Chapter 2 Quickstart

If you’re new to concentrated liquidity provision, follow along as I guide you through the steps of setting up a Uniswap v3 (Univ3) liquidity position. By the end of this chapter, you’ll have opened and closed your first LP position and learned which metrics to monitor. But don’t expect to make money just yet—profitability is the focus of later chapters.

If you’re already experienced, feel free to jump straight to section 2.2, where I explain how to calculate Fee APR—it’s more nuanced than you might think, or section 2.3, where I present formulas for calculating any LP position’s PnL and APR. Finally, in section 2.4, I wrap up the chapter with examples demonstrating Impermanent Loss.

Let’s get started!

2.1 Open a Univ3 LP position

Pick a cheap chain. Uniswap is available on at least five chains: Base, Optimism, Arbitrum, Polygon, and Ethereum. While I used Polygon in the example, Base or Optimism is a better choice as of 27 Feb 2025 because most other EVM chains have largely fallen out of use.

Fund your wallet with $50 USD1. Get some gas token. Buy $25 of USDC (or USDT) and $25 of ETH (or WETH2).

Go to the

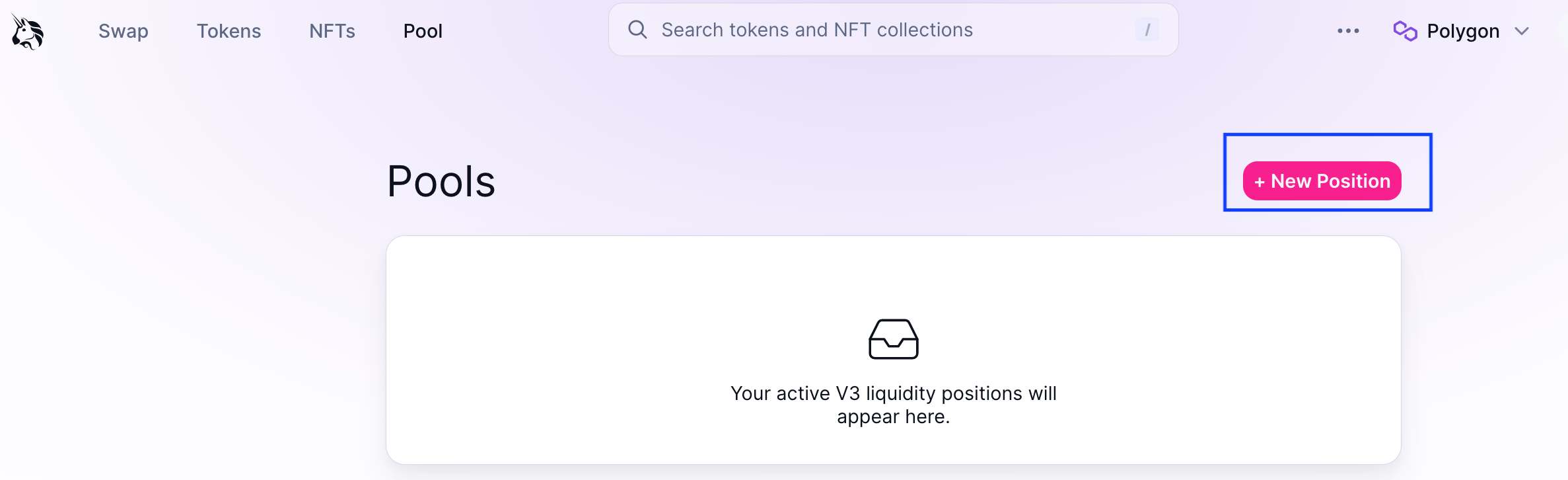

Pooltab of Uniswap’s website (https://app.uniswap.org/pool) and click on+ New Position. Uniswap Pools UI

