction between the actual data \(Y_i\), and the estimate \(\hat{Y}_i\) (i.e., the prediction that our regression line is making). Thirdly, I changed the letters used to describe the coefficients from \(m\) and \(c\) to \(b_1\) and \(b_0\). That’s just the way that statisticians like to refer to the coefficients in a regression model. I’ve no idea why they chose \(b\), but that’s what they did. In any case \(b_0\) always refers to the intercept term, and \(b_1\) refers to the slope.

Excellent, excellent. Next, I can’t help but notice that – regardless of whether we’re talking about the good regression line or the bad one – the data don’t fall perfectly on the line. Or, to say it another way, the data \(Y_i\) are not identical to the predictions of the regression model \(\hat{Y_i}\). Since statisticians love to attach letters, names and numbers to everything, let’s refer to the difference between the model prediction and that actual data point as a residual, and we’ll refer to it as \(\epsilon_i\).214 Written using mathematics, the residuals are defined as: \[ \epsilon_i = Y_i - \hat{Y}_i \] which in turn means that we can write down the complete linear regression model as: \[ Y_i = b_1 X_i + b_0 + \epsilon_i \]

15.2 Estimating a linear regression model

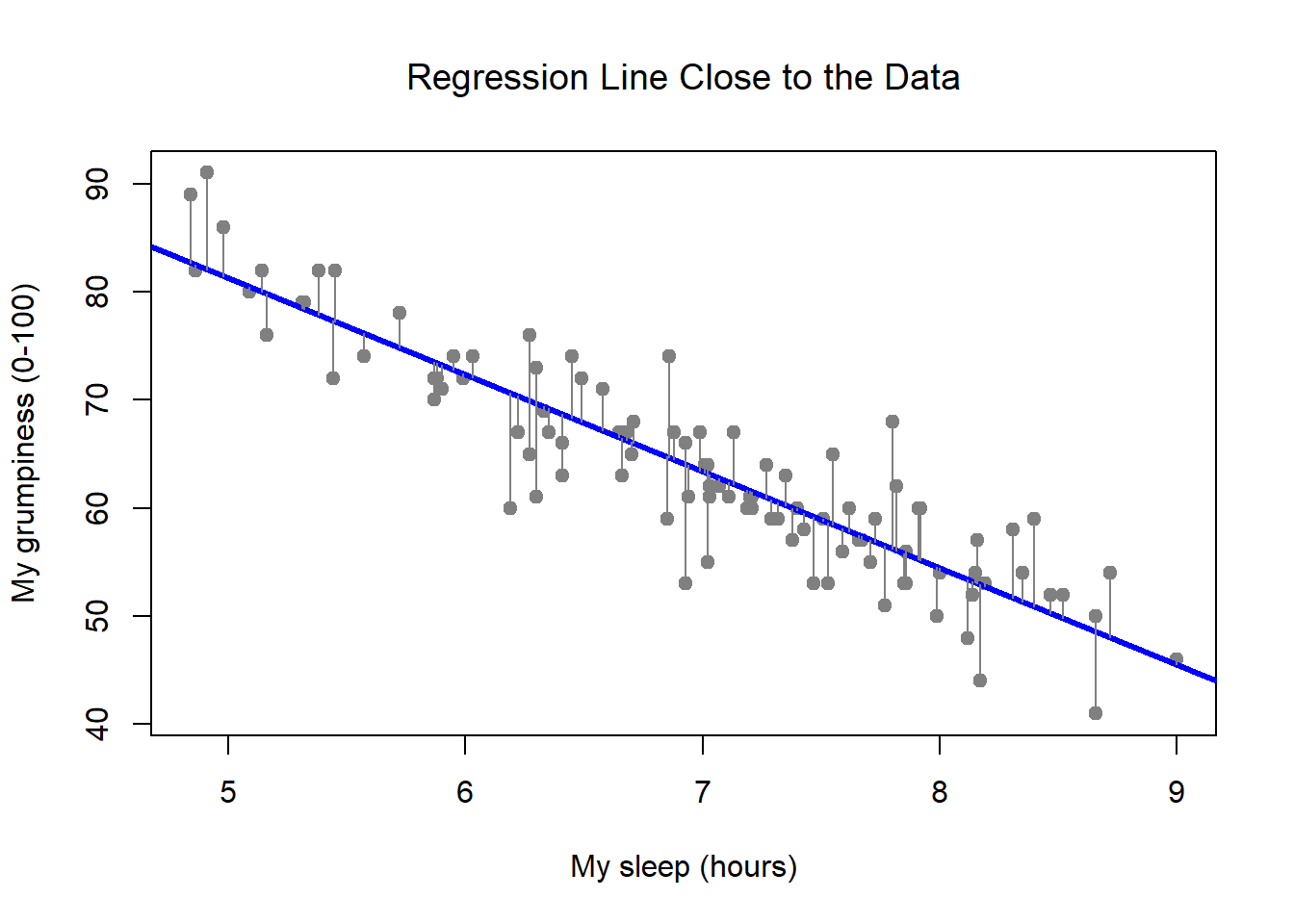

Figure 15.4: A depiction of the residuals associated with the best fitting regression line

Figure 15.5: The residuals associated with a poor regression line

Okay, now let’s redraw our pictures, but this time I’ll add some lines to show the size of the residual for all observations. When the regression line is good, our residuals (the lengths of the solid black lines) all look pretty small, as shown in Figure 15.4, but when the regression line is a bad one, the residuals are a lot larger, as you can see from looking at Figure 15.5. Hm. Maybe what we “want” in a regression model is small residuals. Yes, that does seem to make sense. In fact, I think I’ll go so far as to say that the “best fitting” regression line is the one that has the smallest residuals. Or, better yet, since statisticians seem to like to take squares of everything why not say that …

The estimated regression coefficients, \(\hat{b}_0\) and \(\hat{b}_1\) are those that minimise the sum of the squared residuals, which we could either write as \(\sum_i (Y_i - \hat{Y}_i)^2\) or as \(\sum_i {\epsilon_i}^2\).

Yes, yes that sounds even better. And since I’ve indented it like that, it probably means that this is the right answer. And since this is the right answer, it’s probably worth making a note of the fact that our regression coefficients are estimates (we’re trying to guess the parameters that describe a population!), which is why I’ve added the little hats, so that we get \(\hat{b}_0\) and \(\hat{b}_1\) rather than \(b_0\) and \(b_1\). Finally, I should also note that – since there’s actually more than one way to estimate a regression model – the more technical name for this estimation process is ordinary least squares (OLS) regression.

At this point, we now have a concrete definition for what counts as our “best” choice of regression coefficients, \(\hat{b}_0\) and \(\hat{b}_1\). The natural question to ask next is, if our optimal regression coefficients are those that minimise the sum squared residuals, how do we find these wonderful numbers? The actual answer to this question is complicated, and it doesn’t help you understand the logic of regression.215 As a result, this time I’m going to let you off the hook. Instead of showing you how to do it the long and tedious way first, and then “revealing” the wonderful shortcut that R provides you with, let’s cut straight to the chase… and use the lm() function (short for “linear model”) to do all the heavy lifting.

15.2.1 Using the lm() function

The lm() function is a fairly complicated one: if you type ?lm, the help files will reveal that there are a lot of arguments that you can specify, and most of them won’t make a lot of sense to you. At this stage however, there’s really only two of them that you care about, and as it turns out you’ve seen them before:

formula. A formula that specifies the regression model. For the simple linear regression models that we’ve talked about so far, in which you have a single predictor variable as well as an intercept term, this formula is of the formoutcome ~ predictor. However, more complicated formulas are allowed, and we’ll discuss them later.data. The data frame containing the variables.

As we saw with aov() in Chapter 14, the output of the lm() function is a fairly complicated object, with quite a lot of technical information buried under the hood. Because this technical information is used by other functions, it’s generally a good idea to create a variable that stores the results of your regression. With this in mind, to run my linear regression, the command I want to use is this:

regression.1 <- lm( formula = dan.grump ~ dan.sleep,

data = parenthood ) Note that I used dan.grump ~ dan.sleep as the formula: in the model that I’m trying to estimate, dan.grump is the outcome variable, and dan.sleep is the predictor variable. It’s always a good idea to remember which one is which! Anyway, what this does is create an “lm object” (i.e., a variable whose class is "lm") called regression.1. Let’s have a look at what happens when we print() it out:

print( regression.1 )##

## Call:

## lm(formula = dan.grump ~ dan.sleep, data = parenthood)

##

## Coefficients:

## (Intercept) dan.sleep

## 125.956 -8.937This looks promising. There’s two separate pieces of information here. Firstly, R is politely reminding us what the command was that we used to specify the model in the first place, which can be helpful. More importantly from our perspective, however, is the second part, in which R gives us the intercept \(\hat{b}_0 = 125.96\) and the slope \(\hat{b}_1 = -8.94\). In other words, the best-fitting regression line that I plotted in Figure 15.2 has this formula: \[ \hat{Y}_i = -8.94 \ X_i + 125.96 \]

15.2.2 Interpreting the estimated model

The most important thing to be able to understand is how to interpret these coefficients. Let’s start with \(\hat{b}_1\), the slope. If we remember the definition of the slope, a regression coefficient of \(\hat{b}_1 = -8.94\) means that if I increase \(X_i\) by 1, then I’m decreasing \(Y_i\) by 8.94. That is, each additional hour of sleep that I gain will improve my mood, reducing my grumpiness by 8.94 grumpiness points. What about the intercept? Well, since \(\hat{b}_0\) corresponds to “the expected value of \(Y_i\) when \(X_i\) equals 0”, it’s pretty straightforward. It implies that if I get zero hours of sleep (\(X_i =0\)) then my grumpiness will go off the scale, to an insane value of (\(Y_i = 125.96\)). Best to be avoided, I think.

15.3 Multiple linear regression

The simple linear regression model that we’ve discussed up to this point assumes that there’s a single predictor variable that you’re interested in, in this case dan.sleep. In fact, up to this point, every statistical tool that we’ve talked about has assumed that your analysis uses one predictor variable and one outcome variable. However, in many (perhaps most) research projects you actually have multiple predictors that you want to examine. If so, it would be nice to be able to extend the linear regression framework to be able to include multiple predictors. Perhaps some kind of multiple regression model would be in order?

Multiple regression is conceptually very simple. All we do is add more terms to our regression equation. Let’s suppose that we’ve got two variables that we’re interested in; perhaps we want to use both dan.sleep and baby.sleep to predict the dan.grump variable. As before, we let \(Y_i\) refer to my grumpiness on the \(i\)-th day. But now we have two \(X\) variables: the first corresponding to the amount of sleep I got and the second corresponding to the amount of sleep my son got. So we’ll let \(X_{i1}\) refer to the hours I slept on the \(i\)-th day, and \(X_{i2}\) refers to the hours that the baby slept on that day. If so, then we can write our regression model like this: \[

Y_i = b_2 X_{i2} + b_1 X_{i1} + b_0 + \epsilon_i

\] As before, \(\epsilon_i\) is the residual associated with the \(i\)-th observation, \(\epsilon_i = {Y}_i - \hat{Y}_i\). In this model, we now have three coefficients that need to be estimated: \(b_0\) is the intercept, \(b_1\) is the coefficient associated with my sleep, and \(b_2\) is the coefficient associated with my son’s sleep. However, although the number of coefficients that need to be estimated has changed, the basic idea of how the estimation works is unchanged: our estimated coefficients \(\hat{b}_0\), \(\hat{b}_1\) and \(\hat{b}_2\) are those that minimise the sum squared residuals.

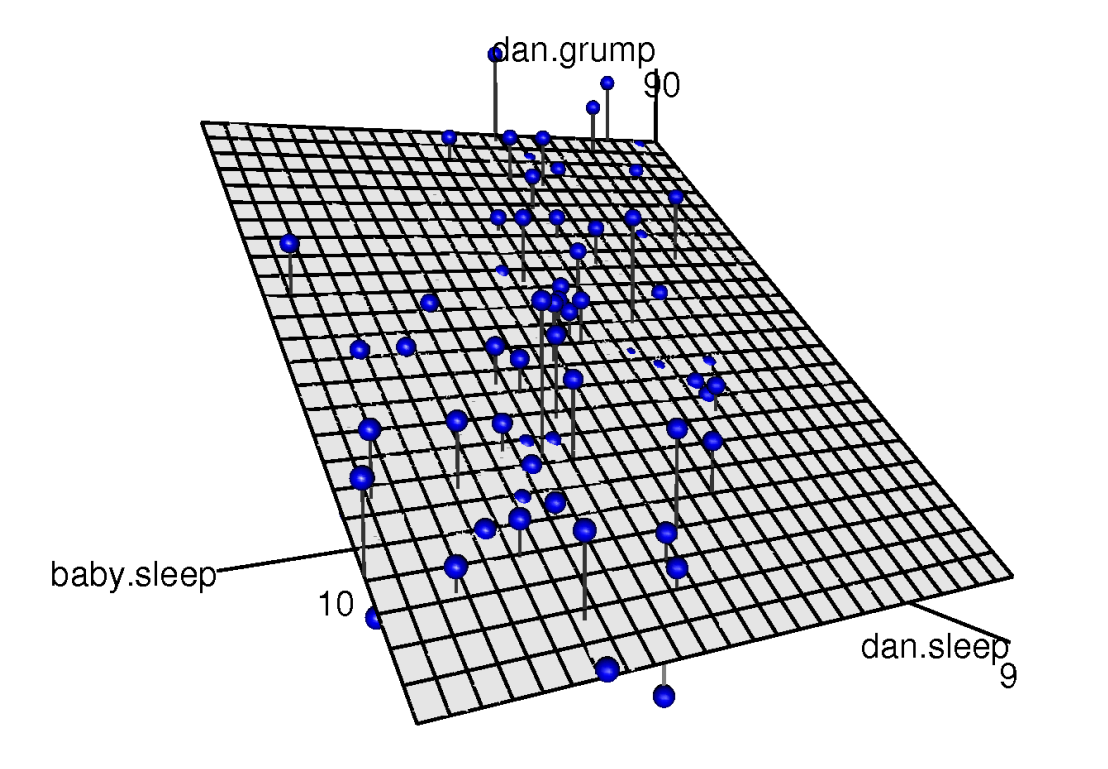

Figure 15.6: A 3D visualisation of a multiple regression model. There are two predictors in the model, dan.sleep and baby.sleep; the outcome variable is dan.grump. Together, these three variables form a 3D space: each observation (blue dots) is a point in this space. In much the same way that a simple linear regression model forms a line in 2D space, this multiple regression model forms a plane in 3D space. When we estimate the regression coefficients, what we’re trying to do is find a plane that is as close to all the blue dots as possible.

