Carbon tax: incidence with vertical integration and price regulation

What we do

Use price and contract data on all gas stations operating in Colombia to estimate the incidence of a carbon tax.

- 4 incidence types: independent (regulated or unregulated) and integrated (regulated or unregulated)

Confirm that passthrough rate of carbon tax is higher for vertically integrated gas stations (Bajo-Buenestado & Borrella-Mas, EJ 2022).

- Provide evidence that their findings interact with other regulatory interventions

Why care?

Fossil fuel regulation is all the rage.

Regulations sometimes collide.

Excise taxes are used to discourage consumption (soft drinks).

Tax incidence is affected by vertical structure of market but said incidence interacts with regulations (cap-price regulation)

Our paper among others

We contribute to the following literature strands

Passthrough and vertical integration: Hellerstein and Villas-Boas (2010), Hastings (2004), Auer and Shoenle (2016)

Tax incidence Muehlegger and Sweeney(2022), Weyl and Fabinger (2013)

Carbon abatement

Our main contribution at this stage: point out that the results in Bajo and Borrellas hold only for certain regulatory frameworks.

Regulation and vertical structure

The price of premium gasoline is not subject to price ceilings.

The price of regular gasoline is capped depending on the type of city

- cities where stations can set prices freely (25)

- cities where the price is capped.

So in cities with price caps, stations selling premium and regular gas will face both regulations/decisions.

Regulation vertical structure (2)

Using our dataset containing the transactions between stations and wholesalers we can identify two types of stations:

- Independent stations

- Integrated stations (owned and operated by the wholesaler)

We will have 4 types of prices: regulated (unregulated) prices at independent stations, regulated (unregulated) prices at integrated stations

How is the carbon tax levied

Introduced in 2017 as an amount of pesos per ton of CO2. In 2017 it started at (15.000COP or 5.08USD)

- Updated ever since using the CPI: \(tax_t=tax_{t-1}(\Delta CPI_{t-1}+1)\)

Other fuels are taxed but we focus on gasoline.

The tax pesos per gallon are determined by the theoretical amount of CO2 emitted after burning it (137COP in 2017).

But fuel is mixed with ethanol which is not taxed. So the effective tax depends on the blend (ranges from 4% to 10% in our data).

The data

All wholesaler-retailer transactions between 2018 and 2012

- All prices (retail prices and terminal gate prices)

- Vertical contracts

- Location of station

- Brand

Price frequency vary because stations only have to report price changes.

Descriptive statistics

| Panel A: Regular gas prices | |||||

|---|---|---|---|---|---|

| Independent | Integrated | ||||

| Mean | SD | Mean | SD | ||

| Marginal Cost | 9048.9 | 507.9 | 9032.4 | 510.1 | |

| Price | 8969.6 | 474.5 | 8785.9 | 453.7 | |

| Tax | 138.35 | 9.8 | 138.5 | 9.8 | |

| Ethanol mix (%) | 8.71 | 2.18 | 8.69 | 2.19 | |

| Observations | 591680 | 148264 | |||

| Stations | 1085 | 158 | |||

| Panel B: Premium gas prices | |||||

| Independent | Integrated | ||||

| Mean | SD | Mean | SD | ||

| Marginal Cost | 9038.1 | 506.4 | 9002.4 | 519.7 | |

| Price | 12643.7 | 1497.5 | 12256.0 | 1542.0 | |

| Tax | 138.1 | 9.6 | 138.8 | 9.6 | |

| Ethanol mix | 8.75 | 2.16 | 8.68 | 2.21 | |

| Observations | 69513 | 29106 | |||

| Stations | 624 | 143 | |||

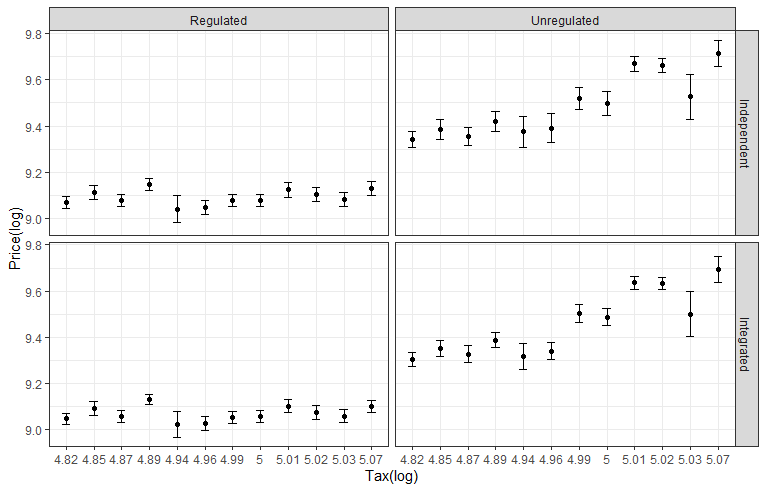

Correlation tax and price

Theoretical framework

- Wholesaler: produces a gallon of fuel at marginal cost \(c\) and sells it to stations at a wholesale price \(w\)

- Station: sells \(q\) gallons to consumers at a retail price \(p\). Faces demand \(D(p)\).