Uniswap Pools UI Open a new position

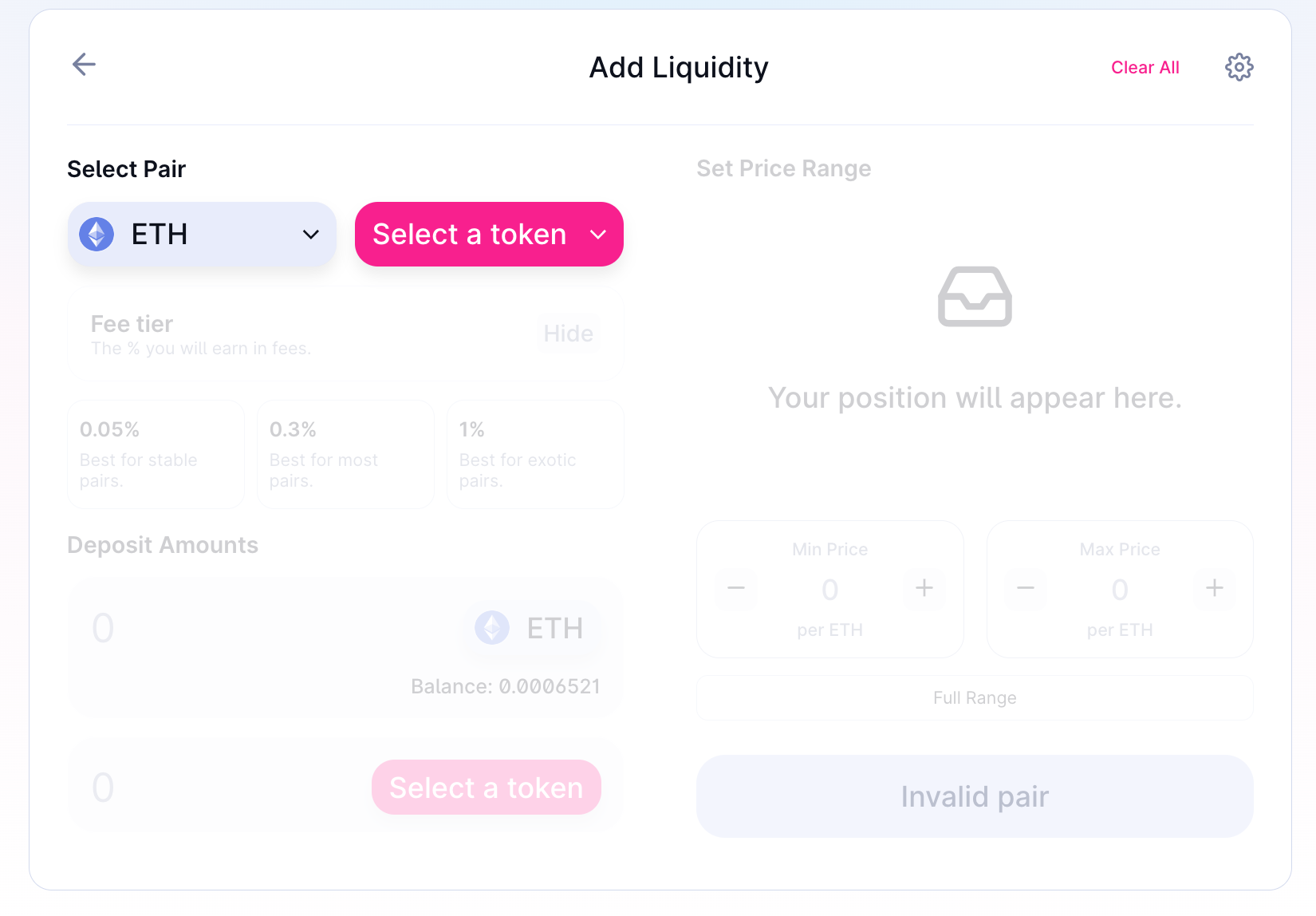

Open a new positionIf you bought ETH in step 2, don’t touch the left box under

Select Pairsince ETH is auto-selected by default. If you bought WETH, you want to select WETH for the left box. Then go to the right box and select either USDC or USDT, depending on what you prepared in step 2. For example, I bought 0.0232251 WETH and 36.668957 USDT in step 2, so I selected WETH and USDT.Choose the

0.05%fee tier. This means that you’ll earn 0.05% of the trading volume for every ETH <-> USDC (or USDT) swap that goes through the pool. In later chapters, I’ll show you how to pick fee tiers using historical data. For ETH-USDC pools, the0.05%fee tier often works well. Configure a new position