15.3.1 Doing it in R

Multiple regression in R is no different to simple regression: all we have to do is specify a more complicated formula when using the lm() function. For example, if we want to use both dan.sleep and baby.sleep as predictors in our attempt to explain why I’m so grumpy, then the formula we need is this:

dan.grump ~ dan.sleep + baby.sleepNotice that, just like last time, I haven’t explicitly included any reference to the intercept term in this formula; only the two predictor variables and the outcome. By default, the lm() function assumes that the model should include an intercept (though you can get rid of it if you want). In any case, I can create a new regression model – which I’ll call regression.2 – using the following command:

regression.2 <- lm( formula = dan.grump ~ dan.sleep + baby.sleep,

data = parenthood )And just like last time, if we print() out this regression model we can see what the estimated regression coefficients are:

print( regression.2 )##

## Call:

## lm(formula = dan.grump ~ dan.sleep + baby.sleep, data = parenthood)

##

## Coefficients:

## (Intercept) dan.sleep baby.sleep

## 125.96557 -8.95025 0.01052The coefficient associated with dan.sleep is quite large, suggesting that every hour of sleep I lose makes me a lot grumpier. However, the coefficient for baby.sleep is very small, suggesting that it doesn’t really matter how much sleep my son gets; not really. What matters as far as my grumpiness goes is how much sleep I get. To get a sense of what this multiple regression model looks like, Figure 15.6 shows a 3D plot that plots all three variables, along with the regression model itself.

15.3.2 Formula for the general case

The equation that I gave above shows you what a multiple regression model looks like when you include two predictors. Not surprisingly, then, if you want more than two predictors all you have to do is add more \(X\) terms and more \(b\) coefficients. In other words, if you have \(K\) predictor variables in the model then the regression equation looks like this: \[ Y_i = \left( \sum_{k=1}^K b_{k} X_{ik} \right) + b_0 + \epsilon_i \]

15.4 Quantifying the fit of the regression model

So we now know how to estimate the coefficients of a linear regression model. The problem is, we don’t yet know if this regression model is any good. For example, the regression.1 model claims that every hour of sleep will improve my mood by quite a lot, but it might just be rubbish. Remember, the regression model only produces a prediction \(\hat{Y}_i\) about what my mood is like: my actual mood is \(Y_i\). If these two are very close, then the regression model has done a good job. If they are very different, then it has done a bad job.

15.4.1 The \(R^2\) value

Once again, let’s wrap a little bit of mathematics around this. Firstly, we’ve got the sum of the squared residuals: \[

\mbox{SS}_{res} = \sum_i (Y_i - \hat{Y}_i)^2

\] which we would hope to be pretty small. Specifically, what we’d like is for it to be very small in comparison to the total variability in the outcome variable, \[

\mbox{SS}_{tot} = \sum_i (Y_i - \bar{Y})^2

\] While we’re here, let’s calculate these values in R. Firstly, in order to make my R commands look a bit more similar to the mathematical equations, I’ll create variables X and Y:

X <- parenthood$dan.sleep # the predictor

Y <- parenthood$dan.grump # the outcomeNow that we’ve done this, let’s calculate the \(\hat{Y}\) values and store them in a variable called Y.pred. For the simple model that uses only a single predictor, regression.1, we would do the following:

Y.pred <- -8.94 * X + 125.97Okay, now that we’ve got a variable which stores the regression model predictions for how grumpy I will be on any given day, let’s calculate our sum of squared residuals. We would do that using the following command:

SS.resid <- sum( (Y - Y.pred)^2 )

print( SS.resid )## [1] 1838.722Wonderful. A big number that doesn’t mean very much. Still, let’s forge boldly onwards anyway, and calculate the total sum of squares as well. That’s also pretty simple:

SS.tot <- sum( (Y - mean(Y))^2 )

print( SS.tot )## [1] 9998.59Hm. Well, it’s a much bigger number than the last one, so this does suggest that our regression model was making good predictions. But it’s not very interpretable.

Perhaps we can fix this. What we’d like to do is to convert these two fairly meaningless numbers into one number. A nice, interpretable number, which for no particular reason we’ll call \(R^2\). What we would like is for the value of \(R^2\) to be equal to 1 if the regression model makes no errors in predicting the data. In other words, if it turns out that the residual errors are zero – that is, if \(\mbox{SS}_{res} = 0\) – then we expect \(R^2 = 1\). Similarly, if the model is completely useless, we would like \(R^2\) to be equal to 0. What do I mean by “useless”? Tempting as it is demand that the regression model move out of the house, cut its hair and get a real job, I’m probably going to have to pick a more practical definition: in this case, all I mean is that the residual sum of squares is no smaller than the total sum of squares, \(\mbox{SS}_{res} = \mbox{SS}_{tot}\). Wait, why don’t we do exactly that? The formula that provides us with out \(R^2\) value is pretty simple to write down, \[ R^2 = 1 - \frac{\mbox{SS}_{res}}{\mbox{SS}_{tot}} \] and equally simple to calculate in R:

R.squared <- 1 - (SS.resid / SS.tot)

print( R.squared )## [1] 0.8161018The \(R^2\) value, sometimes called the coefficient of determination216 has a simple interpretation: it is the proportion of the variance in the outcome variable that can be accounted for by the predictor. So in this case, the fact that we have obtained \(R^2 = .816\) means that the predictor (my.sleep) explains 81.6% of the variance in the outcome (my.grump).

Naturally, you don’t actually need to type in all these commands yourself if you want to obtain the \(R^2\) value for your regression model. As we’ll see later on in Section 15.5.3, all you need to do is use the summary() function. However, let’s put that to one side for the moment. There’s another property of \(R^2\) that I want to point out.

15.4.2 The relationship between regression and correlation

At this point we can revisit my earlier claim that regression, in this very simple form that I’ve discussed so far, is basically the same thing as a correlation. Previously, we used the symbol \(r\) to denote a Pearson correlation. Might there be some relationship between the value of the correlation coefficient \(r\) and the \(R^2\) value from linear regression? Of course there is: the squared correlation \(r^2\) is identical to the \(R^2\) value for a linear regression with only a single predictor. To illustrate this, here’s the squared correlation:

r <- cor(X, Y) # calculate the correlation

print( r^2 ) # print the squared correlation## [1] 0.8161027Yep, same number. In other words, running a Pearson correlation is more or less equivalent to running a linear regression model that uses only one predictor variable.

15.4.3 The adjusted \(R^2\) value

One final thing to point out before moving on. It’s quite common for people to report a slightly different measure of model performance, known as “adjusted \(R^2\)”. The motivation behind calculating the adjusted \(R^2\) value is the observation that adding more predictors into the model will always call the \(R^2\) value to increase (or at least not decrease). The adjusted \(R^2\) value introduces a slight change to the calculation, as follows. For a regression model with \(K\) predictors, fit to a data set containing \(N\) observations, the adjusted \(R^2\) is: \[ \mbox{adj. } R^2 = 1 - \left(\frac{\mbox{SS}_{res}}{\mbox{SS}_{tot}} \times \frac{N-1}{N-K-1} \right) \] This adjustment is an attempt to take the degrees of freedom into account. The big advantage of the adjusted \(R^2\) value is that when you add more predictors to the model, the adjusted \(R^2\) value will only increase if the new variables improve the model performance more than you’d expect by chance. The big disadvantage is that the adjusted \(R^2\) value can’t be interpreted in the elegant way that \(R^2\) can. \(R^2\) has a simple interpretation as the proportion of variance in the outcome variable that is explained by the regression model; to my knowledge, no equivalent interpretation exists for adjusted \(R^2\).

An obvious question then, is whether you should report \(R^2\) or adjusted \(R^2\). This is probably a matter of personal preference. If you care more about interpretability, then \(R^2\) is better. If you care more about correcting for bias, then adjusted \(R^2\) is probably better. Speaking just for myself, I prefer \(R^2\): my feeling is that it’s more important to be able to interpret your measure of model performance. Besides, as we’ll see in Section 15.5, if you’re worried that the improvement in \(R^2\) that you get by adding a predictor is just due to chance and not because it’s a better model, well, we’ve got hypothesis tests for that.

15.5 Hypothesis tests for regression models

So far we’ve talked about what a regression model is, how the coefficients of a regression model are estimated, and how we quantify the performance of the model (the last of these, incidentally, is basically our measure of effect size). The next thing we need to talk about is hypothesis tests. There are two different (but related) kinds of hypothesis tests that we need to talk about: those in which we test whether the regression model as a whole is performing significantly better than a null model; and those in which we test whether a particular regression coefficient is significantly different from zero.

At this point, you’re probably groaning internally, thinking that I’m going to introduce a whole new collection of tests. You’re probably sick of hypothesis tests by now, and don’t want to learn any new ones. Me too. I’m so sick of hypothesis tests that I’m going to shamelessly reuse the \(F\)-test from Chapter 14 and the \(t\)-test from Chapter 13. In fact, all I’m going to do in this section is show you how those tests are imported wholesale into the regression framework.

15.5.1 Testing the model as a whole

Okay, suppose you’ve estimated your regression model. The first hypothesis test you might want to try is one in which the null hypothesis that there is no relationship between the predictors and the outcome, and the alternative hypothesis is that the data are distributed in exactly the way that the regression model predicts. Formally, our “null model” corresponds to the fairly trivial “regression” model in which we include 0 predictors, and only include the intercept term \(b_0\) \[ H_0: Y_i = b_0 + \epsilon_i \] If our regression model has \(K\) predictors, the “alternative model” is described using the usual formula for a multiple regression model: \[ H_1: Y_i = \left( \sum_{k=1}^K b_{k} X_{ik} \right) + b_0 + \epsilon_i \]

How can we test these two hypotheses against each other? The trick is to understand that just like we did with ANOVA, it’s possible to divide up the total variance \(\mbox{SS}_{tot}\) into the sum of the residual variance \(\mbox{SS}_{res}\) and the regression model variance \(\mbox{SS}_{mod}\). I’ll skip over the technicalities, since we covered most of them in the ANOVA chapter, and just note that: \[ \mbox{SS}_{mod} = \mbox{SS}_{tot} - \mbox{SS}_{res} \] And, just like we did with the ANOVA, we can convert the sums of squares in to mean squares by dividing by the degrees of freedom. \[ \begin{array}{rcl} \mbox{MS}_{mod} &=& \displaystyle\frac{\mbox{SS}_{mod} }{df_{mod}} \\ \\ \mbox{MS}_{res} &=& \displaystyle\frac{\mbox{SS}_{res} }{df_{res} } \end{array} \]

So, how many degrees of freedom do we have? As you might expect, the \(df\) associated with the model is closely tied to the number of predictors that we’ve included. In fact, it turns out that \(df_{mod} = K\). For the residuals, the total degrees of freedom is \(df_{res} = N -K - 1\).

Now that we’ve got our mean square values, you’re probably going to be entirely unsurprised (possibly even bored) to discover that we can calculate an \(F\)-statistic like this: \[ F = \frac{\mbox{MS}_{mod}}{\mbox{MS}_{res}} \] and the degrees of freedom associated with this are \(K\) and \(N-K-1\). This \(F\) statistic has exactly the same interpretation as the one we introduced in Chapter 14. Large \(F\) values indicate that the null hypothesis is performing poorly in comparison to the alternative hypothesis. And since we already did some tedious “do it the long way” calculations back then, I won’t waste your time repeating them. In a moment I’ll show you how to do the test in R the easy way, but first, let’s have a look at the tests for the individual regression coefficients.

15.5.2 Tests for individual coefficients

The \(F\)-test that we’ve just introduced is useful for checking that the model as a whole is performing better than chance. This is important: if your regression model doesn’t produce a significant result for the \(F\)-test then you probably don’t have a very good regression model (or, quite possibly, you don’t have very good data). However, while failing this test is a pretty strong indicator that the model has problems, passing the test (i.e., rejecting the null) doesn’t imply that the model is good! Why is that, you might be wondering? The answer to that can be found by looking at the coefficients for the regression.2 model:

print( regression.2 ) ##

## Call:

## lm(formula = dan.grump ~ dan.sleep + baby.sleep, data = parenthood)

##

## Coefficients:

## (Intercept) dan.sleep baby.sleep

## 125.96557 -8.95025 0.01052I can’t help but notice that the estimated regression coefficient for the baby.sleep variable is tiny (0.01), relative to the value that we get for dan.sleep (-8.95). Given that these two variables are absolutely on the same scale (they’re both measured in “hours slept”), I find this suspicious. In fact, I’m beginning to suspect that it’s really only the amount of sleep that I get that matters in order to predict my grumpiness.

