8 Upcoming Trends: Enchanced Privacy

There has been a lot of attention on Bitcoin and its perceived role in enabling criminals to transfer units of cryptocurrency anonymously. Whilst it is difficult to attribute a public key an individual unless records are available – transactions on a blockchain like Bitcoin are transparent.In fact, every single transaction that has been verified is accessible via Bitcoin’s blockchain. Here is a useful article detailing how you can trace and analyse bitcoin transactions. In fact, anyone is free to download Bitcoin’s block chain here it is currently a 145GB download. This means if you have knowledge of an individual’s public key address, you can see the transactions he/she is making. It is for reasons like this that individuals have created cryptocurrencies that mask their blockchain/public ledger. We will now turn focus to these more ‘cryptic’ cryptocurrencies.

8.1 ‘Private’ Cryptocurrencies

There are cryptocurrencies that will that go provide much deeper levels of anonymity than bitcoin. When researching this, I believed the list to be under ten, but further searching would reveal there are at least 35 cryptocurrencies that could be considered ‘private’. Private in this sense means transactions are either difficult to trace to a user or are completely anonymous. Probably the most common way to obscure transactions, because it is commonly used with Bitcoin, is through mixing. Coin mixing essentially adds a layer of anonymity to transactions through sending smaller proportions of your intended payment in several wallets. With Bitcoin, individuals wishing to mix coins can set up a scheme with others to achieve this such as https://coinmixer.se/en/. With DASH this comes built in, with masternodes providing the coordination required to mix coins.

Other privacy based cryptocurrencies either use the ‘cryptonote’ protocol or the zero-knowledge protocol called Zk-snark (Zero-Knowledge Succinct Non-Interactive Argument of Knowledge). The cryptonote protocol very briefly explained makes transactions hard to read utilizing the use of cryptographic technologies such as ring signatures and stealth addresses. This means that for every transaction there could be multiple receivers and senders which are equiprobable. Zero knowledge proofs work by providing the option to ‘mint’ new untraceable coins. Minted coins are then mixed with other minted coins. When a user wants to send a unit of the currency to another user, it will be a random coin picked at random meaning no one can trace it back to original sender.

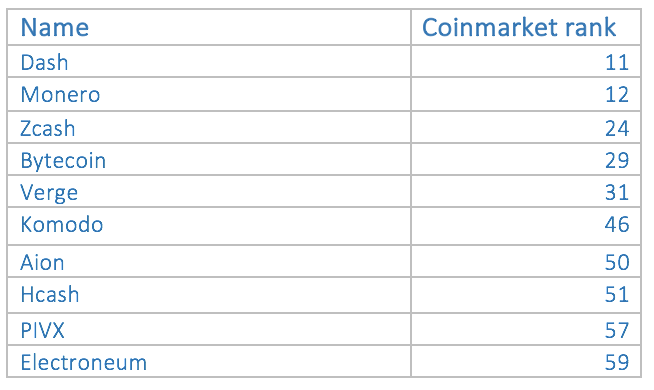

Here I have provided the top ten according to a coinmarketcap rating:

The data for this was downloaded during February 2018

8.2 Atomic Swapping and TOR Nodes

Two trends interested me when I analysed the top ten looking for trends that I did not know. One is the implantation of TOR nodes into cryptocurrencies. This is for instance the case with the Cryptocurrency Verge. Verge has adopted a different approach to approaching the issue of privacy. Unlike other popular privacy based cryptocurrencies that use methods from cryptography to make their blockchain harder to read, Verge uses TOR and I2P network to make the IP addresses of individuals impossible to read.

Another is the implementation of private cryptocurrencies enabling ‘atomic swapping’ both Verge, as just discussed, and Komodo enable users to switch cryptocurrencies for other cryptocurrencies without going through an exchanger or intermediary. This means that criminals around the world may have another way of evading an overseer. Even if governments around the world had access to the most popular exchanges given an individual already has some cryptocurrency they can trade it for other cryptocurrencies freely. However atomic swapping is not the only method of exchanging cryptocurrencies for other cryptocurrencies and fiat currency there are also dark pools and increasing smart contracts that are a cause for concern to authorities around the world.

8.3 Emergence of Darkpools

Dark pools are used to enable investors wanting to trade in large quantities to do so outside standard exchanges. This is done to ensure no effect is made on the price of the asset they are trading. When applied to cryptocurrency there are two main differences.

Firstly, as mentioned above dark pools are above to conduct trades utilizing atomic swaps i.e one cryptocurrency for another. Second, the execution as Investopedia points out is different. Instead of a direct matching, some darkpools (Republic Protocol for instance) can match a large order with several individuals looking to sell through a matching engine known as Multiparty Computation Protocol (MCP). Kraken is also offering its uses a service to trade cryptocurrencies in large quantities off the standard exchange.

8.4 Smart contracts for peer-to-peer trading

Ethereum Smart contracts are now being designed to allow individuals to trade peer2peer without going through an exchange. http://www.localethereum.com. This shows the potential to use smart contracts as a method to launder money. It would be easy to list a bespoke listing to sell either illicitly gained Ethereum or fiat currency.

8.5 Intial Coin Offerings to Launder?

Initial coin offerings as well as offering an ability for criminals to set up scams as outlined in the section above also offer a new way of ‘transaction laundering’. Transaction laundering is essentially when you list a product for sale on the internet and get someone you know to pay for it. In the past, this has been done on eBay using ‘black Disney videos’ – videos that a listed at particularly high prices that no-one other than the other criminal will buy. Tokens also present this possibility. Criminals could set up an ICOs just to transfer funds. Worthless tokens could be sent in return for ether that could then be exchanged. With the emergence of darkpools a criminal could transfer large amounts of ether at once to fiat currency.