Configure a new positionSet the max and min prices at

current ETH price +/- 150. For example, if ETH is at $1650, set the min price at $1500 and the max price at $1800. This range, equally distant from the current price, should let you send all $25 of ETH and $25 of stablecoin to the pool.Click

PreviewandAdd Liquidity. But first, you may need to click twoApprovebuttons. When you open a position on Univ3, you can pay gas up to three times: twice for allowing Uniswap to interact with the coins and once for depositing the coins into the pool.After your liquidity is added, you will see a page where you can

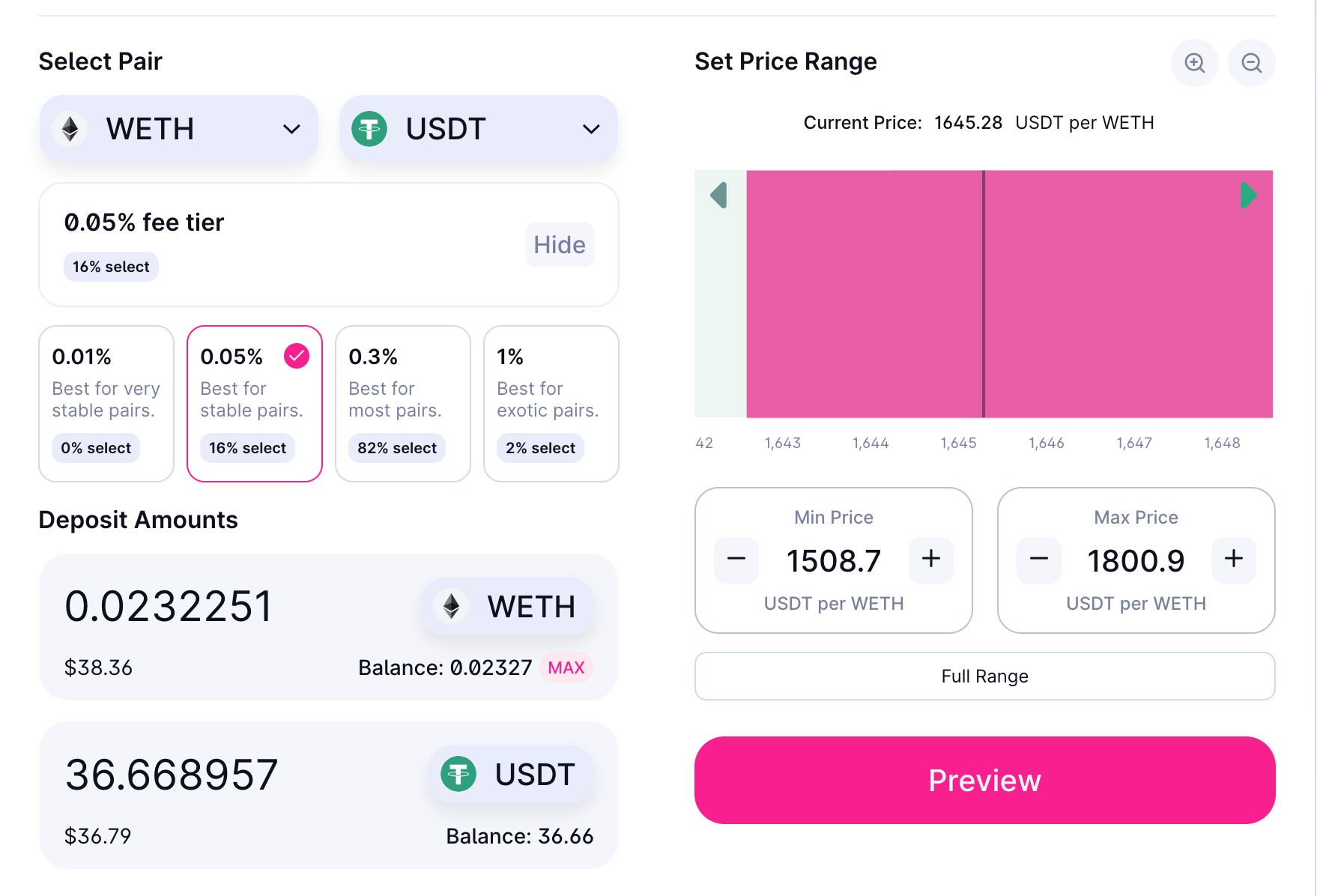

Collect feesto claim the fees earned without removing liquidity.Remove Liquidityto remove liquidity and claim fees at the same time. Gas saving, useful on Ethereum.Increase Liquidityto add more liquidity to your position.