Once again, we can reuse a hypothesis test that we discussed earlier, this time the \(t\)-test. The test that we’re interested has a null hypothesis that the true regression coefficient is zero (\(b = 0\)), which is to be tested against the alternative hypothesis that it isn’t (\(b \neq 0\)). That is: \[ \begin{array}{rl} H_0: & b = 0 \\ H_1: & b \neq 0 \end{array} \] How can we test this? Well, if the central limit theorem is kind to us, we might be able to guess that the sampling distribution of \(\hat{b}\), the estimated regression coefficient, is a normal distribution with mean centred on \(b\). What that would mean is that if the null hypothesis were true, then the sampling distribution of \(\hat{b}\) has mean zero and unknown standard deviation. Assuming that we can come up with a good estimate for the standard error of the regression coefficient, \(\mbox{SE}({\hat{b}})\), then we’re in luck. That’s exactly the situation for which we introduced the one-sample \(t\) way back in Chapter 13. So let’s define a \(t\)-statistic like this, \[ t = \frac{\hat{b}}{\mbox{SE}({\hat{b})}} \] I’ll skip over the reasons why, but our degrees of freedom in this case are \(df = N- K- 1\). Irritatingly, the estimate of the standard error of the regression coefficient, \(\mbox{SE}({\hat{b}})\), is not as easy to calculate as the standard error of the mean that we used for the simpler \(t\)-tests in Chapter 13. In fact, the formula is somewhat ugly, and not terribly helpful to look at. For our purposes it’s sufficient to point out that the standard error of the estimated regression coefficient depends on both the predictor and outcome variables, and is somewhat sensitive to violations of the homogeneity of variance assumption (discussed shortly).

In any case, this \(t\)-statistic can be interpreted in the same way as the \(t\)-statistics that we discussed in Chapter 13. Assuming that you have a two-sided alternative (i.e., you don’t really care if \(b >0\) or \(b < 0\)), then it’s the extreme values of \(t\) (i.e., a lot less than zero or a lot greater than zero) that suggest that you should reject the null hypothesis.

15.5.3 Running the hypothesis tests in R

To compute all of the quantities that we have talked about so far, all you need to do is ask for a summary() of your regression model. Since I’ve been using regression.2 as my example, let’s do that:

summary( regression.2 )##

## Call:

## lm(formula = dan.grump ~ dan.sleep + baby.sleep, data = parenthood)

##

## Residuals:

## Min 1Q Median 3Q Max

## -11.0345 -2.2198 -0.4016 2.6775 11.7496

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 125.96557 3.04095 41.423 <2e-16 ***

## dan.sleep -8.95025 0.55346 -16.172 <2e-16 ***

## baby.sleep 0.01052 0.27106 0.039 0.969

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 4.354 on 97 degrees of freedom

## Multiple R-squared: 0.8161, Adjusted R-squared: 0.8123

## F-statistic: 215.2 on 2 and 97 DF, p-value: < 2.2e-16The output that this command produces is pretty dense, but we’ve already discussed everything of interest in it, so what I’ll do is go through it line by line. The first line reminds us of what the actual regression model is:

Call:

lm(formula = dan.grump ~ dan.sleep + baby.sleep, data = parenthood)You can see why this is handy, since it was a little while back when we actually created the regression.2 model, and so it’s nice to be reminded of what it was we were doing. The next part provides a quick summary of the residuals (i.e., the \(\epsilon_i\) values),

Residuals:

Min 1Q Median 3Q Max

-11.0345 -2.2198 -0.4016 2.6775 11.7496 which can be convenient as a quick and dirty check that the model is okay. Remember, we did assume that these residuals were normally distributed, with mean 0. In particular it’s worth quickly checking to see if the median is close to zero, and to see if the first quartile is about the same size as the third quartile. If they look badly off, there’s a good chance that the assumptions of regression are violated. These ones look pretty nice to me, so let’s move on to the interesting stuff. The next part of the R output looks at the coefficients of the regression model:

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 125.96557 3.04095 41.423 <2e-16 ***

dan.sleep -8.95025 0.55346 -16.172 <2e-16 ***

baby.sleep 0.01052 0.27106 0.039 0.969

---

Signif. codes: 0 �***� 0.001 �**� 0.01 �*� 0.05 �.� 0.1 � � 1 Each row in this table refers to one of the coefficients in the regression model. The first row is the intercept term, and the later ones look at each of the predictors. The columns give you all of the relevant information. The first column is the actual estimate of \(b\) (e.g., 125.96 for the intercept, and -8.9 for the dan.sleep predictor). The second column is the standard error estimate \(\hat\sigma_b\). The third column gives you the \(t\)-statistic, and it’s worth noticing that in this table \(t= \hat{b}/\mbox{SE}({\hat{b}})\) every time. Finally, the fourth column gives you the actual \(p\) value for each of these tests.217 The only thing that the table itself doesn’t list is the degrees of freedom used in the \(t\)-test, which is always \(N-K-1\) and is listed immediately below, in this line:

Residual standard error: 4.354 on 97 degrees of freedomThe value of \(df = 97\) is equal to \(N-K-1\), so that’s what we use for our \(t\)-tests. In the final part of the output we have the \(F\)-test and the \(R^2\) values which assess the performance of the model as a whole

Residual standard error: 4.354 on 97 degrees of freedom

Multiple R-squared: 0.8161, Adjusted R-squared: 0.8123

F-statistic: 215.2 on 2 and 97 DF, p-value: < 2.2e-16 So in this case, the model performs significantly better than you’d expect by chance (\(F(2,97) = 215.2\), \(p<.001\)), which isn’t all that surprising: the \(R^2 = .812\) value indicate that the regression model accounts for 81.2% of the variability in the outcome measure. However, when we look back up at the \(t\)-tests for each of the individual coefficients, we have pretty strong evidence that the baby.sleep variable has no significant effect; all the work is being done by the dan.sleep variable. Taken together, these results suggest that regression.2 is actually the wrong model for the data: you’d probably be better off dropping the baby.sleep predictor entirely. In other words, the regression.1 model that we started with is the better model.

15.6 Testing the significance of a correlation

15.6.1 Hypothesis tests for a single correlation

I don’t want to spend too much time on this, but it’s worth very briefly returning to the point I made earlier, that Pearson correlations are basically the same thing as linear regressions with only a single predictor added to the model. What this means is that the hypothesis tests that I just described in a regression context can also be applied to correlation coefficients. To see this, let’s take a summary() of the regression.1 model:

summary( regression.1 )##

## Call:

## lm(formula = dan.grump ~ dan.sleep, data = parenthood)

##

## Residuals:

## Min 1Q Median 3Q Max

## -11.025 -2.213 -0.399 2.681 11.750

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 125.9563 3.0161 41.76 <2e-16 ***

## dan.sleep -8.9368 0.4285 -20.85 <2e-16 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 4.332 on 98 degrees of freedom

## Multiple R-squared: 0.8161, Adjusted R-squared: 0.8142

## F-statistic: 434.9 on 1 and 98 DF, p-value: < 2.2e-16The important thing to note here is the \(t\) test associated with the predictor, in which we get a result of \(t(98) = -20.85\), \(p<.001\). Now let’s compare this to the output of a different function, which goes by the name of cor.test(). As you might expect, this function runs a hypothesis test to see if the observed correlation between two variables is significantly different from 0. Let’s have a look:

cor.test( x = parenthood$dan.sleep, y = parenthood$dan.grump )##

## Pearson's product-moment correlation

##

## data: parenthood$dan.sleep and parenthood$dan.grump

## t = -20.854, df = 98, p-value < 2.2e-16

## alternative hypothesis: true correlation is not equal to 0

## 95 percent confidence interval:

## -0.9340614 -0.8594714

## sample estimates:

## cor

## -0.903384Again, the key thing to note is the line that reports the hypothesis test itself, which seems to be saying that \(t(98) = -20.85\), \(p<.001\). Hm. Looks like it’s exactly the same test, doesn’t it? And that’s exactly what it is. The test for the significance of a correlation is identical to the \(t\) test that we run on a coefficient in a regression model.

15.6.2 Hypothesis tests for all pairwise correlations

Okay, one more digression before I return to regression properly. In the previous section I talked about the cor.test() function, which lets you run a hypothesis test on a single correlation. The cor.test() function is (obviously) an extension of the cor() function, which we talked about in Section 5.7. However, the cor() function isn’t restricted to computing a single correlation: you can use it to compute all pairwise correlations among the variables in your data set. This leads people to the natural question: can the cor.test() function do the same thing? Can we use cor.test() to run hypothesis tests for all possible parwise correlations among the variables in a data frame?

The answer is no, and there’s a very good reason for this. Testing a single correlation is fine: if you’ve got some reason to be asking “is A related to B?”, then you should absolutely run a test to see if there’s a significant correlation. But if you’ve got variables A, B, C, D and E and you’re thinking about testing the correlations among all possible pairs of these, a statistician would want to ask: what’s your hypothesis? If you’re in the position of wanting to test all possible pairs of variables, then you’re pretty clearly on a fishing expedition, hunting around in search of significant effects when you don’t actually have a clear research hypothesis in mind. This is dangerous, and the authors of cor.test() obviously felt that they didn’t want to support that kind of behaviour.

On the other hand… a somewhat less hardline view might be to argue we’ve encountered this situation before, back in Section 14.5 when we talked about post hoc tests in ANOVA. When running post hoc tests, we didn’t have any specific comparisons in mind, so what we did was apply a correction (e.g., Bonferroni, Holm, etc) in order to avoid the possibility of an inflated Type I error rate. From this perspective, it’s okay to run hypothesis tests on all your pairwise correlations, but you must treat them as post hoc analyses, and if so you need to apply a correction for multiple comparisons. That’s what the correlate() function in the lsr package does. When we use the correlate() function in Section 5.7 all it did was print out the correlation matrix. But you can get it to output the results of all the pairwise tests as well by specifying test=TRUE. Here’s what happens with the parenthood data:

library(lsr)## Warning: package 'lsr' was built under R version 3.5.2correlate(parenthood, test=TRUE)##

## CORRELATIONS

## ============

## - correlation type: pearson

## - correlations shown only when both variables are numeric

##

## dan.sleep baby.sleep dan.grump day

## dan.sleep . 0.628*** -0.903*** -0.098

## baby.sleep 0.628*** . -0.566*** -0.010

## dan.grump -0.903*** -0.566*** . 0.076

## day -0.098 -0.010 0.076 .

##

## ---

## Signif. codes: . = p < .1, * = p<.05, ** = p<.01, *** = p<.001

##

##

## p-VALUES

## ========

## - total number of tests run: 6

## - correction for multiple testing: holm

##

## dan.sleep baby.sleep dan.grump day

## dan.sleep . 0.000 0.000 0.990

## baby.sleep 0.000 . 0.000 0.990

## dan.grump 0.000 0.000 . 0.990

## day 0.990 0.990 0.990 .

##

##

## SAMPLE SIZES

## ============

##

## dan.sleep baby.sleep dan.grump day

## dan.sleep 100 100 100 100

## baby.sleep 100 100 100 100

## dan.grump 100 100 100 100

## day 100 100 100 100The output here contains three matrices. First it prints out the correlation matrix. Second it prints out a matrix of \(p\)-values, using the Holm method218 to correct for multiple comparisons. Finally, it prints out a matrix indicating the sample size (number of pairwise complete cases) that contributed to each correlation.

So there you have it. If you really desperately want to do pairwise hypothesis tests on your correlations, the correlate() function will let you do it. But please, please be careful. I can’t count the number of times I’ve had a student panicking in my office because they’ve run these pairwise correlation tests, and they get one or two significant results that don’t make any sense. For some reason, the moment people see those little significance stars appear, they feel compelled to throw away all common sense and assume that the results must correspond to something real that requires an explanation. In most such cases, my experience has been that the right answer is “it’s a Type I error”.

15.7 Regarding regression coefficients

Before moving on to discuss the assumptions underlying linear regression and what you can do to check if they’re being met, there’s two more topics I want to briefly discuss, both of which relate to the regression coefficients. The first thing to talk about is calculating confidence intervals for the coefficients; after that, I’ll discuss the somewhat murky question of how to determine which of predictor is most important.

15.7.1 Confidence intervals for the coefficients

Like any population parameter, the regression coefficients \(b\) cannot be estimated with complete precision from a sample of data; that’s part of why we need hypothesis tests. Given this, it’s quite useful to be able to report confidence intervals that capture our uncertainty about the true value of \(b\). This is especially useful when the research question focuses heavily on an attempt to find out how strongly variable \(X\) is related to variable \(Y\), since in those situations the interest is primarily in the regression weight \(b\). Fortunately, confidence intervals for the regression weights can be constructed in the usual fashion, \[

\mbox{CI}(b) = \hat{b} \pm \left( t_{crit} \times \mbox{SE}({\hat{b})} \right)

\] where \(\mbox{SE}({\hat{b}})\) is the standard error of the regression coefficient, and \(t_{crit}\) is the relevant critical value of the appropriate \(t\) distribution. For instance, if it’s a 95% confidence interval that we want, then the critical value is the 97.5th quantile of a \(t\) distribution with \(N-K-1\) degrees of freedom. In other words, this is basically the same approach to calculating confidence intervals that we’ve used throughout. To do this in R we can use the confint() function. There arguments to this function are

object. The regression model (lmobject) for which confidence intervals are required.parm. A vector indicating which coefficients we should calculate intervals for. This can be either a vector of numbers or (more usefully) a character vector containing variable names. By default, all coefficients are included, so usually you don’t bother specifying this argument.level. A number indicating the confidence level that should be used. As is usually the case, the default value is 0.95, so you wouldn’t usually need to specify this argument.