- Carbon tax: \(\tau\)

The station’s problem

\[\max_p \pi^R=(p-w-\tau)D(p)\]

The wholesaler’s problem

\[\max_w \pi^W=(w-c)D^R(w,\tau)\]

Theoretical framework 2

If station and wholesaler are independent

Lema 1: \(\frac{\partial p*(w,\tau)}{\partial w} > 0\) and \(\frac{\partial p*(w,\tau)}{\partial \tau} > 0\)

Lema 2: \(\frac{\partial D^R(w,\tau)}{\partial w} < 0\) and \(\frac{\partial D^R(w,\tau)}{\partial \tau} < 0\)

Lema 3: \(\frac{\partial w^*(c,\tau)}{\partial \tau} < 0\)

If they are integrated: \(\frac{\partial\hat{p}}{\partial \tau} > \frac{\partial p^*}{\partial \tau}\)

Empirical strategy

We leverage the exogenous variation in taxes over time and across regions and the variation of regulation across types of fuel to estimate the rate of carbon tax passthrough.

- In particular we are interested in the differential effect of being an integrated station selling regulated fuel.

\[ \begin{multline} \log(\text{Price})_{ijmt} = \beta_1 \log(\text{CT})_{ijmt} + \beta_2 \log(\text{MC})_{ijmt} + \beta_3 \text{Int}_{jm} + \beta_4 \text{Reg}_i\\ +\beta_5 \log(\text{CT})_{ijmt} \times \text{Int}_{jm} +\beta_6 \log(\text{CT})_{ijmt} \times \text{Reg}_{i} +\color{blue}{\beta_7} \log(\text{CT})_{ijmt} \times \text{Reg}_{i}\times \text{Int}_{jm} \\ +\beta_8 \log(\text{MC})_{ijmt} \times \text{Int}_{jm} +\beta_9 \log(\text{MC})_{ijmt} \times \text{Reg}_{i} +\beta_{10} \log(\text{MC})_{ijmt} \times \text{Reg}_{i}\times \text{Int}_{jm} \\ +\beta_{11} \text{Int}_{jm} \times \text{Reg}_i + \gamma_j+ \gamma_m + \gamma_t+ \epsilon_{ijmt} \end{multline} \]

Identification

Ideally, we’d like exogenous variation of the tax. There might be some threats to said exogeneity:

If the stations can decide the percent of ethanol in the mix, their exposure to the tax would be endogenous.

There might be also unobserved demand/supply shocks that affect integrated stations’ pricing decisions.

Threat 1 is not a concern: stations do not decide the mix

Threat 2: we attenuate with fixed effects. Moreover, we are basically comparing a station to itself.

Results: all stations

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Tax(log) | 1.11*** | 1.10*** | 1.82*** | 1.28*** | 1.29*** |

| (0.03) | (0.03) | (0.19) | (0.05) | (0.05) | |

| Integrated | -0.31 | -0.30 | |||

| (0.20) | (0.17) | ||||

| Regulated | 5.79*** | 5.78*** | 5.89*** | 5.88*** | 5.88*** |

| (0.13) | (0.14) | (0.11) | (0.12) | (0.12) | |

| Tax(log)×Integrated | 0.06* | 0.06 | 0.05 | 0.07** | 0.07** |

| (0.03) | (0.04) | (0.03) | (0.03) | (0.03) | |

| Tax(log)×Regulated | −1.24*** | −1.24*** | −1.26*** | −1.26*** | −1.26*** |

| (0.03) | (0.03) | (0.02) | (0.03) | (0.03) | |

| Integrated×Regulated | 0.60*** | 0.56** | 0.56** | 0.62*** | 0.62*** |

| (0.14) | (0.17) | (0.15) | (0.13) | (0.13) | |

| Tax(log)×Integrated×Regulated | −0.12*** | −0.11** | −0.11*** | −0.12*** | −0.12*** |

| 0.03) | (0.04) | (0.03) | (0.03) | (0.03) | |

| Share | -0.04*** | ||||

| (0.01) | |||||

| Num. obs. | 2081508 | 2081508 | 2081508 | 2081508 | 2081508 |

| Adj. R2 | 0.74 | 0.71 | 0.84 | 0.91 | 0.91 |

| Num. groups: stations | 4422 | 4422 | 4422 | ||

| Num. groups: cities | 779 | 779 | 779 | ||

| Num. groups: month-year | 62 | 62 | 62 |

Results: price cap markets

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Tax(log) | 1.04*** | 1.06*** | 1.92*** | 1.19*** | 1.19*** |