After adding liquidity

After adding liquidityThe NFT on the left side shows a 6-digit ID (above

Min Tick), which also appears at the end of the URL. For example, ID 111222 corresponds to https://app.uniswap.org/pool/111222.Now your LP position is opened, you can monitor it on Revert Finance. Simply take your NFT ID and construct a URL as follows:

https://revert.finance/uniswap-position/chain/nftidFor example, if you opened the position on base and your

nftidis 111222, you could monitor its performance at https://revert.finance/uniswap-position/base/111222. Go ahead and visit the Revert Finance page of your position now. You will see some big red negative numbers. This is because your position is fresh. Give it 30 minutes and the numbers will make sense.You can also look up all Univ3 LP positions of any EVM address by constructing the following URL:

https://revert.finance/account/0x______________________For example, https://revert.finance/account/0x1638d75b9ca2dbc33cabfcff80d7c5ae94f45124.

2.2 Monitor your position

Now that you’ve opened an ETH-Stablecoin position and are earning swap fees— thanks to price staying within your liquidity range—what metrics should you monitor?

The 50-50 setup places the lower and upper bounds of the liquidity range roughly the same distance from the current price. It signals a neutral outlook—no strong opinion on price movement or preference for holding more ETH or stables. So we should track fees earned and consider closing the position when its earning rate drops significantly. This is measured by Fee APR, defined as

\(\text{Fee APR} = \frac{\text{Fees Earned}}{\text{Liquidity Provided}}*\text{annualization factor}\).

For example, say you provided $50 in liquidity, and the position earned $2 over 30 days. The Fee APR would be \(\frac{\$2}{\$50} * \frac{365}{30}=48.7\%\).