So, suppose I want 99% confidence intervals for the coefficients in the regression.2 model. I could do this using the following command:

confint( object = regression.2,

level = .99)## 0.5 % 99.5 %

## (Intercept) 117.9755724 133.9555593

## dan.sleep -10.4044419 -7.4960575

## baby.sleep -0.7016868 0.7227357Simple enough.

15.7.2 Calculating standardised regression coefficients

One more thing that you might want to do is to calculate “standardised” regression coefficients, often denoted \(\beta\). The rationale behind standardised coefficients goes like this. In a lot of situations, your variables are on fundamentally different scales. Suppose, for example, my regression model aims to predict people’s IQ scores, using their educational attainment (number of years of education) and their income as predictors. Obviously, educational attainment and income are not on the same scales: the number of years of schooling can only vary by 10s of years, whereas income would vary by 10,000s of dollars (or more). The units of measurement have a big influence on the regression coefficients: the \(b\) coefficients only make sense when interpreted in light of the units, both of the predictor variables and the outcome variable. This makes it very difficult to compare the coefficients of different predictors. Yet there are situations where you really do want to make comparisons between different coefficients. Specifically, you might want some kind of standard measure of which predictors have the strongest relationship to the outcome. This is what standardised coefficients aim to do.

The basic idea is quite simple: the standardised coefficients are the coefficients that you would have obtained if you’d converted all the variables to \(z\)-scores before running the regression.219 The idea here is that, by converting all the predictors to \(z\)-scores, they all go into the regression on the same scale, thereby removing the problem of having variables on different scales. Regardless of what the original variables were, a \(\beta\) value of 1 means that an increase in the predictor of 1 standard deviation will produce a corresponding 1 standard deviation increase in the outcome variable. Therefore, if variable A has a larger absolute value of \(\beta\) than variable B, it is deemed to have a stronger relationship with the outcome. Or at least that’s the idea: it’s worth being a little cautious here, since this does rely very heavily on the assumption that “a 1 standard deviation change” is fundamentally the same kind of thing for all variables. It’s not always obvious that this is true.

Leaving aside the interpretation issues, let’s look at how it’s calculated. What you could do is standardise all the variables yourself and then run a regression, but there’s a much simpler way to do it. As it turns out, the \(\beta\) coefficient for a predictor \(X\) and outcome \(Y\) has a very simple formula, namely \[

\beta_X = b_X \times \frac{\sigma_X}{\sigma_Y}

\] where \(\sigma_X\) is the standard deviation of the predictor, and \(\sigma_Y\) is the standard deviation of the outcome variable \(Y\). This makes matters a lot simpler. To make things even simpler, the lsr package includes a function standardCoefs() that computes the \(\beta\) coefficients.

standardCoefs( regression.2 )## b beta

## dan.sleep -8.95024973 -0.90474809

## baby.sleep 0.01052447 0.00217223This clearly shows that the dan.sleep variable has a much stronger effect than the baby.sleep variable. However, this is a perfect example of a situation where it would probably make sense to use the original coefficients \(b\) rather than the standardised coefficients \(\beta\). After all, my sleep and the baby’s sleep are already on the same scale: number of hours slept. Why complicate matters by converting these to \(z\)-scores?

15.8 Assumptions of regression

The linear regression model that I’ve been discussing relies on several assumptions. In Section 15.9 we’ll talk a lot more about how to check that these assumptions are being met, but first, let’s have a look at each of them.

- Normality. Like half the models in statistics, standard linear regression relies on an assumption of normality. Specifically, it assumes that the residuals are normally distributed. It’s actually okay if the predictors \(X\) and the outcome \(Y\) are non-normal, so long as the residuals \(\epsilon\) are normal. See Section 15.9.3.

- Linearity. A pretty fundamental assumption of the linear regression model is that relationship between \(X\) and \(Y\) actually be linear! Regardless of whether it’s a simple regression or a multiple regression, we assume that the relatiships involved are linear. See Section 15.9.4.

- Homogeneity of variance. Strictly speaking, the regression model assumes that each residual \(\epsilon_i\) is generated from a normal distribution with mean 0, and (more importantly for the current purposes) with a standard deviation \(\sigma\) that is the same for every single residual. In practice, it’s impossible to test the assumption that every residual is identically distributed. Instead, what we care about is that the standard deviation of the residual is the same for all values of \(\hat{Y}\), and (if we’re being especially paranoid) all values of every predictor \(X\) in the model. See Section 15.9.5.

- Uncorrelated predictors. The idea here is that, is a multiple regression model, you don’t want your predictors to be too strongly correlated with each other. This isn’t “technically” an assumption of the regression model, but in practice it’s required. Predictors that are too strongly correlated with each other (referred to as “collinearity”) can cause problems when evaluating the model. See Section 15.9.6

- Residuals are independent of each other. This is really just a “catch all” assumption, to the effect that “there’s nothing else funny going on in the residuals”. If there is something weird (e.g., the residuals all depend heavily on some other unmeasured variable) going on, it might screw things up.

- No “bad” outliers. Again, not actually a technical assumption of the model (or rather, it’s sort of implied by all the others), but there is an implicit assumption that your regression model isn’t being too strongly influenced by one or two anomalous data points; since this raises questions about the adequacy of the model, and the trustworthiness of the data in some cases. See Section 15.9.2.

15.9 Model checking

The main focus of this section is regression diagnostics, a term that refers to the art of checking that the assumptions of your regression model have been met, figuring out how to fix the model if the assumptions are violated, and generally to check that nothing “funny” is going on. I refer to this as the “art” of model checking with good reason: it’s not easy, and while there are a lot of fairly standardised tools that you can use to diagnose and maybe even cure the problems that ail your model (if there are any, that is!), you really do need to exercise a certain amount of judgment when doing this. It’s easy to get lost in all the details of checking this thing or that thing, and it’s quite exhausting to try to remember what all the different things are. This has the very nasty side effect that a lot of people get frustrated when trying to learn all the tools, so instead they decide not to do any model checking. This is a bit of a worry!

In this section, I describe several different things you can do to check that your regression model is doing what it’s supposed to. It doesn’t cover the full space of things you could do, but it’s still much more detailed than what I see a lot of people doing in practice; and I don’t usually cover all of this in my intro stats class myself. However, I do think it’s important that you get a sense of what tools are at your disposal, so I’ll try to introduce a bunch of them here. Finally, I should note that this section draws quite heavily from the Fox and Weisberg (2011) text, the book associated with the car package. The car package is notable for providing some excellent tools for regression diagnostics, and the book itself talks about them in an admirably clear fashion. I don’t want to sound too gushy about it, but I do think that Fox and Weisberg (2011) is well worth reading.

15.9.1 Three kinds of residuals

The majority of regression diagnostics revolve around looking at the residuals, and by now you’ve probably formed a sufficiently pessimistic theory of statistics to be able to guess that – precisely because of the fact that we care a lot about the residuals – there are several different kinds of residual that we might consider. In particular, the following three kinds of residual are referred to in this section: “ordinary residuals”, “standardised residuals”, and “Studentised residuals”. There is a fourth kind that you’ll see referred to in some of the Figures, and that’s the “Pearson residual”: however, for the models that we’re talking about in this chapter, the Pearson residual is identical to the ordinary residual.

The first and simplest kind of residuals that we care about are ordinary residuals. These are the actual, raw residuals that I’ve been talking about throughout this chapter. The ordinary residual is just the difference between the fitted value \(\hat{Y}_i\) and the observed value \(Y_i\). I’ve been using the notation \(\epsilon_i\) to refer to the \(i\)-th ordinary residual, and by gum I’m going to stick to it. With this in mind, we have the very simple equation \[ \epsilon_i = Y_i - \hat{Y}_i \] This is of course what we saw earlier, and unless I specifically refer to some other kind of residual, this is the one I’m talking about. So there’s nothing new here: I just wanted to repeat myself. In any case, you can get R to output a vector of ordinary residuals, you can use a command like this:

residuals( object = regression.2 )## 1 2 3 4 5 6

## -2.1403095 4.7081942 1.9553640 -2.0602806 0.7194888 -0.4066133

## 7 8 9 10 11 12

## 0.2269987 -1.7003077 0.2025039 3.8524589 3.9986291 -4.9120150

## 13 14 15 16 17 18

## 1.2060134 0.4946578 -2.6579276 -0.3966805 3.3538613 1.7261225

## 19 20 21 22 23 24

## -0.4922551 -5.6405941 -0.4660764 2.7238389 9.3653697 0.2841513

## 25 26 27 28 29 30

## -0.5037668 -1.4941146 8.1328623 1.9787316 -1.5126726 3.5171148

## 31 32 33 34 35 36

## -8.9256951 -2.8282946 6.1030349 -7.5460717 4.5572128 -10.6510836

## 37 38 39 40 41 42

## -5.6931846 6.3096506 -2.1082466 -0.5044253 0.1875576 4.8094841

## 43 44 45 46 47 48

## -5.4135163 -6.2292842 -4.5725232 -5.3354601 3.9950111 2.1718745

## 49 50 51 52 53 54

## -3.4766440 0.4834367 6.2839790 2.0109396 -1.5846631 -2.2166613

## 55 56 57 58 59 60

## 2.2033140 1.9328736 -1.8301204 -1.5401430 2.5298509 -3.3705782

## 61 62 63 64 65 66

## -2.9380806 0.6590736 -0.5917559 -8.6131971 5.9781035 5.9332979

## 67 68 69 70 71 72

## -1.2341956 3.0047669 -1.0802468 6.5174672 -3.0155469 2.1176720

## 73 74 75 76 77 78

## 0.6058757 -2.7237421 -2.2291472 -1.4053822 4.7461491 11.7495569

## 79 80 81 82 83 84

## 4.7634141 2.6620908 -11.0345292 -0.7588667 1.4558227 -0.4745727

## 85 86 87 88 89 90

## 8.9091201 -1.1409777 0.7555223 -0.4107130 0.8797237 -1.4095586

## 91 92 93 94 95 96

## 3.1571385 -3.4205757 -5.7228699 -2.2033958 -3.8647891 0.4982711

## 97 98 99 100

## -5.5249495 4.1134221 -8.2038533 5.6800859One drawback to using ordinary residuals is that they’re always on a different scale, depending on what the outcome variable is and how good the regression model is. That is, Unless you’ve decided to run a regression model without an intercept term, the ordinary residuals will have mean 0; but the variance is different for every regression. In a lot of contexts, especially where you’re only interested in the pattern of the residuals and not their actual values, it’s convenient to estimate the standardised residuals, which are normalised in such a way as to have standard deviation 1. The way we calculate these is to divide the ordinary residual by an estimate of the (population) standard deviation of these residuals. For technical reasons, mumble mumble, the formula for this is: \[ \epsilon_{i}^\prime = \frac{\epsilon_i}{\hat{\sigma} \sqrt{1-h_i}} \] where \(\hat\sigma\) in this context is the estimated population standard deviation of the ordinary residuals, and \(h_i\) is the “hat value” of the \(i\)th observation. I haven’t explained hat values to you yet (but have no fear,220 it’s coming shortly), so this won’t make a lot of sense. For now, it’s enough to interpret the standardised residuals as if we’d converted the ordinary residuals to \(z\)-scores. In fact, that is more or less the truth, it’s just that we’re being a bit fancier. To get the standardised residuals, the command you want is this:

rstandard( model = regression.2 )## 1 2 3 4 5 6

## -0.49675845 1.10430571 0.46361264 -0.47725357 0.16756281 -0.09488969

## 7 8 9 10 11 12

## 0.05286626 -0.39260381 0.04739691 0.89033990 0.95851248 -1.13898701

## 13 14 15 16 17 18

## 0.28047841 0.11519184 -0.61657092 -0.09191865 0.77692937 0.40403495

## 19 20 21 22 23 24

## -0.11552373 -1.31540412 -0.10819238 0.62951824 2.17129803 0.06586227

## 25 26 27 28 29 30

## -0.11980449 -0.34704024 1.91121833 0.45686516 -0.34986350 0.81233165

## 31 32 33 34 35 36

## -2.08659993 -0.66317843 1.42930082 -1.77763064 1.07452436 -2.47385780

## 37 38 39 40 41 42

## -1.32715114 1.49419658 -0.49115639 -0.11674947 0.04401233 1.11881912

## 43 44 45 46 47 48

## -1.27081641 -1.46422595 -1.06943700 -1.24659673 0.94152881 0.51069809

## 49 50 51 52 53 54

## -0.81373349 0.11412178 1.47938594 0.46437962 -0.37157009 -0.51609949

## 55 56 57 58 59 60

## 0.51800753 0.44813204 -0.42662358 -0.35575611 0.58403297 -0.78022677

## 61 62 63 64 65 66

## -0.67833325 0.15484699 -0.13760574 -2.05662232 1.40238029 1.37505125

## 67 68 69 70 71 72

## -0.28964989 0.69497632 -0.24945316 1.50709623 -0.69864682 0.49071427

## 73 74 75 76 77 78

## 0.14267297 -0.63246560 -0.51972828 -0.32509811 1.10842574 2.72171671

## 79 80 81 82 83 84

## 1.09975101 0.62057080 -2.55172097 -0.17584803 0.34340064 -0.11158952

## 85 86 87 88 89 90

## 2.10863391 -0.26386516 0.17624445 -0.09504416 0.20450884 -0.32730740

## 91 92 93 94 95 96

## 0.73475640 -0.79400855 -1.32768248 -0.51940736 -0.91512580 0.11661226

## 97 98 99 100

## -1.28069115 0.96332849 -1.90290258 1.31368144Note that this function uses a different name for the input argument, but it’s still just a linear regression object that the function wants to take as its input here.