| (0.05) | (0.05) | (0.14) | (0.14) | (0.14) | |

| Integrated | -0.64* | -0.69** | |||

| (0.29) | (0.23) | ||||

| Regulated | 5.44*** | 5.54*** | 5.67*** | 5.49*** | 5.49*** |

| (0.23) | (0.27) | (0.20) | (0.23) | (0.23) | |

| Tax(log)×Integrated | 0.14* | 0.12* | 0.13* | 0.16** | 0.16** |

| (0.06) | (0.06) | (0.05) | (0.06) | (0.06) | |

| Tax(log)×Regulated | −1.17*** | −1.19*** | −1.21*** | −1.18*** | −1.18*** |

| (0.05) | (0.05) | (0.04) | (0.05) | (0.05) | |

| Integrated×Regulated | 1.13*** | 1.03** | 1.06*** | 1.22*** | 1.23*** |

| (0.33) | (0.31) | (0.29) | (0.32) | (0.32) | |

| Tax(log)×Integrated×Regulated | −0.23*** | −0.21** | −0.21*** | −0.25*** | −0.25*** |

| (0.07) | (0.06) | (0.06) | (0.07) | (0.07) | |

| Share | -0.01 | ||||

| (0.01) | |||||

| Num. obs. | 743016 | 743016 | 743016 | 743016 | 743016 |

| Adj. R2 | 0.62 | 0.58 | 0.75 | 0.89 | 0.89 |

| Num. groups: stations | 2333 | 2333 | 2333 | ||

| Num. groups: cities | 661 | 661 | 661 | ||

| Num. groups: month-year | 57 | 57 | 57 |

Results: free markets

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Cost(log) | 0.93*** | 0.94*** | 0.83*** | 1.05* | 1.05* |

| (0.03) | (0.03) | (0.24) | (0.36) | (0.36) | |

| Integrated | −2.61*** | −2.66*** | |||

| (0.53) | (0.52) | ||||

| Regulated | 6.72*** | 6.78*** | 6.73*** | 6.71*** | 6.71*** |

| (0.21) | (0.21) | (0.23) | (0.22) | (0.22) | |

| Tax(log) | 1.42*** | 1.42*** | 1.58*** | 1.63*** | 1.64*** |

| (0.03) | (0.03) | (0.09) | (0.12) | (0.12) | |

| Cost(log)×Integrated | 0.22*** | 0.22*** | 0.23*** | 0.22*** | 0.22*** |

| (0.04) | (0.04) | (0.04) | (0.04) | (0.04) | |

| Cost(log)×Regulated | −0.07* | −0.08** | −0.07** | −0.07* | −0.07* |

| (0.03) | (0.03) | (0.03) | (0.03) | (0.03) | |

| Integrated×Regulated | 3.00*** | 2.98*** | 3.10*** | 3.03*** | 3.04*** |

| (0.56) | (0.56) | (0.53) | (0.54) | (0.55) | |

| Tax(log)×Integrated | 0.12** | 0.11* | 0.11* | 0.12** | 0.13** |

| (0.04) | (0.05) | (0.05) | (0.04) | (0.04) | |

| Tax(log)×Regulated | −1.30*** | −1.30*** | −1.30*** | −1.30*** | −1.30*** |

| 0.03) | (0.04) | (0.04) | (0.03) | (0.03) | |

| Cost(log)×Integrated×Regulated | −0.24*** | −0.24*** | −0.25*** | −0.24*** | −0.24*** |

| (0.05) | (0.05) | (0.04) | (0.05) | (0.05) | |

| Tax(log)×Integrated×Regulated | −0.17*** | −0.15** | −0.16*** | −0.17*** | −0.17*** |