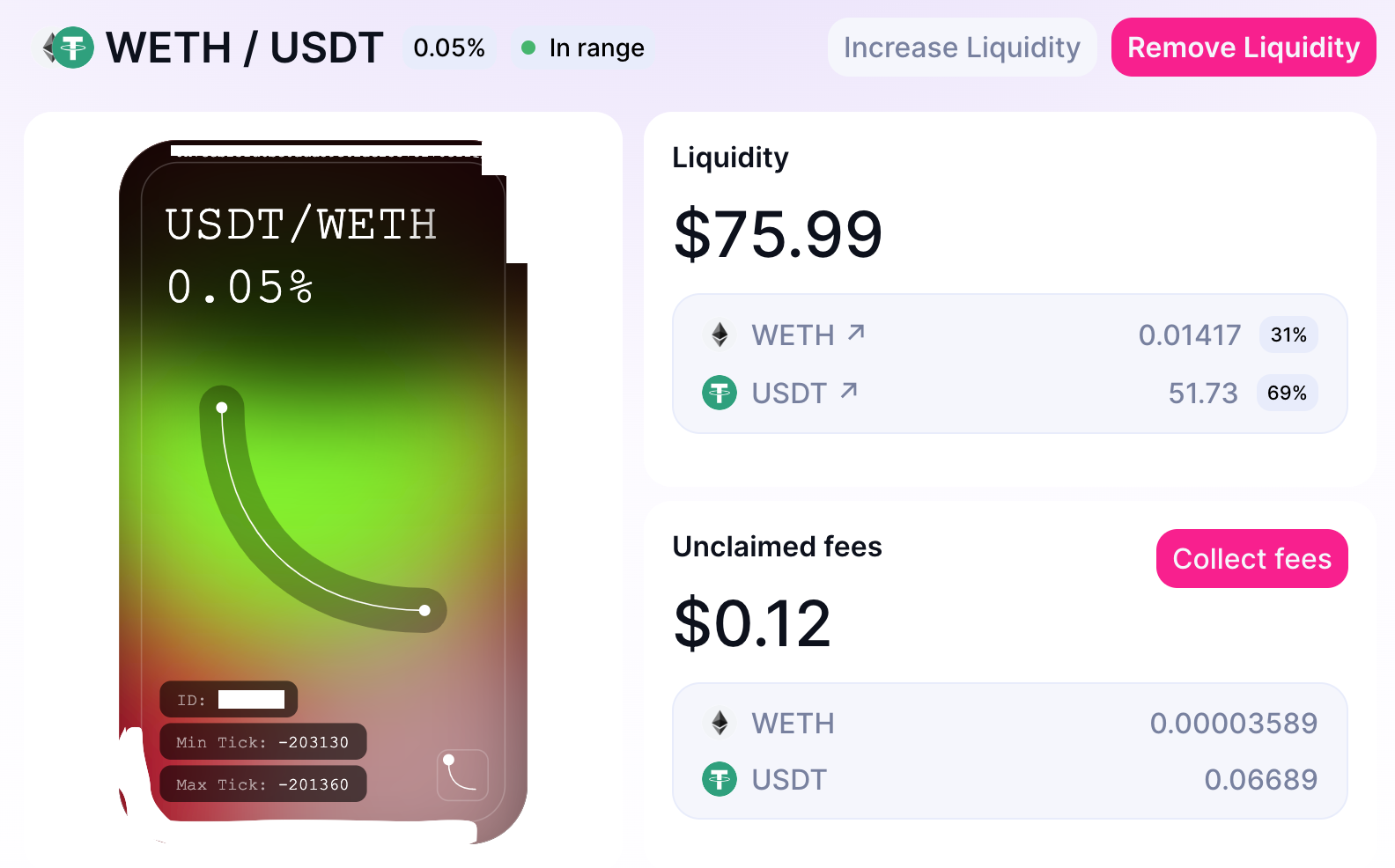

You can monitor your position’s Fee APR on Revert Finance. For example, the following screen shows the ETH-USDT position I created. Let’s focus on the four metrics in red boxes:

pooled_assetsshows the current USD value of the liquidity provided.total_fees_usdshows the current USD value of all fees earned by the position.fee_aprshows the annualized rate of return from fees alone.gas_costsshows the total amount of gas spent from adding, increasing, and removing liquidity and collecting fees.

In my example, I sent 36.669 USDT and 0.0232 WETH to the pool, and the gas cost for opening the position was 0.02526 MATIC. At the time of the screenshot, the tokens (42.6886 USDT + 0.0195 WETH) in the position were worth $75.44, and the position earned 10 cents of fees, which translated to a Fee APR of 62.28%.

The formula for calculating Fee APR has three variants, depending on the point in time used to determine the value of the liquidity provided.

- Fee APR = Fees Earned / Liquidity Value at position open.

- Fee APR = Fees Earned / average Liquidity Value between position open and now.

- Fee APR = Fees Earned / current Liquidity Value.

(Remember to annualize the numbers.)

Formula 1 is the natural choice, as it aligns with common sense. Formula 3 (or 2) is used by Revert Finance. Formula 1 and 3 are simple to use, but Formula 2 requires tracking of liquidity value continuously. A simple version of Formula 2 just uses the midpoint value between open and close times.

Let’s walk through an example. Suppose on Day 1, ZRO (LayerZero) was priced at

$3.14, and ETH at $3,504.43. We opened a ZRO-ETH position by depositing

246.0804499 ZRO and 0 ETH into a Univ3 pool, with an initial liquidity value

of $3.14 * 246.0804499 = $772.69.

After 81.3132 days, ZRO reached $3.64, and ETH fell to $2,338.02. The

position earned $166.93 in fees and ended with 0 ZRO and 0.28223846129 ETH,

resulting in a liquidity value of $2,338.02 * 0.28223846129 = $659.88.

The average of the two liquidity values is ($772.69 + $659.88) / 2 = $716.29.

The Fee APR of this position, calculated three ways, is:

- Fee APR =

$166.93 / $772.69*365/81.3132=96.98%. - Fee APR =

$166.93 / $716.29*365/81.3132=104.61%. - Fee APR =

$166.93 / $659.88*365/81.3132=113.55%.