The third kind of residuals are Studentised residuals (also called “jackknifed residuals”) and they’re even fancier than standardised residuals. Again, the idea is to take the ordinary residual and divide it by some quantity in order to estimate some standardised notion of the residual, but the formula for doing the calculations this time is subtly different: \[ \epsilon_{i}^* = \frac{\epsilon_i}{\hat{\sigma}_{(-i)} \sqrt{1-h_i}} \] Notice that our estimate of the standard deviation here is written \(\hat{\sigma}_{(-i)}\). What this corresponds to is the estimate of the residual standard deviation that you would have obtained, if you just deleted the \(i\)th observation from the data set. This sounds like the sort of thing that would be a nightmare to calculate, since it seems to be saying that you have to run \(N\) new regression models (even a modern computer might grumble a bit at that, especially if you’ve got a large data set). Fortunately, some terribly clever person has shown that this standard deviation estimate is actually given by the following equation: \[ \hat\sigma_{(-i)} = \hat{\sigma} \ \sqrt{\frac{N-K-1 - {\epsilon_{i}^\prime}^2}{N-K-2}} \] Isn’t that a pip? Anyway, the command that you would use if you wanted to pull out the Studentised residuals for our regression model is

rstudent( model = regression.2 )## 1 2 3 4 5 6

## -0.49482102 1.10557030 0.46172854 -0.47534555 0.16672097 -0.09440368

## 7 8 9 10 11 12

## 0.05259381 -0.39088553 0.04715251 0.88938019 0.95810710 -1.14075472

## 13 14 15 16 17 18

## 0.27914212 0.11460437 -0.61459001 -0.09144760 0.77533036 0.40228555

## 19 20 21 22 23 24

## -0.11493461 -1.32043609 -0.10763974 0.62754813 2.21456485 0.06552336

## 25 26 27 28 29 30

## -0.11919416 -0.34546127 1.93818473 0.45499388 -0.34827522 0.81089646

## 31 32 33 34 35 36

## -2.12403286 -0.66125192 1.43712830 -1.79797263 1.07539064 -2.54258876

## 37 38 39 40 41 42

## -1.33244515 1.50388257 -0.48922682 -0.11615428 0.04378531 1.12028904

## 43 44 45 46 47 48

## -1.27490649 -1.47302872 -1.07023828 -1.25020935 0.94097261 0.50874322

## 49 50 51 52 53 54

## -0.81230544 0.11353962 1.48863006 0.46249410 -0.36991317 -0.51413868

## 55 56 57 58 59 60

## 0.51604474 0.44627831 -0.42481754 -0.35414868 0.58203894 -0.77864171

## 61 62 63 64 65 66

## -0.67643392 0.15406579 -0.13690795 -2.09211556 1.40949469 1.38147541

## 67 68 69 70 71 72

## -0.28827768 0.69311245 -0.24824363 1.51717578 -0.69679156 0.48878534

## 73 74 75 76 77 78

## 0.14195054 -0.63049841 -0.51776374 -0.32359434 1.10974786 2.81736616

## 79 80 81 82 83 84

## 1.10095270 0.61859288 -2.62827967 -0.17496714 0.34183379 -0.11101996

## 85 86 87 88 89 90

## 2.14753375 -0.26259576 0.17536170 -0.09455738 0.20349582 -0.32579584

## 91 92 93 94 95 96

## 0.73300184 -0.79248469 -1.33298848 -0.51744314 -0.91435205 0.11601774

## 97 98 99 100

## -1.28498273 0.96296745 -1.92942389 1.31867548Before moving on, I should point out that you don’t often need to manually extract these residuals yourself, even though they are at the heart of almost all regression diagnostics. That is, the residuals(), rstandard() and rstudent() functions are all useful to know about, but most of the time the various functions that run the diagnostics will take care of these calculations for you. Even so, it’s always nice to know how to actually get hold of these things yourself in case you ever need to do something non-standard.

15.9.2 Three kinds of anomalous data

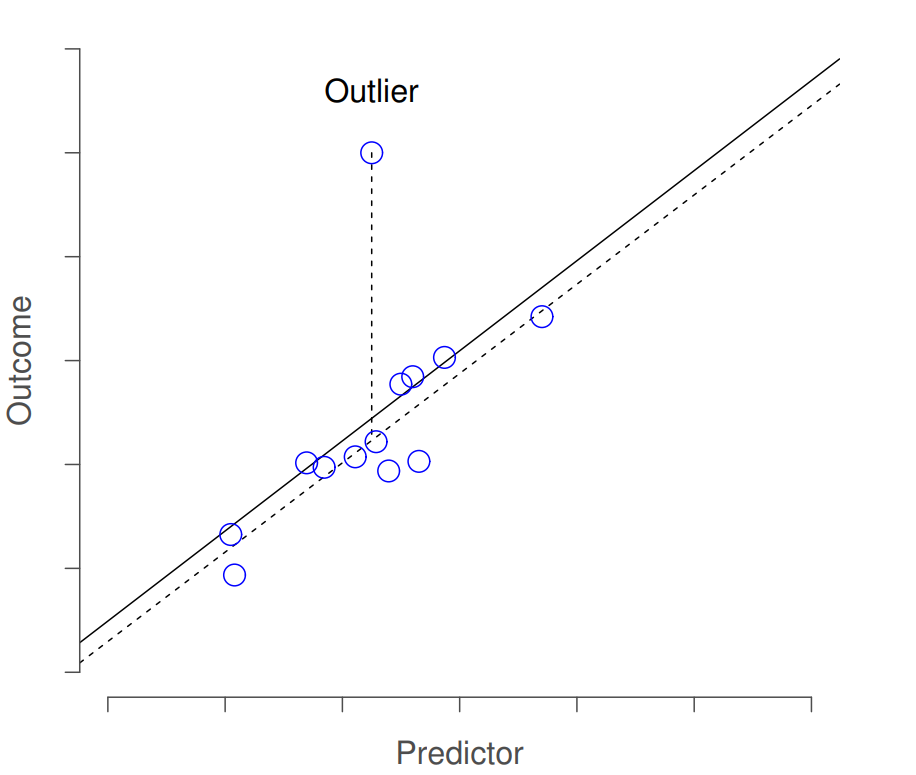

One danger that you can run into with linear regression models is that your analysis might be disproportionately sensitive to a smallish number of “unusual” or “anomalous” observations. I discussed this idea previously in Section 6.5.2 in the context of discussing the outliers that get automatically identified by the boxplot() function, but this time we need to be much more precise. In the context of linear regression, there are three conceptually distinct ways in which an observation might be called “anomalous”. All three are interesting, but they have rather different implications for your analysis.

Figure 15.7: An illustration of outliers. The dotted lines plot the regression line that would have been estimated without the anomalous observation included, and the corresponding residual (i.e., the Studentised residual). The solid line shows the regression line with the anomalous observation included. The outlier has an unusual value on the outcome (y axis location) but not the predictor (x axis location), and lies a long way from the regression line.

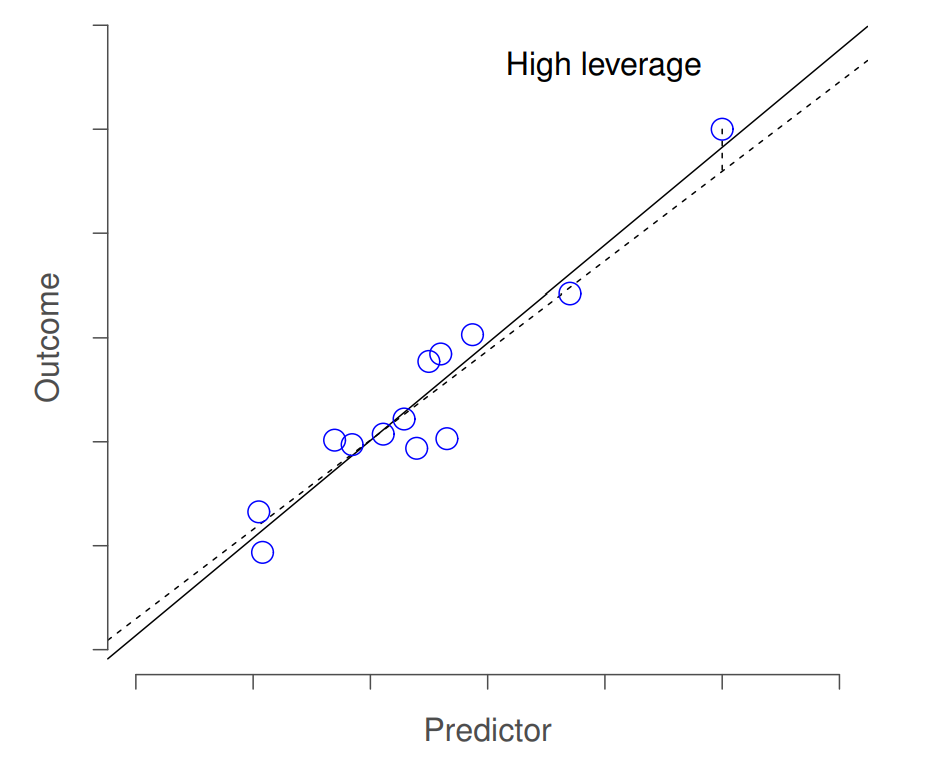

The second way in which an observation can be unusual is if it has high leverage: this happens when the observation is very different from all the other observations. This doesn’t necessarily have to correspond to a large residual: if the observation happens to be unusual on all variables in precisely the same way, it can actually lie very close to the regression line. An example of this is shown in Figure 15.8. The leverage of an observation is operationalised in terms of its hat value, usually written \(h_i\). The formula for the hat value is rather complicated221 but its interpretation is not: \(h_i\) is a measure of the extent to which the \(i\)-th observation is “in control” of where the regression line ends up going. You can extract the hat values using the following command:

hatvalues( model = regression.2 )## 1 2 3 4 5 6

## 0.02067452 0.04105320 0.06155445 0.01685226 0.02734865 0.03129943

## 7 8 9 10 11 12

## 0.02735579 0.01051224 0.03698976 0.01229155 0.08189763 0.01882551

## 13 14 15 16 17 18

## 0.02462902 0.02718388 0.01964210 0.01748592 0.01691392 0.03712530

## 19 20 21 22 23 24

## 0.04213891 0.02994643 0.02099435 0.01233280 0.01853370 0.01804801

## 25 26 27 28 29 30

## 0.06722392 0.02214927 0.04472007 0.01039447 0.01381812 0.01105817

## 31 32 33 34 35 36

## 0.03468260 0.04048248 0.03814670 0.04934440 0.05107803 0.02208177

## 37 38 39 40 41 42

## 0.02919013 0.05928178 0.02799695 0.01519967 0.04195751 0.02514137

## 43 44 45 46 47 48

## 0.04267879 0.04517340 0.03558080 0.03360160 0.05019778 0.04587468

## 49 50 51 52 53 54

## 0.03701290 0.05331282 0.04814477 0.01072699 0.04047386 0.02681315

## 55 56 57 58 59 60

## 0.04556787 0.01856997 0.02919045 0.01126069 0.01012683 0.01546412

## 61 62 63 64 65 66

## 0.01029534 0.04428870 0.02438944 0.07469673 0.04135090 0.01775697

## 67 68 69 70 71 72

## 0.04217616 0.01384321 0.01069005 0.01340216 0.01716361 0.01751844

## 73 74 75 76 77 78

## 0.04863314 0.02158623 0.02951418 0.01411915 0.03276064 0.01684599

## 79 80 81 82 83 84

## 0.01028001 0.02920514 0.01348051 0.01752758 0.05184527 0.04583604

## 85 86 87 88 89 90

## 0.05825858 0.01359644 0.03054414 0.01487724 0.02381348 0.02159418

## 91 92 93 94 95 96

## 0.02598661 0.02093288 0.01982480 0.05063492 0.05907629 0.03682026

## 97 98 99 100

## 0.01817919 0.03811718 0.01945603 0.01373394

Figure 15.8: An illustration of high leverage points. The anomalous observation in this case is unusual both in terms of the predictor (x axis) and the outcome (y axis), but this unusualness is highly consistent with the pattern of correlations that exists among the other observations; as a consequence, the observation falls very close to the regression line and does not distort it.

In general, if an observation lies far away from the other ones in terms of the predictor variables, it will have a large hat value (as a rough guide, high leverage is when the hat value is more than 2-3 times the average; and note that the sum of the hat values is constrained to be equal to \(K+1\)). High leverage points are also worth looking at in more detail, but they’re much less likely to be a cause for concern unless they are also outliers. % guide from Venables and Ripley.