| (0.03) | (0.04) | (0.04) | (0.03) | (0.03) | |

| Share(log) | −0.31** | ||||

| (0.08) | |||||

| Num. obs. | 856789 | 856789 | 856789 | 856789 | 856789 |

| Adj. R2 | 0.92 | 0.89 | 0.89 | 0.92 | 0.92 |

| Num. groups: station | 1244 | 1244 | 1244 | ||

| Num. groups: city | 17 | 17 | 17 | ||

| Num. groups: year-month | 59 | 59 | 59 |

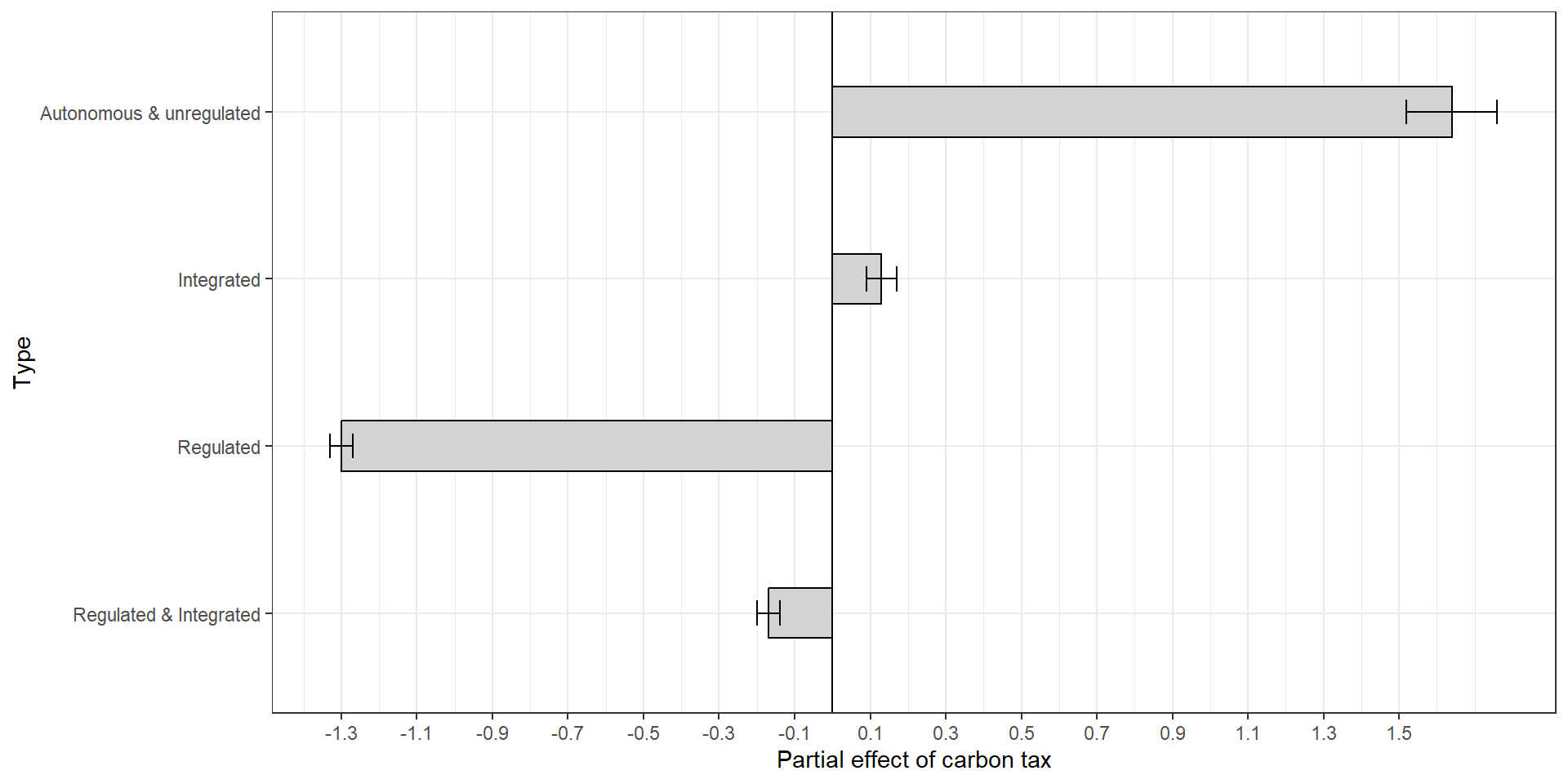

Summary results

Partial tax incidence by type

Summary results (2)

Effective tax incidence by type

| Regulated | |||

|---|---|---|---|

| Yes | No | ||

| Integrated | Yes | 0.30 | 1.77 |

| No | 0.34 | 1.64 | |

Tax incidence is higher for integrated stations only if the good’s price is not regulated.

Robustness checks

Out of our 1371 of stations 552 sell only one kind of fuel.

- We obtain the estimates with the 819 stations that sell both and the results hold.

Different brands might be more integrated and have different attitudes towards the rate of tax pass through. In that case the integration variable might be capturing the brand effect.

- We obtain the estimates with brand fixed effects

Final remarks

We have shown that the passthrough rate of the carbon tax is higher when stations are vertically integrated

- But only when the integrated station sells a good that is not subject to price ceilings

Our results hold even when the passthrough rate is obtained with a subsample of markets where stations do not face a price ceiling

- Suggesting that the more elastic demand for regular gas plays a role