In practice, it’s rarely necessary to manually calculate Fee APR, as most DEXs display it in real time. However, understanding how it’s calculated allows us to verify the numbers for accuracy. I once encountered a newer DEX that inflated its Fee APR, which I only discovered after running the calculations myself.

Typically, Fee APR peaks within the first 48 hours of opening a position and gradually decreases as the price moves out of range or swap volume declines. During periods of high volatility or upward price movement, trading volume tends to surge, as a result, we can easily earn 200%+ Fee APR on ETH-USDC, SOL-USDC, or SUI-USDC positions. However, as market stabilizes—especially in a bear market with limited price movement—Fee APR can drop below 30%. A low Fee APR can be a valid reason to close an LP position. After all, if I’m only earning 10%, why bother with LP? For example, I recently had an ETH-USDC position on Univ4 with a Fee APR of just over 4%, while a similar setup on Univ3 yielded more than 100%. It was a no-brainer to close the Univ4 position and re-provide liquidity on Univ3.

2.3 Close your position

The object of opening an LP position is to close it on solid gains.

While a low Fee APR pushes us to close an LP position, we often hesitate because closing it could lock in a net loss due to price movement. There’s no free lunch—LPs take on price risk to earn swap fees.

Take the 50-50 ETH-Stablecoin position you just opened. If you check it after a week or two, one of three scenarios will have occurred:

ETH price falls below your range minimum: Your position becomes 100% ETH and stops earning fees.

ETH price stays within your range: Your position remains a mix of ETH (\(x\%\)) and stablecoin (\(y\%\)) and continues earning fees.

ETH price rises above your range maximum: Your position becomes 100% stablecoin and stops earning fees.

Regardless of the scenario, go ahead and calculate the PnL and APR of your position as follows:

- position PnL = Current Liquidity Value - Initial Liquidity Value + Fees Earned - Gas Cost.

- position APR = Position PnL / Initial Liquidity Value / Position Age (days) * 365.

Mathematically, these can be written as

- \(pPnL(t) = LV(t) - LV(t_0) + fees(t) - gas\), where \(LV\) stands for Liquidity Value.

- \(pAPR(t) = \frac{pPnL(t)}{LV(t_0)} * \frac{365}{days}\).

You can get the value of each term from Revert Finance:

- Current Liquidity Value (

pooled_assets) - Fees Earned (

total_fees_usd) - Gas Cost (

gas_costs)

The Initial Liquidity Value is $50 if you followed my instructions.

For example:

- If

pooled_assetsis $51,total_fees_usdis $0.2, andgas_costsis $0.01, your position’s PnL will be $1.19. If its age is 14 days, its APR will be 62.05%. - If

pooled_assetsis $49, your position’s PnL and APR will be -$0.81 and -42.24%, respectively.

So, which scenario played out for you, and what are your PnL and APR?

I can tell you that you will have a net gain under Scenario 3 but face a net

loss under Scenario 1. In later chapters, we will discuss how to reduce losses

and boost gains. For now, if either scenario happens, just close the position

by clicking the Remove Liquidity button, moving the slider to 100%, and

confirming the transaction. This will also claim any fees the position has

earned. If you’d rather collect fees without removing liquidity, click the

Collect fees button—but avoid doing this on ETH mainnet, as gas costs can

be high.

If Scenario 2 happens, do nothing as long as Fee APR is above 20%. Close the position when it drops below 20%. Why 20%? Anchor, a lending protocol, used to pay a fixed 20% interest on UST (an algorithmic stablecoin) deposits before Luna collapsed. Since then, I’ve used it as my minimum target rate for stablecoin yield—anything I do with stablecoins, I aim for at least a 20% return.

2.4 What’s the alternative

Always be asking: what’s the alternative?

Instead of sending $25 of ETH and $25 of USDC to a liquidity pool, we could have simply held them in a wallet. Would that have been better?

The short answer is: if ETH pumps, hodl wins; if ETH dumps, hodl also wins;

if ETH trades sideways, LP likely comes out ahead. This can be best

illustrated with the following three examples.

Example 1: LP ETH Single-Sided from Current Price Upward

If ETH pumps, LP will have a positive PnL, but hodl would yield a larger

profit. To demonstrate, suppose ETH is currently at $2,000. We buy 0.1 ETH for

$200 and provide it to an ETH-USDC pool with a price range of $2,000 - $2,060.