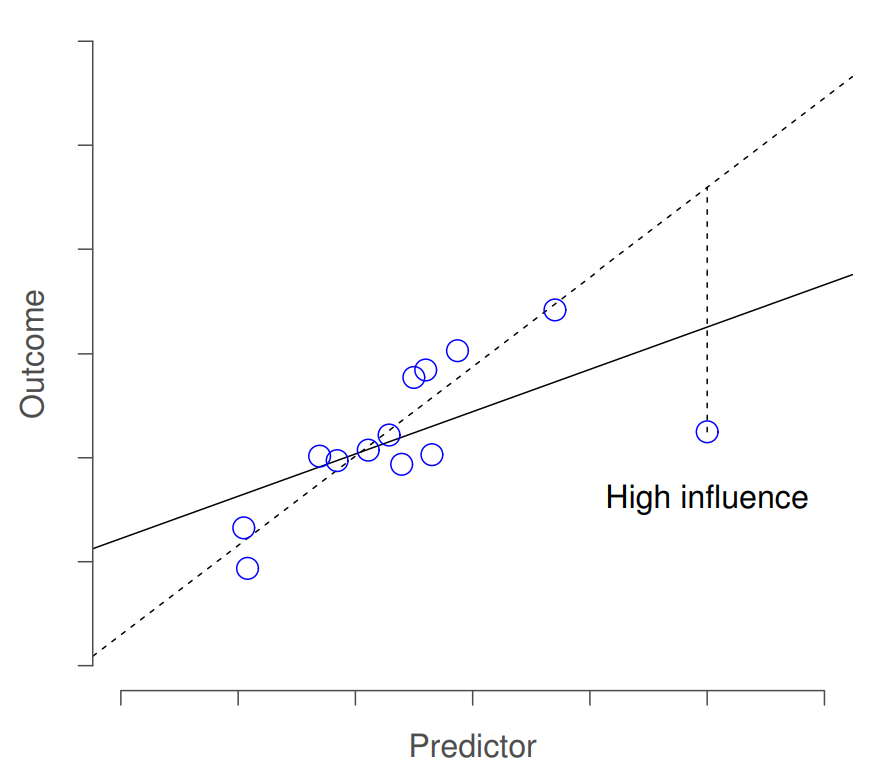

This brings us to our third measure of unusualness, the influence of an observation. A high influence observation is an outlier that has high leverage. That is, it is an observation that is very different to all the other ones in some respect, and also lies a long way from the regression line. This is illustrated in Figure 15.9. Notice the contrast to the previous two figures: outliers don’t move the regression line much, and neither do high leverage points. But something that is an outlier and has high leverage… that has a big effect on the regression line.

Figure 15.9: An illustration of high influence points. In this case, the anomalous observation is highly unusual on the predictor variable (x axis), and falls a long way from the regression line. As a consequence, the regression line is highly distorted, even though (in this case) the anomalous observation is entirely typical in terms of the outcome variable (y axis).

That’s why we call these points high influence; and it’s why they’re the biggest worry. We operationalise influence in terms of a measure known as Cook’s distance, \[ D_i = \frac{{\epsilon_i^*}^2 }{K+1} \times \frac{h_i}{1-h_i} \] Notice that this is a multiplication of something that measures the outlier-ness of the observation (the bit on the left), and something that measures the leverage of the observation (the bit on the right). In other words, in order to have a large Cook’s distance, an observation must be a fairly substantial outlier and have high leverage. In a stunning turn of events, you can obtain these values using the following command:

cooks.distance( model = regression.2 )## 1 2 3 4 5

## 1.736512e-03 1.740243e-02 4.699370e-03 1.301417e-03 2.631557e-04

## 6 7 8 9 10

## 9.697585e-05 2.620181e-05 5.458491e-04 2.876269e-05 3.288277e-03

## 11 12 13 14 15

## 2.731835e-02 8.296919e-03 6.621479e-04 1.235956e-04 2.538915e-03

## 16 17 18 19 20

## 5.012283e-05 3.461742e-03 2.098055e-03 1.957050e-04 1.780519e-02

## 21 22 23 24 25

## 8.367377e-05 1.649478e-03 2.967594e-02 2.657610e-05 3.448032e-04

## 26 27 28 29 30

## 9.093379e-04 5.699951e-02 7.307943e-04 5.716998e-04 2.459564e-03

## 31 32 33 34 35

## 5.214331e-02 6.185200e-03 2.700686e-02 5.467345e-02 2.071643e-02

## 36 37 38 39 40

## 4.606378e-02 1.765312e-02 4.689817e-02 2.316122e-03 7.012530e-05

## 41 42 43 44 45

## 2.827824e-05 1.076083e-02 2.399931e-02 3.381062e-02 1.406498e-02

## 46 47 48 49 50

## 1.801086e-02 1.561699e-02 4.179986e-03 8.483514e-03 2.444787e-04

## 51 52 53 54 55

## 3.689946e-02 7.794472e-04 1.941235e-03 2.446230e-03 4.270361e-03

## 56 57 58 59 60

## 1.266609e-03 1.824212e-03 4.804705e-04 1.163181e-03 3.187235e-03

## 61 62 63 64 65

## 1.595512e-03 3.703826e-04 1.577892e-04 1.138165e-01 2.827715e-02

## 66 67 68 69 70

## 1.139374e-02 1.231422e-03 2.260006e-03 2.241322e-04 1.028479e-02

## 71 72 73 74 75

## 2.841329e-03 1.431223e-03 3.468538e-04 2.941757e-03 2.738249e-03

## 76 77 78 79 80

## 5.045357e-04 1.387108e-02 4.230966e-02 4.187440e-03 3.861831e-03

## 81 82 83 84 85

## 2.965826e-02 1.838888e-04 2.149369e-03 1.993929e-04 9.168733e-02

## 86 87 88 89 90

## 3.198994e-04 3.262192e-04 4.547383e-05 3.400893e-04 7.881487e-04

## 91 92 93 94 95

## 4.801204e-03 4.493095e-03 1.188427e-02 4.796360e-03 1.752666e-02

## 96 97 98 99 100

## 1.732793e-04 1.012302e-02 1.225818e-02 2.394964e-02 8.010508e-03As a rough guide, Cook’s distance greater than 1 is often considered large (that’s what I typically use as a quick and dirty rule), though a quick scan of the internet and a few papers suggests that \(4/N\) has also been suggested as a possible rule of thumb.

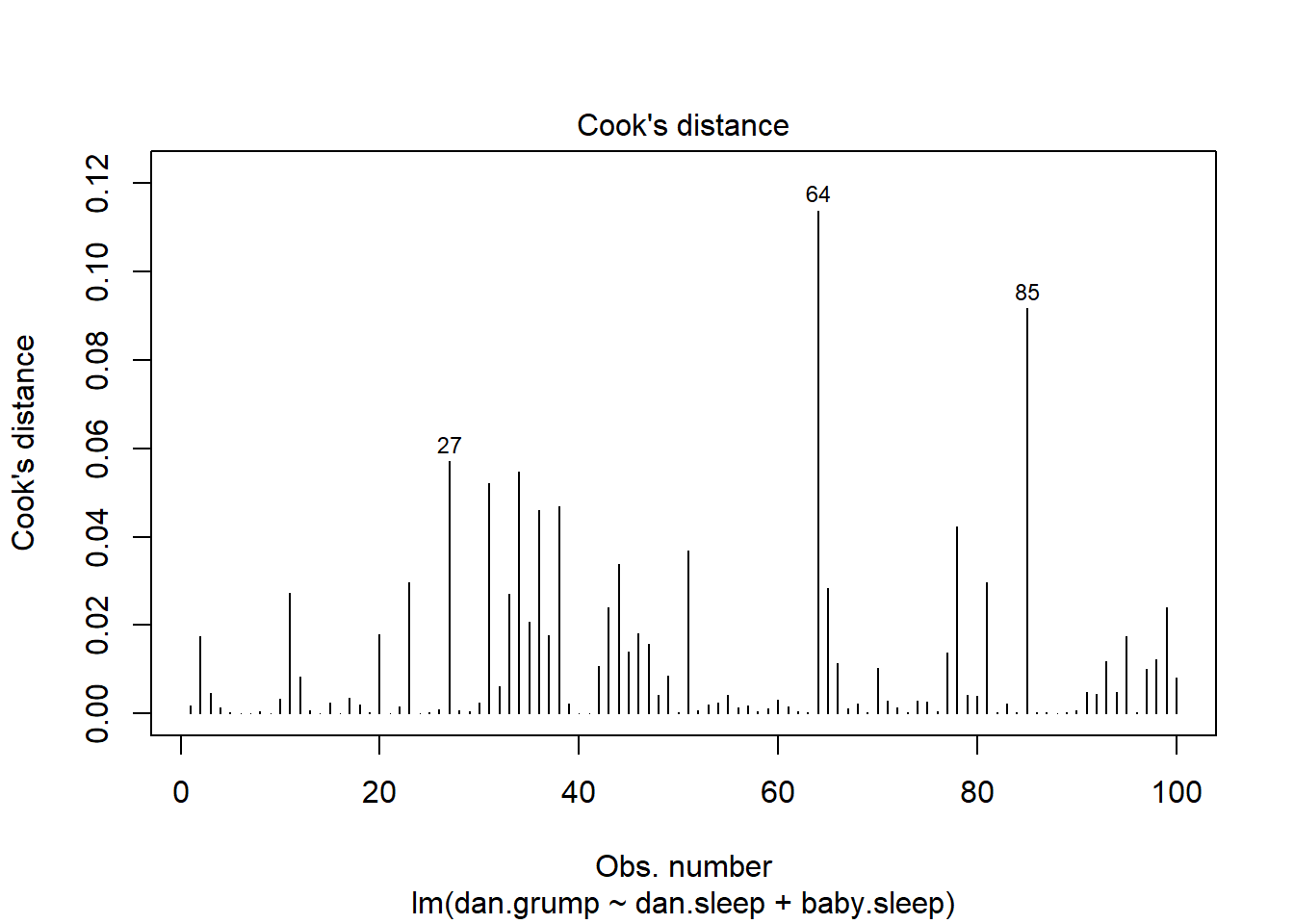

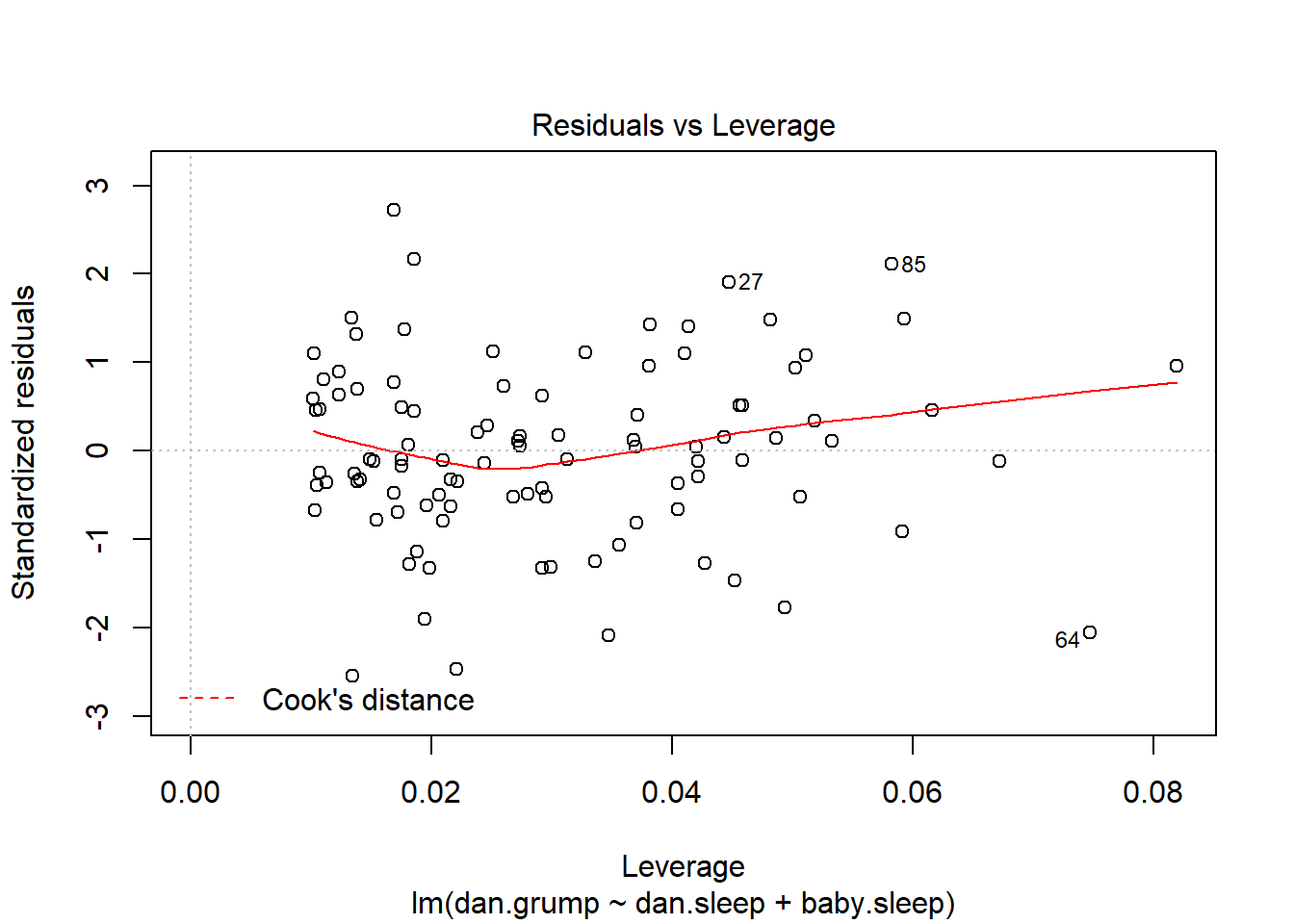

As hinted above, you don’t usually need to make use of these functions, since you can have R automatically draw the critical plots.222 For theregression.2 model, these are the plots showing Cook’s distance (Figure 15.10) and the more detailed breakdown showing the scatter plot of the Studentised residual against leverage (Figure 15.11). To draw these, we can use the plot() function. When the main argument x to this function is a linear model object, it will draw one of six different plots, each of which is quite useful for doing regression diagnostics. You specify which one you want using the which argument (a number between 1 and 6). If you don’t do this then R will draw all six. The two plots of interest to us in this context are generated using the following commands:

Figure 15.10: Cook’s distance for every observation. This is one of the standard regression plots produced by the plot() function when the input is a linear regression object. It is obtained by setting which=4

Figure 15.11: Residuals versus leverage. This is one of the standard regression plots produced by the plot() function when the input is a linear regression object. It is obtained by setting which=5.

An obvious question to ask next is, if you do have large values of Cook’s distance, what should you do? As always, there’s no hard and fast rules. Probably the first thing to do is to try running the regression with that point excluded and see what happens to the model performance and to the regression coefficients. If they really are substantially different, it’s time to start digging into your data set and your notes that you no doubt were scribbling as your ran your study; try to figure out why the point is so different. If you start to become convinced that this one data point is badly distorting your results, you might consider excluding it, but that’s less than ideal unless you have a solid explanation for why this particular case is qualitatively different from the others and therefore deserves to be handled separately.223 To give an example, let’s delete the observation from day 64, the observation with the largest Cook’s distance for the regression.2 model. We can do this using the subset argument:

lm( formula = dan.grump ~ dan.sleep + baby.sleep, # same formula

data = parenthood, # same data frame...

subset = -64 # ...but observation 64 is deleted

)##

## Call:

## lm(formula = dan.grump ~ dan.sleep + baby.sleep, data = parenthood,

## subset = -64)

##

## Coefficients:

## (Intercept) dan.sleep baby.sleep

## 126.3553 -8.8283 -0.1319As you can see, those regression coefficients have barely changed in comparison to the values we got earlier. In other words, we really don’t have any problem as far as anomalous data are concerned.

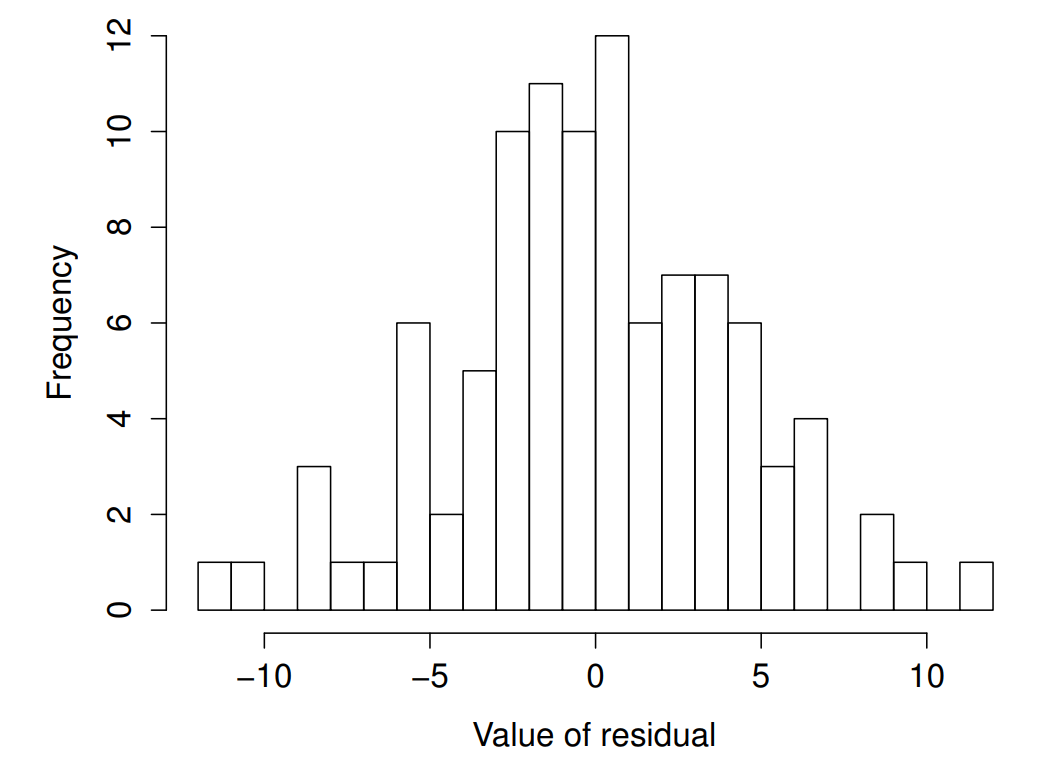

15.9.3 Checking the normality of the residuals

Like many of the statistical tools we’ve discussed in this book, regression models rely on a normality assumption. In this case, we assume that the residuals are normally distributed. The tools for testing this aren’t fundamentally different to those that we discussed earlier in Section 13.9. Firstly, I firmly believe that it never hurts to draw an old fashioned histogram. The command I use might be something like this:

hist( x = residuals( regression.2 ), # data are the residuals

xlab = "Value of residual", # x-axis label

main = "", # no title

breaks = 20 # lots of breaks

)The resulting plot is shown in Figure 15.12, and as you can see the plot looks pretty damn close to normal, almost unnaturally so.

Figure 15.12: A histogram of the (ordinary) residuals in the regression.2 model. These residuals look very close to being normally distributed, much moreso than is typically seen with real data. This shouldn’t surprise you… they aren’t real data, and they aren’t real residuals!

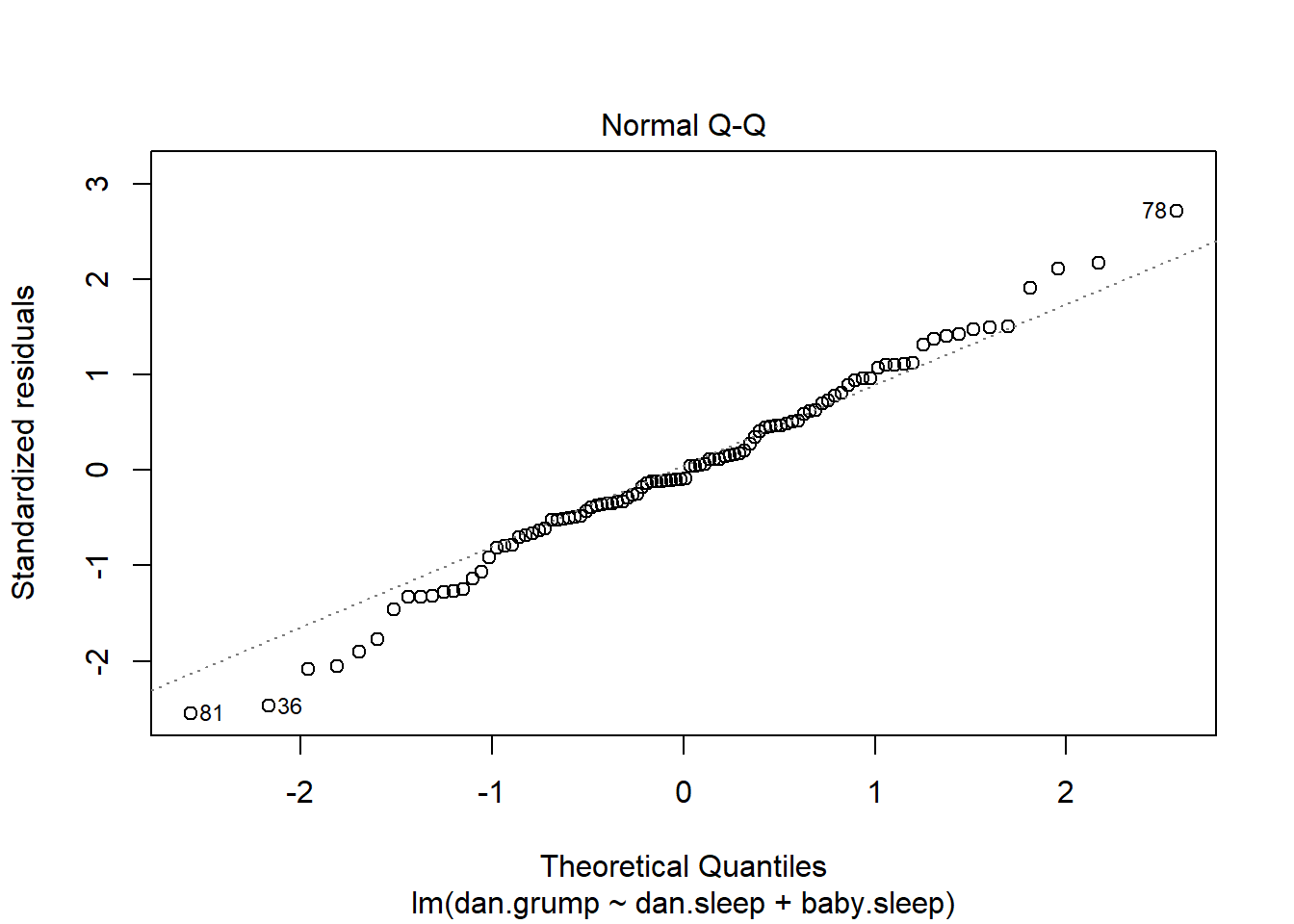

I could also run a Shapiro-Wilk test to check, using the shapiro.test() function; the \(W\) value of .99, at this sample size, is non-significant (\(p=.84\)), again suggesting that the normality assumption isn’t in any danger here. As a third measure, we might also want to draw a QQ-plot using the qqnorm() function. The QQ plot is an excellent one to draw, and so you might not be surprised to discover that it’s one of the regression plots that we can produce using the plot() function:

plot( x = regression.2, which = 2 ) # Figure @ref{fig:regressionplot2}

Figure 15.13: Plot of the theoretical quantiles according to the model, against the quantiles of the standardised residuals. This is one of the standard regression plots produced by the plot() function when the input is a linear regression object. It is obtained by setting which=2.

The output is shown in Figure 15.13, showing the standardised residuals plotted as a function of their theoretical quantiles according to the regression model. The fact that the output appends the model specification to the picture is nice.

15.9.4 Checking the linearity of the relationship

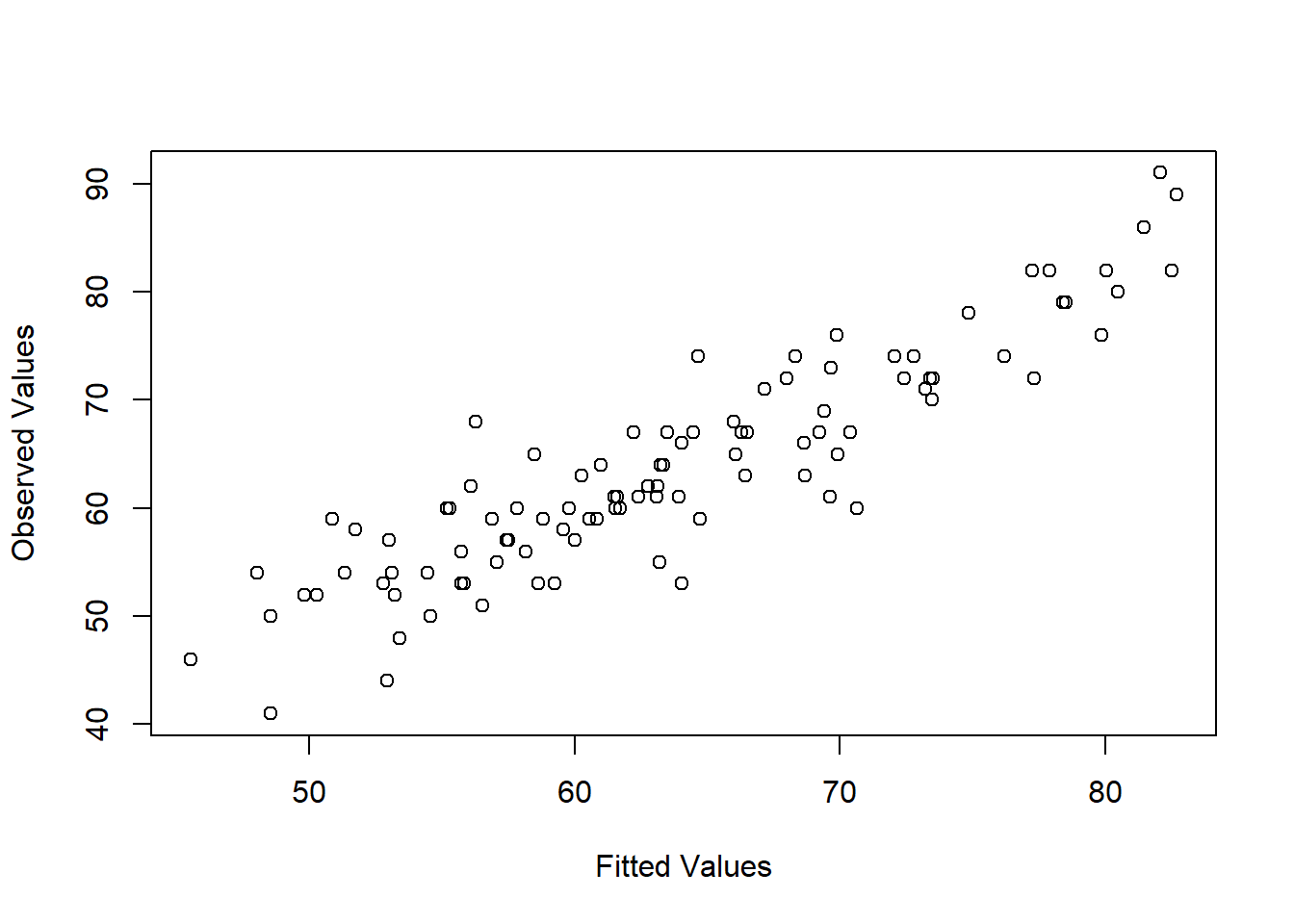

Figure 15.14: Plot of the fitted values against the observed values of the outcome variable. A straight line is what we’re hoping to see here. This looks pretty good, suggesting that there’s nothing grossly wrong, but there could be hidden subtle issues.