After 7 days, the position earns $10 in fees, and ETH price rises to $2,160.

The position’s PnL can be calculated as follows:

- Day 0: The position holds 0.1 ETH and 0 USDC, worth $200.

- Day 7: The position holds 0 ETH and 202.98 USDC3, worth $202.98.

- PnL: $202.98 - $200 + $10 = $12.98 (assuming 0 gas).

Had we held the 0.1 ETH in wallet, its value would have been $216, resulting in

a $16 profit—outperforming the LP.

Example 2: LP USDC Single-Sided from Current Price Downward

If ETH dumps, LP will have a negative PnL, but hodl would result in a smaller

loss. Again, suppose ETH is currently at $2,000, and we provide 200 USDC to an

ETH-USDC pool with a price range of $2,000 - $1,940. After 7 days, the position

earns $10 in fees, and ETH price falls to $1,840. The position’s PnL can be

calculated as follows:

- Day 0: The position holds 0 ETH and 200 USDC, worth $200.

- Day 7: The position holds 0.10153464 ETH and 0 USDC, worth $186.82.

- PnL: $186.82 - $200 + $10 = -$3.18 (assuming 0 gas).

Had we held the 200 USDC, we would’ve outperformed the LP.

Example 3: LP ETH and USDC in a 50-50 ratio Two-Sided around Current Price

If ETH trades sideways, LP will likely outperform hodl. Once again, suppose

ETH is currently at $2,000. We take 100 USDC to buy 0.05 ETH and send it with

another 100 USDC to an ETH-USDC pool with a price range of $1,940 - $2,060.

After 7 days, the position earns $10 in fees, and ETH price is back at $2,000.

The position’s PnL can be calculated as follows:

- Day 0: The position holds 0.05 ETH and 100 USDC, worth $200.

- Day 7: The position again holds 0.05 ETH and 100 USDC, worth $200.

- PnL: $200 - $200 + $10 = $10 (assuming 0 gas).

By doing the LP, we make $10 more than just keeping the USDC in wallet.

At any point, we can compare the PnL numbers of our LP position with the

counterfactual hodl position. If the hodl position’s PnL is greater, we

experience Impermanent Loss (IL); if the LP position’s PnL is greater, we

enjoy Impermanent Gain (IG). For example, in Example 1 above, we have an IL of

$3.02; in Example 2, an IL of $3.18; and in Example 3, an IG of $10. These

losses and gains are impermanent as long as our LP position remains open,

since prices continue to fluctuate, causing the PnL values to change. We will

revisit IL in later chapters. For now, just remember that IL means you

would have been better off hodling the assets—but it’s not a real loss, as

future price action could erase it entirely.

Let me wrap up this chapter by congratulating you on your first LP position! Not only did we walk through the steps of opening and closing a Univ3 LP position, but we also showed how to use Revert Finance to track these key metrics:

- Current Liquidity Value (

pooled_assets) - Fees Earned (

total_fees_usd) - Gas Cost (

gas_costs) - Fee APR (

fee_apr)

In addition, we studied the formulas for calculating an LP position’s

PnL (pPnL) and APR (pAPR), which take into account both asset value changes

and fees earned. Finally, we learned the concept of Impermanent Loss. In the

next chapter, we will dive into the mechanics of Automated Market Makers (AMMs).

You don’t have to do exactly $50, but definitely keep it < $100. In my case, I put up $75.15 ($36.79 USDT + $38.36 WETH).↩︎

WETH, or Wrapped ETH, is a 1:1 pegged representation of ETH. It was created because native ETH cannot be issued on chains other than Ethereum. Since WETH and ETH hold equal value, they are often used interchangeably. For instance, throughout this book, I frequently use

ETH-USDCeven though many DEXs display the pair asWETH-USDC.↩︎As price rises from $2,000 to $2,060, the ETH in the LP position will be converted to USDC at an average price of $2,029.778 (\(\sqrt{2000 * 2060}\)).↩︎

As price falls from $2,000 to $1,940, the USDC in the LP position will be converted to ETH at an average price of $1,969.77. (\(\sqrt{2000 * 1940}\)).↩︎