The third thing we might want to test is the linearity of the relationships between the predictors and the outcomes. There’s a few different things that you might want to do in order to check this. Firstly, it never hurts to just plot the relationship between the fitted values \(\hat{Y}_i\) and the observed values \(Y_i\) for the outcome variable, as illustrated in Figure 15.14. To draw this we could use the fitted.values() function to extract the \(\hat{Y_i}\) values in much the same way that we used the residuals() function to extract the \(\epsilon_i\) values. So the commands to draw this figure might look like this:

yhat.2 <- fitted.values( object = regression.2 )

plot( x = yhat.2,

y = parenthood$dan.grump,

xlab = "Fitted Values",

ylab = "Observed Values"

)One of the reasons I like to draw these plots is that they give you a kind of “big picture view”. If this plot looks approximately linear, then we’re probably not doing too badly (though that’s not to say that there aren’t problems). However, if you can see big departures from linearity here, then it strongly suggests that you need to make some changes.

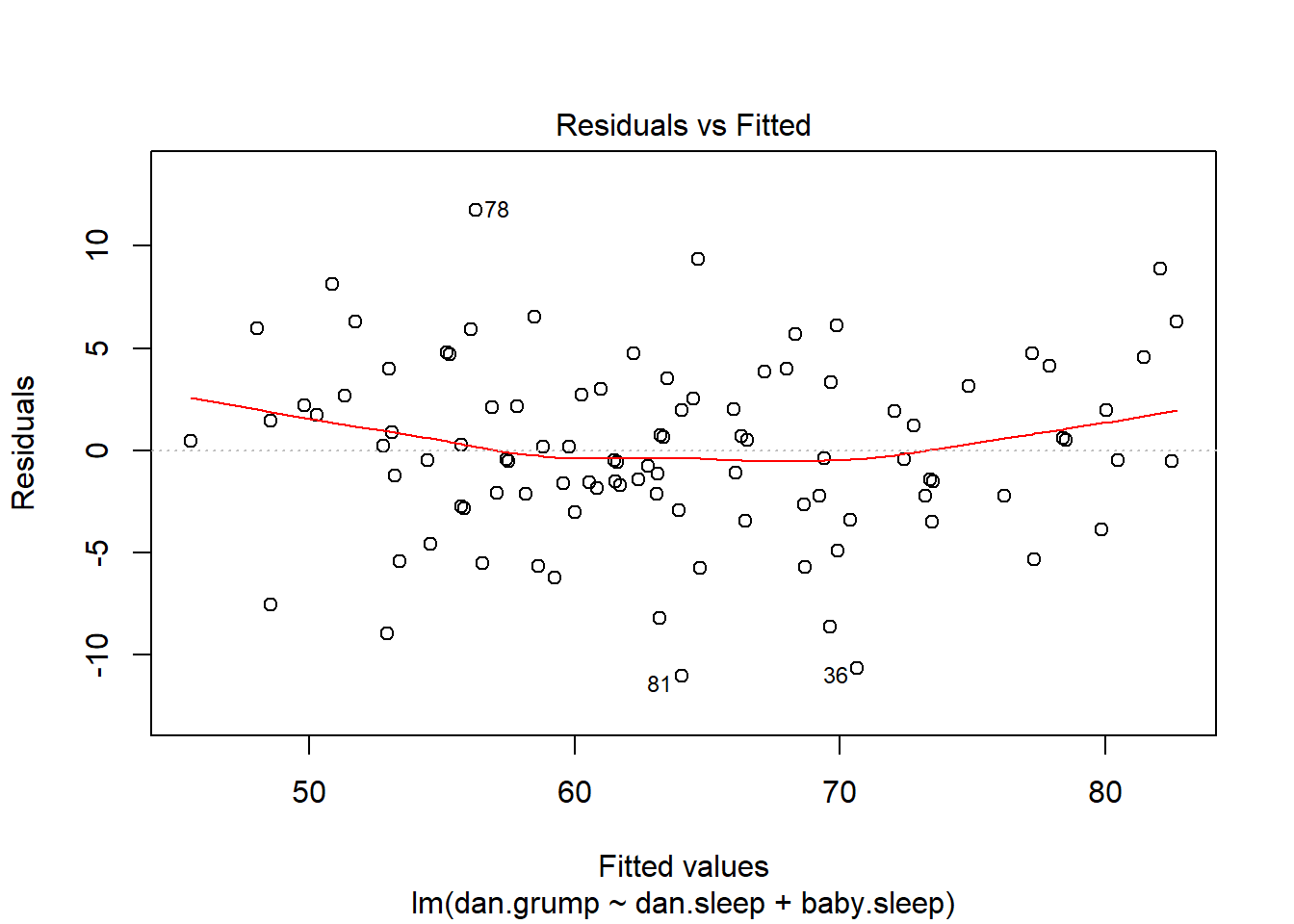

In any case, in order to get a more detailed picture it’s often more informative to look at the relationship between the fitted values and the residuals themselves. Again, we could draw this plot using low level commands, but there’s an easier way. Just plot() the regression model, and select which = 1:

plot(x = regression.2, which = 1)

Figure 15.15: Plot of the fitted values against the residuals for regression.2, with a line showing the relationship between the two. If this is horizontal and straight, then we can feel reasonably confident that the “average residual” for all “fitted values” is more or less the same. This is one of the standard regression plots produced by the plot() function when the input is a linear regression object. It is obtained by setting which=1.

The output is shown in Figure 15.15. As you can see, not only does it draw the scatterplot showing the fitted value against the residuals, it also plots a line through the data that shows the relationship between the two. Ideally, this should be a straight, perfectly horizontal line. There’s some hint of curvature here, but it’s not clear whether or not we be concerned.

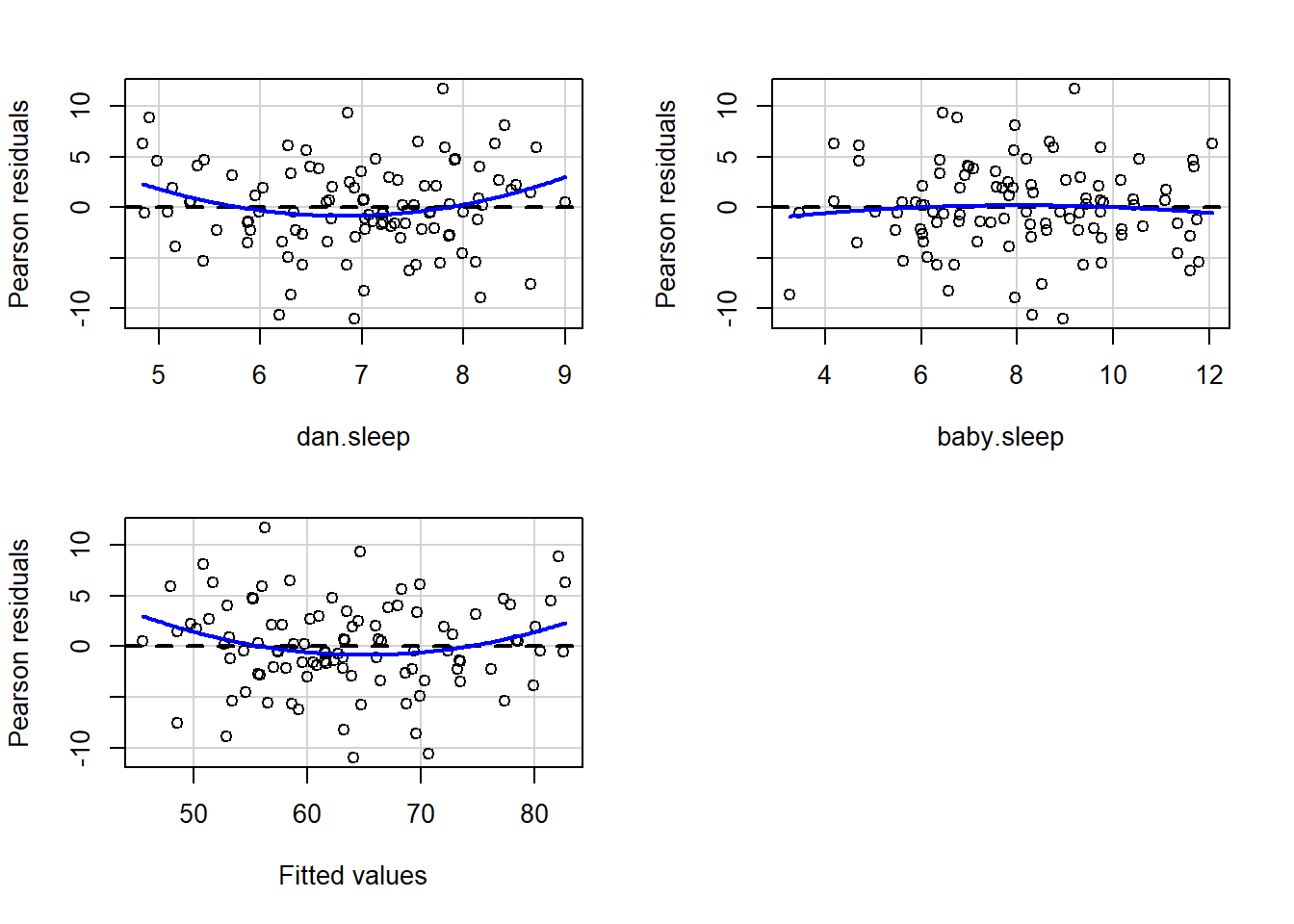

A somewhat more advanced version of the same plot is produced by the residualPlots() function in the car package. This function not only draws plots comparing the fitted values to the residuals, it does so for each individual predictor. The command is and the resulting plots are shown in Figure 15.16.

residualPlots( model = regression.2 ) ## Loading required package: carData

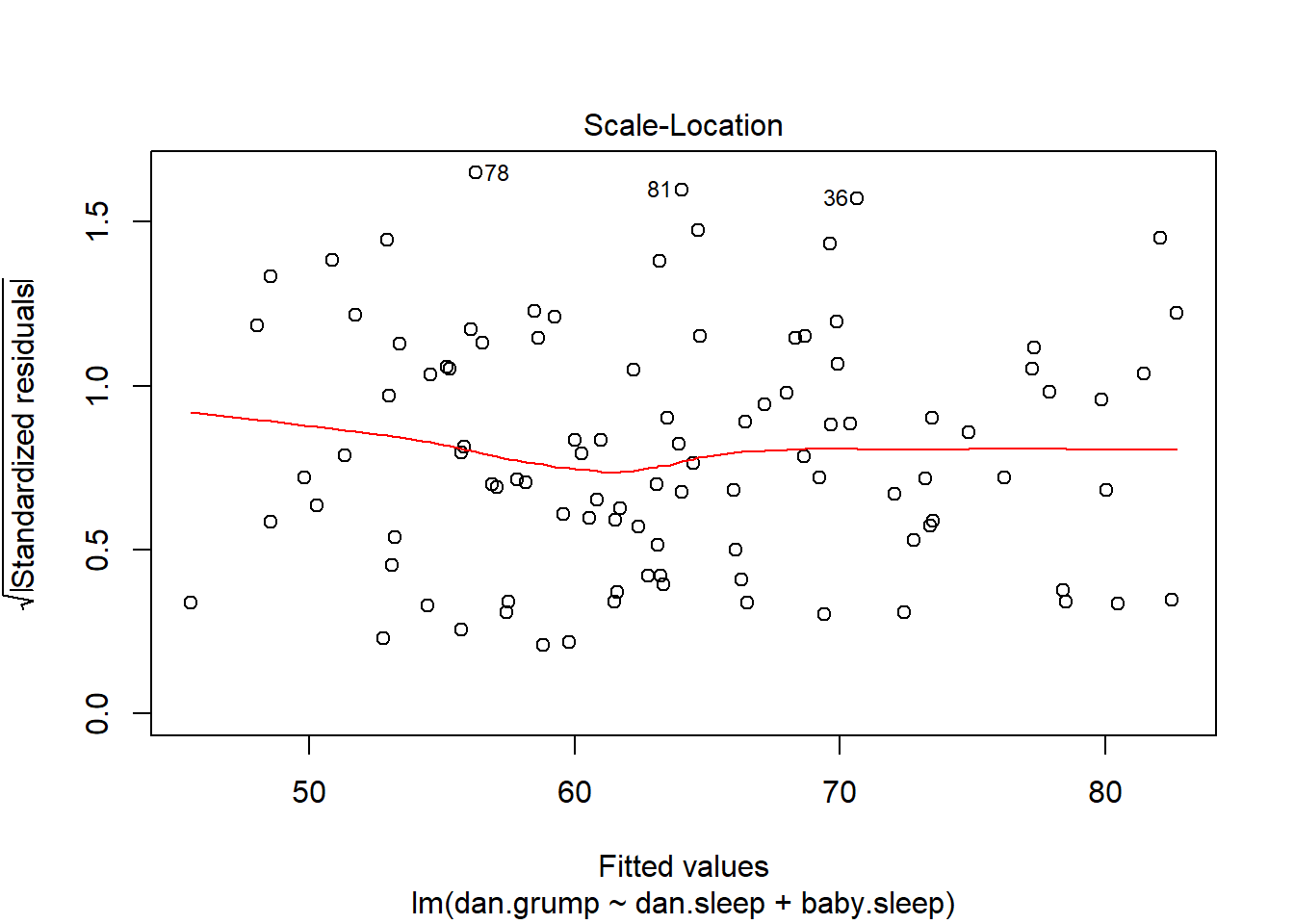

Figure 15.16: Plot of the fitted values against the residuals for regression.2, along with similar plots for the two predictors individually. This plot is produced by the residualPlots() function in the car package. Note that it refers to the residuals as “Pearson residuals”, but in this context these are the same as ordinary residuals.